Polyester Filament Yarn Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431378 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Polyester Filament Yarn Market Size

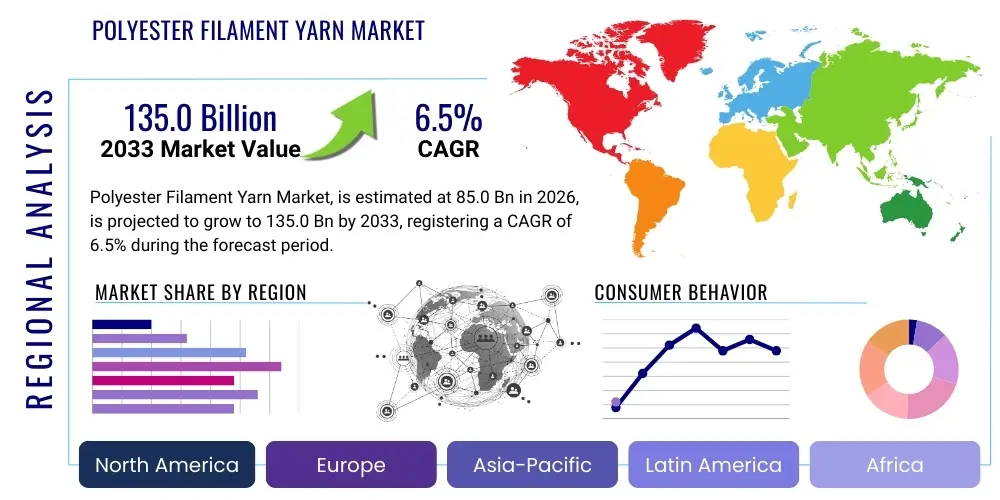

The Polyester Filament Yarn Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 52.5 Billion in 2026 and is projected to reach USD 77.8 Billion by the end of the forecast period in 2033.

Polyester Filament Yarn Market introduction

Polyester Filament Yarn (PFY) is a synthetic yarn derived primarily from polyethylene terephthalate (PET), a petroleum derivative. It is characterized by its high strength, wrinkle resistance, durability, and excellent dimensional stability, making it a foundational material in the modern textile industry. PFY is produced through a process of extrusion and drawing, resulting in continuous filaments that can be textured, twisted, or finished into various forms such as Partially Oriented Yarn (POY), Drawn Textured Yarn (DTY), Fully Drawn Yarn (FDY), and Air Textured Yarn (ATY). The versatility of PFY allows it to be used across a broad spectrum of applications, ranging from basic apparel to highly specialized technical textiles.

The principal applications of PFY lie within the fashion and clothing sector, home furnishings, and industrial usage. In apparel, it is valued for its ability to mimic natural fibers while offering superior performance characteristics like moisture-wicking and quick-drying properties. The increasing global population, coupled with rising disposable incomes in emerging economies, particularly in the Asia Pacific region, fuels the constant demand for clothing and textiles, directly driving the consumption of PFY. Furthermore, rapid urbanization necessitates increased production of home textiles such including carpets, upholstery, and drapes, further bolstering market expansion.

The market growth is significantly driven by continuous technological advancements in manufacturing processes, leading to the creation of differentiated yarns such as microfilaments, specialty yarns, and recycled polyester yarns (RPET). These innovations improve the aesthetic and functional properties of the final products, meeting the sophisticated demands of modern consumers. Key benefits of PFY, such as its cost-effectiveness compared to natural fibers, color fastness, and high tensile strength, cement its position as the preferred synthetic fiber globally. The stability of supply chains and the scalability of production capacity in major manufacturing hubs also serve as core driving factors for the overall market trajectory.

Polyester Filament Yarn Market Executive Summary

The Polyester Filament Yarn (PFY) market demonstrates robust growth, primarily propelled by burgeoning demand from the textile and non-woven industries across Asia Pacific. Business trends indicate a strong shift towards sustainability, with manufacturers increasingly investing in recycled polyester (rPET) production technologies to meet corporate social responsibility goals and consumer preference for eco-friendly products. Vertical integration remains a critical business strategy, allowing major players to control raw material sourcing (PTA and MEG) and ensuring stable profit margins despite volatile crude oil prices. Moreover, the focus on technical textiles, which require high-performance PFY variants for automotive, construction, and medical applications, is opening premium pricing opportunities for specialized yarn producers.

Regionally, Asia Pacific, dominated by China, India, and Southeast Asian countries, stands as the unrivaled production and consumption hub, accounting for the largest market share due to established textile manufacturing infrastructure and massive domestic populations. North America and Europe, while slower in production volume growth, exhibit high demand for premium and specialty PFY, particularly those used in functional sportswear and sophisticated home furnishings. Regional trends also show stringent regulatory pressure in Western markets concerning chemical use and environmental impact, prompting innovation in dope-dyed and low-water-consumption processing technologies.

Segment trends reveal that Drawn Textured Yarn (DTY) retains the largest market share due to its versatility in blending and bulkiness, making it ideal for apparel and home textiles. However, the Fully Drawn Yarn (FDY) segment is experiencing rapid growth, driven by its high speed of processing and suitability for lightweight fabrics. The segmentation by application highlights apparel as the dominant category, yet the industrial and non-woven segment is expanding significantly, reflecting global investments in infrastructure and hygiene products. Overall, the market remains highly competitive, characterized by high capacity utilization and a continuous effort to optimize efficiency and product differentiation.

AI Impact Analysis on Polyester Filament Yarn Market

User queries regarding AI in the Polyester Filament Yarn (PFY) market often center on optimizing production efficiency, predictive maintenance, and enhancing supply chain resilience. Key themes include how AI can mitigate the volatility associated with raw material (PTA/MEG) pricing by improving demand forecasting accuracy, and whether machine learning algorithms can refine the polymerization and spinning processes to reduce defects and energy consumption. Users also express interest in AI's role in developing smart textiles, analyzing consumer trends for fashion forecasting, and automating quality control checks, ultimately seeking to understand the quantitative benefits—specifically, reduction in waste and increase in yield—that AI integration can deliver across the value chain, from polymerization to final textile manufacture.

- AI-driven optimization of polymerization kinetics and spinning parameters to minimize batch-to-batch variations and enhance yarn uniformity.

- Predictive maintenance systems utilizing sensor data to anticipate equipment failures in extruders and winders, drastically reducing unplanned downtime.

- Advanced demand forecasting models integrated with global textile order databases to optimize inventory levels of various PFY types (POY, DTY, FDY).

- Automated optical inspection systems powered by deep learning for high-speed, accurate detection of yarn defects such as broken filaments or denier variations.

- Optimization of energy consumption and utility usage in energy-intensive processes like drawing and texturing through AI-based control algorithms.

- Streamlining supply chain logistics and reducing transportation costs by predicting optimal routing and warehouse management for raw materials and finished goods.

- Development of smart textiles by integrating AI into material science, enabling yarns with adaptive properties (e.g., temperature regulation).

DRO & Impact Forces Of Polyester Filament Yarn Market

The dynamics of the Polyester Filament Yarn (PFY) market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and investment decisions. The primary driver is the persistently high demand from the fast-growing global apparel industry, particularly the rise of fast fashion and athleisure wear, which heavily rely on durable and cost-effective polyester fibers. Opportunities lie predominantly in technological innovation, focusing on the development of recycled and bio-based polyester yarns, aligning with global mandates for environmental sustainability. However, the market faces significant restraints, chiefly the volatility and dependence on crude oil prices, which directly influence the cost of key raw materials, Paraxylene (PX), Purified Terephthalic Acid (PTA), and Monoethylene Glycol (MEG).

The key drivers propelling the market include favorable demographics, such as a growing middle class in Asia Pacific with higher purchasing power for consumer goods, including textiles and home furnishings. Furthermore, the functional superiority of PFY over natural fibers in terms of resistance to stretching, shrinking, and chemical damage ensures its widespread adoption in industrial applications like conveyor belts, tire cords, and safety nets. This robust demand base creates a positive feedback loop, encouraging manufacturers to invest in expanding capacity and modernizing production lines to achieve economies of scale.

Impact forces currently shaping the market include strict environmental regulations, particularly in developed economies, pushing manufacturers towards circular economy models and forcing rapid adoption of Recycled PFY (RPFY). Competitive pricing pressure, especially from large-scale manufacturers in China, acts as a downward force on margins for smaller regional players. Geopolitical instability and trade wars occasionally disrupt the complex global supply chain for PFY, compelling companies to diversify sourcing strategies and production locations. Successfully navigating these impact forces requires strategic sourcing, technological differentiation, and a strong commitment to sustainable manufacturing practices.

Segmentation Analysis

The Polyester Filament Yarn market is highly segmented based on product type, processing technique, color, and end-use application, providing a granular view of market dynamics and consumer preferences. The product type segmentation (POY, DTY, FDY, ATY) reflects the different stages of processing and the final physical properties desired, dictating the suitability for specific textile uses. Geographically, the market is analyzed across major regions, recognizing the concentration of both production capacity and consumption demand in distinct areas. Understanding these segmentations is vital for manufacturers planning investment strategies and for retailers customizing their sourcing based on technical specifications and cost efficiency.

- By Product Type:

- Partially Oriented Yarn (POY)

- Drawn Textured Yarn (DTY)

- Fully Drawn Yarn (FDY)

- Air Textured Yarn (ATY)

- Polyester Monofilament Yarn (PFY)

- By Application:

- Apparel (Clothing and Fashion)

- Home Textiles (Bedding, Curtains, Upholstery)

- Industrial Textiles (Safety Belts, Conveyor Belts, Ropes)

- Technical Textiles (Automotive, Filtration, Medical)

- By Color:

- Conventional (Raw White)

- Dope Dyed/Color-Dyed

- By Denier/Luster:

- Semi-Dull

- Bright

- Full Dull

- By Raw Material Source:

- Virgin Polyester

- Recycled Polyester (RPET)

- Bio-Based Polyester

Value Chain Analysis For Polyester Filament Yarn Market

The Polyester Filament Yarn value chain is a complex, capital-intensive structure starting with petrochemical feedstock and culminating in finished textile products. Upstream analysis begins with the crude oil and natural gas sector, which supplies the basic petrochemicals needed to produce Paraxylene (PX), Purified Terephthalic Acid (PTA), and Monoethylene Glycol (MEG). These raw material producers have significant leverage due to the cyclical nature of commodity pricing and the high capital required for large-scale production facilities. PFY manufacturers, the central component of this chain, convert these monomers into various yarn types (POY, DTY, FDY) through polymerization and spinning processes. Efficiency and scale are crucial at this stage to maintain cost competitiveness.

The midstream involves the conversion process, where yarn manufacturers utilize high-speed machinery to produce and process PFY. Direct sales channels are often used for bulk orders to large, integrated textile mills, allowing for consistent high volume and reduced complexity. Indirect distribution involves various intermediaries, including trading houses, regional distributors, and agents, who play a vital role in reaching smaller knitting, weaving, and processing units that may require customized volumes or specialty yarn grades. Effective management of these distribution channels is critical for optimizing lead times and inventory holding costs across different geographies.

Downstream analysis focuses on the end-use sectors. Processors purchase PFY to produce fabrics, which are then sold to garment manufacturers, home furnishing companies, and industrial product manufacturers. The high fragmentation of the garment industry means that PFY demand is highly sensitive to consumer fashion trends and seasonal cycles. Direct distribution from PFY manufacturers to large, multinational garment brands is becoming more common to ensure quality control and traceability, especially for sustainable or certified yarns. The profitability across the entire chain is often tested by the price volatility of the initial petrochemical inputs and the intense competition at the garment manufacturing stage.

Polyester Filament Yarn Market Potential Customers

The primary customers for Polyester Filament Yarn (PFY) are large-scale textile mills and integrated weaving and knitting units globally. These facilities require massive, consistent volumes of various PFY types (DTY being the most common) for the continuous production of apparel fabric bases. The athleisure sector, marked by brands requiring durable, moisture-wicking synthetic materials, represents a high-growth customer segment. Additionally, manufacturers of industrial products, such as automotive seat cover producers, providers of safety equipment, and geotextile specialists, are crucial bulk buyers who demand high-tenacity and specialized PFY tailored to performance specifications.

Another significant customer base lies within the home furnishings and decor industry, encompassing companies that produce curtains, upholstery, carpets, and non-woven backing materials. These buyers prioritize aesthetic properties like luster, texture, and color fastness, making them key consumers of textured and dope-dyed yarns. Furthermore, the growing medical and hygiene sector acts as a potential customer for specialty PFY, particularly in non-woven applications like surgical drapes and disposable protective wear, driven by stricter global health standards and preparedness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 52.5 Billion |

| Market Forecast in 2033 | USD 77.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reliance Industries Limited, Sinopec Yizheng Chemical Fibre Company, Far Eastern Group, Zhejiang Hengyi Group, Jiangsu Sanfangxiang Group, Tongkun Group Co., Ltd., Shenghong Group, Indorama Ventures Public Company Limited, S-Group (Sinopec), Xinfengming Group, Shandong Ruyi Group, Lealea Enterprise Co., Ltd., Toray Industries, Inc., Bombay Dyeing, Polytex Group, Alok Industries Limited, Century Enka Limited, Grasim Industries, LCY Chemical Corp., Sritrang Agro-Industry Public Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyester Filament Yarn Market Key Technology Landscape

The technological landscape of the Polyester Filament Yarn (PFY) market is characterized by continuous process optimization aimed at achieving higher throughput, reducing production costs, and enhancing product functional attributes. Key technological advancements center around high-speed spinning (HSS) and ultra-high-speed spinning (UHSS) techniques, which allow manufacturers to produce yarns at much faster rates (up to 6,000 meters per minute) while maintaining superior yarn quality and uniformity. These advancements minimize the energy footprint per unit of production and improve overall operational efficiency, which is crucial in a highly competitive, commodity-driven market.

Another area of intense technological focus is texturing and post-processing. Modern Drawn Textured Yarn (DTY) machines incorporate sophisticated automation and precision heating elements, enabling the creation of specialized yarns with enhanced stretch, softer hand-feel, and better bulk. Furthermore, the development of specialty filaments, such as hollow-core fibers for insulation and multi-lobal cross-sections for improved luster or moisture management, is driven by proprietary nozzle and spinneret technologies. This diversification allows PFY to penetrate high-value technical textile and performance apparel markets previously dominated by other materials.

Crucially, the sustainability imperative is accelerating the adoption of innovative technologies related to recycling and dyeing. Chemical recycling technologies, which revert PET back to its original monomers (PTA and MEG), offer a closed-loop solution for high-quality recycled PFY (rPFY), circumventing the quality degradation associated with mechanical recycling. Furthermore, dope dyeing technology, where color pigments are introduced directly into the polymer melt before spinning, dramatically reduces water consumption and wastewater pollution compared to conventional wet dyeing processes, positioning it as a key technological differentiator for environmentally conscious manufacturers.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for PFY, dominating both production capacity and consumption, primarily driven by China and India. China holds a significant competitive advantage due to massive vertical integration, economies of scale, and governmental support for textile exports. Rapid urbanization, large domestic markets, and shifting manufacturing bases to Southeast Asian nations (Vietnam, Indonesia) ensure sustained regional growth.

- Europe: The European market is characterized by high demand for specialty and sustainable PFY, particularly recycled polyester and technical textiles used in high-end fashion and automotive interiors. While production volumes are relatively lower compared to APAC, the region commands premium pricing for yarns complying with strict environmental standards (e.g., REACH regulations).

- North America: North America is a net importer of PFY but exhibits robust consumption, especially in the athleisure, outdoor wear, and home furnishing segments. Demand is heavily focused on functional yarns, innovative blends, and yarns derived from sustainable sources, aligning with strong consumer preference for transparent supply chains and performance attributes.

- Latin America (LATAM): LATAM presents a growing market, driven by expanding local textile industries in countries like Brazil and Mexico. The region focuses on catering to domestic apparel needs, often prioritizing cost-effective standard PFY grades. Investment in modernization and local production capacity remains a key growth area.

- Middle East and Africa (MEA): The MEA region is emerging, with growth concentrated in textile manufacturing hubs like Turkey and Egypt, serving both regional and European markets. Demand is increasing for basic apparel and home textile applications, supported by favorable trade agreements and access to petrochemical raw materials in the Gulf countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyester Filament Yarn Market.- Reliance Industries Limited

- Sinopec Yizheng Chemical Fibre Company

- Far Eastern Group

- Zhejiang Hengyi Group

- Tongkun Group Co., Ltd.

- Shenghong Group

- Indorama Ventures Public Company Limited

- Xinfengming Group

- Toray Industries, Inc.

- Jiangsu Sanfangxiang Group

- Bombay Dyeing

- Polytex Group

- Alok Industries Limited

- Century Enka Limited

- Grasim Industries

- LCY Chemical Corp.

- Sritrang Agro-Industry Public Co. Ltd.

- Hyosung Corporation

- Liaoning Xindongfang Group

- Aditya Birla Group

Frequently Asked Questions

Analyze common user questions about the Polyester Filament Yarn market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Polyester Filament Yarn (PFY)?

The primary driver is the accelerating demand from the global apparel and textile industries, particularly the fast fashion and athleisure segments, owing to PFY's cost-effectiveness, durability, and superior performance characteristics compared to natural fibers.

How does the volatility of crude oil prices impact the PFY market?

Crude oil price volatility directly influences the cost of raw materials, specifically Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG). Fluctuations in these petrochemical feedstocks lead to cost inflation and instability in PFY production margins.

Which geographical region holds the largest market share for Polyester Filament Yarn?

The Asia Pacific (APAC) region dominates the PFY market, both in terms of production volume and consumption, driven primarily by established manufacturing hubs and high domestic demand in countries such as China and India.

What are the key technological advancements shaping the future of PFY?

Key technological advancements include ultra-high-speed spinning (UHSS) for efficiency, dope dyeing to reduce environmental impact, and advancements in chemical recycling processes for high-quality Recycled PFY (RPFY).

What is the difference between Partially Oriented Yarn (POY) and Drawn Textured Yarn (DTY)?

POY is an intermediate, semi-finished yarn requiring further processing (drawing and texturing). DTY is the finished product, achieved by texturing POY, giving it bulkiness, elasticity, and a soft feel, making it ready for weaving or knitting.

What is the role of sustainable practices in the current PFY market?

Sustainable practices, particularly the adoption of Recycled Polyester (rPET) derived from post-consumer PET bottles and bio-based polyesters, are crucial. These initiatives respond to consumer demand and stringent regulatory pressures in developed economies concerning environmental footprint.

How does AI contribute to optimizing PFY manufacturing?

AI is applied for predictive maintenance on complex spinning machinery, optimizing polymerization parameters for quality control, and improving supply chain resilience through accurate demand forecasting, leading to reduced waste and higher operational efficiency.

Which PFY product type is projected to exhibit the fastest growth?

While Drawn Textured Yarn (DTY) currently holds the largest share, Fully Drawn Yarn (FDY) is projected to exhibit rapid growth due to its suitability for high-speed knitting and weaving of lightweight, high-quality fabrics, minimizing the need for subsequent drawing processes.

In which application segment is high-tenacity PFY primarily used?

High-tenacity PFY is primarily used in the industrial and technical textiles segment for applications requiring extreme strength and durability, such as seat belts, tire cord fabrics, geotextiles, and specialized filtration media.

What restraints impede the overall market growth despite strong demand?

Market growth is restrained by dependency on highly volatile petrochemical raw materials, fierce price competition among large Asian manufacturers, and the high capital expenditure required for setting up new, technologically advanced production facilities.

How are PFY manufacturers addressing the issue of water consumption in dyeing?

Manufacturers are increasingly adopting dope dyeing (or solution dyeing) technology, where pigments are added to the molten polymer before spinning. This method eliminates the need for water-intensive wet-dyeing processes, significantly reducing water consumption and effluent discharge.

What are 'specialty yarns' in the context of the PFY market?

Specialty yarns are PFY variants engineered for specific high-performance functions, including flame-retardant yarns, antimicrobial yarns, yarns with enhanced UV protection, and microfilament yarns offering a silk-like texture and superior drape.

What is the significance of the shift toward bio-based polyester materials?

The shift towards bio-based polyester (e.g., derived from plant sources instead of petroleum) is significant as it addresses the core issue of petrochemical dependency and helps textile manufacturers achieve ambitious decarbonization and sustainability targets required by global brands.

Who are the major downstream buyers of PFY in the value chain?

Major downstream buyers include large textile processors, integrated garment manufacturers, and specialized technical textile producers catering to automotive, medical, and filtration industries globally.

How do trade agreements influence the regional PFY trade?

Trade agreements, such as those between the EU and Southeast Asia, influence regional trade by altering tariff structures and quotas, affecting the cost competitiveness of imported finished goods and subsequently shifting the demand for regional PFY production.

What competitive strategy do major players in APAC use to maintain dominance?

Major players in APAC maintain dominance through aggressive capacity expansion, achieving massive economies of scale, extensive vertical integration (controlling PTA/MEG supply), and continuous investment in high-speed, cost-efficient production technology.

Is there a trend toward consolidation in the PFY manufacturing sector?

Yes, there is a distinct trend toward consolidation, particularly in Asia, where larger players acquire or merge with smaller units to eliminate excess capacity, gain control over specific technology niches, and enhance market share, leading to a more oligopolistic structure.

What type of PFY is most suitable for sportswear production?

Drawn Textured Yarn (DTY) is highly suitable for sportswear due to its bulkiness, moisture-wicking capability, elasticity, and comfort, often blended with spandex or other fibers to enhance stretch and recovery properties necessary for athletic wear.

What is the primary challenge in scaling up recycled polyester (rPET) production?

The primary challenge is securing a consistent, clean, and high-quality feedstock supply of post-consumer PET bottles or textile waste, coupled with the need for high investment in advanced sorting and purification technologies to ensure the final rPET yarn meets quality standards.

How does denier affect the application of Polyester Filament Yarn?

Denier, which measures yarn fineness, directly dictates application. Lower denier yarns (microfilaments) are used for lightweight apparel and fine textiles, while higher denier yarns are reserved for industrial applications like ropes, webbings, and heavy upholstery fabrics requiring high tensile strength.

What are the implications of the shift from conventional dyeing to dope dyeing for manufacturers?

The shift requires significant upfront investment in specialized equipment but leads to long-term operational cost savings (less water, fewer chemicals, less energy), improved yarn color fastness, and a reduced environmental footprint, offering a competitive advantage.

How does the demand for home textiles influence the PFY market?

The growing construction sector and increasing home decor expenditures globally drive substantial demand for PFY, particularly in high-volume DTY and FDY forms, for manufacturing products such as curtains, carpets, blankets, and non-woven substrates.

Why is traceability becoming important in the PFY supply chain?

Traceability is critical, especially for rPET and certified sustainable yarns, as major global brands require verification of the source and processing conditions to ensure compliance with sustainability mandates and combat fraudulent claims in their supply chains.

What is the typical lifespan of manufacturing equipment in the PFY industry?

Due to the high-speed and demanding nature of spinning and texturing, core manufacturing equipment typically has a lifespan of 10 to 15 years, requiring regular upgrades or replacement to incorporate the latest automation and efficiency technologies.

How are Western manufacturers positioning themselves against low-cost Asian competition?

Western manufacturers focus on niche markets requiring high-performance characteristics, specialized technical yarns (e.g., aerospace, medical), rapid delivery, and certified sustainable products, leveraging high quality and geographical proximity over competing solely on price.

What are the key raw materials used in PFY production?

The two key raw materials are Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG). These are polymerized to form Polyethylene Terephthalate (PET) chips, which are then melted and spun into filament yarn.

Does the rise of circular economy models affect the PFY market structure?

Yes, circular economy models mandate increased material reuse, directly boosting the market for recycled PFY (rPFY) and encouraging manufacturers to invest in chemical recycling infrastructure, fundamentally altering raw material sourcing and waste management practices.

What is the main advantage of using Fully Drawn Yarn (FDY) over Partially Oriented Yarn (POY)?

FDY is immediately ready for subsequent processes like weaving or knitting without needing an intermediate drawing process, saving time and energy for textile manufacturers, particularly suitable for smooth, lustrous fabrics.

How significant is the role of governmental policies in shaping PFY market investments?

Government policies, particularly in major producing regions like China and India, significantly influence the market through export incentives, subsidies for sustainable manufacturing (like rPET), and capacity control measures aimed at stabilizing supply and demand dynamics.

What role do microfilaments play in modern PFY applications?

Microfilaments (extremely fine PFY) are essential for producing lightweight, high-density fabrics with superior drape and a soft tactile feel, primarily used in high-end fashion, technical filtering media, and advanced non-woven textiles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Polyester Filament Yarn Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Recycled Polyester Filament Yarn Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Polyester Filament Yarn Market Size Report By Type (Partially Oriented Yarn (POY), Polyester Fully Drawn Yarn (FDY), Polyester Drawn Textured Yarn (DTY), Other), By Application (Apparel, Industrial, Household Textiles, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Polyester Fiber Market Statistics 2025 Analysis By Application (Apparel, Industrial and Consumer Textiles, Household and Institutional Textiles, Carpets and Rugs), By Type (Polyester Staple Fiber (PSF), Polyester Filament Yarn (PFY)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Recycled Polyester Filament Yarn Market Statistics 2025 Analysis By Application (Apparel, Automotive, Construction), By Type (Solid Fiber, Hollow Fiber), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager