Crane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427200 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Crane Market Size

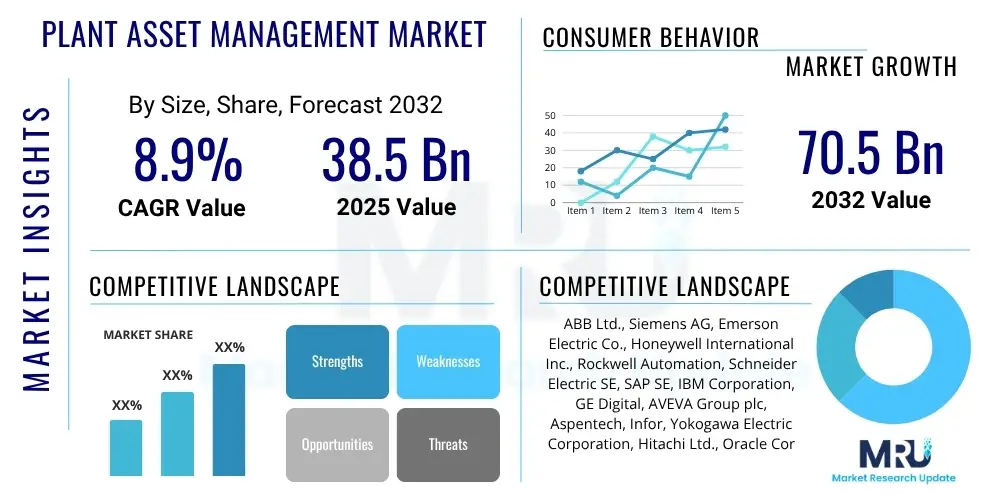

The Crane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 45.2 billion in 2025 and is projected to reach USD 66.5 billion by the end of the forecast period in 2032.

Crane Market introduction

The global crane market encompasses the manufacturing, distribution, and utilization of heavy machinery designed for lifting and moving materials in various industrial sectors. Cranes are indispensable tools that facilitate complex operations in construction, infrastructure development, manufacturing, logistics, and resource extraction, contributing significantly to project efficiency and safety. These robust machines are engineered to handle enormous loads, ranging from small components to multi-ton structures, making them central to modern industrial processes and urban expansion worldwide.

The market primarily features a diverse range of crane types, including mobile cranes, tower cranes, overhead cranes, marine and offshore cranes, and specialized industrial cranes. Each type is tailored for specific applications, offering unique operational benefits such as versatility, height capabilities, load capacity, and mobility. For instance, mobile cranes provide flexibility across different job sites, while tower cranes are paramount for high-rise construction. The ongoing global emphasis on infrastructure development, coupled with increasing industrialization and urbanization, continues to be a pivotal driver for market expansion.

Major applications of cranes span across commercial and residential construction, where they lift structural elements and materials; shipbuilding and port operations, involving container handling and heavy equipment transfer; manufacturing facilities for assembly line support; and the energy sector, particularly in renewable energy installations like wind turbine erection and oil and gas exploration. The inherent benefits of cranes, such as enhanced operational safety, significant time savings, and the ability to perform tasks beyond human capability, underscore their critical role in ensuring project timelines and economic progress across diverse global economies.

Crane Market Executive Summary

The crane market is experiencing dynamic shifts, characterized by several key business, regional, and segmental trends that collectively shape its growth trajectory. Globally, the industry is witnessing an accelerated adoption of advanced technologies, including automation, telematics, and digital control systems, aimed at enhancing operational efficiency, safety, and predictive maintenance capabilities. Sustainability is also emerging as a critical business imperative, driving demand for electric and hybrid crane models that reduce emissions and operational noise, aligning with stricter environmental regulations and corporate social responsibility initiatives. Furthermore, the growth of equipment rental services is transforming traditional sales models, offering greater flexibility and cost-effectiveness for end-users, especially in fluctuating economic environments.

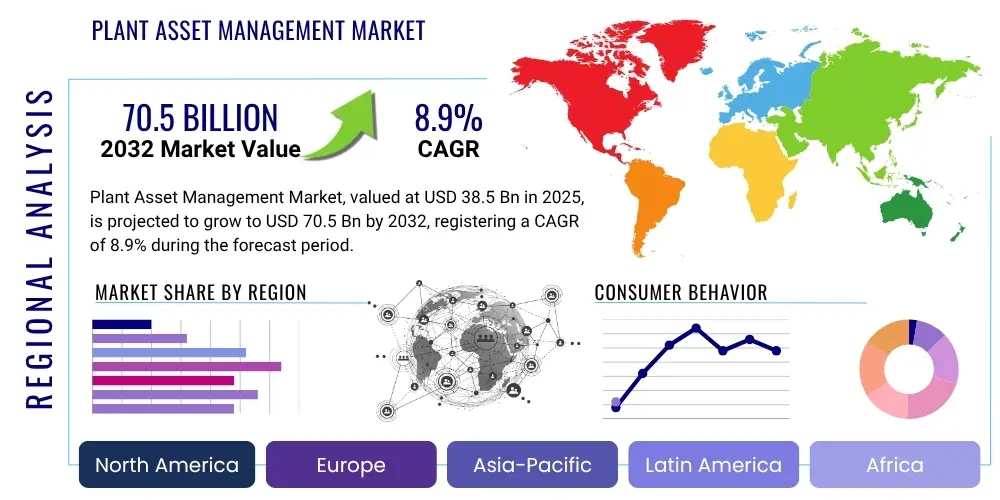

Regionally, the Asia Pacific continues to dominate the market, propelled by massive infrastructure projects, rapid urbanization, and a burgeoning manufacturing sector in countries like China, India, and Southeast Asian nations. North America and Europe demonstrate a consistent demand, primarily driven by investments in renewable energy infrastructure, modernization of existing industrial facilities, and stringent safety standards necessitating the upgrade of older equipment. Emerging economies in Latin America, the Middle East, and Africa are also poised for substantial growth, benefiting from government-led initiatives in construction, mining, and oil and gas, as these regions strive to enhance their industrial capabilities and urban landscapes.

From a segmentation perspective, mobile cranes, particularly all-terrain and rough-terrain variants, maintain a significant market share due to their versatility and adaptability to various job sites. There is an increasing demand for specialized cranes tailored for niche applications, such as heavy-lift cranes for complex industrial installations and intelligent cranes for automated warehouses. The market also observes a trend towards higher capacity cranes to handle larger prefabricated components in construction and heavier loads in logistics. These trends highlight an evolving market focused on technological integration, sustainability, and specialized solutions to meet diverse industrial demands efficiently.

AI Impact Analysis on Crane Market

User questions regarding AIs impact on the crane market frequently revolve around its potential to revolutionize operational safety, enhance efficiency, and introduce new levels of autonomy. Users are keen to understand how AI can mitigate human error, which is a leading cause of accidents in crane operations, through advanced collision avoidance systems, predictive maintenance, and real-time operational analytics. There is also significant interest in AIs capacity to automate complex lifting tasks, optimize logistics, and improve site management, thereby reducing project timelines and operational costs. Concerns often emerge regarding job displacement for traditional crane operators, the initial investment required for AI integration, and the cybersecurity implications of connected smart crane systems, along with the reliability of AI algorithms in unpredictable real-world scenarios.

The integration of Artificial Intelligence (AI) into the crane market is rapidly transforming traditional lifting operations, ushering in an era of enhanced safety, precision, and efficiency. AI-powered systems are being deployed for real-time data analysis, enabling cranes to make more informed decisions regarding load balancing, swing control, and obstacle avoidance. This not only significantly reduces the risk of accidents by minimizing human intervention in hazardous environments but also optimizes the entire lifting process, from planning to execution. Furthermore, AI contributes to predictive maintenance by analyzing operational data patterns to anticipate equipment failures, thereby reducing downtime and extending the lifespan of machinery.

Beyond safety and maintenance, AI is also driving innovation in autonomous and semi-autonomous crane operations, particularly in repetitive or highly controlled environments such as automated warehouses and port terminals. These systems can autonomously navigate, pick, and place loads with extreme accuracy, leading to substantial gains in productivity and operational speed. The application of AI in route optimization, resource allocation, and job site management further streamlines construction and industrial processes, allowing for more efficient project execution and better resource utilization. As AI technologies mature, their pervasive influence is expected to make crane operations smarter, safer, and more sustainable across the global market.

- Enhanced Safety: AI-driven collision avoidance, stability control, and real-time risk assessment reduce accidents.

- Predictive Maintenance: AI algorithms analyze sensor data to anticipate equipment failures, minimizing downtime and maintenance costs.

- Operational Efficiency: AI optimizes lift paths, load balancing, and task scheduling, leading to faster project completion.

- Autonomous Operations: Development of semi-autonomous and fully autonomous cranes for repetitive and hazardous tasks, increasing productivity.

- Data-Driven Insights: AI processes operational data to provide actionable insights for fleet management, performance monitoring, and resource allocation.

- Remote Operation & Control: AI facilitates more precise and safer remote operation, expanding human operator reach and reducing on-site personnel risk.

DRO & Impact Forces Of Crane Market

The crane markets trajectory is profoundly shaped by a confluence of drivers, restraints, opportunities, and pervasive impact forces. Key drivers include accelerating global infrastructure development, rapid urbanization, and increasing industrialization in emerging economies, which collectively fuel the demand for heavy lifting equipment across various sectors like construction, manufacturing, and logistics. Furthermore, the growing adoption of renewable energy projects, particularly wind farm installations, necessitates specialized high-capacity cranes. Technological advancements such as automation, digitalization, and the integration of IoT and AI are also propelling market growth by enhancing crane efficiency, safety, and operational capabilities.

Conversely, the market faces significant restraints. The high capital investment required for purchasing and maintaining cranes, coupled with the escalating costs of raw materials, poses a considerable barrier, especially for smaller players. A persistent shortage of skilled operators and technicians worldwide is another critical challenge impacting operational efficiency and safety. Moreover, stringent environmental regulations regarding emissions and noise pollution, alongside complex safety standards, necessitate continuous technological upgrades and compliance efforts, adding to operational complexities and costs. Economic downturns and geopolitical uncertainties can also dampen investment in construction and industrial projects, thereby impacting crane demand.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The increasing focus on smart city development and sustainable construction practices presents avenues for electric and hybrid crane adoption. The vast potential in emerging markets for infrastructure upgrades and industrial expansion offers fertile ground for growth. Additionally, the development of advanced materials for lighter yet stronger cranes, coupled with the rising demand for crane rental services, provides manufacturers with diverse revenue streams and enhanced market penetration. The continuous evolution of digital technologies for remote monitoring, predictive analytics, and enhanced human-machine interfaces further underscores significant growth potential. The market is also impacted by broader economic forces influencing construction and manufacturing output, technological forces driving innovation in design and operation, environmental forces pushing for greener solutions, and regulatory forces shaping safety and performance standards globally.

Segmentation Analysis

The crane market is extensively segmented to reflect the diverse applications, operational characteristics, and end-user requirements prevalent across the globe. This segmentation allows for a nuanced understanding of market dynamics, growth drivers within specific niches, and the varying competitive landscapes. Analyzing these segments provides critical insights into product development strategies, regional market focus, and the technological advancements that are shaping the future of the heavy lifting industry. Understanding these distinctions is crucial for stakeholders to identify key growth areas and tailor their offerings to specific market demands.

Market segmentation typically categorizes cranes based on their design, mobility, capacity, power source, and end-use application, each influencing purchasing decisions and market share. For instance, the type of crane often dictates its primary utility, with mobile cranes offering flexibility for varied sites and tower cranes dominating high-rise urban construction. Similarly, capacity and power source considerations directly relate to the specific lifting requirements and environmental mandates of different projects. This multi-faceted approach to segmentation highlights the complexity and specialization inherent in the crane market, ensuring that a wide spectrum of industrial needs is met with appropriate and efficient solutions.

- By Type:

- Mobile Cranes: All-terrain cranes, Rough-terrain cranes, Truck-mounted cranes, Crawler cranes.

- Tower Cranes: Top-slewing, Luffing-jib, Self-erecting.

- Overhead Cranes: Bridge cranes, Gantry cranes, Monorail cranes, Jib cranes.

- Marine/Offshore Cranes: Ship cranes, Offshore platform cranes, Port cranes.

- Loader Cranes: Knuckle boom cranes, Stiff boom cranes.

- Others: Railroad cranes, Bulk-handling cranes.

- By End-User Industry:

- Construction: Residential, Commercial, Infrastructure (roads, bridges, airports, utilities).

- Manufacturing: Automotive, Heavy Machinery, Industrial Plants.

- Shipping and Port Operations: Container handling, Shipbuilding, Logistics.

- Mining and Excavation: Material handling, Equipment assembly.

- Energy and Utilities: Power plants, Wind farms, Oil & Gas.

- Others: Waste management, Defense.

- By Lifting Capacity:

- Small-Duty Cranes (up to 20 tons)

- Medium-Duty Cranes (20-100 tons)

- Heavy-Duty Cranes (over 100 tons)

- By Technology:

- Hydraulic Cranes

- Electric Cranes

- Manual/Mechanical Cranes

- By Operation:

- Manned Cranes

- Remote-Controlled Cranes

- Autonomous/Semi-Autonomous Cranes

Crane Market Value Chain Analysis

The value chain of the crane market is a complex ecosystem beginning with upstream activities focused on the sourcing and processing of raw materials and specialized components. This stage involves suppliers of high-grade steel, advanced hydraulic systems, precision-engineered engines, robust electrical components, and sophisticated control systems. Manufacturers engage in rigorous research and development to innovate designs, improve structural integrity, and integrate advanced technologies like IoT and AI. Efficient management of these upstream activities is critical to ensure cost-effectiveness, quality, and the timely availability of materials, directly impacting the final products performance and market competitiveness.

Midstream activities involve the core manufacturing and assembly processes where various components are brought together to construct the final crane products. This stage includes welding, machining, painting, and the integration of complex mechanical, hydraulic, and electronic systems. Quality control and testing are paramount to ensure that cranes meet stringent safety standards and performance specifications. Following manufacturing, products move into the distribution phase, which involves both direct and indirect channels. Direct distribution includes sales through the manufacturers own sales force and service centers, often catering to large enterprises and specialized projects requiring custom solutions or extensive support. This direct approach allows for closer client relationships and tailored services.

Downstream activities focus on reaching the end-users and providing post-sales support. Indirect distribution channels leverage a network of authorized dealers, distributors, and rental companies who play a crucial role in broader market penetration, especially for smaller businesses and projects with fluctuating demands. These partners often provide localized sales, maintenance, spare parts, and training services, enhancing customer accessibility and support. Post-sales services, including maintenance contracts, spare parts supply, training for operators, and equipment repair, are vital for customer satisfaction and long-term equipment performance, significantly contributing to the overall value proposition. The strength of these relationships and the efficiency of the service network are critical determinants of brand loyalty and market success in the crane industry.

Crane Market Potential Customers

Potential customers for the crane market represent a broad spectrum of industries, all requiring robust and reliable solutions for lifting and material handling. Primarily, the construction sector stands as the largest end-user, encompassing companies involved in residential, commercial, and infrastructure development. These customers, ranging from large-scale civil engineering firms to smaller independent builders, depend on cranes for erecting structures, positioning heavy prefabricated components, and handling construction materials efficiently and safely across diverse project sites. The continuous global investment in urban development, transportation networks, and public utilities ensures a sustained demand from this segment.

Beyond construction, the manufacturing industry constitutes a significant customer base, particularly in sectors dealing with heavy machinery, automotive assembly, and industrial plant operations. Manufacturers utilize cranes, especially overhead and gantry types, for moving raw materials, assembling large components, and transporting finished products within their facilities, thereby optimizing production lines and improving workplace ergonomics. The shipping and logistics sectors, including port authorities, container terminals, and shipbuilding yards, also represent critical customers, relying on specialized marine and port cranes for loading, unloading, and transferring heavy cargo and massive vessel components, facilitating global trade and maritime operations.

Furthermore, the mining and energy sectors are substantial consumers of crane technology. Mining companies deploy heavy-duty cranes for equipment maintenance, material extraction, and processing, often in remote and challenging environments. The energy industry, particularly in oil and gas, and the rapidly expanding renewable energy sector (e.g., wind farm construction), utilizes specialized cranes for installation, maintenance, and decommissioning of large-scale infrastructure. Utility providers, defense organizations, and waste management companies also form part of the diverse customer ecosystem, each requiring specific crane types tailored to their unique operational demands, highlighting the pervasive utility of cranes across modern industrial landscapes.

Crane Market Key Technology Landscape

The technology landscape within the crane market is undergoing a significant transformation, driven by a continuous push towards enhanced efficiency, safety, and operational intelligence. A paramount technological advancement is the integration of the Internet of Things (IoT), which enables real-time monitoring of crane performance, health, and operational parameters. IoT sensors collect data on load, stress, fuel consumption, and environmental conditions, providing operators and fleet managers with critical insights for predictive maintenance, optimized scheduling, and improved asset utilization. This connectivity allows for proactive problem-solving, reducing downtime and extending the lifespan of the equipment, thereby contributing to higher overall operational productivity.

Furthermore, the adoption of Artificial Intelligence (AI) and machine learning algorithms is revolutionizing crane operations, moving towards greater autonomy and precision. AI-powered systems facilitate advanced features such as intelligent load balancing, collision avoidance, and automated sequencing of lifting tasks, significantly mitigating human error and enhancing safety protocols. Telematics and remote control technologies are also becoming standard, allowing operators to control cranes from a safe distance, often enhancing visibility and reducing on-site risks. These technologies also enable remote diagnostics and software updates, which are crucial for maintaining peak performance and adapting to new operational requirements without requiring physical presence.

The industry is also witnessing significant innovations in power sources and materials science. There is a growing trend towards electrification and hybrid power systems for cranes, aligning with global sustainability goals and stringent emission regulations. Electric and hybrid cranes offer reduced noise, lower emissions, and improved fuel efficiency, making them ideal for urban construction sites and enclosed industrial environments. Alongside, the use of advanced lightweight materials, such as high-strength steel and composite alloys, is enabling the development of cranes with higher lifting capacities and extended reach, without compromising structural integrity or adding excessive weight. These technological advancements collectively contribute to a smarter, safer, and more sustainable future for the crane market.

Regional Highlights

- Asia Pacific: This region stands as the largest and fastest-growing market for cranes, primarily driven by robust economic growth, rapid urbanization, and massive government investments in infrastructure development. Countries like China and India are at the forefront, with extensive projects in residential, commercial, and transportation infrastructure, coupled with a booming manufacturing sector. Southeast Asian nations are also contributing significantly, experiencing a surge in construction activities and port expansions. The demand here is further fueled by the increasing adoption of advanced construction techniques requiring modern and high-capacity lifting equipment, making it a critical region for global manufacturers.

- North America: The North American crane market demonstrates consistent growth, propelled by strong economic recovery, significant public and private investments in infrastructure upgrades, and a thriving renewable energy sector, particularly in wind power installations. The United States and Canada are leading the demand, with an emphasis on modernizing aging infrastructure, developing smart cities, and expanding industrial capacities. Stringent safety regulations and environmental concerns also drive the adoption of technologically advanced and eco-friendly crane models, encouraging innovation and replacement of older fleets.

- Europe: Europe represents a mature but stable market, characterized by advanced technological integration, a strong focus on sustainability, and high safety standards. Western European countries like Germany, the UK, and France are key contributors, investing in renewable energy projects, urban redevelopment, and industrial modernization. The region exhibits a strong demand for specialized cranes and rental services, driven by the need for efficient operations in densely populated areas and adherence to strict environmental norms, fostering a market for innovative and high-performance equipment.

- Latin America: The Latin American crane market is experiencing moderate growth, primarily influenced by ongoing urbanization, investments in mining and resource extraction, and infrastructure development projects across various countries. Brazil, Mexico, and Chile are prominent markets, benefiting from foreign direct investment and government initiatives aimed at boosting economic growth and improving logistics. While economic volatility can impact investment, the long-term outlook remains positive due to the regions vast natural resources and continuous need for infrastructure enhancement.

- Middle East & Africa: This region is characterized by substantial investments in large-scale construction and infrastructure projects, particularly in the Middle East, driven by economic diversification efforts away from oil and gas. Countries like UAE, Saudi Arabia, and Qatar are undertaking ambitious mega-projects, including new cities, ports, and tourism infrastructure, generating immense demand for heavy lifting equipment. In Africa, growing industrialization, mining activities, and infrastructure development initiatives are contributing to market expansion, albeit at a slower pace, with significant long-term potential for growth in construction and resource sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crane Market.- Liebherr

- XCMG

- Terex Corporation

- Tadano Ltd.

- Konecranes Plc

- Sany Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- The Manitowoc Company, Inc.

- Cargotec Corporation (Hiab)

- Palfinger AG

- Caterpillar Inc.

- Hitachi Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Kobelco Construction Machinery Co., Ltd.

- Altec Industries Inc.

Frequently Asked Questions

What is the projected growth rate of the Crane Market?

The Crane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. This growth is underpinned by global infrastructure development, increasing urbanization, and technological advancements in lifting equipment. The market is expected to expand from an estimated USD 45.2 billion in 2025 to USD 66.5 billion by 2032, reflecting a steady upward trend in demand across various industrial sectors. This consistent growth trajectory highlights the critical role of cranes in supporting global construction, manufacturing, and logistics operations, and points towards sustained investment in both new equipment and rental fleets.

Which factors are primarily driving the demand for cranes?

Primary drivers for crane demand include significant global infrastructure development, particularly in emerging economies where extensive road networks, bridges, and public utilities are being built. Rapid urbanization worldwide fuels demand for residential and commercial construction projects, necessitating diverse types of cranes. Furthermore, the expansion of the manufacturing sector, the growth of the renewable energy industry (especially wind farm installations), and increasing investments in port modernization and logistics infrastructure are crucial factors. Technological advancements leading to more efficient, safer, and automated cranes also act as a significant market impetus, encouraging equipment upgrades and new purchases.

How is AI impacting the safety and efficiency of crane operations?

AI significantly enhances both the safety and efficiency of crane operations through various applications. For safety, AI-powered systems enable real-time collision avoidance, intelligent load stabilization, and predictive maintenance, drastically reducing human error and preventing potential accidents. By analyzing sensor data, AI can anticipate equipment failures, allowing for proactive servicing and minimizing unexpected downtimes. In terms of efficiency, AI optimizes lift paths, schedules operations, and automates repetitive tasks, leading to faster project completion and reduced operational costs. AI also supports advanced remote control capabilities, enabling operators to manage complex lifts from a safer vantage point, thus improving overall operational precision and speed in dynamic work environments.

What are the key challenges faced by the Crane Market?

The Crane Market faces several key challenges, including the high initial capital investment and substantial maintenance costs associated with heavy machinery, which can deter smaller enterprises. A critical restraint is the global shortage of skilled crane operators and technicians, impacting operational efficiency and safety across the industry. Stringent environmental regulations and evolving safety standards necessitate continuous technological upgrades, adding to operational complexities and expenses. Furthermore, economic uncertainties, supply chain disruptions for raw materials and components, and geopolitical tensions can also lead to project delays and reduced demand, collectively posing significant hurdles for market growth and stability.

Which regions are expected to show the most significant growth in the Crane Market?

The Asia Pacific region is anticipated to exhibit the most significant growth in the Crane Market, driven by extensive infrastructure development, rapid urbanization, and a burgeoning manufacturing sector in countries such as China, India, and other Southeast Asian nations. This region benefits from large-scale government investments in mega-projects and an increasing need for modernized lifting solutions. Additionally, the Middle East and Africa are projected to demonstrate strong growth due to ambitious construction and infrastructure initiatives, particularly in the GCC countries, alongside growing industrialization and resource extraction activities across the African continent. These regions collectively present substantial opportunities for market expansion and increased crane adoption in the coming years.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Global Industrial Crane Collectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Port Crane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Crane rail Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Crane Wheels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Crane Cables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager