Recycled Polyester Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435949 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Recycled Polyester Market Size

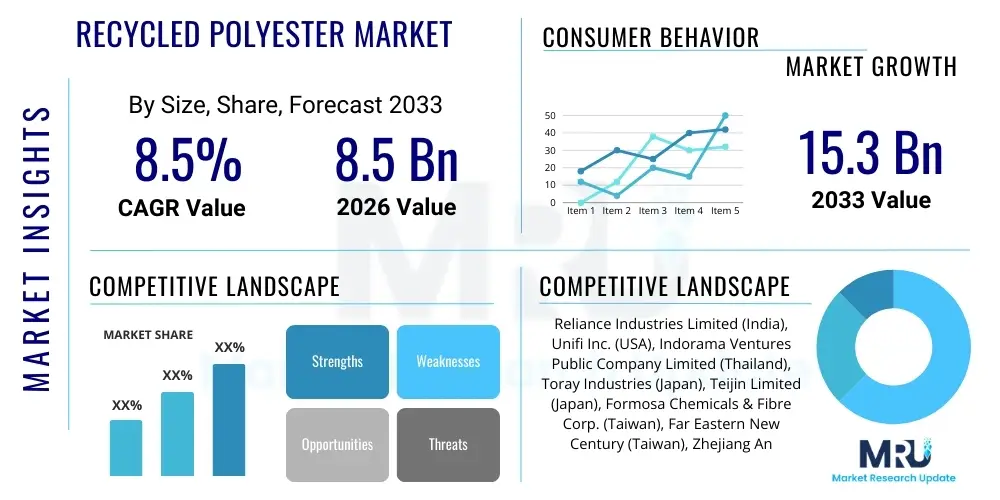

The Recycled Polyester Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 15.3 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by escalating consumer demand for sustainable apparel and textiles, coupled with stringent environmental regulations implemented globally, particularly in North America and Europe, targeting plastic waste reduction. The economic viability of recycled polyester (rPET) compared to virgin polyester, especially amid volatile petrochemical feedstock prices, further stabilizes its market expansion, positioning it as a critical component in the circular economy.

Recycled Polyester Market introduction

The Recycled Polyester Market encompasses the production, distribution, and consumption of polyester fibers and resins derived from post-consumer or post-industrial waste materials, predominantly polyethylene terephthalate (PET) plastic bottles and textile scraps. This market is a cornerstone of the sustainable materials industry, aiming to minimize reliance on fossil fuels, reduce energy consumption, and significantly decrease landfill waste associated with traditional synthetic textiles. Recycled polyester, chemically identical to virgin polyester, maintains comparable performance attributes such as durability, wrinkle resistance, and low moisture absorption, making it suitable for high-performance applications across various sectors.

The major applications of recycled polyester span critical industries, including the apparel sector, where it is utilized extensively in fast fashion, sportswear, and outdoor gear; the automotive industry, for interiors, carpets, and non-woven components; and the home furnishings segment, used in upholstery, bedding, and curtains. Furthermore, specialized uses include technical textiles, filtration media, and geotextiles in construction. The core benefit of adopting recycled polyester lies in its environmental footprint reduction, requiring up to 59% less energy than virgin polyester production and curbing greenhouse gas emissions, aligning perfectly with global corporate sustainability goals and consumer preferences toward eco-friendly products.

Driving factors stimulating market growth include aggressive corporate commitments to using 100% sustainable materials by major global brands, regulatory mandates focusing on extended producer responsibility (EPR) for plastic packaging, and significant technological advancements in chemical recycling processes. Chemical recycling, which depolymerizes waste PET back into its original monomers, offers a crucial pathway for treating lower-quality, colored, or mixed-material waste that traditional mechanical recycling cannot handle efficiently, thereby expanding the available feedstock and ensuring higher quality output suitable for closed-loop systems.

Recycled Polyester Market Executive Summary

The Executive Summary highlights dynamic business trends characterized by intense investment in recycling infrastructure and vertical integration across the supply chain, as fiber producers and major apparel brands seek to secure stable access to high-quality recycled feedstock. Partnerships between petrochemical giants and waste management companies are becoming increasingly common, driving innovation in advanced sorting and chemical recovery technologies. Segment trends indicate that the Recycled PET (rPET) segment, particularly derived from plastic bottles, currently dominates the market due to its established infrastructure and high collection rates. However, the Recycled Polyester Staple Fiber (rPSF) sub-segment is projected to register the fastest growth, fueled by its versatile applications in non-woven textiles and insulation materials across Asia Pacific manufacturing hubs.

Regionally, Asia Pacific (APAC) holds the dominant market share, driven by its expansive manufacturing capacity for textiles and yarn, particularly in China and India, alongside increasing governmental policies supporting plastic waste management and material circularity. Nonetheless, Europe and North America are pivotal growth drivers in terms of value, characterized by the highest per capita consumption of sustainable textiles and leading regulatory environments that mandate recycled content targets. The European Union’s Green Deal initiatives and mandatory recycled content laws in specific U.S. states are creating guaranteed demand for high-grade recycled polyester, pushing manufacturers to establish production facilities closer to these end-user markets to minimize logistical costs and carbon footprint.

The market faces operational challenges related to feedstock quality variability, which impacts the consistency and color of mechanically recycled products. However, the rapidly maturing chemical recycling technologies are poised to mitigate these restraints by offering infinite recycling loops and producing textile-grade monomers equivalent to virgin material. Strategic acquisitions focused on securing proprietary depolymerization technologies and advanced sorting capabilities are defining the competitive landscape. Overall, the market is transitioning from a niche sustainable offering to a mainstream raw material standard, fundamentally changing the sourcing strategies of global consumer goods and textile giants, thereby guaranteeing sustained, high-volume growth through the forecast period.

AI Impact Analysis on Recycled Polyester Market

User inquiries regarding the impact of AI on the Recycled Polyester Market frequently revolve around three core themes: improving waste stream efficiency, optimizing recycling logistics, and ensuring the quality and consistency of the final recycled product. Users are keenly interested in how Artificial Intelligence can address the major bottleneck of mechanical recycling—the inconsistency of feedstock quality. Key concerns include the application of machine learning for advanced automated sorting to separate PET from other plastics (such as PVC and HDPE) and foreign contaminants more effectively and rapidly than traditional optical sorters. Furthermore, there is significant curiosity about predictive maintenance in complex chemical recycling plants and the use of AI algorithms to model and optimize depolymerization kinetics, aiming to reduce energy usage and improve monomer yield.

The integration of AI systems is fundamentally reshaping the upstream segment of the value chain. AI-powered robotics and computer vision systems are deployed in Material Recovery Facilities (MRFs) to identify and classify waste PET based not just on color, but also polymer type, clarity, and potential contamination levels, achieving purity levels essential for textile-grade rPET production. This precision sorting minimizes material loss and reduces the need for extensive manual labor. Additionally, machine learning models are optimizing collection routes and forecasting waste generation rates in urban areas, leading to more efficient logistics and a steadier supply of feedstock, which is crucial for maintaining continuous production in large-scale recycling facilities.

In the chemical recycling domain, AI is employed to manage complex reaction parameters. Deep learning models analyze sensor data (temperature, pressure, catalyst concentration) in real-time to adjust process variables, ensuring optimal throughput and maximizing the quality of the recovered monomers. This capability is paramount for achieving the closed-loop circularity goal, where recycled polyester meets the stringent quality requirements of high-value applications, such as food-grade packaging or premium technical textiles. The ability of AI to ensure material traceability through blockchain integration further enhances market transparency, addressing consumer and regulatory demand for verifiable sustainability claims.

- AI enhances feedstock quality identification via advanced computer vision in sorting facilities.

- Machine learning optimizes logistical routes for waste collection, improving supply chain efficiency.

- Predictive analytics minimizes downtime in complex recycling machinery and chemical reactors.

- AI models optimize chemical depolymerization processes, boosting yield and reducing energy consumption.

- AI-driven traceability systems, often combined with blockchain, verify sustainable sourcing and recycled content.

- Automated quality control using AI ensures the consistency of rPET fibers and resins, reducing variability.

DRO & Impact Forces Of Recycled Polyester Market

The Recycled Polyester Market is influenced by a powerful interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. The primary Driver is the overwhelming global legislative push toward plastic waste reduction and the mandated inclusion of recycled content in packaging and textiles, complemented by vigorous corporate social responsibility (CSR) goals adopted by multinational corporations. Opportunities primarily lie in scaling up chemical recycling technologies to handle mixed and complex polyester waste streams, opening up new feedstock sources, and expanding high-value applications in sectors like performance automotive components and aerospace materials that require stringent material specifications.

Restraints largely center on the inconsistent quality and price volatility of post-consumer PET feedstock. Feedstock collection rates and sorting infrastructure vary significantly by region, leading to supply bottlenecks and competition with the food and beverage packaging sector for high-quality clear PET. Furthermore, while mechanical recycling is cost-effective, the resulting material undergoes a gradual quality degradation (downcycling) after multiple cycles, posing a long-term challenge to achieving infinite material circularity. Initial high capital expenditures required for establishing advanced chemical recycling facilities also act as a short-term constraint, particularly for smaller market participants who rely solely on mechanical methods.

Impact forces indicate a high influence from environmental and social governance (ESG) factors, where investor sentiment increasingly favors companies demonstrating robust circular economy practices, channeling capital towards innovative recycling solutions. Substitutability risk is relatively low in the short term, as recycled polyester offers a unique balance of performance and sustainability that few other fibers can match cost-effectively at scale. Competitive intensity is rising due to new market entrants specializing in advanced recycling technologies and increasing vertical integration by major brands seeking control over their material inputs, compelling established players to continuously innovate and optimize their operational efficiencies to maintain market leadership.

Segmentation Analysis

The Recycled Polyester Market segmentation provides a granular view of market dynamics based on source material, product type, technology used for recycling, and application industry. Understanding these segments is crucial for identifying areas of highest growth potential and technological maturity. The market is primarily bifurcated based on whether the input waste originates from clear plastic bottles (rPET), which is the most common source, or from textile scraps (post-industrial and post-consumer textile waste), which presents a more complex recycling challenge but is essential for achieving true textile-to-textile circularity.

The technology segment reveals a dichotomy between the mature and cost-effective Mechanical Recycling process and the emerging, capital-intensive Chemical Recycling methods (like glycolysis, methanolysis, and hydrolysis). While mechanical recycling dominates current production volumes, chemical recycling is rapidly gaining importance due to its ability to produce material equivalent to virgin polyester, allowing for continuous closed-loop recycling without downcycling. The application segmentation clearly shows the dominance of the Apparel sector, followed by growing demand from the Automotive and Home Furnishing industries, reflecting the broad acceptance of recycled content across diverse end-use markets seeking both cost optimization and sustainability compliance.

These segmentations highlight regional disparities; for instance, Asia Pacific leads in Recycled Polyester Staple Fiber (rPSF) production driven by non-woven fabric demand, while Europe and North America prioritize high-quality Recycled Polyester Filament Yarn (rPFY) for performance apparel and stringent food-grade rPET requirements. Strategic investment is therefore shifting towards technologies that can increase the yield and purity of textile-to-textile recycling, balancing the established mechanical process efficiency with the future-proof potential of advanced chemical methods to meet escalating global sustainability targets.

- By Source:

- Plastic Bottles (Post-Consumer PET)

- Textile Waste (Post-Industrial and Post-Consumer)

- Other Sources (Films, Sheets)

- By Product Type:

- Recycled PET (rPET) Resin (Flakes, Pellets)

- Recycled Polyester Staple Fiber (rPSF)

- Recycled Polyester Filament Yarn (rPFY)

- By Technology:

- Mechanical Recycling

- Chemical Recycling (Glycolysis, Hydrolysis, Methanolysis, etc.)

- By Application:

- Apparel (Sportswear, Outerwear, Casual Wear)

- Automotive (Interior fabrics, Carpets, Headliners)

- Home Furnishings (Upholstery, Bedding, Carpets)

- Filtration

- Non-woven Fabrics

- Construction and Industrial

Value Chain Analysis For Recycled Polyester Market

The Recycled Polyester value chain begins with the critical upstream phase, which involves the collection, sorting, and preparation of feedstock, primarily waste PET bottles and textile scraps. Upstream analysis focuses on Material Recovery Facilities (MRFs) and specialized textile recycling collectors. The efficiency of this stage directly dictates the cost and quality of the final recycled product. Investment in sophisticated sorting technologies, including AI-driven systems and optical sorters, is essential to minimize contamination and ensure a steady supply of high-grade clear PET flakes suitable for mechanical recycling or monomer-grade input for chemical processes. Challenges in the upstream include fragmented collection systems and competition for high-quality clear PET.

The midstream constitutes the actual processing—the recycling phase. This includes both mechanical recycling (washing, grinding, melting, and spinning into fibers or pellets) and chemical recycling (depolymerization). Key players in this stage are specialized recyclers, fiber manufacturers, and chemical companies that possess the proprietary technology for advanced material recovery. The choice between mechanical and chemical routes is driven by the desired product quality and the nature of the feedstock. Mechanical recycling offers lower processing costs, while chemical recycling allows for closed-loop, textile-to-textile recovery, producing material indistinguishable from virgin polyester, thereby mitigating the downcycling effect.

The downstream analysis covers the transformation of recycled polyester pellets or fibers into final products and their subsequent distribution. Major downstream consumers include global textile manufacturers, automotive suppliers, and consumer goods companies. Distribution channels are varied, encompassing direct sales from major fiber producers to large apparel brands (direct channel), and indirect channels involving distributors, agents, and textile converters who supply smaller or regional manufacturing houses. The global nature of the apparel supply chain necessitates complex logistics, but there is a growing trend toward localization, particularly in Europe and North America, to reduce carbon emissions associated with long-distance material transport, aligning with consumer demand for localized, transparent sourcing.

Recycled Polyester Market Potential Customers

The potential customers for recycled polyester are diverse, spanning multiple high-volume industries driven by consumer demand and regulatory pressures for sustainability. The largest and most influential customer base resides within the fast-moving consumer goods (FMCG) sector, particularly global apparel and footwear brands that have committed publicly to eliminating virgin fossil-fuel-based inputs. These brands are seeking Recycled Polyester Filament Yarn (rPFY) for high-performance applications like sportswear and outerwear, demanding stringent quality and verifiable traceability to back their sustainability marketing claims.

Another major segment includes Tier 1 and Tier 2 automotive suppliers. These end-users utilize Recycled Polyester Staple Fiber (rPSF) extensively in vehicle interiors, including acoustic insulation, headliners, and seating fabrics, driven by vehicle lightweighting trends and corporate requirements from Original Equipment Manufacturers (OEMs) to improve the overall sustainability profile of their vehicle components. The third significant customer group comprises producers of home furnishings and bedding, which prioritize bulk volumes of rPSF for filling, non-woven carpets, and upholstery where environmental certifications offer a competitive edge in retail markets. Customer acquisition in this market is heavily dependent on the supplier's capacity to provide certified materials (such as GRS - Global Recycled Standard) and ensure price stability relative to virgin alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 15.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reliance Industries Limited (India), Unifi Inc. (USA), Indorama Ventures Public Company Limited (Thailand), Toray Industries (Japan), Teijin Limited (Japan), Formosa Chemicals & Fibre Corp. (Taiwan), Far Eastern New Century (Taiwan), Zhejiang Anshun Pettechs Fiber Co. Ltd. (China), RGE Group (Sateri), PolyQuest, Inc. (USA), Foss Manufacturing Company, LLC, Longdian Chemical Fiber Co. Ltd., Braidy Industries, Evergreen Plastics, Alpek S.A.B. de C.V., Worn Again Technologies, Eastman Chemical Company, Loop Industries, Ganesha Ecosphere Ltd., Kairav Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recycled Polyester Market Key Technology Landscape

The technology landscape of the Recycled Polyester Market is characterized by a dual approach: the optimization of mature mechanical recycling and the intensive development and scaling of advanced chemical recycling methods. Mechanical recycling involves physically cleaning, grinding, melting, and extruding PET waste into new pellets or fibers. This method is the most widely adopted globally due to its lower operational costs and established infrastructure. Recent technological advancements in mechanical recycling focus on improving sorting precision, utilizing specialized washing and melt filtration systems to handle increasingly complex or contaminated feedstock, thereby minimizing the degradation of polymer properties over subsequent recycling loops.

Chemical recycling, often termed 'molecular recycling,' represents the frontier of technological innovation, promising true circularity by breaking down the polyester polymer back into its constituent monomers (Dimethyl Terephthalate or Pure Terephthalic Acid). Leading chemical methods include Glycolysis, which uses glycols to break down PET; Methanolysis, using methanol; and Hydrolysis, employing water. Companies are heavily investing in these technologies because they can process mixed, colored, and multi-layer plastic waste that mechanical processes cannot efficiently handle, yielding monomers equivalent to those derived from petrochemicals. This high-purity output allows rPET to be used in high-end applications like food-grade packaging and premium textiles without quality compromises, addressing the "downcycling" limitation inherent in mechanical methods.

Furthermore, enzymatic recycling, although still nascent, presents a promising biological alternative. This process utilizes specialized enzymes to naturally break down the PET polymer at low temperatures, offering lower energy consumption and minimal harsh chemical inputs compared to traditional chemical methods. The ongoing technological evolution is focused on commercializing these advanced methods by enhancing catalyst efficiency, scaling reactor capacity, and reducing overall energy input, ultimately aiming to make high-quality, textile-to-textile recycling economically competitive with primary polyester production, thereby ensuring long-term material sustainability and supply reliability for global brands.

Regional Highlights

Regional dynamics play a crucial role in shaping the Recycled Polyester Market, reflecting varying levels of waste management infrastructure, regulatory intensity, and manufacturing capacity. Asia Pacific (APAC) stands as the undisputed global leader in terms of production volume. Countries like China, India, and Taiwan house the majority of the world's large-scale mechanical recycling and textile manufacturing facilities. This dominance is driven by low labor costs, high manufacturing output across the textile and electronics sectors, and increasing domestic governmental emphasis on managing monumental plastic waste streams. While APAC excels in volume, the focus is increasingly shifting towards implementing advanced technologies, particularly chemical recycling, often through joint ventures with Western technology providers, to meet the quality standards demanded by export markets in Europe and North America.

Europe represents a high-value market characterized by robust regulatory frameworks and high consumer awareness regarding sustainability. The European Union's Circular Economy Action Plan and initiatives like the mandatory minimum recycled content targets for packaging significantly boost demand. European manufacturers are leaders in advanced sorting and specialized recycling processes, focusing intensely on achieving high material purity for both food-grade rPET and premium technical textiles. North America, particularly the United States, shows strong growth driven by voluntary corporate commitments and localized state-level regulations. Major US-based brands are heavily investing in supply chain integration and securing long-term contracts for rPET feedstock, especially for the robust domestic sportswear and outdoor apparel markets, often sourcing from dedicated US-based recycling facilities to minimize transportation impacts and ensure traceable material origin.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets, characterized by rapid urbanization and developing waste management infrastructure. Growth in LATAM is spurred by regional economic integration and increasing pressure on consumer goods companies to adopt sustainable practices. Countries like Brazil and Mexico are witnessing foundational investments in PET collection and recycling capacity. In MEA, the focus is largely concentrated in industrialized nations and petrochemical hubs, where the availability of energy resources and government diversification strategies support the establishment of localized recycling facilities. Although starting from a smaller base, these regions offer significant future growth potential as waste collection systems mature and local manufacturing capabilities expand, particularly targeting regional markets with specialized rPSF production for construction and hygiene non-wovens.

- Asia Pacific (APAC): Dominates global production volume; hub for textile manufacturing; increasing adoption of chemical recycling to meet export quality demands.

- Europe: High-value market; driven by strict EU regulations (Circular Economy, recycled content mandates); focus on high-purity, food-grade, and textile-to-textile recycling.

- North America: Strong corporate sustainability drivers and brand commitments; significant investment in securing domestic rPET supply chains; focus on performance apparel and traceable sourcing.

- Latin America (LATAM): Emerging market growth driven by urbanization and improving waste collection; increasing foundational investment in recycling capacity, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Nascent market, driven by petrochemical industry diversification and localized initiatives to manage plastic waste; focus on specialized industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recycled Polyester Market.- Reliance Industries Limited (India)

- Unifi Inc. (USA)

- Indorama Ventures Public Company Limited (Thailand)

- Toray Industries (Japan)

- Teijin Limited (Japan)

- Formosa Chemicals & Fibre Corp. (Taiwan)

- Far Eastern New Century (Taiwan)

- Zhejiang Anshun Pettechs Fiber Co. Ltd. (China)

- RGE Group (Sateri)

- PolyQuest, Inc. (USA)

- Foss Manufacturing Company, LLC

- Longdian Chemical Fiber Co. Ltd.

- Braidy Industries

- Evergreen Plastics

- Alpek S.A.B. de C.V.

- Worn Again Technologies

- Eastman Chemical Company

- Loop Industries

- Ganesha Ecosphere Ltd.

- Kairav Chemicals

- Shandong Jinyi Plastic Co., Ltd.

- Nanya Plastics Corporation

- DAK Americas (An Alpek subsidiary)

- Clear Path Recycling

- Fibertex Nonwovens A/S

- Wellman International (A division of Auriga Polymers Inc.)

- APG Polytech USA

- Huanqiu Chemical Co., Ltd.

- Jiangsu Sanfangxiang Group Co., Ltd.

- Suzhou Goldencrown Textile Co., Ltd.

- Petoskey Plastics Inc.

- Plastics Forming Enterprises (PFE)

- Avantium N.V.

- Carbios

- Ambercycle

- Gr3n Recycling

Frequently Asked Questions

Analyze common user questions about the Recycled Polyester market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Recycled Polyester Market?

The primary driver is the accelerating global shift towards sustainable and circular economy practices, underpinned by stringent governmental regulations on plastic waste and ambitious corporate sustainability goals adopted by major textile and consumer brands worldwide.

What are the key differences between mechanical and chemical recycling of polyester?

Mechanical recycling is a physical process that melts and reshapes plastic, making it cost-effective but prone to quality degradation (downcycling). Chemical recycling, an advanced process, depolymerizes the plastic back into its original monomers, yielding high-purity material equivalent to virgin polyester, suitable for infinite recycling loops.

Which geographical region holds the largest market share for Recycled Polyester?

Asia Pacific (APAC), specifically led by manufacturing hubs in China and India, holds the largest market share in terms of volume due to extensive textile production capacity and robust, albeit developing, plastic waste management infrastructure supporting mechanical recycling output.

How does the price of Recycled Polyester compare to virgin polyester?

While the feedstock cost (waste PET) for rPET is generally lower than crude oil required for virgin polyester, the price of high-quality rPET can sometimes exceed virgin polyester due to costs associated with sorting, cleaning, quality assurance, and high demand for certified, traceable recycled content. However, the long-term price stability of rPET is often favored over volatile fossil fuel-based inputs.

What is the role of technology, such as AI, in optimizing the Recycled Polyester supply chain?

AI significantly optimizes the supply chain by utilizing computer vision for highly accurate automated sorting of mixed plastic waste, ensuring high feedstock purity. Furthermore, machine learning models optimize logistics, predict material availability, and control complex chemical recycling reactor parameters to maximize output and energy efficiency.

What challenges does feedstock quality variability pose to the market?

Inconsistent quality and contamination of post-consumer PET feedstock create significant processing challenges, leading to variability in the final rPET product's color and strength. This necessitates advanced sorting and cleaning techniques, increasing operational costs, and limiting the use of mechanically recycled polyester in high-specification applications.

Which end-use application is the primary consumer of Recycled Polyester?

The Apparel sector is the primary consumer, driven by major sportswear and fast fashion brands' public commitments to sustainability, utilizing recycled polyester primarily in the form of Recycled Polyester Filament Yarn (rPFY) for clothing, outdoor gear, and performance textiles.

What is the significance of the Global Recycled Standard (GRS) certification in this market?

The GRS certification is critical as it verifies the recycled content of the product and confirms responsible social, environmental, and chemical practices in the production process. This certification is essential for market access, especially in Europe and North America, enabling brands to make credible sustainability claims to consumers.

Are there substitutes that pose a threat to the Recycled Polyester Market?

Substitutes include natural fibers (cotton, wool), bio-based polymers (like bio-PET or PLA), and other sustainable synthetics. However, recycled polyester's established production scale, cost-performance ratio, and structural similarity to virgin PET make it difficult to replace at current volume and price points in most major applications like technical textiles and mass-market apparel.

How are petrochemical companies engaging with the recycled polyester trend?

Petrochemical giants are actively engaging by acquiring or partnering with advanced chemical recycling technology firms. This integration allows them to diversify their raw material sources, utilize their existing chemical processing expertise, and meet shareholder and regulatory pressure by incorporating recycled content into their product portfolios, securing their long-term relevance in a circular economy.

What specific role does Recycled Polyester Staple Fiber (rPSF) play in the market?

rPSF is versatile and widely used in non-woven textiles, automotive interiors (carpets, headliners), acoustic insulation, and filling materials for bedding and toys. It often utilizes lower-grade mechanically recycled flakes and represents a significant volume segment, particularly in APAC manufacturing.

How do Extended Producer Responsibility (EPR) schemes influence market growth?

EPR schemes mandate that producers bear financial or operational responsibility for the post-consumer stage of their products' life cycle. These schemes directly drive demand for recycled polyester by increasing the cost of non-recycled packaging or materials, incentivizing investment in domestic collection and recycling infrastructure to meet mandated targets.

What is the typical energy saving associated with using rPET instead of virgin PET?

Recycling PET into rPET typically results in a significant energy saving, often reported to be around 59% compared to producing virgin PET from primary fossil fuel sources, greatly reducing the associated carbon footprint and greenhouse gas emissions.

Why is textile-to-textile recycling considered the ultimate goal for the industry?

Textile-to-textile recycling represents the true circular economy model, ensuring that discarded clothing and fabrics are recycled back into high-quality textiles rather than being downcycled into lower-value products or ending up in landfills. Chemical recycling technologies are key to achieving high-quality textile-to-textile circularity.

What impact does China's 'National Sword' policy still have on the market?

China's ban on importing certain waste materials initially destabilized global feedstock supply chains, forcing developed nations to invest heavily in domestic sorting and recycling infrastructure. This indirectly boosted the market by localizing recycling capacity and improving the overall quality and purity standards of globally available recycled feedstock.

What are the limitations of current mechanical recycling infrastructure?

Current mechanical recycling infrastructure is limited by its inability to effectively process mixed polymer waste, highly contaminated or colored plastics, and multi-layer packaging. This limitation often necessitates downcycling or exclusion of complex textile waste, leaving a significant portion of potential feedstock unaddressed.

How are investors viewing the Recycled Polyester Market?

Investors show strong positive sentiment, recognizing the market as a high-growth sector aligned with global ESG (Environmental, Social, and Governance) mandates. Venture capital and private equity are increasingly targeting advanced chemical recycling startups, viewing proprietary technology as a critical competitive advantage and long-term value driver.

What is the fastest growing segment by product type?

Recycled Polyester Staple Fiber (rPSF) is projected to be one of the fastest growing segments, driven by robust demand from the burgeoning non-woven fabrics industry, used in hygiene products, filtration, and insulation, particularly across developing economies and industrial applications.

How does the automotive industry utilize recycled polyester?

The automotive industry utilizes recycled polyester for weight reduction and sustainability improvements, employing rPET in interior fabrics, seat covers, door panels, carpets, and non-woven acoustic dampening materials, driven by OEM targets for incorporating sustainable and traceable components in vehicle construction.

What is 'depolymerization' in the context of chemical recycling?

Depolymerization is the process used in chemical recycling where the long polymer chains of PET are broken down by chemical reagents (like glycols or methanol) or heat into their original monomer building blocks, which can then be purified and re-polymerized into high-quality new polyester, ensuring true material circularity.

Why is traceability of recycled content important for major brands?

Traceability is paramount for major brands to substantiate their public sustainability claims, meet evolving regulatory requirements (especially in Europe), and assure consumers that the recycled content is ethically sourced and derived from the intended waste stream, often achieved through partnerships using blockchain technology.

What is the role of technology licensing in the market?

Technology licensing, particularly for proprietary chemical recycling processes like Loop Industries’ depolymerization or Eastman's molecular recycling, allows for rapid global scaling. It enables established chemical or fiber companies to quickly adopt advanced recycling capabilities without the need for extensive in-house R&D, accelerating the transition away from virgin inputs.

How does government procurement influence the demand for rPET?

Government procurement policies, especially in defense and public sectors, increasingly include mandates for the use of sustainable or recycled materials in uniforms, office furnishings, and infrastructure projects. This creates a stable, high-volume demand floor, further encouraging manufacturers to invest in rPET production capacity and certifications.

What impact does microplastic pollution have on the rPET market?

While the focus is on reducing overall plastic waste, the microplastic issue, often linked to synthetic textile shedding during washing, presents a reputational risk. The industry is responding by investing in fiber development and innovative textile treatments to minimize shedding, ensuring rPET remains a preferred sustainable alternative to virgin synthetics.

Which chemical recycling method is showing the most commercial promise?

Glycolysis is currently showing strong commercial promise due to its maturity and established use for non-fiber grade PET waste. However, advanced methods like Hydrolysis and Methanolysis, pioneered by companies like Eastman and Loop Industries, are gaining traction for producing high-purity, fiber-grade monomers required for textile-to-textile recycling at scale.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Recycled Polyester (RPET) Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Recycled Polyester Filament Yarn Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Polyester Staple Fiber Market Statistics 2025 Analysis By Application (Cloth Materials, Home Furnishings, Industrial Materials), By Type (Virgin Polyester Staple Fiber (Virgin PSF), Recycled Polyester Staple Fiber (Recycled PSF)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Recycled Polyester Fiber Market Statistics 2025 Analysis By Application (Apparel and Fashion, Home Furnishing, Filtration, Construction, Automotive), By Type (Recycled Polyester Filament, Recycled Polyester Staple Fiber), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Recycled Polyester Filament Yarn Market Statistics 2025 Analysis By Application (Apparel, Automotive, Construction), By Type (Solid Fiber, Hollow Fiber), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager