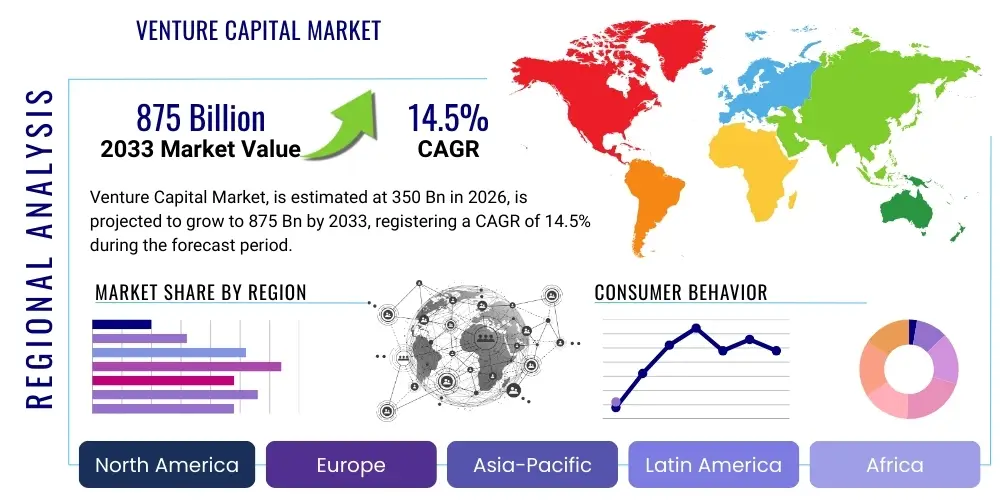

Venture Capital Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439814 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Venture Capital Market Size

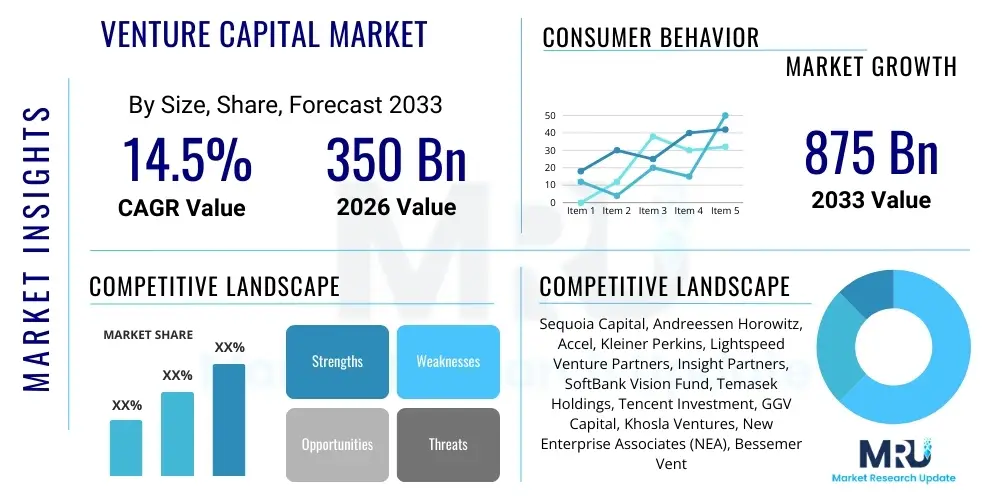

The Venture Capital Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $350 Billion in 2026 and is projected to reach $875 Billion by the end of the forecast period in 2033.

Venture Capital Market introduction

The Venture Capital (VC) market is a vital financial ecosystem that provides crucial funding to early-stage, high-growth potential companies, acting as a powerful engine for innovation and economic development. This specialized form of private equity capital is typically supplied by venture capital firms, which meticulously identify promising startups, invest capital in exchange for equity, and offer strategic guidance and operational expertise. The core offering of VC is growth capital paired with invaluable mentorship, enabling nascent companies to scale operations, develop groundbreaking technologies, and disrupt established industries. Major applications of venture capital span a diverse range of technology-driven sectors, including software, biotechnology, artificial intelligence, fintech, and renewable energy, where rapid innovation cycles and substantial capital requirements for research, development, and market penetration are common characteristics. VC is not merely about financial transactions; it's about nurturing disruptive ideas into viable, impactful businesses that can redefine markets and generate significant societal value.

The multifaceted benefits of venture capital extend significantly beyond simple financial injections. It invigorates economic growth by fostering a vibrant culture of entrepreneurship, creating new job opportunities, and efficiently commercializing cutting-edge research and intellectual property. For startups, VC funding provides the essential lifeline required to transform innovative concepts into scalable businesses, supplying critical resources for product development, attracting top-tier talent, and executing ambitious market expansion strategies. For investors, particularly Limited Partners (LPs) in VC funds, it offers the potential for exceptionally high returns on investment, albeit accompanied by a higher risk profile inherent in early-stage ventures. Key driving factors propelling the robust expansion of the VC market include the accelerating pace of technological advancements, particularly in areas like advanced AI, machine learning, blockchain, and quantum computing, which continually give rise to novel business models and entirely new industries. Furthermore, the increasing globalization facilitates unprecedented market access for startups, while the development of resilient startup ecosystems, strong government support for innovation policies, and the growing global availability of skilled talent collectively stimulate sustained demand for venture capital, firmly establishing its role as an indispensable catalyst for future global economic prosperity and technological progress, ensuring a continuous flow of capital to the most promising entrepreneurial endeavors worldwide.

Venture Capital Market Executive Summary

The Venture Capital market is undergoing a profound transformation, marked by dynamic shifts in business trends, significant regional realignments, and compelling developments across its various segments. Globally, current business trends indicate a pronounced pivot towards investment in disruptive technological innovations, with a particular emphasis on artificial intelligence, advanced analytics, and sustainable technologies. This focus is channeling substantial capital into sectors poised for revolutionary change. A discernible trend involves increasingly larger and later-stage funding rounds, as startups achieve maturity more rapidly and demonstrate proven traction, often attracting substantial follow-on investments from a diverse array of investors. This shift reflects a strategic intent to de-risk investments while maximizing returns from companies with established growth trajectories. Concurrently, the proliferation of Corporate Venture Capital (CVC) arms and the formation of strategic alliances between incumbent corporations and nimble startups are actively reshaping the competitive landscape. These collaborations provide startups with not only essential capital but also invaluable market access and strategic partnerships, while offering corporations a direct conduit to disruptive technologies and entrepreneurial talent. This evolving environment fosters an intensely competitive investment arena, compelling venture firms to continuously innovate their value proposition beyond mere capital provision, focusing on strategic support, network access, and operational guidance to differentiate themselves and attract the most promising founders.

Regional trends vividly illustrate a recalibration of global venture activity, though North America, especially the United States, continues to exert significant influence in terms of deal value and volume. Silicon Valley, New York, and Boston persist as foundational global hubs for technological innovation and venture investment. However, the Asia-Pacific (APAC) region, spearheaded by the burgeoning ecosystems of China and India, is rapidly asserting itself as a dominant force, demonstrating exponential growth in both the number of startups founded and the aggregate volume of venture investments. This surge is primarily propelled by vast domestic markets, widespread digital adoption rates, and robust governmental policies actively supporting technological innovation and entrepreneurship. Europe also maintains a strong and increasingly competitive presence, with vibrant tech hubs across cities like London, Berlin, and Paris attracting substantial capital, particularly for fintech, deep tech, and software-as-a-service ventures. Furthermore, nascent yet rapidly maturing ecosystems in Latin America and the Middle East & Africa are witnessing a significant uptick in investor interest, driven by relatively untapped markets, youthful demographics, and an accelerating pace of digital transformation. These emerging regions offer compelling long-term growth prospects for venture capital, providing diversified opportunities for global investors seeking new frontiers for high-potential investments and contributing to a more globally distributed innovation economy.

An in-depth analysis of segmentation trends reveals a sophisticated diversification of investment strategies across the Venture Capital market. While the Information Technology sector, encompassing Software-as-a-Service (SaaS), cybersecurity, and enterprise software, continues to command the largest share of capital allocation, there is a notable and increasing deployment of funds towards healthcare and biotechnology. This growth is spurred by groundbreaking innovations in areas such as gene therapies, digital health solutions, and advanced medical devices. Financial Technology (FinTech) remains a perennially strong and evolving segment, continuously adapting with new models in embedded finance, blockchain-based payment systems, and decentralized finance. Beyond these established sectors, impact investing and sustainability-focused ventures are garnering significantly increased attention and capital, reflecting a broader, global societal imperative towards addressing Environmental, Social, and Governance (ESG) criteria. From an investment stage perspective, while seed and early-stage funding remain absolutely critical for the health and vitality of the startup ecosystem, the market has observed a substantial acceleration in growth equity and late-stage rounds. These rounds often involve larger capital injections as companies aim for aggressive global scaling or prepare for public market entry, indicating a broader maturation of the venture capital asset class and a wider spectrum of sophisticated funding options available across the entire startup lifecycle, supporting companies from their inception through to successful exit events.

AI Impact Analysis on Venture Capital Market

The pervasive integration of Artificial Intelligence (AI) is fundamentally transforming the Venture Capital market, sparking extensive discussions among investors, founders, and industry analysts regarding its profound and multifaceted implications. Common inquiries frequently center on how AI is disrupting conventional VC processes, such as the initial stages of deal sourcing, the meticulous procedures of due diligence, and the ongoing strategies of portfolio management. Significant curiosity exists around AI's capacity to enhance predictive analytics for identifying successful startups, automate various administrative functions within VC firms, and even influence the intricate valuation methodologies specifically for AI-centric companies. Concerns are also prevalent, touching upon the ethical ramifications of AI's role in investment decisions, the potential for algorithmic bias to skew outcomes, and the broader impact on human intuition and relationship-building—elements traditionally considered cornerstones of venture investing. Stakeholders are keen to ascertain whether AI will truly democratize access to capital or, conversely, further concentrate power within a select few. Furthermore, there is considerable interest in how VC firms are strategically adapting their internal operations to both capitalize on new AI investment opportunities and leverage AI tools to achieve superior operational efficiency and gain a decisive competitive advantage. The overarching consensus acknowledges AI as a powerful, transformative force: a source of unprecedented opportunities for innovation and operational streamlining, yet one that necessitates diligent consideration of its disruptive potential, ethical governance, and strategic integration within the evolving investment landscape.

- AI-driven platforms enhance deal sourcing, identifying promising startups via data analysis, predictive modeling, and pattern recognition, augmenting traditional network approaches.

- Due diligence processes gain efficiency through AI tools analyzing market trends, competitive landscapes, financial projections, and team dynamics at scale.

- AI enables sophisticated portfolio management, providing real-time insights into company performance, market shifts, and risks for proactive strategic adjustments.

- New investment theses emerge, focusing on AI infrastructure, foundational models, AI applications, and ethical AI governance technologies.

- VC firms improve operational efficiencies by automating administrative tasks, reporting, and market research, reallocating human capital to strategic activities.

- AI facilitates data-backed investment decision-making, reducing cognitive biases, though human judgment remains vital for nuanced assessments.

- Valuation models for AI-native companies evolve, incorporating metrics like data moats, algorithmic sophistication, and scalability alongside traditional financials.

- Increased focus on proprietary data sets and unique algorithms as key competitive advantages for startups influences investment criteria.

- New risks include assessing AI technology defensibility, ethical concerns (data privacy, bias), and rapid obsolescence of certain AI solutions.

- AI fosters greater collaboration and knowledge sharing within investment teams through intelligent systems aggregating and distributing insights.

DRO & Impact Forces Of Venture Capital Market

The Venture Capital market is dynamically influenced by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that collectively shape its growth trajectory and investment landscape. Key drivers include the relentless pace of technological innovation, particularly in advanced fields such as artificial intelligence, biotechnology, and sustainable energy, which continuously generate new market segments and drive demand for disruptive solutions. The global expansion of robust startup ecosystems, significantly bolstered by supportive government initiatives, incubators, and accelerators, provides a fertile ground for entrepreneurial ventures. Furthermore, increasing global capital liquidity, fueled by diverse institutional investors and a growing pool of high-net-worth individuals, ensures a robust supply of funds for promising startups. Concurrently, the escalating digitalization across all major industries, greatly accelerated by recent global events, has created immense opportunities for technology-enabled businesses, positioning venture capital as an increasingly attractive asset class poised to capture substantial future growth. However, this growth is balanced by significant restraints, including macroeconomic volatility, intense competition for quality deals leading to high valuations, and complex regulatory environments. Despite these challenges, abundant opportunities exist in emerging markets, impact investing, and deep tech, all operating under the pervasive influence of global economic health, geopolitical stability, and the ever-present speed of technological disruption.

Segmentation Analysis

The Venture Capital market is meticulously segmented to reflect the diverse nature of investments, effectively categorizing funding according to specific stages of company growth, distinct industry verticals, varied investor types, and significant geographical regions. This granular segmentation is crucial for venture capital firms, enabling them to specialize their focus, strategically allocate capital, and manage inherent risks more effectively, while simultaneously providing startups with precisely tailored funding solutions that align with their developmental needs. Understanding these detailed segments is indispensable for a comprehensive analysis of market dynamics, for identifying underserved investment areas, and for accurately predicting future growth trajectories within the expansive innovation economy. Each segment inherently presents distinct risk-reward profiles and unique investment horizons, catering to the varying mandates and appetites of both Limited Partners and General Partners. This sophisticated framework thereby fosters a vibrant, resilient, and multi-faceted investment ecosystem that robustly supports a wide spectrum of entrepreneurial endeavors, ranging from nascent ideas in their earliest conceptual stages to mature growth companies poised for successful exit events. This clear structure empowers market participants to identify their optimal niche and refine their investment strategies for maximum impact and superior returns within the dynamic global venture landscape.

- By Stage:

- Seed Stage: Initial capital for product development, market research; for nascent companies.

- Early Stage (Series A, B): Funding for proven concepts with traction, focused on scaling operations.

- Late Stage (Series C, D, E+): Significant capital for established companies aiming for aggressive growth or pre-IPO.

- Growth Equity: Investments in mature, revenue-generating companies for further expansion.

- By Industry Vertical:

- Information Technology (IT): SaaS, Cybersecurity, AI/ML, Cloud, Enterprise Software, Data Analytics.

- Healthcare & Biotechnology: Biopharma, MedTech, Digital Health, Health IT, Genomics.

- Financial Technology (FinTech): Payments, Blockchain/Crypto, InsurTech, Challenger Banks.

- Consumer Goods & Services: E-commerce, D2C, Social Platforms, Marketplaces.

- Energy & Cleantech: Renewable Energy, Energy Storage, EVs, Sustainable Ag.

- Industrials & Manufacturing: Advanced Manufacturing, Robotics, Industrial IoT, Logistics.

- Media & Entertainment: Gaming, Content Platforms, Streaming, AdTech, VR/AR.

- Real Estate Tech (PropTech): Property Management, Transactions, Smart Buildings.

- By Investor Type:

- Corporate Venture Capital (CVC): Investment arms of large corporations for strategic returns.

- Institutional Venture Capital Firms: Traditional VCs managing funds for LPs (pension, endowments).

- Angel Investors & Seed Funds: Individuals or micro-VCs providing very early-stage capital.

- Family Offices: Private wealth firms increasingly investing directly in venture deals.

- Government-backed Funds: Public-supported funds to stimulate innovation in regions/sectors.

- By Region:

- North America: Dominant market, led by U.S. (Silicon Valley, New York, Boston).

- Europe: Growing ecosystem with hubs in London, Berlin, Paris, Stockholm.

- Asia Pacific (APAC): Rapidly expanding, led by China, India, Southeast Asia.

- Latin America: Emerging market, strong growth in Brazil, Mexico, Colombia.

- Middle East & Africa (MEA): Nascent but growing, particularly UAE, Saudi Arabia, Egypt.

Value Chain Analysis For Venture Capital Market

The value chain of the Venture Capital market functions as a intricate, multi-tiered ecosystem, meticulously structured from its upstream capital sources through the rigorous investment process, extending to the downstream impact on portfolio companies, and ultimately culminating in the realization of financial returns. Upstream analysis primarily scrutinizes the Limited Partners (LPs), who serve as the foundational capital providers for venture funds. These LPs typically encompass a diverse group of institutional investors, including large pension funds, university endowments, sovereign wealth funds, insurance companies, ultra-high-net-worth family offices, and individual accredited investors. Their strategic decisions regarding asset allocation and specific fund commitments are paramount, as they directly dictate the overall flow of capital into the venture ecosystem. These decisions are critically influenced by factors such as expected risk-adjusted returns, portfolio diversification benefits, and adherence to long-term investment horizons. The performance, credibility, and established reputation of General Partners (GPs)—the venture capital firms themselves—are therefore pivotal in successfully attracting, retaining, and growing this crucial upstream capital base, necessitating demonstrably strong track records, clearly articulated investment theses, and consistently transparent reporting practices.

Downstream analysis in the Venture Capital value chain concentrates intensely on the strategic deployment of committed capital into highly innovative startups and high-growth companies. This critical phase involves a rigorous and iterative process encompassing deal sourcing, comprehensive due diligence, precise investment execution, and dynamic, active portfolio management. Deal sourcing is the initial step, involving the identification of promising ventures through extensive professional networks, direct engagement with incubators and accelerators, and increasingly, sophisticated data-driven platforms leveraging AI. Due diligence then proceeds as a thorough assessment of the startup's founding team, core technology, market potential, viable business model, financial projections, legal framework, and intellectual property. Upon making an investment, the VC firm transcends the role of a mere financier to become a committed strategic partner, providing not only essential capital but also invaluable mentorship, operational support, access to vital talent networks, and strategic connections to industry experts. This hands-on engagement is a critical differentiator for venture capital compared to more passive forms of financing, as it actively helps portfolio companies scale operations and achieve key growth milestones. The ultimate success in this downstream segment is unequivocally measured by the robust growth and lucrative exit potential of these portfolio companies, which directly translates into significant returns for both the GPs and their supporting LPs.

The distribution channel within the Venture Capital market elucidates the diverse mechanisms through which capital and intrinsic value flow, operating through both direct and indirect avenues. Direct channels involve the straightforward investment by a VC firm into a startup in exchange for an equity stake, accompanied by the firm's direct, active support. Indirect channels, by contrast, are more intricate and include syndication, a common practice where multiple VC firms co-invest in a single startup, thereby sharing financial risk and collectively leveraging diverse expertise. Fund-of-funds structures represent another significant indirect channel, where an LP invests in a master fund that, in turn, allocates capital across multiple underlying venture capital funds, offering a robust layer of diversification for the LP. Furthermore, strong relationships with specialized accelerators, incubators, and extensive angel investor networks function as crucial indirect feeders for high-quality deal flow, significantly broadening the VC firm's reach. The entire venture capital value chain is intricately supported by an expansive network of essential service providers, including specialized legal firms, expert accounting services, targeted talent recruitment agencies, and insightful market research consultants, all contributing indispensable services to the efficient functioning and overarching value creation within the dynamic venture capital ecosystem. The efficacy of these interwoven direct and indirect channels profoundly influences the velocity of capital deployment and the ultimate success rate of entrepreneurial ventures, underscoring their critical role in the market's operational efficiency.

Venture Capital Market Potential Customers

The primary potential customers, or more accurately, the direct beneficiaries and highly sought-after "products" within the Venture Capital market, are innovative startups and high-growth companies spanning a multitude of cutting-edge industries. These dynamic entities represent the foundational demand side for venture capital, actively seeking not merely financial backing but also invaluable strategic guidance, profound industry expertise, and critical access to extensive professional networks. This comprehensive support is essential to accelerate their development from nascent, groundbreaking ideas into established, market-leading enterprises. Typically, these companies are distinctly characterized by their disruptive technologies, inherently scalable business models, substantial addressable market potential, and a clear, compelling need for significant capital investment that often extends far beyond what traditional lenders or early-stage angel investors can adequately provide. They predominantly operate in sectors undergoing rapid and transformative change, such as advanced artificial intelligence, precision biotechnology, financial technology (fintech), renewable energy solutions, and sophisticated enterprise software platforms, where the costs associated with research and development, initial market entry, and operational scaling are considerable, and the timelines required to achieve sustainable profitability can be notably extended. These attributes make them ideal candidates for venture capital funding, which is specifically designed to support such high-potential, high-risk endeavors.

These diverse potential customers span the entire spectrum of entrepreneurial development, ranging from pre-seed ventures with a compelling concept and a robust founding team, through early-stage companies demonstrating clear product-market fit and initial revenue traction, all the way to late-stage growth companies poised for aggressive global expansion or imminent market leadership. Each distinct stage of development necessitates varying levels and types of capital, as well as unique strategic support tailored to their specific challenges and opportunities from venture investors. For example, a seed-stage biotechnology startup might urgently require capital to fund crucial clinical trials and navigate complex regulatory approvals, whereas a late-stage Software-as-a-Service (SaaS) company might be seeking significant funding specifically for international sales expansion initiatives and strategic acquisitions to consolidate market share. The unifying common thread among all these potential customers is their unwavering ambition for rapid growth and profound market disruption, coupled with an intrinsic reliance on external equity financing to successfully achieve their strategic objectives and realize their full potential. Venture capital firms diligently seek out and engage with these companies through a myriad of channels, actively making them the indispensable lifeblood of the venture capital market's demand side, continuously driving innovation and fostering critical economic progress on a global scale. This symbiotic relationship ensures that capital is efficiently channeled to areas of maximum potential impact, thereby nurturing a dynamic and evolving environment for continuous technological and business model evolution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Billion |

| Market Forecast in 2033 | $875 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sequoia Capital, Andreessen Horowitz, Accel, Kleiner Perkins, Lightspeed Venture Partners, Insight Partners, SoftBank Vision Fund, Temasek Holdings, Tencent Investment, GGV Capital, Khosla Ventures, New Enterprise Associates (NEA), Bessemer Venture Partners, Fidelity Growth Partners, General Catalyst, Tiger Global Management, Coatue Management, Thrive Capital, Founders Fund, Union Square Ventures |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Venture Capital Market Key Technology Landscape

The Venture Capital market is increasingly leveraging and actively investing in a sophisticated array of advanced technologies to significantly enhance operational efficiency, improve the precision of investment decision-making, and proactively identify entirely new investment opportunities. Data analytics and advanced business intelligence platforms constitute the fundamental backbone of modern VC operations, empowering firms to meticulously process vast quantities of information related to nascent market trends, the nuanced performance of various startups, the ever-evolving competitive landscapes, and intricate investor behavior patterns. These powerful tools provide critical, actionable insights across the entire investment lifecycle, from initial deal sourcing and comprehensive due diligence to dynamic portfolio management, thereby enabling VC professionals to make more informed, truly data-driven investment decisions. The application of sophisticated statistical models and advanced machine learning algorithms is increasingly prevalent, employed to identify subtle patterns, accurately predict startup success probabilities, and even flag potential risks that traditional human analysis might inadvertently overlook. The capability to rapidly parse through numerous pitch decks, complex financial models, and extensive market reports using AI-powered tools substantially streamlines the initial, resource-intensive stages of the investment funnel, accelerating the evaluation process with unprecedented efficiency and accuracy.

Regional Highlights

The global Venture Capital market showcases distinct regional dynamics, with each geographical area contributing uniquely to the overall growth and innovation landscape. North America, particularly the United States, continues to stand as the undisputed leader in both deal volume and aggregate deal value. Iconic innovation hubs like Silicon Valley, New York, and Boston remain paramount, consistently attracting massive capital flows into cutting-edge technology, transformative biotechnology, and advanced deep tech sectors. The region benefits profoundly from a highly mature ecosystem characterized by a wealth of experienced entrepreneurs, an expansive and highly skilled talent pool, robust institutional support mechanisms, and a deeply ingrained cultural ethos that strongly embraces risk-taking and disruptive innovation. A significant presence of large institutional investors, coupled with a vast number of well-established VC firms, ensures a continuous and healthy supply of capital across all investment stages, making North America a crucial barometer for global venture trends and an indispensable engine for global technological advancement, often setting the pace for innovation in key sectors like SaaS, AI, and healthcare with a strong emphasis on scalable business models and rapid global expansion from inception.

The Asia Pacific (APAC) region has rapidly ascended to become the fastest-growing market within the Venture Capital landscape, increasingly challenging North America's long-standing dominance. China and India are the primary locomotives driving this exponential growth, fueled by their vast domestic markets, widespread and rapid digital adoption rates, a burgeoning middle class, and highly proactive government policies that actively support technological innovation and entrepreneurship. Major metropolitan areas like Beijing, Shanghai, Shenzhen, Bengaluru, and Jakarta are now globally recognized as formidable tech hubs, attracting significant domestic and international venture capital. The APAC region demonstrates particular strength in consumer internet technologies, e-commerce platforms, advanced fintech solutions, and innovative AI applications, often developing unique solutions meticulously tailored to specific local market conditions, which frequently possess export potential. Southeast Asia is also gaining substantial momentum, with increasing investment activity observed in countries such as Singapore, Indonesia, and Vietnam, propelled by a youthful demographic profile and steadily increasing internet penetration. The competitive landscape across APAC is intensely dynamic, with a blend of formidable local giants and influential international players fiercely vying for market share, collectively contributing to a vibrant, rapidly evolving, and profoundly impactful entrepreneurial ecosystem.

Europe represents a robust and increasingly diverse Venture Capital market, with prominent hubs in cities such as London, Berlin, Paris, Stockholm, and Amsterdam leading significant investment activity. The region has experienced substantial growth across key sectors including fintech, deep tech, sophisticated software-as-a-service (SaaS) platforms, and a growing number of sustainability-focused ventures. European startups are consistently attracting larger funding rounds, indicative of a maturing ecosystem and an enhanced capacity to achieve global scale. Supportive governmental initiatives, a highly educated and skilled workforce, and a strong foundational research base emanating from leading universities collectively contribute significantly to a rich and continuous innovation pipeline. While historically trailing the U.S. in terms of the sheer volume of mega-rounds, Europe is systematically closing this gap, cultivating an environment where groundbreaking innovative companies can thrive and expand. The historic market fragmentation across various national borders still presents lingering challenges, but the increasing trend of cross-border collaboration and the emergence of pan-European funds are effectively helping to overcome these hurdles, thereby creating a more integrated, competitive, and globally influential venture landscape that is poised for sustained future growth and impact.

Latin America and the Middle East & Africa (MEA) are rapidly emerging as significant growth markets for Venture Capital, experiencing accelerated expansion driven by widespread digital transformation, increasing internet penetration rates, and a palpable surge in entrepreneurial spirit across their respective regions. In Latin America, countries such as Brazil, Mexico, and Colombia are at the forefront of this surge, attracting substantial investment in fintech, e-commerce, and logistics sectors, aimed at addressing specific local market inefficiencies and catering to previously underserved populations. Cities like São Paulo, Mexico City, and Bogotá are steadily solidifying their positions as important regional tech centers. Within the MEA region, the United Arab Emirates, Saudi Arabia, Egypt, and South Africa are witnessing a notable increase in venture activity, particularly focused on fintech innovations, e-commerce platforms, and sophisticated enterprise software solutions. Governmental visions for comprehensive economic diversification away from traditional oil revenues, coupled with substantial investments from influential sovereign wealth funds, are providing a powerful impetus for robust startup growth and widespread venture capital deployment. These regions, while comparatively smaller in absolute investment terms than North America or APAC, offer substantial long-term growth potential, underpinned by favorable demographic profiles, rapidly expanding digital economies, and an increasing accessibility to crucial early-stage and growth capital, making them attractive frontiers for global venture investors.

- North America: Global leader (U.S.), hubs like Silicon Valley, strong in IT/Biotech; mature, capital-rich ecosystem.

- Asia Pacific (APAC): Fastest growing (China, India), robust in consumer tech, e-commerce, AI; vast markets, digital adoption.

- Europe: Growing hubs (London, Berlin, Paris), excelling in fintech, deep tech, SaaS; increasing late-stage funding.

- Latin America: Emerging (Brazil, Mexico), focused on fintech, e-commerce; addressing local market needs.

- Middle East & Africa (MEA): Rapidly expanding (UAE, Saudi Arabia), driven by fintech, e-commerce; government diversification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Venture Capital Market.- Sequoia Capital

- Andreessen Horowitz

- Accel

- Kleiner Perkins

- Lightspeed Venture Partners

- Insight Partners

- SoftBank Vision Fund

- Temasek Holdings

- Tencent Investment

- GGV Capital

- Khosla Ventures

- New Enterprise Associates (NEA)

- Bessemer Venture Partners

- Fidelity Growth Partners

- General Catalyst

- Tiger Global Management

- Coatue Management

- Thrive Capital

- Founders Fund

- Union Square Ventures

Frequently Asked Questions

Analyze common user questions about the Venture Capital market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Venture Capital (VC) and how does it differ from other financing methods?

Venture Capital (VC) is a form of private equity funding provided by specialized firms to early-stage, high-growth potential companies in exchange for an equity stake, typically with a long-term investment horizon. It fundamentally differs from traditional bank loans, which require collateral and offer debt financing, as VC is equity-based and involves higher risk with the potential for higher returns. Unlike angel investing, which often involves individual investors providing smaller sums at the very initial stages, VC firms typically invest larger amounts across seed, early, and growth stages, often taking a more active, strategic role in the development and operations of their portfolio companies. It also distinguishes itself from general private equity, which usually targets more mature, established businesses for buyouts or significant minority investments, focusing on operational improvements rather than funding disruptive innovation from inception. The primary distinctions lie in VC's high-risk/high-reward profile, its equity-for-funding model, and the active involvement in nurturing and scaling innovative, often disruptive, startups.

How do venture capital firms make investment decisions and what factors are crucial for startups seeking VC funding?

Venture capital firms employ a rigorous, multi-stage evaluation process to make investment decisions, prioritizing a strategic blend of market opportunity, the strength and experience of the founding team, the degree of product innovation, and the inherent scalability of the business model. Initially, firms actively source deals through extensive professional networks, direct engagement with incubators and accelerators, and increasingly, through sophisticated data analytics platforms. Once a promising startup is identified, a comprehensive due diligence process commences, involving a deep dive into the company's core technology, the size and dynamics of its target market, its competitive positioning, detailed financial projections, legal structures, and intellectual property portfolio. The quality of the management team is a paramount factor; VCs seek experienced, visionary, and adaptable founders who possess a profound understanding of their market and a demonstrable ability to execute their vision. They meticulously assess the product's defensibility, its potential for disruptive innovation, and its unique value proposition. The scalability of the business model is also critical, signaling the potential to achieve significant market share and exponential revenue growth. Firms also look for a clear, viable path to profitability or a substantial exit strategy, such as a lucrative acquisition or a successful initial public offering (IPO), which ultimately allows them to realize significant returns on their investment. Finally, the VC firm's own specific investment thesis and overarching portfolio strategy play a crucial role in determining the ideal fit, ensuring strong alignment with their sector focus, stage preference, and desired risk-reward profile. The decision-making process is highly selective and competitive, with only a small fraction of pitched startups ultimately securing crucial funding.

What are the current key trends and challenges shaping the Venture Capital market?

The Venture Capital market is currently characterized by several pivotal trends and significant challenges. A dominant trend is the escalating integration and prominence of Artificial Intelligence (AI) and Machine Learning (ML), both as highly attractive investment categories and as transformative tools that profoundly enhance VC operational efficiency, optimizing processes such as deal sourcing and due diligence. Another significant trend is the increasing proliferation of Corporate Venture Capital (CVC) and the emergence of highly specialized funds, which specifically target niche industries like deep tech, fintech, and sustainability (ESG), indicating a progressive maturation and strategic diversification of the asset class. Furthermore, pronounced regional shifts are evident, with the Asia-Pacific (APAC) region, notably China and India, rapidly expanding its share of global VC investment, actively challenging North America's longstanding leadership. Key challenges include persistent global economic uncertainties, such as inflationary pressures and the potential for recessions, which can negatively impact investor sentiment and lead to more cautious valuation approaches. Intense competition for access to high-quality deals continues to drive up valuations, making it increasingly difficult for VCs to secure favorable investment terms. Complex and evolving regulatory frameworks, particularly concerning data privacy, antitrust regulations, and intricate international investment laws, pose ongoing operational and compliance hurdles. Additionally, longer capital holding periods and a more challenging public market for Initial Public Offerings (IPOs) in recent times mean that capital can remain tied up for extended durations, thereby affecting fund returns and liquidity for limited partners. Navigating these multifaceted trends and challenges requires venture capital firms to maintain exceptional agility, strategic foresight, and continuous innovation in their investment methodologies and operational models to sustain success in a dynamic global environment.

How does the Venture Capital market contribute to economic growth and innovation?

The Venture Capital market plays a profoundly pivotal role in catalyzing economic growth and fostering relentless innovation by efficiently channeling capital and invaluable expertise to nascent, high-potential businesses. Firstly, VC funding provides essential seed and growth capital to innovative startups that would otherwise face insurmountable barriers in accessing traditional financing, largely due to their early stage, unproven business models, or lack of tangible collateral. This critical influx of capital empowers these companies to undertake rigorous research and development, engineer groundbreaking products, and cultivate disruptive technologies, ultimately leading to transformative breakthroughs across diverse sectors like advanced healthcare, information technology, and clean energy. Secondly, venture-backed companies are consistently significant creators of new jobs. As these enterprises scale their operations, they expand their workforce, making substantial contributions to employment rates and overall economic stability. Thirdly, VC firms frequently provide hands-on strategic guidance, invaluable mentorship, and critical access to extensive professional networks, which collectively help startups adeptly navigate complex challenges, meticulously refine their business models, and aggressively accelerate their market penetration. This active, hands-on support significantly enhances the probability of success for these innovative ventures. Lastly, highly successful venture-backed companies often mature into publicly traded entities or are strategically acquired by larger corporations, generating substantial wealth for both investors and founders. This wealth can then be dynamically reinvested into a new generation of entrepreneurial ventures, thereby creating a powerful, self-reinforcing virtuous cycle of innovation, capital formation, and sustained economic dynamism. By courageously funding the technologies and companies of tomorrow, venture capital is undeniably an indispensable engine for global progress and long-term prosperity, driving forward the frontiers of human ingenuity and economic possibility.

What are the ethical considerations and potential risks associated with Venture Capital investing?

Venture Capital investing, while an exceptionally powerful catalyst for innovation, inherently carries several critical ethical considerations and significant risks. Ethically, concerns frequently emerge regarding the extent of investor influence on a startup's core culture and foundational mission, particularly when the intense pursuit of financial profit might diverge from fundamental social impact objectives or the responsible, ethical development of products. Issues of data privacy and potential algorithmic bias can also arise in AI-driven startups, especially where the rapid acceleration of growth objectives might inadvertently overshadow rigorous data governance practices or the imperative for fair and unbiased AI development. The inherent power dynamics between well-capitalized VC firms and resource-constrained startups can occasionally lead to potentially inequitable deal terms or, in extreme cases, the exploitation of founders. From a risk perspective, VC is by its very nature a high-risk asset class; a substantial majority of startups ultimately fail, inevitably leading to significant capital loss for investors. Valuation bubbles, often fueled by intense competitive pressures and exuberant market conditions, can result in overpaying for companies, which subsequently yields poor returns if ambitious growth expectations are not met. Longer holding periods for investments and increasingly uncertain exit opportunities can tie up capital for extended durations, negatively impacting liquidity for Limited Partners. Global economic downturns and market volatility can severely impair portfolio performance and significantly complicate future fundraising efforts. Furthermore, geopolitical risks, unpredictable regulatory changes, and intense market competition can all detrimentally impact the success rates of portfolio companies and the overall profitability of venture funds. Effectively balancing the strong drive for financial returns with robust ethical responsibilities, while meticulously managing these substantial inherent risks, are all critical facets of achieving sustainable success within the complex landscape of venture capital investing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Venture capital investment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Venture Capital & Private Equity Firms Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager