Food Delivery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434048 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Food Delivery Market Size

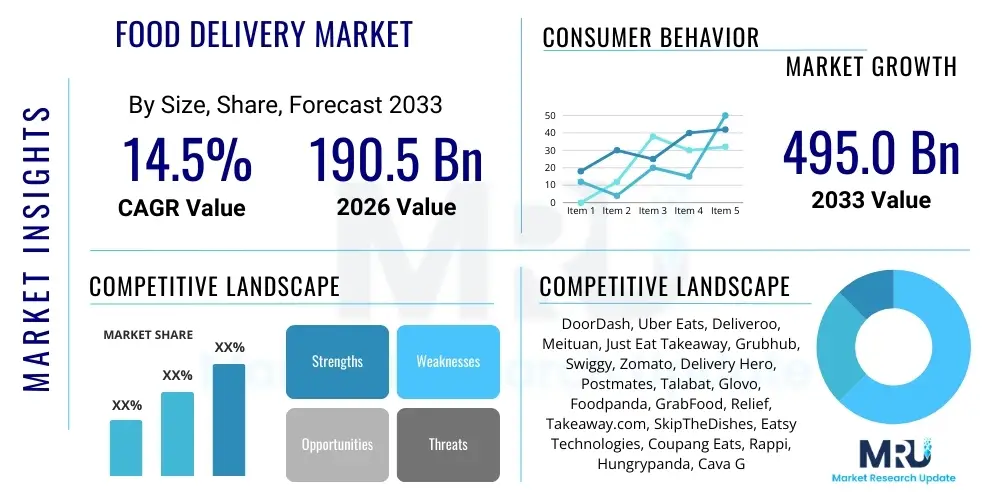

The Food Delivery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 190.5 Billion in 2026 and is projected to reach USD 495.0 Billion by the end of the forecast period in 2033.

Food Delivery Market introduction

The Food Delivery Market represents a paradigm shift in how consumers access prepared meals and specialized grocery items, fundamentally redefining the interface between the hospitality sector and the end-user. This market encompasses sophisticated, multi-sided digital platforms that facilitate the ordering, payment, and logistical fulfillment of food from numerous partner restaurants to consumers’ homes or workplaces. The service ecosystem is highly dependent on scalable mobile technology, which enables real-time interaction between consumers, delivery personnel, and restaurant partners. The core operational definition has expanded significantly from simple telephone orders to include complex algorithmic management of thousands of simultaneous deliveries across dense metropolitan areas, necessitating continuous technological refinement and extensive investment in data infrastructure. The market's structural resilience has been proven by its essential role during global public health crises, accelerating adoption across older demographic groups who previously relied on traditional dining or cooking methods, cementing its position as a critical modern utility. The evolution includes a strong focus on sustainability, with platforms increasingly experimenting with electric vehicles and sustainable packaging solutions to meet rising consumer expectations regarding environmental responsibility, thereby integrating corporate social responsibility into logistical planning and execution.

Product descriptions within the food delivery context vary widely based on the model deployed. The dominant models include platform-to-consumer (P2C), where major aggregators like DoorDash or Uber Eats manage the entire delivery logistics chain, and restaurant-to-consumer (R2C), where established food chains utilize their own dedicated fleet but interface with third-party platforms for order volume generation and visibility. Major applications are diverse, spanning routine residential meal ordering for dinner and lunch, specialized corporate catering subscriptions for employee benefits, and targeted delivery services for specific demographics such as students on university campuses or residents in high-rise complexes. The utility provided transcends mere convenience; it serves as a critical economic stabilizer for the restaurant industry, allowing smaller businesses without significant upfront capital for delivery infrastructure to access a broader digital customer base, thereby democratizing market access within the competitive food service sector. Further application expansion includes integration with smart home technology, allowing for voice-activated ordering and automated reordering based on learned consumption patterns, optimizing the ordering funnel for maximal user comfort.

The fundamental benefits driving the unparalleled growth trajectory of the food delivery market are multifaceted, primarily centered on optimizing the consumer experience and enhancing restaurant profitability. For consumers, the principal benefit is time utility—the ability to access a wide variety of meals instantly, eliminating the necessity of commuting, waiting, or preparing food. This convenience translates directly into improved quality of life for busy urban dwellers, affording them greater flexibility in their daily routines. For restaurants, partnering with delivery platforms offers extended revenue opportunities, allowing them to monetize latent kitchen capacity during non-peak hours and operate efficiently without the need for large, expensive dining areas, thereby improving asset utilization. Key driving factors propelling market expansion include the sustained high global penetration rates of smartphones, particularly in emerging markets, coupled with demographic shifts toward younger, technology-adept populations that prioritize seamless digital experiences. Furthermore, continuous infrastructure improvements in logistics, mapping accuracy, and high-speed payment processing, alongside cultural shifts that favor experiential spending and personalized services, guarantee a sustained high CAGR throughout the forecast period. The regulatory environment, although complex, is also beginning to standardize, offering clearer operational guidelines which encourages further investor confidence and scale, particularly in cross-border operations.

Food Delivery Market Executive Summary

The Food Delivery Market is undergoing rapid structural transformation, defined by aggressive vertical integration, sophisticated technological deployment, and an escalating focus on achieving sustainable unit profitability. Business trends indicate a move away from pure volume growth toward efficiency gains, driven by the maturity of key Western markets where customer acquisition costs are rising rapidly. Platforms are aggressively diversifying revenue streams beyond standard commission fees, implementing services such as fulfillment solutions, virtual brand incubation, financial lending to restaurants, and high-value advertising placements on their applications, effectively becoming essential technology partners to the hospitality industry. A major structural business shift involves the strategic investment in cloud kitchens, or dark kitchens, which are purpose-built facilities optimized solely for delivery efficiency, operating outside traditional restaurant models. This trend mitigates reliance on existing restaurant infrastructure, allowing platforms greater control over preparation speed and geographical reach, and represents a key capital expenditure focus for market leaders seeking competitive logistical advantages in dense urban areas, often resulting in margin improvements.

Regional trends reveal a highly bifurcated global landscape. Asia Pacific continues to lead in absolute market size and annual growth rate, characterized by intense platform rivalry and the prevalence of the "super-app" model, where food delivery is deeply integrated with ride-sharing, finance, and e-commerce services, offering unmatched convenience and user stickiness. Conversely, North America and Europe are grappling with mature market challenges, including regulatory pressures regarding courier labor rights, which necessitate complex operational adjustments and potentially higher labor costs, shifting the operational focus from growth to compliance and efficiency. These Western regions are focusing intensely on technological innovation, specifically utilizing AI to streamline dynamic pricing and exploring autonomous delivery solutions to counter rising wage expenses. The growth impetus in Latin America and the Middle East & Africa is tied closely to ongoing infrastructure development and the increasing accessibility of mobile payment technologies, opening vast, previously untapped consumer markets but demanding tailored logistical solutions adapted to varied urban planning and security challenges, requiring bespoke platform adjustments.

Segmentation trends highlight the increasing strategic importance of the Platform-to-Consumer (P2C) model, which commands the largest market share due to its full-service logistics capability and the ability to dictate end-to-end user experience, crucial for maintaining service quality and brand consistency. Within Food Type segmentation, the Quick Service Restaurant (QSR) category remains the volume leader, benefiting from rapid preparation times and strong brand recognition suitable for frequent, low-AOV orders. However, Full-Service Restaurant (FSR) delivery is growing rapidly, aided by platforms developing specialized packaging and delivery protocols designed to maintain the integrity of high-quality meals, addressing a crucial segment constraint related to food temperature and presentation. Furthermore, the diversification into non-prepared food delivery, such as specialty groceries, pharmaceuticals, and essential retail items, is rapidly blurring the traditional lines of the food delivery market, positioning platforms as essential last-mile logistical providers for a broad array of consumer goods, ensuring resilience against purely culinary-driven demand fluctuations and maximizing asset utilization.

AI Impact Analysis on Food Delivery Market

User inquiries regarding the integration of Artificial Intelligence into the food delivery ecosystem consistently focus on three core areas: the tangible impact on delivery time and cost, the ethical implications of sophisticated data usage for personalization, and the timeline for widespread deployment of autonomous delivery vehicles. Consumers expect AI to not only optimize the operational efficiency of the platform but also to deliver a genuinely personalized and predictive experience, anticipating needs before explicit orders are placed, such as predicting reorder cycles or suggesting complementary items based on historical context. The conversation often shifts to transparency—users want clarity on how their vast amounts of ordering and movement data are utilized to improve service without infringing on privacy rights, necessitating robust data governance policies from platforms. Operationally, restaurants are concerned with AI’s role in managing kitchen throughput and inventory, ensuring that prediction models are accurate enough to minimize perishable waste and optimize staffing levels during highly volatile peak ordering windows, demonstrating a strong reliance on external algorithmic intelligence.

The application of advanced machine learning models is revolutionizing the internal operational architecture of major food delivery platforms, moving beyond simple statistical analysis to complex, multi-variable dynamic systems. For example, AI algorithms now manage the 'matching' engine, deciding which courier receives which order based on real-time factors including predictive path overlap, historical reliability scores, current load balance, and even the type of food being transported (e.g., matching fragile or temperature-sensitive items with couriers using specialized thermal packaging). This high level of computational orchestration ensures that the capacity of the courier network is optimally utilized at every minute of operation, drastically reducing the total cycle time from order placement to delivery. Furthermore, AI is critical for advanced fraud detection, scrutinizing anomalous ordering patterns, unusual payment methods, and suspicious refund requests using behavioral analysis, thereby mitigating significant financial losses that are inherent in high-volume, low-margin transactional businesses, bolstering the financial sustainability of the platform business model against increasingly sophisticated attempts at exploitation.

In the realm of consumer interaction, AI facilitates sophisticated predictive search functionality and highly effective marketing attribution, significantly enhancing the customer journey. By analyzing vast datasets of successful and abandoned orders, dietary preferences, and demographic information, AI systems can present highly curated menus and timely promotional offers tailored to individual users, significantly improving conversion rates and increasing the average frequency of customer orders. The future trajectory involves leveraging AI for conversational commerce, where natural language processing integrates seamlessly into ordering processes via smart speakers or messaging apps, making the experience instantaneous and hands-free, minimizing friction points. This technological dependency ensures that platforms with superior data science capabilities and larger proprietary datasets will maintain a durable competitive advantage, dictating industry standards for speed, reliability, and personalization for the foreseeable future, making investment in machine learning infrastructure the core investment area and primary differentiator in the market.

- Optimization of delivery routes through real-time traffic analysis and predictive modeling, drastically reducing delivery times and operational fuel costs by efficiently clustering orders and minimizing courier idle time, utilizing complex graph theory algorithms.

- Enhanced customer personalization via machine learning algorithms that analyze extensive preference data, dietary history, and time-of-day variables to offer highly relevant restaurant and meal recommendations, increasing user engagement and expanding order basket size.

- Implementation of AI-driven demand forecasting systems, enabling cloud kitchens and restaurants to optimize inventory and staffing levels with high accuracy, leading to minimized food waste, greater kitchen throughput, and improved profitability for partners.

- Automation of sophisticated customer service interactions using advanced Natural Language Processing (NLP) chatbots, capable of handling complex order modifications, payment issues, and status inquiries instantaneously, improving resolution speed and reducing reliance on expensive human support staff.

- Facilitation of autonomous last-mile delivery mechanisms (drones and ground robots) by providing the computational framework for navigation, obstacle avoidance, and secure package transfer, increasing scalability and reducing reliance on human labor in select urban areas where regulations permit deployment.

- Development of dynamic pricing and incentive algorithms for couriers, adjusting compensation based on real-time demand, weather conditions, and geographical density to ensure adequate fleet supply during peak hours while optimizing platform payout structures for efficiency and fairness.

- Improved quality assurance through image recognition and sensor data analysis, where AI monitors packaging integrity, temperature control, and handling metrics during transit to ensure food safety standards and customer expectations are consistently met upon arrival.

DRO & Impact Forces Of Food Delivery Market

The operational landscape of the Food Delivery Market is characterized by robust drivers, persistent structural restraints, and expansive opportunities, all subjected to intense competitive impact forces which dictate strategic movement. The primary drivers underpinning market expansion include the sustained global rise in mobile connectivity and the widespread cultural shift towards convenience-centric lifestyles, particularly among urban populations facing significant time scarcity and demanding immediate service gratification. Furthermore, the structural capability of platforms to offer unparalleled choice and seamless digital transaction experiences acts as a continuous pull factor for consumer adoption and repeat usage. From a supply-side perspective, the ability of restaurants to leverage delivery platforms to hedge against rising rents, limited dining capacity, and geographic market saturation provides a vital economic incentive. These internal and external drivers collectively guarantee continued consumer expenditure on delivery services, often making it a non-discretionary spending category for high-frequency users, securing future demand against economic volatility.

However, the market's long-term sustainability is severely challenged by critical restraints that limit profitability and operational flexibility. The foremost issue remains the persistent difficulty in achieving acceptable profit margins across all geographical markets, often hampered by intense price competition, high customer acquisition costs, and the necessity for high commission demands that strain crucial restaurant partnerships. Logistical complexity, especially maintaining service consistency across highly fragmented urban and suburban geographies, contributes significantly to operational expenditure and requires continuous technological investment. Moreover, the evolving regulatory environment concerning the classification of gig workers remains a major constraint in mature markets like the European Union and specific states within the U.S. Adverse rulings regarding worker employment status could drastically increase labor costs, forcing platforms to fundamentally restructure their variable-cost business models and pricing strategies, potentially disrupting the low-cost, flexible courier model that underpins current operational efficiency and scale.

Opportunities for market growth are centered on leveraging advanced technological developments and strategic market diversification into adjacent sectors. The expansion of cloud kitchens, optimized for delivery only, represents a massive opportunity to improve kitchen efficiency, capture higher margins, and test new virtual brands with minimal capital risk. Geographic penetration into underserved, lower-density suburban and rural areas, coupled with strategic diversification into non-meal delivery (e.g., pharmacy items, specialty retail, quick commerce—q-commerce), offers significant avenues for expanding the addressable market and utilizing existing logistics networks more efficiently during off-peak hours. Impact forces are severe, dominated by intense rivalry among a few globally dominant players who possess massive war chests for market share acquisition, leading to frequent price wars, high promotional spending, and an elevated threat of M&A activity. The threat of substitution, from improved meal kits or rapid grocery delivery services (q-commerce), remains high, forcing delivery platforms to continuously innovate their service offerings and integrate complementary services to maintain consumer loyalty and mitigate the pressure exerted by powerful competitors and substitutes effectively.

Segmentation Analysis

Segmentation analysis is crucial for dissecting the diverse revenue streams and operational models within the expansive Food Delivery Market, allowing stakeholders to precisely target investment and strategic initiatives. The primary axes of segmentation delineate service capability, the type of meal offered, the technology used for fulfillment, and the ultimate end-user demographic profile. Understanding these inherent differences allows platforms to tailor their technology investment, marketing expenditure, and commission structures to maximize profitability within each specific micro-market. For instance, the economics of delivering a high-volume, low-margin Quick Service Restaurant (QSR) order, where speed is paramount, differ dramatically from the specialized logistics and premium pricing required for a high-Average Order Value (AOV) delivery from a Full-Service Restaurant (FSR), demanding separate operational protocols and, potentially, specialized courier training to ensure service quality and margin protection.

Key to strategic segmentation is the separation of Platform Type—Aggregators versus New Delivery Providers—as this distinction defines the fundamental business model and required capital structure. Aggregators function primarily as listing services and digital storefronts, relying heavily on the restaurant's own internal delivery infrastructure (R2C model), generating revenue mainly through advertising and standardized listing fees. Conversely, New Delivery Providers (e.g., Uber Eats, DoorDash) offer a complete logistical solution (P2C model), utilizing a vast, digitally managed courier fleet that requires significant upfront technology and labor investment. This distinction dictates competitive strategy: Aggregators compete primarily on restaurant breadth and user interface quality, while New Delivery Providers compete robustly on speed, reliability, efficiency, and geographical coverage. Furthermore, geographical segmentation is essential, as emerging markets often favor bicycle or motorcycle delivery due to high traffic congestion, whereas developed markets are increasingly piloting autonomous or drone-based solutions, reflecting highly divergent investment priorities based on local infrastructure, labor availability, and regulatory openness to new technologies.

The increasing importance of End-User segmentation reflects the market's move toward highly targeted marketing and customized product development. While residential users remain the engine of order volume, the rapid growth of the Commercial/Corporate segment, driven by employee benefit programs, subsidized lunch schemes, and large-scale catered events, offers significantly higher AOV and predictable, subscription-based revenue streams, improving financial stability. Platforms are customizing user interfaces, integrating specialized invoicing, and developing dedicated account management services specifically for enterprise accounts, differentiating the service offering dramatically from standard consumer transactions. This detailed segmentation not only reveals untapped market niches but also helps optimize the platform’s financial model, ensuring that high costs associated with customer acquisition and complex logistical fulfillment are accurately matched to the premium revenue generated by specific user cohorts, promoting healthier, more stable long-term unit economics and reinforcing investor confidence in the growth model.

- By Platform Type

- Aggregators: Platforms primarily listing restaurants; revenue generated through marketing and fixed order fees; minimal direct logistical involvement.

- New Delivery Platforms (Full-Stack Logistics): Platforms managing ordering, payment, and proprietary delivery fleet logistics (P2C model), demanding heavy technology investment.

- By Operational Model

- Platform-to-Consumer (P2C): Third-party platform employs/contracts couriers and manages the delivery process end-to-end, offering maximum service control.

- Restaurant-to-Consumer (R2C): Restaurants utilize their own delivery staff but use the platform solely for customer acquisition and ordering interface, prevalent among large established chains.

- By Food Type

- Quick Service Restaurants (QSR): High-volume, standardized menu items, optimized for speed and low cost per order, forming the volume backbone of the market.

- Full-Service Restaurants (FSR): Higher Average Order Value (AOV), requires specialized packaging and temperature control for high-quality meal preservation during transit.

- Specialty Food (e.g., Healthy/Dietary Specific): Catering to niche consumer groups with specific nutritional requirements, often commanding premium pricing.

- By Delivery Mode

- Conventional Vehicle Delivery (Cars, Motorcycles, Bicycles): Standard, labor-intensive last-mile solution, highly dependent on local infrastructure and traffic conditions.

- Autonomous Delivery (Drones, Robots): Emerging technology focused on hyper-local and regulated environments for efficiency gains and labor cost reduction.

- By End User

- Residential: Individual and household ordering; high frequency, often highly sensitive to delivery fees and promotions.

- Commercial/Corporate: Bulk orders, catering, and subscription services for businesses; focuses on reliability, integration with invoicing, and dedicated service channels.

Value Chain Analysis For Food Delivery Market

The Food Delivery Market value chain commences with the upstream segment, which is centered around the core inputs required for meal preparation and the digital infrastructure required to initiate the transaction. Upstream activities are dominated by the restaurant partners—ranging from small independent kitchens to globally standardized chains—and the increasingly crucial cloud kitchens specifically designed for delivery volume optimization. This phase involves ingredient sourcing, standardized meal preparation protocols, careful adherence to health regulations, and the procurement of specialized packaging solutions designed for transport integrity. Additionally, upstream value includes the specialized technology suppliers who develop and maintain the proprietary GIS mapping software, real-time tracking APIs, and secure cloud hosting services essential for platform functionality. Effective management of the upstream relationship, particularly ensuring rapid order handover to the courier, is a key determinant of overall service latency and, consequently, customer satisfaction ratings.

The midstream segment is the core operational hub, managed entirely by the delivery platform itself. This stage is primarily a complex logistical orchestration and software management function, integrating the three disparate user groups: consumers, restaurants, and couriers, requiring robust computational power. Key activities include order aggregation, highly complex algorithmic dynamic route optimization (crucial for efficiently clustering multiple orders and minimizing miles traveled), secure digital payment processing, and real-time risk management and fraud mitigation using proprietary behavioral analytics. The distribution channel is overwhelmingly indirect, leveraging a highly flexible, variable-cost network of gig-economy couriers operating as independent contractors. This model allows platforms to scale labor capacity instantaneously in response to demand fluctuations (e.g., during severe weather events or holiday peaks). Direct distribution models, involving salaried employees and company-owned vehicles, are occasionally employed for specific high-value or high-volume corporate contracts, offering enhanced quality control and branding consistency at the expense of a higher fixed cost structure.

The downstream segment encompasses the final consumer interaction and the subsequent crucial feedback loop, which is vital for continuous service refinement. This involves the physical last-mile delivery, strict adherence to customer instructions (e.g., contactless delivery protocols), and the essential post-transaction customer service resolution process, handled increasingly by sophisticated AI-powered chatbots and automated ticket systems. The most valuable downstream asset is the proprietary, rich data generated by user behavior—delivery speed ratings, specific food quality feedback, and detailed courier performance metrics. This data feeds directly back into the midstream operational algorithms (a process known as 'downstream analysis'), allowing platforms to refine their predictive models, dynamically adjust localized pricing, target personalized promotions with high accuracy, and improve courier training programs. The continuous, data-driven optimization loop distinguishes successful market leaders from slower competitors, creating substantial, technology-based entry barriers built upon superior data scale and sophisticated analytical capability.

Food Delivery Market Potential Customers

The segmentation of potential customers in the Food Delivery Market goes beyond simple demographics, deeply integrating lifestyle characteristics, disposable income levels, and tolerance for convenience pricing. The core audience comprises urban, technology-proficient individuals (primarily Millennials and Gen Z) residing in high-density areas, who view delivery as an embedded and necessary part of their consumption routine due to time constraints and preference for variety. This segment is characterized by a high frequency of ordering, often low intrinsic brand loyalty (switching based on current promotional offers, price, or instantaneous speed), and a high propensity to use multiple platforms simultaneously to maximize benefits. These high-frequency users often prioritize convenience and speed above all else, driving platform investment in optimizing logistical latency and expanding culinary choices aggressively. Retaining these valuable customers requires sophisticated, data-driven loyalty programs, often utilizing subscription services that bundle benefits like free delivery or discounted service fees in exchange for guaranteed high order volume and customer commitment.

A rapidly expanding customer base is the family and multi-person household segment, particularly in suburban and peri-urban areas where platforms are expanding coverage beyond traditional city centers. These customers typically place larger, less frequent orders (resulting in a higher AOV), often replacing traditional grocery runs or family cooking nights as a convenient, time-saving alternative. This segment is highly sensitive to total delivery cost and demands extreme reliability and punctuality, especially during standardized peak dinner times, as late deliveries disrupt household routines significantly. To capture this segment effectively, platforms are investing in specialized features such as family-style meal options, bulk purchasing incentives, and seamlessly integrated grocery or meal-kit delivery services, positioning the platform not merely as a quick meal solution but as a comprehensive, convenient household food provision service capable of handling diverse needs. The expansion into suburban markets also necessitates logistical adjustments, moving from bicycle reliance to car-based courier fleets.

Specialized customer groups, often underserved by traditional food services, also present significant untapped revenue potential and opportunities for service differentiation. These include individuals with highly specific dietary needs (e.g., severe allergy sufferers, high-performance athletes, individuals adhering to specific medical diets) who require detailed nutritional information and verified ingredient sourcing, which platforms are increasingly providing through enhanced filter functionality and certified restaurant partnerships. Furthermore, customers utilizing delivery services for non-traditional items, such as pharmacy prescriptions, convenience store goods, or specialized pet supplies (a clear result of q-commerce integration), are rapidly expanding the operational definition of the potential buyer. The Food Delivery Market is increasingly focusing on the optimization of lifetime customer value (LTV) rather than simple transactional profit, meaning potential customers are defined not just by their immediate ordering power but by the probability of high-frequency engagement over an extended period, incentivizing platforms to invest heavily in robust customer relationship management (CRM) systems and data-driven engagement strategies across all diverse user types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 190.5 Billion |

| Market Forecast in 2033 | USD 495.0 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DoorDash, Uber Eats, Deliveroo, Meituan, Just Eat Takeaway, Grubhub, Swiggy, Zomato, Delivery Hero, Postmates, Talabat, Glovo, Foodpanda, GrabFood, Relief, Takeaway.com, SkipTheDishes, Eatsy Technologies, Coupang Eats, Rappi, Hungrypanda, Cava Group, Delivery Dot Com, Waitr Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Delivery Market Key Technology Landscape

The Food Delivery Market is fundamentally a technology-driven logistics sector, relying heavily on a sophisticated interplay of mobile computing, Geographical Information Systems (GIS), and massive real-time data processing capabilities. The foundational technology involves highly resilient, proprietary software architectures capable of managing millions of concurrent user sessions and coordinating thousands of couriers across complex urban grids with high precision. Central to this infrastructure are advanced mapping and geo-location APIs that provide hyper-accurate real-time tracking, essential not only for customer transparency but also for minimizing the 'detour distance'—a critical metric in delivery efficiency that directly impacts fuel consumption and time. Secure, high-throughput payment gateway integration is also paramount, supporting diverse global payment methods and ensuring instantaneous transaction confirmation across multiple currencies and regulatory jurisdictions, often requiring robust compliance infrastructure to handle sensitive financial and personal data in accordance with international standards.

The competitive edge in the technological landscape is increasingly shifting towards predictive analytics and automation, spearheaded by Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These systems are responsible for dynamic fleet management, where complex predictive models forecast short-term demand spikes (e.g., anticipating lunch rush increases based on minute-by-minute weather changes or local event calendars) and proactively deploy couriers to optimal waiting zones, significantly reducing response time and maximizing courier throughput. Furthermore, these predictive models guide the strategic placement, menu design, and capacity optimization of platform-owned cloud kitchens, ensuring that preparation capacity aligns perfectly with forecasted local demand without excessive food waste. This technological mastery over supply-demand matching is the single greatest determinant of operational efficiency, directly impacting the platform's ability to reduce cost per delivery and achieve the elusive goal of sustained, healthy profitability across all operating regions.

Looking forward, the technology landscape is being profoundly shaped by disruptive investments in cutting-edge last-mile solutions designed to bypass human labor costs and urban congestion. Pilot programs involving autonomous ground delivery robots, particularly for short-distance, high-frequency drops in closed environments (like corporate campuses or retirement communities), and specialized drone delivery systems for highly controlled suburban or low-density areas are gaining significant traction globally. Concurrently, platforms are leveraging technology to enhance the restaurant side of the equation, offering integrated Point of Sale (POS) systems, proprietary order management tablets that integrate seamlessly with kitchen display systems (KDS), and detailed data dashboards that help partners manage kitchen flow, minimizing the time between order placement and courier pickup. The exploration of blockchain technology is also underway to ensure tamper-proof delivery logs and transparent contractual payments to couriers and restaurants, addressing lingering trust and accountability issues within the multi-sided platform ecosystem, reinforcing the role of technology as both a facilitator and a rigorous regulator of modern market activities.

Regional Highlights

Regional market performance in food delivery is a highly dynamic reflection of varying economic maturity, complex regulatory environments, and diverse consumer density patterns. Asia Pacific (APAC) dominates global statistics, not only in current market value but also in future growth potential, driven primarily by the massive, rapidly urbanizing populations of economic giants like China (Meituan) and India (Swiggy, Zomato). The operational model in APAC often features highly integrated 'super-apps'—platforms that bundle food delivery seamlessly with adjacent services like financial technology, ride-hailing, and e-commerce, creating powerful, monopolistic ecosystems that foster extreme customer loyalty and high frequency of use. Competition is incredibly intense, often involving substantial promotional discounts and fierce localized market battles, which necessitate highly efficient, typically low-cost logistical networks often reliant on motorcycles and bicycles to navigate dense, highly congested city traffic effectively and quickly.

The North American and European markets exhibit different operational dynamics, largely due to significantly higher labor costs, increased consumer protection standards, and mounting regulatory scrutiny. North America, led by DoorDash and Uber Eats, is characterized by high Average Order Values (AOV) and a strategic focus on margin optimization through advanced AI routing and proprietary customer loyalty subscription models (e.g., DashPass, Uber Pass). The strategic priority here is aggressively expanding into adjacent services like grocery delivery (q-commerce) and specialty retail to utilize existing courier capacity efficiently during non-peak meal times. Europe faces complex and fragmented labor laws across different member states, prompting platforms like Deliveroo and Just Eat Takeaway to continuously navigate the legal classification of their couriers, often necessitating heavier investment in legal compliance and sometimes adopting more restrictive operational models to mitigate severe financial liabilities related to mandated employee benefits.

Emerging markets in Latin America and the Middle East & Africa (MEA) offer exceptionally high growth ceilings but come with unique infrastructural and regulatory challenges that demand specific localization strategies. LATAM markets, exemplified by Rappi, are seeing rapid adoption driven by mobile penetration and a strong cultural preference for delivery convenience, often in regions where public transportation infrastructure is less reliable. MEA markets, particularly the wealthy Gulf Cooperation Council (GCC) countries, show strong, expenditure-driven growth supported by high per capita income and a significant reliance on high-quality luxury delivery services, often requiring customized logistical security and rigorously enforced service standards. Success in these emerging regions depends heavily on localizing logistical solutions, including developing proprietary addressing systems where formal municipal street addresses are often lacking, making flexible technology adaptation and local partnership a critical success factor for platforms seeking durable market presence.

- Asia Pacific (APAC): Leads in market volume and expected growth; defined by super-app strategies, reliance on two-wheeled transport, and intense competitive pressure in high-density markets (China, India, Indonesia).

- North America: Mature market focusing intensely on profitability and consolidation; characterized by high AOV, sophisticated AI logistics, and expansion into high-margin grocery/alcohol delivery (US, Canada).

- Europe: Operational efficiency challenged by strict regulatory frameworks concerning courier employment status; stable demand across Western Europe with a strong focus on sustainability initiatives and electric vehicle adoption (UK, Germany, Netherlands).

- Latin America (LATAM): High growth driven by rapid urbanization and digital adoption; infrastructure investment (logistics mapping, digital payment security) is paramount for continued expansion and service reliability (Brazil, Mexico).

- Middle East & Africa (MEA): Growth centered in affluent urban hubs; characterized by high service level expectations, reliance on expatriate labor, and the need for customized addressing and heightened security protocols (UAE, Saudi Arabia).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Delivery Market.- DoorDash Inc.

- Uber Eats (Uber Technologies Inc.)

- Deliveroo plc

- Meituan (Meituan-Dianping)

- Just Eat Takeaway.com N.V.

- Grubhub (Just Eat Takeaway subsidiary)

- Swiggy (Bundl Technologies Private Limited)

- Zomato Ltd.

- Delivery Hero SE

- Postmates (Uber Technologies Inc. subsidiary)

- Talabat (Delivery Hero subsidiary)

- Glovo (Delivery Hero subsidiary)

- Foodpanda (Delivery Hero subsidiary)

- GrabFood (Grab Holdings)

- Relief

- Takeaway.com

- SkipTheDishes

- Eatsy Technologies

- Coupang Eats

- Rappi

- Hungrypanda

- Cava Group

- Delivery Dot Com

- Waitr Holdings Inc.

Frequently Asked Questions

Analyze common user questions about the Food Delivery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Food Delivery Market through 2033?

The Food Delivery Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033, driven primarily by increasing global urbanization, widespread digital consumerism, and the structural shift towards convenience-centric services.

How is Artificial Intelligence fundamentally changing food delivery logistics?

AI is transforming logistics by enabling real-time, highly granular dynamic route optimization, predictive demand forecasting, and sophisticated personalization algorithms, leading to significant improvements in delivery speed and critical operational cost reductions across the entire fulfillment chain.

Which segment currently dominates the Food Delivery Market in terms of operational model?

The Platform-to-Consumer (P2C) operational model, where the delivery platform contracts and manages the end-to-end logistics, holds the dominant market share due to its unparalleled scalability, higher service control, and ability to centralize and standardize the overall customer experience.

What are the key financial challenges restraining market profitability?

Key financial restraints include intense competition leading to aggressive price wars and high promotional spend, escalating customer acquisition costs, substantial commission rates charged to restaurant partners, and the persistent regulatory risks associated with courier labor classification, which threatens fixed costs.

Which geographical region exhibits the fastest growth and why?

Asia Pacific (APAC) exhibits the fastest and largest growth globally, attributed to its massive population density, rapid mobile internet penetration, and the prevalence of fully integrated super-app ecosystems that drive extremely high user engagement and transaction volume.

What role do cloud kitchens play in modern food delivery strategy?

Cloud kitchens (dark kitchens) are critical assets as they are purpose-built and optimized solely for high-volume delivery efficiency, minimizing real estate costs, expanding geographical coverage quickly, and allowing platforms to incubate virtual restaurant brands with superior operational control and margin capture.

How are labor regulations impacting food delivery in Europe?

Stricter labor regulations in key European markets regarding the legal classification of couriers as employees rather than independent contractors are forcing delivery platforms to fundamentally reassess their operational models, potentially leading to increased labor costs and requiring significant structural business adjustments to ensure compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Food delivery logistics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Online Food Delivery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Food Delivery Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Digital Food Delivery Market Statistics 2025 Analysis By Application (Business, Family), By Type (Call To Order, Web Site Order), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Food Delivery Lockers Market Statistics 2025 Analysis By Application (Residentail, Offce Center, School Campus), By Type (Refrigerated Lockers, Heated Lockers, Refrigerated+Heated Lockers, Room Temperature), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager