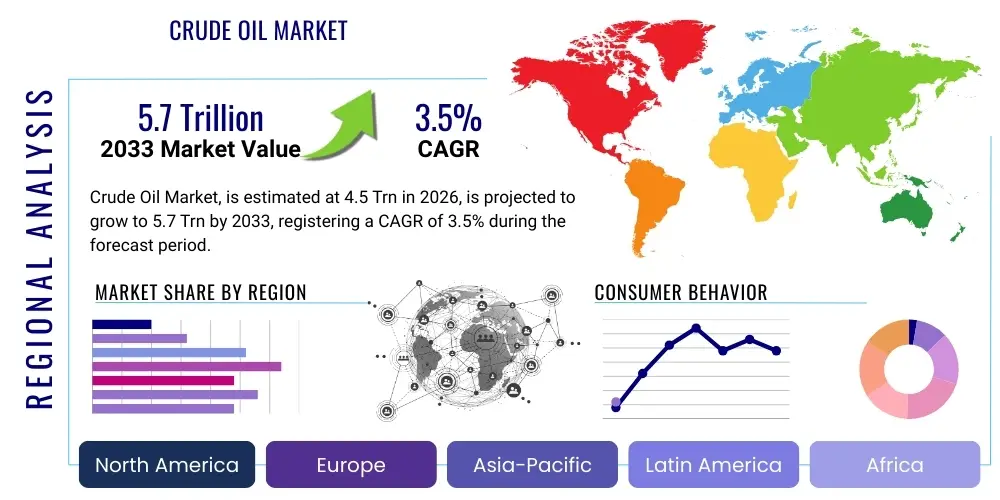

Crude Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439838 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Crude Oil Market Size

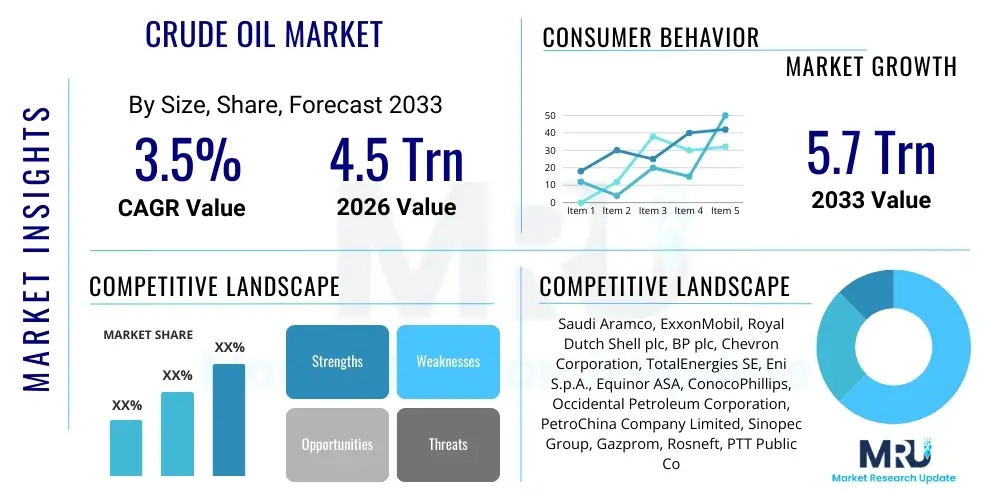

The Crude Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.5% between 2026 and 2033. The market is estimated at USD 4.5 Trillion in 2026 and is projected to reach USD 5.7 Trillion by the end of the forecast period in 2033. This consistent growth trajectory underscores the enduring global demand for crude oil, driven by industrial expansion, transportation needs, and the petrochemical sector's reliance on this foundational resource. Despite increasing pressures from renewable energy adoption and environmental regulations, the sheer scale and versatility of crude oil continue to solidify its position as a critical component of the global energy mix and industrial supply chain, particularly in emerging economies where energy consumption is rapidly escalating.

Crude Oil Market introduction

The global crude oil market represents one of the largest and most strategically significant commodity markets worldwide, serving as the primary source of energy and raw material for a vast array of industries. Crude oil, a naturally occurring fossil fuel, is refined into products such as gasoline, diesel, jet fuel, heating oil, and various petrochemical feedstocks. Its extensive applications span across transportation, power generation, industrial processes, and the manufacturing of plastics, fertilizers, and pharmaceuticals. The market's dynamics are influenced by a complex interplay of geopolitical events, economic growth patterns, technological advancements, and evolving environmental policies. Understanding these intricate relationships is crucial for stakeholders navigating this volatile yet indispensable sector.

Product description highlights crude oil as a viscous liquid hydrocarbon mixture found in geological formations beneath the Earth's surface. It varies significantly in density and sulfur content, leading to classifications like light sweet crude (e.g., WTI, Brent) and heavy sour crude. These characteristics determine its market value and refining suitability. Major applications include propelling virtually all forms of motorized transport, from cars and trucks to ships and aircraft; fueling industrial machinery and power plants; and acting as a fundamental feedstock for the petrochemical industry, which converts crude oil derivatives into countless consumer and industrial products. The global consumption patterns reflect both the industrialization of developing nations and the sustained energy demands of developed economies, making crude oil an essential commodity that underpins modern civilization.

The benefits derived from crude oil are extensive, ranging from providing a dense and easily transportable energy source to serving as a versatile raw material for chemical synthesis. Its high energy density makes it ideal for transportation, enabling global trade and mobility. The driving factors behind market growth are multifaceted and robust, including sustained global economic expansion, particularly in rapidly industrializing regions of Asia and Africa, which fuels demand for energy and petrochemicals. Population growth and urbanization further intensify the need for transport fuels and consumer goods derived from crude oil. Furthermore, continued reliance on existing infrastructure, the relatively slow pace of energy transition in heavy industries, and the indispensable role of crude oil in the petrochemical value chain ensure its market resilience. Geopolitical factors and production decisions by major oil-producing nations also play a significant role in shaping market supply and price stability.

Crude Oil Market Executive Summary

The Crude Oil Market is currently navigating a period of profound transformation, characterized by dynamic shifts in business trends, regional consumption patterns, and segmentation nuances. Global business trends are heavily influenced by the interplay of economic recovery post-pandemic, persistent inflationary pressures, and the acceleration of the energy transition agenda. Companies are increasingly focusing on operational efficiencies, digital transformation, and sustainable practices, even within the traditional oil and gas sector, to remain competitive and meet stakeholder expectations. Investment in exploration and production continues, albeit with a growing emphasis on optimizing existing assets and selectively pursuing projects that offer quicker returns and lower carbon footprints, reflecting a cautious yet determined approach to market expansion.

Regional trends reveal a distinct bifurcation in demand and supply dynamics. Asia Pacific, particularly China and India, continues to be the primary engine of crude oil demand growth, driven by rapid industrialization, expanding middle classes, and burgeoning transportation sectors. North America remains a significant producer and consumer, with the Permian Basin leading robust output, while Europe is focusing heavily on reducing its fossil fuel dependence through stringent environmental policies and investments in renewables, impacting its crude oil import requirements. The Middle East and Africa continue to be pivotal supply regions, leveraging their vast reserves and lower production costs to meet global demand, often playing a critical role in stabilizing international oil prices through OPEC+ agreements and strategic production adjustments, reflecting complex geopolitical and economic considerations.

Segmentation trends highlight the increasing importance of crude oil quality, with light sweet crude remaining highly prized due to its easier refining process and higher yield of valuable products like gasoline and jet fuel. The application segment continues to be dominated by transportation fuels, but the petrochemical sector exhibits resilient growth as a key demand driver, particularly for plastics and other derivatives, ensuring a diversified demand base for crude oil. Furthermore, the market sees continued differentiation in onshore versus offshore production, with offshore projects often requiring substantial capital and advanced technology but offering access to vast untapped reserves. These segmentation insights are critical for producers, refiners, and investors in strategically positioning themselves within a market that, while mature, continuously presents new challenges and opportunities.

AI Impact Analysis on Crude Oil Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is revolutionizing various facets of the crude oil market, addressing key industry challenges from exploration to distribution. Common user questions often revolve around how AI can enhance operational efficiency, reduce costs, improve safety, and contribute to environmental sustainability within this capital-intensive and historically conventional industry. Stakeholders are particularly interested in AI's role in optimizing drilling operations, predicting equipment failures, managing complex supply chains, and enabling more accurate reservoir characterization. There is also significant anticipation regarding AI's potential to facilitate the energy transition by optimizing carbon capture processes and integrating renewable energy sources into existing infrastructure, signaling a dual impact of improving traditional operations while aiding future-proofing strategies.

- AI-driven seismic interpretation significantly improves accuracy in hydrocarbon exploration, reducing dry well rates and optimizing drilling locations.

- Predictive maintenance programs powered by AI minimize downtime for critical equipment, enhancing operational reliability and extending asset lifespans.

- Real-time optimization of drilling parameters using AI algorithms improves drilling efficiency, reduces costs, and enhances wellbore stability.

- AI applications in reservoir simulation and management allow for more precise forecasting of production, maximizing recovery rates from existing fields.

- Enhanced oil recovery (EOR) techniques are optimized through AI, which analyzes complex geological data to determine the most effective injection strategies.

- AI-powered systems improve crude oil refining processes by optimizing feedstock selection, reaction conditions, and product yields, leading to higher profitability.

- Supply chain and logistics are streamlined by AI, which predicts demand fluctuations, optimizes shipping routes, and reduces transportation costs and emissions.

- AI contributes to environmental monitoring and compliance by analyzing satellite imagery and sensor data to detect leaks, spills, and reduce methane emissions.

- Risk assessment and trading strategies in the crude oil market are enhanced by AI models that process vast amounts of data to predict price movements and geopolitical impacts.

- Autonomous robotic systems for inspection and maintenance in hazardous environments, guided by AI, significantly improve worker safety and operational efficiency.

DRO & Impact Forces Of Crude Oil Market

The Crude Oil Market is profoundly shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), alongside various Impact Forces that dictate its trajectory. Among the primary drivers is the relentless global energy demand, fueled by sustained population growth, urbanization, and industrialization in emerging economies. The transportation sector's heavy reliance on liquid fuels, particularly for aviation, shipping, and heavy-duty road transport, continues to underpin crude oil consumption. Furthermore, the burgeoning petrochemical industry, which uses crude oil derivatives as fundamental building blocks for plastics, chemicals, and fertilizers, represents a robust and expanding demand segment, ensuring the commodity's indispensable role beyond just energy generation. Geopolitical stability or instability in major producing regions also significantly impacts supply dynamics, often leading to price volatility but also reinforcing the strategic importance of diversified energy sources.

Conversely, significant restraints challenge market growth. The accelerating global energy transition, driven by climate change concerns and international agreements like the Paris Accord, is pushing for a shift towards renewable energy sources and electric vehicles, potentially curbing future crude oil demand in the long term. Stricter environmental regulations, including carbon taxes and emission standards, increase operational costs for oil and gas companies, making some projects less economically viable. Geopolitical tensions, while sometimes creating opportunities for specific suppliers, more often introduce significant supply chain risks and price uncertainty, deterring long-term investments. Additionally, market volatility due to economic downturns, technological disruptions, and the inherent boom-bust cycles of commodity markets can lead to periods of oversupply and depressed prices, impacting profitability and investment appetite across the industry value chain.

Opportunities within the crude oil market primarily stem from technological advancements, particularly in enhanced oil recovery (EOR) techniques, which allow for the extraction of more oil from mature fields, extending their productive life. Exploration in frontier regions, though capital-intensive, holds the promise of discovering new, substantial reserves. The petrochemical sector's continuous innovation and expansion also present a resilient and growing demand avenue for crude oil feedstocks. Moreover, the increasing adoption of digital technologies, AI, and automation in exploration, production, and refining processes offers significant potential for cost reduction, efficiency gains, and improved safety. These impact forces collectively underscore a market characterized by both enduring foundational demand and a necessity for agile adaptation to evolving global priorities and technological innovations, shaping both short-term market dynamics and long-term strategic planning for all stakeholders involved.

Segmentation Analysis

The Crude Oil Market is extensively segmented to provide granular insights into its complex structure, enabling stakeholders to understand specific demand-supply dynamics, price differentials, and strategic opportunities. These segmentations are crucial for producers to tailor their output, for refiners to optimize their processes, and for investors to identify lucrative ventures. The market is primarily broken down by crude oil type, application, and location of production, each reflecting distinct market characteristics and influencing the overall value chain. Understanding these segments is key to deciphering market trends, forecasting future demand, and formulating effective business strategies in this globally significant commodity sector. The interplay between these segments often dictates regional supply-demand balances and impacts global trade flows, thereby influencing pricing mechanisms and competitive landscapes across the industry.

- By Type:

- Light Sweet Crude: Characterized by low density and low sulfur content (e.g., WTI, Brent Crude). Highly desirable for refining into gasoline and diesel.

- Medium Sour Crude: Moderate density and higher sulfur content. Requires more extensive refining processes.

- Heavy Sour Crude: High density and high sulfur content. Requires complex and costly refining but yields valuable asphalt and heavy fuel oils.

- Oil Sands/Extra Heavy Oil: Extremely viscous, requiring specialized extraction and upgrading processes (e.g., Canadian oil sands).

- By Application:

- Transportation Fuel: Dominant segment, including gasoline, diesel, jet fuel, and marine fuel for vehicles, aircraft, and ships.

- Petrochemical Feedstock: Used as raw material for plastics, synthetic rubber, fertilizers, solvents, and other chemical products.

- Industrial Fuel: Used in heavy industries for power generation and heating, particularly in sectors like manufacturing and construction.

- Power Generation: Historically significant for electricity generation, though increasingly replaced by natural gas and renewables.

- Residential & Commercial Heating: Heating oil for homes and businesses, especially in colder climates.

- By Location/Source:

- Onshore: Oil extracted from land-based reservoirs, typically less complex and costly than offshore operations.

- Offshore: Oil extracted from beneath the seabed, requiring advanced drilling and production technologies (e.g., deepwater, ultra-deepwater).

- Shale Oil/Tight Oil: Oil extracted from shale formations using hydraulic fracturing and horizontal drilling.

Value Chain Analysis For Crude Oil Market

The crude oil market operates through a sophisticated and capital-intensive value chain that begins with exploration and extends all the way to end-user consumption. This intricate process involves several distinct stages, each presenting unique challenges and opportunities. Understanding the value chain from upstream to downstream, including the complex distribution channels, is essential for identifying areas of efficiency, potential bottlenecks, and profit maximization. The upstream segment focuses on finding and producing crude oil, a high-risk, high-reward endeavor driven by geological science, advanced technology, and substantial capital investment. This stage sets the foundation for the entire industry by ensuring the availability of the raw material that powers global economies.

Upstream analysis encompasses geological surveys, seismic imaging, exploration drilling, and ultimately, the development and production from oil fields. Companies engage in significant R&D to improve exploration success rates and enhance oil recovery (EOR) from mature reservoirs. This stage is characterized by long lead times, high financial exposure, and significant technological demands, including deepwater drilling and unconventional resource extraction techniques like hydraulic fracturing. The primary output of the upstream segment is crude oil, which is then transported to refineries. Downstream analysis focuses on refining and marketing activities. Refineries transform crude oil into a wide range of refined petroleum products, such as gasoline, diesel, jet fuel, lubricants, and petrochemical feedstocks. This process requires massive infrastructure, advanced chemical engineering, and careful management of product specifications to meet market demand and environmental regulations. The downstream segment is often characterized by lower margins but higher volumes, with profitability sensitive to crude oil prices and refined product demand.

The distribution channel is a critical link connecting the upstream and downstream segments to the final consumers. It involves a complex network of pipelines, supertankers (direct), railcars, trucks (indirect), and storage facilities. Direct distribution typically involves large-volume transfers, such as crude oil sales from producers to refiners, or bulk refined product sales to major industrial users and power plants. Indirect distribution channels include wholesale distributors, retailers (e.g., gas stations), and specialized chemical distributors who serve a myriad of smaller industrial and consumer markets. The efficiency, safety, and reliability of these distribution networks are paramount to ensuring a consistent supply of crude oil and its derivatives, thereby impacting market stability and consumer prices. Each stage of this value chain is interconnected, with disruptions or innovations in one segment having ripple effects across the entire industry, highlighting the need for integrated and resilient operational strategies.

Crude Oil Market Potential Customers

The crude oil market serves a vast and diverse customer base, reflecting its foundational role in global energy and industrial supply chains. The end-users or buyers of crude oil are not singular entities but rather a multifaceted group of industries, businesses, and ultimately, individual consumers who indirectly rely on its products. Primarily, crude oil is purchased by refineries, which act as the central processing hubs, converting raw crude into a spectrum of usable petroleum products. These refineries, owned by major integrated oil companies or independent entities, are the direct purchasers from crude oil producers and traders, driving the bulk of the market's transactional volume. Their purchasing decisions are influenced by crude quality, logistical costs, refined product demand, and geopolitical factors impacting supply security. This direct relationship forms the cornerstone of the crude oil trading ecosystem.

Beyond refineries, the processed petroleum products cater to an extensive array of downstream customers. The transportation sector represents the largest end-user segment, encompassing airlines, shipping companies, railway operators, and millions of individual vehicle owners who consume gasoline, diesel, and jet fuel. Industrial customers, including manufacturers, construction companies, and agricultural enterprises, utilize various fuels and lubricants derived from crude oil to power machinery, heat facilities, and operate processes. The petrochemical industry stands as another critical customer segment, using naphtha, gas oil, and other crude derivatives as feedstocks to produce plastics, synthetic fibers, detergents, and fertilizers, which are then sold to an even broader array of manufacturing sectors and consumer markets globally.

Furthermore, power generation facilities, particularly in regions with less developed natural gas infrastructure or those reliant on oil-fired plants, represent significant buyers of heavy fuel oil. Commercial and residential sectors also consume heating oil, especially in cooler climates, for warmth. Government agencies and military organizations are substantial purchasers for defense, infrastructure, and public services. In essence, almost every sector of the modern economy is either a direct or indirect consumer of crude oil and its refined products. This pervasive demand underscores crude oil's status as a critical commodity that enables industrial activity, facilitates global trade, supports national defense, and underpins the daily lives of billions, making its potential customer base virtually universal and deeply integrated into the fabric of contemporary society.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Trillion |

| Market Forecast in 2033 | USD 5.7 Trillion |

| Growth Rate | CAGR of 3.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saudi Aramco, ExxonMobil, Royal Dutch Shell plc, BP plc, Chevron Corporation, TotalEnergies SE, Eni S.p.A., Equinor ASA, ConocoPhillips, Occidental Petroleum Corporation, PetroChina Company Limited, Sinopec Group, Gazprom, Rosneft, PTT Public Company Limited, Kuwait Petroleum Corporation, National Iranian Oil Company, Petróleos Mexicanos (PEMEX), Petróleo Brasileiro S.A. (Petrobras), Lukoil. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crude Oil Market Key Technology Landscape

The crude oil market is increasingly characterized by a dynamic technology landscape, with continuous innovation being vital for maximizing efficiency, reducing costs, and navigating environmental challenges. A broad spectrum of advanced technologies is employed across the entire value chain, from initial exploration and production (E&P) to refining and distribution. In the upstream segment, seismic imaging technologies have evolved significantly, offering higher resolution and more accurate subsurface mapping, enabling more precise hydrocarbon discovery and reservoir characterization. Techniques such as 4D seismic provide real-time monitoring of reservoir changes over time, optimizing drilling paths and enhancing recovery rates. Furthermore, advanced drilling technologies, including horizontal drilling and multilateral wells, combined with hydraulic fracturing, have unlocked vast unconventional resources, particularly shale oil, fundamentally altering global supply dynamics and demanding sophisticated operational management systems.

Enhanced Oil Recovery (EOR) methods represent another critical technological frontier, especially as mature fields decline. These technologies involve injecting various substances like water, gas (CO2, natural gas), or chemicals into reservoirs to increase pressure and improve oil mobility, thereby extending the economic life of fields and maximizing resource utilization. Digital oilfield solutions, powered by the Internet of Things (IoT), Artificial Intelligence (AI), and Machine Learning (ML), are transforming operations by enabling real-time data acquisition, predictive analytics, and remote monitoring and control. These digital tools enhance operational decision-making, optimize production, predict equipment failures, and improve safety, leading to substantial cost savings and increased productivity across distributed assets. The integration of big data analytics allows for a more comprehensive understanding of complex geological and operational parameters, further streamlining processes.

In the downstream sector, advanced refining technologies are crucial for processing diverse crude feedstocks more efficiently and producing higher-value products while meeting stringent environmental regulations. Technologies like hydrocracking, fluid catalytic cracking, and alkylation are continuously refined to improve yield and reduce emissions. Carbon Capture, Utilization, and Storage (CCUS) technologies are gaining prominence as the industry seeks to decarbonize operations and reduce its environmental footprint, focusing on capturing CO2 emissions from industrial sources and either utilizing them for EOR or storing them permanently underground. Robotics and automation are also increasingly deployed in hazardous environments for inspection, maintenance, and logistics, enhancing worker safety and operational efficiency. The collective adoption of these technological innovations is not merely about incremental improvements but rather about fundamentally reshaping the economics, environmental impact, and strategic resilience of the crude oil market in a rapidly evolving global energy landscape.

Regional Highlights

The global crude oil market exhibits significant regional disparities in terms of production, consumption, and market dynamics, reflecting diverse economic development stages, geopolitical landscapes, and energy policies. Each major region contributes uniquely to the overall market equilibrium, influencing global trade flows, price benchmarks, and investment patterns. Understanding these regional highlights is critical for a comprehensive market analysis, as localized factors often have ripple effects that resonate across the international stage. From the established production powerhouses in the Middle East to the demand-driven growth in Asia Pacific and the evolving energy transition in Europe, each geographical area presents a distinct set of challenges and opportunities for crude oil stakeholders.

- North America: A significant producer, particularly due to the shale revolution in the United States, making it less reliant on imports. The U.S. is a major consumer, with extensive refining capacity. Canada is a key producer of oil sands. Mexico also contributes, primarily to the U.S. market. The region is characterized by advanced E&P technologies and robust pipeline infrastructure.

- Europe: Predominantly a net importer, with declining production from the North Sea. The region is at the forefront of the energy transition, with aggressive policies to reduce fossil fuel dependence and invest in renewables, which will gradually impact crude oil demand. Refining capacity is substantial but facing modernization challenges.

- Asia Pacific (APAC): The largest and fastest-growing crude oil consumer globally, driven by industrialization, urbanization, and population growth in China, India, and Southeast Asian nations. While some countries like China and India have domestic production, the region is highly dependent on imports from the Middle East and Africa, making supply security a paramount concern. Significant investments in refining and petrochemical capacity are ongoing.

- Middle East: The world's largest crude oil reserve holder and producer, with the lowest production costs. Countries like Saudi Arabia, Iran, Iraq, UAE, and Kuwait are pivotal in global supply and price stability, often influencing market dynamics through OPEC+ policies. The region also plays an increasing role in downstream activities, with significant investments in refining and petrochemical complexes.

- Latin America: A diverse region with major producers like Brazil (deepwater), Venezuela (heavy oil, though production constrained), and Mexico. Argentina is emerging as a player in unconventional oil. The region balances domestic demand with export opportunities, often facing challenges related to political stability and investment climates.

- Africa: Home to significant oil producers such as Nigeria, Angola, Algeria, and Libya. Production is primarily export-oriented, with a large share going to Europe, Asia, and North America. The continent holds substantial untapped reserves but faces challenges related to infrastructure, security, and governance, which can impact investment and consistent output.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crude Oil Market.- Saudi Aramco

- ExxonMobil

- Royal Dutch Shell plc

- BP plc

- Chevron Corporation

- TotalEnergies SE

- Eni S.p.A.

- Equinor ASA

- ConocoPhillips

- Occidental Petroleum Corporation

- PetroChina Company Limited

- Sinopec Group

- Gazprom

- Rosneft

- PTT Public Company Limited

- Kuwait Petroleum Corporation

- National Iranian Oil Company

- Petróleos Mexicanos (PEMEX)

- Petróleo Brasileiro S.A. (Petrobras)

- Lukoil

Frequently Asked Questions

What are the primary factors driving crude oil demand?

The primary drivers of crude oil demand include global economic growth, which fuels industrial activity and transportation, sustained population growth and urbanization, and the robust expansion of the petrochemical sector, which relies on crude oil as a fundamental feedstock for a vast array of products.

How do geopolitical events impact crude oil prices?

Geopolitical events significantly impact crude oil prices by influencing supply stability and market sentiment. Conflicts, political instability in major producing regions, sanctions, or production cuts by cartels like OPEC+ can lead to supply disruptions, heightened uncertainty, and consequently, sharp price increases due to perceived scarcity.

What is the role of the energy transition in the crude oil market?

The energy transition is a major restraint and transformative force in the crude oil market, aiming to reduce reliance on fossil fuels. It promotes renewable energy, electric vehicles, and energy efficiency, gradually shifting long-term demand away from crude oil, particularly in developed economies, thereby necessitating strategic adaptation from industry players.

Which regions are key for future crude oil demand growth?

Asia Pacific, particularly rapidly industrializing nations like China, India, and Southeast Asian countries, is expected to be the primary driver of future crude oil demand growth. This is due to increasing energy consumption, expanding transportation sectors, and burgeoning petrochemical industries in these regions.

What key technologies are enhancing crude oil extraction and refining?

Key technologies enhancing crude oil operations include advanced seismic imaging for exploration, horizontal drilling and hydraulic fracturing for unconventional resources, Enhanced Oil Recovery (EOR) methods, and digital oilfield solutions leveraging AI, IoT, and big data for optimized production and predictive maintenance across the value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Waxy Crude Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Crude Oil Carriers Market Size Report By Type (Ultra Large Crude Carriers, Very Large Crude Carriers, Suezmax Tankers, Panamax Tankers, Aframax Tankers), By Application (.), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Tank Cleaning Service Market Size Report By Type (Manual Cleaning Service, Automated Cleaning Service), By Application (Crude Oil Tanks, Refinery Tanks, Commercial Tank, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pour Point Depressant of Crude Oil Market Statistics 2025 Analysis By Application (Industrial, Automotive Industry, Aviation, Marine, Oil & Gas Industry), By Type (Surface Active Agents Type Based, Polymer Type Based, Compound Copolymer Type Based), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Crude Oil Pour Point Depressant Market Statistics 2025 Analysis By Application (Crude Oil Transportation, Crude Oil Exploitation, Crude Oil Processing), By Type (Polymeric Depressant, Surfactant Depressant, Compound Depressant), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager