Automotive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432184 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Automotive Market Size

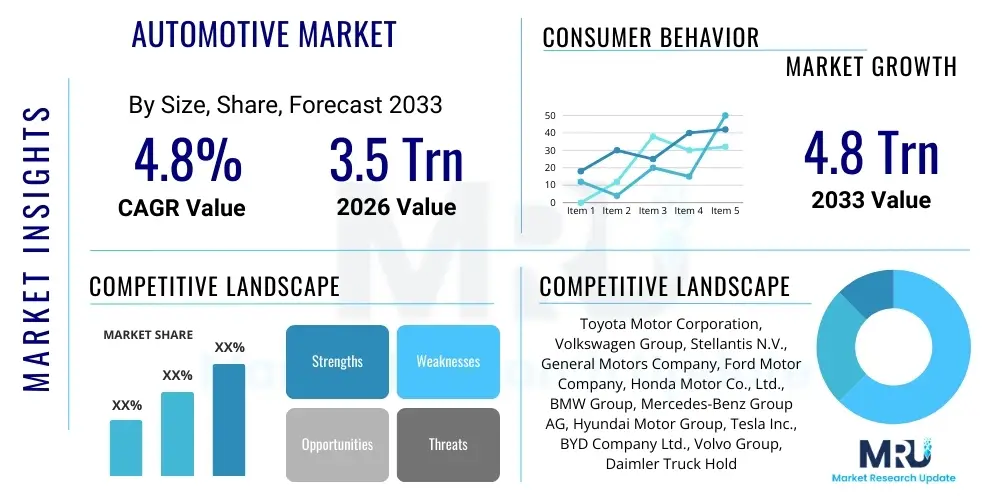

The Automotive Market is undergoing a profound transformation driven by electrification, connectivity, and autonomy, positioning it as one of the most dynamic sectors globally. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. This robust expansion is primarily fueled by rapid technological integration, shifting consumer preferences towards sustainable mobility solutions, and substantial regulatory backing across major economies encouraging zero-emission vehicles (ZEVs). Furthermore, the structural resilience demonstrated by the supply chain, post-pandemic, coupled with increasing demand for personalized and software-driven vehicle experiences, ensures consistent revenue generation and market penetration for advanced automotive products.

The market is estimated at USD 3.5 Trillion in 2026, encompassing not just vehicle sales but also the burgeoning revenue streams derived from aftermarket services, software subscriptions, and integrated mobility solutions. The foundational shift from internal combustion engines (ICE) to electric vehicle (EV) platforms requires massive capital investment in battery production and charging infrastructure, which is accounted for in this valuation. The competitive landscape is evolving rapidly, with traditional OEMs facing intense pressure from new entrants focused purely on electric and autonomous technologies, forcing accelerated innovation cycles and strategic partnerships aimed at securing critical component supply and access to cutting-edge software development capabilities.

By the end of the forecast period in 2033, the global automotive market is projected to reach USD 4.8 Trillion. This significant increase reflects the projected mass adoption of electric vehicles, which are expected to constitute a majority share of new vehicle sales in mature markets by the early 2030s. Moreover, the integration of Level 3 and Level 4 autonomous driving capabilities into high-volume consumer vehicles will unlock new segments, such as robotics-as-a-service (RaaS) and dedicated autonomous shuttle services, further expanding the addressable market size beyond traditional vehicle ownership models. The convergence of automotive manufacturing with consumer electronics and software development is the critical enabler for achieving this forecasted valuation.

Automotive Market introduction

The global automotive market encompasses the design, development, manufacturing, marketing, and sale of motor vehicles, including passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and two-wheelers. Traditionally centered around mechanical engineering and internal combustion technology, the sector is rapidly redefining itself as a high-technology, mobility-focused industry. Modern automotive products are increasingly complex, integrating sophisticated electronics, advanced safety systems (ADAS), and connectivity features that fundamentally change the driving experience and the vehicle's functional lifespan. Major applications span personal transportation, logistics and freight movement, construction, agriculture, and public transit, making the sector indispensable to global economic activity and infrastructure development.

The primary benefits delivered by the modern automotive sector include enhanced safety through active and passive safety technologies, improved fuel efficiency and sustainability (via electrification), increased accessibility to personal and shared mobility, and productivity gains through connected vehicle services and fleet management optimization. Driving factors fueling the current market trajectory include stringent global emission standards (such as Euro 7 and CAFE regulations), compelling government subsidies and tax incentives promoting electric vehicle adoption, rapid consumer acceptance of digital cockpits and connectivity features, and substantial long-term investments by technology giants and automotive OEMs into autonomous driving research and development. This convergence of regulatory push and technological pull is reshaping manufacturing processes and the entire business ecosystem.

A crucial element of the current market dynamic is the transition toward Software-Defined Vehicles (SDVs), where vehicle features, performance, and upgrades are increasingly managed through software updates and digital services rather than hardware replacements. This shift fundamentally alters the product description, transforming a capital good into an interconnected, upgradable digital platform. Furthermore, rising urbanization rates, particularly in Asia Pacific and other developing regions, are driving demand not only for personal vehicles but also for efficient public transportation and Mobility-as-a-Service (MaaS) solutions, requiring specialized vehicle designs and optimized fleet operations managed by digital platforms. This multi-faceted evolution defines the modern automotive landscape, moving it from a product-centric model to a service-centric ecosystem.

Automotive Market Executive Summary

The Automotive Market Executive Summary reveals several pivotal business trends dominating the 2026–2033 period. Key among these is the accelerated shift toward vertical integration, particularly in the EV supply chain, where OEMs are increasingly securing direct control over battery cell production, raw material sourcing (lithium, nickel, cobalt), and semiconductor design capabilities to mitigate supply chain vulnerabilities experienced in recent years. Furthermore, consolidation is occurring in the high-performance computing and software domains, leading to strategic alliances between automakers and major tech companies (e.g., Google, NVIDIA, Qualcomm) to develop standardized operating systems and AI-driven autonomous stacks. Business models are shifting away from pure transactional sales towards recurring revenue streams generated through subscription services for features like advanced connectivity, performance enhancements, and ADAS functionalities, driving profitability and customer lifetime value.

Regional trends indicate a pronounced divergence in market maturity and growth vectors. Asia Pacific, led by China, remains the volume leader and the epicenter of EV manufacturing and adoption, benefiting from favorable domestic policies and strong consumer enthusiasm for indigenous brands focusing on smart technology. Europe is characterized by aggressive regulatory mandates aiming for rapid ICE phase-out, supporting a strong market for premium EVs and sophisticated charging networks, though grappling with the challenge of scaling affordable EV production. North America is experiencing robust growth driven by significant governmental incentives (like the US Inflation Reduction Act), focusing on localized manufacturing and fostering domestic battery gigafactories, while also being a critical testbed for L4 autonomous trucking and robotaxi services due to its favorable regulatory environment for testing.

Segment trends underscore the dominance of electric propulsion, not only in passenger cars but increasingly in the commercial vehicle space (e-trucks and e-vans), driven by Total Cost of Ownership (TCO) advantages in fleet operations. Within technology segments, Advanced Driver-Assistance Systems (ADAS) are moving rapidly toward standardization across all vehicle classes, laying the groundwork for higher levels of autonomy. Software and electronics architecture is transitioning from distributed control units (ECUs) to centralized domain controllers or zonal architectures, simplifying wiring harnesses, enabling over-the-air (OTA) updates, and preparing vehicles for complex, integrated AI applications. This foundational segment shift is crucial for realizing the long-term vision of fully autonomous and connected mobility.

AI Impact Analysis on Automotive Market

Common user questions regarding AI's impact on the automotive sector typically revolve around safety and ethical implications of Level 4 and Level 5 autonomous systems, specifically asking how AI handles unpredictable "edge cases" and ensures verifiable reliability compared to human drivers. Concerns are also frequent regarding job displacement in manufacturing and traditional driving roles (e.g., trucking, taxi services) due to automation, and the intense computational requirements and energy consumption associated with training and deploying sophisticated deep learning models for perception and decision-making. Users also query the security and privacy aspects, focusing on how the immense volume of data collected by AI-enabled vehicles is managed, protected, and potentially monetized. The consensus expectation is that AI will revolutionize safety and manufacturing efficiency, but concerns about liability and data governance remain paramount.

The integration of Artificial Intelligence (AI) serves as the core enabler for the next generation of automotive technologies, fundamentally transforming vehicle design, manufacturing, and user experience. In the realm of autonomous driving, AI algorithms are indispensable for complex tasks such as sensor fusion (combining data from cameras, lidar, and radar), object recognition, path planning, and sophisticated decision-making in dynamic traffic environments. Beyond driving, AI significantly enhances the in-car experience through personalized infotainment systems, predictive maintenance scheduling based on diagnostic data analysis, and highly sophisticated natural language processing (NLP) for advanced voice command interfaces, moving towards true conversational assistance.

In manufacturing and supply chain operations, AI is utilized for quality control through computer vision systems that detect minuscule defects on assembly lines faster and more reliably than human inspection. Predictive analytics, powered by machine learning models, optimize complex supply chain logistics, forecasting demand fluctuations for critical components like semiconductors and optimizing inventory levels globally, thereby improving operational resilience. The long-term impact dictates that successful OEMs will transition into highly sophisticated AI companies that happen to build cars, with software engineering becoming the primary competitive differentiator over traditional mechanical engineering expertise.

- AI enables Level 3+ autonomous driving through advanced perception and sensor fusion algorithms.

- Predictive maintenance uses machine learning to forecast component failures, reducing downtime and increasing vehicle lifespan.

- AI optimizes manufacturing processes, including robot path planning and visual inspection for enhanced quality control.

- Natural Language Processing (NLP) improves human-machine interaction (HMI) within the vehicle cabin.

- AI-driven optimization enhances battery management systems (BMS) for range extension and thermal efficiency in EVs.

- Personalized in-car experiences (settings, media, climate control) are tailored using behavioral data and AI analysis.

- Generative AI tools accelerate vehicle design and simulation testing (digital twin environments).

- AI enhances cybersecurity by detecting and neutralizing real-time threats within the vehicle's network architecture.

DRO & Impact Forces Of Automotive Market

The market is defined by strong Drivers, significant Restraints, emerging Opportunities, and powerful Impact Forces. Key drivers include rigorous global mandates pushing for decarbonization and the subsequent governmental support (subsidies, infrastructure spending) for ZEVs. Consumer demand for advanced safety features (e.g., L2+ ADAS), seamless connectivity, and digitally integrated experiences also acts as a primary catalyst. Conversely, major restraints encompass the persistently high upfront cost of electric vehicles and hydrogen fuel cell vehicles compared to ICE counterparts, the insufficient rollout of comprehensive charging infrastructure in many geographies, and the ongoing, though mitigating, risk associated with global supply chain dependencies, particularly concerning battery minerals and high-end semiconductors. These constraints require substantial industry-wide investment and regulatory alignment to overcome.

Opportunities are centered around the creation of new revenue models and technological leaps. Mobility-as-a-Service (MaaS) represents a massive growth opportunity, allowing operators to leverage autonomous fleets for ride-hailing and logistics, bypassing traditional vehicle ownership barriers. Furthermore, the development of subscription-based software services for vehicle features offers sustainable, high-margin revenue streams independent of cyclical vehicle sales volumes. The pursuit of next-generation battery technologies, such as solid-state batteries, promises higher energy density, faster charging times, and enhanced safety, which, if commercialized successfully, will significantly accelerate mainstream EV adoption and unlock new performance levels across all segments, particularly heavy-duty trucking.

Impact forces are dominated by rapid technological disruption and geopolitical dynamics. The shift toward zonal electronic architectures and over-the-air (OTA) updates forces OEMs to fundamentally restructure their engineering processes, moving from hardware iteration to agile software development methodologies. Regulatory impact forces, especially those concerning data privacy (e.g., GDPR, CCPA) and autonomous vehicle safety standards, profoundly affect product design and deployment timelines. Geopolitical tensions impacting trade relationships and resource access (especially critical raw materials) also exert substantial pressure on supply chain localization efforts, encouraging regional manufacturing hubs and diversifying sourcing strategies, thereby impacting production costs and market competitiveness across major regions.

Segmentation Analysis

The segmentation analysis of the automotive market reveals a highly complex, multidimensional landscape driven by accelerating technological convergence. Segmentation must account not only for traditional factors like vehicle type and price point but also for critical modern variables such as propulsion type, level of autonomy (L0-L5), connectivity features, and the underlying software architecture. The increasing adoption of modular EV platforms means that component segmentation, particularly concerning batteries, power electronics, and high-performance computing units, has become more crucial than segmenting by traditional mechanical parts. This shift reflects the transition toward platforms that can efficiently accommodate diverse vehicle types, from sedans to SUVs, sharing core electric and digital components.

Crucial segment trends include the differentiation between Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and traditional ICE vehicles, with BEVs rapidly gaining market share in mature economies while hybrids maintain a strong foothold in markets lacking robust charging infrastructure. Within the commercial vehicle segment, segmentation by Gross Vehicle Weight Rating (GVWR) is essential, distinguishing between last-mile delivery vans (often electrified) and long-haul heavy-duty trucks (where battery size and charging time pose greater technological challenges, leading to exploration of hydrogen fuel cells). The connectivity and infotainment segment is further segmented by service tiers, ranging from basic emergency telematics to premium 5G-enabled V2X communication and integrated digital service ecosystems.

- Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Buses and Coaches)

- Two-Wheelers and Micro-mobility (E-bikes, Scooters)

- Propulsion Type:

- Internal Combustion Engine (ICE) (Gasoline, Diesel)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Component & System:

- Powertrain System (Engine, Transmission, E-Axles, Power Electronics)

- Chassis System (Suspension, Brakes, Steering)

- Safety and ADAS Systems (Airbags, ABS, Lidar, Radar, Cameras)

- Exterior/Interior (Seating, Lighting, Body Panels)

- Infotainment and Telematics (HMI, Connectivity Modules, Navigation)

- Technology/Autonomy Level:

- Level 1 (Driver Assistance)

- Level 2 (Partial Automation – L2+)

- Level 3 (Conditional Automation)

- Level 4 (High Automation – Robotaxis, Autonomous Shuttles)

- Level 5 (Full Automation)

- End-User:

- Individual Owners

- Fleet Operators (Rental, Corporate, Logistics)

- Mobility Service Providers (Ride-hailing, Car-sharing)

Value Chain Analysis For Automotive Market

The traditional automotive value chain, which historically focused heavily on physical manufacturing and large component suppliers (Tier 1), is rapidly fragmenting and being redefined by digital capabilities. The upstream segment now includes critical raw material mining and processing (e.g., lithium extraction, cathode/anode production) for batteries, which has become a significant area of strategic investment and geopolitical focus. Moreover, the upstream reliance on high-end semiconductors, AI chips (e.g., specialized GPUs and NPUs), and sophisticated sensor technologies (Lidar, HD mapping services) necessitates strong partnerships with non-traditional suppliers like semiconductor manufacturers (TSMC, Samsung) and software developers. Securing supply in these critical digital components is paramount, often overshadowing concerns about traditional materials like steel and rubber.

The core manufacturing process is evolving towards increased automation and modularity, often leveraging platforms like 'skateboard' chassis designs to streamline production across different models. Downstream activities involve traditional sales via dealerships, but increasingly incorporate direct-to-consumer (D2C) models, pioneered by EV startups, allowing OEMs greater control over pricing and customer data. The aftermarket segment, traditionally focused on spare parts and mechanical repairs, is shifting towards software updates, over-the-air performance upgrades, and digital diagnostics. Distribution channels are diversifying; while traditional franchised dealerships remain strong for servicing and localized sales, the rise of online configurators and dedicated experience centers emphasizes digital engagement and centralized inventory management.

The key shift in value capture lies in the migration from hardware gross margin to recurring software revenue. Value creation is moving from the initial vehicle sale to the entire lifecycle of the vehicle through connectivity and functional upgrades. Direct distribution allows OEMs to capture margin previously shared with dealerships. Indirect distribution, leveraging established dealer networks, remains crucial for scale, especially in complex global markets requiring local sales, financing, and maintenance support. The ability to manage complex data streams, ensure data security, and provide seamless integrated services (navigation, media, payments) determines long-term profitability and competitive advantage in the new, software-driven automotive value chain.

Automotive Market Potential Customers

Potential customers for the automotive market are broadly categorized into three main groups: individual consumers (B2C), commercial entities (B2B), and governmental/institutional buyers (B2G). Individual consumers remain the largest volume segment, driven by needs for personal transportation, safety, comfort, and increasingly, alignment with sustainability goals. The purchase criteria for B2C buyers are rapidly shifting from traditional metrics like horsepower and fuel economy to factors such as electric range, charging speed, software features, and advanced safety ratings (ADAS levels). These buyers are highly influenced by brand perception regarding technology leadership and commitment to future mobility solutions.

Commercial entities represent a high-value, fast-growing segment, encompassing logistics companies, last-mile delivery services, corporate fleets, rental car agencies, and taxi/ride-hailing operators. B2B buyers prioritize Total Cost of Ownership (TCO), fleet management efficiency, reliability, and suitability for specific duty cycles. The strong TCO argument favoring electric commercial vehicles (due to lower maintenance and fuel costs) is driving rapid electrification in this segment, particularly for urban delivery fleets. These buyers often require customized telematics solutions and comprehensive service contracts, making long-term operational support a key differentiator for OEMs.

Governmental and institutional buyers include public transport authorities, police and emergency services, military organizations, and municipal utility providers (B2G). These customers prioritize reliability, specialized modifications, durability, security features, and increasingly, procurement standards tied to sustainable and local manufacturing requirements. Public procurement often dictates large-scale adoption of alternative fuel vehicles (electric buses, hybrid utility trucks) to meet municipal emissions targets. Additionally, Mobility-as-a-Service (MaaS) providers, while technically B2B, are becoming a distinct customer type requiring highly optimized, robust, and technologically advanced vehicles suitable for continuous, heavy-duty utilization in shared fleet environments, often necessitating customized L4 autonomous platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Trillion |

| Market Forecast in 2033 | USD 4.8 Trillion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toyota Motor Corporation, Volkswagen Group, Stellantis N.V., General Motors Company, Ford Motor Company, Honda Motor Co., Ltd., BMW Group, Mercedes-Benz Group AG, Hyundai Motor Group, Tesla Inc., BYD Company Ltd., Volvo Group, Daimler Truck Holding AG, Renault-Nissan-Mitsubishi Alliance, ZF Friedrichshafen AG, Continental AG, Robert Bosch GmbH, Aptiv PLC, NVIDIA Corporation, Mobileye (an Intel Company) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Market Key Technology Landscape

The current automotive technology landscape is defined by three converging pillars: electrification, autonomy, and connectivity, all underpinned by massive advancements in high-performance computing (HPC) and artificial intelligence. Electrification technology extends far beyond simple battery installation; it includes sophisticated Battery Management Systems (BMS), high-voltage power electronics (inverters and converters), and the development of highly integrated e-Axles that combine the electric motor, power electronics, and transmission into a compact unit. Crucially, the focus is now on achieving thermal stability and longevity for large battery packs, with ongoing research into next-generation chemistries like solid-state batteries promising significant reductions in charging time and improvements in energy density, addressing core consumer range anxiety concerns.

The development of the Software-Defined Vehicle (SDV) architecture represents a fundamental technological shift, moving away from disparate Electronic Control Units (ECUs) to centralized domain controllers or zonal architectures. This centralization enables Over-The-Air (OTA) updates, allowing automakers to deploy new features, fix bugs, and enhance vehicle performance throughout its lifecycle, mirroring the model used in the consumer electronics industry. Connected vehicle technology (V2X, specifically V2I - vehicle-to-infrastructure and V2N - vehicle-to-network) leverages 5G connectivity to facilitate real-time communication for traffic management, hazard warnings, and navigation optimization. This connectivity is essential for the safe and efficient operation of Level 3 and Level 4 autonomous systems, providing crucial information beyond the vehicle's line of sight sensors.

Advanced manufacturing techniques are also critical technological components. The adoption of gigacasting, a process popularized by leading EV manufacturers, allows for the production of large single-piece structural components, significantly reducing assembly time, complexity, and vehicle weight. Furthermore, the extensive use of sensor technology (Lidar, high-resolution cameras, 4D radar) coupled with powerful processing platforms (e.g., NVIDIA Drive, Qualcomm Snapdragon Ride) is central to enabling advanced ADAS and autonomy features. The integration of high-definition digital mapping and localization services ensures that autonomous vehicles can accurately place themselves within their environment, providing the necessary redundancy and precision required for safety-critical operations at highway speeds and in dense urban areas.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing automotive market globally, driven primarily by robust demand in China and India. China dominates the global EV landscape, benefiting from aggressive government targets, extensive charging infrastructure investment, and strong indigenous manufacturers who are technology leaders in battery production and smart cockpit features. India is emerging as a significant market, especially for two-wheelers and compact cars, with a strong push towards electric mobility for pollution mitigation in urban centers. This region focuses heavily on high-volume production, affordability, and integration of localized digital services, making it the primary battleground for mass-market electrification.

- North America: The North American market, dominated by the United States, is characterized by high consumer demand for larger vehicles (SUVs and trucks) and significant technological investment in autonomous driving, particularly Level 4 autonomous trucking and robotaxi services. Government incentives, notably those tied to localized battery and vehicle production (via the Inflation Reduction Act), are accelerating the shift to EVs. The region is seeing massive capital expenditure in setting up domestic battery Gigafactories and establishing robust, high-power DC fast-charging corridors, creating a localized, secure EV supply chain less reliant on international dependencies.

- Europe: Europe is defined by stringent emission regulations (e.g., planned phase-out dates for ICE sales) and a strong emphasis on sustainability, favoring premium and efficient BEVs. Markets such as Germany, Norway, and the Netherlands lead in EV penetration rates, supported by well-developed charging networks and strong consumer acceptance. The region is a pioneer in implementing V2X communication standards and focuses on developing robust cybersecurity frameworks for connected vehicles, often leading global regulatory trends concerning data governance and vehicle safety standards.

- Latin America: This region presents significant growth potential, although EV adoption remains slower due to infrastructure challenges and higher upfront costs. The market is primarily driven by fleet renewal and commercial vehicle sales (LCVs and buses) necessary for logistics and public transport modernization. Brazil and Mexico are critical manufacturing hubs, attracting foreign investment, though the policy environment is often fragmented, requiring OEMs to adopt a nuanced strategy blending established ICE products with localized EV rollouts targeting specific urban areas.

- Middle East and Africa (MEA): The MEA region is characterized by diverse market maturities. The GCC countries (Saudi Arabia, UAE) are investing heavily in smart city development and sustainable initiatives (e.g., NEOM), creating demand for luxury EVs and testing grounds for autonomous mobility services. Africa remains a challenging market, dominated by used vehicle imports and price sensitivity, though there is emerging growth in electric two-wheelers and localized assembly operations aimed at affordable transport solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Market.- Toyota Motor Corporation

- Volkswagen Group

- Stellantis N.V.

- General Motors Company

- Ford Motor Company

- Honda Motor Co., Ltd.

- BMW Group

- Mercedes-Benz Group AG

- Hyundai Motor Group

- Tesla Inc.

- BYD Company Ltd.

- Volvo Group

- Daimler Truck Holding AG

- Renault-Nissan-Mitsubishi Alliance

- ZF Friedrichshafen AG

- Continental AG

- Robert Bosch GmbH

- Aptiv PLC

- NVIDIA Corporation

- Mobileye (an Intel Company)

Frequently Asked Questions

Analyze common user questions about the Automotive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth trajectory of the Automotive Market?

The primary factor is the global transition towards electrification and zero-emission vehicles (ZEVs), mandated by stringent government regulations and supported by significant public investment in charging infrastructure and consumer subsidies. This shift accelerates innovation in battery technology, power electronics, and high-performance computing necessary for electric and connected vehicles.

How will the rise of Software-Defined Vehicles (SDVs) impact vehicle ownership costs?

SDVs are expected to introduce new recurring revenue streams through subscription services for features like advanced ADAS functions, performance enhancements, and connectivity updates. While the initial purchase price might remain high, the lifetime cost of ownership (TCO) could be lowered by improved energy efficiency and proactive, predictive maintenance enabled by software diagnostics and Over-The-Air (OTA) updates.

Which geographic region currently dominates global electric vehicle (EV) production and adoption?

The Asia Pacific region, particularly China, currently dominates global EV production, sales volume, and battery manufacturing capacity. China's market leadership is driven by favorable policy support, aggressive domestic manufacturing targets, and strong consumer adoption of indigenous EV brands offering high levels of embedded technology and competitive pricing.

What are the greatest technological restraints facing mass Level 4 autonomous vehicle deployment?

The greatest restraints include resolving safety certification for handling unpredictable "edge cases" (unforeseen environmental or traffic scenarios), ensuring robust cybersecurity protection against remote vehicle hijacking, and managing the massive, real-time data processing requirements needed for sensor fusion and complex path planning in dense urban environments.

How is the automotive value chain changing due to new market dynamics?

The value chain is shifting away from traditional hardware-centric manufacturing towards a model centered on software development, battery material sourcing, and semiconductor supply. OEMs are moving towards vertical integration for critical components and adopting direct-to-consumer (D2C) distribution models to maximize control over customer experience and capture recurring software revenue.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Electric Power Steering Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Cargo Carriers and Baskets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Door Module Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Sports Appearance Kit Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Testing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager