Connector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428652 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Connector Market Size

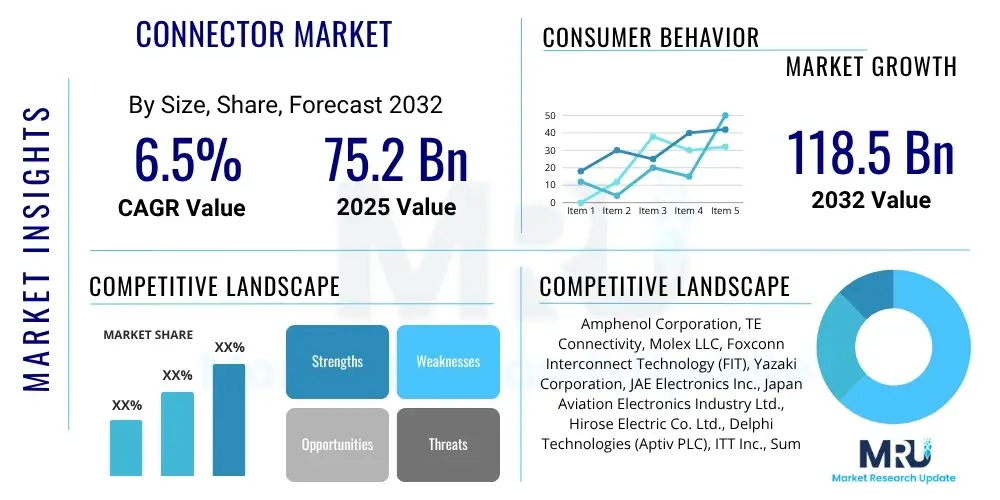

The Connector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at $75.2 Billion in 2025 and is projected to reach $118.5 Billion by the end of the forecast period in 2032.

Connector Market introduction

The global connector market is a critical foundational industry, underpinning virtually every sector that relies on electronic communication and power transfer. Connectors, essential components that link electrical and electronic circuits, play a pivotal role in ensuring the seamless flow of data, signals, and power across devices, systems, and networks. These seemingly small components are instrumental in the functionality and reliability of everything from consumer electronics to complex industrial machinery, medical devices, and advanced aerospace systems. Their ubiquitous presence and constant evolution reflect the ongoing advancements in technology across various domains.

Connectors encompass a vast array of designs and functionalities, engineered to meet specific application requirements. They facilitate temporary or permanent connections, enabling modularity, repairability, and scalability within electronic architectures. Major applications span a diverse range, including automotive for advanced driver assistance systems (ADAS) and electric vehicles (EVs), telecommunications for 5G infrastructure and data centers, industrial automation for smart factories, and consumer electronics for smartphones and wearables. The primary benefits derived from high-quality connectors include enhanced signal integrity, reliable power delivery, robust environmental protection, and significant cost savings through modular design and easier maintenance.

Several significant factors are currently driving the expansion of the connector market. The relentless demand for higher bandwidth and faster data transfer rates, particularly with the proliferation of IoT devices and the rollout of 5G networks, necessitates advanced high-speed and high-frequency connectors. Furthermore, the rapid growth in electric vehicle production and autonomous driving technologies is spurring demand for robust, high-power, and environmentally sealed connectors. Miniaturization trends in consumer electronics and medical devices also drive innovation towards smaller, more compact, and yet highly reliable connector solutions. The increasing complexity of electronic systems across industries continually pushes the boundaries for connector performance and design.

Connector Market Executive Summary

The connector market is experiencing dynamic shifts, characterized by strong growth across multiple end-use industries and sustained technological innovation. Key business trends indicate a consolidation among major players seeking to expand their product portfolios and geographical reach, alongside increasing specialization in niche applications requiring high-performance characteristics. Companies are investing heavily in research and development to address critical challenges such as heat management in high-density applications, electromagnetic interference (EMI) shielding, and the development of advanced materials for harsher operating environments. The focus is increasingly on providing integrated solutions rather than standalone components, encompassing aspects like smart connectors with embedded intelligence and modular systems that offer greater flexibility to designers.

Regional trends highlight Asia Pacific (APAC) as the leading and fastest-growing market, driven by its robust manufacturing base for consumer electronics, automotive components, and industrial equipment, alongside significant investments in telecommunications infrastructure. North America and Europe continue to represent mature markets with strong demand for high-reliability connectors in aerospace, defense, medical, and high-performance computing sectors. Emerging economies in Latin America, the Middle East, and Africa are also showing promising growth, fueled by urbanization, industrialization initiatives, and expanding digital infrastructure projects. The globalization of supply chains, while offering efficiency, also introduces vulnerabilities, prompting companies to diversify manufacturing locations and enhance supply chain resilience.

Segment-wise, the market is witnessing robust expansion in several areas. Automotive connectors are experiencing explosive growth due to the electrification of vehicles, proliferation of ADAS features, and demand for in-car connectivity. The IT and telecommunications segment continues its upward trajectory, propelled by the build-out of data centers, cloud infrastructure, and 5G networks, demanding high-speed fiber optic and board-to-board connectors. Industrial connectors are seeing increased adoption with the rise of Industry 4.0, smart factories, and automation, requiring ruggedized and intelligent solutions. Consumer electronics remain a consistent demand driver, albeit with a focus on miniaturization and cost-effectiveness. The medical and aerospace & defense sectors, while smaller in volume, command a premium for ultra-reliable and specialized connector solutions.

AI Impact Analysis on Connector Market

User questions regarding the impact of Artificial Intelligence (AI) on the connector market primarily revolve around how AI hardware requirements translate into connector design and demand, the role of connectors in AI-driven data infrastructure, and the potential for AI to optimize connector manufacturing. Key themes include the need for ultra-high-speed, high-density, and low-latency connectors to support the massive data processing capabilities of AI accelerators and graphic processing units (GPUs). There is significant interest in how connectors will manage increased power delivery and thermal loads associated with powerful AI chips, as well as ensure signal integrity in complex AI systems. Users also express concerns about the scalability of current connector technologies to meet future AI demands and the potential for AI to introduce new standards or requirements for connectivity. Expectations center on connectors enabling the next generation of AI innovation by facilitating unprecedented levels of data throughput and system reliability.

- AI drives demand for ultra-high-speed connectors for data centers and AI accelerators.

- Increased power requirements for AI hardware necessitate higher current-carrying capacity in power connectors.

- Advanced thermal management in AI systems requires connectors designed for high-temperature environments.

- Miniaturization and high-density designs are crucial for compact AI devices and embedded systems.

- Signal integrity and electromagnetic compatibility (EMC) become paramount for reliable AI data transmission.

- Development of smart connectors with embedded sensors for predictive maintenance in AI infrastructure.

- AI applications in autonomous vehicles demand robust, fault-tolerant connectors for safety-critical systems.

- AI in manufacturing processes enhances connector design optimization and quality control.

DRO & Impact Forces Of Connector Market

The connector market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, alongside various impact forces that shape its trajectory. Key drivers include the exponential growth in data generation and consumption, fueled by the proliferation of the Internet of Things (IoT), cloud computing, and advanced analytics. This creates an unceasing demand for high-speed, high-bandwidth connectivity solutions. The global rollout of 5G technology is another significant impetus, requiring a new generation of high-frequency, compact, and robust connectors for network infrastructure and end-user devices. The rapidly expanding electric vehicle (EV) market and the increasing sophistication of autonomous driving systems mandate specialized connectors capable of handling high voltages, currents, and extreme environmental conditions, ensuring both performance and safety. Furthermore, the push for industrial automation and smart manufacturing (Industry 4.0) necessitates rugged, reliable, and often intelligent connectors for diverse factory environments, enhancing efficiency and productivity.

Despite these powerful growth drivers, the market faces several notable restraints. Price sensitivity, particularly in high-volume consumer electronics segments, can exert downward pressure on profit margins, compelling manufacturers to continually optimize production costs. The challenge of establishing global standardization across different connector types and applications can hinder interoperability and create market fragmentation, complicating design and procurement processes for OEMs. Geopolitical tensions and trade disputes pose significant risks, potentially disrupting global supply chains for raw materials and finished components, leading to increased costs and delays. The inherent complexity of designing and manufacturing high-performance connectors, which often requires precision engineering and specialized materials, can also limit market entry for new players and slow down innovation cycles.

However, significant opportunities exist for market participants. The ongoing development of advanced materials, such as high-performance plastics and lightweight alloys, offers avenues for creating more durable, smaller, and higher-performing connectors. The emergence of new markets, particularly in developing economies undergoing rapid digitalization and industrialization, presents untapped growth potential. Innovations in miniaturization continue to be a key opportunity, enabling the integration of more functionality into smaller form factors, crucial for portable devices and embedded systems. The increasing focus on sustainability and energy efficiency also creates demand for connectors that reduce power loss and are made from recyclable materials. Moreover, the growing adoption of smart city infrastructure, renewable energy projects, and advancements in medical technology further broadens the application scope for specialized connector solutions. Collectively, these forces demand continuous innovation and strategic adaptation from connector manufacturers to maintain competitiveness and capitalize on emerging trends.

Segmentation Analysis

The connector market is highly diversified, segmented across various parameters to reflect the complexity and breadth of its applications. These segmentations allow for a granular understanding of market dynamics, pinpointing areas of growth, technological shifts, and competitive intensity. Analyzing the market through these lenses provides critical insights into product development strategies, targeted marketing efforts, and investment priorities for stakeholders. The primary segmentation criteria typically include connector type, application, end-use industry, and material, each offering a distinct perspective on market structure and demand drivers. The varied requirements across these segments underscore the need for specialized engineering and manufacturing capabilities.

- By Type:

- Board to Board Connectors

- Wire to Board Connectors

- Fiber Optic Connectors

- RF Connectors

- USB Connectors

- Power Connectors

- Circular Connectors

- Rectangular Connectors

- Heavy Duty Connectors

- I/O Connectors

- Memory Card Connectors

- Others (e.g., Audio/Video, HDMI, D-Sub)

- By Application:

- Data Communication & Telecommunications (Data Centers, Networking Equipment, 5G Infrastructure)

- Automotive (Infotainment, ADAS, Powertrain, Body & Chassis, EV Charging)

- Industrial (Factory Automation, Robotics, Control Systems, Test & Measurement)

- Consumer Electronics (Smartphones, Laptops, Wearables, Home Appliances)

- Aerospace & Defense (Avionics, Satellite Communication, Military Equipment)

- Medical (Diagnostic Imaging, Surgical Equipment, Patient Monitoring)

- Energy & Power (Renewable Energy, Power Distribution, Smart Grid)

- Transportation (Rail, Marine)

- By End-Use Industry:

- Consumer Electronics

- Automotive & Transportation

- IT & Telecommunications

- Industrial

- Healthcare

- Aerospace & Defense

- Energy & Power

- By Material:

- Copper Alloys

- Aluminum Alloys

- Plastics (LCP, PBT, Nylon)

- Composites

- Other Metals (e.g., Brass, Stainless Steel)

- By Pitch Size:

- 0.4mm and Below

- 0.5mm to 1.0mm

- 1.25mm to 2.54mm

- Above 2.54mm

- By Technology:

- Standard Connectors

- High-Speed Connectors

- High-Power Connectors

- Fiber Optic Connectors

- Wireless Connectors

Value Chain Analysis For Connector Market

The value chain for the connector market is intricate, involving multiple stages from raw material sourcing to end-use integration, each adding value and specialized services. At the upstream end, the chain begins with the procurement of critical raw materials, primarily metals such as copper, brass, and various alloys for contacts, and plastics like liquid crystal polymer (LCP), nylon, and PBT for housings and insulators. These materials are sourced from global suppliers, whose quality, cost, and availability significantly impact the overall production efficiency and final product performance. Specialized manufacturers then process these raw materials into precision-stamped metal contacts, molded plastic bodies, and other intricate subcomponents that form the basic building blocks of a connector. Innovation in material science, particularly in developing high-performance alloys and more sustainable plastics, plays a crucial role at this stage, influencing electrical conductivity, mechanical durability, and environmental resistance.

Moving downstream, these subcomponents are assembled into finished connector products through highly automated manufacturing processes that emphasize precision, repeatability, and stringent quality control. Connector manufacturers often specialize in specific types or applications, developing proprietary technologies for signal integrity, power delivery, or harsh environment sealing. Once manufactured, these connectors are distributed through various channels to reach their end-users. Direct sales involve manufacturers selling directly to large original equipment manufacturers (OEMs) who integrate the connectors into their final products, such as automotive systems, data center equipment, or consumer electronics. This channel allows for close collaboration and customization.

Indirect distribution channels involve a network of distributors, wholesalers, and online marketplaces that cater to a broader range of customers, including smaller OEMs, contract manufacturers, and repair and maintenance providers. These distributors often provide value-added services such as inventory management, technical support, and assembly services, helping to broaden market reach and facilitate efficient supply to diverse client bases. The choice between direct and indirect channels often depends on the scale of the customer, the complexity of the product, and the desired level of customer engagement. The final stage involves the integration of these connectors into complex electronic systems by end-users, where the performance and reliability of the connector directly contribute to the functionality and lifespan of the entire product. Maintaining strong relationships across this entire value chain is essential for ensuring product quality, cost-effectiveness, and market responsiveness.

Connector Market Potential Customers

The potential customer base for the connector market is incredibly vast and diverse, spanning virtually every industry that utilizes electronic systems. These customers are primarily Original Equipment Manufacturers (OEMs) who integrate connectors into their products, as well as various service providers and system integrators. In the automotive sector, potential customers include major vehicle manufacturers, Tier 1 suppliers of automotive electronics, and emerging electric vehicle (EV) companies, all requiring robust and reliable connectors for everything from engine control units and infotainment systems to battery management and ADAS. The IT and telecommunications sector represents another significant customer segment, encompassing data center operators, cloud service providers, network equipment manufacturers, and telecom operators building 5G infrastructure, all demanding high-speed, high-density, and fiber optic connectivity solutions.

Industrial manufacturers constitute a large and growing customer group, covering automation companies, robotics manufacturers, heavy machinery producers, and system integrators for smart factories. These customers seek ruggedized connectors capable of withstanding harsh environments, vibration, and extreme temperatures, often with advanced features like power over Ethernet (PoE) and intelligent monitoring capabilities. The consumer electronics market, driven by constant innovation, includes smartphone manufacturers, laptop and PC builders, wearable device companies, and producers of smart home appliances. This segment prioritizes miniaturization, cost-effectiveness, and high-volume production capabilities, with a continuous need for advanced USB, board-to-board, and power connectors.

Additionally, the aerospace and defense industries require highly specialized, high-reliability, and often custom-designed connectors for avionics, satellites, and military communication systems, where performance and safety are paramount. The healthcare sector presents opportunities with medical device manufacturers, hospital equipment providers, and diagnostic imaging companies requiring biocompatible, sterile, and highly accurate connectors for patient monitoring, surgical tools, and imaging equipment. Energy and power companies, particularly those in renewable energy (solar, wind) and smart grid infrastructure, also represent a growing customer segment for high-power and durable connectors. Each of these customer groups has distinct technical requirements, purchasing cycles, and regulatory compliance needs, making a targeted approach essential for connector manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $75.2 Billion |

| Market Forecast in 2032 | $118.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amphenol Corporation, TE Connectivity, Molex LLC, Foxconn Interconnect Technology (FIT), Yazaki Corporation, JAE Electronics Inc., Japan Aviation Electronics Industry Ltd., Hirose Electric Co. Ltd., Delphi Technologies (Aptiv PLC), ITT Inc., Sumitomo Electric Industries Ltd., Würth Elektronik GmbH & Co. KG, HARTING Technology Group, Phoenix Contact, Weidmüller Interface GmbH & Co. KG, Rosenberger Hochfrequenztechnik GmbH & Co. KG, Samtec Inc., CUI Inc., LEMO SA, Esterline Technologies Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Connector Market Key Technology Landscape

The connector market's technological landscape is continually evolving, driven by the ever-increasing demands for higher performance, greater reliability, and enhanced functionality across various applications. One of the most significant technological advancements is in high-speed data transfer capabilities. With the advent of 5G, IoT, and high-performance computing, there is an escalating need for connectors that can support multi-gigabit data rates without signal degradation. This involves innovations in differential pair designs, impedance matching, and advanced shielding techniques to minimize crosstalk and electromagnetic interference (EMI). Fiber optic connectors are also gaining prominence, offering unparalleled bandwidth and immunity to electrical noise, becoming indispensable in data centers, telecom networks, and long-haul communication. Materials science plays a critical role, with development in low-loss dielectrics and highly conductive alloys improving electrical performance and thermal dissipation.

Another crucial area of technological development is miniaturization. As electronic devices become smaller and more compact, the demand for connectors with reduced form factors and higher pin densities intensifies. This requires precision manufacturing techniques, advanced molding processes for ultra-fine pitch designs, and robust yet compact locking mechanisms. Simultaneously, the market is seeing a surge in demand for ruggedized and environmentally sealed connectors, particularly for industrial, automotive, and aerospace applications. Technologies such as IP-rated sealing (Ingress Protection), vibration resistance, and corrosion-resistant coatings are essential to ensure reliable operation in harsh conditions. Connectors are being designed to withstand extreme temperatures, humidity, and exposure to chemicals, which is vital for the longevity and safety of critical systems.

Beyond physical design, the integration of smart features is becoming a key differentiator. This includes connectors with embedded sensors for monitoring parameters like temperature, current, or connection status, enabling predictive maintenance and enhanced system diagnostics. Wireless power and data transmission technologies are also impacting connector design, as hybrid solutions that combine traditional physical contacts with wireless capabilities emerge for specific use cases. Furthermore, advancements in manufacturing processes, such as additive manufacturing (3D printing) for prototyping and custom designs, and automated assembly techniques, are enabling faster product development cycles and more cost-effective production. The convergence of these technological innovations is shaping a future where connectors are not just passive conduits but intelligent components integral to the overall system's performance and efficiency.

Regional Highlights

- North America: This region is characterized by a strong presence of high-tech industries, advanced manufacturing, and significant investments in data centers and aerospace & defense. The demand for high-performance, high-speed, and robust connectors is particularly strong, driven by innovation in AI, autonomous vehicles, and medical devices. The United States leads in R&D and adoption of advanced connector technologies.

- Europe: A mature market with a robust automotive sector, industrial automation, and strong focus on renewable energy. Germany, France, and the UK are key markets, driving demand for heavy-duty, industrial-grade, and high-reliability connectors. The region also emphasizes adherence to stringent environmental and safety regulations, influencing connector design and material choices.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily due to its dominant manufacturing base for consumer electronics, automotive, and telecommunications equipment. Countries like China, Japan, South Korea, and India are key contributors, fueled by rapid urbanization, industrialization, and massive infrastructure development projects, including 5G rollout and EV manufacturing.

- Latin America: An emerging market experiencing steady growth driven by industrialization, infrastructure development, and increasing adoption of consumer electronics. Brazil and Mexico are significant markets, with demand for connectors in automotive production, telecommunications expansion, and energy projects.

- Middle East and Africa (MEA): This region is witnessing growth spurred by diversification efforts away from oil economies, leading to investments in smart cities, renewable energy, and digital infrastructure. Countries like UAE, Saudi Arabia, and South Africa are key players, creating demand for robust and specialized connectors for various industrial and telecom applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Connector Market.- Amphenol Corporation

- TE Connectivity

- Molex LLC

- Foxconn Interconnect Technology (FIT)

- Yazaki Corporation

- JAE Electronics Inc.

- Japan Aviation Electronics Industry Ltd.

- Hirose Electric Co. Ltd.

- Delphi Technologies (Aptiv PLC)

- ITT Inc.

- Sumitomo Electric Industries Ltd.

- Würth Elektronik GmbH & Co. KG

- HARTING Technology Group

- Phoenix Contact

- Weidmüller Interface GmbH & Co. KG

- Rosenberger Hochfrequenztechnik GmbH & Co. KG

- Samtec Inc.

- CUI Inc.

- LEMO SA

- Esterline Technologies Corporation

Frequently Asked Questions

What is the projected growth of the global connector market?

The global Connector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. It is estimated to reach $118.5 Billion by 2032, up from $75.2 Billion in 2025.

Which key factors are driving the expansion of the connector market?

The market's expansion is primarily driven by the escalating demand for high-speed data transfer, the proliferation of IoT devices, the global rollout of 5G networks, increasing electric vehicle (EV) adoption, and the continuous growth of industrial automation and smart manufacturing.

How does AI technology influence the connector industry?

AI significantly impacts the connector industry by demanding ultra-high-speed, high-density, and low-latency connectors for AI accelerators and data centers. It also drives the need for enhanced power delivery, thermal management, and robust signal integrity solutions, and can aid in optimizing connector manufacturing.

What are the major application areas for connectors globally?

Major application areas for connectors include data communication and telecommunications (data centers, 5G), automotive (EVs, ADAS), industrial automation, consumer electronics (smartphones, wearables), aerospace and defense, and medical devices.

Which geographic region leads the global connector market?

The Asia Pacific (APAC) region currently leads the global connector market and is also the fastest-growing. This is largely attributed to its robust manufacturing base in consumer electronics and automotive, coupled with significant investments in telecommunications infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- VSFF Connector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- MDC Connector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Spring and Twist Wire Connector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Circular Connector Clamp Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Actuator Connector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager