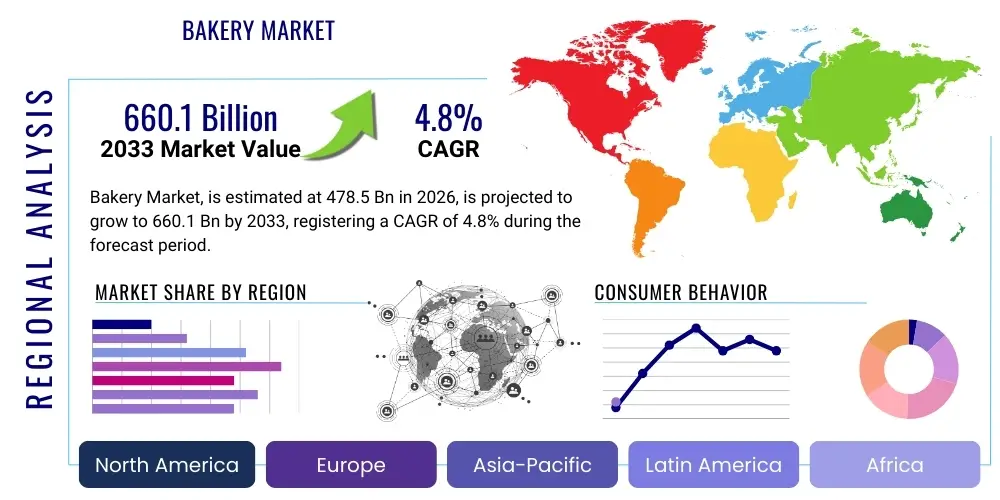

Bakery Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442922 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Bakery Market Size

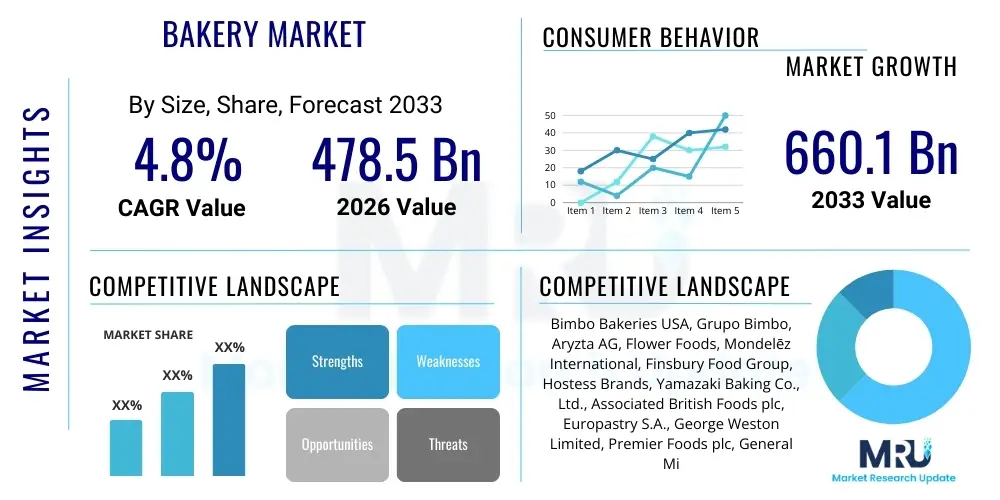

The Bakery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% CAGR between 2026 and 2033. The market is estimated at USD 478.5 Billion in 2026 and is projected to reach USD 660.1 Billion by the end of the forecast period in 2033.

Bakery Market introduction

The global bakery market encompasses a vast spectrum of manufactured and artisanal food products, primarily based on flour, characterized by their diverse applications in daily consumption and celebratory events. Core product descriptions include essential staples such as packaged and unpackaged breads (whole wheat, sourdough, multigrain), morning goods like bagels and muffins, intricate cakes and pastries, and shelf-stable items such as biscuits, cookies, and breakfast cereals. This sector is fundamentally driven by its ability to deliver convenient, palatable, and increasingly nutritious food options to a global consumer base. Key benefits offered by bakery products revolve around affordability, versatility in consumption (from quick breakfasts to elaborate desserts), and their intrinsic role in cultural culinary traditions worldwide, reinforcing their status as non-discretionary purchases for a large portion of the global population.

Major applications of bakery products extend beyond direct retail consumption into robust foodservice sectors, including hotels, restaurants, cafes (HORECA), and institutional catering. The industrial application segment focuses on providing pre-mixes, ingredients, and semi-finished products to commercial bakers and other food manufacturers. A significant factor driving market expansion is the accelerated pace of urbanization and associated lifestyle changes, particularly the rising demand for on-the-go food solutions and convenient snacking alternatives that bakery items readily provide. Furthermore, evolving dietary trends, such as the preference for healthier options like low-sugar, high-fiber, and plant-based baked goods, are forcing manufacturers to innovate and diversify their product lines, thereby stimulating continuous market growth and innovation across both traditional and specialty segments.

The continued growth trajectory of the bakery market is underpinned by strong demographic factors, including rising disposable incomes in emerging economies and the increasing penetration of organized retail channels globally, making a wider variety of specialized bakery items accessible to mass markets. Moreover, effective marketing strategies focusing on premiumization, provenance, and the use of natural ingredients are successfully attracting affluent consumers seeking high-quality, artisanal-style products. The persistent consumer demand for indulgence, balanced with a growing awareness of health and wellness, creates a dynamic environment where traditional recipes coexist with cutting-edge functional food developments, ensuring the market's resilience even amidst economic fluctuations. This delicate balance of tradition and modernity defines the current competitive landscape.

Bakery Market Executive Summary

The bakery market is experiencing a significant pivot toward healthier and more functional product formulations, directly influencing contemporary business trends. The emphasis on "clean label" products—those utilizing natural ingredients, minimal preservatives, and transparent sourcing—is driving investment in ingredient technology and supply chain auditing among major manufacturers. Regionally, the Asia Pacific market is poised for the most substantial growth, fueled by rapid expansion of the middle class, increased Westernization of diets, and the proliferation of international QSR (Quick Service Restaurant) chains, which rely heavily on consistent, high-quality bakery supplies. Conversely, mature markets in North America and Europe are witnessing heightened competition focused on niche areas such as gluten-free, keto-friendly, and artisan baked goods, indicating a shift from volume-driven sales to value-added premiumization strategies across established economies.

Segment trends reveal a bifurcation in consumer demand: stability for essential staples like packaged bread and explosive growth in discretionary, convenience-oriented categories such as ready-to-eat cakes, pastries, and premium snack bars. The frozen bakery segment is demonstrating robust performance, benefiting from advancements in freezing and thawing technologies that significantly extend shelf life while maintaining product quality, appealing to both consumers seeking bulk purchasing options and foodservice operators requiring efficient inventory management. The rise of e-commerce and direct-to-consumer (D2C) models, accelerated by recent global events, has necessitated significant digital transformation, particularly in logistics and cold chain management, allowing specialized local bakers to access broader geographical markets, thereby intensifying competition with established industry giants and promoting regional specialization.

Overall market dynamics are characterized by aggressive M&A activity, where larger players seek to acquire innovative, niche brands to quickly integrate desirable attributes like organic certification or proprietary ingredient technology into their portfolios. Sustainability is emerging as a critical competitive differentiator, compelling businesses to adopt eco-friendly packaging solutions, reduce food waste throughout their operations, and ensure ethical sourcing of raw materials like cocoa and palm oil. This focus on corporate social responsibility (CSR) not only meets regulatory requirements but also resonates strongly with Millennial and Generation Z consumers, who increasingly align their purchasing decisions with brands that demonstrate clear environmental and social commitments, further accelerating the transition towards a more responsible and sustainable bakery industry model.

AI Impact Analysis on Bakery Market

Common user inquiries concerning AI's integration into the bakery market predominantly revolve around three key areas: optimizing operational efficiency, enhancing product quality consistency, and personalizing consumer experience. Users frequently ask how AI can reduce the immense food waste inherent in products with short shelf lives, particularly through improved demand forecasting and inventory management systems. Another major concern focuses on the role of computer vision and machine learning in automated quality control, questioning its effectiveness in detecting minute defects in complex products like pastries or decorated cakes, thereby ensuring uniform product excellence. Finally, there is high user interest in how AI algorithms can analyze complex preference data to develop highly customized or localized flavor profiles and nutritional compositions, enabling mass customization while simultaneously managing cost effectiveness, thereby redefining the limits of artisanal versus industrial production.

AI's influence is profound, transitioning the bakery industry from reactive management to predictive manufacturing. Predictive maintenance algorithms, trained on sensor data from mixers, ovens, and packaging lines, minimize costly unplanned downtime, ensuring continuous production flow crucial for high-volume operations. Furthermore, sophisticated machine learning models are being deployed to analyze real-time sales data, weather patterns, local events, and historical demand variability, generating highly accurate forecasting models that significantly cut down on overproduction and subsequent spoilage, directly improving profitability and addressing sustainability goals across the supply chain, especially concerning perishable fresh bakery items.

In terms of consumer engagement, AI is powering advanced recommendation engines on e-commerce platforms, offering personalized product suggestions based on purchase history, dietary restrictions, and declared preferences, mimicking the consultative experience of an artisan baker. For manufacturing, generative design models are exploring novel ingredient combinations and process parameters (e.g., proofing time, temperature curves) to achieve specific texture, taste, and nutritional outcomes, drastically accelerating the R&D cycle for new product introductions, particularly in the complex and precise area of gluten-free or low-glycemic baking, driving innovation at an unprecedented speed.

- AI-driven Predictive Maintenance: Minimizing equipment failure and maximizing operational uptime.

- Precision Demand Forecasting: Reducing inventory spoilage and optimizing production schedules for perishable goods.

- Computer Vision Quality Control: Automated inspection for texture, color, and size consistency on the production line.

- Personalized Product Development: Analyzing consumer data for tailored flavor and nutritional profile creation.

- Supply Chain Optimization: Intelligent routing and temperature monitoring for efficient cold chain logistics.

- Automated Recipe Adjustment: Real-time ingredient modification based on raw material variability (e.g., flour moisture content).

DRO & Impact Forces Of Bakery Market

The bakery market is steered by powerful drivers, notably the increasing global demand for convenient, ready-to-eat breakfast and snack options resulting from accelerated urban lifestyles and shrinking preparation times available to consumers. The growing health and wellness movement acts as a dual driver, pushing innovation towards products offering functional benefits—such as high fiber, protein fortification, and whole-grain incorporation—while simultaneously boosting the niche segment of specialty products like vegan, gluten-free, and organic baked goods. Furthermore, aggressive product innovation, supported by sophisticated packaging that extends freshness and shelf life, consistently keeps the market dynamic and consumer interest high, attracting new consumption occasions beyond traditional mealtimes and further fueling market expansion in diverse socioeconomic demographics.

However, the sector faces substantial restraints that impede optimal growth. Prominently, the high volatility and unpredictable fluctuation in the prices of essential raw materials—such as wheat, sugar, dairy, and edible oils—significantly challenge profit margins and necessitate constant adjustments to procurement strategies and pricing models, often impacting consumer affordability. Additionally, the inherent short shelf life of many fresh bakery products necessitates complex and costly supply chain management, particularly cold chain logistics, contributing to high levels of food waste and operational complexity, acting as a major logistical barrier, especially when expanding into developing regions with underdeveloped infrastructure and stringent food safety regulations.

Significant opportunities exist, particularly in leveraging untapped consumer segments and expanding product portfolios into emerging markets where per capita consumption of packaged and specialized bakery products is rapidly accelerating, reflecting increasing affluence and evolving dietary habits. The sustained rise of allergen-friendly and plant-based diets presents a lucrative avenue for specialized manufacturers, encouraging investment in alternative flours and binding agents that maintain desired texture and taste profiles. The principal impact forces shaping the market include technological advancements in high-speed, flexible automation systems, enabling rapid changes in production lines to meet fluctuating demand for specialized products, coupled with stringent governmental food safety and labeling standards that necessitate complete traceability and transparency throughout the production process, fundamentally altering operational protocols and fostering consumer trust.

Segmentation Analysis

The global bakery market is extensively segmented based on several critical parameters, including the type of product offered, the processing form (fresh vs. frozen), the distribution channel utilized, and the intrinsic nature of the ingredients (conventional versus organic). This detailed segmentation provides manufacturers with the granularity required to target specific consumer needs, manage supply chain complexities inherent to different product categories, and accurately assess the competitive landscape within specialized niches. Understanding these segments is vital for developing effective market entry strategies, optimizing product mix, and forecasting consumer preferences across diverse global regions.

The segmentation by product type, encompassing essential staples like bread alongside more indulgent categories such as cakes and pastries, directly reflects varying demand elasticities, with staples remaining resilient regardless of economic conditions, while discretionary items thrive during periods of higher disposable income. The dichotomy between fresh and frozen products dictates manufacturing complexity and distribution scope; fresh products dominate local and artisanal markets, whereas frozen products enable global market reach and provide flexibility to the foodservice sector. Meanwhile, the growing importance of the distribution channel segment, particularly the rapid expansion of online retail, is shifting marketing focus towards digital engagement and efficient last-mile delivery capabilities, especially for highly perishable baked goods, requiring continuous investment in robust logistical infrastructure.

- By Product Type:

- Bread (Loaves, Rolls, Bagels)

- Cakes and Pastries (Sweet Goods, Donuts, Muffins)

- Biscuits and Cookies (Crackers, Wafers)

- Breakfast Cereals (Ready-to-Eat, Hot Cereals)

- Others (Pies, Tarts, Pizza Bases)

- By Form:

- Fresh Bakery Products

- Frozen Bakery Products

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Artisanal/Specialty Bakeries

- By Nature:

- Conventional

- Organic

- Gluten-Free

- By End-User:

- Retail

- Foodservice (HORECA, Institutional Catering)

Value Chain Analysis For Bakery Market

The bakery market value chain begins with a rigorous upstream analysis focusing on the procurement of primary raw materials, including major cereals (wheat, rice, corn), specialized flours (gluten-free alternatives), sweeteners, fats, and stabilizing agents. This phase is characterized by intense price sensitivity, high reliance on agricultural commodity markets, and the necessity for robust supplier certification to ensure ingredient quality and adherence to food safety standards, particularly concerning allergen control and organic sourcing mandates. Strategic partnerships with key ingredient processors and vertical integration, where feasible, are critical for mitigating supply risk and securing favorable pricing, forming the foundational layer of cost and quality management that fundamentally impacts downstream profitability and final product attributes.

The midstream section involves manufacturing and processing, ranging from small-scale artisanal baking operations emphasizing manual skill and regional recipes to large-scale, automated industrial bakeries utilizing high-throughput mixing, fermentation, baking, and sophisticated packaging technologies to achieve economies of scale. Investment in advanced machinery for consistency, coupled with rigorous quality assurance checks (including AI-enabled vision systems), defines success in this stage. Downstream activities are dominated by distribution and retail, involving complex logistics, particularly cold chain management for frozen and highly perishable fresh products, requiring tailored transport solutions to maintain product integrity and shelf life until they reach the final point of sale, whether via wholesalers, direct distribution fleets, or third-party logistics providers specializing in perishable goods delivery.

Distribution channels in the bakery market are multifaceted, encompassing both direct and indirect routes. Direct sales are typically achieved through company-owned retail outlets, specialized bakeries, or the rapidly expanding direct-to-consumer e-commerce model, which offers better margin control and direct customer relationship management. Indirect channels are far more prevalent, relying heavily on intermediaries such as supermarkets, hypermarkets, convenience stores, and foodservice distributors who aggregate products from multiple manufacturers before sale to the end-user. The choice of channel significantly impacts branding, required shelf-life attributes, and market penetration, with mass-market distribution favoring shelf-stable and frozen goods, while artisanal producers focus on the immediate consumption experience provided via specialized, localized retail environments.

Bakery Market Potential Customers

Potential customers for the bakery market are broadly categorized into two major end-user groups: the Retail consumer segment and the Foodservice sector. Within the Retail segment, the primary buyer is the individual consumer or household purchasing products for immediate or home consumption, driven by factors such as convenience, nutritional value, taste, and price sensitivity. This segment is increasingly segmented based on specific dietary requirements, leading to strong demand from consumers requiring gluten-free, dairy-free, low-sugar, or high-protein options, necessitating extensive product diversification and clear, informative labeling to appeal to this discerning and health-aware demographic, often purchasing through supermarkets and dedicated online grocery platforms.

The Foodservice segment represents a crucial industrial buyer, encompassing a wide range of institutional and commercial customers, including hotels, restaurants, cafes (HORECA), schools, hospitals, airlines, and large corporate catering operations. These professional buyers prioritize consistency, volume capacity, stringent quality control, and the ability to source bulk or customized frozen and par-baked products that reduce on-site preparation time and labor costs while guaranteeing uniform quality across multiple locations. For instance, large QSR chains demand specific bun formulations, while upscale hotels seek premium, artisanal-quality pastries; meeting these varied needs requires highly flexible manufacturing capabilities and robust B2B logistical support, making them high-value, long-term contractual clients for industrial bakery producers.

An emerging high-potential customer group includes online subscription services and specialized meal kit companies, which require custom-sized, often preservative-free baked components delivered on a just-in-time basis. These customers seek innovative packaging solutions to maintain freshness during transit and rely on integrated digital systems for seamless ordering and inventory synchronization. Catering to this segment demands high responsiveness and agility from bakery suppliers, often involving co-development of products, focusing on convenience and premium ingredients that align with the high-value propositions of the subscription model, thereby driving specialized B2B innovation outside traditional wholesale models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 478.5 Billion |

| Market Forecast in 2033 | USD 660.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bimbo Bakeries USA, Grupo Bimbo, Aryzta AG, Flower Foods, Mondelēz International, Finsbury Food Group, Hostess Brands, Yamazaki Baking Co., Ltd., Associated British Foods plc, Europastry S.A., George Weston Limited, Premier Foods plc, General Mills, Kellogg Company, Pepperidge Farm (Campbell Soup Company), Rich Products Corporation, Lantmännen Unibake, McKee Foods Corporation, Dawn Foods, Patisserie Valerie. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bakery Market Key Technology Landscape

The contemporary bakery market's technological landscape is defined by continuous advancements in automation, precision ingredient handling, and extended shelf-life solutions, shifting traditional manual processes toward highly controlled, industrialized operations. High-speed mixing and dosing equipment, coupled with sophisticated sensory technology, ensures exact measurement and homogenization of complex ingredient matrices, crucial for maintaining product consistency in high volumes, especially when handling alternative flours or delicate inclusions. Furthermore, advanced robotics are increasingly integrated into production lines for repetitive, high-precision tasks such as dough handling, decorating, and intricate packaging, minimizing labor costs and dramatically improving throughput efficiency while maintaining hygienic standards that exceed manual capabilities, addressing increasing demands for safety and scalability.

Thermal processing and baking technologies have evolved significantly, moving beyond conventional batch ovens to continuous tunnel ovens equipped with highly precise temperature and humidity control zones, optimized for energy efficiency and uniform baking results across complex product shapes and sizes. Cryogenic freezing and flash-freezing techniques are pivotal for the growth of the frozen bakery segment, preserving the structural integrity and sensory quality of goods like par-baked breads and delicate pastries, allowing for extended global distribution without reliance on chemical preservatives. Additionally, novel packaging technologies, including Modified Atmosphere Packaging (MAP) and active packaging incorporating oxygen scavengers or moisture regulators, are crucial innovations that extend the marketable shelf life of fresh products, mitigating one of the industry's most significant operational challenges—perishability.

Digital technologies form the backbone of modern bakery management, with IoT (Internet of Things) sensors embedded throughout the production environment to collect real-time data on environmental parameters, machinery performance, and ingredient usage. This data feeds into Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) platforms, facilitating complete traceability from farm to fork, which is paramount for compliance and recall management. As discussed, AI and machine learning algorithms utilize this data for predictive quality control, optimizing fermentation times, and enhancing demand forecasting accuracy, fundamentally integrating technological sophistication not just into physical production but also into strategic decision-making and continuous process improvement across the entire value chain.

Regional Highlights

- North America: This region is characterized by high demand for convenience-oriented and specialty baked goods. The market is mature but highly innovative, with a strong focus on wellness trends, driving robust growth in the gluten-free, keto, and plant-based bakery segments. Large industrial bakers dominate the packaged bread and biscuit segments, while smaller, regional artisanal bakeries thrive in metropolitan areas. Investment is high in automation and clean label reformulations due to stringent consumer scrutiny and evolving dietary preferences, making product differentiation through functional benefits a key competitive strategy.

- Europe: As a historical center for baking tradition, Europe exhibits immense diversity, ranging from the highly industrialized packaged goods in Western Europe to the protected, regional specialties in countries like France and Italy. Demand for premium, organic, and ethically sourced ingredients is particularly strong. Regulatory pressures regarding sugar reduction and trans-fat elimination are accelerating product reformulation efforts. The frozen bakery segment, particularly par-baked goods for foodservice, remains a strong growth area due to labor cost challenges and the need for standardized quality across national boundaries.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, primarily driven by rapid urbanization, increased disposable incomes, and the strong influence of Western dietary habits, particularly among younger populations. China and India are focal points for investment, witnessing soaring demand for packaged snacks, biscuits, and standardized breads. The market is fragmented, with local players competing against multinational giants, necessitating localized flavor profiles and aggressive expansion of organized retail infrastructure to reach a broader consumer base, often favoring savory bakery innovations alongside traditional sweet goods.

- Latin America: This region presents a dynamic market focused on volume and value, where packaged bread and sweet baked snacks are staples. Economic volatility occasionally impacts consumer purchasing power, leading to a strong focus on cost-effective, accessible products. Brazil and Mexico are the largest markets, characterized by significant industrial capacity and a high penetration of multinational companies. Opportunities lie in expanding the distribution network into rural areas and introducing healthier product alternatives as health awareness gradually increases among the growing middle class population.

- Middle East and Africa (MEA): Growth in MEA is largely fueled by expanding expatriate populations and high consumption rates of packaged goods in the GCC countries. The market is sensitive to imported ingredients, requiring local manufacturers to navigate complex logistics and supply chain stability issues. There is a strong cultural preference for traditional flatbreads and rich pastries, alongside burgeoning demand for Western-style cakes and specialty coffee shop items, driving investment in local manufacturing capabilities to cater to both traditional demands and modern convenience trends, emphasizing halal certification and high-quality standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bakery Market.- Grupo Bimbo

- Mondelēz International

- Associated British Foods plc

- Aryzta AG

- Flower Foods

- Yamazaki Baking Co., Ltd.

- Kellogg Company

- General Mills

- Hostess Brands

- Finsbury Food Group

- Europastry S.A.

- George Weston Limited

- Premier Foods plc

- Rich Products Corporation

- Lantmännen Unibake

- McKee Foods Corporation

- Dawn Foods

- Bimbo Bakeries USA

- Pepperidge Farm (Campbell Soup Company)

- Patisserie Valerie

Frequently Asked Questions

Analyze common user questions about the Bakery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Bakery Market?

The key growth drivers are the increasing global demand for convenient, ready-to-eat food options, rapidly accelerating urbanization rates, and evolving consumer preference shifts toward healthier, functional bakery products like whole grain, organic, and plant-based offerings.

Which geographical region is expected to demonstrate the highest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by expanding middle-class populations, increased adoption of Westernized diets, and significant investment in organized retail and foodservice infrastructure across key emerging economies like China and India.

How is the adoption of AI and automation changing bakery production processes?

AI and automation are significantly enhancing operational efficiency through precision demand forecasting to minimize food waste, optimizing ingredient handling, and implementing advanced computer vision systems for real-time, high-speed quality control and consistency assurance in large-scale manufacturing.

What is the current consumer trend regarding ingredient labels in bakery products?

The dominant trend is the demand for "clean label" products, meaning consumers highly prioritize baked goods made with minimal, recognizable ingredients, free from artificial additives, preservatives, and excessive sugar, driving manufacturers toward transparent sourcing and natural formulation techniques.

What role does the frozen bakery segment play in market expansion?

The frozen bakery segment is crucial for market expansion as it dramatically extends product shelf life and facilitates international distribution, providing flexible inventory solutions for both mass retail and the high-volume foodservice sector while maintaining quality and reducing logistical complexities associated with fresh perishables.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bakery Confectionary Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Bake Off Bakery Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fortified Bakery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Frozen Bakery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Organic Bakery Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager