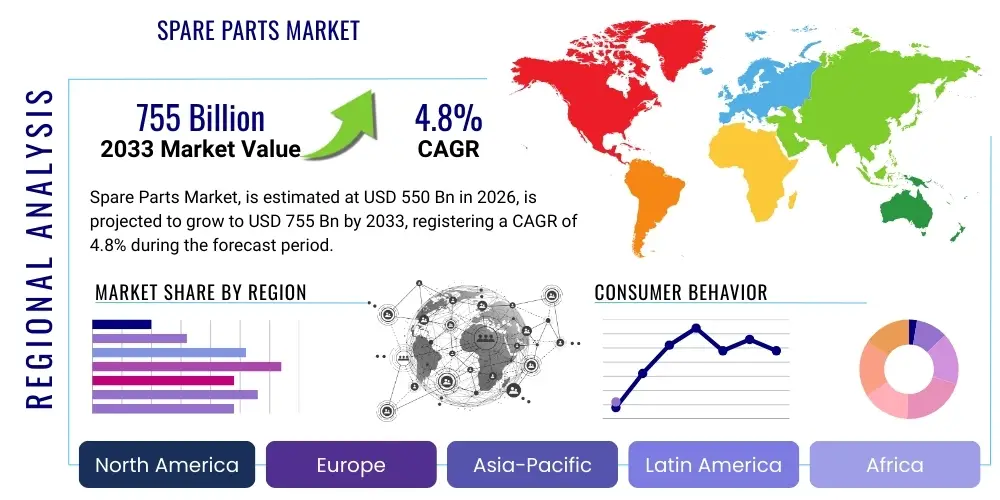

Spare Parts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436359 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Spare Parts Market Size

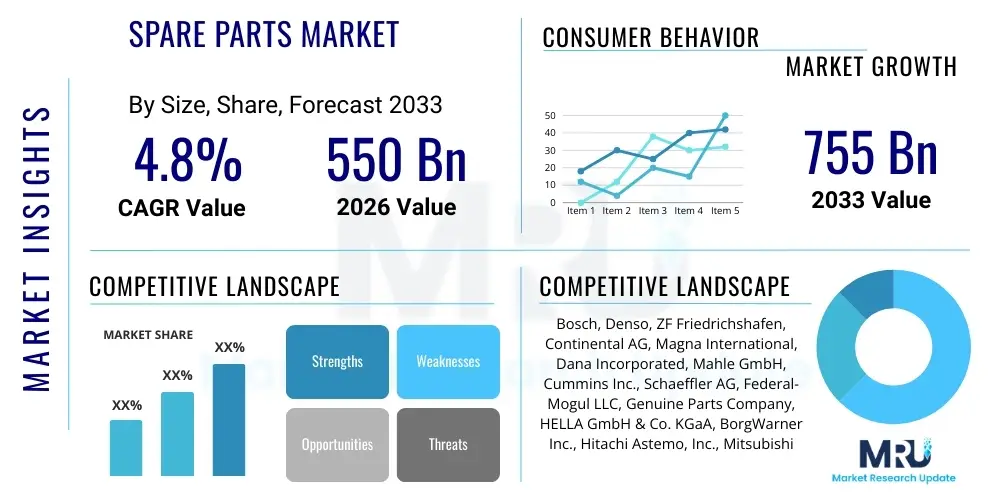

The Spare Parts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 550 Billion in 2026 and is projected to reach USD 755 Billion by the end of the forecast period in 2033.

Spare Parts Market introduction

The Spare Parts Market encompasses the supply and demand of replacement components utilized across numerous industries, primarily automotive, industrial machinery, aerospace, and consumer electronics. These parts are crucial for maintenance, repair, and overhaul (MRO) activities, ensuring the longevity and operational efficiency of capital assets. The market is broadly categorized into the Original Equipment Supplier (OES) channel, where parts are distributed through authorized networks, and the aftermarket, which includes independent retailers and service providers. Technological advancements, such as predictive maintenance, and the increasing complexity of modern machinery drive the demand for specialized and high-quality spare parts, making efficient supply chain management a core competitive factor.

The core product range within this market is extensive, spanning mechanical components, electrical systems, structural elements, and consumables. For instance, in the automotive sector, spare parts include everything from brake pads and filters to complex electronic control units (ECUs) and engine assemblies. Major applications involve routine servicing (filters, lubricants), critical repairs (engine components, transmission), and accident repairs (body panels, lights). The market’s resilience is underpinned by the essential nature of MRO, as companies and consumers prioritize asset uptime over new purchases, particularly during economic volatility. Furthermore, the global trend toward fleet utilization and extending the lifecycle of existing machinery contributes significantly to sustained demand in the spare parts sector.

Key benefits derived from a robust spare parts market include reduced downtime for end-users, optimized asset performance, and improved safety standards, particularly in high-stakes industries like aviation and heavy manufacturing. Driving factors include the sheer size and growing complexity of the global vehicle parc and installed industrial equipment base, increased average age of operational assets, and stringent regulatory requirements regarding equipment maintenance. Moreover, the rapid proliferation of e-commerce platforms has facilitated easier access to parts, broadening the market reach and introducing greater price transparency, further stimulating demand across both developed and developing economies.

Spare Parts Market Executive Summary

The Spare Parts Market is witnessing significant transformation driven by digitalization, shifts in global manufacturing footprints, and evolving consumer expectations regarding service delivery. Business trends highlight a strong movement toward centralized inventory management systems, leveraging IoT for real-time asset tracking, and adopting additive manufacturing (3D printing) for on-demand component production, drastically reducing lead times and warehousing costs for slow-moving inventory. Original Equipment Manufacturers (OEMs) are increasingly focused on protecting their high-margin OES channels through sophisticated authentication technologies to combat counterfeit parts, while simultaneously enhancing their digital service portals to improve customer experience and retention within the aftermarket ecosystem.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in infrastructure development, rapid industrialization, and the exponential growth of vehicle ownership in countries like China and India. North America and Europe, while mature, are characterized by a strong emphasis on sustainability and digitalization, favoring advanced materials and efficient logistics networks. Latin America and the Middle East & Africa (MEA) present burgeoning opportunities, primarily driven by expanding construction and mining sectors, demanding durable and readily available heavy-duty equipment spares. The disparity in logistics infrastructure across these regions necessitates tailored distribution strategies and local partnerships to ensure supply chain resilience.

Segment-wise, the Automotive sector remains the dominant segment, though the Industrial Machinery segment, particularly spares for robotics and automation equipment, is experiencing the fastest growth trajectory, reflecting global shifts toward smart factory implementation. Within the material segment, the demand for composite and high-performance metal alloys is increasing, driven by the need for lightweight and durable parts. Furthermore, the electronic components segment is expanding rapidly, commensurate with the rising electrification of vehicles and industrial systems, underscoring a strategic shift in inventory from purely mechanical components to complex electronic modules requiring specialized diagnostics and replacement procedures.

AI Impact Analysis on Spare Parts Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Spare Parts Market predominantly center on how AI can optimize the notoriously complex logistics and inventory planning processes. Common concerns revolve around predictive maintenance accuracy, the implementation challenges of AI-driven supply chain transparency, and the potential disruption to traditional distributor roles. Users are keenly interested in understanding how AI can forecast component failure with greater precision, thereby reducing emergency stock needs and minimizing obsolescence. Expectations are high that AI will revolutionize demand forecasting by integrating unstructured data points—such as sensor telemetry, weather patterns, and social media sentiment—leading to highly optimized regional stocking decisions and significant reductions in carrying costs across the global supply chain network.

The primary themes emerging from user questioning emphasize the adoption of machine learning (ML) models for enhanced supply chain resilience. Companies are exploring AI tools to dynamically adjust pricing strategies based on real-time market fluctuations, demand signals, and competitive pricing intelligence. Another key area of interest is the deployment of computer vision and robotics in warehousing and distribution centers, aimed at accelerating picking and packing processes and dramatically improving inventory accuracy. This technological integration is viewed not just as a cost-saving measure but as a critical lever for improving service levels, especially in time-sensitive industries like aerospace MRO, where component availability directly impacts operational safety and fleet utilization rates.

Furthermore, consumers and businesses are focused on how AI-powered chatbots and virtual assistants can streamline the customer service experience for spare parts identification and ordering. These AI applications are trained on extensive component databases, enabling rapid cross-referencing of part numbers, compatibility checks, and troubleshooting guidance, thereby decentralizing technical support and allowing customers to procure the correct part the first time. The integration of AI with ERP and maintenance management systems (MMS) is viewed as the final step toward creating a fully autonomous supply chain, where parts ordering, manufacturing scheduling, and logistics execution are optimized algorithmically without constant human intervention.

- AI-driven predictive maintenance significantly reduces unexpected equipment failures, shifting demand from reactive emergency orders to planned MRO schedules.

- Machine learning algorithms enhance demand forecasting accuracy by up to 20%, optimizing inventory levels and minimizing stockouts and obsolescence.

- Integration of AI in warehouse robotics and automated sorting improves logistics efficiency and reduces human error in picking and staging processes.

- AI-powered pricing strategies allow dynamic adjustment of part costs based on real-time demand, stock availability, and competitor actions.

- Natural Language Processing (NLP) tools streamline customer interaction for part identification and technical support, improving service response times.

- Optimization of complex spare parts networks using AI reduces transportation costs and carbon footprint through intelligent route planning and consolidated shipping.

- AI assists in counterfeit detection by analyzing documentation, supply chain history, and physical component characteristics using computer vision.

DRO & Impact Forces Of Spare Parts Market

The Spare Parts Market is influenced by a confluence of powerful drivers, structural restraints, and emerging opportunities that collectively determine its growth trajectory and competitive landscape. Key drivers include the aging global fleet of assets across automotive and industrial sectors, necessitating consistent replacement and maintenance cycles. Furthermore, increasing regulatory focus on safety and environmental standards mandates the use of certified, high-quality spare parts, pushing demand toward authorized channels and premium suppliers. The rapid expansion of e-commerce platforms acts as a powerful enabling factor, democratizing access to specialized parts globally and stimulating competition, ultimately benefiting end-users with wider choices and faster delivery times.

Conversely, the market faces significant restraints, most notably the pervasive issue of counterfeit parts. These illicit components erode OEM profitability, pose substantial safety risks, and undermine consumer trust. The complexity and high cost associated with managing vast inventories across diverse geographical locations—often involving parts that may remain unsold for years—also present a major financial burden for supply chain operators. Additionally, economic volatility and geopolitical instability can disrupt highly optimized global supply chains, leading to raw material shortages and unpredictable lead times, forcing businesses to carry costly buffer stock to maintain service levels.

Opportunities in the market center around the adoption of transformative technologies. The ability to leverage 3D printing (additive manufacturing) for the on-demand production of highly specific, low-volume, or obsolete parts offers a pathway to bypass traditional lengthy production processes and inventory risks. The shift towards circular economy models and remanufactured components presents a sustainable and cost-effective opportunity, particularly for heavy industrial and engine spares. Impact forces, such as the rising cost of raw materials (steel, rare earth metals) and the push toward electric vehicles (EVs) which require different, often less frequent, maintenance parts compared to Internal Combustion Engine (ICE) vehicles, are forcing incumbents to rapidly restructure their product portfolios and logistics networks to remain relevant and capitalize on future growth vectors.

Segmentation Analysis

The Spare Parts Market is meticulously segmented based on end-user industry, component type, sales channel, and material type to provide a granular view of market dynamics and specialized demand patterns. This segmentation is crucial for stakeholders to tailor production, inventory, and distribution strategies effectively. The end-user segmentation clearly dictates the technical specifications and regulatory compliance required for the components, ranging from high-precision aerospace parts to mass-produced automotive consumables. The sales channel split (OES vs. Aftermarket) highlights the differing competitive landscapes and profitability margins, with OES prioritizing quality assurance and the Aftermarket focusing on competitive pricing and availability across a wider array of brands.

Analysis by component type helps track the shift in demand composition. As digitalization and electrification accelerate across all sectors, the growth rate for electronic control units, sensors, and complex wiring harnesses significantly outpaces traditional mechanical parts like gearboxes or chassis elements. Furthermore, the material segmentation reflects global sustainability trends and performance requirements, showing an increasing shift towards lightweight materials such as advanced plastics, aluminum alloys, and carbon composites, especially in the pursuit of energy efficiency and operational resilience in modern machinery and vehicles.

- By End-User Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Industrial Machinery (Manufacturing, Construction, Mining)

- Aerospace and Defense

- Consumer Electronics and Appliances

- Energy and Utilities (Power Generation Equipment)

- By Component Type:

- Mechanical Components (Engine Parts, Gears, Bearings)

- Electrical and Electronic Components (Sensors, ECUs, Wiring)

- Exterior and Structural Parts (Body Panels, Glass)

- Consumables (Filters, Lubricants, Tires)

- By Sales Channel:

- Original Equipment Supplier (OES)

- Independent Aftermarket (IAM)

- By Material Type:

- Metal Alloys (Steel, Aluminum, Copper)

- Plastics and Polymers

- Rubber and Elastomers

- Composites

Value Chain Analysis For Spare Parts Market

The value chain of the Spare Parts Market is intricate and highly sequential, commencing with raw material suppliers and culminating with the end-user installation. The upstream segment involves the sourcing and processing of raw materials—metals, polymers, and electronic components—followed by the component manufacturing process, which includes casting, machining, and assembly, often carried out by specialized Tier 1 and Tier 2 suppliers. Quality control and compliance with strict industry standards (e.g., ISO, AS9100 for aerospace) are paramount at this stage, establishing the foundation of product reliability. OEMs and major aftermarket suppliers exert significant control over upstream activities through long-term contracts and strict specification adherence, ensuring consistency and managing potential supply risks.

The core of the value chain focuses on distribution and logistics, representing a crucial competitive bottleneck. This midstream phase involves inventory management, warehousing, and transportation. Due to the diverse nature and high volume of SKUs (Stock Keeping Units), efficient logistics—spanning international freight, regional distribution centers, and local hubs—is essential for minimizing delivery lead times. Direct distribution channels involve parts flowing directly from the OEM or large independent manufacturers to authorized dealers and large fleet operators, providing greater traceability and service integration. Indirect channels utilize independent distributors, wholesalers, and specialized e-commerce platforms, offering wider geographical reach and often catering to small-scale repair shops and DIY consumers, introducing more intermediary complexity but improving market access.

The downstream segment includes service providers, installers, and the end-users themselves. Independent repair garages, authorized service centers, and maintenance teams in manufacturing plants consume the parts. The effectiveness of the downstream channel is often measured by the speed of installation and the availability of technical support and diagnostics necessary for modern, complex components. Digitalization is profoundly impacting this stage, with online platforms facilitating easy ordering, technical documentation access, and even augmented reality (AR) support for installation. The final stage is end-of-life management, increasingly incorporating circular economy concepts such as core return programs and remanufacturing processes, which feedback into the upstream manufacturing segment, creating a sustainable loop.

Spare Parts Market Potential Customers

The potential customer base for the Spare Parts Market is exceedingly diverse, spanning large multinational corporations managing fleets of assets down to individual consumers maintaining personal vehicles or household appliances. The most significant segment comprises professional end-users—large commercial fleet operators (trucking, maritime, air cargo), original equipment manufacturers seeking components for warranty repair fulfillment, and major industrial entities operating continuous process machinery in sectors like mining, petrochemicals, and power generation. These institutional buyers prioritize quality, guaranteed authenticity, bulk purchasing discounts, and reliable supply contracts that minimize operational disruption.

A rapidly expanding customer base is the professional repair and maintenance service sector, which includes authorized dealership workshops, large chain garages, independent service organizations (ISOs), and specialized MRO providers. These customers require quick access to a comprehensive inventory of multi-brand spare parts, reliable part identification tools, and just-in-time delivery services to optimize their repair throughput and minimize vehicle or machinery bay time. Their purchasing decisions are often influenced heavily by part availability, supplier technical support, and the warranties offered on the replacement components, driving the success of large aftermarket distributors.

The third major group consists of individual consumers and small to medium-sized enterprises (SMEs). Individual consumers typically purchase parts for basic vehicle maintenance or home appliance repair, increasingly utilizing accessible e-commerce channels. SMEs, such as small construction companies or local manufacturers, require spares for limited equipment assets. While quantity demanded per transaction is lower in this segment, the collective volume is substantial. E-commerce platforms and retail auto-parts chains specifically target this group by focusing on user-friendly search interfaces, localized stock availability, and offering a mix of OEM and value-tier aftermarket products to cater to varying budget constraints and technical expertise levels among the DIY segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Billion |

| Market Forecast in 2033 | USD 755 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Denso, ZF Friedrichshafen, Continental AG, Magna International, Dana Incorporated, Mahle GmbH, Cummins Inc., Schaeffler AG, Federal-Mogul LLC, Genuine Parts Company, HELLA GmbH & Co. KGaA, BorgWarner Inc., Hitachi Astemo, Inc., Mitsubishi Electric Corporation, Standard Motor Products, Tenneco Inc., WABCO Holdings Inc., Eaton Corporation, Timken Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spare Parts Market Key Technology Landscape

The Spare Parts Market is undergoing a rapid technological evolution, shifting from traditional manual processes to highly automated and intelligent systems aimed at improving efficiency and responsiveness. A cornerstone technology is Additive Manufacturing (AM), or 3D printing, which allows for decentralized, on-demand production of highly specialized or obsolete spare parts. This technology significantly reduces the need for large physical inventories, eliminates long lead times associated with traditional tooling, and provides a powerful solution for complex geometric parts in low-volume scenarios, particularly beneficial in aerospace and niche industrial applications where component obsolescence is a frequent challenge.

Another pivotal technology is the Internet of Things (IoT) combined with advanced sensor technology. IoT enables predictive maintenance by gathering real-time operational data from assets (e.g., vibration, temperature, performance metrics). This data feeds into sophisticated Analytical Tools and Machine Learning platforms, allowing systems to forecast component failure with high accuracy. This capability fundamentally transforms the demand structure, enabling proactive part ordering and scheduling maintenance events precisely when needed, thereby maximizing asset uptime and moving inventory management from reactive stockpiling to proactive, data-driven supply fulfillment. The integration of Digital Twins—virtual replicas of physical assets—further enhances this capability by allowing for simulated wear and failure scenarios, optimizing spare part stocking based on actual operational profiles.

Furthermore, supply chain technologies such as Blockchain and Advanced Robotics are reshaping logistics and integrity. Blockchain technology offers immutable record-keeping, providing end-to-end traceability for genuine parts, which is a critical defense against the proliferation of counterfeit products, especially in sensitive sectors. Robotics, alongside Automated Guided Vehicles (AGVs) and specialized picking systems in automated warehouses, drastically improves the speed and accuracy of order fulfillment. Finally, the use of Augmented Reality (AR) glasses provides technicians with hands-free access to installation instructions, technical schematics, and remote expert guidance, streamlining complex repair processes and reducing the likelihood of installation errors, thereby improving the quality and speed of service delivery in the field.

Regional Highlights

The regional dynamics of the Spare Parts Market are diverse, reflecting varying levels of industrialization, regulatory maturity, and fleet age across different continents. Each region presents unique opportunities and challenges for supply chain optimization and market penetration.

- Asia Pacific (APAC): This region dominates the global growth narrative, primarily driven by massive infrastructure expansion, escalating industrial output (particularly in China, India, and Southeast Asia), and the rapid expansion of the middle class leading to high vehicle ownership rates. The complexity in APAC lies in navigating fragmented distribution channels and differing regulatory environments. However, demand for both genuine OEM and cost-effective aftermarket parts is exceptionally strong, necessitating substantial investment in localized manufacturing and logistics hubs to meet the scale of growth.

- North America: Characterized by high technological adoption and a mature aftermarket. The focus here is on digitalizing the supply chain, leveraging AI for inventory optimization, and transitioning towards electric vehicle (EV) spares. High labor costs necessitate automated warehousing and a strong reliance on e-commerce platforms for customer reach. The market is highly competitive, demanding premium service quality and rapid delivery guarantees from suppliers.

- Europe: This region is defined by stringent environmental and safety regulations, driving demand for high-quality, certified, and often remanufactured spare parts (circular economy emphasis). Western Europe maintains a mature vehicle parc requiring continuous maintenance, while Eastern Europe offers growing manufacturing bases. Geopolitical factors and the need for cross-border logistics efficiency within the EU framework dictate specialized distribution network planning.

- Latin America: This market is characterized by volatility and infrastructural challenges, yet offers significant potential, especially in Brazil and Mexico. Demand is heavily influenced by the mining, agriculture, and construction sectors, requiring durable and robust components for heavy machinery. Pricing sensitivity is high, favoring competitive aftermarket alternatives, but improving economic stability is gradually supporting investment in genuine parts.

- Middle East and Africa (MEA): Growth is tied heavily to the oil & gas and construction sectors. Demand centers around specialized industrial equipment parts, often imported. The GCC states (Gulf Cooperation Council) act as major logistics hubs, facilitating regional distribution. The African continent presents logistical complexities but has immense long-term potential fueled by urbanization and increasing investments in transportation and power infrastructure, driving demand for heavy-duty vehicle spares.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spare Parts Market.- Robert Bosch GmbH

- Denso Corporation

- ZF Friedrichshafen AG

- Continental AG

- Magna International Inc.

- Dana Incorporated

- Mahle GmbH

- Cummins Inc.

- Schaeffler AG

- Federal-Mogul LLC (Tenneco)

- Genuine Parts Company (NAPA)

- HELLA GmbH & Co. KGaA

- BorgWarner Inc.

- Hitachi Astemo, Inc.

- Mitsubishi Electric Corporation

- Standard Motor Products, Inc.

- Tenneco Inc.

- GKN Automotive (Melrose Industries)

- Eaton Corporation plc

- Timken Company

Frequently Asked Questions

Analyze common user questions about the Spare Parts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Global Spare Parts Market?

The Global Spare Parts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period from 2026 to 2033, driven primarily by the aging global asset base and increasing demand for rapid maintenance, repair, and overhaul (MRO) services across key industries.

How is digitalization impacting the spare parts supply chain?

Digitalization is transforming the supply chain through the adoption of IoT for predictive maintenance, AI for optimized demand forecasting, and Blockchain technology for enhanced part traceability. This shift minimizes unexpected downtime, reduces inventory costs, and significantly combats the proliferation of counterfeit components, streamlining the entire logistics process.

Which end-user industry holds the largest share in the Spare Parts Market?

The Automotive sector, encompassing both passenger and commercial vehicles, consistently holds the largest market share due to the massive global vehicle parc and the high frequency of replacement needs for consumables and wear-and-tear components like brake systems, filters, and lighting. However, the Industrial Machinery segment is demonstrating the highest growth velocity.

What role does Additive Manufacturing (3D Printing) play in inventory management?

Additive Manufacturing (AM) offers a strategic solution for decentralized, on-demand production of low-volume, complex, or obsolete spare parts. This technology significantly reduces warehousing requirements, eliminates the long lead times associated with traditional manufacturing, and allows suppliers to maintain virtual inventories until a specific part is needed, optimizing carrying costs.

What are the key differences between the OES and Aftermarket sales channels?

The Original Equipment Supplier (OES) channel distributes genuine parts directly through authorized networks, focusing on quality assurance, warranty fulfillment, and premium pricing. The Independent Aftermarket (IAM) includes wholesalers and independent retailers, focusing on competitive pricing, multi-brand availability, and catering to the broader independent repair garage network and the cost-sensitive consumer base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Construction Equipment Spare Parts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Heavy Equipment Spare Parts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Gas Turbine Service Market Size Report By Type (Heavy Duty, Industrial, Aeroderivative, Maintenance and Repair, Overhaul, Spare parts supply), By Application (Power Generation, Oil and Gas, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Automotive Spare Parts Logistics Market Size Report By Type (Air Freight, Ocean Freight, Inland Freight), By Application (OEM Supply, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Spare Parts Logistics Market Statistics 2025 Analysis By Application (Automotive, Aerospace, Datacenters, Medical, Telecoms and Utilities), By Type (Last Mile Delivery, Long Distance Transportation), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager