Crystal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432423 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Crystal Market Size

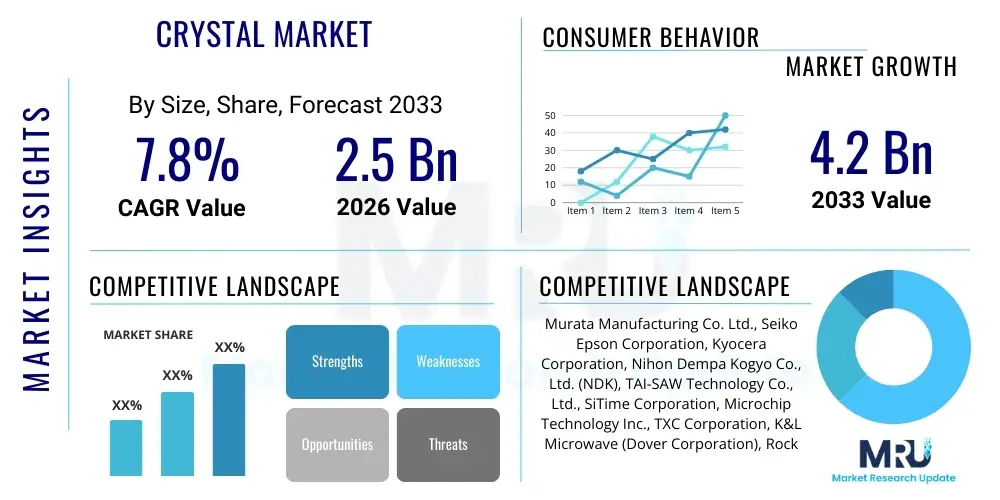

The Crystal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.2 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily attributed to the accelerating demand for high-precision components in the electronics and telecommunications sectors, coupled with the rising global popularity of crystal-based therapeutic and luxury products. The market encompasses a broad spectrum of products, ranging from synthetic quartz used in oscillators and filters to naturally occurring precious and semi-precious stones utilized in jewelry and decorative arts, creating a diverse and resilient commercial landscape responsive to technological advancements and evolving consumer tastes. The increasing complexity of modern electronic devices, such as 5G infrastructure components and advanced computing platforms, necessitates superior frequency control and timing devices, driving core demand within the industrial segments.

The valuation reflects significant investment in synthetic crystal manufacturing capabilities, particularly in Asia Pacific, where major semiconductor and consumer electronics production hubs are concentrated. Furthermore, the market benefits substantially from continuous innovation in crystal growth techniques, allowing manufacturers to produce larger, purer, and more uniform crystals required for sophisticated optical, piezoelectric, and acoustic applications. While the industrial segment remains the largest revenue contributor, the wellness and luxury segments are experiencing a faster pace of growth, influenced by aggressive digital marketing strategies and the perceived metaphysical benefits associated with specific natural crystals. Sustainability and ethical sourcing practices are also beginning to exert a powerful influence, particularly in North America and Europe, mandating increased transparency across the supply chain and influencing purchasing decisions among environmentally conscious consumers, which impacts pricing and market entry strategies for new and established players.

Crystal Market introduction

The Crystal Market constitutes a specialized segment of the global materials industry, defined by the manufacturing, processing, and trade of crystalline materials, both synthetic and natural, employed across a vast array of high-tech industrial, consumer, and luxury applications. These materials are characterized by their highly ordered atomic structure, which imparts unique physical properties, including piezoelectricity, optical transparency, and specific hardness. Key products include quartz crystals (essential for frequency control in electronics), synthetic sapphire and silicon carbide (used in advanced semiconductors and LED lighting), and various natural gemstones (utilized predominantly in jewelry and decorative items). The market’s foundation rests on its critical role in enabling modern digital infrastructure; without precise frequency timing devices derived from quartz crystals, ubiquitous technologies like mobile communication, GPS, and internet routers would not function effectively, highlighting their indispensable nature in contemporary society.

Major applications of crystals span telecommunications, where they are vital for stable signal transmission; consumer electronics, requiring compact and precise oscillators; luxury goods, where aesthetics and perceived value drive demand for natural stones; and the burgeoning optical and laser industries, demanding high-purity synthetic crystals for lenses, prisms, and substrates. The inherent benefits of crystalline materials, such as exceptional thermal stability, high Q-factor (quality factor), and mechanical robustness, position them as superior alternatives in environments demanding precision and reliability. Driving factors for market expansion include the global rollout of 5G networks, which requires exponentially more crystal oscillators per base station and device; the proliferation of IoT devices and autonomous vehicles, demanding resilient timing solutions; and the persistent growth of disposable incomes in developing economies, fueling demand for luxury jewelry and decorative crystals. The convergence of microelectronics miniaturization and high-frequency communication necessitates continuous improvement in crystal material quality and manufacturing techniques, ensuring sustained market vibrancy.

The market dynamics are highly influenced by the interplay between technological sophistication in synthetic production and the finite nature and aesthetic appeal of natural crystals. Manufacturers constantly invest in R&D to optimize crystal growth processes, such as the hydrothermal method for quartz or the Czochralski method for silicon, aiming for higher yield and reduced impurity levels. Simultaneously, the market for natural crystals, while smaller in volume, holds significant value due to factors like rarity, perceived spiritual significance, and craftsmanship associated with cutting and polishing. The regulatory landscape pertaining to conflict materials and ethical sourcing also plays a pivotal role, particularly affecting the natural gemstone segment and increasing the overall scrutiny on supply chain integrity, pushing industry players towards greater traceability and sustainable practices to maintain consumer trust and compliance.

Crystal Market Executive Summary

The Crystal Market is experiencing accelerated growth driven by dual forces: the insatiable demand from the high-tech electronics sector for precision timing and filtering components, and the expanding consumer interest in luxury and wellness products incorporating natural and manufactured crystals. Key business trends include aggressive consolidation among component manufacturers seeking economies of scale and control over proprietary crystal growth technologies, alongside significant vertical integration efforts, especially in the quartz oscillator segment, to ensure supply chain stability and quality control. Furthermore, strategic partnerships between synthetic crystal suppliers and semiconductor foundries are becoming common to co-develop next-generation materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) substrates, crucial for high-power electronics and efficient energy management. The rising cost pressures on raw materials, particularly high-purity quartz and specific rare earth elements, necessitate efficiency improvements in fabrication and recycling initiatives, shaping R&D priorities across the industry value chain.

Regionally, Asia Pacific maintains its dominance as both the largest production hub and the highest consuming market, spearheaded by China, Japan, South Korea, and Taiwan, due to their established leadership in consumer electronics, automotive manufacturing, and semiconductor production. North America and Europe, characterized by mature markets, exhibit strong demand for high-specification, specialized crystals used in defense, aerospace, and advanced medical imaging equipment, emphasizing purity and customized geometric characteristics. The Middle East and Africa (MEA) and Latin America are emerging as high-growth regions, predominantly driven by infrastructure investment in telecommunications (4G/5G rollout) and increasing disposable income boosting luxury crystal consumption, although reliance on imported finished products remains a challenge for local market development. The diverse regional growth rates reflect varying levels of technological maturity and industrial application focus.

Segmentation trends indicate that synthetic crystals, particularly quartz and specialized optical crystals, account for the largest revenue share, predominantly due to their high volume utilization in electronic components and optical systems. Within the application segment, frequency control devices (oscillators, filters, resonators) are the most vital sub-segment, experiencing compounding growth due to 5G implementation and the pervasive deployment of IoT endpoints. However, the market for natural crystals, categorized by product type (e.g., amethyst, clear quartz, citrine), shows remarkable resilience and premium pricing power, fueled by increasing consumer interest in holistic health, meditation, and personalized luxury items. The shift towards miniaturized components is strongly influencing the segment for micro-crystals and thin-film crystal components, pushing manufacturers to develop advanced lithographic and deposition techniques, thereby fragmenting the technology landscape while simultaneously consolidating component supply.

AI Impact Analysis on Crystal Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Crystal Market generally revolve around three core themes: first, how AI-driven optimization can enhance the complex and time-consuming processes of crystal growth and defect detection; second, the implications of AI hardware acceleration (e.g., specialized AI chips) on the demand for advanced crystalline substrates (like SiC and GaN); and third, the integration of AI tools for predictive analytics in market forecasting and inventory management for highly volatile natural crystal commodities. Users are keen to understand if AI can democratize access to high-quality synthetic crystals by lowering production costs and improving consistency, which are critical constraints in precision manufacturing. Furthermore, the role of AI in revolutionizing quality control, replacing subjective human inspection with objective, high-speed automated analysis, is a significant area of user concern and expectation, particularly in the high-stakes aerospace and medical imaging segments where zero defects are mandatory. The overarching expectation is that AI will primarily serve as a powerful tool for accelerating material science discovery and operational efficiency within the synthetic crystal production lifecycle, while its impact on the natural crystal segment will be centered more on logistics and consumer behavior prediction.

The application of machine learning algorithms is profoundly transforming crystal manufacturing by allowing for real-time monitoring and dynamic adjustment of growth parameters, such as temperature gradients, pressure, and nutrient composition, in hydrothermal or melt growth systems. Traditional crystal growth is highly empirical and resource-intensive, often resulting in significant yield loss due to unpredictable defect formation; AI models, trained on vast datasets of successful and failed growth cycles, can predict and preemptively correct conditions leading to dislocations or twinning, dramatically increasing output quality and reducing material waste. This precision engineering capability is crucial for advanced materials like specialized optical crystals (e.g., lithium niobate for photonics) where even microscopic flaws can render the material unusable. By optimizing energy consumption during the lengthy heating and cooling phases, AI also contributes to the sustainability goals of large-scale crystal manufacturers, addressing environmental concerns prevalent in modern industrial operations.

In the application domain, the demand for specialized crystalline substrates is directly proportional to the proliferation of AI and High-Performance Computing (HPC) infrastructure. AI chips and specialized processors designed for neural network training require substrates capable of handling high power density and excellent thermal dissipation—areas where materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) excel over traditional silicon. The rapid expansion of data centers, autonomous vehicles (which rely on embedded AI), and edge computing requires an unprecedented volume of these advanced materials. Therefore, AI not only optimizes the production of existing crystals but also drives the demand for entirely new classes of crystalline materials that can withstand the extreme operating conditions inherent in advanced AI hardware, ensuring the Crystal Market remains technologically pivotal to the ongoing digital transformation.

- AI optimizes crystal growth processes (hydrothermal, Czochralski) through predictive modeling, reducing defects, and improving yield rates significantly.

- Machine Learning (ML) algorithms are deployed for automated, high-throughput defect detection and quality inspection, replacing manual and subjective analysis.

- Increased adoption of AI hardware (accelerators, specialized GPUs) boosts demand for high-thermal-conductivity crystalline substrates like SiC and GaN.

- AI-driven supply chain management improves logistics, inventory forecasting, and pricing strategies for natural crystal segments with volatile supply chains.

- Predictive maintenance for crystal manufacturing equipment is enhanced by AI, minimizing downtime and ensuring continuous, high-purity production runs.

- AI assists in the design and discovery of novel crystalline materials with tailored optical or piezoelectric properties for future photonic and sensor applications.

DRO & Impact Forces Of Crystal Market

The Crystal Market's trajectory is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate investment decisions and strategic planning. A key driver is the relentless demand for high-frequency control devices fueled by the global deployment of 5G and the expansive Internet of Things (IoT) ecosystem, which requires precise, miniaturized frequency components. Simultaneously, substantial restraints include the high capital expenditure required for establishing and maintaining ultra-clean synthesis facilities and the vulnerability of the supply chain to geopolitical disruptions, particularly concerning raw material sourcing (e.g., high-purity quartz and specific rare earth metals). Opportunities emerge predominantly from advancements in material science, such as the synthesis of novel ferroelectric and piezoelectric crystals for advanced sensors and energy harvesting applications, and the untapped potential in emerging markets for both industrial and consumer crystal products. The overall impact forces suggest a market characterized by high entry barriers but significant profitability potential for entities capable of maintaining technological leadership and securing stable supply chains. The necessity for ultra-high purity materials in critical applications like aerospace and defense mandates stringent quality control, acting as a natural filter against lesser-equipped competitors.

The primary driving forces extend beyond technological adoption to include evolving consumer behavior, specifically the increasing acceptance and integration of crystals into the wellness, meditation, and holistic health industries, which substantially boosts the volume and value of the natural crystal segment. Furthermore, government initiatives worldwide supporting renewable energy infrastructure (solar cells, power electronics) amplify the need for specialized crystalline materials, such such as monocrystalline silicon wafers and high-efficiency power substrates. Conversely, major restraints include the ongoing challenge of managing environmental impact, as crystal growth processes, particularly those involving high temperatures and corrosive chemicals, are energy-intensive and produce hazardous waste, leading to increasing regulatory scrutiny in developed nations. The inherent limitations in achieving zero-defect production at commercial scale, especially for highly demanding applications like deep UV lithography optics, also restrains market growth, as the high scrap rate contributes significantly to overall manufacturing costs and limits scalability.

Significant opportunities lie in the development of micro-electromechanical systems (MEMS) resonators, which offer enhanced performance and smaller footprints compared to traditional bulk acoustic wave (BAW) crystals, poised to revolutionize frequency control in wearable technology and micro-sensor networks. Moreover, the integration of quantum computing and advanced photonics offers a highly specialized, albeit nascent, market segment demanding extremely high-quality, exotic crystalline materials for quantum entanglement experiments and optical communication systems. Capitalizing on these opportunities requires continuous R&D investment and collaboration between academic institutions and industrial giants to translate laboratory breakthroughs into viable commercial products. Successful navigation of these impact forces hinges on strategic resilience, technological diversification, and an unwavering commitment to quality assurance across all product lines, mitigating risks associated with supply chain bottlenecks and rapidly shifting technological standards in critical end-use sectors like 5G infrastructure deployment and automotive electronics.

Segmentation Analysis

The Crystal Market is systematically segmented based on Product Type (Natural vs. Synthetic), Application, End-Use Industry, and Region, reflecting the material’s diverse utility across industrial and consumer sectors. The distinction between natural crystals, which are typically mined and valued for their rarity and aesthetic qualities (predominantly in jewelry and collectibles), and synthetic crystals, which are engineered in laboratories for precise physical properties (primarily for electronic, optical, and mechanical functions), fundamentally divides the market’s revenue streams and operational strategies. Synthetic crystals dominate the market by volume and industrial value due to their tailored characteristics and cost-effective scalability. Application-based segmentation further delineates the market into key functional areas such as frequency control, optics, sensors, and decoration, each requiring different crystalline properties and processing standards. The overall segmentation landscape highlights the high degree of specialization required within the market, necessitating distinct manufacturing expertise and sales channels for each major segment, ranging from high-precision component sales to specialized distribution networks for luxury goods.

- By Product Type:

- Synthetic Crystals (Quartz, Sapphire, Silicon Carbide, Lithium Niobate, Germanium)

- Natural Crystals (Amethyst, Clear Quartz, Rose Quartz, Tourmaline, Citrine, others)

- By Application:

- Frequency Control Devices (Oscillators, Resonators, Filters)

- Optics and Photonics (Prisms, Lenses, Substrates, Waveguides)

- Sensors and Transducers (Pressure, Temperature, Acoustic Sensors)

- Luxury and Decoration (Jewelry, Interior Design, Collectibles)

- Others (High-Temperature Substrates, Energy Harvesting)

- By End-Use Industry:

- Electronics and Telecommunications

- Automotive

- Aerospace and Defense

- Healthcare (Medical Imaging, Diagnostics)

- Construction and Infrastructure

- Luxury Goods and Personal Wellness

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Crystal Market

The Crystal Market value chain is highly complex, beginning with the extraction and purification of raw materials (upstream analysis), extending through sophisticated manufacturing and processing stages, and culminating in distribution to diverse end-use markets (downstream analysis). Upstream activities involve the sourcing of high-purity raw materials, such as natural quartz, industrial-grade silicon, aluminum oxide powder, or specific metal oxides. For synthetic crystals, high purity is paramount, often requiring specialized chemical processing and refinement, where a few global suppliers dominate the specialized raw material market. The cost and quality of these inputs significantly dictate the final product’s performance and profitability, necessitating long-term supplier agreements and stringent quality checks. For natural crystals, the upstream process involves mining, sorting, and initial cutting/rough processing, which is often geographically concentrated in specific mining regions and subject to ethical sourcing regulations and geopolitical risks, impacting market price volatility considerably.

The midstream phase—manufacturing and processing—is the most value-intensive stage, encompassing highly technical processes such as crystal growth (e.g., Czochralski, hydrothermal synthesis, float zone method), subsequent slicing, lapping, polishing, and component fabrication (e.g., photolithography for micro-components). This stage demands extremely high capital investment in specialized furnaces, cleanroom facilities, and sophisticated metrology equipment. Differentiation in the synthetic crystal market is primarily achieved through proprietary growth techniques that ensure optimal crystalline structure, minimal defects, and maximum uniformity, especially for materials used in precision timing (quartz) and high-power applications (SiC). The downstream segment focuses on marketing, distribution, and integration, where fabricated crystal components are sold directly to Original Equipment Manufacturers (OEMs) in the electronics and automotive sectors, or polished natural stones are channeled through specialized jewelry distributors and retailers. Direct distribution is common for high-volume industrial components, while the natural crystal market relies heavily on a complex indirect distribution network involving wholesalers, cutters, jewelers, and online marketplaces.

Distribution channels in the crystal market vary significantly based on the product type. Industrial crystals (e.g., quartz blanks, SiC wafers) rely heavily on direct B2B sales facilitated by specialized technical sales teams who provide application support to large OEMs, ensuring seamless integration into electronic assemblies and automotive systems. Indirect distribution channels, utilizing specialized component distributors and authorized resellers, are employed for smaller volume sales and serving the diverse base of small and medium enterprises (SMEs) involved in electronics assembly or sensor manufacturing. Conversely, the distribution of natural crystals is predominantly indirect, moving from mines or large aggregators to lapidaries (cutting centers), then to wholesalers, and finally to retail outlets or e-commerce platforms. The trend towards e-commerce has significantly reduced the complexity in the natural crystal segment, allowing niche retailers to directly reach consumers interested in wellness and decorative applications, increasing market transparency but also intensifying competition based on authentication and ethical sourcing claims.

Crystal Market Potential Customers

Potential customers for the Crystal Market are exceedingly diverse, spanning from multi-billion dollar semiconductor manufacturers requiring high-purity substrates to individual consumers purchasing jewelry or wellness-oriented products. The primary group of industrial end-users includes Original Equipment Manufacturers (OEMs) in the telecommunications sector, which are the primary buyers of quartz oscillators and filters necessary for building 5G base stations, smartphones, and network routers, demanding components that ensure frequency stability and low phase noise. The automotive industry constitutes a rapidly growing customer base, driven by the shift towards electric vehicles (EVs) and autonomous driving systems; these vehicles require vast quantities of high-temperature resistant SiC power substrates for inverters and high-reliability quartz components for safety-critical timing functions within advanced driver-assistance systems (ADAS) modules, making them highly strategic buyers focused on longevity and reliability.

The healthcare and defense sectors represent highly lucrative, specialized customer segments. Healthcare entities, including manufacturers of MRI machines, ultrasound equipment, and advanced diagnostics, require high-precision piezoelectric crystals for transducers and specialized optical crystals for laser systems and imaging detectors. The defense and aerospace industries demand ultra-rugged, radiation-hardened crystals for satellite communication, guidance systems, and military-grade timing devices, where performance stability under extreme environmental conditions is non-negotiable. These customers are typically characterized by long procurement cycles, stringent certification requirements, and a willingness to pay a premium for materials meeting military or medical specifications, often engaging in direct, custom manufacturing contracts with specialized crystal producers.

Finally, the consumer-facing segment provides the broadest customer base, primarily driven by the luxury and personal wellness markets. Luxury consumers are the direct buyers of natural and synthetic gemstones utilized in high-end jewelry, valuing provenance, cut quality, and visual appeal. Simultaneously, a growing segment of consumers focused on holistic health and mindfulness drives demand for specific natural crystals (e.g., amethyst, rose quartz) for decorative, meditation, and perceived therapeutic purposes. This segment, while highly fragmented, relies heavily on branding, storytelling, and digital marketing, making the effective utilization of e-commerce platforms and social media essential for market penetration and customer retention, contrasting sharply with the technical sales approach required for industrial clients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.2 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Manufacturing Co. Ltd., Seiko Epson Corporation, Kyocera Corporation, Nihon Dempa Kogyo Co., Ltd. (NDK), TAI-SAW Technology Co., Ltd., SiTime Corporation, Microchip Technology Inc., TXC Corporation, K&L Microwave (Dover Corporation), Rocky Mountain Quartz Inc., Crystalline Technologies LLC, Swarovski AG, Saint-Gobain Crystals, II-VI Incorporated (now Coherent Corp.), Cree Inc. (now Wolfspeed), Sumitomo Electric Industries, Rubicon Technology, Inc., Heraeus Holding, Bliley Technologies, Inc., and River Trading Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crystal Market Key Technology Landscape

The Crystal Market's technological landscape is dominated by sophisticated manufacturing and material engineering processes designed to achieve ultra-high purity and precise structural control required for advanced applications. Key technologies revolve around crystal growth methods, which dictate the yield, size, and defect concentration of the material. For mass-produced synthetic quartz, the Hydrothermal Synthesis method remains prevalent, using high-pressure autoclaves to grow crystals under controlled thermal conditions, ensuring the piezoelectric properties required for oscillators. Conversely, the Czochralski (CZ) process is vital for producing large, high-purity single crystals of silicon, sapphire, and some specialized optical materials, essential for semiconductor wafers and high-power substrates. Recent advancements focus heavily on modifications of the CZ method, such as magnetic Czochralski (MCZ), to reduce oxygen incorporation and improve structural uniformity, crucial for next-generation microelectronics where component size continues to shrink while performance demands rise exponentially, particularly in high-frequency domains, requiring unprecedented control over material composition.

A second crucial area is the refinement of wide-bandgap (WBG) materials, notably Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC production often employs the physical vapor transport (PVT) method, which allows for growth at extremely high temperatures, yielding robust substrates necessary for power electronics capable of operating under severe voltage and temperature stress in EVs and industrial motor control systems. The ongoing technological challenge here is reducing the defect density in SiC wafers, particularly micropipes and basal plane dislocations, which limit device reliability and yield. Innovation in GaN production focuses on developing large-area, low-defect GaN bulk crystals or utilizing advanced epitaxial growth techniques on alternative substrates (like sapphire or silicon) to overcome the material’s intrinsic growth difficulties. This technological competition between different growth methods and substrate materials is driving significant intellectual property development and capital investment, aiming to secure market leadership in the lucrative power semiconductor sector, a core growth engine for the overall crystalline materials market.

Furthermore, post-growth processing technologies, including high-precision slicing, chemical mechanical polishing (CMP), and photolithography techniques, are critical, especially for miniaturized components like MEMS resonators and thin-film devices. Technological innovation in this area focuses on minimizing material loss during slicing (e.g., utilizing wire saws or advanced laser cutting), reducing surface roughness to atomic levels to maximize optical and electrical performance, and developing advanced packaging techniques (e.g., vacuum sealing) to protect sensitive crystal components from environmental degradation. The emerging adoption of AI in process control and defect identification (as detailed previously) is a technological breakthrough, shifting quality assurance from subjective, human-intensive monitoring to objective, machine-driven analysis, significantly enhancing manufacturing consistency and enabling the production of previously unattainable high-quality large-area crystals. The relentless pursuit of material perfection, driven by the demands of quantum technology and advanced photonics, ensures that the technological landscape of the Crystal Market remains highly dynamic and capital-intensive.

Regional Highlights

The Crystal Market exhibits distinct regional dynamics, influenced by local industrial concentration, regulatory frameworks, and consumer wealth. Asia Pacific (APAC) stands as the undeniable leader, commanding the largest market share in terms of both consumption and manufacturing volume. This dominance is attributed to the region's concentration of global semiconductor giants, consumer electronics manufacturing hubs (China, South Korea, Japan), and substantial investment in telecommunications infrastructure (5G rollout). Countries like China and Taiwan are not only major consumers of quartz crystals for local electronic production but also significant global suppliers of synthetic quartz and processed crystalline components. Furthermore, APAC represents a major mining and processing center for natural gemstones, particularly in South Asia and Southeast Asia, driving the regional consumption of luxury and decorative crystals, making the supply chain highly dense and interconnected across the region.

North America and Europe represent mature markets characterized by high demand for specialized, high-specification crystals used predominantly in mission-critical applications across the aerospace, defense, and high-end medical industries. These regions typically prioritize material purity, stringent certification standards (ITAR, ISO), and low-volume, high-value custom orders (e.g., optical components for high-power lasers and precision timing devices for military platforms). While manufacturing capacity for basic synthetic crystals has somewhat shifted to APAC, North America and Europe retain significant technological leadership in advanced materials like specialized high-purity optical crystals, SiC and GaN substrates, and proprietary MEMS resonator technologies, driven by robust public and private R&D funding and strong intellectual property protection frameworks. Consumer demand for high-end, ethically sourced natural crystals is also significant in these regions, commanding premium prices.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions that promise substantial future growth, primarily fueled by infrastructural development and demographic shifts. In LATAM, market growth is intrinsically linked to the expansion of regional telecommunications networks and the burgeoning automotive manufacturing sector, leading to increased importation and local assembly of crystal components. In MEA, major government investments in smart city projects and digitalization initiatives are driving initial demand for high-reliability crystals in communication and power infrastructure. Furthermore, the Gulf Cooperation Council (GCC) countries, leveraging high per capita income, represent a strong consumer market for luxury natural crystals and high-end jewelry. However, both regions often face challenges related to supply chain maturity and lack of localized high-tech crystal processing facilities, meaning reliance on imports from APAC and North America remains high, characterizing them predominantly as consuming markets rather than major production centers in the immediate forecast period.

- Asia Pacific (APAC): Dominates manufacturing and consumption due to massive presence of electronics and semiconductor industries; leading markets include China, Japan, and Taiwan, crucial for quartz and silicon processing.

- North America: High demand for specialized, high-reliability crystals in Aerospace, Defense, and Medical sectors; focus on SiC/GaN substrates and advanced optical components, leveraging strong R&D ecosystems.

- Europe: Key consumer of industrial crystals driven by automotive electronics (EVs) and sophisticated industrial automation; strong regulatory emphasis on ethical sourcing impacts the natural crystal segment significantly.

- Latin America (LATAM): Emerging market growth linked to telecommunications infrastructure upgrades and automotive assembly expansion, primarily dependent on component imports.

- Middle East and Africa (MEA): Growth driven by digitalization projects, smart city developments, and substantial demand for luxury natural crystals in affluent GCC economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crystal Market.- Murata Manufacturing Co. Ltd.

- Seiko Epson Corporation

- Kyocera Corporation

- Nihon Dempa Kogyo Co., Ltd. (NDK)

- TAI-SAW Technology Co., Ltd.

- SiTime Corporation

- Microchip Technology Inc.

- TXC Corporation

- K&L Microwave (Dover Corporation)

- Rocky Mountain Quartz Inc.

- Crystalline Technologies LLC

- Swarovski AG

- Saint-Gobain Crystals

- II-VI Incorporated (now Coherent Corp.)

- Cree Inc. (now Wolfspeed)

- Sumitomo Electric Industries

- Rubicon Technology, Inc.

- Heraeus Holding

- Bliley Technologies, Inc.

- River Trading Co.

Frequently Asked Questions

Analyze common user questions about the Crystal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for synthetic quartz crystals in the current market?

The primary factor is the global rollout and mass adoption of 5G telecommunication networks and the proliferation of IoT devices, both requiring a massive volume of highly precise, miniature crystal oscillators and resonators for stable frequency control and timing synchronization.

How is the automotive industry influencing the demand for specialized crystalline materials?

The shift to Electric Vehicles (EVs) and autonomous driving systems necessitates high-performance power electronics. This fuels immense demand for wide-bandgap crystalline substrates like Silicon Carbide (SiC) and Gallium Nitride (GaN), crucial for power inverters and efficient battery management systems due to their superior thermal and electrical properties.

What is the main difference between MEMS resonators and traditional quartz crystal oscillators?

MEMS resonators utilize micro-electromechanical systems fabricated using silicon technology, offering significantly smaller form factors, lower power consumption, and better integration with ICs compared to traditional bulk quartz crystals, making them ideal for space-constrained mobile and wearable applications.

Which geographical region holds the largest market share for crystal manufacturing and consumption?

Asia Pacific (APAC), led by countries like China, Japan, and Taiwan, holds the largest market share. This dominance is driven by the region's concentration of semiconductor production, consumer electronics manufacturing, and robust investments in telecommunications infrastructure.

What are the key technological restraints limiting crystal production efficiency?

The key technological restraints include the inherently high capital expenditure and energy intensity of crystal growth processes, the difficulty in achieving zero-defect materials at commercial scale (high defect density, especially in SiC), and the technical challenges associated with maintaining ultra-high purity during synthesis and subsequent processing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Crystal Watch Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Single Crystal Germanium Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Liquid Crystal Polymer Fiber (LCP Fiber) Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Tetragonal Zirconium Polycrystal Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Crystal Therapies Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager