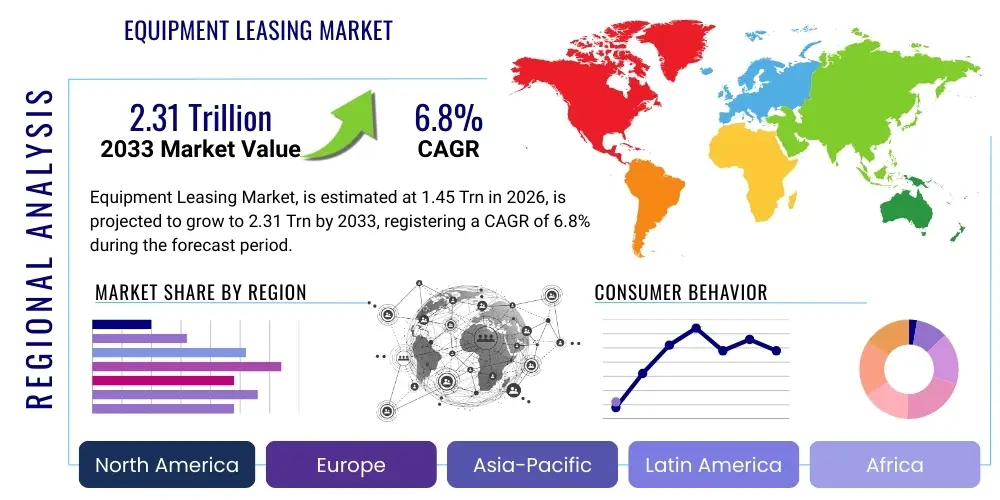

Equipment Leasing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441362 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Equipment Leasing Market Size

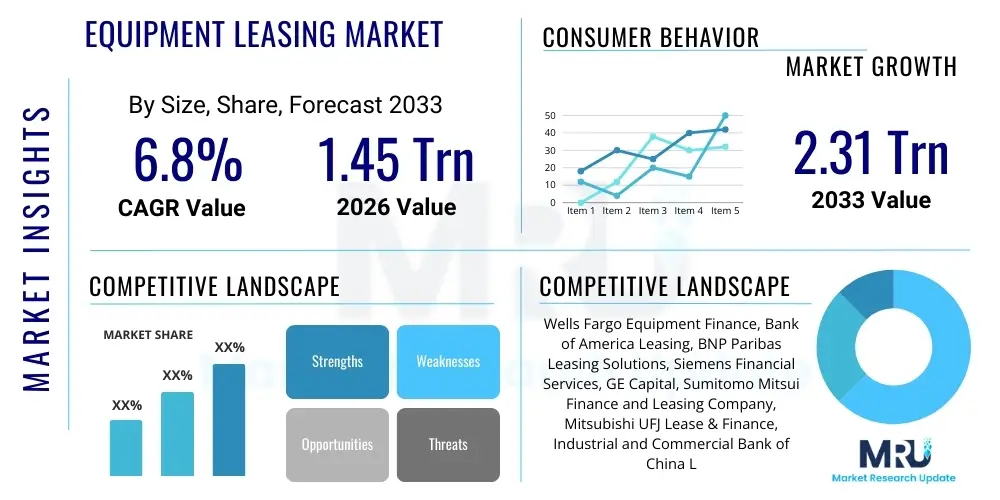

The Equipment Leasing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.45 Trillion in 2026 and is projected to reach USD 2.31 Trillion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing need for capital expenditure flexibility among Small and Medium Enterprises (SMEs) and large corporations seeking to manage their balance sheets more efficiently by avoiding outright asset purchases. Economic volatility and the rapid obsolescence of technology necessitate flexible acquisition models, positioning leasing as a preferred financial strategy across diverse industrial sectors globally. The stability provided by structured leasing contracts, coupled with the ability to frequently upgrade mission-critical machinery, further solidifies this upward trajectory.

Equipment Leasing Market introduction

The Equipment Leasing Market encompasses financial services where assets, ranging from heavy machinery and specialized transportation vehicles to high-end IT and medical devices, are rented out or leased to businesses for a predefined period. This arrangement allows companies to gain access to necessary capital goods without the large upfront investment traditionally required for ownership. The product description spans two primary types: operating leases, which treat the asset as off-balance sheet and often include maintenance, and financial leases (capital leases), which function more like a secured loan, transferring the risks and rewards of ownership to the lessee. Major applications cut across nearly every industry, including construction, manufacturing, healthcare, aviation, and information technology, where timely access to cutting-edge equipment is a critical determinant of competitive advantage.

The core benefits of equipment leasing include improved cash flow management, enhanced balance sheet liquidity by preserving capital, tax advantages (deductibility of lease payments), and mitigation of asset obsolescence risk, especially pertinent in fast-evolving sectors like IT and robotics. Furthermore, leasing often provides immediate access to 100% financing, simplifying the procurement process compared to traditional bank loans. These inherent financial and operational advantages make leasing an indispensable tool for companies aiming for operational agility and sustained growth without overburdening their debt structure. The accessibility of these financing options fuels the ability of nascent and established businesses alike to scale operations efficiently.

Driving factors for this market expansion include global industrialization, particularly in emerging economies, which necessitates massive investments in infrastructure and production capacity. The cyclical nature of technological innovation, demanding frequent equipment upgrades (especially in sectors like chip manufacturing and medical diagnostics), strongly favors flexible leasing models. Government incentives supporting SME growth and capital investment, coupled with favorable accounting standards (such as adjustments under IFRS 16 and ASC 842), further stimulate demand. Additionally, the shift towards usage-based economic models and the growing acceptance of asset-light strategies among corporate entities solidify the foundational growth drivers of the equipment leasing industry. The complexity of modern machinery maintenance also often drives companies to opt for bundled operating leases.

Equipment Leasing Market Executive Summary

The global Equipment Leasing Market is characterized by robust growth driven primarily by macroeconomic stability, favorable interest rate environments conducive to financing, and widespread corporate adoption of asset-light strategies across North America and Europe. Business trends indicate a strong move towards specialized leasing, focusing on high-value, technology-intensive assets like aerospace components and advanced manufacturing equipment, which demand sophisticated maintenance and shorter replacement cycles. Furthermore, vendors are increasingly integrating ancillary services, such as predictive maintenance, insurance, and fleet management solutions, into lease agreements, transitioning from pure financing providers to comprehensive asset management partners. This trend enhances customer stickiness and justifies higher yields for leasing companies capable of offering end-to-end solutions, thereby restructuring traditional competitive landscapes.

Regional trends reveal the Asia Pacific (APAC) region, led by China and India, as the fastest-growing market segment, fueled by massive infrastructure projects, burgeoning manufacturing sectors, and rapidly expanding small and medium-sized enterprises (SMEs) that require quick, capital-efficient access to production machinery. North America maintains its position as the largest market due to its high penetration of financial leases, advanced legal frameworks, and the significant presence of globally dominant leasing corporations and financial institutions. European markets are characterized by stringent regulatory environments but exhibit consistent demand, largely driven by environmental standards requiring frequent fleet and equipment renewal in transportation and logistics sectors, favoring operating leases for compliance management.

Segmentation trends highlight the dominance of the IT & Computers segment within the End-User vertical, reflecting the pervasive need for timely hardware refreshment in the digital economy. By Lease Type, financial leases currently hold a larger market share due to the long-term strategic needs of heavy industries, yet operating leases are gaining momentum, particularly in highly dynamic sectors where minimizing balance sheet liability and mitigating obsolescence risk are paramount. The emergence of usage-based and short-term rental models within the operating lease category represents a significant structural shift, allowing businesses unprecedented flexibility and aligning costs directly with actual asset utilization, optimizing procurement strategies across the entire organizational spectrum. The diversification of financing options across different asset classes continues to be a defining characteristic of market development.

AI Impact Analysis on Equipment Leasing Market

User queries regarding AI's impact on Equipment Leasing frequently center on its role in risk assessment, optimizing pricing models, and automating the entire lease lifecycle, from origination to end-of-term management. Users are concerned with how AI-driven predictive maintenance will affect residual value forecasting, potentially leading to more accurate and competitive lease terms. They also seek information on the integration of AI in assessing creditworthiness of lessees and mitigating default risks using sophisticated behavioral and financial data analysis. A key theme revolves around AI's capability to provide hyper-personalized lease agreements and improve customer experience through intelligent chatbots and automated documentation processes, addressing the need for efficiency and responsiveness in high-volume leasing operations. The common expectation is that AI will fundamentally transform the industry, moving it towards proactive, data-driven decision-making, while concerns linger about data privacy and the accuracy of complex residual value predictions based on machine learning models.

- Residual Value Forecasting Optimization: AI algorithms analyze historical maintenance data, utilization rates, and secondary market pricing to provide highly accurate residual value predictions, minimizing financial risk for lessors.

- Credit Risk Assessment Enhancement: Machine learning models leverage vast datasets, including non-traditional financial indicators, to assess lessee creditworthiness more rapidly and accurately, improving default rate management.

- Predictive Maintenance Integration: AI-powered IoT sensors embedded in leased equipment enable predictive maintenance scheduling, reducing downtime, extending asset life, and supporting better lease structuring.

- Automated Lease Origination and Underwriting: Utilizing natural language processing (NLP) and computer vision for automated document processing and contract generation, significantly speeding up the time-to-funding.

- Dynamic Pricing Strategy: AI enables real-time adjustment of lease rates based on demand fluctuations, competitor pricing, and specific asset utilization forecasts, maximizing profitability per asset.

- Fraud Detection and Compliance: Advanced analytics systems monitor transaction patterns and documentation for anomalies, strengthening regulatory compliance and minimizing fraudulent activities across the leasing portfolio.

- Customer Experience Personalization: AI-driven chatbots and recommendation engines offer tailored financing options and immediate customer support, enhancing service quality and retention.

DRO & Impact Forces Of Equipment Leasing Market

The Equipment Leasing Market's trajectory is primarily propelled by strong macroeconomic Drivers, notably the universal need for capital expenditure conservation among businesses of all sizes, coupled with technological dynamism that necessitates frequent asset renewal. Restraints, however, include fluctuating global interest rates, which directly impact the cost of funds for lessors, making leasing less attractive when borrowing costs surge. High levels of geopolitical instability also introduce uncertainty, curbing long-term capital investment. Opportunities are abundant, specifically through the digitalization of leasing processes (FinTech integration) and the expansion of specialized leasing models targeting niche, high-growth sectors such as renewables, robotics, and advanced biotech equipment. The collective influence of these factors shapes the market dynamics, dictating investment strategies and operational flexibility within the leasing ecosystem, pushing lessors toward innovative financial products.

Drivers: The dominant driver is the shift towards asset-light business models, where corporations prioritize core competencies and outsource asset management. This is powerfully supported by technological obsolescence, especially in IT and manufacturing, forcing rapid equipment turnover. Favorable tax treatments in many jurisdictions, allowing the expensing of lease payments, provide significant financial incentives. Furthermore, the increasing complexity and cost of modern industrial machinery mean that outright purchase is often financially prohibitive for SMEs, making leasing a critical gateway to advanced technology adoption. The expansion of global infrastructure projects, particularly in transportation and energy, continuously fuels demand for leased construction and heavy-duty equipment.

Restraints: Significant restraints include the inherent exposure of lessors to residual value risk—the uncertainty of an asset's worth at the end of the lease term—which can lead to substantial losses if market conditions deteriorate or technology advances faster than anticipated. Regulatory compliance burdens, particularly varying accounting standards across different international territories, add complexity and cost to cross-border operations. Moreover, intense competition from traditional banks offering secured loans and specialized captive finance companies often limits pricing power for independent lessors. Economic downturns, which increase lessee default rates and decrease demand for new capital investment, pose a systemic risk to the stability and profitability of the leasing sector.

Opportunities: The primary opportunities lie in the adoption of subscription-based or "Equipment-as-a-Service" (EaaS) models, moving beyond traditional leases to offer holistic equipment provision and maintenance bundles, capitalizing on the circular economy trend. Geographical expansion into untapped emerging markets, characterized by rapid industrial growth and limited local financing options, presents lucrative prospects. The integration of advanced digital technologies, including blockchain for contract management and IoT for real-time asset tracking and utilization monitoring, dramatically improves operational efficiency and reduces administrative overhead. Specialty leasing focusing on assets critical to the energy transition (e.g., wind turbines, battery storage equipment) provides a high-growth, resilience-focused avenue for diversification and market leadership.

Segmentation Analysis

The Equipment Leasing Market is critically segmented based on various operational and financial parameters, including Equipment Type, End-User Industry, and Lease Type, allowing for precise market targeting and strategic analysis. The Equipment Type segmentation divides the market based on the physical nature of the leased asset, recognizing unique financing and maintenance requirements for heavy machinery versus high-turnover IT equipment. The End-User analysis focuses on vertical demand patterns, reflecting the differential impact of leasing across diverse sectors such as manufacturing, transportation, and healthcare. Meanwhile, Lease Type differentiates between operating leases (short-term, off-balance sheet) and financial leases (long-term, capital intensive), reflecting varied strategic financial needs of corporate lessees. These segmentations are vital for understanding the underlying competitive dynamics and identifying areas of rapid commercialization and regulatory change, driving specialized product development and geographical expansion strategies.

- By Equipment Type:

- IT & Computers

- Industrial & Manufacturing Equipment

- Construction & Heavy Machinery

- Transportation (Fleet & Aviation)

- Medical Equipment

- Others (Agricultural, Office Furniture)

- By Lease Type:

- Financial Lease (Capital Lease)

- Operating Lease (True Lease)

- Synthetic Lease

- By End-User:

- SMEs (Small and Medium Enterprises)

- Large Enterprises

- Government/Public Sector

- By Industry Vertical:

- Manufacturing

- Transportation and Logistics

- Healthcare

- Information Technology & Telecom

- Construction

- Energy & Utilities

- Retail and Consumer Goods

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France)

- Asia Pacific (China, Japan, India)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Equipment Leasing Market

The value chain of the Equipment Leasing Market begins with the Upstream Analysis, which involves the acquisition of the asset. This stage is dominated by equipment manufacturers and authorized distributors (OEMs) who supply the physical goods to the lessors. Lessors, who are the core financial institutions (banks, captive finance companies, independent lessors), play a pivotal role in structuring the financing, performing risk assessment, and managing the legal complexities of the lease agreement. Their efficiency in sourcing capital and negotiating bulk purchase discounts from OEMs directly impacts the competitiveness of their lease rates. The relationship between lessors and manufacturers is increasingly symbiotic, particularly for captive finance arms, which use leasing as a strategic tool to drive equipment sales and market share, ensuring continuous product flow and high asset quality for subsequent leasing operations.

The Midstream component focuses on the leasing transaction itself, encompassing credit underwriting, contract origination, legal compliance, and ongoing asset management (maintenance coordination, tracking). Distribution channels are critical here, typically involving Direct sales channels where the lessor engages directly with the end-user, often used for large, complex transactions. Conversely, Indirect channels involve intermediaries, such as brokers, independent finance agents, or through the OEM’s distribution network (vendor finance programs). The increasing digitalization of the origination process through online portals and automated underwriting systems is streamlining this midstream element, drastically reducing turnaround times and operational costs, thereby enhancing the overall efficiency of the distribution network and improving the scalability of leasing operations across diverse geographical regions.

The Downstream analysis focuses on the end-of-term management and the subsequent remarketing of the used equipment. Once the lease expires, the lessor is responsible for determining the asset's residual value, managing its retrieval, reconditioning, and eventual sale or re-lease in the secondary market. The effectiveness of this downstream process is crucial, as the residual value recovery forms a significant portion of the lessor’s profitability model, particularly for operating leases. Efficient remarketing, often leveraging specialized auction houses, digital platforms, or direct manufacturer buyback agreements, minimizes losses and mitigates residual value risk. The quality of asset tracking and maintenance performed throughout the lease term directly impacts the final recovered value, linking the upstream sourcing strategy to the ultimate profitability realized downstream.

Equipment Leasing Market Potential Customers

The primary End-Users or buyers of equipment leasing services are universally categorized into Small and Medium Enterprises (SMEs) and Large Enterprises across various industry verticals. SMEs represent a critical, high-growth customer segment, often lacking the substantial capital reserves required for outright purchases, making leasing an essential mechanism for accessing sophisticated machinery and scaling operations without immediate debt strain. For these smaller businesses, the operating lease offers flexibility, immediate tax deductions, and off-balance sheet treatment, vital for maintaining healthy financial ratios and attracting further investment. Their demand is highly sensitive to local economic conditions and government financing support programs, making them a volatile yet lucrative segment requiring tailored financing solutions and simplified application processes.

Conversely, Large Enterprises, while having greater financial capacity, utilize equipment leasing strategically. Their motivation is less about capital scarcity and more about optimizing capital structure, maximizing tax advantages, and mitigating technology obsolescence risk associated with high-value, high-turnover assets (like aircraft or complex IT infrastructure). Large corporations frequently utilize structured financial leases for long-term strategic assets and operating leases for assets requiring frequent upgrades, ensuring their technology base remains cutting-edge without tying up shareholder capital in depreciating assets. Sectors like global logistics, large-scale manufacturing, and specialized healthcare providers are consistently the heaviest users, demanding comprehensive, customized master lease agreements that cover entire fleets or technology cycles across multiple international jurisdictions.

Beyond the corporate structure, specialized sectors constitute significant customer bases. The construction industry consistently relies on leased heavy machinery (cranes, excavators) to manage fluctuating project demands and avoid high storage and maintenance costs during non-peak seasons. The healthcare sector, driven by rapid advancements in imaging and surgical technology, frequently leases state-of-the-art medical devices to ensure patient care standards are met while managing the substantial capital expenditure associated with MRI machines and robotic surgery systems. Similarly, the transportation sector, including shipping and trucking companies, relies heavily on fleet leasing to manage regulatory compliance, fleet turnover, and seasonal demand volatility, making these specialized verticals crucial focal points for lessors offering specific domain expertise and integrated maintenance packages.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.45 Trillion |

| Market Forecast in 2033 | USD 2.31 Trillion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wells Fargo Equipment Finance, Bank of America Leasing, BNP Paribas Leasing Solutions, Siemens Financial Services, GE Capital, Sumitomo Mitsui Finance and Leasing Company, Mitsubishi UFJ Lease & Finance, Industrial and Commercial Bank of China Leasing, DLL (De Lage Landen), U.S. Bancorp, CIT Group, Commerce Bank, TIAA Bank, CHG-MERIDIAN, Société Générale Equipment Finance, Volvo Financial Services, Toyota Financial Services, Caterpillar Financial, Cisco Systems Capital, IBM Global Financing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Equipment Leasing Market Key Technology Landscape

The equipment leasing sector is undergoing a profound technological transformation, moving away from legacy paper-based processes towards hyper-efficient digital platforms. Key technologies driving this change include advanced Enterprise Resource Planning (ERP) systems specifically tailored for asset finance, which integrate customer relationship management (CRM), risk assessment, and general ledger functions, providing a single source of truth for all portfolio data. Furthermore, the adoption of specialized Lease Management Software (LMS) is crucial for automating complex calculations related to interest accrual, depreciation schedules, and adherence to evolving international accounting standards (IFRS 16/ASC 842). These systems ensure regulatory compliance and drastically reduce the administrative overhead associated with managing millions of lease contracts simultaneously across multiple jurisdictions, significantly lowering the cost-to-serve ratio for lessors.

The emergence of the Internet of Things (IoT) and telematics represents a paradigm shift in managing physical assets. IoT sensors embedded within leased equipment, particularly in transportation and construction, provide real-time data on asset location, operational status, utilization rates, and machine health. This data is leveraged for usage-based billing models, optimizing maintenance schedules through predictive analytics, and crucially, improving the accuracy of residual value calculations. By understanding the true wear-and-tear condition of an asset, lessors can structure more competitive and less risky lease agreements. Moreover, the integration of telematics facilitates stringent compliance with stipulated operating boundaries, minimizing asset misuse and unauthorized secondary uses, thereby protecting the lessor’s collateral throughout the lease duration.

Financial technology (FinTech) innovations, particularly the use of Artificial Intelligence (AI) and blockchain, are further revolutionizing the operational and security aspects of equipment leasing. AI and machine learning are deployed for advanced credit scoring, moving beyond traditional metrics to assess the behavioral and market risk of lessees, leading to faster, more granular underwriting decisions. Blockchain technology is beginning to be explored for creating immutable, transparent, and secure digital lease contracts (smart contracts), potentially eliminating the need for extensive third-party legal verification and streamlining cross-border transactions. This blend of operational software efficiency, real-time asset intelligence, and cutting-edge financial security infrastructure is establishing a new standard for competitiveness, favoring firms that invest heavily in digitalizing their end-to-end leasing lifecycle management capabilities.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share due to its mature financial infrastructure, high penetration of structured finance products, and favorable tax environment that encourages leasing. The region is characterized by high demand across specialized sectors like aviation, high-tech manufacturing, and advanced medical device leasing. The market benefits from the presence of major global financial institutions and captive finance companies, which drive innovation in lease products and aggressively promote vendor finance programs. High corporate liquidity and stable interest rates generally support large-scale financial lease arrangements, while the rapid pace of technological change maintains a strong demand for operating leases in IT and software sectors, reinforcing the region's position as a global leader in leasing volume and complexity.

- Europe: Europe is a highly segmented market, influenced heavily by regional economic performance and varying national regulatory frameworks, particularly surrounding depreciation rules and accounting standards. Germany and the United Kingdom are core contributors, showcasing strong demand from the automotive, machinery, and logistics sectors. The European market exhibits a preference for operating leases, largely driven by environmental regulations (e.g., EU emissions standards) that necessitate frequent fleet replacement, making flexibility and low capital commitment paramount. The rise of green leasing—financing specialized equipment for renewable energy and sustainable manufacturing—is a prominent emerging trend, propelled by EU directives and state-level incentives aimed at achieving net-zero carbon targets, creating niche market opportunities.

- Asia Pacific (APAC): APAC is the fastest-growing region, experiencing exponential expansion driven by massive infrastructure investments in countries like China and India, and the rapid industrialization across Southeast Asia. The region’s growth is fundamentally linked to the expansion of its manufacturing base and the increasing sophistication of its supply chain and logistics networks. While financial leases dominate transactions involving heavy, long-life assets (construction equipment, factory machinery), the SME sector's reliance on leasing to overcome initial capital hurdles is driving overall volume. Market growth is also fueled by government efforts to liberalize financial markets and the entry of global lessors seeking to capitalize on the region's high industrial output growth and rising capital expenditure needs.

- Latin America (LATAM): The LATAM market faces challenges due to currency volatility, higher interest rates, and often complex legal and tax environments, yet it offers significant growth potential, particularly in Brazil and Mexico. Demand is concentrated in mining, energy, and commercial transportation sectors. Lessors often employ shorter lease terms and require enhanced security measures due to the higher perceived risk. The gradual modernization of financial laws and the increasing stability of key economies are slowly attracting international lessors who are willing to navigate the complexities for access to the substantial resource and consumer base, focusing primarily on high-yield, secured transactions.

- Middle East and Africa (MEA): The MEA region’s leasing market is driven primarily by large-scale government-backed projects, especially in the GCC states (UAE, Saudi Arabia) related to infrastructure, tourism, and energy diversification (non-oil sectors). Demand for specialized equipment leasing, particularly in construction and aviation, remains strong. In Africa, the market is nascent but rapidly developing, focusing on agricultural equipment and telecommunications infrastructure leasing, supported by multilateral development bank financing and increasing foreign direct investment aiming to improve local operational capabilities. Sharia-compliant leasing models (Ijara) represent a specialized and growing segment catering to regional financial requirements, providing a distinct competitive edge to locally focused financial institutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Equipment Leasing Market.- Wells Fargo Equipment Finance

- Bank of America Leasing

- BNP Paribas Leasing Solutions

- Siemens Financial Services

- GE Capital

- Sumitomo Mitsui Finance and Leasing Company

- Mitsubishi UFJ Lease & Finance

- Industrial and Commercial Bank of China Leasing

- DLL (De Lage Landen)

- U.S. Bancorp

- CIT Group

- Commerce Bank

- TIAA Bank

- CHG-MERIDIAN

- Société Générale Equipment Finance

- Volvo Financial Services

- Toyota Financial Services

- Caterpillar Financial

- Cisco Systems Capital

- IBM Global Financing

Frequently Asked Questions

Analyze common user questions about the Equipment Leasing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between an operating lease and a financial lease?

The primary difference lies in risk and accounting treatment. An Operating Lease (True Lease) is short-term, generally does not transfer asset ownership risk, and is treated as off-balance sheet expense, making it favorable for mitigating obsolescence risk. A Financial Lease (Capital Lease) is long-term, transfers most risks and rewards of ownership to the lessee, and is capitalized on the balance sheet as an asset and a liability, functioning economically similar to a debt-financed purchase.

How does the adoption of new accounting standards (IFRS 16 and ASC 842) impact the Equipment Leasing Market?

IFRS 16 and ASC 842 mandated that most operating leases must now be recognized on the balance sheet, significantly increasing the reported assets and liabilities for lessees. This change has led companies to carefully re-evaluate their lease versus buy decisions, driving increased demand for shorter, usage-based contracts and prompting lessors to innovate in how lease agreements are structured and presented to minimize financial statement impact while ensuring regulatory compliance.

What role does technology play in mitigating residual value risk for equipment lessors?

Technology, particularly IoT and predictive analytics, is crucial for residual value mitigation. IoT sensors provide real-time data on asset utilization, maintenance history, and operational stress, enabling lessors to more accurately forecast the equipment’s condition and market value at the end of the lease term. This data-driven approach reduces uncertainty, allows for dynamic pricing, and maximizes the realized value during the asset remarketing process, improving portfolio profitability.

Which geographical region is expected to demonstrate the highest growth rate in equipment leasing?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by extensive government-led infrastructure development, burgeoning manufacturing sectors in countries like China and India, and a growing population of Small and Medium Enterprises (SMEs) requiring flexible financing options to support rapid industrial expansion and modernization efforts across key economic hubs.

How are Equipment-as-a-Service (EaaS) models transforming traditional equipment leasing?

EaaS transforms leasing from a simple financing arrangement into a complete service solution. Under EaaS, customers pay for the performance or output of the equipment, not just its use, with the lessor retaining full ownership and responsibility for maintenance, repairs, and technological upgrades. This shift reduces the lessee's operational burden and capital risk, aligning business costs directly with output, which is particularly appealing for highly specialized or rapidly evolving technology assets like robotics and industrial automation systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Equipment Leasing Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- General office Equipment Leasing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Healthcare Equipment Leasing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager