Motor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432080 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Motor Market Size

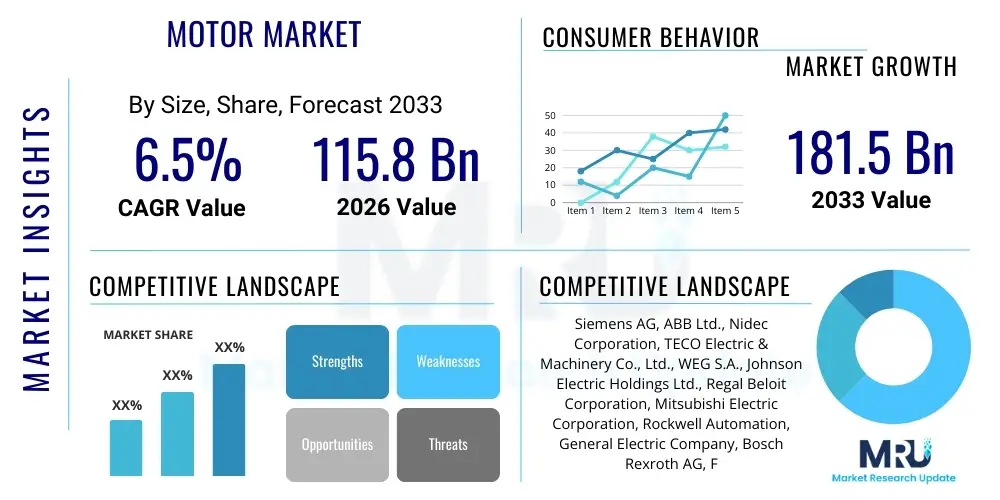

The Motor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 115.8 Billion in 2026 and is projected to reach USD 181.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by accelerated industrial automation, stringent energy efficiency regulations mandating the replacement of older motors with high-efficiency counterparts, and the rapid expansion of the electric vehicle (EV) sector globally, which heavily relies on advanced electric motor technologies.

Motor Market introduction

The Motor Market encompasses the manufacturing, sales, and servicing of various electromechanical devices designed to convert electrical energy into mechanical energy. These products range from micro-motors used in consumer electronics and medical devices to massive industrial motors employed in heavy machinery, HVAC systems, power generation, and transportation infrastructure. Key product descriptions include AC motors (induction and synchronous), DC motors (brushed and brushless), and specialized motors such as stepper motors, servo motors, and traction motors. The technological evolution in this market is intensely focused on maximizing energy efficiency (IE3, IE4, and IE5 standards), reducing size and weight, and enhancing connectivity for integration into the Industrial Internet of Things (IIoT).

Major applications of electric motors span across nearly every industrial and commercial sector. In manufacturing, they are essential for pumps, compressors, fans, and material handling systems. The automotive industry relies heavily on traction motors for EVs and hybrid vehicles, alongside smaller motors for various vehicle subsystems. Additionally, motors are critical components in home appliances, aerospace actuators, and complex robotic systems. The primary benefits driving market demand include improved operational efficiency, reduced energy consumption leading to lower operating costs, enhanced precision and reliability in automated processes, and the capability to operate reliably in diverse and often harsh environmental conditions.

Driving factors propelling market growth include the global trend toward industrial automation and the implementation of smart factory initiatives, particularly in emerging economies. Government regulations worldwide imposing mandatory minimum energy performance standards (MEPS) act as a powerful catalyst, forcing industries to adopt premium efficiency (PE) motors. Furthermore, the surging demand for electric vehicles, coupled with substantial investments in renewable energy infrastructure (wind turbines, requiring specialized generators/motors), significantly boosts the demand for high-performance and specialty motors. The replacement market, driven by the lifecycle end of older, inefficient motors, also constitutes a significant portion of market activity.

Motor Market Executive Summary

The Motor Market is currently defined by disruptive business trends centered around sustainability, digitalization, and electrification. Key business trends include the shift towards Permanent Magnet Synchronous Motors (PMSMs) over traditional induction motors due to their superior efficiency, and the increasing adoption of integrated motor and drive solutions, optimizing system performance and reducing installation complexity. Mergers and acquisitions remain a consistent strategy among major players seeking to consolidate technology platforms, particularly in the fields of high-density motor design and power electronics integration. Competitive dynamics are intensifying, driven by Asian manufacturers offering cost-effective, high-quality standard products, while Western players focus on high-margin, specialized, and digitally enabled solutions.

Regionally, the Asia Pacific (APAC) continues to dominate the market volume and is the fastest-growing region, fueled by rapid industrialization in China, India, and Southeast Asia, coupled with aggressive EV manufacturing targets. North America and Europe, characterized by mature industrial bases, are leading the shift towards premium efficiency and smart motor technologies, driven by strict regulatory frameworks like the European Union’s Ecodesign Directive. These developed markets show high adoption rates for advanced motor controls and integrated diagnostic capabilities, emphasizing long-term asset management over initial cost concerns. The Middle East and Africa (MEA) and Latin America are showing moderate growth, tied predominantly to infrastructure development and oil and gas sector investments requiring robust, heavy-duty motors.

Segmentation trends indicate strong performance across the Brushless DC (BLDC) motor segment, specifically due to its pervasive use in robotics, drones, and high-efficiency home appliances. By voltage, the low-voltage motor segment retains the largest share due to its wide applicability in general industry and commercial HVAC, though the high-voltage segment is seeing significant growth tied to large infrastructure projects and power generation. The crucial trend across all segments is the convergence of hardware and software; motors are increasingly sold as part of a system solution, integrating condition monitoring sensors and advanced variable frequency drives (VFDs) that optimize energy consumption based on real-time operational data, transforming the market from a component sale model to a solution provision model.

AI Impact Analysis on Motor Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Motor Market primarily revolve around predictive maintenance capabilities, energy optimization potential, and the future role of human labor in motor diagnostics and servicing. Users frequently ask: "How can AI prevent motor failures?", "What is the ROI of implementing AI-driven motor control systems?", and "Will AI integration make existing industrial motors obsolete?" The core expectation is that AI will move motor management from reactive or scheduled maintenance to a highly proactive state, maximizing uptime and lifespan while simultaneously optimizing energy consumption in dynamic load environments. Concerns often center on data security, the cost of retrofitting older assets with necessary sensors, and the complexity of integrating AI platforms with legacy factory floor systems (Operational Technology or OT).

The application of AI and Machine Learning (ML) is fundamentally transforming how motors are operated and maintained. By processing massive streams of sensor data—including vibration, temperature, current, and acoustic signatures—AI algorithms can identify subtle deviations that precede catastrophic failures long before traditional monitoring systems. This shift allows manufacturers and end-users to schedule precise, condition-based maintenance, thereby minimizing unplanned downtime, reducing inventory holding costs for spare parts, and dramatically extending the operational life of critical assets. AI further enables the development of digital twins for motors, simulating real-world performance under various stress conditions to refine design and operational parameters.

Furthermore, AI is crucial in optimizing the motor's performance in variable load situations, common in pump and fan applications. ML models analyze historical operational profiles and real-time process requirements to dynamically adjust Variable Frequency Drive (VFD) settings, ensuring the motor runs at its peak efficiency point for the instantaneous task. This real-time optimization capability is essential for industries striving to meet stringent energy reduction goals. The integration of edge computing facilitates faster, local decision-making, ensuring that latency-sensitive adjustments can be made immediately, enhancing both efficiency and safety in industrial environments.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by predicting component failure using sensor data analysis.

- Energy Consumption Optimization: ML algorithms dynamically adjust VFDs to ensure motors operate at maximum instantaneous efficiency.

- Motor Design Simulation: AI accelerates the development of new high-efficiency motors by simulating performance and material stresses.

- Anomaly Detection: Real-time identification of operational deviations indicating potential mechanical or electrical issues.

- Automated Diagnostics: AI platforms provide precise failure mode and effects analysis (FMEA) without human intervention.

- Asset Performance Management (APM): Integration of motor data into broader factory management systems for holistic performance tracking.

DRO & Impact Forces Of Motor Market

The dynamics of the Motor Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and inherent Impact Forces that dictate market direction and growth velocity. The primary driving force is the global imperative for energy efficiency, codified by stringent governmental regulations like IE3/IE4/IE5 standards, which compels industries to upgrade their installed base of motors. Coupled with this, the dramatic and continuous expansion of the electric vehicle (EV) sector, demanding specialized, high-performance traction motors and auxiliary motors, represents a critical growth engine. Additionally, the proliferation of automated manufacturing processes and robotic systems globally sustains high demand for precision motion control components, further accelerating market expansion across various motor types, especially servo and stepper motors.

However, the market faces significant restraints that slow adoption in certain sectors. A major hurdle is the high initial cost associated with premium efficiency (IE4/IE5) and specialized motors (like PMSMs) compared to legacy induction motors, particularly affecting small and medium enterprises (SMEs) operating on tight capital expenditure budgets. Furthermore, the supply chain volatility for key raw materials, most notably rare earth elements (like Neodymium and Dysprosium) essential for permanent magnets, poses a significant risk to manufacturing consistency and pricing stability. Technological inertia and the long replacement cycles inherent in heavy industries mean that the massive installed base of older, inefficient motors is slow to be fully replaced, limiting immediate market penetration of advanced solutions.

Opportunities abound, primarily driven by ongoing technological innovation and new application domains. The shift towards digitalization offers significant opportunity through the sale of integrated smart motors equipped with embedded sensors and IoT connectivity, transforming motors into data-generating assets. Emerging economies present vast untapped potential for infrastructure projects, requiring substantial quantities of large industrial motors. Crucially, the development of rare-earth-free motor technologies (such as synchronous reluctance motors and advanced induction motors) provides a hedge against supply chain risks and opens pathways for more cost-effective high-efficiency products. Impact forces, such as rapid urbanization and demographic shifts leading to increased global transportation needs, exert sustained pressure on motor manufacturers to innovate traction and energy-efficient pumping solutions.

In summary, while market growth is strongly propelled by efficiency mandates and electrification trends, challenges related to material costs and the necessity of overcoming capital barriers in end-user industries require focused strategic responses, including the development of innovative financing models and material substitution techniques to unlock the full potential presented by global automation and sustainability initiatives.

Segmentation Analysis

The Motor Market is highly diverse, segmented based on technology type, voltage, output power, application, and end-user industry. This granular segmentation allows manufacturers to tailor product offerings to specific operational requirements, ranging from the high-torque, precise control needs of robotics (servo motors) to the continuous, heavy-duty requirements of large compressors (AC induction motors). Understanding these segments is crucial for strategic planning, as distinct drivers influence each sub-market. For instance, efficiency standards predominantly impact the AC induction segment, while material costs heavily influence the Permanent Magnet Synchronous Motor (PMSM) segment.

Technological segmentation highlights the ongoing transition from traditional AC induction motors, which still hold the largest volume share, toward technologically superior alternatives. Brushless DC (BLDC) motors and PMSMs are rapidly gaining ground due to their higher power density and better efficiency, crucial for battery-operated devices and traction applications. Application-wise, industrial machinery remains the cornerstone of demand, but the automotive sector, driven by EV adoption, is exhibiting exponential growth rates, requiring significant shifts in manufacturing capacity and R&D focus toward specialized traction systems.

Geographic segmentation underscores the disparity between regions focused on replacement and high-efficiency mandates (North America, Europe) and regions focused on new installation and capacity expansion (Asia Pacific). The market structure reflects a trend toward system integration, where motors are bundled with corresponding variable speed drives (VFDs) and specialized controls, enhancing value capture and optimizing overall system efficiency, thereby redefining the traditional component-focused segments into integrated system solutions.

- Type:

- AC Motors (Induction Motors, Synchronous Motors)

- DC Motors (Brushed DC, Brushless DC (BLDC))

- Hermetic Motors

- Servo Motors

- Stepper Motors

- Voltage:

- Low Voltage Motors (<1 kV)

- Medium Voltage Motors (1 kV – 6.6 kV)

- High Voltage Motors (>6.6 kV)

- Output Power:

- Fractional Horsepower (FHP)

- Integral Horsepower (IHP)

- Application:

- Pumps and Fans

- Compressors

- Material Handling

- Electric Vehicles (Traction)

- Household Appliances

- Robotics and Automation

- End-User Industry:

- Industrial (Oil and Gas, Chemical, Mining, Water Treatment)

- Commercial (HVAC)

- Automotive and Transportation

- Aerospace and Defense

Value Chain Analysis For Motor Market

The value chain for the Motor Market is complex and capital-intensive, starting with raw material extraction and culminating in sophisticated system integration services and end-of-life recycling. Upstream analysis involves the procurement of critical materials, including copper for windings, electrical steel laminations, aluminum or cast iron for casings, and increasingly, rare earth permanent magnets (Neodymium, Samarium-Cobalt). Control over stable, high-quality sourcing of electrical steel and rare earths is a crucial determinant of competitive advantage and cost management. Companies vertically integrating magnet production or securing long-term supply agreements are better positioned to mitigate price volatility.

Midstream activities involve core motor manufacturing, which demands high precision engineering, advanced winding techniques, and rigorous quality control to meet efficiency standards. This stage is dominated by established global players leveraging automated production lines and standardized designs for economies of scale, especially in standard AC induction motors. However, the production of highly specialized motors, such as traction motors for EVs or motors for explosive environments, requires significant specialized R&D and specialized certification processes.

Downstream analysis focuses on distribution and after-sales support. The distribution channel is bifurcated into direct sales for large OEMs and major infrastructure projects, and indirect channels relying heavily on a global network of authorized distributors, channel partners, and system integrators for general industry and maintenance/repair/overhaul (MRO) markets. Effective digital platforms and strong technical service teams are essential in the downstream segment, providing rapid spares delivery, technical consultation, and installation support. The trend toward digital services—including remote monitoring and predictive diagnostics sold as subscriptions—is rapidly becoming a key differentiator in the value chain, shifting the focus from purely hardware sales to comprehensive asset management.

Motor Market Potential Customers

Potential customers for electric motors span almost all sectors of the global economy, broadly categorized by their operational characteristics and specific technical needs. The largest group comprises industrial end-users, including the chemical processing, oil and gas, mining, cement, and pulp and paper industries. These customers require robust, reliable, high-power motors capable of continuous operation in harsh or volatile environments (e.g., ATEX certification), primarily utilizing medium and high-voltage AC induction and synchronous motors for pumps, compressors, and large conveyors. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO), focusing on energy efficiency and motor longevity rather than merely initial purchase price.

A rapidly expanding segment of buyers includes manufacturers of automated machinery and robotics, particularly in the electronics and automotive manufacturing sectors. These customers prioritize high-precision motion control, demanding compact servo motors and stepper motors that offer dynamic response, high torque density, and seamless integration with complex control systems. For these high-tech OEMs, delivery speed, customization capability, and integration support are paramount, driving relationships with specialized motor vendors rather than general industrial suppliers.

The third major segment consists of high-volume original equipment manufacturers (OEMs) focused on consumer and commercial products, notably automotive OEMs (for EVs and hybrid systems), and HVAC equipment manufacturers. Automotive traction motor procurement requires massive capacity, lightweight design, and specific battery voltage compatibility, creating unique demands. Commercial HVAC customers are driven by energy efficiency standards (e.g., seasonal energy efficiency ratio) and noise reduction, favoring high-efficiency BLDC and ECM (electronically commutated motors) for fans and blowers. These high-volume customers often demand customized designs and highly competitive pricing, forming long-term strategic partnerships with motor suppliers to ensure supply chain stability and co-development efforts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.8 Billion |

| Market Forecast in 2033 | USD 181.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., Nidec Corporation, TECO Electric & Machinery Co., Ltd., WEG S.A., Johnson Electric Holdings Ltd., Regal Beloit Corporation, Mitsubishi Electric Corporation, Rockwell Automation, General Electric Company, Bosch Rexroth AG, Franklin Electric Co., Inc., Danaher Corporation, Allied Motion Technologies Inc., Ametek Inc., Yaskawa Electric Corporation, Hitachi, Ltd., Toshiba Corporation, Shenzhen Inovance Technology Co., Ltd., and Brook Crompton. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motor Market Key Technology Landscape

The Motor Market technology landscape is characterized by intense innovation focused on achieving higher efficiency, greater power density, and smarter operational capabilities. Key technological advancements center around materials science and digital integration. In materials, the push is toward alternative magnets to reduce reliance on rare earth elements, such as utilizing Ferrite magnets or exploring new designs like Synchronous Reluctance Motors (SynRM) which offer IE4 level efficiency without permanent magnets. Furthermore, advancements in electrical steel lamination techniques are reducing core losses, contributing significantly to overall motor efficiency improvements across all motor classes.

Digitalization forms the second major technological pillar. The integration of sensors (e.g., vibration, temperature, current, and flux sensors) directly into the motor winding or housing transforms the traditional motor into a smart asset. This integrated technology enables real-time condition monitoring, leading to predictive maintenance capabilities driven by embedded or cloud-based analytics. The development of integrated motor and drive packages, often incorporating advanced Variable Frequency Drives (VFDs) optimized specifically for the motor characteristics, minimizes losses and simplifies installation for end-users, ensuring optimal system performance.

A crucial area of specialized technological focus is traction motors for electric vehicles. These motors require extremely high power density (power per unit volume and weight), robust thermal management systems (often requiring advanced liquid cooling), and reliable operation across a wide speed and torque range. Technologies like Hairpin winding (reducing resistance and boosting performance) and the continued evolution of SiC (Silicon Carbide) power electronics in the accompanying inverters are driving breakthroughs, enabling vehicles to achieve longer range and faster acceleration, setting the standard for high-performance motor design across the broader market.

Regional Highlights

Regional dynamics within the Motor Market show significant variance dictated by industrial maturity, regulatory environment, and electrification penetration. Asia Pacific (APAC) dominates the global market both in production capacity and consumption volume. This dominance is driven by China and India, which are undergoing massive industrial expansion and infrastructure projects, coupled with substantial government support for domestic EV manufacturing. The region serves as the primary global manufacturing hub for low-to-medium power motors, focusing heavily on scale and cost competitiveness, although there is a rapidly increasing domestic demand for premium efficiency motors (IE3/IE4) in developed Asian nations like Japan and South Korea.

North America and Europe represent mature markets characterized by stringent regulatory environments and a strong emphasis on sustainability. These regions are primary adopters of premium and high-voltage motors for modernization and efficiency upgrades across sectors like manufacturing, utilities, and infrastructure. Europe, guided by the EU’s Ecodesign Directive, mandates the highest efficiency standards globally, creating a substantial replacement market opportunity for IE4 and IE5 class motors. In North America, the focus is on integrating smart, interconnected motor systems into smart factories, leveraging IT/OT convergence and prioritizing energy monitoring and asset performance management.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets whose motor demand is closely tied to specific resource-intensive sectors. In the Middle East, substantial investment in oil and gas infrastructure, desalination plants, and ambitious construction projects necessitates large, robust, and often specialized motors capable of handling high temperatures and corrosive environments. LATAM growth is sustained by mining and agricultural sectors, demanding durable, medium-to-high voltage motors, often sourced internationally. While these regions possess lower initial efficiency requirements compared to the West, rapid urbanization and environmental pressures are slowly introducing stricter local standards, suggesting future growth potential for energy-efficient products.

- North America: Leading adoption of smart motor technology and predictive maintenance solutions, driven by high labor costs and efficiency mandates.

- Europe: Governed by the strict Ecodesign Directive, driving high demand for IE4 and IE5 motors, strong focus on industrial digitalization (Industry 4.0).

- Asia Pacific (APAC): Largest market share, fastest growth, fueled by mass industrialization, EV manufacturing leadership (especially China), and infrastructure development.

- Latin America: Growth tied to commodity extraction (mining, oil) and infrastructure modernization projects.

- Middle East and Africa (MEA): High demand for specialized motors in energy, water treatment, and petrochemical sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motor Market.- Siemens AG

- ABB Ltd.

- Nidec Corporation

- TECO Electric & Machinery Co., Ltd.

- WEG S.A.

- Johnson Electric Holdings Ltd.

- Regal Beloit Corporation

- Mitsubishi Electric Corporation

- Rockwell Automation

- General Electric Company

- Bosch Rexroth AG

- Franklin Electric Co., Inc.

- Danaher Corporation

- Allied Motion Technologies Inc.

- Ametek Inc.

- Yaskawa Electric Corporation

- Hitachi, Ltd.

- Toshiba Corporation

- Shenzhen Inovance Technology Co., Ltd.

- Brook Crompton

Frequently Asked Questions

Analyze common user questions about the Motor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from AC Induction motors to Permanent Magnet Synchronous Motors (PMSMs)?

The primary driver is the superior energy efficiency (often meeting IE4 and IE5 standards) and higher power density of PMSMs compared to traditional AC Induction motors. This shift is crucial for applications requiring compact design, high torque, and reduced operational energy consumption, notably in electric vehicles (EVs) and high-efficiency industrial pumps.

How do global energy efficiency standards (like IE3 and IE4) affect market demand?

Global energy efficiency standards mandate minimum motor performance, compelling industries worldwide to replace older, inefficient motors with certified high-efficiency models (IE3, IE4, and beyond). These regulations act as a powerful market driver, especially in mature industrial economies, creating a vast replacement market opportunity.

What role does digitalization play in modern motor systems?

Digitalization involves integrating smart sensors and IoT connectivity into motors, enabling real-time condition monitoring, remote diagnostics, and AI-driven predictive maintenance. This transformation minimizes unplanned downtime, optimizes energy usage dynamically, and facilitates comprehensive Asset Performance Management (APM).

Which geographic region presents the most significant growth opportunity for motor manufacturers?

Asia Pacific (APAC) currently offers the most significant growth opportunity. This is driven by rapid infrastructure development, high industrialization rates in countries like China and India, and leading global investment in electric vehicle production capacity, requiring massive volumes of new motor installations.

What is the main constraint hindering the wider adoption of high-efficiency motors?

The main constraint is the high initial capital expenditure (CapEx) associated with premium efficiency motors (e.g., IE4/IE5) and rare-earth-based motors (PMSMs), particularly for small and medium-sized enterprises (SMEs). Supply chain volatility and cost of critical materials like rare earth elements also pose significant limitations to mass production and price stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sliding Vane Air Motor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- EV Motor Controller Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electric Motor Repair Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Endodontic Electric Motor System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Flatwire & HAIR-PIN Motor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager