Life insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431696 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Life insurance Market Size

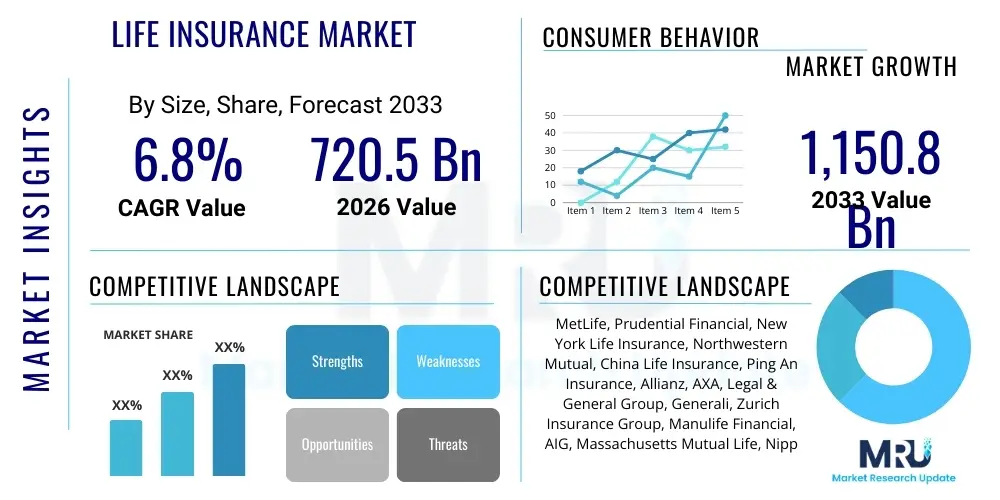

The Life insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $720.5 Billion in 2026 and is projected to reach $1,150.8 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by increasing awareness regarding financial security, coupled with the rising disposable income in emerging economies. Furthermore, the global aging population necessitates sophisticated retirement and wealth transfer solutions, directly augmenting the demand for diverse life insurance products, particularly universal and whole life policies that offer both protection and savings components.

Life insurance Market introduction

The global Life Insurance Market encompasses a wide range of financial products designed to provide monetary protection against the risk of premature death, ensuring the financial stability of beneficiaries. Core product offerings include Term Life Insurance, which provides coverage for a specific period without cash value accumulation; Whole Life Insurance, which offers lifelong coverage alongside a guaranteed savings component; and Universal Life Insurance, known for its flexibility in premium payments and death benefits. These products serve as foundational pillars for personal financial planning, retirement security, and wealth preservation across various socioeconomic demographics globally. The fundamental mechanism involves regular premium payments by the policyholder in exchange for a lump-sum payout, known as the death benefit, upon the insured's demise.

Major applications of life insurance extend beyond basic protection to include sophisticated financial instruments such as estate planning, business succession planning, and collateral for loans. The market's significant growth is currently being propelled by several key driving factors, notably the expansion of digital distribution channels, enabling wider access and easier policy comparison for consumers. Additionally, regulatory reforms in various jurisdictions aimed at enhancing consumer protection and promoting financial literacy have indirectly bolstered market confidence and penetration rates. The integration of advanced analytics and personalized risk assessment models allows insurers to offer more competitive and customized products, catering specifically to the evolving needs of modern consumers who prioritize flexibility and transparency in their financial commitments.

The industry is undergoing a transformative shift characterized by technological adoption, which optimizes operational efficiencies and improves the customer experience. Insurtech startups are forcing established players to rapidly adopt AI-driven underwriting and automated claims processing, reducing turnaround times and administrative costs. Benefits derived by consumers include comprehensive financial safety nets, tax advantages on certain policy types, and the ability to systematically accumulate wealth through permanent life policies. This evolution ensures that life insurance remains an essential component of household financial resilience, adaptable to various global economic cycles and individual life stages, positioning the market for sustained expansion throughout the forecast period.

Life insurance Market Executive Summary

The global Life Insurance Market exhibits strong growth, underpinned by critical business trends focusing heavily on digital transformation and personalization. Insurers are prioritizing the shift from traditional agency models toward direct-to-consumer digital platforms and enhanced bancassurance partnerships to reduce acquisition costs and improve penetration, especially among younger, digitally native populations. Key business trends include the incorporation of behavioral economics into product design, the utilization of wearable technology data for dynamic underwriting, and the move towards hybrid insurance models that combine protection with wellness incentives. This digital pivot is essential for maintaining competitive edge and addressing consumer demand for simplified application processes and transparent policy management.

Regionally, the market displays divergent trends. Asia Pacific (APAC) is emerging as the powerhouse of growth, fueled by the rapidly expanding middle class in countries like China and India, coupled with relatively low insurance penetration rates, presenting massive untapped potential. North America and Europe, while mature, are characterized by product innovation focused on longevity risk management, variable universal life, and sophisticated wealth transfer solutions tailored to high-net-worth individuals. Regulatory environments significantly influence regional performance, with European insurers navigating complex solvency requirements (e.g., Solvency II), while North American companies focus on adapting to evolving interest rate environments that impact policy liabilities and returns on investments.

Segmentation trends highlight a notable preference shift in product choices. While Term Life remains popular for its affordability and simplicity, Universal Life Insurance is gaining significant momentum due to its structural flexibility, allowing policyholders to adjust premiums and death benefits based on changing financial circumstances. The distribution channel segment is undergoing the most rapid transformation, with digital and direct channels showing the highest CAGR, chipping away at the historical dominance of traditional agents and brokers. Furthermore, there is a growing consolidation trend among larger global players, seeking mergers and acquisitions to acquire specialized technological capabilities, expand geographic reach, and achieve economies of scale necessary to meet capital requirements and withstand economic volatility.

AI Impact Analysis on Life insurance Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Life Insurance Market frequently center on themes of fairness in underwriting, the potential for reduced premium costs, data privacy concerns associated with the use of personal health data (e.g., wearables), and the future role of human agents. Users are keenly interested in how AI-driven predictive analytics will expedite the application and claims process, moving away from protracted medical exams towards instant, data-driven decisions. The central expectation is that AI will democratize access to insurance by enabling highly personalized risk pricing, making coverage more affordable for individuals previously categorized as high-risk, while simultaneously demanding assurances regarding the ethical deployment and transparency of algorithmic decision-making systems.

AI’s influence is profoundly restructuring operational models within the life insurance sector, leading to enhanced efficiency and precision across the value chain. In underwriting, machine learning algorithms analyze vast datasets, including medical records, behavioral data, and socioeconomic indicators, to accurately assess risk profiles far quicker than traditional methods. This not only shortens the policy issuance lifecycle from weeks to minutes in some cases but also allows insurers to price policies more accurately, reducing adverse selection and improving overall portfolio profitability. This hyper-efficient risk assessment capability is crucial for serving the immediate gratification expectations of modern consumers, who are accustomed to instant services in other industries.

Beyond underwriting, AI is revolutionizing customer experience (CX) and claims management. Chatbots and virtual assistants powered by natural language processing (NLP) handle routine customer inquiries 24/7, offering personalized advice and guidance. In claims processing, AI models rapidly detect fraudulent claims by cross-referencing information against historical data patterns, minimizing financial losses for insurers. Moreover, AI-driven marketing and sales tools are enabling hyper-segmentation, ensuring that specific life products are targeted effectively to relevant demographic groups at optimal times in their life stages, maximizing conversion rates and increasing overall policy sales velocity across digital channels globally. The successful deployment of AI is intrinsically linked to robust data governance frameworks to mitigate public concerns over privacy.

- AI enables accelerated, data-driven underwriting, moving towards instantaneous policy issuance.

- Machine learning optimizes premium pricing by utilizing predictive risk modeling for enhanced accuracy.

- Natural Language Processing (NLP) powers sophisticated chatbots for 24/7 customer service and personalized engagement.

- Computer vision and advanced analytics facilitate rapid and accurate claims processing and fraud detection.

- AI supports highly personalized product recommendations, improving customer lifetime value and retention.

- Predictive analytics aids in actuarial science by forecasting future mortality and longevity trends more effectively.

- Automation of repetitive administrative tasks frees human agents to focus on complex advisory roles.

DRO & Impact Forces Of Life insurance Market

The dynamics of the Life Insurance Market are shaped by a complex interplay of internal and external forces summarized by Drivers, Restraints, and Opportunities (DRO). Key drivers include the global demographic shift towards an aging population, which necessitates increased demand for retirement and longevity planning products, and the heightened public awareness regarding financial vulnerability exacerbated by global health crises. Restraints primarily involve the persistently low-interest rate environment in developed economies, which compresses investment returns for insurers and impacts the profitability of long-term savings products. Furthermore, the complexity and opaqueness of certain life insurance products often lead to consumer hesitancy, requiring simplified policy structures and increased transparency to overcome this hurdle. Opportunities abound in emerging markets with burgeoning middle classes, significant digital penetration, and favorable regulatory environments supporting Insurtech innovation and market entry.

The impact forces driving growth are primarily socioeconomic and technological. Socioeconomic drivers involve increasing urbanization and the rise of nuclear families, making financial protection more critical for dependents. The technological imperative, driven by Insurtech, mandates digital transformation, enabling insurers to reach underserved populations through mobile and online platforms. Restraining forces, conversely, include rigorous and fragmented regulatory compliance requirements across different geographies, which significantly increases operational complexity and capital expenditure for multinational insurers. Additionally, market saturation in mature economies necessitates a pivot toward value-added services and highly specialized products, moving away from commoditized offerings where price competition is fierce.

The most significant opportunities lie in leveraging big data and AI to transition towards a 'predict and prevent' model, integrating life insurance with wellness programs and preventative healthcare services, thereby managing mortality risk proactively. Partnerships between established insurers and tech firms are crucial for innovating distribution and enhancing customer onboarding, particularly tapping into the younger demographic who demand seamless digital interactions. Furthermore, the development of parametric insurance policies, which pay out based on predefined triggers rather than lengthy claims assessments, represents a key area of potential growth, offering simplicity and rapid liquidity. Navigating the balance between consumer privacy expectations and the utilization of extensive personal data remains a core challenge that dictates the sustainable exploitation of these opportunities.

Segmentation Analysis

The Life Insurance Market is meticulously segmented based on Type, Distribution Channel, and End-User, reflecting the diverse needs and purchasing behaviors of the global consumer base. Segmentation by Type is crucial for product strategy, differentiating between risk-only protection products (Term Life) and those incorporating a savings or investment component (Whole and Universal Life). The dominance of a particular segment often varies by regional economic development and cultural savings habits, with mature markets showing strong uptake of sophisticated Universal Life policies designed for wealth accumulation and legacy planning. This granular segmentation allows insurers to tailor actuarial models and marketing messages effectively, addressing the unique financial planning stages of various consumer groups, from young families seeking basic protection to retirees focusing on estate conservation.

Segmentation by Distribution Channel reveals the transformative shift underway in the industry's go-to-market strategy. While traditional channels such as Agencies and Brokers remain vital for complex sales requiring human consultation and advisory services, digital and direct channels (including online aggregators and direct-to-consumer websites) are exhibiting the highest growth rate. Bancassurance, leveraging the massive customer base and trust associated with retail banks, remains a formidable channel in Europe and parts of Asia, particularly for selling simpler, bundled protection products. The increasing adoption of digital platforms is directly correlated with rising consumer comfort levels in managing financial transactions online, forcing the market to invest heavily in robust, secure digital infrastructure.

The End-User segmentation primarily separates individual consumers from corporate entities. The individual segment is the largest, driven by personal needs for income replacement and family security. However, the business segment is critical, encompassing key-man insurance, partnership protection, and employee benefits programs, which require specialized group policies and significant underwriting expertise. Analyzing these segments is essential for allocating marketing resources and product development efforts, recognizing that product requirements, sales cycles, and pricing sensitivity differ significantly between a retail individual buying term life and a corporation seeking specialized group medical coverage or high-value key-man protection policies.

- Type:

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

- Distribution Channel:

- Agencies

- Bancassurance

- Brokers

- Digital & Direct Channels

- End-User:

- Individuals

- Businesses

- Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Life insurance Market

The value chain for the Life Insurance Market begins with upstream activities focused on product development, which involves intensive actuarial science, risk modeling, and legal compliance review to design sustainable and compliant policies. This phase relies heavily on data analytics and economic forecasting to determine appropriate premium levels and reserve requirements. Following product design, core operational activities include underwriting and policy administration. Underwriting, historically manual, is rapidly moving towards automation through AI, leveraging vast external and internal data sources to assess mortality risk efficiently. Effective policy administration ensures accurate billing, premium collection, and management of policy changes throughout the contract's duration, demanding robust IT infrastructure and strict adherence to data security standards.

The midstream segment is dominated by distribution, which acts as the crucial link between the insurer and the policyholder. Distribution channels are varied, including direct sales (via company websites or call centers), independent brokers who represent multiple carriers, captive agents exclusive to one company, and bancassurance partnerships. The choice of channel significantly impacts acquisition costs and customer relationship intensity. The growing reliance on digital channels simplifies the purchase process, offering price transparency and comparison tools, appealing to consumers seeking straightforward policies. Conversely, complex products like variable life or sophisticated wealth transfer solutions still predominantly rely on the advisory expertise provided by financial advisors and specialized brokers, emphasizing relationship-based sales.

Downstream activities focus on claims management and policy servicing, which are critical determinants of customer satisfaction and brand loyalty. Claims handling must be executed with speed, empathy, and accuracy, utilizing technology to verify policy details and validate claims efficiently, particularly in complex cases. Post-sale policy servicing includes handling payouts, managing customer inquiries, processing withdrawals or loans against cash value, and managing policy lapses. The efficiency of the downstream process, heavily reliant on seamless data exchange and automation, directly influences renewal rates and the company’s reputational standing. A well-optimized value chain minimizes leakage, accelerates capital deployment, and ensures compliance with global consumer protection mandates, thus improving overall market viability.

Life insurance Market Potential Customers

The potential customer base for the Life Insurance Market is exceptionally broad, segmented primarily based on life stage, income level, and specific financial goals. Millennials and Gen Z represent a rapidly growing segment, characterized by their preference for affordable Term Life policies purchased through digital platforms, driven by early career growth and the formation of new families. These younger consumers demand simple, transparent products and highly personalized digital engagement, often combining life insurance decisions with broader financial wellness applications. Insurers are specifically targeting this group with flexible, unbundled products and simplified underwriting processes that utilize alternative data points rather than mandatory medical examinations, facilitating rapid market entry and conversion.

The high-net-worth (HNW) and ultra-high-net-worth (UHNW) segments constitute a highly lucrative customer base, primarily seeking complex life insurance solutions for estate planning, wealth transfer, and tax-efficient asset protection. These customers frequently purchase sophisticated products such as private placement life insurance (PPLI) or large Universal Life policies, using them as strategic tools to minimize inheritance taxes and ensure intergenerational wealth continuity. The service model required for this segment is advisory-intensive, involving coordinated efforts between financial advisors, tax attorneys, and the insurance provider, emphasizing privacy, customization, and long-term fiduciary relationships, often leading to very high policy values and persistency rates.

Furthermore, small and medium-sized enterprises (SMEs) and large corporations are crucial potential customers for group life insurance and business-specific policies. SMEs utilize life insurance for key-man protection—insuring the life of an essential employee whose death could jeopardize business operations—and for funding buy-sell agreements among partners. Large corporations are major purchasers of employee benefits packages, where group life insurance is often a standard component, enhancing talent attraction and retention efforts. These institutional buyers prioritize competitive pricing, administrative efficiency, and seamless integration of group policies with existing human resource management systems, making digital administration capabilities a significant competitive differentiator for insurers targeting the B2B sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $720.5 Billion |

| Market Forecast in 2033 | $1,150.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MetLife, Prudential Financial, New York Life Insurance, Northwestern Mutual, China Life Insurance, Ping An Insurance, Allianz, AXA, Legal & General Group, Generali, Zurich Insurance Group, Manulife Financial, AIG, Massachusetts Mutual Life, Nippon Life Insurance, Dai-ichi Life Holdings, Standard Life Aberdeen, Swiss Life |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Life insurance Market Key Technology Landscape

The technological landscape of the Life Insurance Market is undergoing rapid transformation, fundamentally shifting from reliance on legacy mainframes to dynamic, cloud-based architectures. Cloud computing platforms (such as AWS, Azure, and Google Cloud) are foundational, providing the necessary scalability and computational power to handle massive amounts of data generated by advanced analytics and personalized policy management systems. This transition enables faster product launches, reduces infrastructure costs, and supports remote operational models. Furthermore, the adoption of Application Programming Interfaces (APIs) is critical, facilitating seamless integration between core policy administration systems and third-party insurtech solutions, such as digital health apps or data brokers, accelerating the industry's ability to innovate and partner effectively across the financial ecosystem.

Insurers are heavily investing in integrating telematics, wearables, and Internet of Things (IoT) devices, establishing a data feedback loop that allows for continuous, dynamic risk assessment. This technology enables 'living policies' where premiums can potentially adjust based on real-time health and behavioral data, promoting a healthier lifestyle among policyholders and reducing long-term risk for the insurer. Data derived from these sources, while requiring stringent security and consent protocols, fuels advanced predictive models for underwriting. Additionally, the development and deployment of Robotic Process Automation (RPA) tools are instrumental in automating mundane, high-volume administrative tasks, such as data entry, policy renewal processing, and compliance reporting, leading to substantial gains in efficiency and reductions in human error throughout the back-office operations.

Blockchain technology, while still nascent in widespread life insurance application, holds immense promise for enhancing trust and efficiency, particularly in managing reinsurance contracts and verifying identities for claims processing. Smart contracts, built on blockchain, can automatically execute payouts upon verification of an insured event (e.g., death certificate registration), drastically reducing processing delays and administrative complexity, thereby improving the customer experience during a stressful time. Finally, the evolution of sophisticated Customer Relationship Management (CRM) platforms, powered by AI, allows insurers to create a unified view of the customer, enabling predictive retention strategies and highly targeted cross-selling of related financial products, moving the interaction from transactional to relationship-based advisory service.

Regional Highlights

- North America (United States and Canada): This region is characterized by a mature and highly competitive market, leading in technological adoption and sophisticated product design, particularly Variable Universal Life and specialized longevity products. The US market is highly segmented, driven by robust regulatory oversight and strong consumer trust in established brands. Growth is steady, focused on managing the long-term impact of baby boomers retiring and demanding wealth transfer and retirement income solutions. Digital distribution is pervasive, but the advisory model remains paramount for high-value policies.

- Europe (Germany, U.K., France): Europe presents a complex landscape defined by stringent regulatory environments, particularly Solvency II, which mandates high capital reserves and impacts product pricing and insurer strategy. The market is recovering from a prolonged period of low-interest rates, pushing insurers toward unit-linked and risk-transfer products. Bancassurance dominates distribution in Southern Europe, while the UK leads in digital innovation and comparison platforms. Longevity risk and pension reform are central market drivers across the continent, necessitating innovation in annuity and specialized retirement products.

- Asia Pacific (China, India, Japan, South Korea): APAC is the fastest-growing region globally, driven by surging economic development, increasing insurance penetration rates (starting from a low base), and the expansion of the middle class in emerging economies like China and India. Digital channels and mobile-first strategies are crucial for market entry, bypassing traditional infrastructure deficits. China is the regional growth engine, focusing heavily on health and protection products. Japan, a mature market, concentrates on addressing its rapidly aging population through retirement and long-term care insurance solutions.

- Latin America (Brazil, Mexico): The LATAM market exhibits significant growth potential, although often hampered by economic volatility and high inflation. Market penetration is low but rising, fueled by urbanization and increasing financial awareness. Regulatory reforms aimed at stabilizing financial markets and encouraging foreign investment are fostering a more favorable environment. Digital access through mobile technology is rapidly transforming distribution, allowing insurers to bypass traditional, often inefficient distribution networks and reach previously underserved populations effectively.

- Middle East and Africa (MEA): This region, particularly the Gulf Cooperation Council (GCC) countries, is witnessing growing demand for Sharia-compliant Takaful and Retakaful life insurance products, reflecting cultural and religious sensitivities. Economic diversification initiatives and large expatriate populations drive demand for basic protection and employee benefits. South Africa is the most established insurance market in Africa, leading in product sophistication, while other African nations represent long-term growth opportunities contingent on increased political and economic stability and rising disposable income levels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Life insurance Market.- MetLife

- Prudential Financial

- New York Life Insurance

- Northwestern Mutual

- China Life Insurance

- Ping An Insurance

- Allianz

- AXA

- Legal & General Group

- Generali

- Zurich Insurance Group

- Manulife Financial

- AIG

- Massachusetts Mutual Life

- Nippon Life Insurance

- Dai-ichi Life Holdings

- Standard Life Aberdeen

- Swiss Life

Frequently Asked Questions

Analyze common user questions about the Life insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is AI fundamentally changing the Life Insurance underwriting process?

AI is transforming underwriting by using machine learning algorithms to analyze vast data sets (including behavioral and health metrics) to assess risk instantly and accurately, often eliminating the need for traditional medical exams and accelerating policy issuance from weeks to minutes, thereby drastically improving customer experience and operational efficiency.

Which distribution channel is experiencing the fastest growth in the Life Insurance Market?

The Digital & Direct Channels segment, including online platforms and mobile applications, is exhibiting the highest growth rate. This acceleration is driven by consumer demand for transparency, convenience, and simplified policy purchasing processes, particularly appealing to younger demographics who are digitally native and prefer self-service financial management.

What is the primary factor restraining market growth in developed economies?

The primary restraint is the persistently low global interest rate environment, particularly in developed regions like Europe and North America. Low rates reduce the investment returns insurers earn on policy reserves, severely compressing the profitability of guaranteed long-term savings and whole life products, requiring complex hedging strategies.

How does Universal Life Insurance differ from Term Life Insurance?

Term Life Insurance provides coverage for a specified period and does not accumulate cash value, making it affordable protection. Universal Life Insurance, conversely, is a permanent policy that includes lifelong coverage, flexibility in premium payments, and a cash value component that grows over time, often used for wealth accumulation and legacy planning.

Why is the Asia Pacific region considered the primary growth driver for the Life Insurance Market?

The APAC region’s robust growth is primarily attributable to the rapid expansion of the middle-class population, increasing disposable incomes, coupled with historically low insurance penetration rates, creating massive untapped potential for both basic protection and sophisticated savings products across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Non-Life Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Private Placement Life Insurance (PPLI) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Corporate Owned Life Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Life & Non-Life Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Outsourced Insurance Investigative Market Statistics 2025 Analysis By Application (Large Enterprises(1000 Users), Medium-Sized Enterprise(499-1000 Users), Small Enterprises(1-499 Users)), By Type (Life Insurance Claims, Workers Compensation Claims, Transportation / Cargo Theft Claims, Auto Insurance Claims, Health Insurance Claims, Homeowners Insurance Claims), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager