Copper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435416 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Copper Market Size

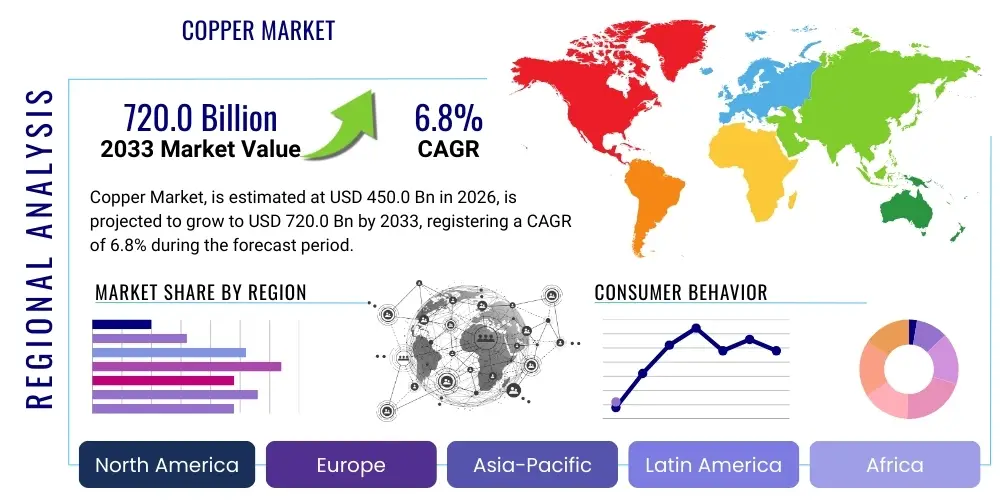

The Copper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% (CAGR) between 2026 and 2033. The market is estimated at USD 450.0 Billion in 2026 and is projected to reach USD 720.0 Billion by the end of the forecast period in 2033.

Copper Market introduction

The Copper Market encompasses the extraction, refining, fabrication, and distribution of copper and its alloys globally. Copper, known for its exceptional electrical conductivity, thermal performance, and corrosion resistance, is a foundational material in modern industry. It serves as a vital component across sectors undergoing significant technological transitions, particularly in electrification and digital infrastructure. Market dynamics are heavily influenced by global macroeconomic conditions, technological advancements in mining, and increasing regulatory pressures related to sustainability and resource management. The shift toward renewable energy sources and electric vehicles (EVs) fundamentally alters the demand profile for refined copper, positioning it as a critical metal for the 21st-century energy transition. The strategic importance of copper reserves and the complexity of establishing new mining operations contribute significantly to price volatility and supply chain considerations.

Key applications of copper span from traditional uses in plumbing and roofing to high-technology applications in data centers, telecommunications, and advanced manufacturing. In the electrical and electronics sector, copper is indispensable for wiring, motors, generators, and transformers, supporting the global expansion of power grids and electronic devices. The construction industry remains a stable consumer, utilizing copper for piping, wiring infrastructure, and architectural elements due to its durability and antimicrobial properties. Furthermore, the burgeoning automotive sector, driven by the shift towards electric mobility, demands substantially higher volumes of copper per vehicle compared to internal combustion engine (ICE) counterparts, accelerating market growth.

The primary benefits driving continuous demand include copper’s unmatched recyclability, which supports circular economy initiatives, and its high performance in energy transfer systems, crucial for minimizing energy losses in transmission and storage. Driving factors for market expansion are predominantly centered around global infrastructure spending, the mandated transition to clean energy technologies, rapid urbanization in developing economies, and continuous innovation in copper alloys that enhance performance in demanding environments, such as high-temperature superconductors and specialized heat exchangers. These factors collectively ensure copper remains a strategic commodity critical to future industrial and environmental goals.

Copper Market Executive Summary

The Copper Market is currently experiencing robust growth, primarily propelled by the global commitment to decarbonization and large-scale infrastructural investments. Business trends indicate a strong divergence between conventional demand (construction, traditional manufacturing) and high-growth demand sectors (EVs, renewable energy generation, and smart grid development). Key stakeholders are increasingly focused on securing stable, ethical supply chains, leading to intensified mergers and acquisitions activity aimed at resource consolidation and technological integration in remote mining operations. Furthermore, the market is characterized by significant capital expenditure towards optimizing refining processes to meet stringent quality standards required by advanced electronics and high-voltage transmission systems, emphasizing the need for sustainable and energy-efficient production methods.

Regionally, the Asia Pacific (APAC) continues to dominate the copper market, driven by massive urbanization, industrial expansion, and governmental support for renewable energy projects, particularly in China and India. North America and Europe are showing accelerated demand growth, specifically tied to ambitious targets for EV adoption and the modernization of aging electrical grid infrastructure. These developed regions are also setting high benchmarks for environmental compliance in mining and processing, influencing global operational standards. Latin America remains the powerhouse for primary copper production, though it faces ongoing challenges related to labor relations, regulatory stability, and investment security, which occasionally disrupt global supply stability.

Segment trends highlight the exceptional growth of refined copper tailored for electrical applications, specifically magnet wire and copper foil used in battery technology and printed circuit boards. While scrap copper recycling is expanding rapidly due to economic incentives and environmental mandates, primary production remains crucial to meet baseline demand. The construction application segment is steady, but the transportation segment, specifically EV manufacturing, is forecast to achieve the highest CAGR during the projected period. This shift necessitates increased collaboration between mining companies and downstream fabricators to develop specialized copper products suitable for high-performance battery systems and charging infrastructure, ensuring material innovation keeps pace with technological demands.

AI Impact Analysis on Copper Market

User queries regarding AI's influence on the Copper Market frequently revolve around optimizing extraction efficiency, predicting price volatility, and enhancing operational safety in hazardous mining environments. Users are highly interested in how machine learning algorithms can analyze complex geological data to identify high-yield deposits, minimizing exploratory costs and environmental disturbance. Furthermore, substantial concern centers on the integration of AI-powered predictive maintenance in refining operations to prevent costly downtime and improve resource utilization. A prevailing theme is the expectation that AI will lead to more sustainable mining practices, reducing water and energy consumption while simultaneously addressing labor shortages through sophisticated automation and robotic integration.

The implementation of Artificial Intelligence and Machine Learning (ML) models is revolutionizing the upstream segment of the copper industry by optimizing core processes from geological exploration to final ore processing. In mining, AI algorithms are deployed to process vast datasets—including satellite imagery, seismic surveys, and chemical analyses—to generate highly accurate 3D models of ore bodies, significantly improving drilling precision and reducing waste material handling. This predictive capability translates directly into lower operational expenditures and enhanced overall resource recovery rates. Additionally, AI-driven automation is critical in managing complex equipment fleets, scheduling maintenance based on real-time operational diagnostics rather than fixed schedules, thereby increasing equipment uptime and longevity.

Downstream, AI is playing a crucial role in optimizing the energy-intensive refining and smelting processes. ML models can adjust furnace parameters in real-time based on input ore characteristics and desired output purity, maximizing energy efficiency and minimizing emissions. Beyond production, AI enhances market intelligence by analyzing geopolitical data, commodity trade volumes, and macroeconomic indicators to generate sophisticated price forecasts, enabling key players to manage risk and secure forward contracts more effectively. This technological integration is transforming copper production from a traditional, labor-intensive process into a data-driven, technologically advanced operation essential for meeting high-purity demands in the electronics and battery sectors.

- AI-driven geological modeling enhances exploration accuracy, reducing discovery time and costs.

- Machine learning optimizes process control in smelters and refineries, improving energy efficiency and metal purity.

- Predictive maintenance schedules minimize equipment downtime in mining sites and processing plants.

- Autonomous heavy machinery deployment, guided by AI, improves worker safety and operational consistency.

- AI-based market analytics provide refined forecasting for copper price volatility and demand shifts.

- Optimization of tailing management and water usage through sophisticated ML control systems supports environmental compliance.

DRO & Impact Forces Of Copper Market

The Copper Market's trajectory is primarily shaped by powerful drivers such as global electrification mandates and the rapid proliferation of Electric Vehicles (EVs), which require four to five times more copper than traditional cars. Restraints include significant environmental scrutiny leading to lengthy permitting processes for new mines, coupled with inherent price volatility driven by speculative trading and macroeconomic instability. Opportunities lie in the technological advancements enabling deeper, safer mining of existing low-grade ore bodies and the exponential growth of the recycling infrastructure. These factors create a complex impact force matrix, where long-term structural demand (electrification) constantly clashes with short-term supply constraints (geopolitical risks and regulatory hurdles), maintaining a high degree of market tension.

Drivers: The monumental shift towards renewable energy sources—solar, wind, and geothermal—is a primary catalyst for copper demand. These installations, along with the necessary grid infrastructure upgrades (smart grids, high-voltage direct current transmission), are copper-intensive. Rapid urbanization, particularly across Asia and Africa, necessitates continuous infrastructure development, including residential, commercial, and utility construction, ensuring a sustained baseline demand for traditional copper applications. Furthermore, the increasing complexity and density of data centers, driven by cloud computing and 5G deployment, require high-conductivity copper cabling and efficient cooling systems, contributing significantly to specialized copper product demand.

Restraints: Capital expenditure requirements for new copper projects are exceptionally high, often involving multi-billion dollar investments with payback periods extending over a decade, making financing challenging. Regulatory complexity and heightened social license requirements, particularly concerning indigenous rights and water management, frequently delay or halt major mining expansion projects. The cyclical nature of commodity prices and the reliance on a few key producing nations introduce significant supply chain risks. Additionally, substitution risk, though limited due to copper’s unique properties, exists in certain applications where aluminum or specialized polymers may be utilized, particularly during periods of extreme price spikes.

Opportunities: Technological breakthroughs in solvent extraction and electrowinning (SX-EW) processes are enabling the economic processing of lower-grade oxide ores that were previously unviable. The significant and expanding reserve of end-of-life copper products presents a major recycling opportunity, offering a more sustainable and less capital-intensive source of supply. Moreover, the development of advanced copper alloys with enhanced properties (e.g., higher strength, improved thermal resistance) opens new market niches in aerospace, high-speed rail, and advanced electronics, further solidifying copper’s indispensable role in future technology.

- Drivers: Global Electrification and Grid Modernization; Rapid Growth in Electric Vehicle Production; Massive Investment in Renewable Energy Infrastructure (Solar/Wind); Sustained Urbanization in Emerging Markets.

- Restraints: Volatile Global Copper Prices; Stringent Environmental Regulations and Permitting Delays; Increasing Operating Costs and Declining Ore Grades; Geopolitical Risks in Major Producing Countries.

- Opportunities: Advancements in Mining and Refining Technologies (AI, Automation); Expansion of Copper Recycling Infrastructure; Development of High-Performance Copper Alloys for Specialized Industries; Government Incentives for Sustainable Resource Management.

- Impact Forces: High long-term demand growth driven by climate goals counteracts short-term supply shocks and regulatory burdens, keeping the market tightly balanced and prices elevated.

Segmentation Analysis

The Copper Market segmentation provides a granular view of supply and demand dynamics, primarily categorized by type (distinguishing between primary and recycled sources) and application (reflecting the end-use sectors driving consumption). The differentiation by type—Refined Copper, Copper Concentrate, and Scrap Copper—is essential for understanding global trade flows and the capital intensity required for processing, with concentrates representing the raw material traded between mines and smelters, and refined copper being the final product for fabrication. Application segmentation highlights the core drivers, emphasizing the dominant role of the Electrical & Electronics sector due to global infrastructure modernization and the accelerating influence of the Transportation sector, specifically electric mobility.

Analyzing these segments reveals critical shifts in market priorities. The increasing emphasis on sustainability and resource efficiency has significantly boosted the importance of the Scrap Copper segment, pushing recycling rates higher across developed economies. Simultaneously, the demand for high-purity, high-conductivity Refined Copper is escalating rapidly, driven by strict material specifications for high-performance batteries and advanced microelectronics, where even minor impurities can compromise system efficacy. This dual dynamic requires producers to invest heavily both in efficient primary refining technologies and sophisticated scrap sorting and processing capabilities.

Geographic segmentation is crucial for understanding trade patterns, as production is highly concentrated in specific regions (Latin America, Australia) while consumption is focused in major industrial centers (APAC, Europe, North America). The disparity between production sites and end-use markets dictates the complexity and cost associated with global shipping and logistics. Future growth will be disproportionately influenced by infrastructure policy decisions within high-consumption regions, particularly government mandates related to energy transition and smart city development, which specifically target the Electrical & Electronics and Construction application segments.

- By Type:

- Refined Copper (Cathodes, Wire Rods, Billets)

- Copper Concentrate

- Scrap Copper

- By Application:

- Electrical & Electronics (Wiring, PCB, Magnet Wire, Telecom)

- Construction (Piping, Roofing, Wiring Infrastructure)

- Transportation (Electric Vehicle Components, Rail, Aviation)

- Industrial Machinery (Heat Exchangers, Motors, Industrial Equipment)

- Others (Coinage, Defense, Specialized Alloys)

- By End-User Industry:

- Power Utilities

- Telecommunications and Data Centers

- Automotive Industry (EV/HEV Manufacturers)

- Infrastructure Developers and Contractors

Value Chain Analysis For Copper Market

The Copper Market value chain is a complex, capital-intensive process spanning multiple continents, beginning with highly localized extraction and ending with globally distributed fabrication. The upstream segment involves exploration, mining (open-pit or underground), and concentration processes, where mined ore is crushed and milled to produce copper concentrate—a commodity traded globally. This initial phase is characterized by high operational risks, significant environmental impact, and massive capital outlay. Success in the upstream is heavily dependent on geological reserves, regulatory stability in host countries, and efficient use of water and energy resources to counter declining ore grades globally.

The midstream comprises smelting and refining, transforming concentrates into high-purity refined copper (cathodes). This stage is energy-intensive and technologically demanding, often located near ports or large energy sources, typically in industrialized nations or major processing hubs like China. Key stakeholders focus on maximizing metal recovery, minimizing sulfur dioxide emissions, and achieving the stringent purity levels (e.g., LME Grade A or higher) required for advanced electrical applications. Logistics and transportation costs are crucial factors here, given the bulk nature of concentrate trade and the subsequent distribution of refined metal.

The downstream segment involves fabrication, where refined copper is converted into semi-finished products—wire rod, tube, sheet, strip—and eventually into end-products like cables, pipes, and electrical components. Distribution channels are highly varied, including direct sales to large industrial buyers (e.g., automotive OEMs, utility companies) and indirect sales through a network of specialized metal distributors and traders who manage inventory and just-in-time delivery requirements. The efficiency and resilience of this downstream network are essential to ensuring that global manufacturing demand, especially from the rapidly growing EV and renewable energy sectors, can be met without excessive lead times or supply bottlenecks.

Copper Market Potential Customers

The primary consumers of refined copper are highly diversified industries that rely on its conductivity and durability for foundational components. The largest cohort of potential customers consists of power utility companies and grid operators who require vast quantities of copper for transmission lines, substations, and distribution networks necessary for maintaining and expanding electricity access. Given the global transition towards decentralized energy production (solar farms, wind parks), these entities are consistently upgrading their infrastructure to handle intermittent power flows, creating sustained high demand for copper wire rods and specialized components.

Another rapidly expanding customer base resides within the automotive sector, specifically manufacturers of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). Each EV utilizes significantly more copper than an equivalent ICE vehicle—for the battery, motor windings, power cables, and charging ports. These customers prioritize high-purity copper and specialized alloy components that offer reduced weight and improved thermal management capabilities under high-load conditions, driving innovation in magnet wire and copper foil production. Securing long-term supply agreements with these major automotive groups is a strategic imperative for copper producers.

Finally, the construction and telecommunications industries represent stable and substantial customer segments. Infrastructure developers and contractors purchase copper for building systems (plumbing, HVAC, internal wiring), while telecommunication providers and data center operators require high-speed, high-bandwidth copper cabling for internal server connections and massive data transmission infrastructure. These customers demand reliability, longevity, and adherence to strict safety standards, ensuring copper remains the preferred material over cheaper substitutes in mission-critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 Billion |

| Market Forecast in 2033 | USD 720.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freeport-McMoRan, Glencore, BHP, Southern Copper Corporation, Rio Tinto, Codelco, Anglo American, First Quantum Minerals, Antofagasta PLC, KGHM Polska Miedź S.A., Vale S.A., Sumitomo Metal Mining Co., Ltd., Jiangxi Copper Company Limited, Zijin Mining Group Co., Ltd., Teck Resources Limited, Kaz Minerals, JX Nippon Mining & Metals Corporation, Sandfire Resources, Nevsun Resources, Norilsk Nickel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Copper Market Key Technology Landscape

The technological evolution within the Copper Market is highly focused on improving operational efficiency, enhancing resource recovery, and minimizing environmental impact across the entire value chain. In the upstream mining sector, significant advancements are centered on autonomous drilling and hauling systems, which rely on GPS, sensors, and real-time data processing to operate large machinery continuously and safely in challenging environments. Furthermore, geometallurgy—the integration of geological and metallurgical data—is increasingly used to optimize blending strategies, ensuring that the processing plant receives consistent ore feed, thereby maximizing recovery rates despite declining ore grades.

The midstream refining process is seeing a push towards cleaner and more energy-efficient technologies. Pyrometallurgical processes (smelting) are being optimized using predictive control systems and enhanced gas management technologies to capture sulfur dioxide emissions more effectively, meeting stricter air quality standards. Simultaneously, hydrometallurgical routes, such as Solvent Extraction and Electrowinning (SX-EW), are being adapted to handle increasingly complex sulfide ores, expanding the range of economically viable deposits. These innovations are critical for maintaining supply levels while reducing the overall carbon footprint associated with copper production.

In the downstream fabrication sector, the focus is on developing high-performance copper alloys tailored for specific high-growth applications, particularly in high-voltage batteries and high-frequency electronics. Techniques such as continuous casting and controlled atmosphere hot rolling are being refined to produce ultra-fine wire rods and thin copper foil with superior conductivity and mechanical strength. This technological specialization is essential for meeting the stringent specifications demanded by advanced manufacturing, where material purity and microstructural integrity are paramount to system performance and longevity.

Regional Highlights

The Copper Market exhibits pronounced regional variances in terms of production, consumption, and growth drivers, making regional analysis vital for strategic planning. Asia Pacific (APAC) stands as the undisputed consumption leader globally, driven primarily by China’s massive industrial base, its aggressive renewable energy deployment goals, and rapid infrastructure buildout across Southeast Asia. China alone accounts for approximately half of the global refined copper consumption, influencing international price benchmarks and trade flows significantly. India is emerging as a critical secondary growth engine, fueled by urbanization and government initiatives supporting domestic manufacturing and electrification programs.

North America and Europe represent mature markets characterized by stable consumption in the construction sector and explosive demand growth within the high-tech and clean energy segments. In these regions, market expansion is less about raw infrastructure buildout and more focused on technological replacement cycles—modernizing decades-old power grids, installing high-speed broadband, and rapidly expanding EV charging networks and manufacturing plants. European regulations strongly push for circular economy practices, leading to advanced development in scrap copper processing and stringent traceability requirements for primary supply chains.

Latin America is paramount for global supply, hosting some of the world's largest copper deposits, particularly in Chile and Peru. This region dominates upstream production but relies heavily on exporting copper concentrate to APAC and European processing centers. The geopolitical stability, resource nationalism policies, and labor relations in these countries are major determinants of global supply consistency. Meanwhile, the Middle East and Africa (MEA) region is emerging, driven by planned large-scale infrastructure projects and, in Africa, the exploitation of vast, untapped copper resources, particularly in the Copperbelt region (DRC and Zambia), attracting significant foreign investment to develop new mining and processing capacities.

- Asia Pacific (APAC): Dominates global consumption (especially China); rapid growth driven by EVs, renewables, and massive infrastructure investment; primary destination for global copper concentrate trade.

- North America: Strong demand from grid modernization and domestic EV manufacturing; emphasis on recycling technology and secure, ethical supply chains; significant investment in specialized high-conductivity alloys.

- Europe: Driven by ambitious decarbonization targets; strong regulatory push for circular economy models; robust demand for industrial machinery and high-voltage transmission components.

- Latin America: Primary global production hub (Chile, Peru); major exporter of copper concentrate; market sensitive to regulatory changes, mining policies, and labor disputes.

- Middle East and Africa (MEA): Growing importance due to untapped reserves (African Copperbelt) and strategic infrastructure projects in the Gulf region; high potential for new mine development and processing capacity expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Copper Market.- Freeport-McMoRan

- Glencore

- BHP

- Southern Copper Corporation

- Rio Tinto

- Codelco

- Anglo American

- First Quantum Minerals

- Antofagasta PLC

- KGHM Polska Miedź S.A.

- Vale S.A.

- Sumitomo Metal Mining Co., Ltd.

- Jiangxi Copper Company Limited

- Zijin Mining Group Co., Ltd.

- Teck Resources Limited

- Kaz Minerals

- JX Nippon Mining & Metals Corporation

- Sandfire Resources

- Nevsun Resources

- Norilsk Nickel

Frequently Asked Questions

Analyze common user questions about the Copper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of future Copper Market growth?

Future copper market growth is fundamentally driven by global electrification, particularly the exponential rise in Electric Vehicle (EV) adoption and massive investments in renewable energy infrastructure, including solar, wind power, and smart grid modernization projects globally. These transitions mandate high volumes of high-ppurity copper due to its superior electrical conductivity.

How does the shift to Electric Vehicles (EVs) impact copper demand?

The transition to EVs significantly elevates copper demand because an average battery electric vehicle requires substantially more copper (up to four times) compared to a traditional internal combustion engine vehicle. This increase stems from the copper utilized in battery components, electric motor windings, and extensive internal cabling, alongside the necessary charging infrastructure development.

Which region currently dominates the global consumption of copper?

Asia Pacific (APAC), primarily driven by China, dominates the global consumption of refined copper. This consumption is fueled by rapid industrial expansion, large-scale infrastructure development, and the region's aggressive push toward establishing renewable energy generation and high-speed rail networks.

What major challenges affect the copper supply chain?

Major challenges include declining ore grades globally, necessitating higher processing costs; stringent environmental and regulatory hurdles leading to delays in new mine development; high capital expenditure requirements; and recurrent geopolitical and labor stability issues within key producing countries like Chile and Peru.

How is the Copper Market addressing sustainability and resource efficiency?

The market addresses sustainability through increased reliance on scrap copper recycling (promoting the circular economy) and by adopting advanced mining technologies, such as automation and AI-driven process optimization, to reduce water and energy consumption and minimize the overall environmental footprint of primary extraction and refining operations.

The Copper Market's projected growth trajectory underscores its status as a foundational commodity essential for the global energy transition. Demand is structurally sound, supported by government policies pushing decarbonization and widespread infrastructure upgrades across developed and developing nations. The electrical and electronics sector remains the largest consumer, but the transportation segment, specifically driven by battery technology and electric vehicles, is poised for the most dramatic percentage increase in demand over the forecast period. This sustained high demand, coupled with increasing challenges in securing new, high-grade mining assets, suggests that supply chain tightness and price volatility will remain defining characteristics of this market.

Technological integration, particularly the adoption of Artificial Intelligence and advanced automation, is transforming the traditionally labor-intensive copper industry. These technologies are crucial for managing complex logistics, improving resource extraction efficiency from lower-grade ores, and ensuring adherence to increasingly strict environmental standards. Companies that successfully leverage these innovations will gain significant competitive advantages, particularly those able to rapidly scale up sustainable and verifiable production processes. Furthermore, the importance of secondary production, derived from scrap recycling, is growing, driven by both economic incentives and regulatory mandates in major consumer markets, contributing to overall market supply resilience.

Strategic success in the Copper Market hinges on navigating geopolitical risks, managing complex stakeholder relationships in primary production regions, and making timely investments in advanced refining and fabrication capacities closer to the major consumption hubs, such as Asia and North America. Stakeholders must prioritize long-term off-take agreements with key end-users—specifically utility companies and automotive giants—to mitigate price exposure and secure demand certainty. The future market equilibrium depends heavily on the speed at which new, sustainable supply sources can be brought online versus the unprecedented pace of electrification required to meet global climate objectives.

The demand for high-purity refined copper is becoming increasingly specialized, moving beyond standard commodity grades. This trend is driven by the performance requirements of advanced semiconductor manufacturing and high-capacity electrical transmission systems, which necessitate copper products with superior thermal and electrical properties, often achieved through specialized alloy development and fabrication techniques. Investment in research and development for new copper-based materials that can withstand extreme conditions (e.g., high temperatures, high stress) is paramount for producers aiming to capture premium segments of the market. This technological push aligns with the broader industrial shift toward material optimization for energy efficiency.

Furthermore, regulatory frameworks are evolving globally, placing significant emphasis on traceability and ethical sourcing of raw materials. The Copper Market is seeing increased pressure from investors and consumers to demonstrate robust environmental, social, and governance (ESG) compliance across the entire supply chain. Producers are responding by implementing sophisticated tracking systems and participating in industry-led certifications to verify the origin and sustainable production methods of their copper. Failure to meet these heightened ESG expectations can lead to market exclusion or devaluation, making sustainability a core business imperative rather than just a compliance issue.

In summary, while the market faces structural challenges related to resource depletion and environmental constraints, the overarching forces of global energy transition provide an undeniable and powerful tailwind. Copper remains irreplaceable in most high-conductivity applications. Strategic focus on vertical integration, technological adaptation (especially in AI and automation), and robust commitment to sustainability practices will define leadership and resilience within the highly competitive Copper Market landscape through 2033.

The continuous push for enhanced battery technology in the Electric Vehicle sector is spurring innovation in copper foil production. Manufacturers require extremely thin yet highly durable copper foils for lithium-ion battery anodes, demanding precision manufacturing processes that minimize material flaws and maximize energy storage capacity. This segment represents a high-margin, technologically intensive niche within the overall copper market. Companies capable of meeting the stringent quality and volume requirements for EV battery gigafactories are securing long-term strategic positions, demonstrating that downstream fabrication excellence is just as critical as upstream mining output.

Beyond the established markets, emerging applications such as additive manufacturing (3D printing) using copper powders and alloys are creating new, albeit smaller, pockets of specialized demand. These techniques allow for the creation of intricate copper components with optimized thermal dissipation properties, suitable for advanced cooling systems in supercomputers and military hardware. While these applications do not consume copper at the scale of electrical wiring or construction, they represent valuable high-technology testing grounds that drive innovation in metallurgical science and processing purity. The market must therefore cater not only to bulk commodity needs but also to hyper-specific, high-value industrial requirements.

Finally, the interplay between copper and other critical materials, such as nickel, cobalt, and lithium, is intensifying due to their co-location in battery and energy storage systems. Price movements and supply chain disruptions in one metal often impact the strategic planning for copper procurement, particularly for automotive and energy companies. Comprehensive market analysis must therefore adopt a multi-commodity perspective, recognizing copper as a central component in the broader basket of energy transition metals. This holistic view is essential for mitigating risk and ensuring stable supply for the future green economy.

The Copper Market's inherent cyclicality, influenced by global economic health and industrial output, adds another layer of complexity to market forecasting. While the structural demand drivers provide a long-term bullish outlook, short-term fluctuations, often triggered by changes in inventory levels at major exchanges (LME, COMEX, SHFE) or shifts in Chinese construction and manufacturing indices, require rapid and adaptive strategic response from market participants. Effective hedging strategies and operational flexibility—such as the ability to quickly ramp up or down processing activities—are vital tools for navigating these economic cycles.

Investment into mine infrastructure and processing capacity is often hindered by the long lead times associated with environmental approvals and the high cost of securing operational licenses in resource-rich but politically complex jurisdictions. The average time from discovery to commercial production for a major copper mine can exceed 15 years, creating significant inertia in the global supply response to sudden demand surges. This supply-side rigidity further exacerbates price volatility, reinforcing the strategic importance of stable, high-production mines currently operating in low-risk regions, even if their operational costs are relatively higher.

In conclusion, the Copper Market is at a pivotal inflection point, transitioning from a commodity primarily linked to construction and general industry to a crucial enabler of the high-tech, electrified future. The confluence of overwhelming clean energy demand and constrained, geographically concentrated supply necessitates unprecedented levels of investment in both new primary projects and enhanced recycling capabilities. Successfully managing the ESG mandate while ensuring adequate material flow defines the current challenge for miners, refiners, and end-users alike, shaping the market dynamics through 2033 and beyond.

The geopolitical landscape significantly impacts copper supply security. Trade tensions, coupled with resource nationalism trends in major producing nations (e.g., increased royalty demands or attempts to nationalize assets), introduce significant risk premiums into copper pricing. Companies with geographically diversified mining portfolios are better positioned to weather regional disruptions, but the concentration of high-yield assets in specific countries means that macro-political stability remains a critical external factor influencing global supply availability and investment decisions. Establishing strong, mutually beneficial partnerships with host governments is therefore a non-negotiable component of any long-term copper strategy.

Furthermore, labor availability and specialization are emerging as constraints, particularly in highly automated mining environments. The shift towards technology-intensive operations requires a workforce skilled in data analytics, automation maintenance, and remote operational control, a profile often scarce in traditional mining regions. Companies must invest heavily in workforce training and development programs to bridge this skill gap, ensuring that the substantial investment in advanced technology translates into tangible operational gains and safety improvements. Recruitment and retention of specialized technical talent will be a silent, yet critical, competitive battlefield.

The financial instruments used to trade copper, including futures contracts and options, play a crucial role in price discovery and risk management. The transparency and liquidity of key exchanges (LME, COMEX) allow global players to hedge against price volatility, though speculative trading activity can sometimes decouple short-term prices from underlying physical demand. The increasing focus on traceable and verified physical delivery systems, especially for high-purity copper cathodes required by sensitive industries, is gradually evolving the financial trading landscape to better reflect genuine physical market conditions and ethical sourcing preferences.

Finally, the long-term viability of the copper industry relies on continuous innovation in environmental management, particularly regarding tailing storage facilities and acid mine drainage. Catastrophic failures in these areas can lead to significant environmental damage, huge financial penalties, and irreversible loss of social license to operate. Utilizing advanced monitoring technologies, remote sensing, and engineering solutions to stabilize and remediate mining waste sites is critical for securing future operating permits and maintaining investor confidence in the sector’s commitment to responsible resource extraction.

The integration of the copper market with the rapidly evolving semiconductor industry is also noteworthy. Copper is essential for advanced chip packaging and interconnection technologies, demanding ultra-high purity and precise fabrication standards. As chip densities increase, the reliance on copper’s superior heat dissipation properties becomes more pronounced. This linkage means that global semiconductor manufacturing cycles and technological breakthroughs directly influence a niche but highly demanding segment of refined copper demand, particularly for specialized thin copper foil and sputtering targets, further diversifying the market's high-tech dependencies.

The role of specialized copper alloys, such as those incorporating nickel, zinc, or beryllium, is expanding across diverse industrial applications, including marine engineering and medical devices. These alloys are engineered to offer enhanced mechanical strength, improved corrosion resistance, or specific antimicrobial properties that pure copper lacks. While the volume consumed by these niche markets is smaller, they command premium pricing and require specialized metallurgical expertise, representing high-value areas for downstream fabricators to focus their technological development and market penetration strategies.

Regulatory adherence concerning the use of hazardous substances, such as the European Union’s Restriction of Hazardous Substances (RoHS) Directive, also continually shapes the copper market, particularly in electronics manufacturing. While copper itself is generally compliant, regulations affect the alloys and coatings used alongside it, prompting continuous refinement of manufacturing processes and material inputs to ensure global market access. Staying ahead of these evolving chemical and environmental regulations is a constant operational challenge for producers and fabricators supplying international markets.

The market also faces inherent risks related to resource concentration. A small number of very large mines account for a significant portion of global primary output. Any major unforeseen event—be it a natural disaster, extended labor strike, or political conflict—at one of these key operations can send immediate shockwaves throughout the global supply chain, illustrating the inherent fragility despite the sheer scale of the overall market. Supply chain diversification, where economically viable, remains a key risk mitigation strategy for large multinational consumers of copper.

In conclusion, the Copper Market is characterized by a strong, positive long-term outlook anchored by the energy transition, but it is perpetually challenged by complex operational, geopolitical, and environmental constraints. Success demands significant capital investment, technological innovation, and a deep commitment to sustainable practices to ensure the continuous and ethical supply of this essential metal to the burgeoning electrified world.

The energy costs associated with copper production, particularly in smelting and refining, pose a significant operational challenge. As global energy prices remain volatile and pressure mounts to decarbonize industrial processes, copper producers are actively seeking long-term, renewable energy power purchase agreements (PPAs) to stabilize operating expenses and reduce Scope 1 and Scope 2 emissions. This shift is driving innovation in energy efficiency within processing plants, often facilitated by AI systems that optimize electricity consumption based on real-time process dynamics and energy market prices.

Furthermore, the competitive landscape is shifting, with major diversified miners increasingly competing with specialized copper producers and state-owned enterprises (SOEs). SOEs, particularly those based in China, often benefit from government support and long-term strategic directives, allowing them to secure resource access and make long-term capital investments that Western, publicly traded miners might find challenging under strict quarterly earnings pressure. This dynamic contributes to global overcapacity in refining but maintains pressure on raw material supply.

The crucial role of copper in defense and specialized aerospace applications, though a smaller segment by volume, is strategically important. The high-performance requirements for conductivity, heat resistance, and structural integrity in military equipment and spacecraft mandate the use of the highest purity and most specialized copper alloys. This sector often operates under strict confidentiality and specific regulatory standards (ITAR, etc.), creating a secure, high-value market niche where reliability and technical specification compliance outweigh price sensitivity, ensuring a steady, high-margin revenue stream for select specialized fabricators.

The development of 'smart mining' concepts, utilizing the Internet of Things (IoT) sensors and advanced data telemetry, is becoming standard practice in the industry. These connected technologies provide real-time monitoring of equipment health, geological conditions, and worker location, drastically improving safety protocols and allowing for instant operational adjustments. Smart mining is not just an efficiency tool; it is becoming essential for meeting the heightened safety expectations set by regulators and labor unions across major producing regions.

Finally, market stability depends on effective infrastructure investment globally, not just in mining. Port facilities, rail networks, and bulk handling capabilities in key production regions must be capable of efficiently transporting massive volumes of concentrate and finished cathodes to global markets. Logistics bottlenecks, such as those experienced during recent global shipping crises, directly translate into supply delays and higher input costs for downstream consumers, impacting the overall market efficiency and pricing structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Copper Kitchenware Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Copper core automotive harness Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Atomizing Copper Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Copper Busbar and Profiles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Copper Paste Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager