Garage Door Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433987 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Garage Door Market Size

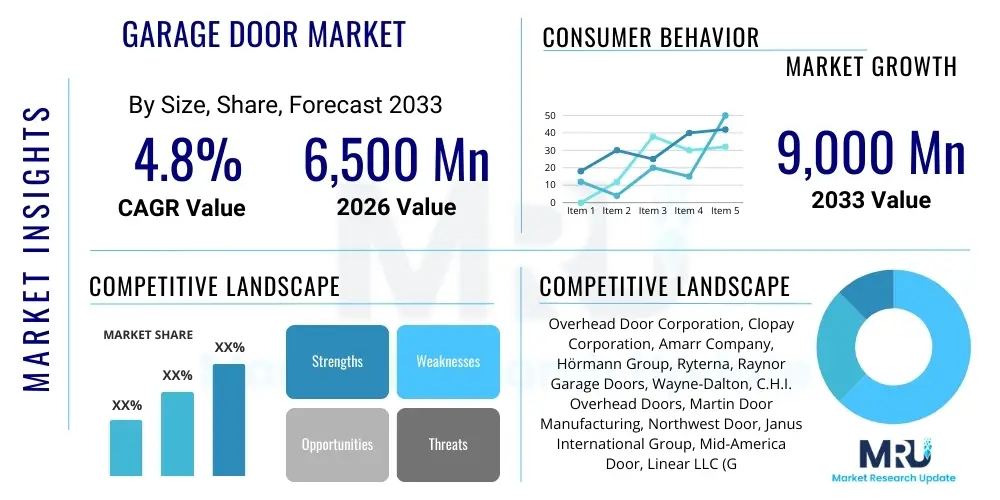

The Garage Door Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Garage Door Market introduction

The Garage Door Market encompasses the manufacturing, distribution, installation, and maintenance of various types of garage doors utilized in residential, commercial, and industrial settings. Products range from basic manual sectional doors to highly sophisticated automated, insulated, and smart garage door systems. Major applications include enhancing building security, improving energy efficiency through better insulation, and increasing the aesthetic appeal of properties. Key benefits derived from modern garage doors include enhanced safety features, reliable operation, and integration with smart home ecosystems. The market is significantly driven by robust residential construction activity, increasing consumer demand for premium, customized, and durable materials, and stringent regulatory requirements pertaining to building energy codes and safety standards across developed economies.

Garage Door Market Executive Summary

The global Garage Door Market is characterized by resilient business trends driven primarily by the steady recovery in the housing market and increasing remodeling expenditures worldwide. Strategic shifts are evident toward highly customized and technologically integrated products, focusing on superior insulation, advanced materials like aluminum and glass, and incorporating IoT capabilities for remote monitoring and access control. Regional trends highlight North America and Europe as mature markets demanding high-performance and aesthetically pleasing doors, while the Asia Pacific region demonstrates the fastest growth trajectory, propelled by rapid urbanization and infrastructure development in emerging economies. Segment trends reveal strong performance in the residential sector, particularly for insulated and premium-grade sectional doors, and a growing adoption of high-speed rolling doors within the commercial and industrial segments driven by logistics and warehouse efficiency requirements.

AI Impact Analysis on Garage Door Market

Common user questions regarding AI’s impact on the Garage Door Market frequently center on themes such as predictive maintenance reliability, enhanced security features, and the integration of AI-driven diagnostics into smart openers. Users inquire about how AI algorithms can anticipate mechanical failures before they occur, thereby minimizing downtime and maintenance costs. Furthermore, there is significant interest in how AI-powered computer vision and machine learning can improve physical security, such as distinguishing between authorized users, pets, and unauthorized intruders, offering a higher level of safety than traditional sensors. The key expectation is that AI will move garage doors beyond simple opening and closing mechanisms, transforming them into proactive, intelligent security and access hubs within the broader smart building ecosystem, optimizing efficiency and user experience.

- AI facilitates predictive maintenance schedules by analyzing operational data from openers and sensors, reducing unexpected component failure.

- Machine learning enhances security through object recognition and anomaly detection, improving the accuracy of obstruction sensors and preventing unauthorized access.

- AI algorithms optimize energy consumption in smart doors by learning user patterns and controlling ventilation or insulation settings automatically.

- Integration with voice assistants and smart home platforms is streamlined using AI to process complex commands and environmental data.

- Generative AI tools assist manufacturers in design optimization, material stress analysis, and rapid prototyping of new door models.

DRO & Impact Forces Of Garage Door Market

The Garage Door Market is positively influenced by key drivers such as increasing demand for smart home integration, which elevates the value proposition of modern garage access systems, and steady global construction growth, particularly in the residential remodeling sector. These forces create a sustainable demand pipeline, compelling manufacturers to invest in product innovation focusing on connectivity and efficiency. Conversely, the market faces restraints primarily stemming from volatility in raw material costs, particularly steel and aluminum, which pressures profit margins, and the ongoing need for skilled labor for complex installations and maintenance of advanced systems. These constraints necessitate efficient supply chain management and investments in training.

Opportunities for growth are abundant, primarily centered around expanding penetration in emerging markets with rising disposable incomes and rapid infrastructure development, alongside the development of high-performance, aesthetically integrated doors suitable for modern architectural designs. Furthermore, leveraging sustainable and recycled materials in manufacturing presents a significant long-term competitive advantage. Impact forces within the industry are driven by stringent environmental regulations promoting energy-efficient insulation standards, the rising trend of do-it-yourself (DIY) installations for simpler models, and intense price competition, particularly in standardized product segments, mandating continuous cost reduction and differentiation strategies.

The cumulative effect of these dynamic forces shapes the strategic landscape. While technological advancement and construction momentum provide significant upward thrust, manufacturers must deftly navigate material cost fluctuations and labor shortages. Successful market players are those who strategically focus on high-margin, differentiated products—such as highly insulated, customized, and technologically advanced smart doors—to mitigate the pressures exerted by commoditization in the lower-end segments.

- Drivers: Growing global residential and commercial construction; increasing adoption of smart home technologies and IoT integration; emphasis on energy efficiency and thermal insulation; rising replacement demand in mature markets.

- Restraints: Volatility in the price of key raw materials (steel, aluminum, resins); high initial installation costs for specialized systems; dependency on skilled labor for maintenance and complex setup.

- Opportunities: Untapped potential in emerging economies due to urbanization; development of lightweight and durable composite materials; expansion of aftermarket services and maintenance contracts; increasing demand for customized architectural designs.

- Impact Forces: Intense competition driving pricing pressures; strict government safety and building code regulations; technological disruption from AI-enabled openers; consumer preference shifts towards aesthetic and noise-reduction features.

Segmentation Analysis

The Garage Door Market is segmented based on Material, Product Type, Application, and End-User, providing a multidimensional view of market dynamics and consumer preferences. The dominance of steel in the material segment is attributed to its durability and cost-effectiveness, although wood and aluminum are gaining traction in premium and modern architectural applications, respectively. Product types are broadly categorized into sectional, roll-up, slide-to-side, and swing doors, with sectional doors maintaining the largest market share due to their versatility and suitability for residential use. Analyzing these segments helps stakeholders tailor their manufacturing processes, distribution strategies, and marketing campaigns to specific market needs, optimizing resource allocation and maximizing potential return on investment.

The application segmentation distinguishes between residential, commercial, and industrial usage. Residential applications drive the volume, focusing on aesthetic integration and smart access features, while commercial and industrial uses prioritize robustness, security, and operational speed. Industrial applications, particularly within logistics and manufacturing, rely heavily on high-speed and insulated doors to maintain specific temperature zones and accelerate operational flow. Understanding this application split is vital for manufacturers specializing in heavy-duty or highly customized solutions, allowing them to focus on specific performance criteria such as fire ratings, wind load resistance, and thermal efficiency tailored to industrial needs.

Furthermore, segmentation allows for a granular analysis of competitive landscapes within specific product niches. For instance, the market for smart garage door openers (a subset of product type) is intensely focused on connectivity protocols and cybersecurity features, distinct from the competition found in the basic roll-up door segment. This detailed categorization enables accurate forecasting of demand shifts driven by regulatory changes, technological advancements, or macroeconomic factors impacting specific end-user groups, thus forming the foundation for strategic decision-making across the value chain.

- By Material: Steel, Aluminum, Wood, Fiberglass, Others (Vinyl, Composites)

- By Product Type: Sectional Doors, Roll-Up Doors, Swing-Out Doors, Slide-to-Side Doors, Specialty Doors

- By Application: Residential, Commercial, Industrial

- By Operation: Manual, Automatic/Electric (Openers)

- By Distribution Channel: Direct Sales, Distribution Networks (Specialty Dealers, Home Centers, Online Retail)

Value Chain Analysis For Garage Door Market

The value chain of the Garage Door Market begins with the upstream activities centered on raw material procurement, including the sourcing of steel, aluminum, wood, and advanced plastics, alongside components such as springs, hinges, tracks, and electronic openers. This stage is crucial, as material quality directly impacts the door's durability and thermal performance. Manufacturers often engage in vertical integration or establish long-term contracts with specialized suppliers to ensure consistent quality and manage cost volatility. Efficiency in the upstream segment determines manufacturing cost effectiveness and the ability to meet market demand for specific material types, such as corrosion-resistant coatings or specialized insulation foams.

Manufacturing and assembly form the core midstream activities, where components are processed, fabricated, and integrated into final products. This stage involves significant investment in automation, precise cutting, and quality control systems, particularly for insulated and custom-sized doors. Downstream activities involve distribution channels, which are typically segmented into direct sales to large commercial builders and distribution through specialized dealers, home improvement centers, and increasingly, online retail platforms. Specialty dealers often provide value-added services such as custom design consultation, professional installation, and ongoing maintenance, playing a critical role in customer satisfaction and product longevity.

The distribution network is bifurcated between direct and indirect channels. Direct channels are common for large-scale industrial projects or specialized commercial contracts requiring custom specifications and installation oversight directly from the manufacturer. Indirect channels, predominantly involving independent distributors and big-box retailers, cater primarily to the residential replacement and new construction market. Optimizing this distribution mix is essential; manufacturers utilize specialized dealers for premium, high-technology doors that require expert installation, while utilizing indirect retail channels for high-volume, standard models, ensuring wide market reach and balanced operational costs.

Garage Door Market Potential Customers

Potential customers for the Garage Door Market are diverse, spanning multiple segments including individual homeowners, residential builders, commercial property developers, and industrial operators. Homeowners are primary end-users, typically seeking replacement doors due to wear and tear, damage, or as part of home renovation projects focused on aesthetic enhancement and improved security. Builders and contractors form a crucial high-volume customer group, purchasing standardized doors for new residential developments, prioritizing reliability, cost efficiency, and ease of installation to meet construction schedules.

In the commercial sector, customers include owners and managers of retail facilities, multi-family housing complexes, and office buildings. These buyers prioritize features like aesthetic compatibility, fire safety ratings, and high cycle counts required for frequent usage. Industrial potential customers, comprising logistics hubs, manufacturing plants, and warehousing facilities, demand highly specific products such as high-speed roll-up doors, specialized dock doors, and heavy-duty insulated sectional doors capable of withstanding severe operational stress and meeting stringent environmental control requirements necessary for efficient operations.

Furthermore, niche markets such as governmental facilities, specialized transportation depots, and agricultural storage facilities also constitute potential customers. These end-users typically require highly robust, certified products often meeting unique specifications related to security clearance, wind load resistance in extreme weather areas, or very specific dimensions for oversized equipment access. Targeting these specific end-user requirements necessitates customized sales strategies, specialized product lines, and adherence to relevant industry certifications and compliance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6,500 Million |

| Market Forecast in 2033 | USD 9,000 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Overhead Door Corporation, Clopay Corporation, Amarr Company, Hörmann Group, Ryterna, Raynor Garage Doors, Wayne-Dalton, C.H.I. Overhead Doors, Martin Door Manufacturing, Northwest Door, Janus International Group, Mid-America Door, Linear LLC (GTO Access Systems), Eden Coast, ASSA ABLOY (specifically for high-speed industrial solutions), Tormax, and Genie Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Garage Door Market Key Technology Landscape

The Garage Door Market technology landscape is rapidly evolving beyond basic mechanical operation, driven primarily by the integration of Internet of Things (IoT) and advanced sensor technologies. Smart garage door openers now utilize Wi-Fi and Bluetooth connectivity, allowing users to monitor the door status, open or close it remotely via smartphone applications, and grant temporary access to delivery services or maintenance personnel. This reliance on connectivity necessitates robust cybersecurity measures to prevent unauthorized digital intrusion, making secure firmware and encrypted communication protocols essential components of modern door systems. Furthermore, battery backup systems are becoming standard, ensuring functionality during power outages, addressing a key consumer pain point.

Another significant technological advancement is in materials science and insulation technology. Manufacturers are increasingly utilizing composite materials and high-density polyurethane or polystyrene foam insulation to significantly enhance the thermal efficiency (R-value) of sectional doors. This aligns directly with stricter energy consumption standards and consumer desire for climate-controlled garage spaces. In the industrial segment, Variable Frequency Drives (VFDs) are being incorporated into high-speed door operators. VFDs allow for smoother acceleration and deceleration, reducing wear and tear, prolonging the lifespan of mechanical components, and providing superior operational efficiency and speed crucial for high-throughput logistics environments.

Sensor technology has also seen significant refinement. Traditional infrared safety sensors are being supplemented or replaced by advanced laser and radar-based systems, offering enhanced object detection capabilities, particularly in low-light or adverse weather conditions. The incorporation of biometric access systems (fingerprint or facial recognition) is emerging in high-security residential and commercial applications, offering keyless entry and customized access privileges. Overall, the technology trajectory points towards doors that are not only highly durable and thermally efficient but also seamlessly integrated, intelligent, and proactive components of a modern building's security and energy management infrastructure.

Regional Highlights

- North America: North America represents a mature and technologically advanced market, dominating revenue share primarily driven by the significant volume of residential repair and remodeling (R&R) activity and robust housing starts in the US and Canada. Consumer preferences strongly favor highly insulated (high R-value), aesthetically appealing steel and composite doors, often integrated with advanced smart features (e.g., MyQ, HomeKit compatibility). The region shows high demand for specialized, heavy-duty doors in its vast logistics and warehousing sector, particularly high-speed and impact-resistant models. Regulatory compliance regarding safety, such as UL standards for openers, remains a critical factor defining market entry and product specifications.

- Europe: The European market is characterized by a strong emphasis on energy efficiency, leading to widespread adoption of premium, well-insulated sectional doors (often referred to as 'warm doors'). Germany, the UK, and France are key contributors, driven by stringent national building regulations (e.g., KfW standards in Germany) promoting thermal performance and sustainability. The European consumer market also places a high value on bespoke designs and smooth, quiet operation. The industrial segment is defined by strong demand for high-performance industrial doors (e.g., rapid roll doors, dock leveling equipment) necessitated by the dense, efficient manufacturing and logistics infrastructure across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally, fueled by rapid urbanization, significant government investment in infrastructure, and burgeoning residential construction, particularly in emerging economies like China and India. While the market historically favored lower-cost, standard roll-up doors, rising disposable incomes are increasingly shifting demand toward higher-quality, durable, and sometimes automated sectional doors in the residential sector. Japan and Australia represent mature sub-markets with high penetration of sophisticated, wind-load-resistant doors due to regional climatic requirements. The region offers immense opportunity for entry-level smart door solutions and material-efficient products.

- Latin America: This region exhibits moderate growth, focused primarily on essential security features due to prevailing local security concerns. The market is highly price-sensitive, often favoring basic steel doors and standard roll-ups. However, in wealthier urban areas, there is a nascent but growing demand for insulated, automated, and aesthetically enhanced doors mirroring North American trends. Brazil and Mexico are the largest national markets, where new infrastructure projects and mid-to-high-end residential construction activity drive the majority of sales volume.

- Middle East and Africa (MEA): Growth in MEA is driven by large-scale commercial and infrastructure development projects, including major residential housing schemes in the Gulf Cooperation Council (GCC) countries. Extreme heat conditions mandate the use of highly effective thermal insulation materials and heat-resistant coatings. Demand is highly polarized, with luxury residential projects demanding custom-designed, premium materials, while standard construction projects rely on cost-effective metal doors. Political and economic stability fluctuations influence major construction timelines, thus affecting overall market demand in specific sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Garage Door Market.- Overhead Door Corporation (Oversaw several brands including Wayne-Dalton)

- Clopay Corporation

- Amarr Company (A subsidiary of ASSA ABLOY)

- Hörmann Group

- Ryterna

- Raynor Garage Doors

- C.H.I. Overhead Doors

- Martin Door Manufacturing

- Northwest Door

- Janus International Group

- Mid-America Door

- The Genie Company

- Linear LLC (GTO Access Systems)

- Eden Coast

- Aluroll

- Gliderol Garage Doors

- Tormax

- Pella Corporation (for specialized doors)

- Entrematic Group

- Sanwa Holdings Corporation

Frequently Asked Questions

Analyze common user questions about the Garage Door market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for smart garage door openers?

The primary driver is the pervasive trend of smart home integration, allowing users remote monitoring, secure package delivery access management, and enhanced convenience through smartphone control and voice assistant compatibility. Security benefits, such as real-time notifications and integrated video monitoring, also significantly boost consumer demand for smart systems.

Which material segment holds the largest share in the Garage Door Market?

Steel currently holds the largest market share due to its excellent combination of durability, low maintenance requirements, and cost-effectiveness. However, aluminum is rapidly gaining traction in modern residential and commercial designs owing to its light weight and superior resistance to corrosion.

How does the increasing focus on energy efficiency impact garage door design?

The focus on energy efficiency directly mandates higher thermal performance. Manufacturers are responding by increasing the thickness of doors, utilizing advanced insulation materials like polyurethane foam, and incorporating thermal breaks to achieve high R-values, which minimizes heat transfer and lowers energy costs for climate-controlled garages.

What is the key technological innovation transforming industrial garage doors?

The key innovation is the incorporation of high-speed operation mechanisms utilizing Variable Frequency Drives (VFDs) and advanced sensor arrays. This allows for rapid opening and closing cycles, crucial for maintaining climate control and optimizing operational flow in busy logistics and manufacturing environments.

Which geographic region is projected to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate. This acceleration is attributed to massive residential and commercial construction activities, rapid urbanization, and rising middle-class disposable incomes leading to greater adoption of automated and higher-quality garage door systems across countries like China and India.

What role do safety regulations play in market development?

Safety regulations, particularly in North America (UL standards) and Europe (CE marking), are foundational, dictating requirements for anti-pinch features, automatic reversal mechanisms, and reliable photoelectric sensors. These regulations continuously push manufacturers towards incorporating advanced safety technologies, enhancing consumer confidence and product quality across the industry.

How are environmental concerns shaping material choices?

Environmental concerns are driving a shift towards sustainable practices. This includes increasing the use of recycled steel and aluminum content, utilizing sustainably sourced wood or composite alternatives, and developing eco-friendly insulation foams, aligning manufacturing processes with global green building standards and consumer preferences for sustainability.

What are the primary challenges faced by residential garage door manufacturers?

Manufacturers face challenges including volatile pricing and scarcity of key raw materials like steel, aluminum, and resins. Additionally, meeting the growing consumer demand for highly customized aesthetic options while maintaining cost-effective production at scale presents a significant operational hurdle.

Define the primary difference between sectional doors and roll-up doors in terms of market application.

Sectional doors are primarily favored in residential applications because they offer superior insulation, better aesthetics, and quiet operation. Roll-up doors, conversely, are typically used in commercial and industrial settings where maximum headroom clearance and robust, high-cycle operation in demanding environments are the critical performance requirements.

How does AI contribute to predictive maintenance in garage door systems?

AI integrates with smart openers and sensors to analyze operational metrics such as spring tension, motor wear cycles, and system error rates. By identifying minor anomalies or deviations from baseline performance, AI algorithms can accurately predict potential mechanical failures before they occur, allowing users to schedule preemptive maintenance and avoid costly breakdowns.

What competitive strategies are major players utilizing in the market?

Major players are focusing on vertical integration to control the supply chain and maintain quality, investing heavily in product differentiation through smart technology integration (IoT and AI), and pursuing strategic acquisitions to expand their geographic footprint and enhance their service offerings, moving towards being total access solutions providers rather than just door suppliers.

What impact does DIY installation have on the professional installation segment?

The rise of DIY installation, facilitated by easier-to-install basic models and online tutorials, pressures the professional installation segment for standard residential doors. However, complex, large-scale, and smart systems still critically require professional installation and servicing due to safety regulations, complexity, and warranty considerations, maintaining a strong base for expert technicians.

How are aesthetic considerations influencing garage door market trends?

Aesthetic considerations are paramount, moving garage doors from functional necessity to architectural focal points. Current trends include large glass panels for modern designs, custom color matching, specialized wood grains (often fiberglass or steel stamped), and sleek, minimalist designs that integrate seamlessly with contemporary home exteriors, driving demand for premium, custom products.

What is the significance of the replacement market versus the new construction market?

The replacement (R&R) market is highly significant, particularly in mature economies like North America and Western Europe, often generating higher margins than new construction. R&R sales are driven by consumer desire for upgrades (insulation, smart features, aesthetics), while new construction relies on high volume and adherence to developer cost constraints and standard specifications.

In the Value Chain, why is the specialty dealer channel critical?

The specialty dealer channel is critical because it offers value-added services necessary for complex, high-end products. Dealers provide expert consultation, customized measurement, professional installation, and essential post-sale maintenance, which standard retail channels cannot adequately supply, ensuring customer satisfaction for sophisticated and premium garage door systems.

What is the typical lifecycle and replacement period for a residential garage door?

The typical lifespan of a well-maintained residential garage door is generally 20 to 30 years, while the opener unit often lasts 10 to 15 years. Replacement cycles are increasingly being shortened by aesthetic upgrade desires, the demand for better energy efficiency, and the obsolescence of mechanical components or opener technology.

How are rising labor costs affecting market structure?

Rising labor costs for skilled installers contribute to the overall increase in the total installed cost of garage door systems, which can restrain market growth in some price-sensitive segments. This also accelerates manufacturer efforts to simplify installation processes through modular components and pre-assembled kits, reducing reliance on extensive on-site labor.

What is the role of wind load requirements in coastal or storm-prone regions?

Wind load requirements are essential safety factors in coastal and storm-prone regions. Doors must be specifically engineered with reinforcing struts and robust track systems to withstand high winds, often requiring specific certification from organizations like the International Code Council (ICC), ensuring structural integrity during extreme weather events and preventing building envelope failure.

Beyond sectional and roll-up, what are specialty doors primarily used for?

Specialty doors, such as high-lift, vertical-lift, or full-view glass doors, are utilized for unique architectural or operational requirements. Full-view glass doors are popular in modern homes and commercial retail spaces for visibility, while vertical-lift doors are used in industrial settings requiring maximal utilization of ceiling height space.

How significant is cybersecurity in the context of smart garage door operation?

Cybersecurity is highly significant, moving from a niche concern to a critical selling point. As smart doors connect to home networks and control access, the risk of hacking necessitates robust encryption protocols, mandatory firmware updates, and adherence to established IoT security standards to protect property and maintain user trust in connected technologies.

Explain the concept of R-value as it relates to garage doors.

R-value measures a material's resistance to heat flow. A higher R-value indicates better insulation. In garage doors, a high R-value is crucial for energy conservation, particularly if the garage is attached to a conditioned space or utilized as a workshop, reducing heating and cooling costs and maintaining temperature stability inside the structure.

What are the procurement challenges associated with wood garage doors?

Procurement challenges for wood doors involve sourcing high-quality, durable timber, often requiring specialty hardwoods, and managing supply volatility related to sustainable forestry practices and environmental certifications. Additionally, maintaining uniformity in color and grain across large batches requires specialized selection and finishing processes.

How are manufacturers adapting to the trend of oversized garages and openings?

Manufacturers are adapting by producing reinforced track systems, heavier-duty spring and torsion systems, and wider-format door panels that can handle increased size and weight. This often requires custom engineering solutions, particularly for commercial or specialized residential applications where standard door dimensions are insufficient for modern vehicles or equipment.

Which segments are most likely to utilize biometric access technology?

Biometric access technology is primarily utilized in high-security environments, such as luxury residential properties, executive parking garages, and certain commercial facilities requiring auditable access control. It offers superior security and convenience compared to traditional keypads or remote controls by verifying physical user identity.

What role does the aftermarket service segment play in manufacturer revenue?

The aftermarket service segment, encompassing parts replacement (springs, cables, sensors), repair services, and routine maintenance contracts, plays a substantial and stable role in manufacturer and dealer revenue. It typically offers higher margins than new door sales and provides a recurring revenue stream, solidifying long-term customer relationships and brand loyalty.

How is competition intensifying in the automation and opener market?

Competition is intensifying through technological innovation, specifically the race to integrate advanced smart features, video capabilities, and AI-driven diagnostics into openers. Key players are also competing heavily on user interface design, integration compatibility with major smart home ecosystems (e.g., Google Home, Amazon Alexa), and pricing strategies for connected services.

What are the implications of digital sales channels for traditional distributors?

Digital sales channels (e-commerce platforms) primarily cater to standard, non-customized residential doors, increasing price transparency and potentially bypassing traditional distributors for basic parts or DIY kits. However, traditional distributors remain essential for complex custom orders and installation services, maintaining their value proposition through expertise and localized service delivery.

How does urban density influence the selection of garage door type?

In highly dense urban areas where space is constrained, slide-to-side or specialized roll-up doors are often preferred over standard sectional doors. These designs minimize overhead requirements or reduce the swing radius, allowing for better utilization of limited internal and external space, particularly in underground or restricted parking facilities.

Discuss the rising demand for full-view aluminum and glass garage doors.

The rising demand for full-view aluminum and glass doors is driven by modern architectural trends favoring natural light, transparency, and seamless integration of indoor-outdoor living spaces. These doors are popular in contemporary residential designs and commercial applications such as restaurants or showrooms, offering a sleek, sophisticated aesthetic appeal.

What is the long-term impact of fluctuating interest rates on the market?

Fluctuating interest rates have a significant long-term impact, as higher rates can slow down the new residential construction sector and potentially delay large remodeling projects. Conversely, stable or declining rates typically stimulate housing market activity, driving increased demand for both new installations and renovation-related replacements, acting as a major macroeconomic determinant for market volume.

What specific challenges do manufacturers face in the Middle East market?

Manufacturers in the Middle East market must overcome extreme environmental challenges, primarily intense heat and high UV exposure, which demand specialized heat-resistant coatings and high R-value insulation. Additionally, logistical complexities associated with delivering and installing oversized, specialized doors in rapidly developing urban centers present operational difficulties.

How are composite materials transforming high-end residential doors?

Composite materials are transforming high-end residential doors by offering the aesthetic appeal of natural wood without the associated maintenance issues like warping, rotting, or pest damage. They provide superior durability, excellent insulation properties, and allow for detailed customization of texture and finish, appealing to consumers seeking premium, low-maintenance options.

What is the strategic importance of patented technologies in the opener segment?

Patented technologies, particularly those related to secure connectivity, unique mechanical designs (e.g., direct drive systems), and advanced sensor operation, are strategically important. They provide key competitive differentiation, establishing barriers to entry for competitors and allowing patent holders to command premium pricing for features deemed essential by consumers, such as reliable security and quiet operation.

How are manufacturers addressing noise reduction in residential doors?

Manufacturers address noise reduction by utilizing quieter door openers (often belt-driven instead of chain-driven), incorporating high-quality nylon rollers instead of steel, employing robust, insulated panels that dampen sound transmission, and ensuring precise track alignment and high-quality hardware to minimize operational vibration and friction noise.

What are the key drivers for growth in the industrial segment?

The key drivers for industrial segment growth include the global expansion of e-commerce and logistics infrastructure, necessitating high-speed, high-cycle industrial doors to maintain operational efficiency in distribution centers. Furthermore, stringent safety standards and the demand for specialized climate-controlled warehousing also propel investment in high-performance door systems.

How significant is the impact of trade tariffs on raw material costs?

Trade tariffs, particularly on imported steel and aluminum, can significantly impact the raw material costs for manufacturers, leading to increased production expenses and pressure on margins. These tariffs often necessitate strategic adjustments in sourcing and prompt product price increases, affecting the competitive landscape, particularly for imported finished goods.

What is the primary function of a thermal break in an insulated garage door?

The primary function of a thermal break is to create a physical separation between the inner and outer metal skins of an insulated door. This non-conductive barrier prevents the direct transfer of heat or cold through the metal, substantially increasing the door's overall thermal efficiency and reducing condensation build-up in extreme temperatures.

In the context of the Value Chain, what is upstream analysis concerned with?

Upstream analysis in the Value Chain is concerned with the efficient procurement and management of raw materials (steel, wood, aluminum) and critical components (springs, motors). The focus is on securing stable supply contracts, ensuring quality control of materials, and mitigating cost volatility to secure competitive pricing for the final product.

How does warranty provision influence consumer purchasing decisions?

Warranty provision is a critical factor influencing consumer purchasing decisions, especially for high-value items like garage doors and openers. Longer warranties, particularly on hardware (springs, tracks) and finish, signal product quality and reliability, reducing perceived financial risk for the buyer and often justifying a higher initial purchase price.

What is the current market penetration of battery backup systems?

Market penetration of battery backup systems is high and rapidly increasing, driven by consumer safety concerns and regulatory requirements, particularly in regions prone to power outages. In some North American regions, battery backups are mandated by law for all new residential garage door opener installations to ensure emergency egress capabilities.

What technological advancement is commonly found in high-cycle commercial doors?

High-cycle commercial doors commonly incorporate robust direct-drive motors and heavy-duty torsion spring systems designed to withstand hundreds of thousands of cycles. These systems minimize the need for frequent maintenance and ensure operational reliability necessary for high-volume use in loading docks and logistics facilities.

How do customized garage doors affect the manufacturing process?

Customized garage doors significantly increase the complexity of the manufacturing process, requiring flexible production lines, detailed custom order management, and higher quality control standards for unique materials or specific dimensions. This typically results in longer lead times and higher production costs compared to standardized models.

Explain the increasing relevance of smartphone applications for door control.

Smartphone applications have become crucial as they allow users to control access remotely, integrate the door with other smart devices, track usage history, and receive status alerts (e.g., if the door is left open). This centralized control enhances both the convenience and the security offered by modern garage door systems.

What are the specific requirements for fire-rated garage doors?

Fire-rated garage doors are typically required in commercial buildings, shared residential complexes, and specific industrial applications to compartmentalize fire and prevent its spread. These doors must adhere to rigorous testing standards (e.g., NFPA or UL classifications) concerning material composition, installation methods, and specified duration of fire resistance (e.g., 90 minutes).

How does the economic situation in Latin America affect market pricing?

The economic situation in Latin America, marked by currency fluctuations and, in some areas, economic instability, generally pressures market pricing toward affordability. This favors local manufacturers or imports of standardized, cost-effective steel doors, while premium product adoption remains limited to high-income consumer segments.

What is the role of certification bodies in the Garage Door Market?

Certification bodies, such as UL (Underwriters Laboratories) and the Door & Access Systems Manufacturers Association (DASMA), ensure that products meet stringent safety, performance, and operational reliability standards. Compliance is essential for liability protection, market access, and maintaining consumer confidence in the product's quality and safety features.

Discuss the use of aluminum in high-end sectional doors.

Aluminum is used in high-end sectional doors for its sleek, modern aesthetic, lightness, and excellent corrosion resistance, especially popular in coastal regions. When paired with large expanses of tempered glass, it creates the highly sought-after full-view architectural look, commanding a premium price point in the market.

How is the industrial segment addressing the need for better light transmission?

The industrial segment addresses the need for better light transmission by utilizing specialized panels made from translucent materials like polycarbonate or fiberglass inserts within robust metal frames. This allows natural light into warehouses and docks, reducing the need for artificia

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Garage Door Replacement Parts Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Garage Door Openers & Accessories Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Smart Switch Garage Door System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Garage Door Operators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Garage Door Replacement Parts Market Size Report By Type (Metal Parts, Electromechanical Parts), By Application (Residential, Commercial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager