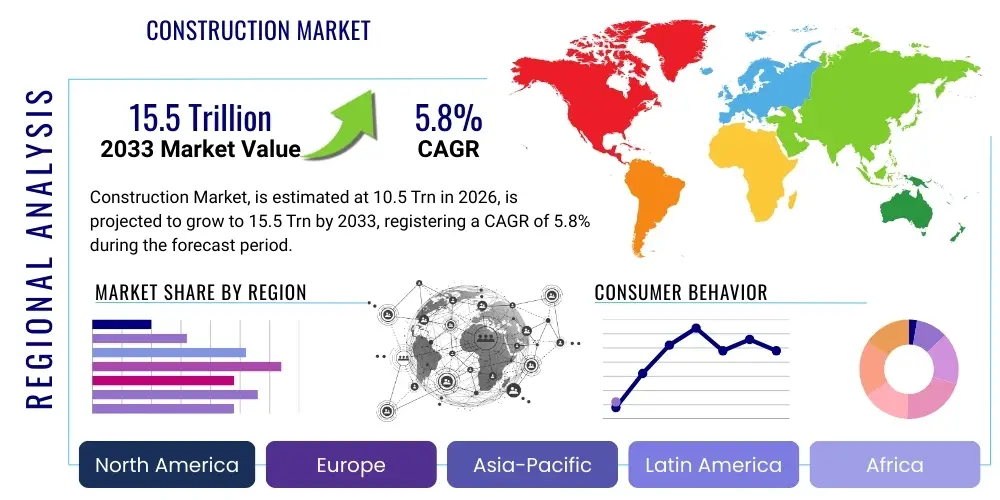

Construction Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441532 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Construction Market Size

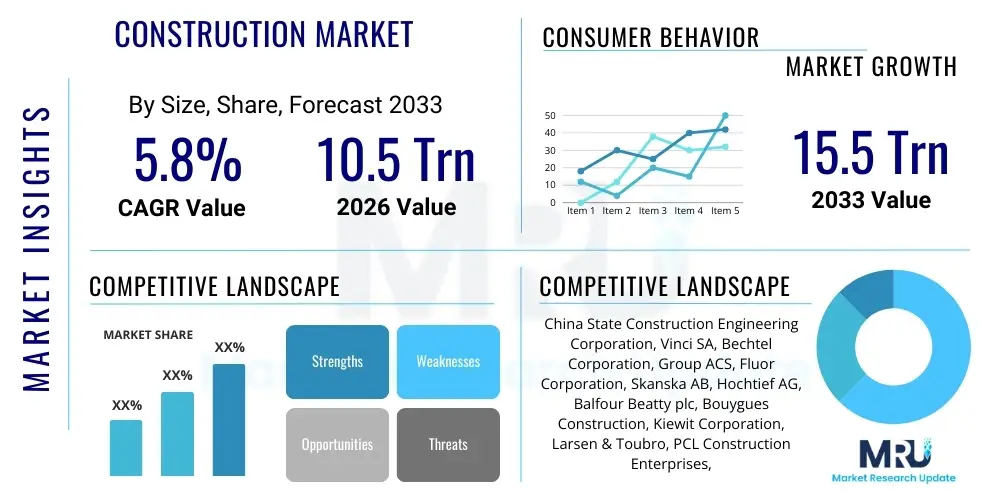

The Construction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% (CAGR) between 2026 and 2033. The market is estimated at $10.5 Trillion in 2026 and is projected to reach $15.5 Trillion by the end of the forecast period in 2033.

Construction Market introduction

The global construction market encompasses all activities related to the development, maintenance, and repair of infrastructure, industrial facilities, and residential and non-residential buildings. This vast industry serves as a foundational pillar of global economic activity, influencing sectors ranging from material production and logistics to real estate and financial services. The market's complexity is driven by a diverse array of stakeholders, including governments investing in public works, private developers undertaking commercial projects, and individual homeowners requiring residential construction services. Product description within this context covers everything from heavy construction materials like cement, steel, and timber, to advanced construction techniques such as modular and prefabricated building systems, alongside the specialized machinery and digital tools used on site. The market is increasingly characterized by a shift towards sustainability, efficiency, and digitalization, fundamentally altering traditional methods of planning and execution.

Major applications of construction span across five primary categories: residential construction (new homes, apartments, renovations), non-residential construction (offices, retail, hospitals, educational institutions), heavy civil engineering (roads, bridges, tunnels, dams, utilities), industrial construction (manufacturing plants, refineries, warehouses), and specialty trades (HVAC, plumbing, electrical installation). The benefits derived from robust construction activity are profound, including significant job creation, improved quality of life through better infrastructure, enhanced economic productivity, and the development of resilient urban and rural environments. Furthermore, modern construction focuses heavily on achieving net-zero energy buildings and implementing circular economy principles, maximizing resource efficiency and minimizing environmental impact throughout a structure's lifecycle.

Key driving factors propelling the construction market forward include rapid urbanization, particularly in emerging economies, which necessitates extensive investment in new housing and supporting municipal infrastructure. Secondly, global governmental spending on public infrastructure renewal and modernization—often packaged in large stimulus or recovery programs—provides a stable demand base for civil engineering projects. Thirdly, technological advancements, such as Building Information Modeling (BIM), drones, and robotics, are improving project efficiency, reducing delays, and lowering long-term operating costs, making complex projects more viable. Finally, the pressing need for climate change mitigation and adaptation is driving demand for green building certification, resilient structures, and renewable energy integration into commercial and residential developments.

Construction Market Executive Summary

The construction market outlook remains robust, underpinned by strong business trends centered around technological integration, supply chain optimization, and heightened focus on sustainability mandates. Business trends indicate a continued consolidation among larger construction firms seeking specialized capabilities (e.g., green technology installation or complex infrastructure management) and operational efficiencies through digitalization. The pressure to complete projects faster and within stringent environmental standards is forcing the adoption of advanced materials like low-carbon concrete and smart construction technologies. Project complexity is increasing, demanding greater collaboration across the value chain, which is being facilitated by integrated project delivery (IPD) models and digital platforms. Financially, the sector is balancing higher input costs (especially energy and raw materials) with improved productivity gains driven by automation and better site management practices.

Regionally, the market exhibits divergent growth patterns. Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure projects in nations like India and Indonesia and ongoing urbanization in China, despite recent economic deceleration in specific segments. North America and Europe are characterized by large-scale renovation and retrofitting projects aimed at energy efficiency and aging infrastructure replacement, rather than purely greenfield development. Regulatory environments promoting net-zero emissions are particularly influential in these regions, driving high demand for sustainable building materials and construction processes. The Middle East and Africa (MEA) continue to see substantial investment in mega-projects related to economic diversification and tourism infrastructure, often funded by sovereign wealth funds, creating specialized high-value construction opportunities.

Segmentation trends highlight the increasing importance of the infrastructure segment, driven globally by governmental spending on utilities, transportation, and energy grid modernization. Within the building sector, the commercial and institutional sub-segment shows resilience, largely due to demand for modernized, flexible office spaces and state-of-the-art healthcare and educational facilities designed for post-pandemic requirements. Furthermore, materials segmentation reveals a clear trend towards prefabricated, off-site construction methods, which offer predictability, quality control, and faster turnaround times compared to traditional on-site building. The technological segment, specifically related to construction software and analytics, is experiencing accelerated adoption as firms leverage data for predictive maintenance and enhanced operational safety across all project types.

AI Impact Analysis on Construction Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Construction Market primarily revolve around themes of job displacement, project efficiency, risk mitigation, and implementation feasibility. Users frequently ask: "How will AI change the role of the site manager?" or "Can AI truly predict project delays better than human schedulers?" and "What is the return on investment (ROI) for adopting AI in small to mid-sized construction firms?" The underlying themes reveal both significant excitement about AI’s potential to solve long-standing industry issues—like chronic cost overruns, safety hazards, and labor shortages—and skepticism about the practical challenges of integrating sophisticated technology into traditional, often labor-intensive workflows. There is a strong expectation that AI will move beyond basic automation into advanced capabilities such as generative design and predictive analytics for maintenance schedules. Key concerns center on data standardization, workforce training requirements, and the initial capital outlay required for successful adoption, signaling that users are seeking clear, demonstrable value propositions and practical implementation roadmaps for AI technologies.

The influence of AI is most transformative in the pre-construction phase, where generative design algorithms can rapidly explore thousands of structural options based on parameters like material cost, energy performance, and regulatory constraints, significantly optimizing the architectural and engineering design process. During the construction phase itself, AI-powered computer vision systems analyze drone and site camera footage in real-time to monitor progress against BIM models, detect safety violations (e.g., lack of hardhat use), and manage inventory levels, leading to proactive decision-making and fewer bottlenecks. This real-time data integration minimizes the gap between planned and actual project status, a critical factor in mitigating delays and cost escalation which historically plague large-scale projects.

Furthermore, AI models are increasingly utilized in risk management and resource allocation. By analyzing historical project data, weather patterns, material price fluctuations, and contractor performance metrics, AI can generate highly accurate risk profiles and optimize workforce scheduling, ensuring critical skilled labor is deployed precisely when needed. This shift from reactive management to predictive operational oversight enhances project profitability and safety outcomes. While implementation requires significant investment in data infrastructure and workforce retraining, the long-term benefits in terms of operational efficiency and minimizing structural failures position AI as a fundamental, non-negotiable technology for future competitive advantage in the global construction market.

- Enhanced Project Planning: AI utilizes historical data to optimize scheduling, budgeting, and resource allocation, dramatically reducing planning errors.

- Generative Design: Algorithms automatically create optimal building layouts based on performance and cost criteria.

- Real-Time Progress Monitoring: Computer vision analyzes site imagery (drones, fixed cameras) to compare current progress against BIM models, ensuring adherence to the timeline.

- Predictive Maintenance: AI identifies potential equipment failures or structural issues before they occur, minimizing downtime and increasing asset longevity.

- Improved Site Safety: Automated detection of safety hazards and violations using video analytics, leading to immediate interventions and reduced accident rates.

- Supply Chain Optimization: Predictive modeling forecasts material needs and price fluctuations, enabling proactive procurement strategies.

DRO & Impact Forces Of Construction Market

The dynamics of the Construction Market are shaped by powerful Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating growth trajectory and competitive landscape. Key drivers include accelerating global population growth and persistent urbanization trends, particularly in developing economies, creating sustained demand for new residential and commercial infrastructure. Government investments, especially in public infrastructure modernization (roads, renewable energy grids, water systems) across established economies, provide substantial market momentum. Furthermore, the global imperative for sustainable development and resilience against climate change necessitates large-scale capital expenditure on green building technologies, retrofitting existing structures for energy efficiency, and building climate-resilient infrastructure.

However, the market faces significant restraints that dampen potential growth. The most pervasive restraint is the persistent shortage of skilled labor across various construction trades, compounded by an aging workforce in developed nations. Secondly, volatility in raw material prices (steel, concrete, lumber) and supply chain disruptions, exacerbated by geopolitical instability and trade tariffs, frequently lead to project delays and cost overruns, undermining contractor profitability and increasing project risk. Regulatory complexities, including stringent zoning laws, lengthy permitting processes, and evolving environmental compliance standards, also act as formidable barriers to rapid project execution and innovation adoption.

Opportunities within the sector are abundant, primarily revolving around the adoption of innovative construction methods and digitalization. The growing acceptance of modular and prefabricated construction offers opportunities for increased efficiency, better quality control, and shorter construction timelines, effectively mitigating skilled labor shortages. The push towards smart buildings and Internet of Things (IoT) integration creates new service opportunities for contractors specializing in digital infrastructure. Crucially, the massive global transition towards renewable energy infrastructure (wind farms, solar plants, transmission lines) represents a multi-trillion-dollar opportunity for civil engineering and specialized industrial construction firms throughout the forecast period. The resultant impact forces are compelling the industry to professionalize its project management, invest heavily in technology training, and embrace sustainable materials to remain economically viable and meet societal demands for resilient and environmentally responsible infrastructure.

Segmentation Analysis

The Construction Market segmentation provides a granular view of demand patterns and structural components defining the industry landscape. The market is primarily segmented based on Type (Residential, Non-residential, Infrastructure, Industrial), Material (Aggregates, Cement, Steel, Wood), and Technology (BIM, Construction Management Software, Robotics). This detailed categorization allows for precise market sizing and forecasting, reflecting the diverse needs of end-users ranging from national governments requiring complex civil engineering solutions to private developers focused on sustainable commercial real estate. The Residential segment, while highly sensitive to interest rates and economic cycles, forms the largest volume segment globally. Conversely, the Infrastructure segment is characterized by higher capital expenditure and governmental backing, providing stability and driving innovation in large-scale engineering projects. Analyzing these segments is essential for identifying strategic investment areas and understanding the varied competitive dynamics within this highly diversified industry.

- By Type:

- Residential Construction (Single-family, Multi-family, Renovations)

- Non-residential Construction (Commercial, Institutional, Hospitality, Healthcare)

- Infrastructure Construction (Transport, Utilities, Energy, Communication)

- Industrial Construction (Manufacturing Facilities, Warehouses, Oil & Gas Infrastructure)

- By Material:

- Cement and Concrete

- Aggregates (Sand, Gravel, Crushed Stone)

- Steel and Metals

- Wood and Timber

- Chemicals and Advanced Materials

- By Technology:

- Building Information Modeling (BIM)

- Construction Management Software (Project Management, ERP)

- Advanced Equipment & Machinery (Robotics, 3D Printing)

- IoT and Telematics

- By Application/End-Use:

- Public Sector

- Private Sector

Value Chain Analysis For Construction Market

The construction market value chain is complex, starting with upstream activities involving material sourcing, manufacturing, and design services. Upstream analysis focuses on suppliers of key raw materials such as steel producers, cement manufacturers, and specialized component providers. These entities face pressure regarding sustainability compliance (e.g., green cement production), logistical efficiency, and volatile commodity pricing. Key upstream services include architectural design, structural engineering, and geotechnical studies, where digitalization via BIM and generative design tools is paramount for optimizing project feasibility and performance before physical construction begins. Strategic partnerships between design firms and material manufacturers are increasingly vital to ensure material specifications align with complex, sustainable building goals.

Midstream operations involve the core construction phase, encompassing site preparation, foundation work, framing, and installation of systems (mechanical, electrical, plumbing). This stage is characterized by intense project management, utilization of heavy machinery, and reliance on subcontractors specializing in various trades. Distribution channels for construction materials are critical, utilizing a mix of direct sales from large manufacturers to tier-one contractors, and indirect channels through specialized distributors and regional construction supply houses. The shift towards off-site and modular construction is redefining the midstream, moving a significant portion of labor and quality control into factory settings before final assembly on site.

Downstream analysis focuses on post-construction activities, including property handover, facility management (FM), operations, and eventual decommissioning or retrofit. Direct downstream engagement involves the contractor delivering the finished project to the end-user (e.g., a real estate developer or government agency). Indirect downstream influence involves the providers of smart building technologies and maintenance services, who utilize IoT data and analytics generated during the operational lifespan of the structure. The highest margin opportunities are increasingly found in the downstream phase, specifically in integrated facilities management and the provision of digital twins for long-term asset optimization and energy performance monitoring.

Construction Market Potential Customers

The construction market serves a highly diversified customer base, categorized primarily by the intended use and funding source of the project. Potential customers, or end-users/buyers, include sovereign and municipal governments (for infrastructure and public buildings), private commercial developers (for offices, retail centers, and industrial parks), industrial enterprises (for manufacturing plants and logistics hubs), and private citizens (for residential housing and home improvement projects). Governments are consistently the largest customers for civil engineering and large institutional projects, driven by public welfare mandates and economic stimulus objectives. Their purchasing decisions are heavily influenced by regulatory compliance, long-term operational costs, and political cycles.

Commercial developers represent sophisticated buyers seeking optimized design, quick turnaround times, and adherence to specific green building standards (e.g., LEED or BREEAM) to maximize asset valuation and attract high-value tenants. These customers prioritize construction firms that demonstrate proficiency in digital project delivery (BIM) and robust supply chain management to minimize financial risk associated with project delays. Industrial clients, such as those in the energy, mining, and manufacturing sectors, require highly specialized and safety-critical construction services for complex facilities, where engineering precision and compliance with international standards are paramount concerns, often leading to long-term, high-value contracts with niche contractors.

Finally, financial institutions and investors increasingly act as indirect but powerful customers, influencing project design and execution through financing requirements that mandate specific environmental, social, and governance (ESG) performance targets. The demand for resilient infrastructure and sustainable building portfolios is driving institutional capital towards construction projects that demonstrate superior long-term performance and lower carbon footprints. Thus, success in the construction market hinges on a contractor's ability to tailor their services to the specific risk tolerance, regulatory environment, and long-term asset management needs of these diverse end-user segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Trillion |

| Market Forecast in 2033 | $15.5 Trillion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | China State Construction Engineering Corporation, Vinci SA, Bechtel Corporation, Group ACS, Fluor Corporation, Skanska AB, Hochtief AG, Balfour Beatty plc, Bouygues Construction, Kiewit Corporation, Larsen & Toubro, PCL Construction Enterprises, Taisei Corporation, Shimizu Corporation, Samsung C&T Corporation, Strabag SE, Tekfen Construction, AECOM, Jacobs Engineering Group, Turner Construction Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Market Key Technology Landscape

The construction market's technological landscape is undergoing a profound transformation driven by the need for greater efficiency, safety, and data-driven decision-making. Building Information Modeling (BIM) remains the foundational technology, moving beyond 3D visualization to encompass 4D (time), 5D (cost), and 6D (sustainability/lifecycle management), integrating project data from design through demolition. Furthermore, Construction Management Software (CMS) platforms, often cloud-based, are essential for centralized documentation, workflow management, and real-time collaboration among geographically dispersed teams and numerous subcontractors, providing a single source of truth for complex project data. The shift to digital twins, where virtual replicas of physical assets are maintained post-construction, is gaining traction, enabling advanced simulation and predictive maintenance strategies that drastically reduce long-term operational costs.

Field technologies are rapidly evolving, integrating the physical site with the digital plan. The adoption of IoT sensors embedded in materials and machinery provides constant feedback on conditions like temperature, pressure, and structural stress, optimizing material curing and ensuring structural integrity. Drones and robotic systems are increasingly used for site mapping, topographic surveys, and monitoring construction progress, offering high-resolution data quickly and safely, minimizing the need for human personnel in hazardous areas. Wearable technology for workers enhances site safety by monitoring vital signs and detecting potential falls or proximity to heavy machinery, feeding critical data back into site management systems.

Another crucial innovation area is modular and prefabricated construction techniques, facilitated by automated factory environments using advanced robotics and precision manufacturing. This approach reduces waste, improves quality control, and significantly shortens the construction phase on site, addressing critical industry constraints like skilled labor shortages and environmental impact. The integration of 3D printing, especially for non-structural components or smaller residential projects, also represents a promising disruptive technology, potentially revolutionizing material usage and geometric freedom in design. Successful firms are those that can strategically combine these technologies into an integrated digital thread that runs across the entire project lifecycle, optimizing planning, execution, and long-term asset performance.

Regional Highlights

Regional growth patterns in the global construction market reflect varying stages of economic development, infrastructure needs, and regulatory frameworks focusing on sustainability and urban resilience. Asia Pacific (APAC) dominates the global market in terms of volume and growth potential, driven primarily by demographic pressures requiring extensive residential and social infrastructure development, particularly in emerging economies like India, Vietnam, and Indonesia. China remains a massive, albeit maturing, market focusing increasingly on internal efficiency and higher-value, specialized construction such as high-speed rail and smart cities. Regional policy support for large-scale urban infrastructure projects ensures consistent high-level investment throughout the forecast period.

North America and Europe represent mature markets characterized by replacement demand, renovation, and the construction of high-specification commercial and green buildings. In North America, public spending, particularly related to the modernization of aging civil infrastructure and energy grids, is a significant market driver. Europe is strongly influenced by stringent EU directives on energy performance and carbon neutrality, leading to robust growth in retrofitting services and sustainable construction materials, prioritizing Net Zero strategies over pure volume expansion. These regions exhibit higher adoption rates of advanced technologies like BIM, modular construction, and AI-driven project management, due to higher labor costs and strict quality control requirements.

The Middle East and Africa (MEA) region presents a dynamic yet volatile market, heavily reliant on sovereign investments in diversification programs, particularly in Saudi Arabia and the UAE (e.g., NEOM, Dubai World Expo follow-up projects). These nations are undertaking mega-projects that require specialized international expertise and high-technology applications. African construction markets are driven by rapid population growth and the fundamental need for basic infrastructure (power, water, transportation), often supported by international development financing. Latin America faces economic challenges but sees steady demand in residential housing and infrastructure concessions, with Brazil and Mexico being the largest regional contributors, focusing on sustainable and resource-efficient construction solutions to manage operational costs and environmental impact.

- Asia Pacific (APAC): Highest growth rate, fueled by rapid urbanization, massive infrastructure development (e.g., high-speed rail networks, smart city initiatives), and increasing investment in residential construction in emerging economies.

- North America: Strong market driven by infrastructure modernization, commercial retrofitting for energy efficiency, and high adoption of digital construction technologies (BIM and modular building).

- Europe: Growth concentrated in sustainability-driven renovation, compliance with strict carbon neutrality standards, and investment in sophisticated public transport systems.

- Middle East and Africa (MEA): High-value, concentrated growth from mega-projects funded by state wealth funds (e.g., tourism, energy diversification), alongside critical basic infrastructure needs in sub-Saharan Africa.

- Latin America: Steady demand in mining, energy infrastructure, and residential development, sensitive to commodity price fluctuations and political stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Market.- China State Construction Engineering Corporation

- Vinci SA

- Bechtel Corporation

- Group ACS (Actividades de Construcción y Servicios)

- Fluor Corporation

- Skanska AB

- Hochtief AG

- Balfour Beatty plc

- Bouygues Construction

- Kiewit Corporation

- Larsen & Toubro

- PCL Construction Enterprises

- Taisei Corporation

- Shimizu Corporation

- Samsung C&T Corporation

- Strabag SE

- Tekfen Construction

- AECOM

- Jacobs Engineering Group

- Turner Construction Company

Frequently Asked Questions

Analyze common user questions about the Construction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the global construction market?

The primary global growth driver is the convergence of rapid urbanization in emerging economies and substantial governmental investments in infrastructure modernization and replacement projects (roads, utilities, energy grids) worldwide. Additionally, the mandated shift toward sustainable and net-zero building standards significantly increases project value and complexity.

How is technology reshaping traditional construction methods?

Technology is causing a shift from traditional site-based methods to highly optimized, factory-based construction models. Key technologies like Building Information Modeling (BIM) 5D/6D, Artificial Intelligence (AI) for predictive analytics, and modular/prefabricated construction are enhancing project efficiency, reducing waste, and mitigating the pervasive skilled labor shortage.

What are the major challenges facing the construction industry in developed economies?

Developed economies primarily struggle with an acute shortage of skilled labor, high and volatile material costs stemming from global supply chain risks, and the complex challenge of complying with stringent environmental, social, and governance (ESG) regulations, particularly related to carbon emissions and circular economy principles in existing building stock.

Which geographical region offers the most significant new construction opportunities?

The Asia Pacific (APAC) region, driven by countries such as India and Indonesia, offers the most significant volume of new construction opportunities, particularly in residential and fundamental public infrastructure segments, supported by strong population growth and continued government spending on foundational economic assets.

What role does sustainability play in future construction contracts and procurement?

Sustainability is moving from a niche requirement to a core mandate. It drives procurement decisions toward low-carbon materials, dictates design through energy efficiency requirements (Net Zero standards), and influences financing, with investors increasingly favoring construction companies that utilize green building certification and resilient design practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Energy and Utilities Construction Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- AECO (Architectural Engineering, Construction and Operation) Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Construction Adhesives & Sealants Chemical Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Infrastructure Construction Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Engineering, Procurement & Construction Management Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager