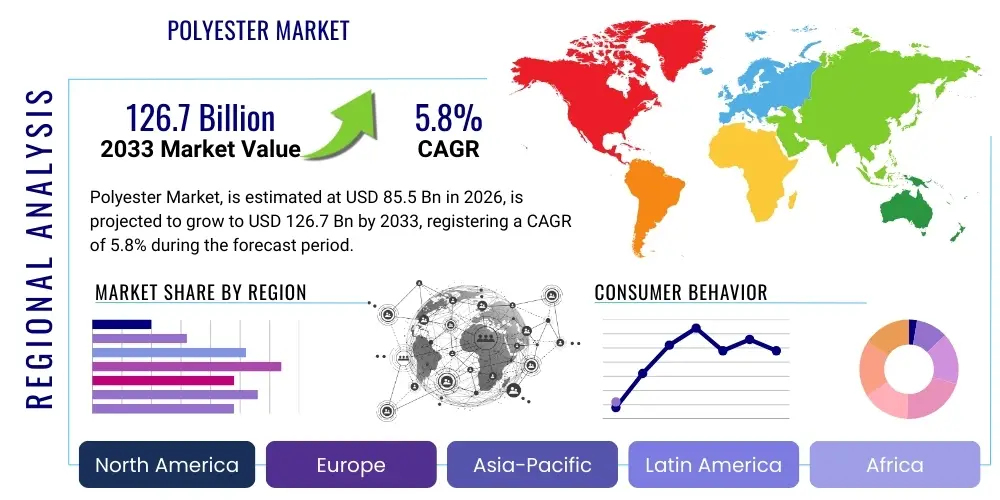

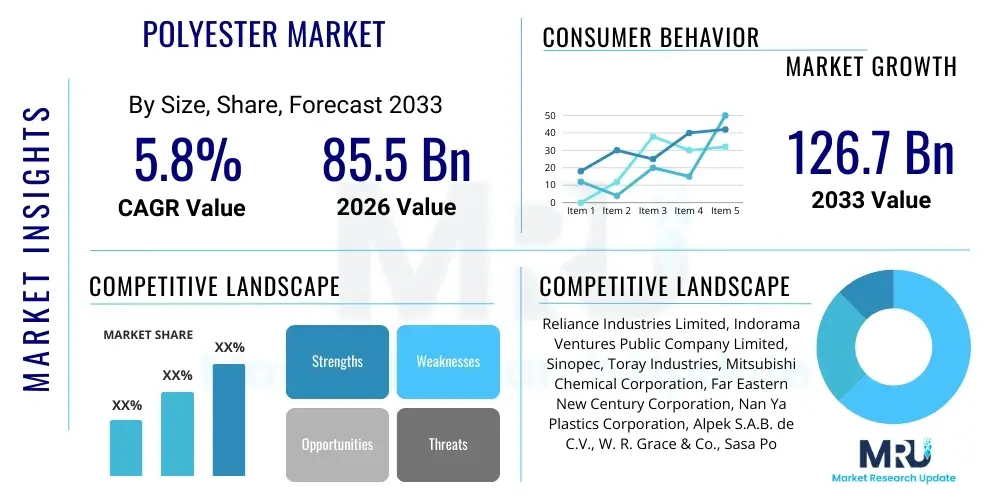

Polyester Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438894 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Polyester Market Size

The Polyester Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $85.5 Billion in 2026 and is projected to reach $126.7 Billion by the end of the forecast period in 2033.

Polyester Market introduction

The Polyester Market encompasses various synthetic polymers, most notably Polyethylene Terephthalate (PET), Polybutylene Terephthalate (PBT), and Polytrimethylene Terephthalate (PTT). These versatile polymers are derived primarily from crude oil derivatives, such as purified terephthalic acid (PTA) and monoethylene glycol (MEG). Polyester is highly valued across numerous industries due to its inherent properties, including high tensile strength, excellent durability, resistance to stretching and shrinking, chemical inertness, and lightweight nature. Its low cost relative to natural fibers and competing polymers makes it the material of choice for mass production, especially in the textile and packaging sectors. The continuous advancements in polymerization techniques and the growing demand for sustainable variants, such as recycled PET (rPET) and bio-based polyesters, are redefining the market landscape.

Major applications of polyester span across rigid and flexible packaging, textiles and apparel, automotive components, and electrical and electronics goods. In the packaging industry, PET is crucial for manufacturing bottles for beverages, food containers, and films due to its excellent barrier properties and clarity. The apparel segment remains the largest consumer, where polyester is often blended with cotton or used alone for sportswear, technical textiles, and fast fashion, capitalizing on its quick-drying and wrinkle-resistant qualities. Furthermore, technical applications are rapidly expanding, involving the use of polyester fibers in geotextiles, roofing materials, and safety equipment, driven by infrastructure development and stringent regulatory standards demanding durable and high-performance materials.

The primary driving factors sustaining the market's robust growth include the soaring global population, leading to increased consumption of packaged food and beverages, and the continuous expansion of the fast fashion industry, particularly in emerging economies. The inherent cost-effectiveness of polyester production compared to natural fibers provides a significant competitive advantage, enabling scalable manufacturing and price stability. Additionally, technological improvements in fiber manufacturing are yielding new generations of polyester with enhanced functionalities, such as antimicrobial properties and improved flame resistance, further broadening their adoption in specialized applications like medical textiles and protective wear. The intensifying global push towards circular economy models, particularly through chemical and mechanical recycling processes for PET waste, is also emerging as a critical long-term growth driver.

Polyester Market Executive Summary

The Polyester Market is characterized by intense competition and significant growth, primarily spearheaded by the Asia Pacific region, which serves as both the largest producer and consumer due to the concentration of textile manufacturing hubs and rapidly expanding domestic consumption bases in China and India. Key business trends indicate a fundamental shift towards sustainability, compelling major manufacturers to invest heavily in circular economy initiatives, focusing on scaling up recycled polyester production (rPET) to meet stringent corporate and consumer demands for eco-friendly products. Price volatility of upstream raw materials, namely PTA and MEG, derived from oil and gas, continues to be a persistent challenge, influencing the profitability margins across the value chain. Strategic alliances, mergers, and acquisitions focused on securing sustainable feedstock supply chains or vertical integration are common maneuvers adopted by leading market players to mitigate supply risks and gain cost leadership.

Regionally, while APAC dominates volume, North America and Europe lead in terms of technological adoption and demand for premium, high-performance polyesters, particularly in the automotive, construction, and specialized non-woven textiles sectors. These developed markets are also pioneering advanced recycling technologies and regulatory frameworks that prioritize material circularity, setting precedents for global market practices. Conversely, emerging markets in Latin America and the Middle East and Africa (MEA) are experiencing high growth rates, driven by improving economic conditions, urbanization, and increased demand for packaged goods and affordable apparel, though infrastructure limitations sometimes pose challenges to efficient waste collection and recycling efforts.

Segment trends reveal that the PET segment, driven overwhelmingly by beverage bottling and flexible packaging, holds the largest market share and is expected to maintain its dominance throughout the forecast period. However, PBT is witnessing accelerated demand growth in engineering applications, particularly in the automotive and electrical sectors, where its thermal stability and mechanical properties are essential for lightweighting initiatives and high-heat environments. The textile application segment, although mature, is innovating through the incorporation of specialized fibers for athletic wear and smart textiles. Overall, the market's trajectory is highly sensitive to fluctuations in crude oil prices, global economic stability, and the pace of global adoption of mandated recycling targets and plastic reduction strategies.

AI Impact Analysis on Polyester Market

User queries regarding the impact of Artificial Intelligence (AI) on the Polyester Market commonly revolve around themes of manufacturing efficiency, sustainable material innovation, and supply chain resilience. Users are keen to understand how AI algorithms can optimize complex polymerization processes, reduce energy consumption in high-heat manufacturing, and accelerate the development and commercialization of novel bio-based or chemically recycled polyester variants. Concerns often focus on the upfront investment required for integrating AI infrastructure, the need for specialized data scientists in a traditional industrial setting, and the security of proprietary data regarding feedstock utilization and production yields. Expectations are high regarding AI's potential to provide highly accurate, predictive maintenance schedules for continuous polymerization plants, minimizing costly downtime and improving overall output quality consistency.

The adoption of AI and machine learning (ML) within polyester manufacturing facilities is moving beyond simple automation into advanced predictive modeling. These technologies are fundamentally changing how R&D is conducted, allowing chemists to simulate molecular structures and predict material performance under various conditions, significantly shortening the development cycle for specialized fibers or resins. Furthermore, AI-driven process control systems utilize real-time sensor data from polymerization reactors to autonomously adjust temperature, pressure, and catalyst dosage, ensuring optimal reaction kinetics. This level of precision minimizes off-spec products, substantially reduces waste, and directly contributes to lower energy intensity per unit produced, aligning with global sustainability mandates and improving operational margins.

In the downstream segment, AI is being deployed for sophisticated demand forecasting, particularly crucial in the fast-moving textile and apparel sector, where rapid shifts in fashion trends can lead to massive inventory surpluses or shortages. By integrating vast datasets—including consumer sentiment analysis, social media trends, macroeconomic indicators, and historical sales data—AI models can provide manufacturers with highly granular predictions, enabling just-in-time production planning. Within the circular economy, AI platforms are being utilized in sorting facilities to accurately identify and separate different polymer types (e.g., PET from PVC or PP) in mixed plastic waste streams, significantly boosting the purity and efficiency of mechanical and chemical recycling processes, which is vital for achieving high-quality rPET output.

- AI optimizes reactor conditions for continuous polymerization, reducing energy usage and maximizing yield.

- Machine learning models accelerate R&D for novel materials, including bio-based and chemically recycled polyester formulations.

- Predictive maintenance algorithms reduce unplanned downtime in production facilities by anticipating equipment failure.

- AI-enhanced vision systems improve the sorting purity of post-consumer plastic waste (e.g., PET bottles) for high-grade recycling.

- Advanced supply chain analytics use AI for robust raw material procurement optimization and accurate demand forecasting.

DRO & Impact Forces Of Polyester Market

The Polyester Market is primarily driven by the exceptional versatility and cost-effectiveness of PET and related polymers, which continue to dominate packaging and textile applications, particularly in developing economies experiencing rapid urbanization and lifestyle changes. However, the market faces significant restraints stemming from growing environmental scrutiny regarding plastic pollution and dependency on petrochemical feedstocks. Opportunities are centered around the circular economy, especially the technological advancements in chemical recycling that can produce virgin-grade polyester from waste. These forces collectively shape the market's trajectory, compelling companies to balance economic viability with environmental responsibility. The impact force matrix indicates that regulatory pressures and consumer preference shifts towards sustainable alternatives exert the highest influence on strategic decision-making and innovation investment within the industry.

Drivers: A paramount driver is the sustained, robust demand from the packaging industry, where PET's lightweight nature, strength, and recyclability make it indispensable for bottled beverages and food packaging. Furthermore, the textile industry's reliance on polyester is deeply ingrained; its performance characteristics (durability, wrinkle resistance, low water absorption) and cost efficiency make it superior to many natural fibers for mass-market and performance apparel. Additionally, regulatory support for lightweighting vehicles and promoting electric vehicle adoption indirectly drives demand for high-performance polyester engineering plastics (like PBT) in automotive components due to their thermal stability and favorable strength-to-weight ratio, contributing to overall energy efficiency.

Restraints: The most prominent constraint is the environmental backlash against single-use plastics and microplastic pollution originating from textiles, leading to increased pressure from NGOs, governments, and consumers. Regulatory actions, such as proposed bans or taxes on non-recycled plastic content, increase operational costs and complexity. Moreover, the market remains highly susceptible to the volatile pricing of upstream raw materials (PTA and MEG), which are directly tied to crude oil market fluctuations. This volatility hinders long-term investment planning and compresses margins, especially for downstream converters lacking vertical integration. The capital-intensive nature of chemical recycling infrastructure also presents a barrier to rapid widespread adoption, slowing the transition to a fully circular material flow.

Opportunities: Significant growth opportunities exist in scaling up chemical recycling technologies, such as depolymerization, which allow for the infinite reuse of polyester waste, addressing the purity issues associated with mechanical recycling. This development is crucial for establishing true material circularity. The development and commercialization of bio-based polyesters, derived from renewable sources like corn starch or sugarcane, offer a pathway to decouple production from fossil fuels, appealing strongly to environmentally conscious brand owners. Furthermore, niche applications in high-end industrial sectors, including specialized films, composites, and high-tenacity yarns for medical devices and aerospace components, offer higher margins and insulation from commodity price swings.

Segmentation Analysis

The Polyester Market is primarily segmented based on the polymer type (PET, PBT, PEN, etc.), form (Filament, Staple Fiber, Resin), application (Textiles, Packaging, Automotive, Construction), and end-use industry. Polyethylene Terephthalate (PET) is the dominant segment by type due to its overwhelming usage in the packaging sector, particularly for carbonated soft drinks, water bottles, and food containers, leveraging its inherent barrier properties and high clarity. The Resin form constitutes the largest market share, predominantly driven by the rigid packaging sector. Analysis of these segments is crucial for understanding specific supply-demand dynamics and for tailoring manufacturing strategies to meet specialized industry requirements, such as high-temperature resistance in the automotive sector or specific fiber denier in the apparel market.

The application segmentation highlights the symbiotic relationship between the polyester market and major consumer-driven industries. While textiles represent the largest volume consumer, the packaging application, characterized by short product life cycles and massive scale, provides the most consistent demand growth. The expansion of e-commerce platforms has further amplified the need for durable and lightweight packaging materials, thus boosting the PET market. Furthermore, the increasing use of technical textiles in infrastructure projects (geotextiles) and construction (insulation, roofing materials) ensures diversification of demand, stabilizing the market against fluctuations in the fast-fashion cycle or beverage consumption patterns.

Geographic segmentation confirms that Asia Pacific remains the central engine of market growth, attributed to the presence of large-scale, integrated manufacturing facilities and burgeoning consumption across major economies. However, segment growth rates vary significantly by region; North America and Europe show accelerated adoption of rPET and advanced engineering plastics, reflecting maturity and regulatory focus on sustainability, whereas developing regions prioritize growth in commodity polyester fibers and basic packaging resins driven by economic accessibility.

- By Product Type:

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polytrimethylene Terephthalate (PTT)

- Polyethylene Naphthalate (PEN)

- Others (e.g., unsaturated polyester resins)

- By Form:

- Staple Fiber (Used in blended fabrics, filling materials, nonwovens)

- Filament Yarn (Used in apparel, industrial fabrics, tire cord)

- Resin (Used in packaging, films, sheets, engineering plastics)

- By Application:

- Textiles & Apparel

- Packaging (Rigid and Flexible)

- Automotive (Interiors, safety systems, composites)

- Construction (Insulation, roofing, geotextiles)

- Electrical & Electronics (Connectors, switches)

- Others (Industrial, Medical)

Value Chain Analysis For Polyester Market

The Polyester Market value chain is highly integrated, starting from upstream raw material procurement and extending through highly capitalized polymerization processes to diverse downstream conversion and end-use applications. Upstream analysis focuses on the petrochemical industry, where key intermediates like Purified Terephthalic Acid (PTA), Monoethylene Glycol (MEG), and Dimethyl Terephthalate (DMT) are derived from crude oil and natural gas. Price fluctuations in crude oil directly influence the cost structure of PTA/MEG, which typically account for 60-70% of the total production cost of virgin polyester. Strategic integration between petrochemical suppliers and major polyester producers is critical for managing supply security and hedging against price volatility, often involving long-term contracts or shared ownership structures.

The middle segment of the chain involves the bulk polymerization process, converting PTA and MEG into polyester chips (resin), staple fibers, or filament yarns. This stage is dominated by large-scale, continuous process facilities requiring significant capital investment and high operational efficiency to achieve competitive pricing. Market leaders often possess proprietary technology for polymerization and spinning, enabling the production of specialized, high-tenacity, or recycled grades. Distribution channels in this commodity-driven market are optimized for high-volume logistics, relying heavily on shipping and rail transport to move massive quantities of chips and fibers from production hubs in Asia to conversion centers globally. Direct sales relationships are common for large-scale industrial buyers, while smaller converters rely on regional distributors and traders.

Downstream analysis encompasses converters and end-users. Converters transform polyester resins into final products—for packaging, this involves blow molding and injection molding; for textiles, this includes weaving, knitting, and dyeing operations. The complexity of the downstream market requires close collaboration between polymer producers and converters to meet specific product requirements, such as precise viscosity for molding or specific denier for weaving. Indirect channels, such as specialized traders, play a crucial role in fulfilling localized or fragmented demand, particularly in the spot market. Ultimately, the end-users—including major beverage companies, global apparel brands, and automotive OEMs—dictate quality specifications, sustainability requirements (e.g., mandated rPET content), and volume demands, effectively pulling innovation and driving product differentiation throughout the entire value chain.

Polyester Market Potential Customers

Potential customers for the Polyester Market are broadly categorized into major industrial sectors that rely on polyester’s performance characteristics, cost-efficiency, and flexibility. The primary customer base includes global fast-moving consumer goods (FMCG) companies, especially those in the beverage industry, due to their reliance on PET for bottling; multinational apparel and sportswear corporations utilizing polyester for performance and durability; and large-scale automotive manufacturers integrating polyester fibers and resins into various vehicle components. These key buyer segments dictate the volume and specifications required, driving innovations in sustainability and high-performance properties. The decision-making process for these customers is heavily influenced by material cost, supply reliability, and increasingly, the verifiable sustainable sourcing credentials (e.g., certified rPET content).

Within the consumer packaged goods sector, customers such as major beverage bottlers are particularly crucial. Their demand patterns are predictable but extremely high volume, necessitating consistent supply of clear, food-grade PET resin that meets stringent regulatory standards for safety and barrier performance. For these customers, the primary purchasing drivers are minimizing environmental impact through lightweighting and maximizing recycled content penetration while maintaining product integrity and brand image. The rising trend of 'bottle-to-bottle' recycling loops necessitates that polymer suppliers develop sophisticated, chemically recycled PET that can achieve virgin-like quality to satisfy these demanding end-users.

Another major customer segment is the textile and apparel industry, encompassing both mass-market producers (fast fashion) and high-end technical textile manufacturers (sports and outdoor gear). While mass-market buyers prioritize volume and low cost, technical textile customers demand specialized polyester features, such as flame retardancy, UV stability, or moisture-wicking properties. The growing construction and infrastructure industries represent a substantial group of potential customers for specialized polyester forms like geotextiles, reinforcing fibers, and durable coatings, valuing polyester's resistance to weathering, biological degradation, and high tensile strength over long periods. As global infrastructure investment increases, this segment promises sustained, high-value demand for robust polyester derivatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $85.5 Billion |

| Market Forecast in 2033 | $126.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reliance Industries Limited, Indorama Ventures Public Company Limited, Sinopec, Toray Industries, Mitsubishi Chemical Corporation, Far Eastern New Century Corporation, Nan Ya Plastics Corporation, Alpek S.A.B. de C.V., W. R. Grace & Co., Sasa Polyester Sanayi A.Ş., DuPont de Nemours, Inc., Lotte Chemical Corporation, Zhejiang Huarui Information Technology Co., Ltd., Sanfangxiang Group, Jiangsu Sanqiang, Tairilin Chemical Industry, Teijin Limited, DAK Americas LLC, Eastman Chemical Company, JBF Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyester Market Key Technology Landscape

The Polyester Market technology landscape is undergoing rapid evolution, moving beyond traditional melt polymerization towards innovative processes focused on sustainability, speed, and product performance specialization. Continuous polymerization (CP) remains the cornerstone of large-scale production, offering superior energy efficiency and quality consistency compared to batch processes. Recent technological advances in CP focus on optimizing reactor design and control systems, often integrating advanced sensors and digital twins to maximize throughput while minimizing the formation of detrimental byproducts, such as acetaldehyde (AA) in PET production, a critical quality metric for beverage packaging. The push for lightweighting and enhanced mechanical properties drives research into solid-state polymerization (SSP) processes, which increase the intrinsic viscosity of resins suitable for specialized applications like high-strength strapping and engineering plastics.

The most transformative area of technological development is centered on the circular economy, specifically chemical recycling. Technologies such as glycolysis, methanolysis, and hydrolysis are being perfected to break down post-consumer polyester back into its monomeric or oligomeric building blocks (PTA and MEG). This allows for the production of recycled polyester that is chemically identical to virgin material, effectively closing the loop. While mechanical recycling (washing, grinding, remelting) is mature and cost-effective, chemical recycling offers the advantage of handling mixed or contaminated waste streams, yielding higher quality output suitable for food-contact applications, a significant technological hurdle being overcome by several pioneering firms.

Furthermore, significant research is being invested in bio-based polyester technologies. The goal is to replace petroleum-derived PTA and MEG with bio-derived counterparts, such as bio-MEG derived from sugarcane or bio-PTA derived from sustainable biomass. While challenging to scale economically, bio-based polyesters like Bio-PET and Bio-PTT represent a strategic technological pathway to long-term sustainability and reduced carbon footprint. Parallel innovation is occurring in fiber finishing and modification technologies, including plasma treatment, nano-coating, and incorporating performance additives to impart functions like UV protection, self-cleaning, and enhanced moisture management, catering to the growing demand for specialized and smart textiles.

Regional Highlights

- Asia Pacific (APAC): APAC is the unrivaled leader in the global polyester market, both in terms of production capacity and consumption volume. This dominance is primarily driven by the massive presence of the textile industry, particularly in China, India, and Southeast Asia. Robust domestic demand for packaging, fueled by rapidly expanding middle-class populations, increased urbanization, and growth in the e-commerce sector, further solidifies its position. Key trends include significant investment in new integrated PTA/PET complexes and a growing, though nascent, focus on developing large-scale chemical recycling infrastructure in countries like China and Japan to meet domestic sustainability goals.

- North America: The North American market is characterized by high demand for rPET and specialized engineering polyesters. Strict environmental regulations and strong corporate sustainability commitments from major beverage brands drive the push for higher recycled content mandates. The region is a key hub for advanced recycling technology development and PBT resin consumption in the automotive sector, driven by stringent fuel efficiency standards requiring lightweight materials. The demand here is less focused on commodity textile fibers and more on high-value applications.

- Europe: Europe is at the forefront of the circular economy transition for polyester, leveraging legislative measures such as the EU's Single-Use Plastics Directive and mandatory recycling targets. This regulatory environment creates a premium market for certified rPET and bio-based alternatives. The market displays strong demand for high-performance polyester fibers in industrial and technical textile applications, including automotive interiors and construction materials. Investment in enzymatic and chemical recycling facilities is accelerating, aiming to achieve supply chain independence from Asian imports and meet ambitious regional sustainability metrics.

- Latin America: This region presents a high-growth market, spurred by rising disposable incomes, population growth, and increasing consumption of packaged food and beverages, boosting virgin PET demand. Brazil and Mexico are the primary centers of production and consumption. While recycling infrastructure is improving, challenges remain regarding efficient waste collection logistics. The textile sector provides steady, commodity-grade polyester demand, often serving regional fast-fashion supply chains.

- Middle East and Africa (MEA): The MEA market is largely driven by petrochemical feedstock availability, particularly in Saudi Arabia and other Gulf Cooperation Council (GCC) countries, which are major exporters of PTA and MEG. The region is increasing its downstream integration, developing local polymerization capabilities to supply growing construction and packaging markets driven by infrastructure mega-projects and rapid population growth in urban centers. Consumption remains highly skewed toward commodity resins and fibers, with sustainability adoption lagging compared to European counterparts, though awareness is increasing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyester Market.- Reliance Industries Limited

- Indorama Ventures Public Company Limited

- Sinopec (China Petroleum & Chemical Corporation)

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

- Far Eastern New Century Corporation

- Nan Ya Plastics Corporation

- Alpek S.A.B. de C.V.

- W. R. Grace & Co.

- Sasa Polyester Sanayi A.Ş.

- DuPont de Nemours, Inc.

- Lotte Chemical Corporation

- Zhejiang Huarui Information Technology Co., Ltd.

- Sanfangxiang Group

- Jiangsu Sanqiang

- Tairilin Chemical Industry

- Teijin Limited

- DAK Americas LLC

- Eastman Chemical Company

- JBF Group

Frequently Asked Questions

Analyze common user questions about the Polyester market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand growth in the Polyester Market?

The primary driver is the sustained, massive demand from the packaging and textile industries, particularly for Polyethylene Terephthalate (PET) used in beverage bottles and lightweight, cost-effective apparel. Rapid urbanization, increasing disposable incomes in emerging markets, and the inherent durability and versatility of polyester over natural alternatives solidify this growth.

How significant is the role of recycled polyester (rPET) in the market?

The role of recycled polyester (rPET) is critical and rapidly expanding, driven by stringent environmental regulations and corporate sustainability targets set by major brand owners. rPET, produced via mechanical or chemical recycling, is essential for achieving material circularity, reducing reliance on virgin petrochemical feedstocks, and mitigating plastic waste, positioning it as a major growth opportunity.

Which region dominates the global production and consumption of polyester?

Asia Pacific (APAC), led by China and India, dominates both the production capacity and consumption of polyester globally. This dominance is attributed to the concentration of integrated petrochemical and textile manufacturing industries, coupled with rapidly expanding consumer markets for packaged goods and apparel.

What are the key technological advancements addressing the environmental impact of polyester?

Key technological advancements focus on chemical recycling (depolymerization), which allows complex polyester waste to be broken down into pristine monomers for reuse, and the commercialization of bio-based polyesters (e.g., Bio-PET) derived from renewable biomass, significantly reducing the carbon footprint associated with traditional petrochemical synthesis.

What is the main constraint affecting the profitability of polyester manufacturers?

The main constraint impacting profitability is the volatile pricing of upstream petrochemical raw materials, specifically Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG). Since these intermediates are linked to crude oil markets, price fluctuations introduce significant uncertainty into operational costs and margin stability across the value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Polyester Plasticizers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Polyester Bed Sheets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Polyester Resins Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Polyester Filament Yarn Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Polyester TPU Hot Melt Adhesive Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager