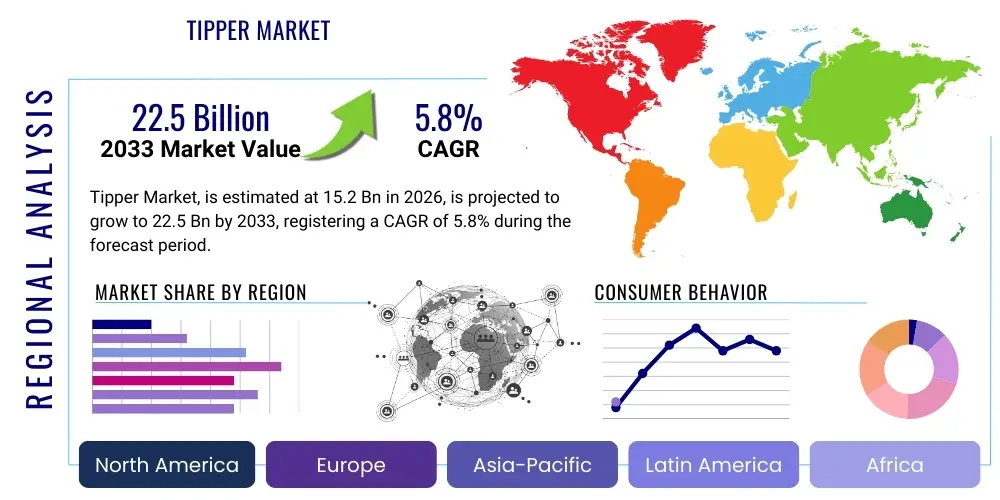

Tipper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439277 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Tipper Market Size

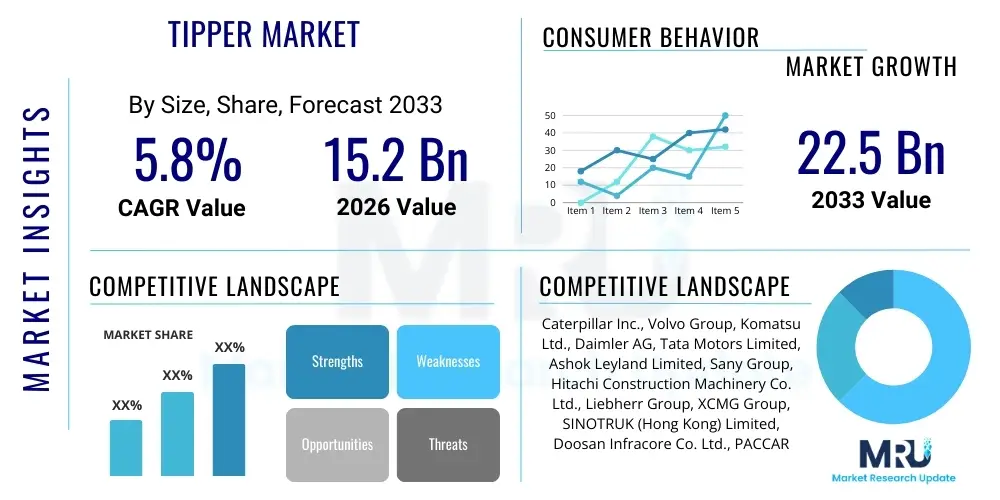

The Tipper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 22.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by significant global investments in infrastructure development, burgeoning construction activities, and the sustained expansion of the mining and waste management sectors across various continents. The increasing demand for efficient bulk material handling solutions, essential for the progression of modern economies, coupled with continuous technological advancements in vehicle design and operational efficiency, are key macro-economic factors driving this consistent market expansion. Manufacturers are continuously innovating to offer more robust, fuel-efficient, and technologically integrated tippers to meet the evolving and diverse demands of end-users in challenging operational environments worldwide.

Tipper Market introduction

Tipper trucks, also universally known as dump trucks, constitute a critical and indispensable segment within the heavy commercial vehicle industry, specifically engineered and designed for the highly efficient transportation and precise discharge of loose bulk materials. These robust and specialized vehicles are fundamentally characterized by their distinctive open-box bed, which is securely hinged at the rear of the chassis, and is typically elevated by a powerful hydraulic ram located at the front, facilitating the rapid and controlled dumping of materials at designated sites. Their primary and essential function is to efficiently move vast quantities of commodities such as sand, gravel, stone aggregates, soil, demolition debris, coal, various ores, and diverse types of waste materials across varying distances and terrains. The inherent robust construction, coupled with specialized hydraulic and mechanical mechanisms of these tippers, ensures exceptional durability, reliability, and consistent performance even under the most challenging and demanding operational conditions, thereby solidifying their status as foundational assets in modern infrastructure development, resource extraction, and material handling operations globally. The continuous evolution of these essential vehicles has progressively witnessed the integration of advanced engineering principles, with a steadfast focus on maximizing payload capacity while rigorously adhering to increasingly stringent safety standards and environmental regulations across the international landscape.

The product spectrum within the global tipper market is remarkably diverse and highly specialized, meticulously designed to cater to an extensive array of operational requirements and specific industry applications. This broad categorization includes standard rigid tippers, which are highly preferred for conventional on-road construction projects and urban material transport due to their maneuverability and straightforward design; articulated dump trucks (ADTs), which are distinctively designed with a flexible pivot hinge connecting the cab and the dump box, offering unparalleled maneuverability, superior traction, and exceptional off-road capabilities crucial for navigating challenging, uneven, soft, or steep terrains commonly found in mining sites, quarries, and large-scale earthmoving projects; and semi-trailer tippers, which are high-capacity units pulled by a separate tractor unit, specifically optimized for high-volume, long-distance transportation of massive quantities of materials over highways and inter-regional routes. Key innovative features consistently observed across these diverse tipper variants encompass high-performance, fuel-efficient engines delivering substantial torque and power; exceptionally durable chassis constructed from advanced high-strength steels for superior load-bearing capabilities and structural integrity; sophisticated hydraulic systems ensuring precise, controlled, and safe tipping operations; and, increasingly, integrated advanced telematics, Global Positioning Systems (GPS), and comprehensive safety systems for enhanced fleet management, predictive maintenance, and improved operator well-being. These continuous technological advancements underscore a significant market trend towards greater specialization, intelligent integration, and a pronounced focus on sustainability to meet the distinct and evolving demands of various heavy industries.

The major applications of tipper trucks are profoundly impactful and span across several vital economic sectors, making them indispensable components of modern industrial operations. In the burgeoning construction industry, tippers are absolutely vital for transporting foundational building materials to diverse construction sites, efficiently clearing excavation debris, and delivering massive quantities of aggregates essential for extensive road construction and other critical infrastructure projects. The global mining sector relies heavily on robust, heavy-duty tippers for the arduous task of moving enormous volumes of ore, overburden, and waste rock within the confines of mines and transporting them to processing plants or disposal areas, often operating continuously in extremely harsh environments. Within the critical domain of waste management, tippers facilitate the highly efficient collection, consolidation, and transportation of municipal solid waste, recyclable materials, and substantial volumes of construction and demolition waste to designated disposal sites, processing plants, or recycling facilities, often requiring specialized body designs and compaction mechanisms. Furthermore, in large-scale agriculture, these versatile vehicles are extensively employed for hauling substantial quantities of harvested crops, grains, animal feed, fertilizers, and other bulk agricultural products. The inherent and compelling benefits of utilizing tipper trucks are substantial and multifaceted, including significantly enhanced operational efficiency, a drastic reduction in manual labor requirements and associated costs, and the unparalleled ability to handle immense material volumes with speed and precision, thereby accelerating project timelines, minimizing logistical complexities, and substantially improving overall productivity across a multitude of industrial applications. The market's sustained growth is predominantly driven by burgeoning global investments in extensive infrastructure development programs, rapid and continuous urbanization necessitating new residential, commercial, and and industrial constructions, the relentless expansion of mining activities in resource-rich regions, and the continuous evolution and increasing needs of sophisticated waste management and recycling industries worldwide, all contributing to the pervasive and indispensable demand for tipper trucks.

Tipper Market Executive Summary

The global tipper market is presently undergoing a profound and dynamic transformation, characterized by significant shifts influenced by overarching business, regional, and segment-specific trends that are collectively reshaping its competitive landscape and future growth trajectories. From a macro-business perspective, the industry is experiencing an accelerating and pervasive integration of advanced digital technologies, with sophisticated telematics and Internet of Things (IoT) solutions evolving from optional features to absolutely essential tools for comprehensive fleet management. These cutting-edge technologies enable real-time, granular monitoring of vehicle performance metrics, precise fuel consumption analysis, and detailed operational efficiency tracking, thereby facilitating proactive maintenance scheduling and highly optimized resource allocation across entire fleets. Concurrently, there is an intensified and global focus on sustainability, compelling manufacturers to invest heavily in the research and development of highly fuel-efficient designs and, more significantly, in the rapid proliferation of electric and hybrid tipper models. This pivotal shift aligns seamlessly with increasingly stringent global emission regulations and a growing worldwide environmental consciousness, ultimately aiming to substantially reduce the carbon footprint associated with heavy-duty transportation. Furthermore, market players are actively exploring innovative manufacturing techniques and the strategic use of lightweight, high-strength materials to enhance payload capacity, reduce overall vehicle weight, and thereby lower operational costs while simultaneously improving fuel economy and structural integrity, marking a significant advancement in material science application within the sector.

Regionally, the tipper market presents a fascinating and highly varied mosaic of growth patterns and distinct market characteristics across different geographical areas. Asia Pacific unequivocally stands out as the primary engine of market expansion, propelled by unprecedented levels of large-scale infrastructure development, rapid and continuous urbanization, and flourishing mining operations across key economies such as China, India, and Southeast Asian nations. These dynamic regions are experiencing substantial, multi-billion dollar investments in extensive road networks, modern smart cities, and expansive industrial zones, collectively creating an immense and sustained demand for tipper trucks of all capacities. In stark contrast, mature markets like North America and Europe, while generally experiencing slower overall volume growth, are profoundly distinguished by a strong emphasis on technological sophistication, the rigorous adoption of advanced safety standards, and a pioneering drive towards the widespread electrification and development of autonomous driving solutions within the heavy commercial vehicle segment. These regions frequently serve as global innovation hubs, setting crucial trends for advanced features, sustainable practices, and regulatory benchmarks. Emerging markets in Latin America, the Middle East, and Africa are also demonstrating considerable and accelerating potential, fueled by robust investments in resource extraction, ambitious urban expansion projects, and the critical modernization of their transportation and construction sectors, making them increasingly vital markets for both new equipment sales and a rapidly burgeoning aftermarket services industry.

Segment-wise, the intricate market dynamics reveal a nuanced interplay of demand and supply across various tipper categories. Heavy-duty tippers continue to assert their market dominance, particularly in large-scale mining operations and major national and international infrastructure projects, a position attributed to their superior load-bearing capacity, inherent robustness, and unparalleled ability to operate reliably in extremely demanding and challenging environmental conditions. However, the market is simultaneously witnessing a burgeoning and accelerating demand for medium and light-duty tippers, which are increasingly sought after for urban construction projects, municipal waste collection services, and specialized agricultural applications where enhanced maneuverability, lower acquisition costs, and reduced fuel consumption are paramount operational considerations. This significant diversification reflects the evolving operational requirements across a multitude of different industries. A particularly significant and rapidly expanding segment is the transformative shift towards alternative powertrain systems, most notably electric and hybrid tippers. While still nascent in its overall market penetration, this segment is unequivocally poised for exponential growth as battery technology continuously improves, charging infrastructure expands globally, and regulatory incentives for zero-emission vehicles become more prevalent and widespread. This crucial trend signifies a long-term and irreversible shift towards a greener, more sustainable, and technologically advanced future for the entire tipper market, presenting both substantial strategic challenges and immense growth opportunities for manufacturers, operators, and technology providers alike.

AI Impact Analysis on Tipper Market

User inquiries and market discourse regarding the profound impact of Artificial Intelligence (AI) on the tipper market frequently gravitate towards several core and critical themes: the potential for radical enhancements in operational efficiency, the fundamental transformation of safety protocols, and the evolutionary development of advanced maintenance strategies. Stakeholders across the industry are particularly keen to understand how AI can facilitate the advent of semi-autonomous and fully autonomous tipper operations, especially within controlled and repetitive environments such as vast mining sites, extensive quarries, or large construction zones, fundamentally altering traditional labor requirements and significantly elevating safety profiles by minimizing human exposure to hazardous conditions. Furthermore, substantial interest lies in AI's inherent capacity to optimize intricate logistics and highly complex route planning, which promises to lead to substantial reductions in fuel consumption, optimized travel times, and improved overall fleet utilization. Users are also eager to explore how AI can contribute to the development of more sustainable and cost-effective fleet management systems, moving decisively beyond basic telematics to sophisticated predictive and prescriptive analytics that empower better, more informed, and data-driven decision-making across the entire value chain of tipper operations, from procurement to final delivery. The overarching expectation is that AI will emerge as a transformative force, enabling tipper fleets to become inherently smarter, significantly more responsive, and considerably more productive than ever before, heralding a new era of intelligent heavy equipment operation.

The strategic integration of AI technologies is poised to fundamentally revolutionize the tipper market by introducing unprecedented levels of intelligence, automation, and analytical capabilities into traditional heavy equipment operations. One of the most significant and immediate impacts will be observed in radically enhanced predictive maintenance capabilities. Leveraging advanced machine learning algorithms, AI systems can process vast datasets continuously gathered from vehicle sensors, telematics units, and extensive operational history to identify subtle patterns and anomalies indicative of impending mechanical failures long before they occur. This sophisticated analytical foresight allows fleet managers to schedule maintenance proactively and precisely, thereby preventing costly breakdowns, significantly reducing unplanned downtime, and substantially extending the operational lifespan of critical components such such as engines, transmissions, hydraulic systems, and tires. Such a proactive and data-driven approach not only minimizes unexpected maintenance expenses but also ensures higher asset utilization, greater fleet reliability, and a significant shift from reactive repairs to predictive, intelligent asset management across the entire tipper fleet, optimizing operational continuity.

Beyond the realm of maintenance, AI's profound influence extends deeply into optimizing operational efficiency, ensuring superior safety, and enabling environmental sustainability. In logistics, AI-powered algorithms are capable of analyzing myriad real-time variables, including current traffic conditions, fluctuating weather forecasts, complex route topography, dynamic construction site logistics, and evolving regulatory constraints, to dynamically generate the most efficient travel paths and optimized delivery schedules. This level of optimization minimizes fuel consumption, drastically reduces travel time, and significantly improves the punctuality and reliability of material deliveries, directly translating into substantial cost savings, reduced carbon emissions, and increased overall productivity. For safety, AI-powered advanced driver-assistance systems (ADAS) are becoming increasingly sophisticated and ubiquitous. These intelligent systems utilize advanced computer vision, lidar, radar, and sensor fusion technologies to detect potential hazards, accurately monitor driver fatigue levels, proactively prevent collisions through automated braking or steering interventions, and provide comprehensive 360-degree situational awareness. In highly controlled environments, such as large-scale mining operations or extensive quarry sites, AI is rapidly paving the way for fully autonomous tipper operations, where vehicles can navigate, load, and dump materials with minimal or no direct human intervention, further enhancing safety by removing personnel from hazardous zones and enabling continuous, optimized operation under ideal conditions. These collective advancements underscore AI's pivotal role in creating a more efficient, safer, environmentally responsible, and highly optimized future for the entire tipper market, setting new industry benchmarks.

- Enhanced predictive maintenance and fault detection through sophisticated machine learning analysis of real-time telematics data, significantly reducing unplanned downtime and maintenance costs.

- Optimized route planning and logistics using AI algorithms for maximum fuel efficiency, minimal travel time, reduced operational costs, and improved delivery schedules.

- Improved operational safety through AI-powered advanced driver-assistance systems (ADAS), intelligent collision avoidance, and driver behavior monitoring.

- Development and deployment of semi-autonomous and fully autonomous tipper operations, particularly viable in controlled environments like mines, quarries, and large construction sites.

- Real-time performance monitoring and advanced data analytics, offering actionable insights into vehicle utilization, operational efficiency, and overall fleet health.

- Automated loading and unloading optimization, ensuring optimal payload distribution for enhanced vehicle stability, safety, and legal compliance.

- Significant reduction in operational costs through intelligent resource utilization, optimized fleet management strategies, and minimized fuel consumption.

- Better driver behavior analysis and targeted training programs based on AI-generated insights, leading to improved driving practices and reduced risk.

- Support for efficient battery management and powertrain optimization in electric and hybrid tippers, maximizing range, charge cycles, and overall longevity.

- AI-driven supply chain transparency and management for faster parts procurement, optimized inventory levels, and reduced logistical complexities.

- Enhanced environmental performance through AI-driven emissions optimization and fuel-efficient operational strategies.

DRO & Impact Forces Of Tipper Market

The global tipper market is fundamentally shaped by a complex interplay of internal and external factors, encompassing distinct drivers that propel its expansion, inherent restraints that moderate its growth, emerging opportunities that promise future evolution, and pervasive impact forces that dictate its strategic direction and competitive dynamics. Foremost among the drivers is the escalating global commitment to vast infrastructure development projects. Countries worldwide are investing unprecedented sums in constructing and upgrading extensive road networks, bridges, airports, port facilities, and modern urban transportation systems, all of which necessitate the extensive and continuous movement of bulk materials that tippers are uniquely and critically equipped to handle. The burgeoning global construction sector, fueled by rapid urbanization, increasing population growth, and the demand for modern facilities, especially in fast-developing economies, creates a sustained and immense demand for tippers to support residential, commercial, and industrial building projects. Furthermore, the sustained expansion of the global mining industry, driven by increasing worldwide demand for essential raw materials like minerals, metals, and aggregates for various manufacturing sectors, significantly boosts the need for robust, heavy-duty tippers for efficient overburden removal and massive material transport. Lastly, the growing global emphasis on efficient waste management and advanced recycling activities, responding directly to escalating environmental concerns and stringent regulatory pressures, mandates specialized tippers for the efficient collection and transportation of diverse waste streams, further cementing their indispensable role in modern, circular economies.

Conversely, the tipper market consistently contends with several significant restraints that can impede its growth trajectory and create substantial operational and financial hurdles for market participants. A primary and considerable constraint is the substantial initial capital investment required for purchasing tipper trucks, particularly specialized or heavy-duty models equipped with advanced technologies and higher capacities. This high entry barrier can significantly limit market access and expansion for smaller enterprises or new fleet operators, particularly in regions with restricted access to affordable financing or capital. Moreover, the increasing stringency of global environmental regulations, such as escalating emission standards (e.g., Euro VI in Europe, EPA Tier 4 in North America), imposes considerable research and development costs on manufacturers for compliance, which invariably translates into higher acquisition prices for end-users. Macroeconomic slowdowns, recessions, or significant geopolitical instabilities in key purchasing regions can substantially depress construction and mining activities, directly resulting in reduced demand for new tipper sales. Additionally, persistent volatility in global raw material prices, ongoing and frequent disruptions in global supply chains (often exacerbated by unforeseen global events), coupled with a perennial and widespread shortage of skilled labor required for the specialized operation and maintenance of these complex machines, present considerable challenges to market stability, production efficiency, and overall profitability for market participants across the value chain.

Despite these formidable and ongoing challenges, the tipper market is replete with numerous opportunities for strategic innovation, aggressive expansion, and sustainable long-term growth. The accelerating development and widespread adoption of electric and hybrid tippers represent a monumental growth avenue, perfectly aligning with global sustainability objectives and offering viable, low-emission solutions for operation in urban low-emission zones and environmentally sensitive areas. These alternative powertrain vehicles promise not only a reduced environmental footprint but also offer lower operational costs over their lifespan due to reduced fuel consumption and often simpler maintenance requirements. The pervasive and continuous integration of advanced technologies such as the Internet of Things (IoT), sophisticated telematics, and AI-powered predictive analytics offers unprecedented avenues for enhancing operational efficiency, streamlining comprehensive fleet management, and developing innovative value-added services that extend significantly beyond mere vehicle sales. The expansion of the rental market for tippers also presents a lucrative opportunity, allowing businesses to access high-quality, specialized equipment without the substantial burden of full ownership. Furthermore, strategic geographical expansion into underserved or rapidly developing markets, coupled with continuous product diversification to meet highly specialized application requirements across various industries, can unlock significant new revenue streams and foster sustained market leadership. These collective impact forces, ranging from rapid technological advancements and evolving regulatory frameworks to fluctuating global economic cycles and escalating environmental concerns, constantly redefine market dynamics, compelling manufacturers and service providers to adapt, innovate, and strategically position themselves to capitalize on emerging trends and maintain a robust competitive edge in this vital industrial sector.

Segmentation Analysis

The tipper market is meticulously segmented across various critical dimensions, providing a granular and comprehensive framework for understanding its intricate structure, diverse demand patterns, and the specific operational requirements of different end-use industries. This detailed segmentation is instrumental for market participants to identify lucrative niches, accurately assess the intensity of competition within various sub-markets, and strategically tailor their product development initiatives, targeted marketing campaigns, and nuanced sales strategies to precisely match the distinct and evolving needs of their target customer base. By dissecting the market along these key parameters, stakeholders can gain profound and actionable insights into consumer preferences, technological adoption rates, and regional demand variances, thereby optimizing their investment decisions, ensuring effective resource allocation, and identifying areas for competitive differentiation. This analytical approach moves significantly beyond a superficial market overview, enabling a deeper exploration of the market's underlying dynamics, latent potentials, and primary growth vectors that drive the industry forward in a complex global landscape.

The primary segmentation categories typically include the type of tipper truck, its specific payload capacity, the dominant end-use industry it serves, and the type of engine powering the vehicle. Each of these comprehensive categories offers a unique and critical lens through which to analyze market trends, evaluate customer behavior, and forecast future demand shifts. For instance, segmenting by type differentiates between rigid, articulated, semi-trailer, and specialty tippers, each meticulously designed for distinct terrains, material characteristics, and hauling distances. Capacity segmentation helps to precisely distinguish between light, medium, and heavy-duty applications, directly reflecting the scale and intensity of operations, from urban projects to heavy mining. The end-use industry segmentation highlights the diverse sectors that heavily rely on tippers, ranging from large-scale mining and infrastructure construction to municipal waste management and agriculture, each presenting unique operational demands, regulatory environments, and procurement processes. Finally, engine type segmentation captures the crucial and accelerating shift towards internal combustion, electric, and hybrid powertrains, effectively illustrating the market's proactive response to pressing environmental concerns, evolving regulatory pressures, and continuous technological advancements aimed at sustainability. A thorough and analytical examination of these meticulously defined segments is absolutely crucial for any market player aiming to develop a precise, effective, and resilient strategy, allowing them to adapt proactively to rapidly evolving market conditions and capitalize on emerging opportunities while comprehensively mitigating potential risks across the dynamic global tipper market landscape.

- By Type: This segmentation categorizes tipper trucks based on their fundamental structural design and inherent operational capabilities, directly reflecting their suitability for various terrains, material handling tasks, and logistical demands.

- Standard Tippers (Rigid Tippers): These are the most common type, widely used for on-road construction, urban infrastructure projects, and general bulk material transport, renowned for their maneuverability and conventional, robust design.

- Articulated Tippers (ADTs): Distinctively designed with a flexible pivot joint between the tractor and trailer units, providing superior flexibility, exceptional traction, and unparalleled off-road capability essential for highly demanding environments like mining, quarrying, and large-scale earthmoving operations.

- Semi-Trailer Tippers: Comprising a powerful tractor unit and a detachable trailer equipped with a tipping mechanism, these units are ideally suited for high-volume, long-distance hauling on highways and inter-regional routes, offering significant payload capacity.

- Specialty Tippers: This category includes highly niche and customized designs such as side tippers for specific unloading requirements, roll-off tippers for containerized waste, aggregate spreaders for road construction, and specialized refuse tippers, all precisely tailored for unique industrial applications and particular material types.

- By Capacity: This critical classification is based on the maximum weight of material a tipper can legally and safely carry, directly impacting its application scope and operational efficiency for different project scales.

- Light Duty Tippers (up to 10 tons): Typically utilized for smaller construction projects, landscaping, municipal services, and light agricultural tasks where maneuverability and lower capacity are sufficient.

- Medium Duty Tippers (10-25 tons): Highly versatile and widely used for a broad range of urban construction activities, municipal waste collection, and medium-scale material transport needs across various industries.

- Heavy Duty Tippers (above 25 tons): Predominantly deployed in large-scale infrastructure projects, extensive mining operations, and quarrying, where immense material volumes require robust and high-capacity vehicles for efficient movement.

- By End-Use Industry: This segment categorizes demand based on the primary sector utilizing tipper trucks, highlighting distinct operational requirements, regulatory frameworks, and market drivers inherent to each industry.

- Construction: Encompasses residential, commercial, and vast infrastructure projects (including roads, bridges, dams, and utilities), demanding various tipper types for aggregate, sand, earth, and debris transport.

- Mining: Requires exceptionally rugged, heavy-duty, and often articulated tippers for moving ore, coal, and overburden in harsh, often remote, and challenging off-road conditions.

- Waste Management: Utilizes specialized tippers for the efficient collection and transportation of municipal solid waste, recyclable materials, and construction and demolition (C&D) waste to processing or disposal facilities.

- Agriculture: Employs tippers for bulk transport of harvested crops, grains, fertilizers, animal feed, and other agricultural products on large-scale farms and cooperatives.

- Logistics and Transportation: Companies specializing in bulk commodity transport for various industrial clients, requiring efficient and reliable tippers as part of their diverse fleet.

- Public Works: Government and municipal departments use tippers for essential road maintenance, snow removal, public infrastructure development projects, and various utility-related tasks.

- By Engine Type: This critical segmentation reflects the powertrain technology employed, indicating the industry's proactive response to pressing environmental regulations and the accelerating global drive for enhanced fuel efficiency and sustainability.

- Internal Combustion Engine (ICE): The traditionally dominant powertrain, primarily utilizing diesel or gasoline, with continuous advancements in fuel efficiency, emissions control technologies, and performance.

- Electric: Battery Electric Vehicles (BEVs) offering zero tailpipe emissions, primarily gaining traction in urban, controlled, and environmentally sensitive environments, with growing range capabilities and expanding charging infrastructure.

Report Attributes Report Details Market Size in 2026 USD 15.2 Billion Market Forecast in 2033 USD 22.5 Billion Growth Rate 5.8% CAGR Historical Year 2019 to 2024 Base Year 2025 Forecast Year 2026 - 2033 DRO & Impact Forces - Drivers: Escalating Global Infrastructure Development, Burgeoning Construction Activities, Sustained Expansion of Mining Operations, Growing Demands from Waste Management & Recycling Sectors, Rapid Urbanization.

- Restraints: High Initial Capital Investment, Increasingly Stringent Environmental Emission Regulations, Economic Slowdowns & Geopolitical Instability, Volatility in Raw Material Prices & Supply Chain Disruptions, Persistent Shortage of Skilled Labor.

- Opportunities: Accelerated Development & Adoption of Electric & Hybrid Tippers, Pervasive Integration of IoT & Telematics for Fleet Management, Expansion of the Tipper Rental Market, Strategic Geographical Expansion into Emerging Markets, Continuous Product Diversification & Specialization.

- Impact Forces: Rapid Technological Advancements, Evolving Regulatory Frameworks, Global Economic Cycles, Escalating Environmental Concerns, Shifting Demographics & Urbanization Trends.

Segments Covered - By Type: Standard Tippers (Rigid Tippers), Articulated Tippers (ADTs), Semi-Trailer Tippers, Specialty Tippers (e.g., Side Tippers, Roll-off Tippers).

- By Capacity: Light Duty Tippers (up to 10 tons), Medium Duty Tippers (10-25 tons), Heavy Duty Tippers (above 25 tons).

- By End-Use Industry: Construction (Residential, Commercial, Infrastructure), Mining, Waste Management, Agriculture, Logistics and Transportation, Public Works.

- By Engine Type: Internal Combustion Engine (ICE), Electric, Hybrid.

Key Companies Covered Caterpillar Inc., Volvo Group, Komatsu Ltd., Daimler AG, Tata Motors Limited, Ashok Leyland Limited, Sany Group, Hitachi Construction Machinery Co. Ltd., Liebherr Group, XCMG Group, SINOTRUK (Hong Kong) Limited, Doosan Infracore Co. Ltd., PACCAR Inc., Scania AB, IVECO S.p.A., John Deere, Hyundai Construction Equipment, BELL Equipment, Rokbak (Volvo CE brand), Kenworth (PACCAR brand) Regions Covered North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) Enquiry Before Buy Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy Tipper Market Key Technology Landscape

The tipper market is currently undergoing a profound and accelerating technological transformation, driven by an imperative demand for significantly increased efficiency, enhanced safety protocols, substantially reduced environmental impact, and improved operational intelligence across all facets of heavy material handling. This rapid evolution is witnessing the widespread and pervasive adoption of several key technologies that are fundamentally reshaping how tipper trucks are meticulously designed, operated, and strategically managed within diverse industrial environments. A prominently emerging and highly impactful area of innovation is the seamless integration of advanced telematics and sophisticated Internet of Things (IoT) systems. These intelligent systems enable real-time, granular tracking of vehicle location, precise monitoring of performance metrics, accurate analysis of fuel consumption patterns, and detailed insights into driver behavior. This wealth of continuous data is invaluable for fleet managers, allowing for highly optimized route planning, proactive and predictive maintenance scheduling, and overall significant improvements in operational efficiency, asset utilization, and safety across the entire fleet.

Regional Highlights

- North America: This region is characterized by a mature and highly developed market that demonstrates high adoption rates of advanced technologies, including sophisticated telematics, AI-powered fleet management systems, and comprehensive advanced driver-assistance systems (ADAS). There is a strong emphasis on adhering to rigorous safety standards and stringent environmental regulations, which continuously drives innovation towards the development of more fuel-efficient, cleaner, and technologically integrated tippers. Significant and sustained investment in national infrastructure renewal projects and continued expansion across construction sectors ensures consistent and robust demand for tipper trucks throughout the region.

- Europe: As a leading region, Europe is at the forefront of the adoption of electric and hybrid tippers, a trend largely driven by increasingly stringent emission norms (such as Euro VI) and the widespread implementation of urban low-emission zones. The market focuses heavily on sustainability, advanced digitalization, and the seamless integration of smart logistics solutions into fleet operations. A robust and consistent demand from both the construction and waste management sectors further underpins market growth, with a strong preference for innovative and eco-friendly heavy equipment.

- Asia Pacific (APAC): APAC stands as the largest and most rapidly growing market globally for tipper trucks, a dynamic expansion fueled by unprecedented levels of urbanization, massive infrastructure development initiatives (such as China's Belt and Road Initiative and India's Sagarmala Project), and continuously expanding mining activities. Countries like China and India are not only major manufacturing hubs but also colossal consumption centers, exhibiting exceptionally high demand for both heavy-duty and medium-duty tippers to support their rapid economic growth and development.

- Latin America: Market growth in this region is primarily fueled by substantial investments in resource extraction (particularly mining and agriculture), extensive urban development projects, and the critical expansion of public infrastructure. The Latin American market is characterized by a strong demand for exceptionally robust, durable, and cost-effective tippers that are capable of efficiently handling challenging terrains and demanding operational conditions. There is also an increasing focus on improving logistics infrastructure and modernizing construction fleets.

- Middle East and Africa (MEA): This region is experiencing substantial growth driven by large-scale construction projects (including ambitious smart cities, commercial infrastructure, and residential developments), significant investments in the burgeoning oil and gas sector, and ongoing rapid urbanization across numerous countries. The demand for heavy-duty tippers is particularly strong, with a growing interest in vehicles that offer superior durability, exceptional reliability, and robust performance suitable for the often harsh and demanding environmental conditions prevalent throughout the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tipper Market.- Caterpillar Inc.

- Volvo Group

- Komatsu Ltd.

- Daimler AG

- Tata Motors Limited

- Ashok Leyland Limited

- Sany Group

- Hitachi Construction Machinery Co. Ltd.

- Liebherr Group

- XCMG Group

- SINOTRUK (Hong Kong) Limited

- Doosan Infracore Co. Ltd.

- PACCAR Inc.

- Scania AB

- IVECO S.p.A.

- John Deere

- Hyundai Construction Equipment

- BELL Equipment

- Rokbak (Volvo CE brand)

- Kenworth (PACCAR brand)

Frequently Asked Questions

What are the primary factors driving the growth of the global tipper market?

The tipper market is primarily driven by extensive global infrastructure development projects, rapid urbanization, increasing mining activities for raw material extraction, and the growing demand for efficient waste management and recycling solutions worldwide. Significant investments in road networks, commercial constructions, and resource exploration notably boost demand for these heavy-duty vehicles across various geographical regions.

How is technological advancement influencing the tipper market?

Technological advancements are profoundly impacting the tipper market through the pervasive integration of telematics and IoT for advanced fleet management, the application of AI for predictive maintenance and optimized route planning, and the development of sophisticated advanced driver-assistance systems (ADAS) for enhanced safety. There's also a significant and accelerating shift towards electric and hybrid powertrains to meet stringent environmental regulations and reduce operational costs.

What are the main types of tippers available in the market?

The main types of tippers include standard rigid tippers, which are common for general construction and urban use; articulated dump trucks (ADTs), specifically designed for rough, off-road conditions such as mining sites; semi-trailer tippers, utilized for high-volume, long-distance hauling on highways; and various specialty tippers tailored for unique industrial applications, such as side tippers or roll-off tippers.

Which regions are expected to show significant growth in the tipper market?

The Asia Pacific (APAC) region is projected to exhibit the most significant growth due to extensive infrastructure development, rapid urbanization, and expanding mining activities in key countries like China and India. Other regions such as Latin America and the Middle East & Africa also present considerable growth opportunities, driven by similar developmental trends and resource extraction investments.

What are the key challenges faced by the tipper market?

Key challenges confronting the tipper market include the high initial capital purchase cost of these specialized trucks, increasingly stringent environmental regulations regarding emissions standards, economic volatility impacting construction and mining investments, and persistent supply chain disruptions. Additionally, a widespread shortage of skilled labor for operation and maintenance continues to pose a significant challenge for the industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Tipper Pad Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Tipper Body Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Tipper Body Equipment Market Size Report By Type (Roll-off Tipper Body, Three-Way Tipper Body, Rear Tipper Body), By Application (Mining, Construction, Agriculture, Sludge Treatment, Waste Management, Marine Services, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Tipper and Semi-trailer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Tipper, Semitrailer), By Application (Construction Industry, Mining, Cement Plant, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Tipper Body Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Roll-off Tipper Body, Three-Way Tipper Body, Rear Tipper Body), By Application (Mining, Construction, Agriculture, Sludge Treatment, Waste Management, Marine Services, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager