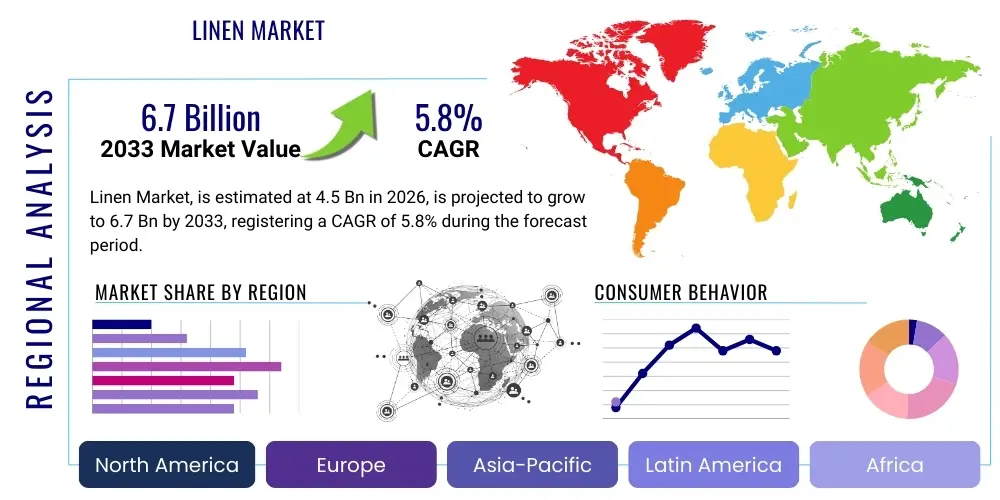

Linen Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441860 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Linen Market Size

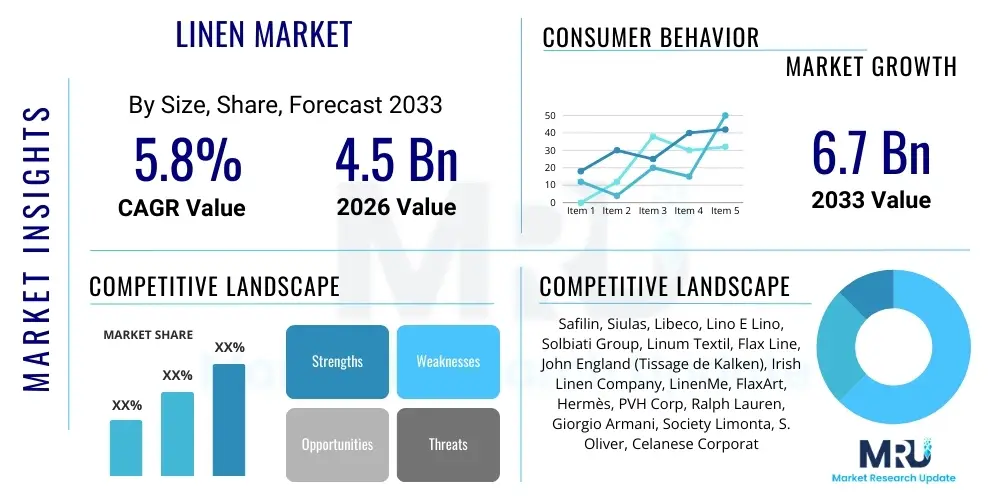

The Linen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% (CAGR) between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global consumer preference for sustainable and natural textiles, particularly in high-end apparel and luxury home furnishings sectors. The inherent attributes of linen—durability, breathability, and natural luster—position it strongly against synthetic alternatives, bolstering its adoption across residential and commercial applications.

The market expansion is also significantly influenced by shifts in global fashion trends favoring organic and environmentally conscious materials. As regulatory frameworks tighten concerning synthetic material production and disposal, linen offers manufacturers a viable, biodegradable alternative. Investment in advanced processing technologies, particularly those aimed at reducing the wrinkling characteristic of linen and improving fiber spinning efficiency, is expected to mitigate historical production challenges and open new avenues for market penetration into mainstream segments previously dominated by cotton or polyester blends.

Furthermore, the diversification of linen applications beyond traditional bedding and shirting—into performance textiles, technical nonwovens, and specialized composites—provides a substantial growth opportunity. Emerging economies, particularly in Asia Pacific, are experiencing rising disposable incomes and rapid urbanization, leading to increased consumer spending on premium interior decor and ethical fashion. These demographic and economic shifts collectively underpin the projected robust financial valuation and steady CAGR throughout the forecast period, cementing linen’s status as a critical player in the global sustainable textile supply chain.

Linen Market introduction

The Linen Market encompasses the production, processing, and distribution of textiles derived from the fibers of the flax plant (Linum usitatissimum). As one of the oldest cultivated natural fibers globally, linen is renowned for its exceptional strength, coolness, absorbency, and natural resistance to bacteria and pests. The product is highly valued across various industries, primarily categorized into home textiles (such as bedding, table linen, and upholstery), apparel (including premium shirts, suits, and dresses), and industrial applications (including canvas, specialized paper, and composite materials). Its inherent biodegradable nature and minimal environmental footprint during cultivation, compared to other fibers, align perfectly with contemporary global sustainability imperatives, driving its increased adoption among environmentally conscious brands and consumers.

Major applications of linen span across residential, commercial (hospitality and healthcare), and fashion sectors. In hospitality, its durability and aesthetic appeal make it ideal for high-traffic environments, while in healthcare, its hypo-allergenic properties are highly desirable. The increasing popularity of ‘slow fashion’ and artisanal crafting has revitalized interest in pure, high-quality linen garments. The primary benefits of linen include its ability to wick moisture away from the body, its natural insulation capabilities, and its unique visual texture which improves with age and washing. These performance characteristics ensure high customer satisfaction and repeat purchase intent across premium market tiers.

Key driving factors propelling the market include the persistent consumer demand for luxurious, natural fibers, coupled with global regulatory pressures favoring sustainable sourcing. Technological advancements in enzyme retting and mechanical processing have improved fiber yield and quality while simultaneously reducing the reliance on chemical treatments. Moreover, effective marketing campaigns emphasizing linen’s heritage, comfort, and eco-friendliness are successfully expanding its consumer base beyond traditional demographics, positioning the fiber as a staple material for modern, sustainable living and design. The increasing vertical integration within the supply chain, from flax cultivation to finished textile manufacturing, also enhances quality control and accelerates market responsiveness.

Linen Market Executive Summary

The global Linen Market is characterized by robust growth, primarily fueled by strong business trends centered on sustainability, premiumization, and supply chain transparency. A notable business trend involves major apparel and home furnishing brands prioritizing traceability and ethical sourcing, leading to dedicated investments in European flax farming and processing infrastructure, thereby ensuring a verifiable, high-quality supply chain. Furthermore, product innovation focusing on linen blends that minimize creasing while retaining breathability is a key strategic imperative, allowing linen to penetrate everyday wear categories. The market exhibits resilience against economic downturns, especially in the luxury segment where consumer willingness to pay a premium for natural, durable goods remains high, offsetting the higher cost associated with linen production compared to cotton or synthetic materials.

Regionally, Europe maintains its dominance due to historical expertise in flax cultivation (particularly France, Belgium, and the Netherlands) and a highly mature textile manufacturing base, coupled with stringent environmental regulations that favor natural fibers. Asia Pacific, however, represents the fastest-growing regional market, driven by rapidly expanding domestic luxury consumption, increasing awareness of sustainable textiles in China and India, and rising operational capacity in textile processing hubs. North America demonstrates consistent demand, heavily influenced by residential interior design trends emphasizing natural, minimalist aesthetics, alongside a high propensity for direct-to-consumer (DTC) sales channels specializing in premium bedding and casual linen wear.

Segmentation trends indicate that the Home Textiles segment, specifically premium bedding and kitchen linen, holds the largest market share due to its extended product lifecycle and high replacement frequency in commercial settings (hotels). Conversely, the Technical Textiles segment, though smaller, is projected to register the highest CAGR, propelled by the use of flax fibers in automotive composites, geotextiles, and specialized industrial nonwovens, leveraging the fiber's strength and lightweight characteristics. The Pure Linen segment continues to command a premium, but blended linen is gaining traction, offering a balance between cost, performance, and aesthetic appeal, particularly attractive to mass-market and high-street fashion retailers seeking competitive pricing.

AI Impact Analysis on Linen Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Linen Market primarily revolve around optimizing the complex agricultural phase, improving manufacturing efficiency, and enhancing consumer personalization. Key themes observed include concerns about how AI can predict flax crop yields under variable climate conditions, whether machine learning can optimize the delicate retting process (fiber separation) to maintain quality consistency, and the potential for AI-driven design tools to forecast textile trends and minimize material waste. Users are particularly keen on AI’s role in ensuring the traceability and authenticity of premium linen, especially concerning verifying European Flax certification through digital ledger technologies integrated with AI analytics. Expectations are high for AI to reduce the overall production cost, thereby making linen more competitive against synthetics, and to revolutionize inventory management based on precise demand forecasting.

The application of predictive analytics, powered by AI, is fundamentally transforming flax farming practices. Farmers are utilizing AI models that integrate real-time data from weather stations, soil sensors, and satellite imagery to optimize irrigation, fertilization, and pest control schedules, significantly improving crop yield and consistency while minimizing resource utilization. In the manufacturing phase, computer vision systems and machine learning algorithms are employed for quality inspection, rapidly identifying defects in spun yarn or woven fabric that human inspectors might miss, leading to superior final product quality. This meticulous level of quality control is paramount for maintaining linen’s reputation as a luxury fiber.

Furthermore, AI-driven solutions are crucial in consumer-facing aspects. Personalized recommendation engines analyze consumer purchase histories, preferred textures, and style preferences to suggest specific linen products, boosting conversion rates for online retailers. Supply chain management benefits immensely from AI, using algorithms to predict bottlenecks, optimize logistics routes for fiber transportation and finished goods distribution, and ensure transparency by integrating blockchain records with real-time tracking data. This holistic AI integration across the value chain promises increased efficiency, reduced environmental impact, and enhanced customer experience.

- AI-driven precision agriculture optimizes flax cultivation, maximizing yield and reducing water/pesticide usage through predictive modeling.

- Machine learning algorithms enhance the efficiency and consistency of the retting and scutching processes, critical steps in fiber extraction.

- Computer vision systems are deployed for automated, high-precision quality control in spinning and weaving, ensuring defect-free premium textiles.

- AI integration with blockchain technology improves supply chain traceability, validating the origin and authenticity of certified flax fibers.

- Predictive analytics optimize inventory levels, minimizing overstocking and reducing fabric waste based on highly accurate demand forecasts.

- Generative AI assists designers in rapidly prototyping new linen textile patterns and identifying emerging consumer aesthetic trends.

DRO & Impact Forces Of Linen Market

The Linen Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary driver is the pervasive global trend toward sustainable consumption and ethical sourcing, compelling consumers and corporations alike to favor biodegradable, natural fibers. This is complemented by the fiber’s intrinsic superior attributes, such as its exceptional durability, hypo-allergenic properties, and comfort, especially in warm climates. Conversely, the market faces notable restraints, chiefly the high production cost and time-intensive nature of flax cultivation and processing (particularly traditional retting), which results in a significantly higher price point compared to mass-produced cotton or synthetic textiles. Additionally, the fiber's inherent propensity to wrinkle necessitates specific care instructions, sometimes deterring everyday consumers, although advancements in blending techniques are starting to mitigate this issue.

Opportunities for growth are abundant, particularly through technological innovation and market diversification. The development of specialized technical textiles, utilizing flax fibers in composite materials for automotive and aerospace industries, offers a high-value, niche application segment. Furthermore, expanding market penetration into rapidly developing economies, where urbanization and growing affluence are driving demand for premium home furnishings, presents substantial revenue potential. The standardization and promotion of certified sustainable linen (e.g., European Flax standards) also serve as a powerful marketing tool, cementing consumer trust and justifying premium pricing. Strategic collaborations between flax growers, processors, and major fashion houses are crucial in stabilizing supply and promoting the fiber’s unique attributes globally.

Impact forces acting upon the market include economic volatility affecting discretionary consumer spending on luxury items, coupled with climate change impacts that directly threaten flax crop yields, which are sensitive to weather variability. Regulatory shifts, such as stricter chemical use prohibitions in textile processing, generally favor linen, enhancing its competitive advantage over chemically intensive synthetic manufacturing. Social factors, particularly the increasing consumer awareness regarding textile waste and microplastic pollution, further accelerate the shift towards natural fibers. The combined effect of these forces suggests a positive long-term outlook, contingent upon the industry's ability to overcome processing cost restraints and ensure a resilient, climate-independent supply chain through innovative farming techniques and geographical diversification of cultivation.

Segmentation Analysis

The Linen Market is structurally segmented based on crucial parameters including application, product type, and distribution channel, providing a multi-dimensional view of market dynamics. Segmentation is critical for producers to tailor their marketing strategies and product offerings to specific end-user requirements, ranging from the highly regulated demands of the hospitality sector to the rapidly evolving trends in high-street apparel. The complexity of the flax fiber supply chain necessitates clear differentiation between pure linen products, which command the highest pricing, and various linen blends designed for affordability and enhanced performance features, such as reduced wrinkling or increased elasticity. Understanding these segments is key to identifying optimal investment areas, such as the accelerating demand within the performance technical textiles domain or the established stability of the luxury home furnishings market.

Analysis of the Application segment reveals that Home Textiles, encompassing bedding, table linen, and bath textiles, consistently dominates the market share due to the volume requirements and high replacement rates in commercial settings. However, the Apparel segment is experiencing significant resurgence, driven by casual wear trends and the rising acceptance of linen garments as sustainable fashion staples, particularly in North America and Europe. The smaller, yet highly strategic, Industrial and Technical Textiles segment focuses on utilizing linen's strength and low environmental impact in specialized uses like packaging, reinforcement fabrics, and automotive interior components, representing an important future growth vector requiring advanced R&D investments.

Further segmentation by Distribution Channel highlights the growing dominance of E-commerce platforms, offering specialized brands direct access to global consumers interested in sustainable and niche textiles, bypassing traditional retail intermediaries. Despite this growth, Offline channels, particularly Specialty Stores and Luxury Boutiques, remain critical for premium linen, allowing consumers to experience the material’s texture and quality firsthand, which is vital for high-ticket purchases like bespoke upholstery or expensive bedding sets. This channel structure mandates a hybrid distribution approach for major market players to ensure comprehensive market coverage and address diverse consumer purchasing behaviors effectively across all geographical regions.

- By Application:

- Apparel (Shirts, Dresses, Outerwear, Casual Wear)

- Home Textiles (Bedding, Upholstery, Kitchen & Table Linen, Bath Textiles)

- Technical & Industrial Textiles (Composites, Filtration, Geotextiles, Specialty Paper)

- By Product Type:

- Pure Linen

- Blended Linen (Linen-Cotton, Linen-Viscose, Linen-Polyester)

- By Distribution Channel:

- Offline (Supermarkets & Hypermarkets, Specialty Stores, Direct Sales)

- Online (E-commerce Platforms, Company-Owned Websites)

- By End-User:

- Residential

- Commercial (Hospitality, Healthcare, Corporate)

Value Chain Analysis For Linen Market

The Linen Market value chain is uniquely complex and highly geographically concentrated, starting with the Upstream phase focused on flax cultivation. This phase is dominated by Western European nations (France, Belgium, Netherlands) which possess the ideal climate and centuries of expertise for producing high-quality long-staple fiber. Key activities include specialized seed development, sustainable farming practices, and the critical biological process of retting (natural separation of fiber from the straw), which requires careful monitoring and expertise. The efficiency and quality achieved at this upstream stage directly dictates the quality and cost of the final textile. Ensuring traceability and adherence to ethical agricultural practices, such as those promoted by the European Flax organization, is paramount in creating premium value.

The Midstream processes involve scutching (mechanical removal of straw residues), hackling (fiber straightening), spinning the processed fiber into yarn, and finally, weaving or knitting the yarn into fabric. This manufacturing stage requires specialized machinery and skill due to the inherent stiffness and non-uniformity of linen fibers compared to cotton. Significant investment is being made in advanced machinery to optimize yarn quality and reduce breakage during weaving. Distribution channels, forming the crucial connection between processors and end-users, are segmented into Direct and Indirect streams. Direct channels involve B2B sales to major fashion houses or contract sales to large hotel chains, ensuring high volume and established relationships. Indirect channels rely on agents, wholesalers, and retailers (both brick-and-mortar and e-commerce) to reach individual consumers and smaller buyers.

The Downstream activities center on fabric finishing, garment or product manufacturing, and consumer marketing. Finishing processes include dyeing, printing, and specialized treatments to enhance attributes like wrinkle resistance or softness. Brand reputation, marketing focused on sustainability and luxury, and effective retail placement determine consumer uptake. Potential customers are heavily influenced by the product's origin and ethical credentials. The overall complexity, spanning agriculture to finished goods, mandates strong vertical integration or close cooperative agreements between different stages to ensure quality consistency and supply reliability, ultimately justifying the premium price point associated with authentic linen products.

Linen Market Potential Customers

The primary potential customers and end-users of the Linen Market are highly diverse, spanning sectors characterized by a demand for quality, durability, and natural aesthetics. In the Residential segment, the core demographic includes affluent, eco-conscious consumers who prioritize luxury, long-lasting home goods, particularly high-thread-count bedding, premium drapery, and artisanal table linens. This segment is significantly influenced by interior design trends that favor natural textures and sustainable materials. Marketing efforts targeting these buyers focus heavily on the health benefits (hypo-allergenic nature) and the environmental provenance of the fiber, using digital content and exclusive specialty retail partnerships to reach them.

The Commercial segment represents a high-volume, professional buyer base, including the upscale Hospitality industry (boutique hotels, resorts) and the Healthcare sector (hospitals, elder care facilities). Hospitality demands linen for its robust durability, ability to withstand frequent high-temperature washing, and aesthetic appeal that contributes to the guest experience. Healthcare buyers value linen for its natural anti-bacterial properties and hypo-allergenic profile. These buyers operate on long-term contracts and procurement cycles, making consistent supply, bulk pricing, and verifiable quality certifications paramount to securing sales.

Furthermore, major Fashion and Apparel houses constitute significant end-users, especially those specializing in luxury ready-to-wear, sustainable clothing lines, and customized garment manufacturing. These customers require varied specifications, including blended fabrics for specific drape and performance requirements. Finally, Industrial buyers, including manufacturers of high-performance composites, specialized paper, and filtration media, seek flax fibers for their structural strength, lightweight nature, and natural fire-resistant properties. These technical applications represent a growing niche where performance metrics outweigh purely aesthetic considerations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safilin, Siulas, Libeco, Lino E Lino, Solbiati Group, Linum Textil, Flax Line, John England (Tissage de Kalken), Irish Linen Company, LinenMe, FlaxArt, Hermès, PVH Corp, Ralph Lauren, Giorgio Armani, Society Limonta, S. Oliver, Celanese Corporation, Sioen Industries, Pure Linen Textiles. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Linen Market Key Technology Landscape

The Linen Market's technological landscape is focused heavily on optimizing the initial stages of fiber processing to enhance consistency, increase yield, and mitigate environmental impact. A significant area of focus is enzyme retting, an advanced biological method replacing traditional dew retting or water retting. Enzyme retting allows for faster, more controlled separation of the bast fibers, resulting in superior quality long fibers with less damage, while significantly reducing the reliance on large water bodies and minimizing pollutant discharge. Furthermore, breakthroughs in scutching machinery, utilizing sophisticated mechanical systems, are improving the efficiency of separating woody core from the fiber, directly leading to better yarn quality and reduced material waste, addressing the high-cost barrier traditionally associated with linen production.

In the midstream sector, specialized spinning technologies are critical due to the intrinsic properties of flax fibers. Wet spinning, a technique commonly used for fine linen yarns, is being refined with advanced automation and temperature control to ensure maximum fiber integrity and produce the delicate, highly uniform yarns required for luxury apparel. For industrial applications, air-jet spinning and rotor spinning technologies are being adapted to handle coarser linen fibers and blends, allowing for higher production speeds and reduced manufacturing costs necessary for technical textiles and composites. These technological adaptations are crucial for expanding linen’s applicability beyond traditional home textiles and into demanding performance environments.

Downstream technological innovations include specialized finishing treatments. Researchers are developing non-chemical or eco-friendly chemical treatments aimed at improving linen’s wrinkle recovery performance without compromising its natural feel or sustainability credentials. Techniques involving nano-coating and bio-polymers are being explored to impart functional properties such as water repellency, enhanced UV protection, and even inherent flame resistance, particularly relevant for upholstery and technical apparel. Additionally, digital textile printing (DTP) technology is enabling rapid prototyping and customization of linen fabrics, meeting the demand for personalized, small-batch luxury goods and significantly reducing the time-to-market for fashion retailers.

Regional Highlights

Europe stands as the definitive global hub for the Linen Market, primarily due to its dominance in high-quality flax cultivation. Countries like France, Belgium, and the Netherlands collectively account for the vast majority of the world's finest long-staple flax fiber production, benefiting from ideal climatic conditions and centuries of established agricultural expertise. This regional superiority is further solidified by stringent quality control standards, such as the European Flax label, which ensures high traceability and sustainable practices, translating directly into premium pricing and strong market positioning. Additionally, Europe houses sophisticated weaving and finishing facilities, particularly in Italy and Ireland, maintaining a high concentration of luxury textile brands and design innovation.

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth rate in the market over the coming years. This surge is primarily attributable to the burgeoning middle class in economic powerhouses like China and India, leading to increased disposable income allocated to luxury goods, including premium home textiles and imported high-end apparel. Furthermore, processing and manufacturing capacities are expanding rapidly across countries such as China and Vietnam, offering cost-competitive options for blending and downstream production. While APAC is a significant consumer, it is increasingly becoming a critical manufacturing hub, although its focus remains more on processing imported European flax or utilizing domestically grown, shorter-staple varieties.

North America (NA) represents a substantial consumption market characterized by high consumer awareness regarding sustainability and a strong preference for natural, durable goods, particularly in the premium home décor sector. The region relies heavily on imports from Europe and Asia for both raw material and finished products. The market growth here is driven by robust e-commerce channels and the success of direct-to-consumer linen brands focused on minimalist aesthetics and ethical sourcing narratives. Latin America and the Middle East & Africa (MEA) remain emerging markets for linen, with growth concentrated in high-end urban centers and hospitality segments, driven by international tourism and expatriate populations seeking luxury furnishings and textiles suitable for warmer climates.

- Western Europe (France, Belgium, Netherlands): Dominant in high-quality flax cultivation; essential for global raw material supply; strong regulatory framework supporting sustainable farming.

- Italy: Key processing and luxury finishing center; home to high-end linen textile mills and renowned apparel brands utilizing premium flax.

- Asia Pacific (China, India): Fastest-growing consumption market driven by rising affluence; expanding manufacturing base for finished goods and blends; increasing demand for sustainable fashion.

- North America (US, Canada): Major consumption market; high disposable income leading to strong demand for premium bedding and apparel; sophisticated e-commerce penetration.

- Middle East & Africa: Niche luxury market concentrated in hospitality and high-end residential projects, especially in the GCC countries, leveraging linen's thermal comfort.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Linen Market.- Safilin

- Siulas

- Libeco

- Lino E Lino

- Solbiati Group (owned by Loro Piana)

- Linum Textil

- Flax Line

- John England (Tissage de Kalken)

- Irish Linen Company

- LinenMe

- FlaxArt

- Hermès International S.A. (Utilization in luxury goods)

- PVH Corp (Tommy Hilfiger, Calvin Klein linen lines)

- Ralph Lauren Corporation (Premium linen apparel and home goods)

- Giorgio Armani S.p.A.

- Society Limonta S.p.A.

- S. Oliver Bernd Freier GmbH & Co. KG

- Celanese Corporation (Linen blending and composite materials)

- Sioen Industries NV (Technical textiles and coating)

- Pure Linen Textiles

- Northern Linen

- Carrington Textiles

- Vandewiele NV (Weaving machinery specialized for flax)

- Decoster

- Tessitura Monti SpA

Frequently Asked Questions

Analyze common user questions about the Linen market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Linen Market?

The primary factor driving market growth is the escalating global consumer preference for sustainable, natural, and biodegradable textiles, coupled with increasing demand for premium, durable home furnishings and ethical fashion apparel.

How does the high cost of linen production impact market accessibility?

The high cost, resulting from specialized agricultural and retting processes, restricts linen primarily to premium and luxury segments. However, the use of blended linen (e.g., linen-cotton) is expanding accessibility into mass-market categories by offering a balance between performance and affordability.

Which geographical region holds the largest market share for flax cultivation and processing?

Europe, specifically Western European countries like France, Belgium, and the Netherlands, holds the largest market share for high-quality, long-staple flax cultivation, which is critical for supplying the global premium linen textile industry.

What role does technology play in overcoming linen's traditional challenges?

Technology, particularly enzyme retting and advanced spinning techniques, improves fiber quality and processing efficiency, while specialized finishing treatments utilizing bio-polymers are being developed to enhance wrinkle resistance, mitigating linen's main care challenge.

What are the key emerging applications for linen beyond traditional clothing and bedding?

Key emerging applications are in Technical and Industrial Textiles, including automotive composites, high-performance reinforcement fabrics, filtration media, and specialized nonwovens, leveraging linen’s strength and lightweight, sustainable properties.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Linen Supply Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hospital Linen Supply Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hospital Linen and Laundry Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hotel linen Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Linen Clothing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager