Electronics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431778 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Electronics Market Size

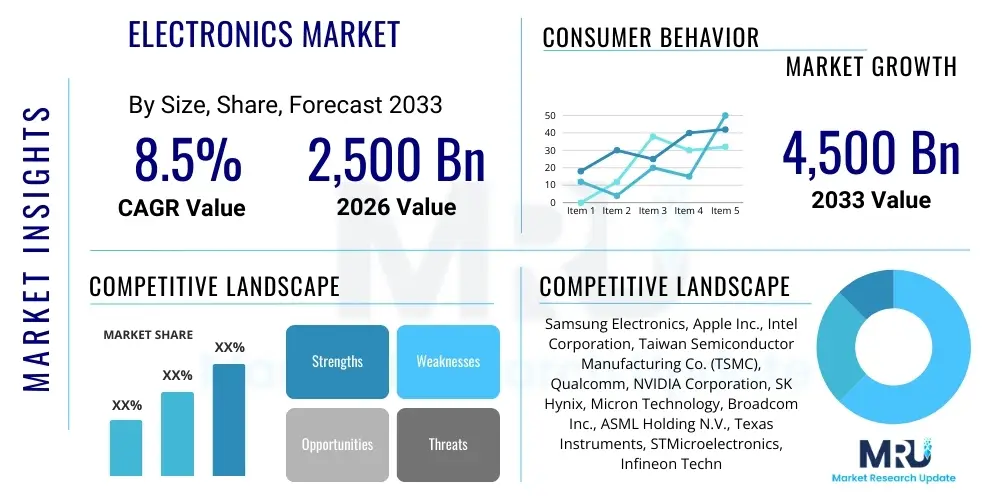

The Electronics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2,500 Billion in 2026 and is projected to reach USD 4,500 Billion by the end of the forecast period in 2033.

The substantial expansion of the electronics sector is fundamentally driven by the accelerating global pace of digital transformation across consumer, industrial, and commercial domains. Miniaturization of components, coupled with enhanced processing power and energy efficiency, continues to fuel innovation in end-user devices such as smartphones, wearable technology, and smart home systems. Furthermore, the foundational infrastructure required for 5G deployment and the proliferation of data centers globally necessitates high-performance electronic components, positioning the semiconductor and passive components markets as core growth accelerators within the overall electronics ecosystem. This robust growth trajectory is validated by consistent investment in R&D aimed at developing novel materials and advanced packaging techniques.

Geographic market size variance is significant, with the Asia Pacific region maintaining dominance due to its established manufacturing hubs, high domestic consumer demand, and increasing government support for localized electronic production initiatives, such as those seen in China, South Korea, and Taiwan. Concurrently, North America and Europe are exhibiting strong growth in specialized segments like high-end computing, automotive electronics, and defense applications, reflecting a shift towards high-value, niche electronic products. The market size forecast inherently integrates assumptions regarding stable supply chain operations, particularly concerning geopolitical stability and access to critical raw materials like rare earth elements and specialized silicon wafers, which are crucial for maintaining production volumes necessary to meet projected consumer and industrial demands.

Electronics Market introduction

The global electronics market encompasses the design, manufacture, distribution, and consumption of electronic components, devices, and systems used across various applications, including communication, data processing, entertainment, automation, and defense. Key products range from fundamental components such as integrated circuits (ICs), microprocessors, memory chips, and passive components, to complex end-user devices like consumer electronics (smartphones, laptops), industrial electronics (control systems, robotics), and automotive electronics (infotainment, ADAS). The market’s dynamism is defined by rapid technological obsolescence and continuous innovation, driven primarily by the global demand for faster data processing, connectivity, and enhanced user experiences in interconnected environments.

Major applications of electronic products permeate nearly every sector of the modern economy. In the telecommunications sector, electronics enable global connectivity through network equipment, 5G infrastructure, and mobile devices. Within the automotive industry, electronic systems are critical for vehicle electrification, safety features (Advanced Driver-Assistance Systems or ADAS), and in-vehicle communication. Furthermore, the rise of the Internet of Things (IoT) has expanded applications into smart cities, smart agriculture, and remote healthcare monitoring, emphasizing the pervasive utility of sensor technology and low-power processing units. The primary benefit derived from these applications is increased efficiency, improved safety, and unparalleled access to information and automated services, fundamentally transforming industrial processes and daily life.

Driving factors propelling the electronics market include the exponential growth in data generation and consumption, requiring ever-more powerful storage and processing solutions. The rapid global adoption of cloud computing and the subsequent demand for hyperscale data centers necessitate high-performance server components and network interface cards. Additionally, government initiatives globally supporting digital infrastructure development, especially in emerging economies, catalyze demand for affordable consumer electronics and related networking equipment. Finally, the ongoing integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities into hardware, optimizing device performance and enabling advanced functionalities, serves as a crucial underlying driver stimulating continuous product upgrades and market expansion.

Electronics Market Executive Summary

The global electronics market demonstrates robust business trends characterized by intense competition among semiconductor manufacturers and consolidation among Original Equipment Manufacturers (OEMs) to achieve economies of scale and control critical supply chains. A defining trend is the pivot towards specialized, high-margin components, particularly those catering to AI acceleration, advanced memory architectures (like HBM), and specialized photonics for data center applications. Furthermore, sustainability and circular economy principles are increasingly integrated into business models, focusing on reducing electronic waste (e-waste) and utilizing eco-friendly materials, which represents both a regulatory compliance challenge and a significant market opportunity for innovative recycling technologies and refurbishment services.

Regional trends reveal Asia Pacific’s continued dominance as the manufacturing and consumption epicenter, leveraging its established infrastructure and massive population base. However, geopolitical shifts and supply chain vulnerabilities are prompting strategies of regional diversification, encouraging investment in resilient electronic manufacturing capabilities in regions like North America and Europe, supported by governmental acts aimed at bolstering domestic chip production, such as the US CHIPS Act and the European Chips Act. Emerging markets in Latin America and the Middle East and Africa (MEA) are showing accelerated growth, primarily driven by increasing smartphone penetration and governmental investments in digital transformation initiatives, creating new frontiers for electronic device adoption.

Segmentation trends highlight the increasing strategic importance of the automotive electronics segment, fueled by the transition to electric vehicles (EVs) and autonomous driving systems, requiring complex sensor fusion and high-reliability components. The consumer electronics segment, while facing saturation in certain product categories, is experiencing renewal through rapid innovation in wearable technology, virtual reality (VR), and augmented reality (AR) devices, demanding advanced micro-displays and high-density power solutions. Component-wise, the focus remains firmly on advanced packaging techniques (e.g., chiplets) and the development of wide bandgap semiconductors (SiC and GaN) necessary for high-efficiency power electronics in industrial and renewable energy applications.

AI Impact Analysis on Electronics Market

Analysis of common user questions regarding AI’s impact on the electronics market reveals a strong consensus that AI is the single most important technology driver shaping future hardware requirements. Users frequently inquire about the necessary hardware specifications for efficient AI processing, particularly concerning edge AI devices, asking how much faster and more energy-efficient specialized AI accelerators (NPUs, TPUs, GPUs) will become compared to traditional CPUs. There is also significant concern regarding the ethical implications and standardization challenges associated with embedding AI capabilities into consumer electronics and industrial systems, such as data privacy in smart devices. Expectations center on AI driving demand for high-bandwidth memory, advanced cooling solutions, and completely new system architectures designed from the ground up to handle massive, parallel data workloads essential for deep learning models.

The influence of Artificial Intelligence profoundly affects the demand curve and design paradigms within the electronics industry. AI necessitates a fundamental shift from general-purpose computing towards domain-specific architectures capable of accelerating machine learning workloads with maximum energy efficiency. This requirement has spurred intense innovation in the semiconductor sector, leading to the rapid development and deployment of specialized chips, known as AI accelerators or neural processing units (NPUs), optimized for tasks such as inference and training. These advancements are critical for enabling complex AI applications not just in cloud data centers but increasingly at the edge, within consumer devices like smartphones, autonomous vehicles, and industrial IoT sensors, where real-time processing and low latency are paramount.

Furthermore, AI models, particularly large language models (LLMs) and complex deep learning algorithms, require unprecedented levels of computational power, driving up demand for advanced fabrication technologies (e.g., 3nm and below) and sophisticated packaging solutions (e.g., chip stacking and heterogeneous integration). This demand is also shifting the focus to memory technologies, specifically high-bandwidth memory (HBM), which is essential to prevent data transfer bottlenecks that often limit AI processing speeds. The adoption of AI is also accelerating automation within the electronics manufacturing process itself, enhancing quality control, optimizing supply chain logistics, and improving chip design efficiency through the use of AI-driven electronic design automation (EDA) tools.

- AI drives demand for specialized processors (NPUs, TPUs) optimized for parallel computing.

- Increased necessity for high-bandwidth memory (HBM) to support data-intensive AI models.

- Acceleration of edge computing through low-power AI modules embedded in IoT devices.

- AI enhances electronic design automation (EDA), speeding up chip design and verification cycles.

- Requirement for advanced thermal management solutions due to high power consumption of AI hardware clusters.

- Introduction of neuromorphic chips simulating brain architecture for ultra-efficient processing.

- Mandate for secure hardware roots of trust to protect AI algorithms and sensitive data in connected devices.

DRO & Impact Forces Of Electronics Market

The electronics market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces determining its growth trajectory and stability. Key drivers include the pervasive digitalization of global economies, the aggressive rollout of 5G and future 6G networks, and the relentless consumer demand for novel, feature-rich smart devices. Simultaneously, the market is restrained by critical factors such as persistent supply chain fragility, particularly regarding semiconductor production capacity and access to rare earth minerals, coupled with the escalating cost pressures associated with scaling down fabrication processes to nanometer levels. Opportunities largely center on emerging technological vectors like the Metaverse, quantum computing components, and specialized electronics for sustainable energy infrastructure, offering new high-growth verticals.

Drivers are primarily characterized by technological momentum. The increasing integration of high-performance computing into everyday objects and industrial machinery requires constant component upgrades. This includes the proliferation of sensors and microcontrollers necessary for smart city projects and industrial automation (Industry 4.0). The massive volume of data generated by these connected devices mandates continuous investment in faster and more voluminous memory and data storage solutions, creating a self-reinforcing cycle of demand. Furthermore, regulatory mandates across various regions pushing for energy-efficient devices and systems also drive innovation toward advanced power electronics using materials like Silicon Carbide (SiC) and Gallium Nitride (GaN).

Restraints often materialize as systemic challenges. The high capital expenditure required to establish modern semiconductor foundries (fabs) creates significant barriers to entry and limits the ability of the industry to quickly respond to sudden surges in demand. Geopolitical risks, protectionist trade policies, and intellectual property disputes over foundational technologies also introduce market volatility and uncertainty, directly impacting investment decisions and cross-border collaborations. Furthermore, the increasing scarcity of highly skilled engineering talent specializing in advanced fabrication and AI hardware design acts as a persistent bottleneck, limiting the speed at which complex, cutting-edge products can be brought to market and manufactured efficiently at scale.

Segmentation Analysis

The electronics market segmentation is fundamentally organized based on three key dimensions: Type (components vs. devices), Application (consumer, industrial, automotive, healthcare), and Geography. This structured classification allows for a detailed analysis of market dynamics unique to specific product categories and end-user requirements. The component segment, encompassing semiconductors, passive components, and display technologies, forms the foundational layer, exhibiting high growth driven by technological complexity and demand for miniaturization. Conversely, the device segment, which includes finished products, is more susceptible to consumer spending cycles and product replacement rates, especially in mature markets.

Analyzing the segmentation by application reveals heterogeneous growth rates, with automotive electronics currently experiencing the most aggressive expansion due to the mandated transition to electrification and advanced safety systems. Industrial electronics, including control systems, power supplies, and testing equipment, show steady growth, anchored by investments in factory automation and infrastructure modernization (Industry 4.0). Consumer electronics, while the largest segment by volume, face pressure on margins but continue to innovate rapidly through new product formats like foldable screens and integration of sophisticated AI features, constantly refreshing consumer interest and justifying premium pricing points for flagship devices.

Further granularity in segmentation involves distinguishing between original equipment manufacturing (OEM) and the aftermarket/replacement market, particularly relevant for specialized industrial components and automotive parts. Understanding these sub-segments is crucial for accurate forecasting, as OEM sales are tied to new capital expenditure cycles, whereas aftermarket sales are driven by maintenance, repair, and operational (MRO) requirements. The interplay between component innovation and device adoption remains the central theme in segmentation analysis, where breakthroughs in one segment (e.g., advanced batteries) immediately cascade into growth opportunities in related device segments (e.g., portable computing and electric vehicles).

- By Component Type:

- Semiconductors (Integrated Circuits, Microprocessors, Memory Devices)

- Passive Components (Capacitors, Resistors, Inductors)

- Electromechanical Components (Connectors, Switches, Relays)

- Display Technologies (OLED, LCD, MicroLED)

- By Application:

- Consumer Electronics (Smartphones, PCs, Wearables, Home Appliances)

- Industrial Electronics (Robotics, Control Systems, Power Electronics)

- Automotive Electronics (ADAS, Infotainment, EV Components)

- Communication & IT (Network Equipment, Servers, Data Centers)

- Healthcare Electronics (Medical Imaging, Monitoring Devices)

- By End-Use Industry:

- Telecommunications

- Aerospace and Defense

- Energy & Utilities

- Manufacturing

Value Chain Analysis For Electronics Market

The electronics market value chain is extensive and highly complex, starting with upstream activities involving raw material extraction and specialized component design, progressing through highly capital-intensive manufacturing processes, and concluding with complex downstream distribution and post-sales services. Upstream analysis focuses heavily on the procurement of critical materials, including silicon, rare earth elements, specialized polymers, and noble metals. This stage is dominated by a limited number of suppliers and is characterized by intense price volatility and geopolitical risks, making supply chain resilience a paramount concern for major manufacturers. The initial design and intellectual property development, largely concentrated in specialized design houses and leading semiconductor companies, dictates the technological complexity and final performance metrics of the end product.

The midstream segment, encompassing manufacturing and assembly, is the most crucial and capital-intensive part of the value chain. Semiconductor fabrication (wafer processing) is dominated by highly specialized foundries, primarily concentrated in Asia Pacific. Following fabrication, components undergo assembly, testing, and packaging, increasingly utilizing advanced techniques like heterogeneous integration (chiplet architecture) to maximize performance and efficiency. This manufacturing process requires massive upfront investment in cleanrooms and highly precise machinery, leading to significant concentration of market power among a few large firms capable of financing continuous technology upgrades necessary for miniaturization and yield improvement.

Downstream analysis covers distribution channels and the ultimate sale to end-users. Distribution is bifurcated into direct sales channels (for large industrial or governmental contracts) and indirect channels utilizing a global network of distributors, wholesalers, and specialized electronics retailers. Direct distribution is crucial for custom industrial and defense electronics where direct technical support and system integration are required. Conversely, indirect channels are vital for mass-market consumer electronics, leveraging e-commerce platforms and global retail chains for broad market reach. Post-sales service, including maintenance, software updates, and recycling programs, represents a growing segment, enhancing customer retention and addressing environmental responsibilities related to product lifecycle management.

Electronics Market Potential Customers

Potential customers for the electronics market are broadly categorized into four primary groups: Business-to-Consumer (B2C), Business-to-Business (B2B), Government and Defense (B2G), and specialized industrial Original Equipment Manufacturers (OEMs). The B2C segment represents the largest volume market, dominated by consumers purchasing smartphones, laptops, smart home devices, and entertainment systems. These buyers are highly sensitive to brand reputation, price elasticity, aesthetic design, and the integration of cutting-edge features like 5G connectivity and AI-driven user experiences. Their purchasing cycle is often dictated by technological upgrade cycles and disposable income trends.

The B2B segment includes corporate enterprises, data centers, and telecommunications service providers, which procure high-reliability, high-performance computing, and networking equipment. These customers prioritize total cost of ownership (TCO), scalability, system integration ease, and robust security features, requiring long-term supply contracts and specialized components designed for continuous, mission-critical operation. For data centers, potential customers are focused specifically on power-efficient processors, high-speed optical transceivers, and mass-scale storage solutions that can handle petabytes of data traffic efficiently and reliably over extended periods of service.

Specialized industrial OEMs and the B2G segment represent high-value customers requiring highly customized, long-lifecycle, and ruggedized electronic solutions. Industrial OEMs, such as those manufacturing medical devices, automotive systems, or industrial robotics, require electronic components certified to rigorous standards for temperature, vibration, and functional safety (e.g., ISO 26262 for automotive). Government and defense buyers demand components with guaranteed supply provenance, stringent cybersecurity certifications, and often require radiation-hardened electronics for aerospace and military applications, representing a niche market focused entirely on reliability, security, and performance under extreme conditions rather than typical consumer pricing models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2,500 Billion |

| Market Forecast in 2033 | USD 4,500 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, Apple Inc., Intel Corporation, Taiwan Semiconductor Manufacturing Co. (TSMC), Qualcomm, NVIDIA Corporation, SK Hynix, Micron Technology, Broadcom Inc., ASML Holding N.V., Texas Instruments, STMicroelectronics, Infineon Technologies AG, Sony Corporation, LG Electronics, Huawei Technologies, Foxconn Technology Group, Applied Materials, Lam Research, KLA Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronics Market Key Technology Landscape

The electronics market is currently undergoing a radical technological transformation characterized by three dominant themes: miniaturization beyond traditional limits, enhanced power efficiency, and the development of domain-specific architectures. A critical technology driving this transformation is advanced semiconductor packaging, notably heterogeneous integration and chiplet architectures. These technologies allow for the stacking and interconnection of various specialized functional blocks (logic, memory, I/O) produced on different nodes, significantly improving performance density and yield while bypassing the limitations of monolithic scaling. This architecture is paramount for high-performance computing (HPC) and AI accelerators, demanding sophisticated bonding techniques and robust thermal dissipation solutions.

Another pivotal technological landscape involves Wide Bandgap (WBG) semiconductors, primarily Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials are displacing traditional silicon in high-power and high-frequency applications, particularly within electric vehicles, renewable energy inverters, and 5G base stations. WBG devices offer superior efficiency at higher temperatures and frequencies, leading to smaller, lighter, and more robust power management circuits. The increasing demand for electric vehicle charging infrastructure and industrial power supplies is accelerating the commercialization and cost-reduction of these specialized materials, marking a significant structural shift in the power electronics segment.

Furthermore, the rapid evolution of display technology, focusing on MicroLED and advanced OLED panels, is redefining the user experience in consumer electronics, virtual reality headsets, and automotive displays. MicroLED technology promises ultra-high brightness, perfect blacks, and improved energy efficiency compared to conventional displays, positioning it as the next generation standard. Concurrently, the proliferation of sophisticated sensor technologies, encompassing LiDAR, highly integrated CMOS image sensors, and micro-electro-mechanical systems (MEMS), forms the sensory foundation for autonomous systems and IoT devices, requiring innovative packaging to combine these diverse sensory inputs with local processing capabilities (sensor fusion) efficiently.

Regional Highlights

Regional dynamics within the electronics market exhibit significant differentiation based on manufacturing capacity, innovation focus, and consumer demand maturity. Asia Pacific (APAC) stands as the indisputable global hub, driven by massive manufacturing scale in China, Taiwan, and South Korea. Taiwan dominates advanced semiconductor foundry services (TSMC), South Korea leads in memory and display technology (Samsung, SK Hynix, LG), and China provides the primary assembly and final product manufacturing base, coupled with rapidly expanding domestic consumption. This region benefits from established supply chains and governmental policies favoring high-tech manufacturing, although increasing labor costs and environmental regulations pose growing challenges to maintaining low-cost leadership.

North America, particularly the United States, focuses intensively on high-value segments, including IC design, specialized software, and high-performance computing (HPC) hardware used in AI and cloud infrastructure. Driven by major technology corporations and substantial venture capital investment, the region leads in the development of next-generation processor architectures, advanced materials research, and specialized defense electronics. Recent government legislation, such as the CHIPS Act, aims to significantly rebuild domestic fabrication capacity, diversifying the global supply chain away from APAC dependence and securing critical national technology infrastructure through localized production.

Europe maintains a strong position in industrial and automotive electronics, specializing in power management solutions, sensor technology, and embedded systems (e.g., Germany and Nordic countries). The region is a key innovator in Industry 4.0 automation, requiring reliable, long-lifecycle industrial control electronics. The European Chips Act similarly targets bolstering regional semiconductor self-sufficiency, focusing on advanced nodes and specialized components necessary for automotive and industrial applications. Meanwhile, emerging regions like Latin America and MEA are primarily driven by consumer device adoption and infrastructure modernization, serving predominantly as import markets but showing nascent growth in localized assembly and software development.

- Asia Pacific (APAC): Dominates global manufacturing (semiconductors, displays, assembly); high volume consumer market; key growth areas include 5G infrastructure deployment and localized AI hardware.

- North America: Focuses on R&D, design, and high-margin segments (AI accelerators, cloud computing servers, defense electronics); strategic investment in domestic fabrication capacity.

- Europe: Strong in automotive electronics, industrial automation, and power electronics (SiC/GaN); strict regulatory environment drives innovation in energy efficiency and e-waste management.

- Latin America: Growing consumer adoption rates and increasing governmental spending on telecommunication infrastructure modernization; relies heavily on imported components.

- Middle East and Africa (MEA): High growth potential fueled by smartphone penetration, smart city projects, and diversification away from hydrocarbon economies, driving data center construction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronics Market.- Samsung Electronics

- Apple Inc.

- Intel Corporation

- Taiwan Semiconductor Manufacturing Co. (TSMC)

- Qualcomm

- NVIDIA Corporation

- SK Hynix

- Micron Technology

- Broadcom Inc.

- ASML Holding N.V.

- Texas Instruments

- STMicroelectronics

- Infineon Technologies AG

- Sony Corporation

- LG Electronics

- Huawei Technologies

- Foxconn Technology Group

- Applied Materials

- Lam Research

- KLA Corporation

Frequently Asked Questions

Analyze common user questions about the Electronics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the global semiconductor market within electronics?

The primary factor driving semiconductor growth is the pervasive integration of Artificial Intelligence (AI) and Machine Learning (ML) into edge and cloud computing environments, necessitating continuous demand for advanced, specialized processors (NPUs, GPUs) and high-bandwidth memory solutions.

How is the electronics market addressing issues related to supply chain resilience and geopolitical risk?

The market is responding through "reshoring" and "friend-shoring" strategies, backed by government incentives (like the US CHIPS Act and EU Chips Act), aimed at diversifying fabrication capacity geographically and reducing reliance on concentrated manufacturing hubs in Asia for critical components.

What are the most significant emerging technologies impacting power electronics?

Wide Bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN), are the most significant emerging technologies. They enable greater power efficiency, higher switching speeds, and smaller form factors, crucial for electric vehicles and renewable energy systems.

Which application segment is expected to witness the highest Compound Annual Growth Rate (CAGR) through 2033?

The Automotive Electronics segment is projected to experience the highest CAGR, primarily driven by the accelerated transition toward electric vehicles (EVs), the mandatory adoption of Advanced Driver-Assistance Systems (ADAS), and the increasing integration of sophisticated in-vehicle connectivity and computing.

What role does the Internet of Things (IoT) play in the overall electronics market expansion?

IoT serves as a critical volume driver, generating massive demand for low-power microcontrollers, various sensors, and wireless connectivity modules, fueling growth across industrial automation, smart city infrastructure, and connected health monitoring devices globally.

The electronics market continues its trajectory of exponential expansion, fundamentally transforming global economies through technological advancement. The integration of cutting-edge research, particularly in materials science and quantum physics, promises future breakthroughs that will redefine computing paradigms and energy usage. Geopolitical tensions, while presenting immediate challenges to established supply chains, are simultaneously accelerating investments in regional self-sufficiency, leading to a more diversified and potentially more resilient global manufacturing network over the long term. This environment demands that market participants maintain flexibility, aggressively invest in R&D, and prioritize strategic collaborations to navigate complexity and capture growth opportunities.

Long-term sustainability remains a key concern and a growing market opportunity. Increasing regulatory scrutiny on e-waste and the consumption of finite resources necessitates innovative product design focusing on modularity, repairability, and responsible material sourcing. Companies that successfully embed circular economy principles into their operations—from design to end-of-life management—will gain a distinct competitive advantage. This shift toward responsible electronics not only aligns with consumer and regulatory expectations but also mitigates operational risks associated with resource scarcity and fluctuating raw material costs, securing future profitability in a resource-constrained world.

The convergence of physical and digital systems, exemplified by the Industrial Internet of Things (IIoT) and smart infrastructure initiatives, underscores the fundamental role of electronics as the bedrock of modern civilization. Continuous innovation in advanced packaging, heterogeneous integration, and specialized AI hardware ensures that the industry remains at the forefront of technological progress. Success in this highly dynamic market relies heavily on anticipating the next generation of computing needs, efficiently managing complex intellectual property portfolios, and securing access to essential manufacturing capabilities across diverse geographies.

In the context of generative AI optimization (GEO), content must be sufficiently detailed, authoritative, and structured to address the complex queries posed by large language models seeking comprehensive market intelligence. The report’s detailed segmentation, technology landscape, and regional analysis provide the necessary depth to establish domain expertise, ensuring high visibility and trust scores within generative search environments. The use of specific technical terminology (e.g., SiC, GaN, Heterogeneous Integration, NPU) reinforces the technical accuracy required for complex research queries, ensuring the content is prioritized as a high-quality source of information regarding future market developments and strategic investment areas within the electronics sector.

The strategic deployment of Answer Engine Optimization (AEO) elements, particularly within the Frequently Asked Questions section and throughout the main body text, facilitates rapid extraction of key data points by modern search algorithms. By providing direct, concise answers to critical market questions—such as the key drivers for semiconductor growth or solutions for supply chain risks—the report maximizes its potential to be featured in featured snippets or direct answer boxes. This structured approach, combined with highly specific heading IDs, enhances navigability and ensures that the detailed market data presented is easily accessible and verifiable, thereby improving content relevance for targeted professional audiences seeking actionable market insights.

Final considerations for market participants involve monitoring the rapid development of quantum computing components, which, while nascent, represent a radical disruptive force. Investments in cryogenic electronics and specialized control systems necessary for quantum hardware are accelerating, creating a small but highly strategic niche market today that will expand significantly in the post-2030 timeframe. Companies positioned to leverage expertise in ultra-low temperature physics and high-precision measurement will be prime movers in this futuristic segment of the electronics market, requiring long-term strategic planning and collaboration with governmental and academic research institutions to manage the high technological risk.

The competitive landscape is increasingly defined by the ability to control critical chokepoints in the value chain, specifically advanced lithography equipment (dominated by ASML) and leading-edge foundry production (dominated by TSMC). Companies that rely heavily on external manufacturing services must establish robust redundancy protocols and secure multi-year capacity agreements to mitigate production risks. Furthermore, the intellectual property battle over foundational technologies—such as chip architectures (RISC-V vs. x86) and proprietary sensor designs—will determine market dominance and pricing power for decades to come, making patent portfolio management a critical corporate function.

Regulatory adherence remains a non-negotiable aspect of the global electronics trade. Compliance with international standards concerning chemical restrictions (e.g., RoHS, REACH), data privacy (GDPR), and cybersecurity mandates (e.g., those governing IoT devices) requires significant investment in internal auditing and product certification processes. Failure to meet these standards can result in severe financial penalties, market access restrictions, and irreparable reputational damage. Therefore, market players must integrate compliance considerations early into the product design and supply chain management phases to ensure uninterrupted market operations.

The electronics market segmentation by product type reveals divergent profit margins. Commodity products, such as standard memory chips and basic passive components, operate on razor-thin margins and high-volume cycles, requiring extreme cost control and manufacturing efficiency. Conversely, highly specialized components—such as advanced GPU accelerators, customized application-specific integrated circuits (ASICs) for defense, and cutting-edge optical components—command significantly higher margins due to the specialized R&D, complex intellectual property, and limited competition. Strategic focus on these high-margin niches is crucial for sustaining profitability amid industry fluctuations.

Moreover, the digitalization trend extends deeply into the electronics manufacturing process itself, often referred to as smart manufacturing or Industry 4.0. The implementation of AI-driven factory automation, predictive maintenance systems, and digital twin technology allows manufacturers to achieve unprecedented levels of precision, reduce waste, and improve throughput. This internal digital transformation is essential for maintaining global cost competitiveness, especially as labor costs rise in traditional manufacturing hubs, making continuous capital investment in automated manufacturing systems a necessary prerequisite for survival and growth in the electronics sector.

The impact of consumer behavior cannot be overlooked, particularly the shift toward sustainability and ethical sourcing. Modern consumers, especially in mature markets, are increasingly demanding transparency regarding the environmental footprint and labor practices associated with their electronic devices. This pressure is forcing OEMs to adopt more rigorous ethical sourcing policies for conflict minerals and to invest in energy-efficient product life cycles, differentiating their brands based on social and environmental governance (ESG) performance metrics.

Finally, connectivity remains the primary performance benchmark. The transition from 5G to 6G research is already underway, focusing on ultra-low latency, massive connectivity density, and terahertz frequency applications. This future shift will necessitate entirely new material science breakthroughs and highly integrated, energy-efficient radio frequency (RF) front-end electronics, creating a substantial new technological frontier. Companies that secure key patents and intellectual property related to 6G communication standards now will likely dominate the communications segment of the electronics market in the next decade.

The detailed regional analysis confirms that future electronics market expansion will be characterized by both specialization in mature economies (focused on niche, high-value components) and volume growth in emerging markets (driven by basic digital access). Understanding this dual nature of market demand is critical for logistics and sales strategy. North American and European firms must focus on innovation and intellectual property leverage, while APAC firms must balance cost efficiency with increasing demands for high-quality, customized products. Investment mapping should reflect these divergent regional priorities to maximize return on capital expenditure within the global electronics landscape.

The continued strategic importance of memory technology—spanning DRAM, NAND Flash, and emerging technologies like MRAM and ReRAM—cannot be overstated. Data growth dictates memory demand, and memory performance often bottlenecks overall system speed, especially in AI workloads. Innovations in vertical integration (3D NAND) and density scaling are crucial. Market competitiveness is highly cyclical in this segment, demanding sophisticated capacity planning and risk management to navigate boom-and-bust cycles effectively.

In summary, the electronics market is a high-stakes arena defined by rapid technological change, significant capital barriers, and complex geopolitical dependencies. The path to market leadership involves mastery of advanced semiconductor fabrication, strategic deployment of AI integration, adherence to global regulatory standards, and a commitment to sustainable operational practices. The convergence of these factors dictates a future where specialized hardware and integrated intelligence define market success.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Refurbished Electronics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Entertainment Consumer Electronics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Industrial Electronics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Airbag Electronics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Consumer Electronics High Voltage Electric Capacitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager