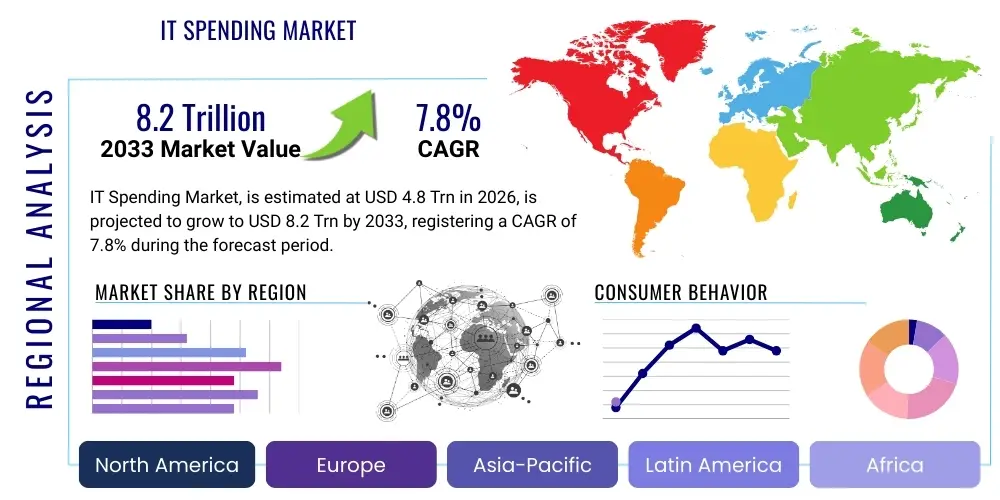

IT Spending Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436018 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

IT Spending Market Size

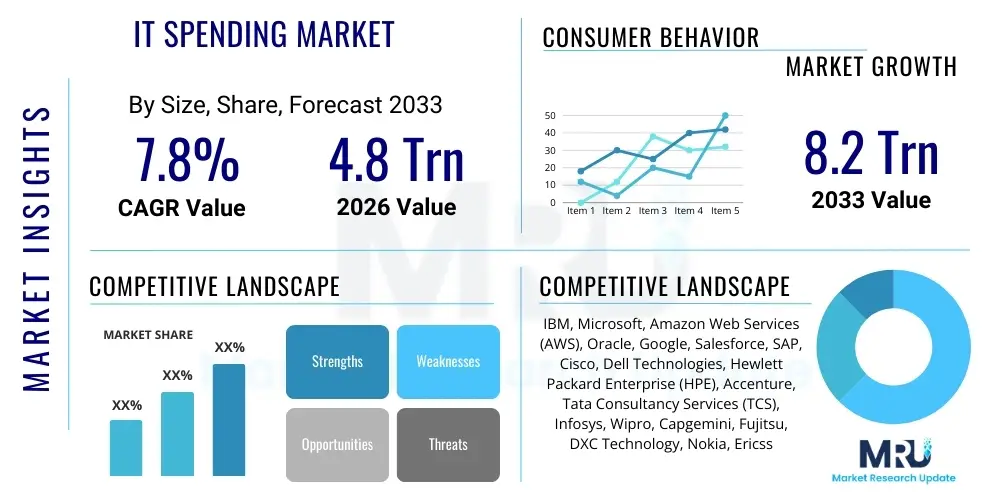

The IT Spending Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $4.8 Trillion in 2026 and is projected to reach $8.2 Trillion by the end of the forecast period in 2033.

IT Spending Market introduction

The global IT Spending market encompasses the total capital and operational expenditure incurred by businesses and governments on information technology resources, including hardware, software, IT services, and telecommunications equipment. This massive ecosystem is the foundational engine driving global digital transformation, supporting crucial business functions such as data management, cloud computing infrastructure, cybersecurity defenses, and enterprise resource planning (ERP) systems. The market is defined by rapid technological obsolescence and continuous innovation, particularly concerning the shift from legacy on-premise solutions to scalable, flexible, and subscription-based cloud environments.

Major applications of IT spending are deeply embedded across all economic sectors, ranging from financial institutions modernizing core banking systems to manufacturers implementing IoT and operational technology (OT) integration for smart factories. Key benefits derived from increased IT investment include enhanced operational efficiency, superior customer experience management through digital channels, and improved organizational agility in response to market changes. Furthermore, strategic IT spending is essential for maintaining competitive parity and compliance with stringent data protection regulations, ensuring business continuity in a digitized world.

Driving factors primarily include the pervasive need for digital transformation initiatives, accelerated adoption of hybrid and multi-cloud strategies, and the imperative to secure rapidly expanding digital perimeters against sophisticated cyber threats. The proliferation of connected devices (IoT) and the demand for real-time data processing capabilities further necessitates substantial investment in advanced analytics platforms and specialized IT infrastructure. Consequently, IT spending is evolving from a necessary cost center to a critical strategic investment directly linked to business growth and innovation cycles.

IT Spending Market Executive Summary

The IT Spending market is experiencing robust growth fueled by irreversible digital shifts and strategic investments in cloud and AI technologies. Business trends indicate a pivot towards outcome-based IT procurement models, favoring as-a-Service consumption (SaaS, PaaS, IaaS) over traditional perpetual licensing, thereby lowering upfront capital expenditure but increasing long-term operational costs. Key segments demonstrating accelerated growth include software, driven by application modernization and data management tools, and IT services, which are critical for complex cloud integration and managed security offerings. Cybersecurity spending, specifically, has become non-negotiable across all enterprise sizes due to the rising frequency and severity of ransomware and data breaches, driving demand for advanced threat detection and response solutions.

Regionally, North America remains the largest spender globally, characterized by early adoption of cutting-edge technologies like generative AI and advanced cloud architectures, driven by high R&D expenditure and a mature vendor ecosystem. Asia Pacific (APAC) represents the fastest-growing region, propelled by the rapid digitalization of emerging economies, significant government investments in smart city infrastructure, and the expansion of domestic hyperscale data centers in China and India. Europe exhibits steady growth, primarily focused on regulatory compliance (GDPR, NIS 2 Directive) and sustainability objectives, leading to IT investments aimed at green computing and efficient data center operations.

Segment trends reveal a sustained reallocation of funds from traditional hardware (excluding specialized data center components) to innovative software and specialized services. Large enterprises continue to drive volume, but the Small and Medium-sized Enterprises (SMEs) segment is rapidly increasing its IT footprint through scalable, affordable cloud solutions. Within industry verticals, Banking, Financial Services, and Insurance (BFSI) and Healthcare are leading the spending intensity, prioritizing IT modernization to meet heightened customer expectations for digital interaction and ensure compliance with stringent industry-specific regulations.

AI Impact Analysis on IT Spending Market

Users frequently inquire about how Artificial Intelligence (AI) and Generative AI (GenAI) will restructure IT budgets, specifically focusing on whether AI will lead to cost displacement or necessitate substantial new investment in specialized infrastructure. Common concerns revolve around the total cost of ownership (TCO) for AI implementation, the shift in labor costs, and the required IT stack upgrades needed to handle massive AI model training and inference workloads. The consensus summarized from these user queries is that AI integration is not a cost-saver in the short term; rather, it represents a massive accelerant for IT spending, fundamentally changing where and how organizations allocate capital, prioritizing computational resources and data governance tools.

The immediate impact is seen in the escalating demand for high-performance computing (HPC) hardware, specifically specialized GPUs and custom AI accelerators, leading to unprecedented capital expenditure in data centers and cloud service providers (CSPs). Furthermore, the need to prepare data for AI models—a crucial and often underestimated step—drives significant spending on data infrastructure, data lakes, integration tools, and expert data science services. Organizations are also allocating substantial budgets to AI-specific software platforms, MLOps tools, and securing the AI pipeline, addressing inherent security and ethical risks associated with complex models and proprietary data usage.

Ultimately, AI adoption forces a critical strategic shift in IT spending away from routine maintenance tasks toward advanced, innovation-focused initiatives. While automation driven by AI may eventually reduce certain IT operational costs, the initial investment required for foundational AI infrastructure, talent acquisition, and specialized software licensing ensures sustained and accelerated market growth for vendors offering AI-enabling technologies and services. This transformation reinforces the strategic importance of IT departments in delivering competitive advantage.

- Accelerated investment in specialized AI hardware (GPUs, NPUs, TPUs) and high-density data centers.

- Increased spending on data management, data governance, and specialized tools for data preparation and labeling.

- Shift in software procurement toward AI development platforms, MLOps, and integrated Generative AI tools.

- Surge in demand for IT consulting and specialized services for AI strategy, implementation, and ethics review.

- Cloud provider spending dominates, driven by organizations utilizing hyperscalers for AI training and scalable model deployment (AI-as-a-Service).

- Mandatory spending on AI security solutions designed to protect models, data inputs, and outputs from adversarial attacks.

DRO & Impact Forces Of IT Spending Market

The IT Spending market is primarily driven by the inescapable necessity for digital transformation, global cloud migration strategies, and the imperative to bolster cybersecurity defenses against evolving threat landscapes. These drivers, coupled with the rapid commercialization of advanced technologies like 5G connectivity, Edge Computing, and Artificial Intelligence, compel organizations across all sectors to continuously upgrade their technology stacks to maintain operational viability and competitive edge. The increasing volume of data generated globally further mandates substantial investment in storage, processing power, and sophisticated analytics tools.

However, the market faces significant restraints, including macroeconomic volatility, which can delay or reduce large-scale IT projects, particularly in budget-sensitive sectors. Furthermore, the persistent global shortage of skilled IT talent, specifically in areas like cloud architecture, advanced cybersecurity, and AI/ML engineering, limits the pace at which complex technologies can be deployed and managed effectively. Regulatory complexity across diverse jurisdictions adds overhead, requiring specialized spending on compliance software and legal services.

Opportunities abound in leveraging hyper-automation and intelligent technologies to enhance business processes, creating new revenue streams through data monetization, and optimizing supply chains using IoT and blockchain. The rise of hybrid work models permanently establishes the need for secure, distributed cloud environments, opening specialized opportunities for vendors focused on collaboration tools and zero-trust security architecture. The most significant impact forces acting upon the market are rapid technological convergence and regulatory pressure, demanding agile response mechanisms and resilient, future-proof IT infrastructure capable of adapting to unforeseen disruptions.

Segmentation Analysis

The IT spending market is meticulously segmented to reflect the diverse nature of technology consumption across the global economy. Segmentation by component (Hardware, Software, Services) provides insight into how budgets are allocated between physical infrastructure, operational programs, and intellectual support. The trend indicates a clear shift in investment prioritization, moving away from capital-intensive hardware purchases toward subscription-based software and specialized, high-value consulting and managed services, optimizing Total Cost of Ownership (TCO) and maximizing operational flexibility. This move is intrinsically linked to the deployment model analysis, specifically the dominance of cloud-based solutions over traditional on-premise implementations.

- Component: Hardware, Software, IT Services, Telecom Services

- Deployment Model: On-premise, Cloud (SaaS, PaaS, IaaS)

- Enterprise Size: Small and Medium Enterprises (SMEs), Large Enterprises

- Industry Vertical: BFSI, IT & Telecom, Manufacturing, Healthcare, Retail & E-commerce, Government & Public Sector, Media & Entertainment, Energy & Utilities

Value Chain Analysis For IT Spending Market

The value chain of the IT Spending market is complex, spanning from upstream component manufacturing to downstream service delivery and end-user consumption. Upstream analysis focuses on the foundational layers, including semiconductor fabrication, hardware component assembly (e.g., CPUs, memory, storage devices), and the creation of operating system platforms. Key players in this stage are semiconductor giants and original equipment manufacturers (OEMs), whose innovation cycles directly dictate the performance and efficiency of subsequent IT deployments. Efficiency and resilience in this stage are vital, as supply chain disruptions can severely impact overall market flow and pricing structures for end solutions.

The midstream segment involves software development, system integration, and the crucial role of distribution channels. This stage is dominated by independent software vendors (ISVs), major cloud service providers (CSPs), and system integrators (SIs) who package disparate components into cohesive, deployable solutions. Distribution occurs through multiple layers, including direct sales models for large-scale enterprise deals, indirect channels via value-added resellers (VARs) and distributors for SMEs, and increasingly, platform marketplaces facilitating cloud software consumption (SaaS).

Downstream analysis centers on service delivery, maintenance, and end-user adoption. IT services (managed services, consulting, outsourcing) represent a crucial part of the downstream value, ensuring the effective implementation and operational support of deployed technology. Direct engagement models are prevalent for customized, mission-critical projects, while indirect channels leverage partnerships to reach geographically dispersed or segment-specific markets. The effectiveness of the overall value chain relies heavily on seamless collaboration between technology developers, integrators, and service providers to meet evolving customer demands for scalability, security, and performance.

IT Spending Market Potential Customers

Potential customers for IT spending solutions are universal, encompassing every type of organized entity globally that leverages technology for operational or strategic purposes. Large enterprises, including multinational corporations (MNCs) in finance, manufacturing, and pharmaceuticals, represent the primary volume drivers, requiring complex, customized, and high-security solutions, often involving hybrid cloud environments and extensive managed services contracts. Their buying behavior is characterized by strategic, multi-year budgetary cycles and stringent vendor selection processes focused on security, reliability, and global support capabilities.

Small and Medium-sized Enterprises (SMEs) constitute a massive, fast-growing customer base, increasingly adopting IT to professionalize operations and compete digitally. SMEs heavily prefer affordable, easy-to-deploy, subscription-based solutions, particularly SaaS applications for common business functions (e.g., CRM, accounting, communication). Their purchasing decisions are often driven by immediate ROI and low barriers to entry, making them primary targets for cloud vendors and specialized local resellers.

Beyond the corporate sector, significant buyers include governmental and public sector organizations that require IT spending for modernization projects, national defense, infrastructure management (smart cities), and citizen service delivery. Healthcare providers are substantial customers, driven by electronic health record (EHR) requirements, telehealth expansions, and complex data analytics needs. These sectors demand highly specialized, compliant, and robust IT solutions, leading to specific spending patterns focused on data security, regulatory adherence, and long-term infrastructure investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.8 Trillion |

| Market Forecast in 2033 | $8.2 Trillion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft, Amazon Web Services (AWS), Oracle, Google, Salesforce, SAP, Cisco, Dell Technologies, Hewlett Packard Enterprise (HPE), Accenture, Tata Consultancy Services (TCS), Infosys, Wipro, Capgemini, Fujitsu, DXC Technology, Nokia, Ericsson, Adobe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Spending Market Key Technology Landscape

The IT Spending market is characterized by several high-impact technological shifts that dictate investment priorities. Cloud computing, specifically the hybrid and multi-cloud architecture, remains the dominant infrastructural technology, enabling scalability and resilience, and attracting the largest share of services and infrastructure spending. Organizations are moving beyond simple virtualization to containerization and serverless computing, optimizing application development and deployment cycles, which drives demand for Platform-as-a-Service (PaaS) and specialized DevOps tools. This paradigm shift requires significant investment in modernized data centers and network connectivity capable of supporting elastic, distributed workloads.

Artificial Intelligence (AI) and Machine Learning (ML) integration are transitioning from experimental projects to core business functions, demanding specialized IT infrastructure, including high-performance graphics processing units (GPUs) and specialized memory architectures. Edge Computing, driven by the proliferation of IoT devices and the need for low-latency processing, is emerging as a critical complement to centralized cloud architectures. This necessitates IT spending on ruggedized hardware, specialized software platforms for managing distributed data, and robust networking solutions to connect millions of endpoints effectively.

Furthermore, the entire IT landscape is now underpinned by Zero Trust Architecture (ZTA) and advanced cybersecurity technologies, including Extended Detection and Response (XDR) and Security Information and Event Management (SIEM) systems. As digital perimeters dissolve with remote work and cloud adoption, IT budgets are heavily directed towards identity management, robust access controls, and automated incident response capabilities. The ongoing evolution of networking technologies, particularly the adoption of Software-Defined Wide Area Networking (SD-WAN) and 5G infrastructure, also requires substantial, mandated spending to ensure high-speed, reliable enterprise connectivity.

Regional Highlights

- North America: Dominates the global IT spending market share due to its established technological maturity, high concentration of technology innovators, and robust enterprise environment. The region is a leader in early adoption of AI, advanced cybersecurity measures, and hybrid cloud migration strategies. Investments are characterized by high spending on sophisticated software solutions, data analytics platforms, and professional IT consulting services, driven by intense competitive pressure and stringent regulatory requirements, particularly in finance and healthcare.

- Europe: Exhibits steady growth, focusing heavily on regulatory compliance (e.g., GDPR, Digital Markets Act) and sustainability initiatives (Green IT). Spending is centered around data protection, cloud sovereignty solutions, and digital public services modernization. The market is moderately fragmented, with a strong emphasis on IT services and specialized vertical market software across countries like Germany (Manufacturing) and the UK (Financial Services).

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, fueled by rapid digitalization across emerging economies like India, Southeast Asia, and robust technological advancements in China, Japan, and South Korea. Key investment areas include mobile infrastructure (5G), public cloud expansion, e-commerce platforms, and government investments in smart city projects, leading to massive hardware and infrastructure spending alongside increasing demand for SaaS.

- Latin America (LATAM): Growth is driven by the acceleration of cloud adoption among SMEs and modernization efforts in the BFSI sector. Political stability and economic conditions often influence IT budget flexibility, leading to a strong preference for scalable cloud services and cost-effective outsourcing solutions to manage operational complexity.

- Middle East and Africa (MEA): This region is heavily influenced by government-led digital transformation agendas (e.g., Saudi Vision 2030, UAE initiatives), focusing on building sovereign cloud capabilities, enhancing cybersecurity infrastructure, and investing in large-scale telecom networks. Oil and gas, and public sector spending, are primary growth engines, prioritizing digital services and secured data residency solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Spending Market.- IBM

- Microsoft

- Amazon Web Services (AWS)

- Oracle

- Salesforce

- SAP

- Cisco

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Accenture

- Tata Consultancy Services (TCS)

- Infosys

- Wipro

- Capgemini

- Fujitsu

- DXC Technology

- Nokia

- Ericsson

- Adobe

Frequently Asked Questions

Analyze common user questions about the IT Spending market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current global IT spending growth?

The primary factor driving global IT spending growth is the pervasive, non-negotiable requirement for digital transformation, particularly the mass migration of enterprise workloads to hybrid and public cloud infrastructure. This shift necessitates sustained investment in modernizing core applications, enhancing data governance, and upgrading network security protocols to support distributed operations and leverage advanced technologies like AI.

How is the IT spending budget segmented by component today?

Current IT budgets show a pronounced shift, with IT Services and Software collectively commanding the largest segment share, often surpassing hardware expenditures. This reflects the industry pivot toward subscription models (SaaS, IaaS) and reliance on professional services for complex cloud integration, cybersecurity management, and customized application development, optimizing operational efficiency over upfront capital outlay.

What impact does macroeconomic instability have on IT spending decisions?

Macroeconomic instability typically introduces caution, causing organizations to prioritize mission-critical IT projects—such as essential cybersecurity upgrades and regulatory compliance—while potentially delaying large-scale, discretionary capital expenditures on non-essential hardware refreshes or experimental innovation projects. However, spending on cloud flexibility and automation often remains resilient as companies seek efficiency gains.

Which geographic region demonstrates the highest growth potential in the IT Spending market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential, fueled by massive population digitalization, rapid expansion of domestic cloud infrastructure, and substantial government investments in smart cities and telecom modernization across India, China, and Southeast Asia. This growth is accelerating due to increased adoption rates among developing economies.

What role does Artificial Intelligence play in restructuring future IT investments?

AI, especially Generative AI, plays a crucial role by restructuring IT investments toward specialized infrastructure and advanced data platforms. It mandates significant immediate spending on high-performance computing (HPC) hardware (GPUs), MLOps tools, and data governance frameworks, viewing AI capability not merely as an application, but as foundational IT infrastructure essential for competitive advantage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- IT Spending in Retail Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Insurance IT Spending Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- IT Spending in Automotive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Defense IT Spending Market Size Report By Type (Services, Hardware), By Application (IT Infrastructure, Network & Cyber Security, IT Application, Logistics & Asset Management, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Big Data IT Spending in Financial Sector Market Statistics 2025 Analysis By Application (Investment Funds, Banks, Real Estate, Insurance Companies), By Type (Hardware, Software, IT Services), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager