Tin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441339 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Tin Market Size

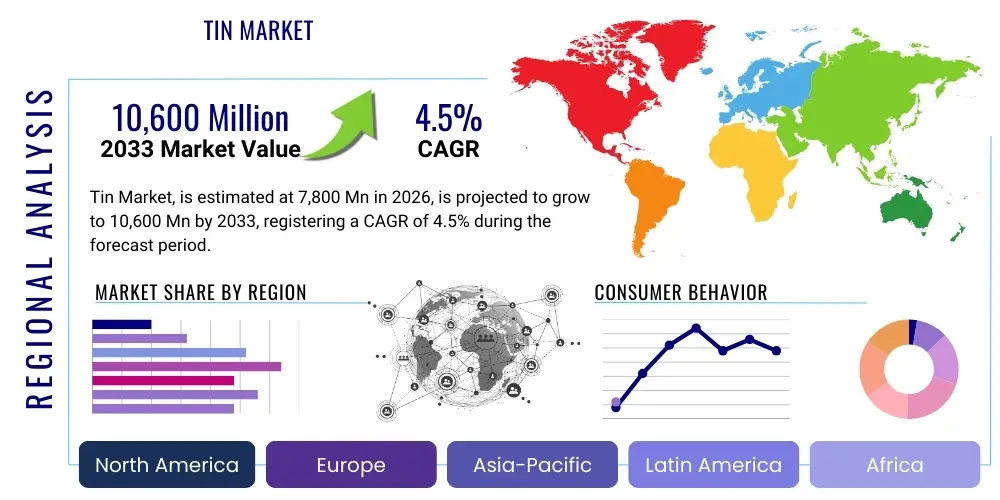

The Tin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $7.8 Billion in 2026 and is projected to reach $10.6 Billion by the end of the forecast period in 2033.

Tin Market introduction

The Tin Market encompasses the global production, refining, trade, and consumption of elemental tin (Sn), a soft, malleable, and corrosion-resistant post-transition metal. Historically vital for bronze production, its modern applications are dominated by its use in solders for the electronics industry, driven primarily by the mandatory shift towards lead-free alternatives mandated by regulatory bodies like the European Union’s Restriction of Hazardous Substances (RoHS) Directive. Tin's low toxicity and favorable mechanical properties make it indispensable for joining sensitive electronic components, powering the expansion across consumer electronics, telecommunications, and high-performance computing sectors. The reliability and efficiency of electronic devices are intrinsically linked to the quality and availability of tin solder alloys, cementing tin’s role as a critical mineral for the digital age.

Beyond soldering, tin serves critical roles in the packaging industry, primarily as tinplate—steel coated with a thin layer of tin—which offers superior corrosion resistance for food and beverage containers. Furthermore, tin chemicals, particularly organotin compounds and inorganic tin compounds, find extensive use as stabilizers in PVC plastics, catalysts in chemical synthesis, and precursors for advanced materials such as tin oxide for transparent conductive layers in flat panel displays and solar cells. The versatility of tin, combined with increasing demand from emerging technologies like photovoltaic (PV) modules and battery anode materials, underscores its strategic importance. Market dynamics are heavily influenced by the concentrated nature of primary tin production, primarily in Asia Pacific countries, leading to complex supply chain logistics and price volatility, which necessitate strategic stockpiling and recycling initiatives globally.

The primary benefits of tin stem from its unique properties, including a low melting point, excellent wetting characteristics, and non-toxicity, making it ideal for food-contact applications and precise electronic assembly. Major applications include sophisticated electronic interconnects (solder), protective coatings (tin plate), chemical intermediates (PVC stabilizers and catalysts), and specialized alloys (bronze and pewter). Driving factors for market expansion include the exponential growth in global electronics manufacturing, especially in high-growth areas such as 5G infrastructure deployment, Internet of Things (IoT) devices, and electric vehicle (EV) battery management systems. Additionally, tightening global sustainability regulations continue to favor tin-based solutions over toxic alternatives, further propelling its demand across various industrial ecosystems and ensuring its status as a vital component in modern manufacturing processes worldwide.

Tin Market Executive Summary

The global Tin Market is navigating a period of significant transition, characterized by robust demand from the Electronics & Semiconductor sector juxtaposed with geopolitical supply chain pressures. Key business trends indicate a strong industry focus on enhancing recycling infrastructure to mitigate supply risks stemming from major producing regions. Companies are investing heavily in advanced refining technologies to meet the stringent purity requirements of modern electronics, particularly for complex semiconductor packaging and micro-soldering applications. Furthermore, there is a pronounced consolidation among major mining and smelting operations, aiming to stabilize output and gain better control over global pricing mechanisms. The market is increasingly adopting sustainable sourcing policies and demanding greater transparency in the tin supply chain, driven by ethical consumerism and regulatory compliance, forcing producers to certify conflict-free and environmentally responsible operations.

Regionally, Asia Pacific maintains its dominant position, serving as both the largest producer of primary tin and the primary consumption hub, owing to the concentration of electronics manufacturing capabilities in countries like China, South Korea, and Taiwan. However, regional trends also highlight growing consumption in North America and Europe, fueled by the resurgence of domestic manufacturing bases for critical technologies, including aerospace and medical devices, requiring high-reliability tin alloys. Developing economies in Latin America and Africa are exhibiting increased tin consumption, primarily driven by infrastructure development and rising demand for packaged goods utilizing tinplate. Supply chain resilience initiatives are prompting diversified sourcing strategies, slowly reducing the overall reliance on single-region supply streams and encouraging exploration and development of tin deposits in politically stable jurisdictions outside the established Asian belt, seeking long-term stability.

Segment trends reveal that the Solder application segment remains the largest and fastest-growing category, highly sensitive to technological cycles in consumer electronics and data centers. The shift from wave soldering to reflow soldering techniques, necessitating higher-purity, specialized tin powders, is driving innovation in material science within this segment. Conversely, the Tin Plate segment, though mature, benefits significantly from increasing global populations and stable demand for canned food and aerosol containers, particularly in regions lacking robust cold chain logistics. The Chemicals segment is experiencing moderate growth, bolstered by demand for high-performance catalysts essential for manufacturing polymers and polyurethane foams. Manufacturers are continually innovating tin alloys and compounds to optimize performance in extreme environments, catering to niche markets such as deep-sea exploration and high-temperature aerospace applications, ensuring tailored material properties.

AI Impact Analysis on Tin Market

User queries regarding AI's influence on the Tin Market primarily center on two critical areas: predictive market analytics for supply chain stability and optimization of processing/mining operations. Users are keenly interested in how Artificial Intelligence can forecast volatile tin prices, given geopolitical risks and highly concentrated production, thereby enabling better procurement and inventory management strategies. Another key theme is the utilization of machine learning algorithms to enhance operational efficiency in complex tin mining and smelting processes, including optimizing ore sorting, reducing energy consumption during refining, and improving yield rates. Furthermore, common questions address the indirect demand effect, querying the substantial growth in high-performance computing (HPC), AI data centers, and advanced semiconductors—all heavy consumers of tin-based solder—and whether this sustained demand surge can be reliably quantified and managed through predictive models, ensuring raw material availability for future technological scaling.

- AI-driven predictive modeling stabilizes volatile tin prices, enabling proactive procurement risk mitigation and strategic inventory holding.

- Integration of machine learning algorithms optimizes mineral processing efficiency in tin mines, improving ore yield and reducing overall operational costs.

- Enhanced quality control systems using AI vision inspect solder joints in high-reliability electronics, critical for advanced AI hardware and server components.

- AI facilitates automated exploration and geological data analysis, leading to the discovery of new, economically viable tin deposits outside traditional mining regions.

- Increased computational demands from AI data centers directly escalate demand for high-purity, lead-free tin solder used in advanced semiconductor packaging.

- Robotics and autonomous vehicles, often utilizing complex electronic systems reliant on tin, are managed and controlled by AI, creating a secondary demand driver.

- Optimization of supply chain logistics through AI minimizes transportation inefficiencies and shortens lead times for refined tin products across global markets.

DRO & Impact Forces Of Tin Market

The Tin Market is fundamentally shaped by several powerful drivers, restraints, and opportunities that collectively determine its growth trajectory and competitive landscape. A primary driver is the non-negotiable and escalating demand for tin-based solder from the global Electronics and Semiconductor industries, fueled by the relentless proliferation of miniaturized devices, 5G networks, IoT sensors, and the rapid electrification of the automotive sector, requiring complex printed circuit board assemblies. The mandated global shift towards lead-free soldering solutions, codified by international environmental and safety regulations, has cemented tin's indispensability, as it currently lacks a broadly viable substitute that meets performance, cost, and regulatory requirements simultaneously. This sustained structural demand, coupled with innovation in tin alloy formulations to meet high-temperature and high-reliability specifications, provides significant impetus for market expansion, especially across emerging application niches such as flexible electronics and advanced packaging technologies.

However, the market faces significant restraints, most notably the high degree of supply concentration and subsequent geopolitical risk. Over 70% of the world's primary tin production is concentrated in a few Southeast Asian and South American nations, rendering the market highly susceptible to political instability, regulatory changes, and illegal mining issues in these regions. This concentration leads to inherent price volatility, which complicates long-term investment planning for end-users. Furthermore, the capital-intensive nature of both primary mining and advanced refining, coupled with increasingly stringent environmental protection standards related to mining waste and emissions, adds substantial operational costs, potentially hindering the entry of new market participants and slowing the development of new reserves. The scarcity of high-grade ore reserves and the reliance on complex, lower-grade deposits also pose a long-term resource challenge, necessitating greater focus on recycling infrastructure.

Opportunities for growth are predominantly centered around technological advancements and sustainable practices. The major opportunity lies in the burgeoning electric vehicle (EV) market, where tin is being investigated for use in advanced lithium-ion battery anodes (tin-based composite materials promising higher energy density) and in critical EV electronics. Additionally, the increasing global focus on renewable energy provides a robust opportunity, with tin oxide utilized in transparent conductive electrodes for solar panels and flexible photovoltaic cells. Impact forces manifest as a strong push for circular economy initiatives; the low toxicity and high recyclability of tin are forcing producers to rapidly develop efficient, industrial-scale tin recycling and reclamation programs from electronic waste (e-waste). This shift impacts profitability across the value chain, rewarding those who can secure secondary, reliable material streams while insulating themselves from primary supply chain shocks.

Segmentation Analysis

The Tin Market segmentation provides a granular view of consumption patterns, driven primarily by application and the subsequent end-use industry. The market is broadly categorized into four major application types: Solder, Tin Plate, Chemicals, and Specialized Alloys, with Solder consistently commanding the largest share due to the electronics revolution. The End-Use Industry segmentation details the final destinations of tin products, dominated by the Electronics & Semiconductor sector, followed by Packaging, Automotive, and Construction. Understanding these distinct segments is crucial for strategic planning, allowing market participants to align production capacity and technological development with high-growth areas, particularly those tied to global digitalization trends and regulatory shifts towards lead-free materials, while managing stable demand from traditional industrial sectors.

- By Application:

- Solder (Lead-free solder, High-temperature solder, Solder pastes, Solder wires)

- Tin Plate (Food cans, Beverage cans, General line containers)

- Chemicals (Organotin stabilizers, Inorganic tin chemicals, Catalysts)

- Specialized Alloys (Pewter, Bronze, Bearing metals)

- Others (Flotation agents, Pigments, Glass production)

- By End-Use Industry:

- Electronics & Semiconductor (PCBs, Semiconductors, Connectors, IoT devices)

- Packaging (Food packaging, Aerosol containers, Industrial goods packaging)

- Automotive (EV electronics, Engine bearings, Heat exchangers)

- Construction (Piping, Coatings, Construction alloys)

- Glass & Ceramics (Float glass production, Ceramic glazes)

Value Chain Analysis For Tin Market

The Tin Market value chain is complex and lengthy, initiating with upstream activities focused on the extraction and concentration of primary tin ore, predominantly cassiterite. This stage involves capital-intensive mining, often conducted through dredging or hard-rock underground methods, followed by physical and chemical processes to produce high-grade tin concentrates. Due to the limited geographic spread of viable deposits, the upstream segment is concentrated and susceptible to supply shocks. Key players at this stage focus on optimizing extraction yields and minimizing environmental impact through advanced tailings management and resource recovery techniques. The efficiency of upstream operations directly dictates the cost of refined tin, thereby influencing downstream profitability across all subsequent stages, necessitating rigorous quality control measures and geopolitical risk assessment.

Midstream processing involves the transformation of tin concentrate into refined tin metal, a crucial stage requiring high-temperature smelting and multiple refining steps (pyrometallurgy and electrometallurgy) to achieve the ultra-high purity (>99.9% Sn) demanded by electronics manufacturers. This process is highly energy-intensive and technologically demanding. The distribution channel then bridges the gap between refiners and end-users, involving specialized traders, large commodity brokers, and logistical service providers who manage international shipping, warehousing, and inventory financing. Direct distribution is common for large-volume industrial consumers (e.g., major solder manufacturers), who often sign long-term supply contracts with refiners, ensuring stable pricing and reliable supply streams for their production lines.

Downstream activities include the conversion of refined tin metal into final products such as solder wire, solder paste, tinplate coils, and specific chemical compounds. This segment is characterized by specialized manufacturing and custom alloy formulation to meet specific customer requirements (e.g., specific melting ranges for automotive PCBs). Indirect distribution dominates smaller-scale supply to diverse end-users, utilizing regional distributors and specialized metal service centers that offer value-added services like cutting, coating, and just-in-time delivery. The critical nature of tin in high-tech applications means that traceability and certification (e.g., London Metal Exchange (LME) brand registration) are paramount throughout the entire value chain, from mine to final product, driving transparency and ethical sourcing mandates.

Tin Market Potential Customers

Potential customers for tin products are globally diverse, spanning large multinational corporations in high-tech manufacturing to smaller specialized fabrication shops, all requiring specific forms of tin customized for their processes. The largest segment of end-users are original equipment manufacturers (OEMs) and Electronics Manufacturing Services (EMS) providers, particularly those engaged in producing high-density PCBs for consumer electronics (smartphones, laptops), telecommunications infrastructure (5G equipment), and industrial automation systems. These buyers require consistent, certified, high-purity solder paste and solder bars that comply strictly with lead-free regulations and international quality standards, seeking partners capable of providing complex, flux-integrated materials with predictable performance under extreme thermal cycling conditions inherent in modern devices.

Another significant customer base resides within the Packaging Industry, consisting primarily of large food and beverage conglomerates and specialized can makers who purchase tinplate, which is low-carbon steel thinly coated with tin to prevent corrosion. These customers prioritize bulk supply, competitive pricing, and logistical reliability, ensuring their continuous high-speed canning operations are never interrupted. Regulatory compliance related to food safety and migration testing is a key concern for these buyers. Furthermore, the Automotive sector represents a rapidly expanding customer segment, driven by the mass adoption of electric vehicles. Automotive customers require highly robust tin alloys for bearing materials, specialized electronic control units (ECUs), and battery management system (BMS) components that must withstand harsh operating environments and satisfy stringent durability and safety certifications over prolonged vehicle lifetimes.

A third major category includes chemical producers and materials science companies that utilize tin compounds as catalysts, stabilizers, and precursors. Customers in this domain, which often includes major polymer manufacturers and specialized chemical synthesis houses, purchase high-grade inorganic and organic tin chemicals. Their purchasing decisions are driven by chemical performance specifications, catalytic activity, and reliable supply chains, as these materials are essential for producing PVC products, fire retardants, and polyurethane foams. Finally, emerging customers include firms in the renewable energy sector, such as solar panel manufacturers, who rely on tin oxides for transparent conductive coatings, signaling a diversification of the industrial buyer base towards green technology applications, valuing both material performance and sustainability metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7,800 Million |

| Market Forecast in 2033 | $10,600 Million |

| Growth Rate | CAGR 4.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | China Tin Group, Malaysia Smelting Corporation Berhad, PT Timah (Persero) Tbk, Minsur S.A., Yunnan Tin Company Limited, Thailand Smelting and Refining Co. Ltd. (Thaitech), Metallo Group, Aurubis AG, Teck Resources Limited, Alpha Assembly Solutions, Nihon Superior Co., Ltd., Fuxin Mining, Geomet SA, A&M Metals, Traxys S.A., Indium Corporation, Kester, AIM Solder, DuPont, H.C. Starck. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tin Market Key Technology Landscape

The technological landscape of the Tin Market is primarily defined by advancements in materials science focused on developing superior solder alloys and innovations in both mining efficiency and resource recovery. A critical area of focus is the creation of complex, high-performance tin-based solder alloys designed to withstand the increasingly high operating temperatures and miniaturization demands of modern electronic devices, particularly those used in automotive and aerospace applications. Researchers are actively developing tin-silver-copper (Sn-Ag-Cu, or SAC) variants and specialized low-bismuth or high-reliability alloys that offer improved fatigue resistance and reduced voiding during reflow soldering processes, ensuring long-term product reliability. The shift from traditional solder bar formats to highly uniform, fine-powder solder paste used in surface mount technology (SMT) requires significant investment in atomization and specialized mixing technologies to ensure homogeneous particle size distribution and optimized flux chemistry, directly affecting manufacturing yields in the electronics sector.

Furthermore, technology is playing a crucial role in optimizing the upstream and midstream value chain segments. In mining, digital technologies like advanced geological mapping, remote sensing, and automated drilling systems are enhancing efficiency and improving resource utilization rates, particularly as miners delve into lower-grade, more complex ore bodies. Refining technologies are also seeing upgrades, moving towards continuous smelting processes and more precise separation techniques to meet the ultra-high purity (>99.99%) standards required for specialized applications like tin sputtering targets for transparent electrodes. Environmental processing technology is vital, involving sophisticated effluent treatment and tailing management systems to meet strict regulatory standards for heavy metal discharge, mitigating the significant ecological footprint historically associated with tin extraction and processing globally.

Looking ahead, emerging technological applications promise to redefine the market structure. Research into tin as an anode material component for next-generation lithium-ion and sodium-ion batteries is gaining momentum, offering the potential for significantly higher energy storage capacities compared to current graphite-based systems. This research necessitates the development of novel tin composite materials and nanostructuring techniques to manage volume expansion during charge/discharge cycles. Moreover, chemical synthesis innovations are creating new applications for tin oxides and sulfides in photocatalysis and advanced sensor technology. The overall technological direction is highly collaborative, linking material science experts, mining engineers, and electronics manufacturers to create robust, sustainable, and high-performance tin solutions that will drive future market demand across critical high-tech industrial sectors.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global Tin Market, dominating both supply and demand. China, Indonesia, and Malaysia are major primary producers and refiners, while the concentration of electronics manufacturing hubs in China, South Korea, and Taiwan drives immense consumption. The region accounts for the largest share of global solder consumption due to its extensive PCB production and assembly operations for consumer electronics, industrial equipment, and automotive components. Regional growth is further bolstered by massive governmental investment in 5G infrastructure deployment and domestic semiconductor fabrication capabilities, ensuring APAC remains the primary determinant of global tin pricing and supply dynamics.

- North America: The North American market is characterized by high-value, specialized consumption, particularly in the aerospace, defense, and high-reliability medical device sectors, which demand stringent quality control and certified sourcing. While primary production is negligible, the region is a major consumer of refined tin and fabricated products, focusing heavily on R&D for advanced solder alloys and tin chemical applications. The push for supply chain resilience and security post-pandemic is encouraging increased domestic recycling efforts and strategic diversification of raw material sourcing to reduce reliance on volatile Asian supply chains.

- Europe: Europe is a mature but sophisticated consumer market, driven by strict environmental regulations (like RoHS and REACH), which heavily favor high-purity, lead-free tin solutions. Key demand sectors include specialized industrial machinery, luxury automotive components, and the burgeoning renewable energy sector (solar PV installation). European refiners are leaders in secondary tin production, utilizing advanced recycling techniques to process e-waste and industrial scrap, contributing significantly to sustainable material sourcing and minimizing dependence on primary mined resources.

- Latin America: This region is notable primarily as a source of primary tin, with countries like Peru and Bolivia hosting significant mining operations. Market activities are strongly correlated with global commodity prices and mining sector stability. Consumption within the region is growing steadily, supported by increasing local demand for canned foods (driving tinplate usage) and nascent growth in electronics assembly and infrastructure projects, although internal market consumption remains small compared to its export volume of concentrates and refined metal.

- Middle East and Africa (MEA): The MEA market is small but expanding, primarily focused on construction projects and infrastructure development (driving demand for specialized alloys and construction materials). Tinplate consumption is increasing in response to rapid urbanization and population growth, particularly for packaged food distribution. The region holds potential for new primary mining development in certain African countries, but such ventures are often hampered by political instability and lack of adequate logistical infrastructure, requiring substantial long-term foreign direct investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tin Market.- China Tin Group

- Malaysia Smelting Corporation Berhad

- PT Timah (Persero) Tbk

- Minsur S.A.

- Yunnan Tin Company Limited

- Thailand Smelting and Refining Co. Ltd. (Thaitech)

- Metallo Group

- Aurubis AG

- Teck Resources Limited

- Alpha Assembly Solutions

- Nihon Superior Co., Ltd.

- Fuxin Mining

- Geomet SA

- A&M Metals

- Traxys S.A.

- Indium Corporation

- Kester

- AIM Solder

- DuPont

- H.C. Starck

Frequently Asked Questions

Analyze common user questions about the Tin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the current global Tin Market demand?

The predominant driver is the exponential growth of the global Electronics and Semiconductor industries. Tin is essential for lead-free solder used in Printed Circuit Boards (PCBs) across all modern electronic devices, 5G infrastructure, and data centers, ensuring compliance with international environmental directives like RoHS and maintaining high electronic component reliability.

How significant is the impact of lead-free legislation on tin consumption patterns?

Lead-free legislation, particularly the EU’s RoHS Directive and similar global mandates, has fundamentally restructured tin demand. It forced the electronics sector to transition away from traditional tin-lead solder, significantly increasing the reliance on high-purity tin-silver-copper (SAC) alloys. This shift has elevated the purity requirements and driven innovation in tin alloy manufacturing, solidifying tin’s indispensable role in compliant manufacturing.

Which geographical regions dominate the global supply of primary tin?

The Asia Pacific region, specifically China, Indonesia, and Malaysia, accounts for the majority of the world's primary tin supply. South America, particularly Peru and Bolivia, also contributes substantially. This highly concentrated supply chain is a major source of market volatility and price fluctuations due to regional political and logistical risks.

What opportunities does the Electric Vehicle (EV) sector present for the Tin Market?

The EV sector offers dual opportunities: first, through the consumption of high-reliability tin solder for complex Battery Management Systems (BMS) and control electronics; and second, through exploratory research into using tin compounds (such as tin-based composites) as advanced anode materials in next-generation lithium-ion and sodium-ion batteries, promising enhanced energy density and performance.

What role does recycling play in mitigating tin supply chain risks?

Tin recycling, primarily from electronic waste (e-waste) and scrap materials, is increasingly critical for enhancing supply chain security and sustainability. As primary ore grades decline and geopolitical risks persist, secondary recovery provides a vital, stable source of refined tin. Technological advancements in pyrometallurgical and hydrometallurgical recycling are crucial for increasing the yield and quality of recovered tin to meet high industry standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Electric Power Steering Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aircraft Refueling Trucks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Immunocytokines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Recombinant Human Serum Albumin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automatic Phoropters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager