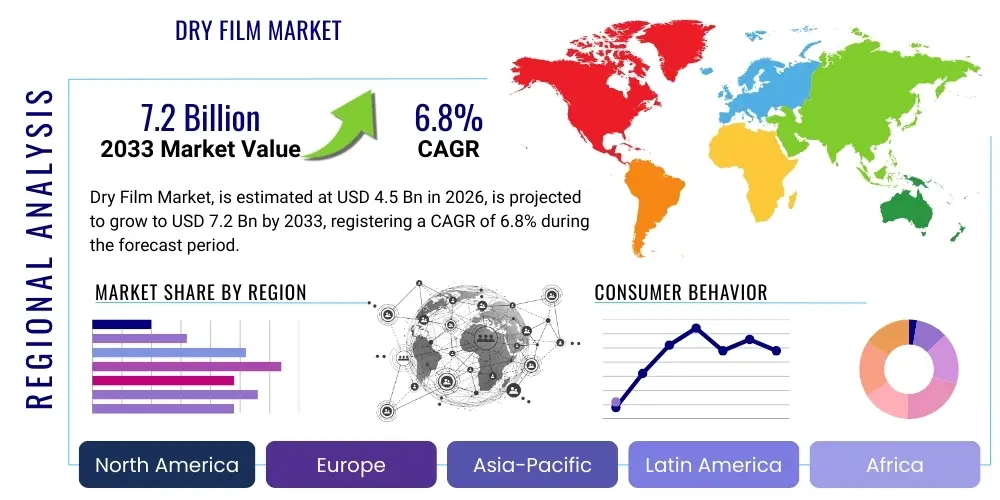

Dry Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438254 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Dry Film Market Size

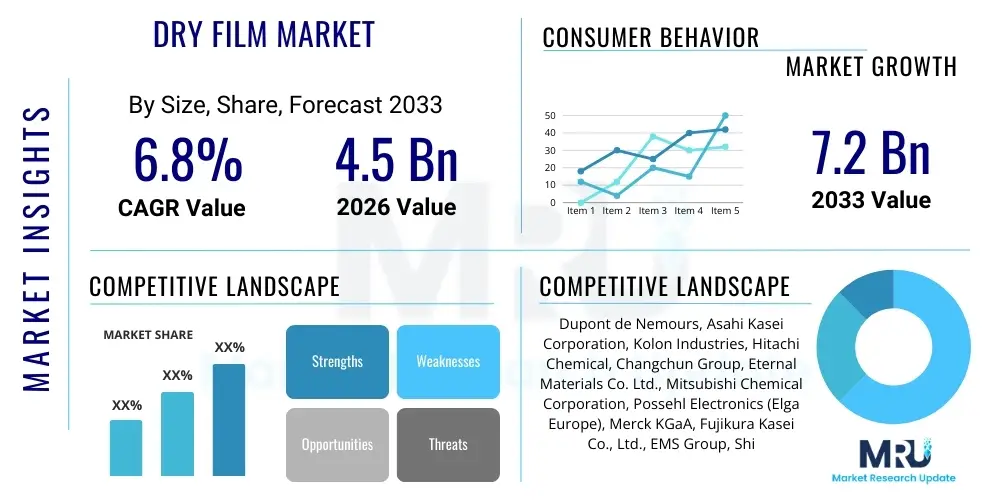

The Dry Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.2 billion by the end of the forecast period in 2033.

Dry Film Market introduction

The Dry Film Market encompasses photosensitive polymer sheets primarily utilized in the electronics manufacturing industry, specifically for applications requiring high-resolution photolithography. These films serve as protective masks or imaging layers, playing a crucial role in the production of Printed Circuit Boards (PCBs), semiconductor packaging, and chemical milling processes. Dry films offer significant advantages over liquid photoresists, including enhanced uniformity, reduced chemical consumption, and improved handling safety, making them essential components in modern high-density interconnect (HDI) and multilayer PCB fabrication. The market growth is inherently tied to the expansion of consumer electronics, automotive electrification, and the global deployment of advanced telecommunication infrastructure like 5G and 6G networks.

Dry film photoresists function by selectively polymerizing when exposed to UV light through a photomask, creating a durable image pattern transfer onto the substrate. Key applications include pattern plating, etching, and tenting/etching in PCB manufacturing. The core product description involves a three-layer structure: a polyethylene protective layer, the photosensitive resist layer, and a polyester carrier film. Their primary benefit lies in their ability to achieve fine line width and high aspect ratios necessary for miniaturization in advanced electronic devices. This superior performance, coupled with reduced environmental impact compared to some wet chemical processes, positions dry film as a cornerstone technology for precision microfabrication.

Major applications driving market demand involve the production of high-performance PCBs used in servers, data centers, mobile devices, and medical electronics. The driving factors include the rapid technological shifts demanding smaller, faster, and more complex electronic components. Furthermore, stringent quality requirements in critical sectors like aerospace and defense necessitate the dimensional stability and defect-free nature offered by dry film resists. The push for flexible electronics and next-generation IC substrates further broadens the scope of dry film utility, ensuring its sustained relevance in the competitive landscape of advanced electronics manufacturing.

Dry Film Market Executive Summary

The Dry Film Market is experiencing robust growth driven predominantly by the escalating demand for high-density interconnect (HDI) PCBs and the transition to advanced semiconductor packaging techniques, particularly in the Asia Pacific region. Business trends indicate significant capital expenditure in automated dry film lamination and imaging equipment, focusing on efficiency and yield improvement. Geographically, Asia Pacific, led by China, South Korea, and Taiwan, remains the dominant hub due to its established ecosystem for PCB production and semiconductor fabrication, although North America and Europe are showing increased uptake driven by reshoring initiatives and investment in high-end specialty electronics manufacturing.

Key segment trends reveal that the aqueous dry film segment holds the largest market share due to its environmental friendliness and widespread use in standard PCB manufacturing, while the semi-aqueous segment is gaining traction for specialized, high-resolution applications. Application-wise, PCB manufacturing continues to be the largest consumer, but the semiconductor packaging sector, fueled by technologies like flip-chip and wafer-level packaging (WLP), is projected to exhibit the highest Compound Annual Growth Rate (CAGR). Competitive dynamics emphasize product innovation, particularly the development of thinner films and resists capable of handling extreme plating conditions, aligning with the industry's continuous push toward miniaturization.

Overall, the market is characterized by moderate consolidation among large chemical suppliers who offer integrated solutions, including dry film, associated chemistry, and equipment. Strategic partnerships and mergers aiming to secure raw material supply (polymers, photoinitiators) are prevalent business strategies. The market outlook remains positive, underpinned by secular growth drivers such as the massive data generated by IoT devices, the widespread rollout of 5G infrastructure requiring complex radio frequency (RF) PCBs, and the accelerating adoption of electric vehicles, all of which depend heavily on sophisticated electronics fabricated using dry film technology.

AI Impact Analysis on Dry Film Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Dry Film Market typically revolve around three major themes: optimization of manufacturing processes, predictive maintenance for lamination equipment, and the influence of AI-driven computing hardware on demand for advanced dry film products. Users are keen to understand how AI can reduce defects during photolithography, a notoriously sensitive process, and how the explosive growth in AI processors (GPUs, specialized ASICs) demanding multilayer high-performance substrates will affect the consumption patterns and technical specifications required for dry films. The core concern is whether AI can enhance yield rates and streamline the complex dry film application process, moving towards a more automated and data-driven fabrication environment.

AI’s influence is multifaceted. Firstly, in manufacturing, AI-powered computer vision and machine learning algorithms are being integrated into automated optical inspection (AOI) systems used post-exposure and development. These systems can detect subtle defects earlier and more accurately than traditional methods, optimizing exposure parameters and development chemistry in real-time, thereby maximizing the utilization efficiency of the dry film material. Secondly, predictive maintenance facilitated by AI analyzes sensor data from lamination machines and exposure units, forecasting equipment failures before they occur, which reduces costly downtime and maintains the critical environmental stability required for high-precision dry film application.

Furthermore, the development and deployment of high-performance computing (HPC) hardware for AI inference and training, which rely on highly complex, high-layer count PCBs and advanced semiconductor packaging, directly fuels the demand for ultra-thin, high-resolution dry film resists. These advanced films are necessary for the extremely fine line/space requirements (often less than 20 micrometers) inherent in these cutting-edge substrates. Therefore, while AI streamlines the production process, its underlying hardware requirements simultaneously necessitate higher-quality, more technically demanding dry film products, solidifying the material’s strategic importance in the electronics supply chain.

- AI-driven optimization of photolithography parameters enhances dry film utilization and reduces material waste.

- Predictive maintenance for lamination equipment improves uptime and operational efficiency in dry film processing lines.

- Computer vision systems powered by AI improve defect detection in exposed and developed dry film patterns, boosting yield rates.

- Increased demand for AI/HPC hardware necessitates ultra-fine resolution dry films for complex semiconductor packaging and multilayer PCBs.

- Machine learning aids in controlling environmental factors (temperature, humidity) critical for consistent dry film performance.

DRO & Impact Forces Of Dry Film Market

The Dry Film Market is primarily driven by the relentless trend of miniaturization in consumer electronics and the substantial increase in demand for high-speed data transmission, necessitating complex multilayer PCBs. Restraints, however, include environmental concerns regarding the chemical processing and waste disposal associated with dry film usage, alongside the inherent high initial capital investment required for specialized lamination and exposure equipment. Opportunities are abundant, specifically in emerging areas like flexible printed electronics, advanced IC substrates (ABF substrates), and the mass adoption of 5G and IoT devices. These forces collectively shape the market's trajectory, mandating continuous innovation in material chemistry and processing technology to maintain competitiveness.

Key drivers include the global push for advanced interconnect solutions in smartphones, tablets, and wearable technology, where space constraint is paramount. The automotive sector's rapid shift towards electric and autonomous vehicles introduces complex electronic control units (ECUs) and sensor arrays, requiring high-reliability PCBs fabricated with dry films. Additionally, the impact forces of technological advancement compel manufacturers to develop dry films that can handle higher thermal stress and aggressive chemical environments, particularly in semiconductor packaging applications. These drivers ensure sustained investment in R&D aimed at achieving finer line widths and improved adhesion characteristics.

However, the industry faces notable restraints. The increasing regulatory pressure globally regarding volatile organic compounds (VOCs) and hazardous chemical waste disposal poses challenges for manufacturers, forcing a pivot towards aqueous and semi-aqueous processing. Furthermore, the volatility in raw material prices, specifically petrochemical-derived polymers and photoinitiators, can impact manufacturing margins. The core impact force driving change remains the dynamic equilibrium between performance requirements (resolution, chemical resistance) and environmental sustainability, pushing suppliers toward developing eco-friendlier, solvent-free dry film solutions and optimizing stripping and etching processes.

- Drivers: Miniaturization of consumer electronics; proliferation of 5G infrastructure; increased complexity in automotive electronics (EVs/Autonomous); high demand for HDI PCBs.

- Restraints: Environmental regulations concerning chemical waste; high capital cost of lamination and exposure equipment; complexity and sensitivity of the photolithography process.

- Opportunities: Growth in advanced semiconductor packaging (WLP, FCBGA); expansion into flexible and stretchable electronics; development of dry film suited for advanced lithography techniques.

- Impact Forces: Technological parity/superiority of competing technologies (e.g., direct imaging); stringent quality standards in critical applications (e.g., medical, aerospace); shift towards sustainable chemical processes.

Segmentation Analysis

The Dry Film Market segmentation provides a detailed view of market structure based on type, application, and geography. By type, the market is broadly divided into aqueous and semi-aqueous processing films, reflecting differences in chemical composition and development procedures. Aqueous dry films dominate the traditional PCB market due to their lower environmental impact and cost-effectiveness. By application, the production of Printed Circuit Boards (PCBs) is the primary revenue generator, followed closely by the fast-growing segment of semiconductor packaging, which demands the highest resolution and thinnest films available on the market, driving innovation.

The segmentation by application highlights the specialized nature of dry film requirements. PCB manufacturing utilizes dry films primarily for pattern plating, etching, and through-hole tenting, where films must offer high chemical resistance and excellent conformation to complex panel geometries. In contrast, the semiconductor segment utilizes dry film photoresists in wafer fabrication and advanced substrate processing, requiring films optimized for sub-micron precision and compatibility with extreme processing temperatures. This distinction influences R&D investments, with leading vendors focusing on enhancing film adhesion and thermal stability for semiconductor applications.

Geographical segmentation underscores the criticality of Asia Pacific, which accounts for the vast majority of global electronics manufacturing capacity, especially high-volume PCB and IC substrate production. However, segments within North America and Europe, while smaller in volume, specialize in high-margin, custom, and defense-related electronics, driving demand for specialized, high-reliability dry film products. Understanding these diverse segmentation needs is essential for market participants to tailor their product offerings and distribution strategies effectively.

- By Type:

- Aqueous Dry Film (Dominant market share, eco-friendly processing)

- Semi-Aqueous Dry Film (Used for higher resolution and specialized substrates)

- By Application:

- Printed Circuit Boards (PCBs) Manufacturing (Largest consumer, includes Inner/Outer Layer)

- Semiconductor Packaging (High growth segment, includes Wafer Level Packaging and Flip Chip)

- Chemical Milling/Etching

- Others (e.g., Nameplates, Decorative Etching)

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Dry Film Market

The value chain for the Dry Film Market begins with upstream activities involving the sourcing and synthesis of specialized raw materials. These materials primarily include synthetic polymers (like acrylics or polyamides), photoinitiators, adhesion promoters, and carrier films (typically PET and polyethylene). Upstream volatility, particularly in petrochemical pricing, directly influences the cost structure of the final dry film product. Major chemical manufacturers play a crucial role in supplying high-purity, standardized components necessary for consistent film performance, often entering into long-term supply agreements with dry film manufacturers to ensure quality control and stability.

Midstream activities involve the complex process of formulating the photoresist chemistry, coating the carrier film with high precision, and laminating the protective cover sheet. Dry film manufacturers, often large multinational chemical corporations, focus heavily on R&D to improve film resolution, sensitivity, and chemical resistance. Distribution channels are critical; due to the sensitive nature of the product (requiring temperature-controlled storage and limited shelf life), a highly specialized logistical network is mandatory. Direct sales are common for major, high-volume customers (Tier 1 PCB manufacturers), allowing for technical support and immediate troubleshooting. Indirect distribution through specialized regional distributors serves smaller-to-mid-sized fabricators, ensuring localized inventory and prompt delivery.

Downstream activities center on the end-users—PCB fabricators, semiconductor packaging houses, and chemical etching firms. The dry film is applied via lamination equipment and subsequently imaged, developed, and stripped. The performance of the dry film directly impacts the yield rate and quality of the final electronic component. Technical support and process optimization services provided by the dry film supplier form a key part of the downstream value proposition. Ultimately, the effectiveness of the entire chain is determined by the seamless collaboration between raw material suppliers and end-users to meet the ever-increasing technical demands of microelectronics.

Dry Film Market Potential Customers

The primary end-users and potential buyers of dry film photoresists are concentrated within the global electronics manufacturing ecosystem. This encompasses large-scale Printed Circuit Board (PCB) manufacturers, who consume the majority of the dry film used globally, ranging from standard multilayer boards to advanced HDI (High-Density Interconnect) and flexible circuits. These customers demand films with excellent uniformity and compatibility with their existing lamination and exposure infrastructure. Their purchasing decisions are highly sensitive to price, yield rate, and technical support provided by the supplier, as dry film performance is a direct determinant of final product quality and manufacturing cost.

A rapidly growing customer base is the semiconductor packaging industry, which includes outsourced semiconductor assembly and test (OSAT) companies and integrated device manufacturers (IDMs). These entities utilize highly specialized, ultra-thin dry films for advanced packaging techniques such as wafer-level packaging (WLP), fan-out wafer-level packaging (FO-WLP), and flip-chip ball grid array (FCBGA) substrates. For these high-end applications, the emphasis shifts from volume to technical specifications, requiring dry films capable of extremely fine line/space definition (often below 10 micrometers) and high thermal stability, justifying a premium price point.

Secondary potential customers include specialized chemical milling and metal etching companies serving industries such as aerospace, medical devices, and precision engineering. These firms use dry films as temporary masks for selective metal removal in processes requiring precise dimensional control and high fidelity. Furthermore, R&D laboratories and academic institutions involved in microfabrication and materials science are also niche, albeit important, consumers, particularly for testing and prototyping advanced electronic materials and structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 7.2 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dupont de Nemours, Asahi Kasei Corporation, Kolon Industries, Hitachi Chemical, Changchun Group, Eternal Materials Co. Ltd., Mitsubishi Chemical Corporation, Possehl Electronics (Elga Europe), Merck KGaA, Fujikura Kasei Co., Ltd., EMS Group, Shin-Etsu Chemical Co., Ltd., Microresist Technology GmbH, Toray Industries, Inc., Taiyo Ink Mfg. Co., Ltd., Showa Denko Materials Co., Ltd., Dymax Corporation, Nan Ya Plastics Corporation, Huntsman Corporation, Dow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Film Market Key Technology Landscape

The core technology landscape of the Dry Film Market is defined by continuous advancements in photoresist chemistry and lamination/imaging equipment. Photoresist formulation technologies are centered on enhancing sensitivity to various light sources (primarily broadband UV and increasingly deep UV), improving the chemical resistance during etching and plating steps, and achieving ultra-high resolution required for sub-20 micrometer line/space features. Recent innovations focus heavily on developing thinner dry films (less than 15 micrometers) that maintain mechanical robustness, crucial for advanced packaging and high-layer count PCB stacking. Furthermore, the push for environmental compliance drives research into highly efficient, low-VOC polymer systems for aqueous processing.

Equipment technology, specifically lamination and exposure systems, forms a critical technological axis. Dry film lamination technology has progressed towards higher precision, vacuum-assisted systems that minimize air entrapment and ensure uniform application, which is vital for high-yield production of HDI boards. Correspondingly, exposure units are shifting towards advanced direct imaging (DI) systems utilizing high-intensity lasers or LEDs, replacing traditional phototooling. While DI systems offer superior resolution and faster throughput, dry film must be compatible with these modern, highly precise light sources, necessitating formulation adjustments to the photoinitiator packages for optimized quantum yield and contrast.

A significant technological development is the integration of dry film technology with flexible substrate processing. This requires films that exhibit exceptional flexibility and adhesion to materials like polyimide without cracking or losing resolution during bending. Furthermore, the convergence of semiconductor fabrication and PCB manufacturing has prompted the development of specialized dry films suitable for temporary bonding and debonding processes used in 3D integrated circuits and advanced wafer handling. This requires dry films that can function effectively as sacrificial layers or planarization materials, significantly expanding their traditional role as merely imaging masks.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant region in the Dry Film Market, accounting for the largest share of both production and consumption. This dominance is attributed to the concentration of the global electronics manufacturing ecosystem, particularly in countries like China, Taiwan, South Korea, and Japan, which house the majority of Tier 1 PCB fabricators and major semiconductor foundries (OSATs and IDMs). The rapid domestic consumption of consumer electronics, coupled with government initiatives supporting semiconductor self-sufficiency (e.g., in China), ensures continuous, high-volume demand for dry film photoresists across all segmentation types. Innovation in APAC is focused on mass production efficiency and the adoption of cutting-edge dry films for advanced packaging techniques.

- North America: The North American market is characterized by high demand for specialized, high-reliability dry film used primarily in aerospace, defense, medical, and high-performance computing (HPC) sectors. While the volume is lower than APAC, the value generated is significant due to the stringent quality requirements and complex certifications needed for these applications. Recent government policies encouraging semiconductor and PCB reshoring initiatives are expected to stimulate investment in new fabrication facilities, thereby increasing regional consumption of high-end dry films tailored for advanced manufacturing specifications and security-sensitive applications.

- Europe: The European Dry Film Market focuses heavily on automotive electronics, industrial automation, and specialized telecommunications equipment. European regulations, particularly the emphasis on environmental sustainability (REACH), have driven a strong preference for aqueous and low-VOC dry film technologies. Key markets include Germany, France, and the UK, where complex PCB manufacturing for industrial machinery and automotive safety systems necessitates high-performance, robust dry films. Europe is a crucial hub for R&D in materials science, influencing global trends in eco-friendly resist chemistry and advanced photolithography processes.

- Latin America & Middle East/Africa (LAMEA): These regions represent emerging markets for dry film consumption, driven primarily by localized electronics assembly, telecommunications infrastructure development (e.g., 5G rollout), and modest growth in automotive assembly plants. The demand generally focuses on standard aqueous dry films for conventional multilayer PCB production. Market penetration and growth are linked to foreign direct investment in electronics manufacturing and the maturation of local industrial ecosystems, offering opportunities for suppliers seeking to expand their geographical footprint beyond established markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Film Market.- Dupont de Nemours

- Asahi Kasei Corporation

- Kolon Industries

- Hitachi Chemical

- Changchun Group

- Eternal Materials Co. Ltd.

- Mitsubishi Chemical Corporation

- Possehl Electronics (Elga Europe)

- Merck KGaA

- Fujikura Kasei Co., Ltd.

- EMS Group

- Shin-Etsu Chemical Co., Ltd.

- Microresist Technology GmbH

- Toray Industries, Inc.

- Taiyo Ink Mfg. Co., Ltd.

- Showa Denko Materials Co., Ltd.

- Dymax Corporation

- Nan Ya Plastics Corporation

- Huntsman Corporation

- Dow Inc.

Frequently Asked Questions

Analyze common user questions about the Dry Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Dry Film Photoresist and where is it primarily used?

Dry film photoresist is a photosensitive polymeric material supplied in sheet form, used extensively in photolithography. It is primarily utilized in the manufacture of Printed Circuit Boards (PCBs) for pattern imaging, etching, and plating, and increasingly in advanced semiconductor packaging processes for creating fine line structures.

How do Aqueous Dry Films differ from Semi-Aqueous Dry Films?

Aqueous dry films are developed using alkaline aqueous solutions, making them environmentally preferred for standard PCB applications. Semi-aqueous films require organic solvents for development, offering higher resolution and superior chemical resistance necessary for more demanding applications like specific IC substrates and ultra-fine line PCBs.

Which region dominates the global Dry Film Market?

The Asia Pacific (APAC) region dominates the global Dry Film Market due to its extensive manufacturing base for consumer electronics, PCBs, and semiconductors. Countries like China, Taiwan, and South Korea drive the highest demand and production volume globally.

What is driving the growth of the Dry Film Market in semiconductor packaging?

Growth in semiconductor packaging is driven by the demand for higher integration and miniaturization (e.g., 3D ICs, WLP, Fan-Out packaging). These advanced techniques require ultra-thin, high-resolution dry films capable of delivering precise geometries and maintaining stability during complex thermal and chemical processes.

What are the main alternatives or competing technologies to Dry Film Photoresists?

The primary competing technologies are liquid photoresists and Direct Imaging (DI) systems. While DI systems enhance the exposure process, they still require a resist material (often liquid or sometimes a specialized dry film). Liquid resists are alternatives, especially in niche or highly sensitive semiconductor applications, but dry films offer advantages in uniformity and handling ease for large-area substrates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dry Film Lubrication Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dry Film Photoresist Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dry Film Laminator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dry Film Market Size Report By Type (Thickness 20µm, Thickness: 21-29µm, Thickness: 30-39µm, Thickness: 40µm), By Application (PCB, Semiconductor Packaging, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dry Film Photoresist Market Size Report By Type (Positive, Negative), By Application (PCB, MPU Packaging, COF/TAB, FPC, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager