HVAC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429275 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

HVAC Market Size

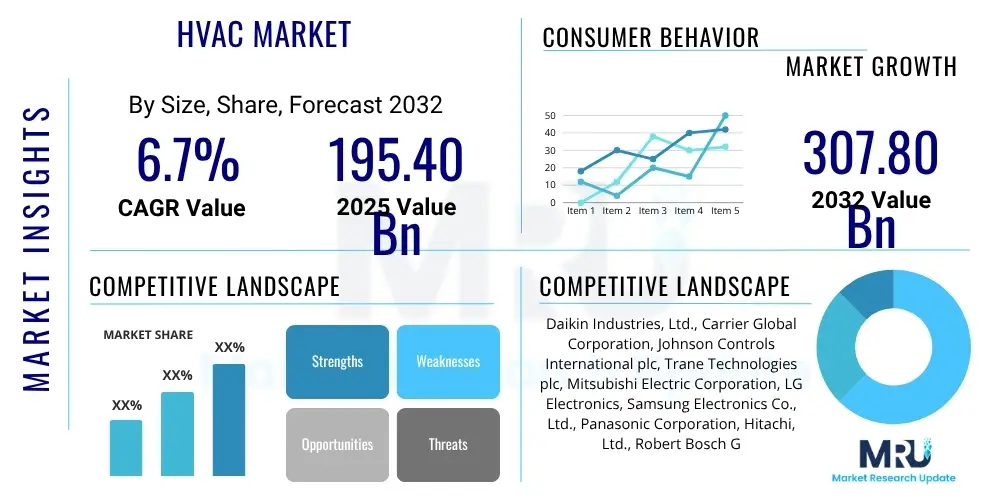

The HVAC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032. The market is estimated at USD 195.40 billion in 2025 and is projected to reach USD 307.80 billion by the end of the forecast period in 2032.

HVAC Market introduction

The Heating, Ventilation, and Air Conditioning (HVAC) market encompasses an extensive array of systems and services designed to ensure optimal indoor environmental quality and thermal comfort. These critical systems regulate temperature, humidity, and air purity across diverse settings, ranging from residential homes and commercial establishments to large-scale industrial complexes and institutional facilities. Products within this market segment include sophisticated air conditioning units, robust heating systems, and advanced ventilation equipment, all of which are essential for maintaining healthy and productive indoor environments. The primary benefits derived from modern HVAC solutions include enhanced occupant comfort, significant improvements in indoor air quality, reduced energy consumption through advanced efficiency features, and overall operational cost savings for building owners.

The global HVAC market is driven by a confluence of influential factors. Rapid urbanization and the concurrent expansion of both residential and commercial infrastructure worldwide necessitate the installation of new HVAC systems in emerging cities and suburbs. Simultaneously, the growing awareness and concern regarding climate change, coupled with increasingly stringent energy efficiency regulations and building codes, are compelling industries and consumers to adopt more sustainable and high-performance HVAC technologies. Furthermore, technological advancements, such as the integration of smart controls, Internet of Things (IoT) capabilities, and Artificial Intelligence (AI), are transforming traditional HVAC systems into intelligent, interconnected climate management solutions that offer superior control, diagnostics, and energy optimization. These pervasive drivers underscore the market's sustained growth trajectory and its pivotal role in contemporary building management and public health.

HVAC Market Executive Summary

The global HVAC market is currently undergoing a dynamic transformation, characterized by robust growth and significant innovation across various business, regional, and segment trends. Business trends highlight a strong industry pivot towards sustainability and digitalization, with a marked increase in the development and adoption of smart HVAC systems that leverage IoT for predictive maintenance, remote monitoring, and enhanced energy management. This shift is also driving demand for integrated building management systems that offer holistic control over environmental parameters, thereby improving operational efficiency and reducing carbon footprints. The focus on green building initiatives and the lifecycle cost of HVAC systems is further influencing procurement decisions, favoring solutions with lower environmental impact and higher long-term value.

From a regional perspective, the Asia-Pacific region stands as the dominant and fastest-growing market, primarily fueled by rapid industrialization, extensive urbanization, and substantial investments in infrastructure development, particularly in economic powerhouses like China and India. North America and Europe represent mature markets, where growth is largely attributed to the replacement of aging infrastructure with advanced, energy-efficient HVAC technologies and the retrofitting of existing buildings to meet modern sustainability standards. Emerging markets in Latin America and the Middle East and Africa are also exhibiting considerable growth potential, spurred by rising disposable incomes, population expansion, and government-backed construction projects aimed at modernizing urban landscapes. Each region presents unique market drivers and regulatory environments, shaping localized demand and technological adoption patterns within the HVAC industry.

Segment-wise, the market is experiencing notable shifts. The residential sector is witnessing increased adoption of compact and energy-efficient solutions, such as ductless mini-split systems and advanced heat pumps, driven by homeowner preferences for comfort, air quality, and lower utility bills. The commercial sector, encompassing offices, retail spaces, and hospitality, is increasingly investing in Variable Refrigerant Flow (VRF) systems and centralized chillers, which offer superior zone control and energy savings for larger, complex buildings. Furthermore, the service and maintenance segment is expanding significantly, reflecting the growing complexity of modern HVAC installations that require specialized technical expertise for commissioning, diagnostics, and preventive maintenance. This robust growth across segments underscores the market's adaptability and responsiveness to evolving customer needs and technological advancements.

AI Impact Analysis on HVAC Market

Users and industry stakeholders frequently pose questions regarding the transformative impact of Artificial Intelligence (AI) on the HVAC market, specifically focusing on its potential to revolutionize system efficiency, operational intelligence, and user experience. Common inquiries delve into how AI can enhance energy optimization through predictive analytics, enable sophisticated predictive maintenance protocols to minimize downtime, and contribute to the development of highly responsive and autonomous climate control systems. There is considerable interest in AI's role in integrating HVAC with broader smart building ecosystems, improving indoor air quality through intelligent monitoring and adaptive ventilation strategies, and personalizing comfort settings based on learned occupant preferences and real-time environmental data. The overarching expectation is that AI will be a pivotal force driving the next generation of smart, sustainable, and user-centric climate control solutions.

The integration of AI technologies is poised to fundamentally redefine traditional HVAC operations by enabling a transition from reactive to proactive management. AI algorithms, leveraging vast datasets from sensors, weather forecasts, and historical usage patterns, can precisely anticipate heating and cooling demands, thereby optimizing system outputs and significantly reducing energy wastage. This capability is critical for achieving stringent energy efficiency targets and lowering operational costs for commercial and industrial facilities. Furthermore, AI-driven diagnostic tools can continuously monitor equipment health, detect anomalies, and predict potential failures long before they occur, allowing for scheduled maintenance and preventing costly breakdowns. This paradigm shift not only extends the lifespan of HVAC assets but also ensures uninterrupted service and consistent indoor comfort, addressing a primary concern for building managers and occupants.

Beyond efficiency and maintenance, AI is also enhancing the user experience and the overall intelligence of HVAC systems. Smart thermostats and building management systems embedded with AI can learn from occupant behaviors and environmental feedback to automatically adjust settings, providing personalized comfort without manual intervention. This adaptability is particularly valuable in dynamic environments where occupancy levels and comfort preferences vary throughout the day. Moreover, AI contributes to improved indoor air quality by analyzing data from air quality sensors and dynamically adjusting ventilation and filtration systems to remove pollutants and maintain optimal air composition. The strategic deployment of AI in HVAC represents a significant leap forward, offering unparalleled levels of control, sustainability, and intelligent adaptability, which are essential for the future of smart buildings.

- Enhanced Energy Efficiency: AI algorithms analyze diverse data points (weather, occupancy, usage patterns) to predict and optimize HVAC operation, leading to substantial reductions in energy consumption.

- Predictive Maintenance: AI monitors system health in real-time, identifying anomalies and predicting potential equipment failures, enabling proactive maintenance scheduling and minimizing downtime.

- Intelligent Climate Control: AI-powered systems learn occupant preferences and adapt to environmental changes, providing personalized and consistent comfort levels autonomously.

- Improved Indoor Air Quality: AI integrates with air quality sensors to continuously monitor pollutants, humidity, and CO2, dynamically adjusting ventilation and filtration for healthier environments.

- Operational Cost Reduction: By optimizing energy usage, streamlining maintenance, and extending equipment lifespan, AI significantly lowers long-term operational expenses for building owners.

- Seamless Integration with Smart Buildings: AI facilitates the holistic integration of HVAC with other building automation systems (lighting, security), creating a centralized and intelligent management ecosystem.

- Adaptive Learning and Self-Optimization: AI systems can continuously learn from operational data and make real-time adjustments to improve performance, efficiency, and responsiveness over time.

DRO & Impact Forces Of HVAC Market

The HVAC market is predominantly driven by a surging global demand for energy-efficient climate control solutions, a trend largely instigated by escalating energy costs and widespread environmental consciousness concerning greenhouse gas emissions. Governments worldwide are implementing more stringent energy efficiency regulations and building codes, compelling new constructions and existing retrofits to incorporate advanced HVAC technologies that minimize power consumption. Concurrently, rapid urbanization and significant infrastructure development, particularly in burgeoning economies across Asia-Pacific and the Middle East, are fueling new installations in residential, commercial, and industrial sectors. The growing adoption of smart home technologies and integrated building management systems further propels market expansion by creating demand for interconnected and intelligent HVAC solutions that offer enhanced comfort and operational control.

Despite these robust drivers, the HVAC market encounters several notable restraints that could impede its growth trajectory. The most significant challenge remains the high initial investment required for advanced and energy-efficient HVAC systems, which can be a substantial barrier for small and medium-sized enterprises (SMEs) and even some residential consumers. Furthermore, a persistent shortage of skilled technicians and installers globally poses operational difficulties, affecting the efficient deployment, maintenance, and servicing of increasingly complex HVAC technologies. Fluctuating raw material prices, particularly for metals like copper and aluminum, and refrigerants, introduce cost volatility into the supply chain, impacting manufacturing expenses and subsequently, end-user pricing. These factors collectively underscore the need for innovative financing models and workforce development initiatives to mitigate their dampening effect on market growth.

Opportunities for growth in the HVAC market are abundant, primarily centered on technological innovation and market expansion. The increasing focus on retrofitting and renovating existing buildings with modern, energy-efficient HVAC systems presents a substantial market segment, especially in mature economies. Furthermore, the burgeoning smart homes and smart building movements offer fertile ground for integrated HVAC solutions that leverage IoT, AI, and cloud connectivity for enhanced control and automation. Emerging economies, characterized by rising disposable incomes and rapid infrastructure build-out, represent untapped markets with immense potential for new HVAC installations. Impact forces that consistently shape the market include continuous technological advancements leading to more sustainable refrigerants and greener systems, evolving environmental policies, and shifts in consumer preferences towards healthy indoor environments and personalized comfort. The long-term market outlook remains positive, driven by these dynamic forces and the imperative for climate control solutions across the globe.

- Drivers: Growing demand for energy-efficient systems, rapid urbanization and infrastructure development, increasing disposable income, stringent building regulations and green building initiatives, technological advancements in smart and IoT-enabled HVAC.

- Restraints: High initial installation and maintenance costs of advanced systems, lack of skilled workforce and specialized technicians, fluctuating raw material prices (e.g., copper, aluminum, refrigerants), complex system integration challenges, and long replacement cycles for existing equipment.

- Opportunities: Rise of smart homes and intelligent building automation, extensive retrofitting and renovation of existing infrastructure, adoption of sustainable and eco-friendly HVAC solutions, expansion into untapped emerging economies, development of integrated service and maintenance contracts, and demand for improved indoor air quality solutions.

- Impact Forces: Technological innovation (IoT, AI, ML), environmental regulations and mandates (e.g., F-Gas Regulations), economic growth and construction spending, changing consumer awareness and preferences towards health and comfort, geopolitical stability affecting supply chains, and climate change driving demand for cooling solutions.

Segmentation Analysis

The HVAC market is comprehensively segmented to provide a detailed understanding of its multifaceted dynamics, catering to diverse needs across various applications, components, and end-user requirements. This granular segmentation is crucial for stakeholders to identify specific market niches, develop targeted product offerings, and formulate effective market penetration strategies. The primary segmentation categories typically include system type, key components, application areas, and the end-use sectors, each revealing unique growth drivers and competitive landscapes. Analyzing these distinct segments enables market players to tailor solutions that address specific operational challenges and customer preferences, optimizing both product development and distribution efforts. For instance, the demand characteristics for a residential air conditioning unit differ significantly from those for an industrial chiller, necessitating specialized approaches in design, marketing, and sales.

Under the 'Type' segmentation, the market differentiates between Heating Equipment, Ventilation Equipment, Air Conditioning Equipment, and Refrigeration Equipment, reflecting the core functions of HVAC systems. Each of these sub-segments, in turn, consists of various technologies and products, such as furnaces, boilers, heat pumps within heating, and AHUs, FCUs, and air purifiers within ventilation. The 'Component' segmentation focuses on the individual parts that constitute an HVAC system, including compressors, condensers, evaporators, motors, controls, sensors, and thermostats, highlighting the crucial role of supply chain efficiency and technological advancements in component manufacturing. Understanding the interplay between these components is vital for ensuring system reliability, efficiency, and integration capabilities. Furthermore, the 'Application' and 'End-Use' segments categorize demand based on the environment and the nature of the project, distinguishing between new construction versus retrofit projects, and residential versus commercial or industrial installations. This detailed breakdown ensures that market analysis is both precise and actionable, guiding strategic decisions across the entire HVAC value chain.

- By Type:

- Heating Equipment: Furnaces (Gas, Electric, Oil), Boilers (Steam, Hot Water), Heat Pumps (Air-source, Geothermal, Water-source), Unitary Heaters, Radiant Heaters.

- Ventilation Equipment: Air Handling Units (AHUs), Fan Coil Units (FCUs), Exhaust Fans, Ventilation Fans, Air Purifiers, Humidifiers, Dehumidifiers, Energy Recovery Ventilators (ERVs), Heat Recovery Ventilators (HRVs).

- Air Conditioning Equipment: Room Air Conditioners (Window, Split, Portable), Ducted Split Air Conditioners, Centralized Air Conditioners, Variable Refrigerant Flow (VRF) Systems, Chillers (Air-cooled, Water-cooled), Coolers (Evaporative Coolers).

- Refrigeration Equipment: Walk-in Coolers/Freezers, Industrial Refrigeration Systems, Commercial Refrigeration Systems.

- By Component:

- Compressors: Reciprocating, Rotary, Scroll, Screw, Centrifugal.

- Condensers: Air-cooled, Water-cooled, Evaporative.

- Evaporators: Finned Tube, Plate, Bare Tube.

- Fans and Blowers: Axial, Centrifugal, Propeller.

- Filters: HEPA, Activated Carbon, Pleated, Panel.

- Ducts and Vents: Sheet Metal, Flexible Ducts, Diffusers, Grilles.

- Controls and Thermostats: Smart Thermostats, Programmable Thermostats, Building Management Systems (BMS), Sensors (Temperature, Humidity, CO2, Occupancy).

- Valves: Expansion Valves, Solenoid Valves, Ball Valves.

- Motors: AC Motors, DC Motors, EC Motors.

- Heat Exchangers.

- Pumps.

- Refrigerants.

- By Application:

- Residential: Single-family homes, Multi-family homes, Apartments, Condominiums.

- Commercial: Offices, Retail Stores, Shopping Malls, Hospitals and Healthcare Facilities, Educational Institutions, Hotels and Hospitality, Data Centers, Restaurants, Sports Complexes.

- Industrial: Manufacturing Plants, Power Generation, Oil & Gas, Mining, Pharmaceuticals, Food & Beverage Processing, Warehouses.

- Others: Transportation (Automotive, Marine), Public Buildings, Government Facilities.

- By End-Use:

- New Construction.

- Retrofit and Replacement.

Value Chain Analysis For HVAC Market

The value chain of the HVAC market is a complex ecosystem, meticulously structured to deliver comprehensive climate control solutions from raw material sourcing to post-installation services. Upstream activities in this chain are primarily dominated by the procurement and processing of essential raw materials, including various metals such as copper, aluminum, and steel, as well as plastics, refrigerants, and electronic components. These raw materials are then supplied to component manufacturers who specialize in producing critical elements like compressors, motors, heat exchangers, fans, and controls. The efficiency and quality of these upstream processes are fundamental, directly impacting the overall cost, performance, and reliability of the final HVAC systems. Strong supplier relationships and robust quality control mechanisms at this stage are crucial for maintaining competitive advantages in the highly competitive HVAC landscape.

Midstream in the value chain, Original Equipment Manufacturers (OEMs) integrate these diverse components into complete HVAC units and systems, encompassing everything from residential air conditioners and commercial chillers to industrial ventilation systems. This stage involves significant investment in research and development, manufacturing expertise, and quality assurance to produce innovative and high-performing products that meet evolving market demands and regulatory standards. Downstream activities focus on bringing these finished products to end-users and ensuring their optimal functioning throughout their lifecycle. This involves a comprehensive network of distributors, wholesalers, and retailers who facilitate market access and product availability across different geographical regions and customer segments. The effectiveness of this distribution network is key to market penetration and consumer reach, requiring efficient logistics and warehousing capabilities.

The final crucial segment of the value chain encompasses installation, maintenance, and after-sales services, which are increasingly pivotal in differentiating market players. Installation services ensure the proper setup and commissioning of HVAC systems, adhering to technical specifications and safety standards. Post-sales support, including routine maintenance, repairs, and energy audits, is vital for ensuring long-term system performance, energy efficiency, and customer satisfaction. This service-oriented segment often involves specialized contractors and certified technicians who possess the expertise to manage complex modern HVAC technologies. Distribution channels are varied, ranging from direct sales models for large commercial or industrial projects, offering personalized solutions and greater control, to indirect channels via third-party distributors and retailers, which provide broader market access and local support, particularly for residential and smaller commercial customers. The interplay of these channels is essential for maximizing market coverage and catering to diverse customer procurement preferences.

HVAC Market Potential Customers

Potential customers for HVAC products and services constitute a broad and diverse spectrum of end-users, each with distinct requirements influenced by their operational scale, specific environmental needs, and budgetary considerations. The residential sector represents a significant customer base, encompassing single-family homes, multi-unit dwellings, apartments, and condominiums. Homeowners and residential developers prioritize systems that offer comfort, energy efficiency to reduce utility bills, superior indoor air quality for health and well-being, and often, quiet operation and aesthetic integration into living spaces. The rising trend of smart homes further drives demand for integrated, app-controlled HVAC solutions that can be remotely managed and automated to enhance convenience and energy savings.

The commercial sector is another expansive segment of potential customers, including a wide array of establishments such as office buildings, retail complexes, shopping malls, hotels, restaurants, healthcare facilities, and educational institutions. These customers typically require robust, scalable, and highly efficient HVAC systems capable of managing large volumes of space, accommodating varying occupancy levels, and maintaining precise temperature and humidity control crucial for occupant comfort and regulatory compliance. Commercial clients often prioritize solutions that offer low operating costs, reliable performance, and advanced building management system (BMS) integration to optimize facility operations and environmental sustainability. For example, hospitals demand highly reliable systems with advanced filtration for infection control, while data centers require precision cooling to prevent equipment overheating.

Industrial end-users form a specialized but highly demanding customer segment, encompassing manufacturing plants, power generation facilities, oil and gas operations, and pharmaceutical production sites. These customers require heavy-duty, customized HVAC solutions that can withstand harsh environmental conditions, maintain specific process temperatures, and ensure the integrity of sensitive equipment and products. Precision climate control is often critical for industrial processes, making reliability and durability paramount. Lastly, institutional buyers, including governmental buildings, public facilities, and defense establishments, seek durable, low-maintenance, and energy-efficient HVAC systems that provide long-term operational value while adhering to public procurement guidelines and sustainability mandates. Each of these customer categories drives specific innovation and product development within the HVAC market, underscoring the industry's adaptability and broad impact.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 195.40 billion |

| Market Forecast in 2032 | USD 307.80 billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daikin Industries, Ltd., Carrier Global Corporation, Johnson Controls International plc, Trane Technologies plc, Mitsubishi Electric Corporation, LG Electronics, Samsung Electronics Co., Ltd., Panasonic Corporation, Hitachi, Ltd., Robert Bosch GmbH, Fujitsu Limited, Lennox International Inc., Nortek Global HVAC, Ingersoll Rand Inc., Gree Electric Appliances Inc. of Zhuhai, Midea Group Co., Ltd., Vaillant Group, Rheem Manufacturing Company, Danfoss A/S, Honeywell International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HVAC Market Key Technology Landscape

The HVAC market is undergoing a profound technological transformation, driven by an imperative for enhanced energy efficiency, sophisticated control, and superior indoor environmental quality. A cornerstone of this evolution is the pervasive integration of the Internet of Things (IoT), enabling HVAC systems to connect, communicate, and collect vast amounts of operational data. IoT-enabled sensors and smart thermostats facilitate real-time monitoring of temperature, humidity, CO2 levels, and occupancy, allowing for dynamic adjustments that optimize system performance and reduce energy waste. This connectivity also supports remote diagnostics and predictive maintenance, shifting from reactive repairs to proactive servicing, which minimizes downtime and extends the lifespan of expensive equipment. Furthermore, the data generated by IoT devices provides invaluable insights into building performance, supporting continuous optimization and strategic decision-making for facility managers.

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being deployed to unlock advanced capabilities within HVAC systems. AI algorithms process complex datasets from IoT sensors, weather forecasts, and historical usage patterns to predict heating and cooling demands with remarkable accuracy. This predictive intelligence enables systems to adapt dynamically to changing conditions, delivering optimal comfort while significantly reducing energy consumption. Beyond optimization, AI is powering self-learning thermostats that personalize climate control based on occupant preferences, creating truly intelligent and responsive indoor environments. Another significant technological trend is the rise of Variable Refrigerant Flow (VRF) systems and advanced heat pumps, which offer superior energy efficiency, precise zone control, and flexible installation options compared to traditional systems, making them ideal for both new constructions and retrofits.

Sustainability and indoor air quality are also driving significant technological advancements in the HVAC sector. The industry is rapidly adopting refrigerants with lower Global Warming Potential (GWP) to comply with evolving environmental regulations and reduce ecological impact. Geothermal HVAC systems, harnessing the Earth's stable temperatures, are gaining traction for their exceptional energy efficiency and reduced carbon footprint. Furthermore, sophisticated air filtration and purification technologies, including HEPA filters, UV-C lights, and advanced electrostatic precipitators, are becoming standard features, addressing growing public health concerns related to indoor air pollutants and airborne pathogens. Building Automation Systems (BAS) continue to evolve, integrating HVAC with lighting, security, and access control to create holistic, smart building ecosystems that deliver unparalleled operational efficiency, occupant comfort, and safety. These technologies collectively underscore the market's commitment to innovation, sustainability, and intelligent climate management for the future.

Regional Highlights

- North America: The North American HVAC market is characterized by maturity and a strong emphasis on upgrading existing infrastructure with smart and energy-efficient solutions. Driven by stringent building codes, environmental regulations, and a high consumer awareness regarding energy savings, there is a consistent demand for advanced systems that incorporate IoT and AI. The region is a key innovator in smart thermostat technology, zoning systems, and advanced air quality solutions. Significant investments in retrofitting commercial and residential buildings with high-efficiency heat pumps and VRF systems contribute to steady market expansion.

- Europe: Europe is a highly regulated market, with a strong focus on decarbonization and compliance with directives such as the F-Gas Regulation, which mandates the phasing down of high-GWP refrigerants. This regulatory environment is accelerating the adoption of heat pump technologies for both heating and cooling, alongside sustainable refrigerants. Countries like Germany, France, and the UK are leading in the transition towards greener HVAC solutions, with government incentives promoting energy efficiency in residential and commercial buildings. The market also shows a robust demand for integrated building management systems for optimal energy performance and reduced carbon emissions.

- Asia Pacific (APAC): The Asia Pacific region stands as the largest and fastest-growing market for HVAC, propelled by rapid urbanization, significant industrialization, and extensive infrastructure development across major economies such as China, India, and Southeast Asian nations. Increasing disposable incomes, a growing middle class, and rising construction activities in both residential and commercial sectors are fueling demand for new HVAC installations. While traditional systems still dominate in some areas, there's a burgeoning demand for energy-efficient and smart HVAC solutions, especially in developed urban centers, driven by environmental concerns and a desire for modern amenities.

- Latin America: The Latin American HVAC market is experiencing steady growth, supported by increasing urbanization, rising disposable incomes, and continuous investments in commercial and residential construction projects. Countries like Brazil, Mexico, and Argentina are key contributors, demonstrating a growing adoption of modern and energy-efficient HVAC systems. While pricing sensitivity remains a factor, there is an increasing preference for inverter technology and smart control systems that offer energy savings. The market is also seeing a gradual shift towards more environmentally friendly refrigerants and sustainable cooling solutions.

- Middle East and Africa (MEA): Characterized by extreme climatic conditions, the MEA region exhibits a consistently high demand for air conditioning systems, particularly in the Gulf Cooperation Council (GCC) countries. Investments in mega-projects, smart city initiatives, and the hospitality sector are significant market drivers. There is a strong focus on energy efficiency in new constructions and a growing awareness of indoor air quality, leading to the adoption of advanced filtration and ventilation solutions. The market is also influenced by government efforts to diversify economies and attract tourism, necessitating world-class climate control infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HVAC Market.- Daikin Industries, Ltd.

- Carrier Global Corporation

- Johnson Controls International plc

- Trane Technologies plc

- Mitsubishi Electric Corporation

- LG Electronics

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Hitachi, Ltd.

- Robert Bosch GmbH

- Fujitsu Limited

- Lennox International Inc.

- Nortek Global HVAC

- Ingersoll Rand Inc.

- Gree Electric Appliances Inc. of Zhuhai

- Midea Group Co., Ltd.

- Vaillant Group

- Rheem Manufacturing Company

- Danfoss A/S

- Honeywell International Inc.

Frequently Asked Questions

What are the primary drivers of growth in the HVAC market?

The HVAC market is primarily driven by increasing global demand for energy-efficient climate control solutions, rapid urbanization and infrastructure development, stringent environmental regulations, and the growing integration of smart home and building technologies for enhanced control and automation.

How is AI impacting the HVAC industry?

AI is revolutionizing HVAC through predictive maintenance, optimizing energy consumption by learning usage patterns, enabling intelligent and personalized climate control, and enhancing indoor air quality management, leading to significant operational efficiencies and superior user experience.

Which regional market holds the largest share and why?

The Asia Pacific region currently holds the largest market share in HVAC. This dominance is attributed to extensive urbanization, rapid industrialization, burgeoning construction activities, and rising disposable incomes in key economies like China and India.

What are the key challenges faced by the HVAC market?

Key challenges include the high initial investment costs associated with advanced HVAC systems, a persistent shortage of skilled labor for installation and maintenance, fluctuating raw material prices, and the complexities involved in integrating diverse system components for optimal performance.

What are the emerging technological trends in HVAC?

Emerging trends include the widespread integration of IoT for remote monitoring and diagnostics, the increasing adoption of Variable Refrigerant Flow (VRF) systems and advanced heat pumps for superior energy efficiency, the shift towards sustainable refrigerants, and the evolution of Building Automation Systems (BAS) for integrated control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Smart HVAC Controls Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- HVAC After Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- HVAC Contained Servers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Nonwoven Fabrics for HVAC Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- HVAC Centrifugal Compressors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager