Car Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432277 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Car Market Size

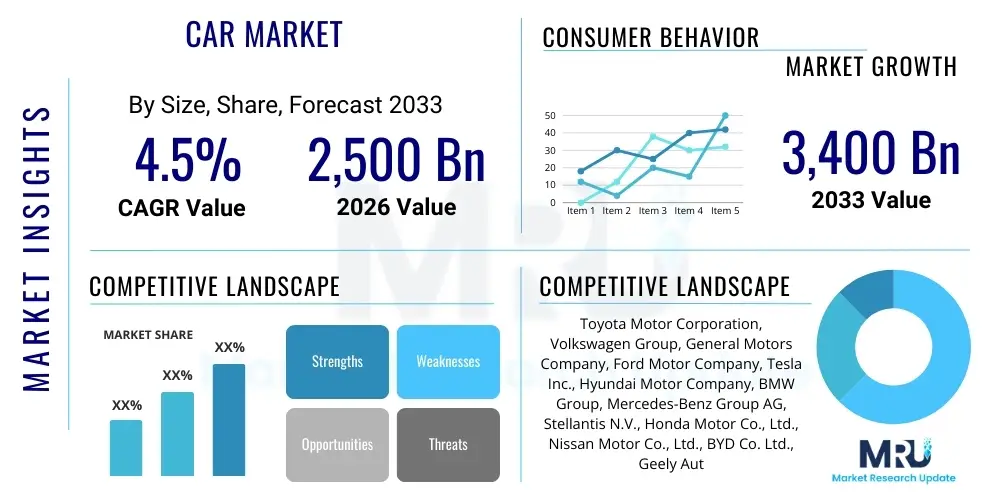

The Car Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2,500 Billion in 2026 and is projected to reach USD 3,400 Billion by the end of the forecast period in 2033.

Car Market introduction

The global Car Market, fundamentally encompassing the entire spectrum of light-duty and medium-duty vehicle production, distribution, and maintenance, is currently undergoing the most significant paradigm shift since the advent of mass production. This industrial domain covers everything from the initial conceptual design and rigorous engineering of vehicle platforms—increasingly centered around modular electric 'skateboard' architectures—to the final consumer delivery and subsequent lifecycle management. The market is defined by intensely complex, multi-tiered supply chains that span continents, integrating traditional mechanical components with sophisticated electronic control units (ECUs), advanced sensor arrays, and high-capacity battery systems. Product offerings now range from affordable, mass-market sedans critical for mobility in emerging economies to ultra-luxury, high-performance electric vehicles (EVs) that serve as platforms for cutting-edge connectivity and autonomous technologies. The inherent complexity mandates high capital expenditure, rigorous safety standards compliance, and a continuous cycle of innovation to maintain competitive relevance.

The market's evolution is driven equally by external socio-economic pressures and internal technological breakthroughs. Major applications extend beyond basic personal transport to include specialized commercial services such as ride-hailing networks (Mobility-as-a-Service, MaaS), complex logistics and last-mile delivery fleets, and public sector operations requiring dependable, large-scale vehicle deployment. The primary benefits derived from the product remain foundational: enhanced economic productivity through efficient movement of labor and goods, improved personal quality of life via accessible mobility, and greater resilience in supply chain operations. Crucially, the driving factors have dramatically shifted from being purely linked to GDP growth and gasoline cost stability to being overwhelmingly influenced by climate policy and energy transition goals. Governmental incentives, such as purchase subsidies, tax breaks, and infrastructure development funding, are now critical determinants of market trajectory, particularly favoring Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) over traditional Internal Combustion Engine (ICE) vehicles.

The contemporary definition of a vehicle is rapidly transforming from a purely mechanical device into a highly connected, software-defined computer on wheels. This crucial technological pivot necessitates that Original Equipment Manufacturers (OEMs) develop deep competencies in data science, artificial intelligence, and cybersecurity. The introduction of software-defined vehicle (SDV) architectures allows for remote diagnostics, performance upgrades via Over-The-Air (OTA) updates, and the implementation of subscription services for specialized features—fundamentally altering the financial relationship between the manufacturer and the consumer, offering potential recurring revenue streams far beyond the point of initial sale. Furthermore, global supply chain fragility, exacerbated by geopolitical tensions and the shortage of critical components like semiconductors, continues to force manufacturers to adopt strategies of regional diversification and vertical integration, particularly regarding the control of battery cell production and associated raw materials, ensuring a more resilient and localized production ecosystem.

Car Market Executive Summary

The Car Market Executive Summary underscores a market environment defined by radical technological disruption, necessitating unprecedented capital expenditure in electrification and autonomous capabilities. Key business trends point toward aggressive timelines for phasing out ICE development, with major legacy OEMs restructuring their operations to function as agile tech companies focused on software integration and services. Strategic alliances and joint ventures, particularly for battery supply and charging network development, are proliferating as companies seek to mitigate the immense costs and risks associated with these transitions. Furthermore, direct-to-consumer sales models are gaining traction, challenging the long-established dealer franchise system and allowing manufacturers greater control over customer data and pricing dynamics, creating a streamlined, end-to-end customer experience.

Regionally, the market exhibits sharp divergence in pace and technological focus. Asia Pacific, driven overwhelmingly by Chinese market demand and industrial policy, maintains global leadership in EV production volume, technological maturity, and supply chain control, particularly in battery minerals processing and cell manufacturing. European markets are characterized by top-down regulatory enforcement, creating a stable but highly competitive environment focused on achieving rigorous corporate average fuel economy (CAFE) standards and Euro 7 emissions targets, leading to high consumer EV penetration rates in countries offering strong fiscal incentives. North America, while slower in initial mass adoption, is accelerating rapidly, primarily focusing on large electric SUVs and pickup trucks, supported by substantial policy initiatives aimed at domestic supply chain fortification and consumer tax credits linked to localized production requirements.

Segment trends reveal that the most significant growth area is concentrated within the Battery Electric Vehicle (BEV) and premium Level 2+ Advanced Driver Assistance Systems (ADAS) segments. While BEVs are capturing consumer interest due to lower running costs and improved performance, the infrastructure gap ensures that Plug-in Hybrid Electric Vehicles (PHEVs) and efficient conventional hybrids (HEVs) retain significant market relevance as bridge technologies, especially in markets lacking charging density. The shift towards light-duty electric commercial vans is also a notable trend, driven by the economic benefits of electrifying urban delivery fleets. The segmentation analysis confirms that future profitability will increasingly derive not merely from vehicle volume, but from the margin generated through high-tech content, including specialized software packages, connectivity services, and bespoke autonomous features delivered via subscription models throughout the vehicle's lifespan, cementing the centrality of software intelligence in valuation.

AI Impact Analysis on Car Market

Analysis of prevalent user questions regarding Artificial Intelligence's influence on the Car Market reveals a central anxiety surrounding the ethical decision-making capabilities of autonomous systems (particularly in complex accident avoidance) and the required regulatory framework for widespread deployment. Users are keenly interested in the practical implications of Level 4 autonomy on daily commuting, vehicle ownership costs, and potential reductions in traffic congestion and emissions. Parallel interest exists concerning how AI optimizes the manufacturing floor (smart factories leveraging predictive analytics for maintenance) and revolutionizes the user interface through highly personalized, voice-activated controls and proactive driver assistance. The consensus is that AI is not just an incremental improvement but a foundational technology enabling the entire concept of the "smart car" and the subsequent transformation of the mobility ecosystem, offering substantial improvements in safety, manufacturing efficiency, and personalized user experience.

The operational impact of AI stretches across the entire automotive value chain, starting with product development where sophisticated machine learning algorithms accelerate simulation cycles for crash testing, material science optimization, and aerodynamic efficiency, drastically reducing the time and cost associated with prototyping. In manufacturing, AI-powered computer vision systems ensure real-time quality control checks on the assembly line, identifying defects with higher accuracy and speed than human inspectors, leading to lower recall rates and enhanced product reliability. Furthermore, predictive AI models optimize the dynamic scheduling of production, balancing raw material inventories with fluctuating demand signals, minimizing waste and improving factory throughput metrics significantly across global operations.

For the consumer, AI integration manifests most visibly in the advancement of ADAS features—such as enhanced lane-keeping, adaptive cruise control, and automated parking—which serve as the building blocks for eventual full autonomy. These systems, powered by deep neural networks, continuously learn from driving data collected across the fleet, improving overall system robustness and ensuring safer, smoother performance in diverse driving conditions. Beyond driving functions, AI is vital for cybersecurity, continuously monitoring vehicle network traffic for anomalies and mitigating threats, thereby protecting proprietary vehicle software and sensitive personal data from sophisticated cyberattacks, solidifying its role as an indispensable component of the modern connected car architecture.

- AI drives the transition from static mapping systems to dynamic, real-time localization and path planning essential for safe Level 4 (L4) and Level 5 (L5) autonomous operation across varying terrains and weather conditions.

- Implementation of AI in Battery Management Systems (BMS) maximizes battery longevity, optimizes charging patterns, and enhances thermal runaway detection, directly increasing the durability and perceived value of electric vehicles.

- Advanced AI models analyze telematics and sensor data to predict component failure with high accuracy, enabling manufacturers to shift from reactive repairs to highly efficient, predictive maintenance schedules, drastically reducing total ownership costs for fleet clients.

- Machine learning algorithms personalize the in-car experience, adapting infotainment suggestions, cabin temperature settings, and acoustic environments based on learned driver biometric inputs and historical preferences.

- AI-driven optimization of sales and marketing processes utilizes consumer behavior analytics to predict purchasing trends, personalize product configuration options, and streamline the transition to direct-to-consumer models.

- Deep reinforcement learning is used to train self-driving systems to handle rare and complex edge cases on the road, improving the system’s ability to react safely to unforeseen events that traditional rule-based programming cannot effectively address.

DRO & Impact Forces Of Car Market

The Car Market’s strategic landscape is dictated by powerful Drivers, substantial Restraints, and transformative Opportunities (DRO), collectively forming crucial Impact Forces that shape strategic decision-making. The paramount Driver is the global regulatory push for sustainable mobility, primarily encapsulated by national commitments to achieve net-zero carbon emissions, necessitating mandatory quotas and stringent timelines for electric vehicle adoption and the complete phase-out of fossil fuel vehicle sales. Complementing this is the accelerating consumer acceptance of digital and connected features, treating the vehicle increasingly as an extension of their digital lifestyle, driving demand for enhanced infotainment, advanced safety features, and seamlessly integrated mobility services. These forces compel massive R&D expenditure and complete operational overhaul across the legacy automotive industry, demanding immediate compliance and adaptation.

Key Restraints currently impeding faster market transition include the persistent high upfront cost of electric vehicles, primarily due to the expense of battery packs, despite continuous declines in cell costs. Compounding this challenge is the structural deficit in public charging infrastructure, particularly for high-power DC fast charging outside dense urban centers, generating substantial range anxiety for potential long-distance EV owners. Furthermore, geopolitical risks pose significant constraints, affecting the stable and predictable supply of crucial raw materials (lithium, cobalt, nickel) and advanced semiconductors, leading to production volatility and extended lead times for vehicle delivery. Navigating these restraints requires substantial capital investment in infrastructure development and strategic global resource diversification.

The structural Opportunities within the Car Market are vast, centered on the profitable exploitation of new business models. The rise of Mobility-as-a-Service (MaaS) represents a paradigm shift, enabling OEMs to monetize vehicle usage rather than just ownership, leveraging subscription and on-demand access. The commercialization of Level 3 (conditional) and Level 4 (high) autonomous technology presents a massive opportunity, particularly in controlled logistical environments, offering revolutionary reductions in operating costs for trucking and delivery fleets. Furthermore, the establishment of sophisticated battery recycling and second-life utilization programs forms a crucial circular economy opportunity, ensuring resource security and generating new revenue streams from end-of-life battery assets, enhancing overall sustainability credentials and mitigating long-term environmental liability.

Segmentation Analysis

The thorough segmentation analysis of the Car Market reveals the structural shift underway, providing a granular view of where growth capital is being deployed and where traditional segments face contraction. Segmentation by Propulsion Type clearly illustrates the rapid decline in R&D investment for ICE vehicles and the reciprocal surge in focus on BEVs, PHEVs, and FCEVs, indicating a necessary transition away from reliance on fossil fuels. Within Vehicle Type, the enduring global preference for SUVs and Crossovers dictates the design priorities across all propulsion methods, emphasizing the need for electric platforms that can accommodate larger passenger capacities and higher energy consumption demands typical of these larger formats.

Analyzing segmentation by Application demonstrates the growing divergence between consumer purchasing behavior (driven by branding, safety, and personal preference) and fleet purchasing behavior (driven by rigorous total cost of ownership calculations, TCO). The fleet segment, encompassing corporate fleets, ride-sharing operations, and dedicated logistics services, is proving to be a key volume driver for electric vehicles due to the compelling economic argument that lower maintenance and energy costs offset the higher initial acquisition price. This commercial adoption creates substantial demand for robust telematics and specialized fleet management software solutions.

The segmentation by Level of Autonomy charts the technological road map, showing the market's progression from basic safety aids (L1/L2) towards fully functional self-driving systems. While L2+ systems are becoming standard features in the premium segment, the deployment of L3 technology (which permits driver disengagement under specific conditions) acts as a critical bottleneck, pending harmonization of complex international regulatory frameworks and extensive real-world validation. The value captured in this segmentation resides heavily in the software and sensor hardware required to support these advanced capabilities, creating high-margin opportunities for specialized technology suppliers and software developers.

- By Propulsion Type:

- Internal Combustion Engine (ICE): Gasoline, Diesel, Flexible Fuel Vehicles (FFV).

- Battery Electric Vehicle (BEV): Pure electric drive, zero tailpipe emissions.

- Plug-in Hybrid Electric Vehicle (PHEV): Combines electric motor with small ICE, requiring grid charging.

- Hybrid Electric Vehicle (HEV): Combines electric motor with ICE, self-charging only.

- Fuel Cell Electric Vehicle (FCEV): Utilizes hydrogen to generate electricity, niche market focus.

- By Vehicle Type:

- Passenger Cars: Sedans, Hatchbacks, Station Wagons, Coupes, Convertibles.

- Sport Utility Vehicles (SUVs) and Crossovers: High-demand, versatile passenger platforms.

- Commercial Vehicles: Light Commercial Vehicles (LCVs), Pickup Trucks, Vans (for delivery/utility).

- By Application/End-User:

- Personal Use: Private ownership, residential transport, primary mobility solution.

- Fleet Operation: Corporate fleets, rental agencies, ride-sharing platforms (Uber, Lyft), last-mile logistics.

- Government and Public Services: Police, ambulances, municipal utility vehicles, defense.

- By Level of Autonomy:

- Level 0 (No Automation): Driver responsible for all actions.

- Level 1 (Driver Assistance): Single function automation (e.g., Adaptive Cruise Control).

- Level 2 (Partial Automation): Simultaneous automated control of steering and acceleration/deceleration (L2+ includes highway pilot).

- Level 3 (Conditional Automation): Driver required to monitor and intervene, but system performs dynamic driving tasks under certain conditions.

- Level 4 (High Automation): System handles dynamic driving task; driver intervention not required under defined operating domain (ODD).

- Level 5 (Full Automation): System handles all dynamic driving tasks under all conditions.

Value Chain Analysis For Car Market

The Value Chain of the modern Car Market is rapidly evolving, demanding strategic control over new critical resources and intellectual property. Upstream activities, traditionally sourcing metals, rubber, and glass, are now dominated by the complex procurement and processing of battery raw materials, including lithium, cobalt, manganese, and nickel. This requires deep, long-term contractual agreements with miners and refiners, often involving substantial foreign direct investment to secure supply and hedge against price volatility, especially in geopolitically sensitive regions. Furthermore, the sourcing and fabrication of high-power semiconductors and sophisticated sensors (LiDAR, high-resolution cameras) are now integral upstream concerns, moving the industry closer to the electronics supply chain than ever before, signifying a crucial shift in core competencies.

The midstream (manufacturing and assembly) is characterized by massive investments in dedicated Gigafactories for battery cell and pack production, often co-located with vehicle assembly plants to minimize logistics costs and improve efficiency. Production processes are optimized for modular electric platforms, utilizing advanced robotics and AI-driven quality assurance systems, forming the core of Industry 4.0 adoption within automotive manufacturing. Downstream activities involve distribution, marketing, sales, and after-sales service. Distribution channels are diverging significantly: the traditional indirect method relying on franchised dealers remains essential for servicing and brand presence, while the direct-to-consumer model allows new entrants and established players (for EV sales) to control pricing, brand messaging, and gain invaluable direct customer feedback data.

After-sales service is transitioning from purely mechanical repair to encompassing high-voltage battery diagnostics and complex software debugging and updates. The crucial element of the modern value chain is the flow of data, enabling remote diagnostics and personalized services, creating high-margin revenue streams independent of hardware sales. This reliance on data transforms service centers into integrated software and hardware support hubs. Consequently, mastering both the physical supply chain (upstream materials) and the digital supply chain (software, data) determines competitive advantage in this vertically integrating industry, pushing OEMs to become platform providers rather than just vehicle assemblers.

Car Market Potential Customers

The identification and targeting of potential customers in the Car Market is segmented meticulously based on purchasing drivers, vehicle usage, and technological readiness. Individual consumers constitute the largest volume segment, sub-divided into first-time buyers prioritizing affordability and reliability, families seeking safety and cabin space (often driving SUV purchases), and affluent early adopters of technology demanding premium, high-performance EVs with advanced L2+/L3 autonomous features. This segment’s purchasing decision is influenced heavily by brand loyalty, marketing narrative surrounding sustainability, availability of local charging infrastructure, and access to favorable financing rates that mitigate the high initial EV cost barrier, requiring targeted marketing campaigns emphasizing TCO benefits.

Commercial fleet operators, including centralized corporate transport services, last-mile delivery specialists, and global ride-sharing giants, represent the highest growth segment, driven purely by operational economics. These customers are exceptionally sensitive to Total Cost of Ownership (TCO) and uptime, making them rapid adopters of electric platforms where the lower energy cost and reduced maintenance requirements provide significant operational advantages over the vehicle's lifespan. Their procurement strategies focus on volume discounts, rapid deployment capabilities, and comprehensive telematics solutions that allow for real-time tracking, diagnostics, and optimized route planning. Partnerships with specialized fleet management software providers and robust warranty provisions for high-mileage use are essential value components for this segment.

Governmental and institutional buyers encompass large-scale purchases for public safety, military, and infrastructure maintenance. These customers operate under strict procurement guidelines emphasizing national security, domestic manufacturing content (Buy America acts), durability, and specialized functional requirements (e.g., armored vehicles, high-payload utility trucks). As public entities commit to environmental goals, these large-scale procurement contracts are increasingly mandating electric or alternative fuel vehicles, serving as a powerful catalyst for the development and standardization of FCEVs and heavy-duty electric commercial vehicles, demonstrating a pivotal commitment to public sector decarbonization goals that influence broader market adoption trends and supply chain readiness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2,500 Billion |

| Market Forecast in 2033 | USD 3,400 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toyota Motor Corporation, Volkswagen Group, General Motors Company, Ford Motor Company, Tesla Inc., Hyundai Motor Company, BMW Group, Mercedes-Benz Group AG, Stellantis N.V., Honda Motor Co., Ltd., Nissan Motor Co., Ltd., BYD Co. Ltd., Geely Automobile Holdings Ltd., SAIC Motor Corporation Limited, Renault Group, Lucid Group, Rivian Automotive, TATA Motors, Xpeng Inc., Nio Inc., Porsche AG, Subaru Corporation, Mazda Motor Corporation, Great Wall Motor Company Limited, Volvo Cars. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Market Key Technology Landscape

The contemporary technological landscape of the Car Market is dominated by revolutionary advancements in three interconnected domains: power generation/storage, vehicular intelligence, and communication infrastructure. In power, the focus remains intensely on achieving breakthroughs in battery energy density and cost reduction, pivoting towards advanced materials such as silicon anodes and exploring next-generation solid-state electrolytes which promise superior safety characteristics, faster charging rates (potentially 80% charge in under 15 minutes), and significantly extended range capabilities. Beyond the cell chemistry, innovations in modular battery pack design (cell-to-pack architecture) and highly efficient 800V charging platforms are essential for reducing manufacturing complexity and increasing the appeal of high-end BEVs to performance-oriented consumers. This energy transformation also requires sophisticated software and hardware integration in the form of highly robust Battery Management Systems (BMS) to regulate thermal dynamics and maximize cycle life under extreme operating conditions.

Vehicular intelligence, the backbone of autonomy, is driven by the rapid maturation of sensor technology and computational power. The transition from Level 2 to commercially viable Level 3 and Level 4 autonomy necessitates the fusion of heterogeneous sensor data—including high-resolution radar capable of penetrating adverse weather, multiple high-definition cameras providing redundancy, and advanced LiDAR systems for precise 3D mapping of the environment. These sensor inputs are processed by dedicated, high-performance computing platforms, often featuring specialized accelerators for neural network processing, requiring automotive-grade reliability and functional safety certification (ISO 26262 compliance). The critical technological challenge remains the development of a highly reliable, safety-verified software stack that can handle diverse global road rules, unpredictable human behavior, and highly complex urban driving scenarios, moving beyond simple highway driving tasks.

Connectivity infrastructure involves the deployment of Vehicle-to-Everything (V2X) communication, crucial for improving safety and efficiency, particularly in dense urban environments. 5G cellular V2X (C-V2X) technology enables low-latency communication between vehicles, infrastructure (traffic lights, smart roads), and cloud services, facilitating real-time traffic optimization, hazard warnings far beyond the driver's line of sight, and cooperative maneuvering in automated platooning applications for commercial logistics. Furthermore, the capacity for secure Over-The-Air (OTA) updates, enabled by robust cyber security protocols and standardized diagnostic interfaces, is paramount. This allows manufacturers to deploy new features, patch vulnerabilities, and update core operating systems throughout the vehicle lifecycle, turning the car into an evolving, personalized digital asset and securing the crucial revenue streams derived from continuous software improvement and feature activation.

Regional Highlights

The global Car Market is highly regionalized, with regulatory frameworks, consumer spending power, and cultural preferences profoundly influencing local market structure and the speed of technological adoption. The three major automotive powerhouses—Asia Pacific, Europe, and North America—each display unique strategic priorities and face distinct market challenges. The economic recovery post-pandemic and geopolitical stability in sourcing key materials like semiconductors and battery elements define the near-term competitiveness in these regions, creating fragmented investment profiles. Successful global manufacturers must adopt a "glocal" strategy, tailoring their propulsion, size, and connectivity features to satisfy nuanced local demands while maintaining platform standardization for cost efficiency.

Asia Pacific (APAC) is fundamentally the epicenter of global automotive growth and the undisputed leader in electrification volume. China, in particular, dictates global trends, driven by rapid urbanization, massive government support for New Energy Vehicles (NEVs), and the establishment of dominant local battery and EV supply chains (BYD, CATL, SAIC). The APAC market is characterized by fierce domestic competition among local start-ups and established global players, resulting in rapidly falling EV prices and quick iteration cycles for technology. Japan and South Korea maintain strong focus on high-quality conventional vehicles and HEVs, while simultaneously pioneering FCEV technology. India is emerging as a critical volume market, prioritizing affordable small cars and robust local manufacturing initiatives aimed at meeting its massive domestic mobility needs while cautiously integrating electric variants tailored for local driving conditions.

Europe is characterized by a high degree of regulatory rigor, acting as a primary force mandating the transition to low- and zero-emission vehicles. The region possesses sophisticated charging infrastructure, particularly in the Nordic countries and Germany, which supports a high penetration rate of BEVs and PHEVs among individual buyers. European consumers emphasize brand heritage, driving dynamics, and cutting-edge safety features, making it a lucrative market for premium manufacturers. However, European OEMs face mounting pressure to secure domestic battery supply chains to avoid over-reliance on Asian imports, leading to unprecedented investment in European Gigafactories. The regional market structure also favors smaller, more efficient electric vehicles suited for urban European dense centers, aligning with strict regional emission requirements.

North America (primarily the United States) represents a market where size and performance still dominate consumer preference, leading to massive early investment in electric pickup trucks (e.g., Ford F-150 Lightning, Tesla Cybertruck) and large SUVs. The policy landscape, specifically the Inflation Reduction Act (IRA), significantly incentivizes domestic production and local battery sourcing, creating a regional fortress economy centered on localized EV manufacturing and job creation. While adoption is accelerating, the charging infrastructure development is slower and more dispersed than in Europe, requiring higher battery ranges to address consumer anxieties about long-distance travel in vast geographical areas. Canada and Mexico remain pivotal manufacturing hubs, deeply integrated into the US supply chain under trade agreements, focusing on robust assembly operations for the North American market.

- Asia Pacific (APAC): Dominates global production and EV market share, driven by robust governmental support, supply chain dominance (batteries, rare earth metals), and high consumer acceptance in China. Key growth drivers include India and Southeast Asia's increasing disposable incomes, necessitating rapid expansion of localized manufacturing capabilities and infrastructure deployment.

- Europe: Characterized by stringent emission standards (Euro 7), strong consumer focus on sustainability, and dense charging infrastructure development, promoting rapid BEV and PHEV adoption. The strategic imperative is securing European domestic battery supply to maintain regional competitive advantage.

- North America: Significant investments in electric truck and large SUV segments, supported by policy frameworks (IRA) that drive supply chain localization and domestic battery manufacturing. The market requires high-range vehicles due to vast geographical distances and fragmented charging networks outside metropolitan areas.

- Latin America (LATAM): Market transitioning slowly, with ICE and flex-fuel vehicles dominant due to high import costs and limited charging infrastructure. Focus remains on affordable mobility solutions and initial commercial fleet electrification in key urban logistics hubs.

- Middle East & Africa (MEA): Emerging market with strategic investments in autonomous and electric vehicle piloting within specialized smart city developments (e.g., NEOM). Market size remains constrained by infrastructure and high import costs, though oil-rich nations are pursuing diversification through EV investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Market.- Toyota Motor Corporation

- Volkswagen Group

- General Motors Company

- Ford Motor Company

- Tesla Inc.

- Hyundai Motor Company

- BMW Group

- Mercedes-Benz Group AG

- Stellantis N.V.

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- BYD Co. Ltd.

- Geely Automobile Holdings Ltd.

- SAIC Motor Corporation Limited

- Renault Group

- Lucid Group

- Rivian Automotive

- TATA Motors

- Xpeng Inc.

- Nio Inc.

- Porsche AG

- Subaru Corporation

- Mazda Motor Corporation

- Great Wall Motor Company Limited

- Volvo Cars

- Fisker Inc.

- Maserati S.p.A.

- Aston Martin Lagonda Global Holdings plc

- McLaren Group

Frequently Asked Questions

Analyze common user questions about the Car market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current transition in the Car Market?

The primary factor driving the current transition is the global imperative for decarbonization, mandated by governmental regulations, such as stringent emission standards (Euro 7/CAFE) and national zero-emission vehicle (ZEV) quotas, which fundamentally redirects capital investment toward Battery Electric Vehicles (BEVs) and associated infrastructure development.

How is the adoption of autonomous driving technology impacting safety and efficiency?

Autonomous driving technology, utilizing sophisticated AI, high-resolution sensors, and redundant software stacks, significantly enhances road safety by drastically reducing human error incidents (the cause of over 90% of accidents) and improves transportation efficiency through optimized fleet utilization and smoother traffic flow in controlled environments.

Which region dominates the future growth prospects of the electric vehicle segment?

Asia Pacific, particularly the market ecosystem in China, dominates the future growth prospects of the electric vehicle segment, owing to its unparalleled scale in manufacturing, control over critical battery supply chains, supportive government policies (NEV mandates), and highly competitive domestic market structure.

What are the main financial challenges restricting mass EV adoption globally?

The main financial challenges include the persistently high initial purchase price of Battery Electric Vehicles, primarily due to costly battery components, alongside the significant capital required to resolve the infrastructural deficit in reliable high-power DC fast-charging networks in non-urbanized areas, hindering consumer confidence and long-distance travel feasibility.

How is the software-defined vehicle concept changing manufacturer business models?

The software-defined vehicle (SDV) concept is fundamentally transforming manufacturer business models by transitioning revenue generation from a single point-of-sale transaction to a continuous, lifecycle relationship, enabling highly profitable recurring revenue streams derived from Over-The-Air (OTA) software updates, personalized digital services, and feature-on-demand subscriptions.

What role does the supply chain stability play in the future of car manufacturing?

Supply chain stability is critical, especially concerning high-demand items like semiconductors and battery raw materials (Lithium, Nickel). Volatility forces OEMs toward vertical integration, regionalized supply chains (e.g., North American IRA requirements), and long-term contracts with suppliers to minimize production halts and secure pricing predictability.

How are legacy automakers competing with dedicated EV manufacturers like Tesla and BYD?

Legacy automakers are competing by leveraging existing scale, brand loyalty, and established global dealer networks while rapidly deploying new, dedicated EV platforms (e.g., VW MEB, GM Ultium). They are focusing on catching up in software capability and supply chain integration, often through strategic tech acquisitions and internal talent development programs.

What is the significance of the shift towards 800V architecture in the Car Market?

The shift towards 800V architecture is significant because it enables much faster DC charging rates and allows for smaller, lighter wiring harnesses, which improves vehicle efficiency, reduces weight, and decreases charge times substantially, addressing one of the major consumer pain points of current EV technology.

How are regulatory policies influencing the size and type of vehicles produced?

Regulatory policies, particularly stringent urban emission zones and carbon taxation schemes, are compelling manufacturers to prioritize the development of smaller, highly efficient BEVs for European and Asian urban centers, while subsidies in North America still favor the electrification of large utility vehicles and trucks, reflecting regional consumer size preferences.

What ethical dilemmas are being addressed in the context of AI and autonomous driving?

Key ethical dilemmas include establishing clear protocols for unavoidable accident scenarios (the trolley problem), ensuring non-discriminatory decision-making processes, addressing the liability framework in autonomous incidents, and protecting sensitive user data generated by vehicle telematics from misuse or cyber exploitation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Railcar Mover Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Magnetic Wireless Car Charger Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Passenger Car Air Suspension Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hybrid and Electric Car Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Car Wash Operators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager