Tooling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434482 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Tooling Market Size

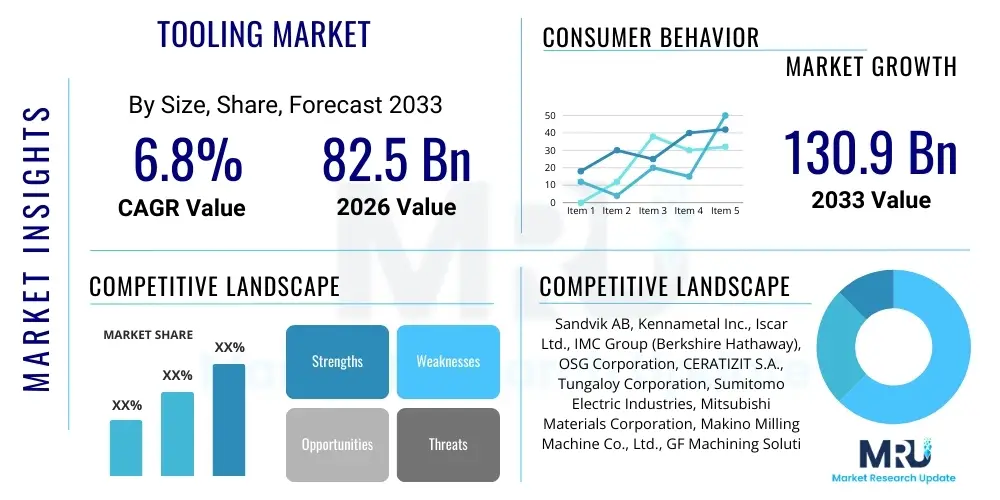

The Tooling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $82.5 Billion in 2026 and is projected to reach $130.9 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the resurgence in global manufacturing activities, particularly within the automotive, aerospace, and general machinery sectors. Furthermore, the increasing complexity of components requiring high precision and specialized fabrication techniques necessitates continuous investment in advanced tooling solutions, which sustains this robust market expansion across diverse industrial geographies.

Tooling Market introduction

The Tooling Market encompasses the design, manufacture, and distribution of essential production equipment such as molds, dies, fixtures, jigs, cutting tools, and gauges, which are critical components in almost every major manufacturing sector globally. These tools are indispensable for shaping, cutting, forming, and assembling raw materials or workpieces with high precision and repeatability, forming the foundation of mass production techniques. Modern tooling solutions are characterized by high durability, advanced material compositions (like cemented carbide or ceramics), and integration with Computer Numerical Control (CNC) and automation systems to enhance operational efficiency and quality control across production lines.

Major applications for tooling span the automotive industry (for engine components, body panels, and interior molds), aerospace and defense (for precision parts and structural components), consumer electronics (for intricate plastic and metal housings), and general machinery manufacturing. The primary benefits derived from investing in advanced tooling include significantly reduced cycle times, minimal material waste, superior product consistency, and the ability to produce geometrically complex parts that meet stringent engineering specifications. The longevity and reliability of tooling directly impact the total cost of ownership in high-volume production environments, making material science and precise fabrication paramount.

Key driving factors accelerating market expansion include the global shift towards Industry 4.0, which integrates smart manufacturing concepts and automation, demanding sophisticated, interconnected tooling systems. Additionally, the rapid electrification of the automotive sector, requiring specialized molds and dies for battery casings and lightweight components, provides a significant boost. The persistent demand for customization and lightweight materials, particularly in the aerospace and medical device industries, further necessitates the development and deployment of highly specialized and adaptable tooling solutions capable of handling exotic alloys and composites, thereby ensuring sustained market growth.

Tooling Market Executive Summary

The global Tooling Market is poised for substantial growth, reflecting fundamental shifts in manufacturing paradigms and increasing demand for high-precision components across key vertical industries. Current business trends indicate a strong move toward digitalization, with manufacturers adopting sophisticated design software (CAD/CAM) and simulation tools to optimize tooling performance and reduce lead times. There is a palpable trend towards integrating additive manufacturing (3D printing) for prototyping and producing complex tooling inserts, which offers unprecedented flexibility and speed in tool creation. Furthermore, sustainability requirements are driving innovation toward tooling materials that offer longer lifecycles and higher energy efficiency in operation, influencing procurement decisions across the value chain, particularly in developed economies.

Regionally, the Asia Pacific (APAC) continues to dominate the market volume, primarily fueled by the presence of massive manufacturing bases in China, Japan, South Korea, and emerging markets like India, where automotive and electronics production is aggressively expanding. However, North America and Europe remain crucial markets, characterized by a focus on high-value, specialized tooling, especially for the medical, aerospace, and high-performance automotive sectors, where stringent quality standards necessitate highly customized solutions. These mature regions are leading in the adoption of smart tools equipped with sensors and IoT capabilities for real-time monitoring and predictive maintenance, setting the benchmark for technological advancement globally.

Segment-wise, the Molds and Dies segment holds the largest market share due to its essential role in plastic injection molding, stamping, and casting processes, driven by consumer electronics and vehicle production volumes. Meanwhile, the Cutting Tools segment is experiencing rapid innovation, particularly in surface coatings and material substrates, catering to the increasing use of hard materials like high-strength steel and titanium alloys in aerospace and energy applications. The high demand for precision and efficiency ensures that market trends heavily favor tooling providers who can offer integrated solutions that combine superior material performance with embedded digital capabilities, supporting fully automated production lines.

AI Impact Analysis on Tooling Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Tooling Market predominantly center on three core themes: operational efficiency, design optimization, and maintenance costs. Users frequently ask how AI can reduce the lengthy design cycle of complex molds and dies, whether AI-driven predictive maintenance can genuinely minimize unplanned downtime on high-value machinery, and the extent to which AI-powered quality inspection systems can replace traditional manual checks. Expectations are high regarding AI's potential to automate complex tool path generation, perform generative design based on functional requirements, and analyze vast operational data streams (vibration, temperature, pressure) collected from smart tools to enhance their lifespan and throughput. These concerns reflect a strong interest in leveraging AI to move from reactive maintenance to fully proactive, adaptive tooling management strategies that directly impact profitability.

AI’s influence is rapidly transforming traditional tooling manufacturing by enabling intelligent automation and deep process optimization. Generative design algorithms, powered by machine learning, can rapidly iterate thousands of complex tooling geometries, optimizing material usage, cooling channels, and structural integrity far beyond traditional human capabilities. This acceleration in the design phase significantly reduces time-to-market for new components. Furthermore, AI systems are now being deployed in advanced quality control, utilizing computer vision and deep learning models to inspect finished tooling and manufactured parts with unprecedented speed and accuracy, identifying microscopic defects that conventional inspection methods might miss.

In the operational sphere, AI is critical for implementing true predictive maintenance. By analyzing sensor data gathered from CNC machines and smart tools (e.g., thermal mapping, wear indices), AI algorithms can forecast tool failure probabilities weeks in advance. This allows manufacturers to schedule replacements or refurbishment precisely when necessary, minimizing costly production interruptions and maximizing tool utilization rates. This shift from time-based maintenance to condition-based maintenance is maximizing the return on investment for expensive tooling assets, fundamentally altering the economics of high-volume manufacturing environments and driving adoption across global industrial enterprises seeking competitive advantages in efficiency.

- AI-driven Generative Design: Automates the creation of complex tool geometries, optimizing structure and cooling efficiency.

- Predictive Maintenance: Uses machine learning on sensor data (vibration, temperature) to forecast tool wear and prevent unplanned downtime.

- Automated Quality Inspection: Deployment of computer vision for real-time, high-precision detection of defects in tooling and manufactured components.

- Process Optimization: AI algorithms optimize cutting parameters, feed rates, and machine settings to maximize material removal rates and extend tool life.

- Smart Tool Monitoring: Integration of embedded sensors and AI edge computing to provide real-time performance feedback and autonomous adjustments.

DRO & Impact Forces Of Tooling Market

The dynamics of the Tooling Market are shaped by a complex interplay of fundamental market Drivers, critical Restraints, promising Opportunities, and pervasive Impact Forces that dictate strategic direction and investment decisions. The primary market driver is the inexorable growth in global industrial output, particularly the expanding manufacturing base in Asia Pacific and the complex requirements generated by electric vehicle (EV) production, which necessitates entirely new tooling sets for battery casings and power electronics. This is coupled with the pervasive trend of digitization and automation (Industry 4.0), demanding sophisticated, sensor-enabled tools capable of real-time communication and self-optimization within smart factories, thus compelling investment in modern, high-performance tooling assets.

However, the market faces significant Restraints, notably the high initial capital investment required for specialized tooling, particularly molds and dies, which can take months to design and fabricate, posing a substantial financial barrier for smaller manufacturers. Furthermore, volatility in the prices of key raw materials, such as tungsten carbide, high-speed steel, and specialized ceramics, introduces cost uncertainties that impact the profitability of tool manufacturers and their subsequent pricing structures for end-users. The persistent skill gap in operating and maintaining advanced CNC machinery and integrated tooling systems also restricts faster adoption, particularly in regions where industrial training infrastructure is less developed, slowing the transition to high-precision manufacturing processes.

Opportunities for growth are concentrated in the rapid adoption of Additive Manufacturing (AM) for tooling applications, allowing for the rapid production of complex, customized inserts and conformal cooling channels that dramatically improve injection molding performance. The burgeoning demand from the medical device industry for micro-tooling and high-precision components used in diagnostics and surgical equipment offers a high-value niche market. Additionally, tool manufacturers can leverage the lifecycle management of tooling through services like resharpening, recoating, and digital monitoring subscriptions, transforming the business model from a transactional sale to a sustained service-based revenue stream. These strategic opportunities necessitate continuous technological investment to maintain competitiveness.

- Drivers:

- Rapid growth in automotive and aerospace manufacturing, especially EV component production.

- Increased adoption of automation and Industry 4.0 standards across manufacturing sectors.

- Demand for complex, high-precision components requiring specialized tooling materials and design.

- Continuous technological advancements in tool coatings and material science (e.g., nanocoatings).

- Restraints:

- High initial capital cost and long lead times for highly customized molds and dies.

- Fluctuating raw material prices (e.g., tungsten, steel, carbide).

- Shortage of skilled labor proficient in advanced tooling design, operation, and maintenance.

- Risk of substitution by additive manufacturing processes for low-volume or temporary tooling needs.

- Opportunities:

- Integration of Additive Manufacturing (3D Printing) for rapid prototyping and complex tooling inserts.

- Expansion into high-growth vertical markets such as medical devices and renewable energy components.

- Development of smart tooling equipped with IoT sensors for real-time performance monitoring and data analytics.

- Offering tool lifecycle management services (reconditioning, coating) to enhance customer retention and recurring revenue.

- Impact Forces (Key Market Dynamics):

- Technological Obsolescence: Rapid advancements in CNC machining and materials necessitate frequent tooling updates.

- Globalization of Supply Chains: Tooling procurement is highly competitive and often outsourced, pressuring margins.

- Environmental Regulations: Pressure to use sustainable manufacturing practices influences material selection and waste reduction targets.

- Demand for Lightweighting: Tooling must adapt to work with new, lightweight, and often harder composites and alloys.

Segmentation Analysis

The Tooling Market is highly diversified and segmented based on product type, material, application, and end-use industry, reflecting the broad range of manufacturing processes globally. Product segmentation is crucial, differentiating between consumables like cutting tools and long-term assets such as molds and dies, each requiring different investment profiles and service models. Material segmentation highlights the technological sophistication of the industry, moving beyond conventional high-speed steel towards advanced composites, ceramics, and cemented carbides, chosen based on the specific workpiece material, required precision, and expected lifecycle. The analysis of these segments is vital for understanding market dynamics, allowing tool manufacturers to focus their R&D efforts and marketing strategies on high-growth niche areas, such as the increasing demand for specialized tooling in the medical and aerospace sectors where margins are typically higher due to strict compliance requirements and complexity.

- By Product Type:

- Cutting Tools (Indexable Inserts, Solid Round Tools, Drills, Milling Tools, Reamers)

- Molds & Dies (Injection Molds, Die Casting Dies, Stamping Dies)

- Fixtures & Jigs

- Gauges & Metrology Tools

- By Material:

- High-Speed Steel (HSS)

- Cemented Carbide

- Ceramics

- Diamond/CBN (Cubic Boron Nitride)

- Others (Tool Steel, Composites)

- By Application:

- Molding

- Forming

- Cutting

- Machining

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Industrial Machinery

- Consumer Electronics

- Medical Devices

- Packaging

- Energy (Oil & Gas, Renewables)

Value Chain Analysis For Tooling Market

The Tooling Market value chain is a multi-layered ecosystem, starting with the upstream suppliers of raw materials and specialized components, extending through complex manufacturing processes, and concluding with sophisticated distribution and after-sales service. Upstream analysis focuses on the sourcing of critical materials such as specialized steel alloys, tungsten carbide powders, and coating materials (e.g., Titanium Nitride). Reliability, quality, and price stability in this segment are paramount, as material composition dictates the final performance and cost of the tool. Key upstream activities also include intellectual property protection regarding proprietary tool designs and patented material treatments, providing a crucial competitive edge in highly specialized niches.

The core manufacturing stage involves design (using advanced CAD/CAM/CAE), precision machining (CNC grinding, EDM), heat treatment, and surface coating processes. Manufacturers focus intensely on quality control and dimensional accuracy, leveraging metrology and inspection equipment to ensure tooling meets extremely tight tolerances. Downstream activities involve distribution and end-user engagement. The distribution channel is bifurcated into direct sales channels, often used for large, customized molds or aerospace tooling where direct consultation and engineering support are necessary, and indirect channels, such as specialized industrial distributors and e-commerce platforms, which handle high-volume standard cutting tools and consumables.

Indirect distribution networks provide crucial logistical support, inventory management, and regional availability, which are essential for minimizing downtime in customer manufacturing plants. Direct sales relationships are crucial for highly complex projects, enabling tool builders to collaborate intimately with the customer's engineering team throughout the design and try-out phases. Post-sales service, including reconditioning, recoating, and digital monitoring subscriptions, is increasingly integrated into the value chain, representing a significant source of recurring revenue and strengthening customer loyalty. This service component leverages data analytics to optimize tool life and usage parameters, further solidifying the tool provider's role as a strategic partner rather than just a component supplier.

Tooling Market Potential Customers

The potential customer base for the Tooling Market is highly diversified, spanning nearly every sector that engages in physical goods manufacturing, with specific clusters demonstrating high growth potential and demanding specialized products. The largest segment of end-users are large-scale Original Equipment Manufacturers (OEMs), particularly those in the automotive sector (including traditional vehicle manufacturers and emerging EV producers) and the aerospace industry, who require complex, high-volume tooling for stamping, molding, and high-precision machining of critical safety components. These customers prioritize durability, cycle time efficiency, and global support infrastructure when selecting tooling partners, often leading to long-term strategic contracts with major global tooling suppliers.

Another significant group comprises independent contract manufacturers and mold makers, often referred to as Tier 1 or Tier 2 suppliers, who rely on standard and specialized cutting tools, fixtures, and smaller molds to produce components for the OEMs. These customers focus intensely on tool cost-efficiency, immediate availability through distribution channels, and consistent performance across various materials. Furthermore, the medical device industry represents a rapidly expanding high-value customer segment, requiring extremely precise, often microscopic, tooling for minimally invasive surgical instruments, implants, and complex diagnostic equipment, where material purity and bio-compatibility are non-negotiable requirements, justifying premium pricing for specialized tools.

The general engineering and heavy machinery sectors, including construction equipment and agricultural machinery manufacturers, also form a substantial customer base, requiring large-scale forming dies and robust cutting tools capable of handling thick, hard metals under heavy load conditions. Emerging customers include renewable energy component producers, notably those manufacturing wind turbine parts, solar panel frames, and specialized heat exchangers, where novel materials and large dimensions necessitate bespoke tooling solutions. Ultimately, any organization involved in the consistent, high-volume, and high-precision production of manufactured goods is a primary potential buyer of tooling products and related services, driving demand across industrialized economies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $82.5 Billion |

| Market Forecast in 2033 | $130.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Kennametal Inc., Iscar Ltd., IMC Group (Berkshire Hathaway), OSG Corporation, CERATIZIT S.A., Tungaloy Corporation, Sumitomo Electric Industries, Mitsubishi Materials Corporation, Makino Milling Machine Co., Ltd., GF Machining Solutions, Roeders GmbH, Schuler Group GmbH, Milacron Holdings Corp., Barnes Group Inc., Alpha Tools Co. Ltd., Misumi Group Inc., Han’s Laser Technology Industry Group Co., Ltd., United Grinding Group, Grob-Werke GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tooling Market Key Technology Landscape

The technological landscape of the Tooling Market is characterized by a strong convergence of advanced materials science, precision engineering, and digital integration, primarily driven by the requirements of Industry 4.0. Central to this evolution is the advancement in surface coating technologies, such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), which apply ultra-hard, friction-reducing layers (like multilayered ceramics or diamond-like carbon, DLC) to cutting tools and molds. These coatings drastically extend tool life, allow for higher cutting speeds, and improve surface finish quality, enabling manufacturers to process increasingly difficult materials, such as titanium alloys and composite materials common in aerospace applications, with greater efficiency and reduced cycle times.

Another pivotal technology is the widespread adoption of high-speed and high-precision Computer Numerical Control (CNC) machining centers, often integrated with five-axis or multi-axis capabilities, which allow for the creation of intricate, complex tool geometries with minimal human intervention. Alongside this hardware advancement, the integration of smart technology is transforming tooling itself. Smart tools are now equipped with miniature IoT sensors capable of measuring temperature, vibration, and acoustic emissions in real-time. This sensor data is analyzed using edge computing and cloud analytics, enabling condition monitoring and facilitating the shift toward predictive maintenance models, thereby maximizing tool utilization and minimizing unexpected production stops, particularly critical in high-cost automotive stamping lines.

Furthermore, Additive Manufacturing (AM), particularly Laser Powder Bed Fusion (LPBF), is increasingly used to produce complex tooling inserts, especially those incorporating conformal cooling channels. These channels follow the exact contour of the part being molded, dramatically improving heat dissipation during the molding process, which, in turn, reduces cycle times and enhances part quality, a significant breakthrough in injection molding technology. Alongside these hardware and material innovations, sophisticated Computer-Aided Engineering (CAE) and simulation software are now standard practice, enabling tool designers to virtually test mold filling, cooling rates, and structural integrity before physical production begins, optimizing performance and drastically reducing the costly and time-consuming trial-and-error phase in tool development. This combination of material enhancement, digital integration, and process simulation defines the modern competitive landscape for tooling manufacturers seeking to deliver high-performance solutions globally.

Regional Highlights

The global Tooling Market exhibits distinct regional dynamics driven by local industrial bases, technological adoption rates, and economic maturity. The Asia Pacific (APAC) region stands out as the largest and fastest-growing market, primarily due to the concentration of global manufacturing hubs in countries like China, which is the world’s leading producer and consumer of molds and dies, and India, which is rapidly expanding its automotive and general machinery sectors. This region benefits from lower operational costs, substantial government investment in industrial infrastructure, and a massive supply chain supporting consumer electronics production. The focus in APAC is often balanced between high-volume, cost-effective tooling and advanced, high-precision tools for export-oriented manufacturing, creating high demand across all product segments.

North America, led by the United States, represents a highly technologically advanced and quality-driven market. Growth here is fueled by robust demand from the aerospace and defense sectors, which require complex, high-tolerance tooling made from exotic materials, and the resurgence of specialized automotive manufacturing, particularly in the EV and premium segments. The regional trend leans heavily toward implementing smart manufacturing technologies, automation, and leveraging advanced digital solutions (e.g., AI/ML in design and monitoring) to justify the higher labor and operational costs. North American manufacturers emphasize long tool life and predictive performance, driving the demand for premium carbide and coated tools.

Europe maintains a strong position, particularly in Western countries like Germany, Italy, and Switzerland, known for their world-leading expertise in high-precision engineering and machine tools. The European market is characterized by stringent environmental and quality regulations, driving innovation toward highly efficient, durable, and sophisticated tooling solutions. The automotive industry remains a core consumer, but there is significant growth in the medical device, precision engineering, and luxury goods sectors. European tooling suppliers often lead in the adoption of specialized manufacturing techniques, such as micro-tooling and advanced coating technologies, maintaining a reputation for superior quality and reliability globally. Latin America, the Middle East, and Africa (MEA) are emerging markets, where growth is highly correlated with regional industrialization efforts and foreign direct investment in sectors like oil and gas, infrastructure, and localized automotive assembly, generating a rising, albeit volatile, demand for standard industrial tooling.

- Asia Pacific (APAC): Dominates the market due to large manufacturing bases in China, India, and Southeast Asia. Growth driven by high-volume automotive, consumer electronics, and general industrial production. Characterized by high consumption of molds, dies, and cutting tools.

- North America: Focused on high-value, high-precision tooling for aerospace, defense, and specialized automotive (EV components). High adoption rates of smart tooling, digital integration, and automation technologies to enhance competitiveness.

- Europe: A mature market defined by stringent quality standards and technological leadership, particularly in Germany and Italy. Strong demand from high-precision engineering, luxury automotive, and medical device manufacturing. Pioneers in advanced coating and specialized tool materials.

- Latin America (LATAM): Growth tied to infrastructure development and localized automotive assembly operations (e.g., Brazil, Mexico). Demand often centers on standard industrial and forming tools, with increasing investment in modernization.

- Middle East and Africa (MEA): Market expansion driven by investment in oil & gas, construction, and emerging manufacturing diversification initiatives. Demand is often project-based and reliant on imported specialized tooling.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tooling Market.- Sandvik AB (Seco Tools)

- Kennametal Inc.

- Iscar Ltd. (IMC Group - Berkshire Hathaway)

- OSG Corporation

- CERATIZIT S.A.

- Tungaloy Corporation

- Sumitomo Electric Industries, Ltd.

- Mitsubishi Materials Corporation

- Makino Milling Machine Co., Ltd.

- GF Machining Solutions

- Roeders GmbH

- Schuler Group GmbH

- Milacron Holdings Corp. (Now part of Hillenbrand)

- Barnes Group Inc. (Synventive)

- Alpha Tools Co. Ltd.

- Misumi Group Inc.

- Han’s Laser Technology Industry Group Co., Ltd.

- United Grinding Group

- Grob-Werke GmbH & Co. KG

- Kaysun Corporation

Frequently Asked Questions

Analyze common user questions about the Tooling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Tooling Market globally?

Market growth is primarily driven by the increasing demand from the automotive industry, particularly electric vehicle (EV) production requiring new molds and dies, coupled with the global adoption of Industry 4.0 automation, which necessitates highly precise and smart tooling solutions for efficient production.

How does the integration of Additive Manufacturing (AM) affect traditional tooling?

AM primarily serves as an opportunity by enabling the rapid production of complex tooling components and inserts, such as those with conformal cooling channels, which dramatically reduces manufacturing cycle times and improves part quality, complementing rather than fully replacing traditional methods.

Which material segment holds the largest market share in tooling?

The Cemented Carbide segment typically holds a significant share, especially within cutting tools, owing to its superior hardness, wear resistance, and ability to handle high-speed machining of hard alloys, making it essential across general engineering and aerospace applications.

What role does Artificial Intelligence (AI) play in optimizing tool performance?

AI is crucial for predictive maintenance, using sensor data to forecast tool wear and scheduling proactive replacement, thereby minimizing expensive downtime. It also aids in generative design, optimizing tool geometry for better material efficiency and performance.

Which end-use industry is the largest consumer of tooling products?

The Automotive industry remains the largest end-user segment, consuming vast volumes of molds, dies, and cutting tools required for stamping, casting, and machining millions of engine parts, body panels, and interior plastic components annually worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Aircraft Maintenance Tooling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Tablet Compression Tooling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Field Effect Rectifier Dioded Market Size Report By Type (45V - Below 60V, 60V - Below 75V, 75V - Below 90V, 90V - 100V), By Application (Auxiliary Power, UPS, Home Appliances, Air Conditioning, Server and Telecom Power, USB Chargers, Switched Mode Power Supply, DC-DC Convertor Modules, Industrial Power, Tooling Chargers, Factory Automation), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Hydrogenated Diamond-Like Carbon Coating(DLC) Market Size Report By Type (PVD, PECVD, Others), By Application (Automobile Components, Tooling Components, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Automotive Tooling (Molds) Market Size Report By Type (Stamping Dies, Casting, Plastic, Others), By Application (Passenger Cars, Commercial Vehicles), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager