Power Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430586 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Power Transformer Market Size

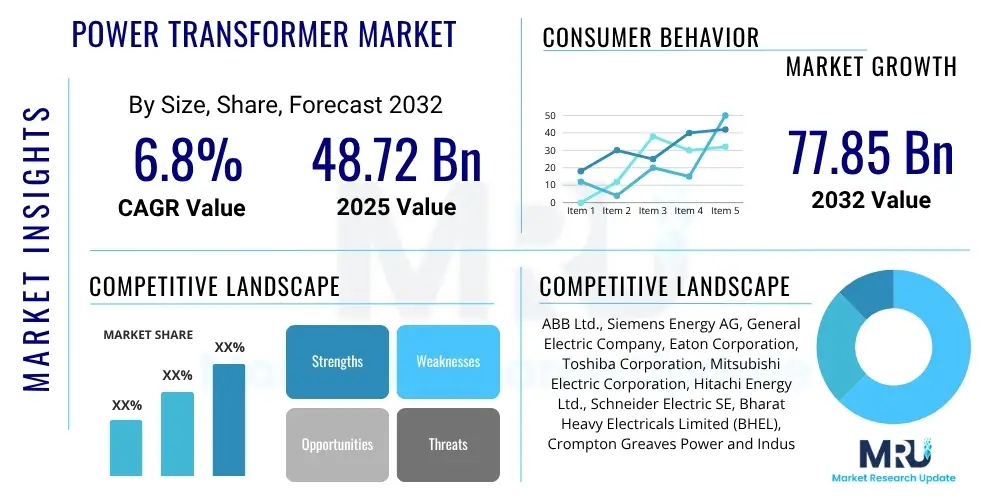

The Power Transformer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.75% between 2025 and 2032. The market is estimated at $48.72 billion in 2025 and is projected to reach $77.85 billion by the end of the forecast period in 2032.

Power Transformer Market introduction

The Power Transformer Market encompasses the global industry dedicated to the manufacturing, distribution, installation, and maintenance of electrical power transformers. These devices are fundamental to the efficient and reliable operation of modern electrical grids, serving the critical function of stepping up or stepping down voltage levels to facilitate long-distance power transmission from generation sources to consumption points, minimizing energy losses during the process. Power transformers are static electrical machines that utilize electromagnetic induction to transfer energy between circuits without changing frequency, making them indispensable components for managing power flow across diverse voltage hierarchies within complex grid infrastructures. Their robust design and long operational lifespan underscore their importance as foundational assets in electricity infrastructure worldwide.

Product descriptions typically categorize power transformers by their insulating medium, such as liquid-filled (oil-immersed) transformers and dry-type transformers, each suited for different applications based on cooling efficiency, environmental considerations, and safety requirements. Liquid-filled transformers, often using mineral oil or ester fluids, are prevalent in high-voltage transmission and distribution networks due to their superior cooling capabilities. Dry-type transformers, utilizing air or solid insulation, are favored in indoor applications, commercial buildings, and sensitive environments where fire safety and minimal maintenance are paramount. Major applications for these transformers span the entire electricity value chain, including power generation plants (stepping up voltage for transmission), high-voltage transmission substations (managing bulk power flow), and primary distribution substations (stepping down voltage for local grids and industrial loads). They are also vital in specialized sectors such as renewable energy integration, railway electrification, and large industrial facilities.

The benefits derived from power transformers are numerous and profoundly impact energy systems. They enable efficient voltage transformation, which is crucial for minimizing resistive losses during long-distance power transmission, thus enhancing overall energy efficiency. Power transformers contribute significantly to grid stability and reliability by facilitating precise voltage regulation and ensuring a consistent power supply to end-users. Furthermore, their role in connecting diverse power generation sources, including intermittent renewable energy plants, to the main grid is increasingly critical for the global energy transition. The market's growth is primarily driven by several overarching factors, including the escalating global demand for electricity due to population growth and industrial expansion, extensive government and private sector investments in modernizing and expanding aging grid infrastructure, and the accelerating integration of renewable energy sources which necessitate new transformer installations and specialized designs for efficient power evacuation and grid synchronization. Urbanization and digitalization trends further amplify electricity demand, consequently fueling the need for robust and advanced power transformer solutions.

Power Transformer Market Executive Summary

The Power Transformer Market is undergoing a dynamic transformation influenced by significant business, regional, and segment-specific trends, all contributing to its projected substantial growth over the forecast period. Business trends indicate a strong industry pivot towards digitalization and automation, with manufacturers increasingly incorporating smart capabilities, such as advanced sensor technology and data analytics, into new transformer designs. There is a heightened focus on energy efficiency, leading to the development of amorphous core transformers and other low-loss variants, driven by global sustainability mandates and the economic benefits of reduced operational costs. Manufacturers are also expanding their service portfolios to include comprehensive lifecycle management, predictive maintenance, and condition monitoring solutions, shifting from purely product-centric offerings to integrated energy solutions. The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions aimed at consolidating market share, enhancing technological capabilities, and expanding geographical reach, particularly in high-growth emerging markets.

Regional trends highlight distinct growth drivers and market characteristics. Asia Pacific continues to hold the largest market share and is expected to exhibit the highest growth rate, propelled by rapid industrialization, burgeoning urbanization, and extensive infrastructure development projects, especially in China, India, and Southeast Asian nations. These countries are making colossal investments in expanding their power generation capacity and upgrading transmission and distribution networks to meet skyrocketing electricity demand. North America and Europe, while mature markets, are experiencing consistent demand driven by critical grid modernization initiatives, the urgent need to replace aging infrastructure, and ambitious renewable energy integration targets. Investments in smart grids, offshore wind farms, and inter-regional transmission lines are key catalysts in these regions. The Middle East and Africa (MEA) regions present significant growth opportunities duement to ongoing electrification programs, the development of large-scale renewable energy projects, and considerable investments in industrial and oil and gas sector expansion, albeit with varying paces of adoption and infrastructure maturity across different countries.

Segment trends within the market demonstrate a robust demand for both liquid-filled and dry-type transformers, each serving distinct application needs. Liquid-filled transformers, favored for high-voltage applications in power transmission and large industrial settings, maintain their dominance due to superior cooling performance and established reliability. However, the dry-type transformer segment is experiencing accelerated growth, particularly in urban, commercial, and environmentally sensitive industrial applications, owing to their enhanced safety features, reduced fire risk, and minimal environmental footprint, alongside lower maintenance requirements. Furthermore, there is a growing demand for specialized transformers, including those designed for high-voltage direct current (HVDC) transmission, compact substations, and offshore applications, reflecting the evolving complexities of modern power grids. The overall trend points towards customized, high-performance, and digitally-enabled transformers that can adapt to the dynamic demands of interconnected, cleaner, and more resilient energy systems globally, underscoring the innovative strides being made across all segments of the power transformer market.

AI Impact Analysis on Power Transformer Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize various aspects of the power transformer market, focusing intensely on applications that enhance operational efficiency, reliability, and lifespan while reducing costs. Common user questions probe the effectiveness of AI in predictive maintenance to preempt failures, its potential for optimizing grid performance and energy management, the role of AI in streamlining design and manufacturing processes, and the implications for ensuring cybersecurity within increasingly smart grids. There is a strong expectation that AI will usher in a new era of intelligent, self-optimizing, and resilient power infrastructure, fundamentally transforming how transformers are monitored, maintained, and integrated into complex energy ecosystems. Stakeholders also express concerns regarding data privacy, the integration challenges with legacy systems, and the imperative for developing specialized skill sets to harness these advanced AI capabilities effectively within the power sector.

- Enhanced Predictive Maintenance: AI algorithms analyze vast streams of operational data from embedded sensors (e.g., temperature, vibration, partial discharge, dissolved gas analysis) to identify subtle anomalies and predict potential equipment failures long before they occur, enabling proactive maintenance scheduling, reducing unplanned downtime, and extending asset lifecycles.

- Optimized Grid Management: AI systems integrate real-time transformer performance data with broader grid conditions, load forecasts, and renewable energy generation patterns to dynamically optimize power flow, regulate voltage, minimize transmission losses, and improve overall grid stability and efficiency.

- Automated Fault Detection and Diagnostics: AI-powered analytics can rapidly detect abnormal operational parameters, pinpoint the precise location and nature of faults within transformers or connected systems, and suggest appropriate diagnostic and corrective actions, significantly accelerating response times and mitigating the risk of cascading failures.

- Improved Design and Manufacturing: AI and machine learning are employed in the design phase to simulate various transformer configurations, material properties, and operational scenarios, leading to optimized, more efficient, compact, and cost-effective designs that meet specific performance criteria and regulatory standards. AI also enhances quality control in manufacturing.

- Cybersecurity and Resilience: As transformers become smarter and more connected, AI plays a crucial role in monitoring network traffic and operational data for unusual patterns indicative of cyber threats, enhancing the cybersecurity posture of critical power infrastructure and bolstering grid resilience against potential attacks.

- Demand-Side Management and Energy Trading: AI-enabled smart transformers can facilitate more dynamic and responsive demand-side management by adjusting power distribution based on real-time energy prices and consumption patterns, supporting more flexible energy markets and integration with distributed energy resources.

- Resource and Inventory Optimization: AI helps utilities manage their fleet of transformers more effectively, optimizing asset deployment, planning for replacements, and managing spare parts inventory, leading to significant operational cost reductions and improved asset utilization.

- Integration of Renewable Energy: AI facilitates the seamless and stable integration of intermittent renewable energy sources (like solar and wind) into the main grid by optimizing voltage regulation and power factor correction through smart transformers, thereby improving grid stability and reliability under variable generation conditions.

DRO & Impact Forces Of Power Transformer Market

The Power Transformer Market is fundamentally shaped by a robust set of drivers that propel its growth, alongside inherent restraints that temper its expansion, and significant opportunities that promise future evolution, all subject to broader impact forces. A primary driver is the accelerating global demand for electricity, stemming from rapid urbanization, industrial growth, increasing population, and the pervasive digitalization across all sectors. This rising demand necessitates continuous investment in power generation, transmission, and distribution infrastructure, with transformers being indispensable components. Furthermore, the global imperative to transition towards cleaner energy sources is a potent driver; the integration of vast capacities of renewable energy (solar, wind) into national grids requires new and specialized transformers, particularly to manage the intermittent nature of these sources and evacuate power efficiently from often remote generation sites. Extensive government initiatives and private sector investments in grid modernization and expansion, especially in developing economies, further amplify demand, focusing on enhancing grid reliability, efficiency, and capacity.

However, the market's trajectory is also constrained by several factors. The substantial capital expenditure associated with the manufacturing, installation, and commissioning of high-voltage power transformers presents a significant barrier, particularly for utilities operating with constrained budgets. Power transformers are characterized by their exceptionally long operational lifespans, often exceeding 30-40 years, which inherently leads to slower replacement cycles compared to other industrial equipment, thereby limiting recurring demand. Environmental concerns, particularly regarding the use of mineral oil as an insulating medium due to its flammability and potential for ecological contamination, impose stringent regulatory compliance costs and drive the adoption of more expensive, eco-friendly alternatives. Additionally, volatility in raw material prices, specifically for key components like electrical steel, copper, and aluminum, can significantly impact manufacturing costs and project timelines, contributing to market uncertainty. The complex design and engineering requirements, coupled with the need for highly skilled labor, also add to operational challenges.

Despite these restraints, the market is rife with transformative opportunities. The emergence and increasing adoption of smart transformers, equipped with advanced sensors, communication capabilities, and embedded intelligence, represent a major growth avenue. These smart devices facilitate real-time monitoring, predictive maintenance, and seamless integration into smart grids, enhancing operational efficiency and reliability. The global push for high-voltage direct current (HVDC) transmission systems, particularly for long-distance bulk power transfer and connecting isolated grids or offshore renewable energy farms, creates a specialized demand for HVDC converter transformers. Furthermore, the extensive need to replace and refurbish aging power infrastructure in developed economies, much of which is nearing or has exceeded its design life, provides a consistent and substantial market opportunity for advanced, more efficient transformer models. The ongoing research and development into eco-friendly insulating materials, compact designs, and advanced diagnostic technologies offer avenues for product differentiation and competitive advantage. These market dynamics are strongly influenced by overarching impact forces such as evolving regulatory landscapes, global economic conditions, geopolitical stability, and the pace of technological innovation, all collectively shaping the long-term outlook for the power transformer industry.

Segmentation Analysis

The Power Transformer Market is comprehensively segmented across various dimensions to provide a nuanced understanding of its intricate dynamics, catering to diverse operational requirements and application environments. These segmentations are critical for analyzing market size, growth drivers, competitive landscapes, and identifying specific opportunities within specialized niches. The classification by type reflects the fundamental differences in insulation and cooling technologies, while segmentation by rating addresses the capacity requirements for different grid levels. Further distinctions by application, phase, and end-user highlight the varied functional roles power transformers play across the entire energy value chain, from large-scale power generation to local industrial and commercial consumption, thereby enabling stakeholders to develop tailored strategies for different market verticals and geographical regions.

- By Type:

- Liquid-filled Transformers: These include units using mineral oil, natural esters, or synthetic esters for insulation and cooling, primarily employed in high-voltage transmission and large-scale industrial applications due to their superior heat dissipation capabilities.

- Dry-type Transformers: Encompassing cast resin and vacuum pressure impregnated (VPI) transformers, these are typically used in indoor installations, commercial buildings, and sensitive environments where fire safety, minimal maintenance, and environmental concerns are paramount.

- By Rating:

- Small Power Transformers (Up to 10 MVA): Used primarily in distribution networks, industrial facilities, and renewable energy generation sites requiring lower power capacities.

- Medium Power Transformers (10 MVA – 100 MVA): Crucial for sub-transmission networks, larger industrial applications, and stepping down voltage for primary distribution substations.

- Large Power Transformers (Above 100 MVA): Essential for power generation plants (step-up), high-voltage transmission networks, and interconnecting grids, handling massive power loads.

- By Application:

- Power Generation: Transformers used to step up voltage at power plants (thermal, hydro, nuclear, renewable) for efficient long-distance transmission.

- Power Transmission: Units deployed in high-voltage substations to transmit bulk power efficiently across long distances.

- Power Distribution: Transformers that step down voltage from transmission levels to local distribution networks for supply to end-users.

- Industrial: Transformers specifically designed for manufacturing plants, mining operations, oil & gas facilities, and other heavy industries to power machinery and processes.

- Commercial: Transformers used in large commercial buildings, data centers, hospitals, and educational institutions for reliable power supply.

- By Phase:

- Single-Phase Transformers: Typically used for lighter loads, residential applications, and certain specialized industrial equipment.

- Three-Phase Transformers: Predominantly used in industrial and utility applications for power generation, transmission, and distribution due to their efficiency and balanced power delivery.

- By End-User:

- Utilities: Power generation, transmission, and distribution companies that manage the national or regional electricity grids.

- Industrial: Manufacturing, mining, oil & gas, chemical, and other heavy industries requiring robust power solutions.

- Commercial & Residential: Businesses, offices, shopping centers, data centers, and residential complexes requiring reliable power distribution.

- Renewable Energy: Solar farms, wind farms (onshore and offshore), and other renewable energy projects for grid connection and power evacuation.

Value Chain Analysis For Power Transformer Market

The value chain for the Power Transformer Market commences with an extensive upstream segment focused on the sourcing, processing, and supply of critical raw materials and components. This foundational stage involves numerous specialized suppliers providing electrical steel (grain-oriented electrical steel for cores), high-purity copper or aluminum for windings, various insulating materials (such as cellulose paper, pressboard, porcelain, epoxy resins, and synthetic composites), and crucial insulating fluids (mineral oil, natural and synthetic esters, or SF6 gas for specific applications). The quality and consistency of these raw materials directly impact the final transformer's performance, efficiency, and longevity, making robust supplier relationships and quality control paramount. Specialized component manufacturers also supply bushings, tap changers, cooling systems, protection devices, and monitoring equipment, which are integral to a transformer's functionality. This upstream segment is characterized by global sourcing networks and the necessity for adhering to stringent technical specifications and quality standards, forming the bedrock upon which the entire value chain operates.

Following the procurement of materials and components, the value chain moves into the core manufacturing and assembly processes. This midstream segment is dominated by power transformer manufacturers who engage in sophisticated design, engineering, and fabrication. This involves precise core cutting and assembly, winding fabrication, tank construction, insulation application, and the meticulous assembly of all components. Advanced manufacturing techniques, including lean manufacturing and automation, are often employed to ensure precision, efficiency, and scalability. Each transformer undergoes rigorous testing and quality assurance procedures to meet international standards (e.g., IEC, ANSI) and customer-specific requirements for insulation, short-circuit withstand, temperature rise, and efficiency. The manufacturing stage is capital-intensive, requiring significant investment in machinery, R&D, and skilled labor for highly specialized processes, including vacuum drying and oil filling for liquid-filled transformers, or resin casting for dry-type units. Customization is a key aspect, as many large power transformers are built to unique specifications based on voltage, power rating, and specific grid integration needs.

The downstream segment of the value chain focuses on distribution, installation, commissioning, and post-sales services. Distribution channels for power transformers are often bifurcated into direct and indirect routes. Large power transformers, especially for national grid projects, major power plants, or industrial complexes, are typically sold directly from manufacturers to end-users such as national transmission system operators, independent power producers, or large industrial entities. These direct sales usually involve long-term contracts, extensive engineering support, and project management services. Engineering, Procurement, and Construction (EPC) contractors also play a critical role, acting as intermediaries by purchasing transformers from manufacturers and integrating them into larger infrastructure projects. For smaller and medium-sized transformers, indirect channels involving a network of authorized distributors, wholesalers, and system integrators are more common, providing local stock, technical support, and installation services to regional utilities, commercial clients, and smaller industrial players. Post-sales services, including transportation, on-site installation, commissioning, routine maintenance, repairs, retrofitting, and eventual decommissioning and recycling, constitute a vital part of the value chain. These services ensure optimal performance, extend asset life, and build long-term customer relationships, contributing significantly to the overall profitability and sustainability of the power transformer market.

Power Transformer Market Potential Customers

The Power Transformer Market serves a diverse and expansive array of potential customers, all fundamentally reliant on robust and efficient electrical infrastructure for their operations. The most significant segment of buyers comprises electricity utilities, which include national and regional power generation companies, transmission system operators (TSOs), and distribution network operators (DNOs). These entities are responsible for the entire journey of electricity, from its production at power plants to its delivery to homes and businesses. Utilities require a wide spectrum of power transformers, from large step-up transformers at generation facilities to intermediate transformers in transmission substations, and step-down transformers in primary distribution networks. Their purchasing decisions are primarily driven by the need to expand grid capacity, replace aging infrastructure, enhance grid reliability, integrate new renewable energy sources, and comply with evolving energy efficiency and environmental regulations, making them continuous and substantial purchasers in the market.

Beyond traditional utilities, a substantial and growing customer base exists within the industrial sector. Large-scale manufacturing plants, heavy industries such as metallurgy, mining, oil and gas extraction and refining, chemical processing facilities, and pulp and paper mills are critical consumers of power transformers. These industrial operations require reliable and appropriately rated transformers to step down high-voltage grid electricity to the specific voltage levels required by their heavy machinery, motors, and internal power distribution systems. For these customers, uninterrupted power supply and operational efficiency are paramount, as any power disruption can lead to significant production losses and safety concerns. The demand from the industrial segment is directly influenced by overall economic growth, industrial expansion, and technological advancements that require more sophisticated power management solutions. Additionally, the proliferation of large data centers, which are massive consumers of electricity, represents another key industrial customer group, requiring highly reliable and efficient transformers to ensure continuous operation of their critical IT infrastructure.

Other significant potential customers include the commercial and public infrastructure sectors. Large commercial establishments, such as extensive office complexes, shopping malls, hospitals, hotels, and educational institutions, require robust power transformer solutions to manage their substantial electricity loads for lighting, HVAC systems, and various electronic equipment. Furthermore, infrastructure development projects, including urban rail networks, metropolitan rapid transit systems, and large-scale public facilities, often incorporate specialized power transformers for their operational needs. The increasing focus on smart city development and decentralized energy systems, including microgrids, also broadens the customer base, as these innovative energy architectures necessitate integrated transformer solutions for local power generation, storage, and distribution. Finally, the renewable energy sector, encompassing large-scale solar farms, onshore and offshore wind farms, and hydroelectric projects, represents a rapidly expanding customer segment. These projects critically depend on power transformers to efficiently connect their generated power to the national grid and manage voltage fluctuations inherent in renewable energy sources, underscoring the universal and indispensable nature of power transformers across the modern global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $48.72 billion |

| Market Forecast in 2032 | $77.85 billion |

| Growth Rate | 6.75% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy AG, General Electric Company, Eaton Corporation, Toshiba Corporation, Mitsubishi Electric Corporation, Hitachi Energy Ltd., Schneider Electric SE, Bharat Heavy Electricals Limited (BHEL), Crompton Greaves Power and Industrial Solutions Limited, Hyosung Heavy Industries, SPX Transformer Solutions, Wilson Power Solutions, WEG S.A., Shandong Juli Electric Power Technology Co. Ltd., Prolec GE, Fuji Electric Co. Ltd., TBEA Co. Ltd., ERMCO, Hyundai Electric & Energy Systems Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Power Transformer Market Key Technology Landscape

The Power Transformer Market is undergoing a profound technological evolution, driven by the pressing need for enhanced grid reliability, energy efficiency, and environmental sustainability. A cornerstone of this evolution is the development and widespread adoption of smart transformers, which represent a paradigm shift from traditional passive components to active, intelligent grid assets. These advanced units integrate sophisticated sensors, advanced communication modules, and embedded processing capabilities that enable real-time monitoring of critical operational parameters such as temperature, voltage, current, and insulation health. This continuous data collection allows for comprehensive condition monitoring and precise diagnostics, facilitating proactive and predictive maintenance strategies that significantly reduce unplanned downtime, extend asset lifespan, and optimize operational efficiency. The integration of Internet of Things (IoT) technologies further enhances the capabilities of smart transformers, allowing for seamless data exchange with grid control centers and other smart grid components, enabling dynamic voltage regulation and adaptive power flow management crucial for modern, complex electrical networks.

Another pivotal technological advancement lies in the continuous innovation in materials science and transformer design. The introduction of amorphous core transformers, utilizing amorphous metals in their core construction, has been instrumental in significantly reducing no-load losses (core losses) compared to traditional silicon steel cores. This reduction in energy waste translates directly into higher energy efficiency, lower operational costs, and reduced carbon footprint, aligning with global sustainability goals. Furthermore, the industry is witnessing a strong push towards eco-friendly insulating fluids, moving away from conventional mineral oil to biodegradable alternatives such as natural and synthetic esters. These ester fluids offer improved fire safety characteristics, higher flash points, better environmental compatibility, and in some cases, superior moisture tolerance, mitigating environmental risks and enhancing the safety profile of transformer installations, particularly in urban areas and sensitive ecosystems. Efforts are also underway to develop more compact and lightweight transformer designs, often employing advanced insulation systems and optimized cooling techniques, which are particularly beneficial for urban substations where space is a premium, and for challenging transportation and installation scenarios.

Moreover, the technological landscape is heavily influenced by the increasing prominence of High-Voltage Direct Current (HVDC) transmission systems, particularly for long-distance bulk power transfer and the efficient integration of remote renewable energy sources. This trend drives the demand for highly specialized HVDC converter transformers, which are designed to handle the unique challenges of converting AC to DC and back, enduring specific harmonic stresses and transient conditions. These transformers are critical for enabling inter-regional grid connections and enhancing grid stability over vast geographical areas. Advanced diagnostic techniques, including online partial discharge monitoring, dissolved gas analysis (DGA) with intelligent interpretation, and fiber optic temperature sensing, are becoming standard practices, leveraging sophisticated analytics and machine learning algorithms to assess transformer health accurately and predict potential failures with greater precision. These innovations collectively ensure that power transformers remain at the forefront of grid modernization, contributing to a more resilient, efficient, and sustainable global energy infrastructure capable of meeting future electricity demands.

Regional Highlights

- North America: This region is characterized by substantial investments in upgrading and modernizing aging grid infrastructure, with a significant focus on improving reliability and integrating digital technologies. Key drivers include government initiatives aimed at grid resilience, the expansion of renewable energy capacity (solar, wind), and the development of smart grid solutions across the United States and Canada. Demand for advanced, high-efficiency, and smart transformers is particularly robust as utilities replace older units and build new capacity.

- Europe: Europe demonstrates a strong market driven by ambitious decarbonization targets, extensive renewable energy integration (especially offshore wind), and the need to replace a large installed base of end-of-life transformers. Countries like Germany, the United Kingdom, France, and Italy are investing heavily in grid interconnections and the development of HVDC lines to support cross-border energy trading and the evacuation of power from remote renewable generation sites, creating consistent demand for specialized and high-capacity transformers.

- Asia Pacific (APAC): This region undeniably dominates the global power transformer market, experiencing unparalleled growth fueled by rapid industrialization, massive urbanization, and extensive electrification projects in populous economies such as China, India, and Southeast Asian nations. Enormous investments in new power generation capacity, the expansion of vast transmission and distribution networks, and the burgeoning manufacturing sector are driving unprecedented demand for a full range of power transformers, from small distribution units to ultra-high voltage transmission transformers.

- Latin America: The Latin American market is exhibiting steady growth, primarily driven by ongoing infrastructure development, increasing electricity access initiatives in underserved areas, and the exploitation of diverse natural resources. Countries like Brazil, Mexico, and Chile are investing in expanding and upgrading their transmission and distribution grids to meet rising energy consumption, support industrial expansion, and integrate renewable energy projects, particularly hydroelectric and solar power.

- Middle East and Africa (MEA): This region is marked by significant investments in large-scale oil and gas infrastructure projects, ambitious renewable energy developments (especially solar power in the GCC countries), and extensive electrification programs aimed at increasing energy access and reliability. Gulf Cooperation Council (GCC) nations are actively modernizing their grids and building new capacity to support economic diversification, while African countries are focusing on expanding their transmission and distribution networks, creating substantial opportunities for power transformer deployment and related services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Transformer Market.- ABB Ltd.

- Siemens Energy AG

- General Electric Company

- Eaton Corporation

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Hitachi Energy Ltd.

- Schneider Electric SE

- Bharat Heavy Electricals Limited (BHEL)

- Crompton Greaves Power and Industrial Solutions Limited

- Hyosung Heavy Industries

- SPX Transformer Solutions

- Wilson Power Solutions

- WEG S.A.

- Shandong Juli Electric Power Technology Co. Ltd.

- Prolec GE

- Fuji Electric Co. Ltd.

- TBEA Co. Ltd.

- ERMCO

- Hyundai Electric & Energy Systems Co. Ltd.

Frequently Asked Questions

What is a power transformer and why is it essential for electricity grids?

A power transformer is a crucial static electrical device used to transfer electrical energy between two or more circuits, changing voltage and current levels without altering frequency. It is essential because it enables efficient long-distance power transmission at high voltages to minimize losses, then steps down voltage for safe distribution and consumption. Without transformers, modern electricity grids would be inefficient, unstable, and unable to deliver power effectively from generation sources to diverse end-users.

How is grid modernization impacting the demand for power transformers globally?

Grid modernization is a primary driver for power transformer demand. It necessitates the replacement of aging infrastructure with more efficient, reliable, and intelligent transformers capable of integrating into smart grids. This includes supporting renewable energy sources, enhancing grid resilience against disruptions, enabling real-time monitoring and control, and optimizing power flow, leading to increased demand for advanced and digitally-enabled transformer solutions.

What are the key technological advancements transforming the power transformer market?

Key technological advancements include the development of smart transformers with integrated sensors, IoT capabilities, and advanced analytics for predictive maintenance and optimized grid management. Other significant innovations encompass eco-friendly insulating fluids, amorphous core transformers for higher energy efficiency, compact and lightweight designs, and specialized transformers for High-Voltage Direct Current (HVDC) transmission to support modern grid requirements.

What are the primary environmental concerns associated with traditional power transformers and how is the industry addressing them?

The main environmental concerns stem from the use of mineral oil as an insulating and cooling medium, which poses risks of leaks, fire hazards, and potential soil/water contamination if not properly managed. The industry is addressing these concerns by developing and adopting biodegradable insulating fluids like natural and synthetic esters, improving recycling and disposal practices for old transformers, and focusing on more efficient designs to reduce energy losses and carbon footprint.

Which geographical regions are expected to lead the growth in the global power transformer market and why?

The Asia Pacific region is expected to lead global growth due to rapid industrialization, extensive urbanization, and massive investments in power infrastructure expansion, particularly in countries like China and India. North America and Europe will also contribute significantly through ongoing grid modernization, replacement of aging infrastructure, and robust integration of renewable energy sources into their respective grids, driving demand for advanced and efficient power transformer technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electrical Power Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Berry Core Power Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Dry Type High Voltage Power Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Auto Transformer Power Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Two Winding Power Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager