Syrup Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429668 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Syrup Market Size

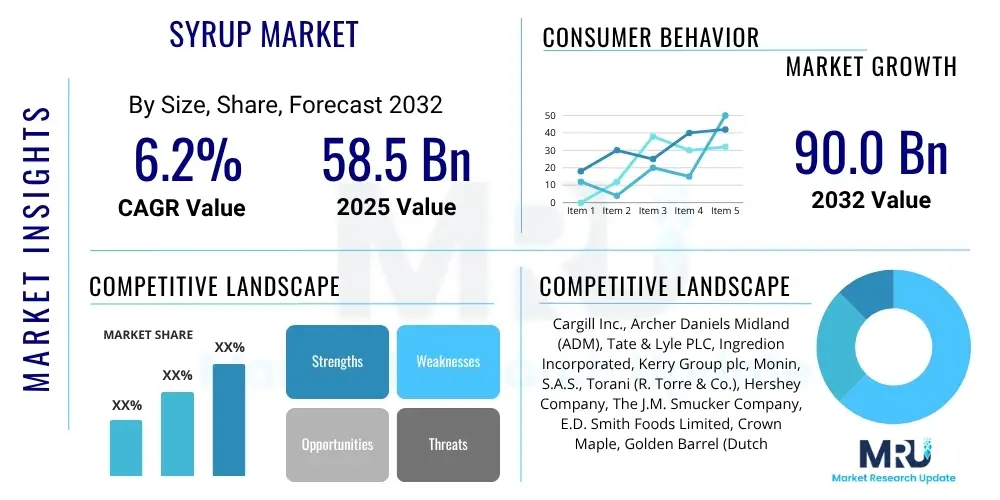

The Syrup Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. The market is estimated at USD 58.5 Billion in 2025 and is projected to reach USD 90.0 Billion by the end of the forecast period in 2032.

Syrup Market introduction

The global syrup market encompasses a wide array of viscous liquid solutions primarily composed of sugar dissolved in water, often enhanced with natural or artificial flavorings and colors. These versatile products serve as sweetening agents, flavor enhancers, and textural components across numerous industries. Syrups vary significantly in their composition, ranging from traditional sugar-based formulations like maple syrup and corn syrup to more specialized variants such as fruit syrups, chocolate syrups, and medicinal syrups, each serving distinct functional and sensory purposes.

Major applications of syrups span the food and beverage sector, pharmaceuticals, and even some cosmetic formulations. In food and beverages, they are indispensable for sweetening drinks, confectioneries, baked goods, dairy products, and savory dishes, providing not only sweetness but also moisture retention, mouthfeel, and preservation. Pharmaceutical industries utilize syrups as palatable vehicles for drug delivery, masking bitter tastes and ensuring consistent dosage. The inherent benefits of syrups include their long shelf life, ease of incorporation into various products, and their ability to impart specific flavors and textures consistently. Key driving factors propelling market growth include evolving consumer preferences for convenience foods and beverages, the increasing demand for diverse flavor profiles, and the growing application in the booming food service industry globally.

Syrup Market Executive Summary

The syrup market is undergoing dynamic shifts, driven by a confluence of evolving business strategies, regional economic developments, and distinct segment trends. Key business trends include a heightened focus on product innovation, with manufacturers investing in new flavor combinations, reduced-sugar options, and natural or organic formulations to cater to health-conscious consumers. Strategic mergers and acquisitions are also prominent as companies seek to consolidate market share, expand product portfolios, and enhance their supply chain efficiencies. Furthermore, the rise of e-commerce channels has significantly broadened market access, allowing smaller brands to compete and offering consumers greater product variety and convenience.

Regional trends indicate robust growth in emerging economies, particularly across the Asia Pacific (APAC) region, fueled by rising disposable incomes, urbanization, and the Westernization of dietary habits. North America and Europe, while mature markets, continue to demonstrate strong demand for premium, specialty, and functional syrups, alongside a persistent trend towards cleaner labels and sustainable sourcing. Latin America and the Middle East and Africa (MEA) are also experiencing steady expansion, driven by increasing industrial application in food processing and beverage manufacturing. Within segments, the natural and organic syrup categories are witnessing accelerated growth as consumers prioritize perceived healthier and less processed alternatives. There is also a notable surge in demand for specialized syrups tailored for specific dietary requirements, such as gluten-free or keto-friendly options, reflecting a broader consumer movement towards personalized nutrition and wellness. This segmentation also highlights the consistent growth of flavor-focused syrups for coffee, cocktails, and culinary uses, underpinning the market's adaptability and responsiveness to consumer desires.

AI Impact Analysis on Syrup Market

Common user inquiries concerning AI's influence on the syrup market frequently revolve around how artificial intelligence can optimize production processes, improve supply chain predictability, enable personalized product development, and enhance quality assurance. Users express curiosity about AI's role in mitigating raw material price volatility, forecasting consumer demand more accurately, and fostering innovation in flavor creation. The overarching themes reflect expectations for AI to drive efficiency, sustainability, and consumer-centric product offerings within the syrup industry.

AI's analytical capabilities offer transformative potential for the syrup market, enabling manufacturers to move beyond traditional operational methodologies. Through advanced machine learning algorithms, companies can analyze vast datasets pertaining to consumer preferences, sales patterns, and ingredient performance, leading to more informed product development and marketing strategies. This predictive power extends to optimizing inventory management and reducing waste, thereby enhancing profitability and resource efficiency across the value chain. Moreover, AI-driven automation in processing plants can ensure consistent product quality, minimize human error, and streamline complex manufacturing tasks, contributing to higher output and operational excellence.

- Enhanced demand forecasting and supply chain optimization using predictive analytics.

- AI-driven precision agriculture for raw material sourcing, improving yield and sustainability.

- Automated quality control and sensory analysis for consistent syrup properties.

- Accelerated new product development through AI-assisted flavor combination and ingredient formulation.

- Personalized syrup recommendations and custom blending options based on consumer data.

- Optimization of energy consumption and waste reduction in manufacturing processes.

- Predictive maintenance for production equipment, minimizing downtime and costs.

DRO & Impact Forces Of Syrup Market

The syrup market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the burgeoning consumer demand for diversified flavor profiles and convenient food and beverage solutions, which positions syrups as essential ingredients for enhancing taste and simplifying preparation. The rapid expansion of the food service sector, including cafes, restaurants, and bakeries, further fuels this demand as syrups are integral to their menu offerings. Moreover, the increasing adoption of natural and organic ingredients, alongside the rising preference for plant-based diets, creates a strong impetus for manufacturers to innovate and expand their natural syrup portfolios. The versatility of syrups in various culinary applications, from beverages to desserts, also consistently drives their market penetration across both retail and industrial segments.

However, the market faces considerable restraints, predominantly health concerns associated with high sugar intake, which has led to a push for reduced-sugar or sugar-free alternatives and increased scrutiny from public health organizations. Regulatory complexities regarding labeling, ingredient sourcing, and nutritional claims pose challenges for manufacturers navigating diverse international markets. Fluctuations in raw material prices, particularly for sugar, fruits, and corn, can significantly impact production costs and profit margins. Additionally, intense competition from artificial sweeteners and emerging natural sweeteners presents an ongoing challenge for traditional syrup products. External impact forces, such as changing consumer lifestyles, technological advancements in food processing, and geopolitical factors affecting trade, further shape the market landscape.

Despite these restraints, significant opportunities exist for market growth. The expansion into emerging economies offers untapped consumer bases and industrial demand. The development of functional syrups fortified with vitamins, minerals, or probiotics, as well as personalized nutrition solutions, presents avenues for innovation and premiumization. Sustainable sourcing practices and eco-friendly packaging initiatives resonate strongly with environmentally conscious consumers and offer a competitive advantage. The continued growth of e-commerce platforms provides an efficient distribution channel, enhancing market reach and consumer engagement. Furthermore, strategic collaborations with food technologists and flavor houses can unlock novel product formulations that cater to evolving dietary trends and preferences, ensuring long-term market vitality.

Segmentation Analysis

The syrup market is broadly segmented to reflect the diverse product offerings, applications, and consumer preferences that characterize this expansive industry. Understanding these segments is crucial for market participants to identify niche opportunities, tailor product development, and refine marketing strategies. Segmentation allows for a granular view of market dynamics, revealing specific areas of growth and potential challenges across different product types, end-users, and distribution channels. This analytical approach helps in comprehending consumer behavior patterns and the varying demands of industrial clients, thereby enabling more targeted market penetration and competitive positioning. The categorization provides a structured framework for assessing market share, forecasting future trends, and allocating resources effectively to capitalize on the most promising market avenues.

- By Type

- Fruit Syrup (e.g., Strawberry, Raspberry, Mango, Orange)

- Maple Syrup

- Corn Syrup (e.g., High-Fructose Corn Syrup, Light Corn Syrup)

- Chocolate Syrup

- Medicinal Syrup (e.g., Cough Syrups, Vitamin Syrups)

- Artificial Sweetener Syrups (e.g., Stevia-based, Erythritol-based)

- Simple Syrup

- Flavored Syrups (e.g., Vanilla, Caramel, Hazelnut, Coffee)

- Specialty Syrups (e.g., Agave Nectar, Rice Syrup, Date Syrup)

- By Application

- Food and Beverage Industry

- Beverages (e.g., Soft Drinks, Juices, Cocktails, Coffee, Tea)

- Dairy Products (e.g., Yogurts, Ice Creams, Milkshakes)

- Confectionery and Bakery (e.g., Cakes, Pastries, Candies, Desserts)

- Sauces and Dressings

- Processed Foods

- Pharmaceutical Industry

- Cosmetics and Personal Care

- Other Industrial Applications

- Food and Beverage Industry

- By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Food Service (B2B)

- Direct Sales

- By Nature

- Natural

- Artificial

- Organic

Value Chain Analysis For Syrup Market

The value chain for the syrup market commences with upstream activities centered around the sourcing and processing of raw materials. This critical stage involves agricultural cultivation and harvesting of key ingredients such as sugar cane, corn, various fruits, maple sap, and other natural botanicals, depending on the type of syrup being produced. Suppliers of industrial sweeteners, flavorings, and preservatives also form an integral part of this upstream segment. Efficient procurement, quality control of raw ingredients, and initial processing steps like juice extraction or sap collection are vital to ensure the quality and consistency of the final syrup product, influencing production costs and overall market competitiveness.

Moving downstream, the value chain encompasses manufacturing, packaging, and distribution. The manufacturing process involves various stages, including filtration, evaporation, blending, pasteurization, and sterilization, to achieve the desired concentration, viscosity, and shelf stability. Advanced technologies are employed to maintain hygiene standards and preserve the sensory attributes of the syrups. Following production, packaging materials are sourced, and the syrups are packaged in various formats, from bulk containers for industrial clients to retail-ready bottles and sachets for consumers. Effective logistics and inventory management are then crucial for transporting these finished products to market, preventing spoilage and ensuring timely delivery.

Distribution channels play a pivotal role in connecting syrup manufacturers with their diverse customer base. Direct distribution involves manufacturers selling directly to large industrial clients, such as beverage companies, bakeries, or pharmaceutical firms, often through B2B contracts. Indirect distribution channels encompass sales through wholesalers, distributors, and ultimately to various retail formats like supermarkets, hypermarkets, convenience stores, and specialty food outlets. The rapid expansion of e-commerce platforms has also created a significant indirect channel, allowing manufacturers to reach a broader consumer base directly and through online marketplaces. The effectiveness of these channels is key to market penetration, brand visibility, and consumer accessibility, dictating the ultimate success of syrup products in a competitive landscape.

Syrup Market Potential Customers

Potential customers for the syrup market are incredibly diverse, spanning across various industries and consumer segments, reflecting the versatile applications of these products. At the industrial level, the largest buyers are typically food and beverage manufacturers who utilize syrups as essential ingredients in the production of soft drinks, juices, alcoholic beverages, dairy products like yogurts and ice creams, and a wide array of confectionery and bakery items. These manufacturers rely on syrups for sweetening, flavoring, moisture retention, and texture modification in their end products, often requiring bulk quantities and consistent specifications.

Another significant segment of industrial customers includes the rapidly growing food service sector, comprising restaurants, cafes, hotels, catering companies, and quick-service establishments. These businesses use syrups extensively for flavoring coffee, cocktails, milkshakes, pancakes, waffles, and various desserts, serving directly to consumers. Furthermore, pharmaceutical companies constitute a vital customer base, employing syrups as excipients to formulate palatable liquid medications, particularly for pediatric and geriatric patients, where taste masking and ease of administration are paramount.

Beyond industrial applications, the retail sector caters directly to household consumers. Supermarkets, hypermarkets, convenience stores, and online retailers provide a broad selection of syrups for home use, including those for breakfast items, baking, homemade beverages, and general culinary purposes. Specialty food stores and organic markets also serve a niche of consumers seeking premium, artisanal, or health-conscious syrup options, such as organic maple syrup or natural fruit concentrates. The evolving preferences of these end-users, driven by health trends, dietary restrictions, and convenience, continuously shape the demand landscape for syrup manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 58.5 Billion |

| Market Forecast in 2032 | USD 90.0 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Inc., Archer Daniels Midland (ADM), Tate & Lyle PLC, Ingredion Incorporated, Kerry Group plc, Monin, S.A.S., Torani (R. Torre & Co.), Hershey Company, The J.M. Smucker Company, E.D. Smith Foods Limited, Crown Maple, Golden Barrel (Dutch Gold Honey), Louis Dreyfus Company B.V., Sensient Technologies Corporation, Givaudan SA, International Flavors & Fragrances Inc. (IFF), Firmenich SA, Barry Callebaut AG, AGRANA Beteiligungs-AG, ADM Corn Processing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Syrup Market Key Technology Landscape

The syrup market's technological landscape is continually evolving to meet demands for higher quality, increased efficiency, and enhanced product innovation. Advanced processing techniques are at the forefront, including sophisticated filtration systems such as ultrafiltration and microfiltration, which ensure purity and clarity, especially for natural and fruit-based syrups. Vacuum evaporation technology is widely utilized to concentrate syrups at lower temperatures, preserving delicate flavors and nutritional compounds that might be degraded by traditional high-heat methods. These technologies are crucial for producing premium syrups with superior sensory attributes and extended shelf life.

Automation and smart manufacturing are transforming syrup production facilities. Robotic systems are increasingly deployed for precise ingredient dosing, blending, and packaging, minimizing human error and increasing throughput. Quality control is significantly enhanced by technologies like spectrophotometry and chromatography, which provide rapid and accurate analysis of sugar content, pH levels, viscosity, and potential contaminants, ensuring consistent product quality batch after batch. Furthermore, innovative packaging solutions, including aseptic filling and sustainable materials, are being adopted to extend shelf life without compromising product integrity and to meet growing consumer demand for eco-friendly options.

Beyond production, emerging technologies such as flavor encapsulation and microencapsulation are enabling the creation of novel syrup products with prolonged flavor release or enhanced stability of sensitive ingredients. In research and development, artificial intelligence and machine learning algorithms are being employed to analyze vast datasets of consumer preferences, ingredient interactions, and processing parameters. This allows for accelerated new product development, optimized formulation, and predictive analysis of market trends, empowering manufacturers to create highly targeted and innovative syrup solutions that resonate with specific consumer segments and dietary trends.

Regional Highlights

The global syrup market exhibits distinct regional dynamics driven by varying consumer preferences, economic developments, and industrial applications. North America stands as a dominant region, characterized by high consumption of traditional syrups like maple and corn syrup, as well as a robust demand for flavored syrups in the beverage and food service sectors. The region benefits from established food processing industries and a culture of convenience, leading to continuous innovation in product offerings and packaging. Consumer trends here are increasingly leaning towards natural, organic, and reduced-sugar options, driving manufacturers to adapt their product lines and explore alternative sweeteners. The presence of major market players and strong distribution networks further solidifies North America's leading position.

Europe represents another significant market, where consumer demand is strongly influenced by health consciousness and a preference for premium, high-quality ingredients. There is a growing inclination towards organic, sustainably sourced, and clean-label syrups, particularly in countries like Germany, the UK, and France. The region also showcases a strong artisanal syrup segment, catering to gourmet culinary applications and specialty beverage markets. Regulatory frameworks regarding sugar content and labeling are stringent, prompting manufacturers to invest in research and development for healthier alternatives and transparent ingredient declarations. The European food and beverage industry's focus on innovation and product diversification continues to propel market growth across various syrup categories.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, primarily due to rapid urbanization, rising disposable incomes, and the Westernization of dietary patterns. Countries like China, India, and Japan are experiencing a surge in demand for processed foods and beverages, where syrups are extensively used. The expanding food service industry, particularly the proliferation of cafes and fast-food chains, is also a key driver. While traditional local sweeteners remain popular, there is a burgeoning market for international flavored syrups, particularly in coffee and dessert applications. Latin America and the Middle East and Africa (MEA) are emerging markets, characterized by increasing industrialization and a growing demand for packaged food products. These regions present significant opportunities for market expansion, though they may face challenges related to infrastructure, local sourcing capabilities, and economic volatility. Each region offers unique opportunities for market players to tailor their product strategies and capture specific consumer segments.

- North America: High consumption, established food service, strong demand for natural and specialty syrups.

- Europe: Health-conscious consumers, emphasis on organic and clean-label products, strong artisanal market.

- Asia Pacific (APAC): Rapid growth, urbanization, increasing disposable income, expanding food and beverage industry.

- Latin America: Growing industrial use, demand for local flavors, increasing adoption of processed foods.

- Middle East and Africa (MEA): Emerging market, reliance on imports, developing food processing sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Syrup Market.- Cargill Inc.

- Archer Daniels Midland (ADM)

- Tate & Lyle PLC

- Ingredion Incorporated

- Kerry Group plc

- Monin, S.A.S.

- Torani (R. Torre & Co.)

- Hershey Company

- The J.M. Smucker Company

- E.D. Smith Foods Limited

- Crown Maple

- Golden Barrel (Dutch Gold Honey)

- Louis Dreyfus Company B.V.

- Sensient Technologies Corporation

- Givaudan SA

- International Flavors & Fragrances Inc. (IFF)

- Firmenich SA

- Barry Callebaut AG

- AGRANA Beteiligungs-AG

- ADM Corn Processing

Frequently Asked Questions

What are the primary factors driving the growth of the syrup market?

The syrup market's growth is primarily driven by increasing consumer demand for diverse flavor profiles, the rising popularity of convenience foods and beverages, the expansion of the food service industry, and a growing inclination towards natural and organic ingredients in various applications.

How do health trends impact the syrup market?

Health trends significantly influence the syrup market, leading to a surge in demand for reduced-sugar, sugar-free, and natural sweetener-based syrups. Manufacturers are innovating to offer healthier alternatives, functional syrups with added nutrients, and products that align with specific dietary restrictions to cater to health-conscious consumers.

Which geographical region is expected to show the fastest growth in the syrup market?

The Asia Pacific (APAC) region is projected to experience the fastest growth in the syrup market. This acceleration is fueled by factors such as rapid urbanization, increasing disposable incomes, the Westernization of dietary habits, and the robust expansion of the food and beverage industry across key countries like China and India.

What role does technology play in the modern syrup industry?

Technology plays a crucial role in the modern syrup industry by enabling advanced processing techniques for quality and flavor preservation, automating production for efficiency, enhancing quality control through precise analysis, and facilitating innovative product development with AI-driven insights and flavor encapsulation.

What are the key segments within the syrup market?

Key segments in the syrup market include segmentation by type (e.g., fruit, maple, corn, chocolate, medicinal), by application (food and beverage, pharmaceuticals, cosmetics), by distribution channel (retail, online, food service), and by nature (natural, artificial, organic), each reflecting distinct market dynamics and consumer preferences.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Malt Corn Syrup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Banana Syrup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Sugar Syrup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Date Syrup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Coffee Syrup Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager