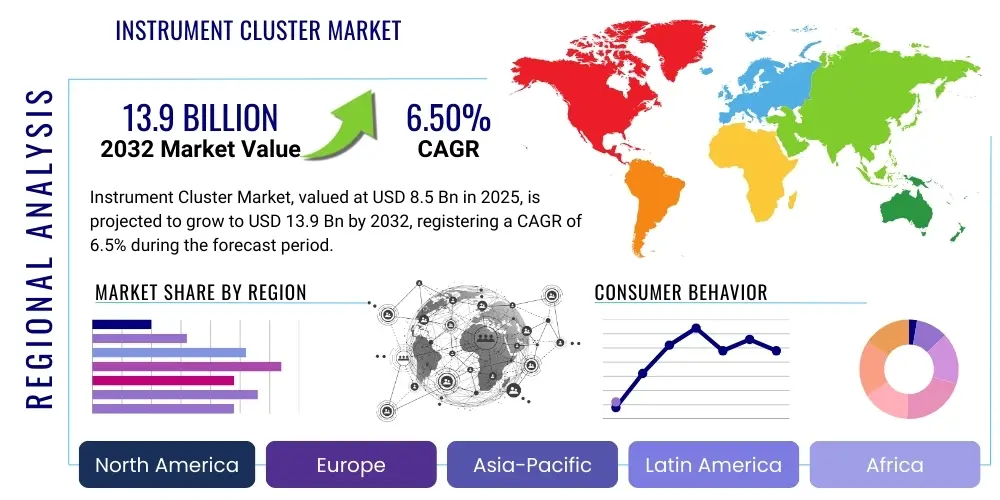

Instrument Cluster Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427564 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Instrument Cluster Market Size

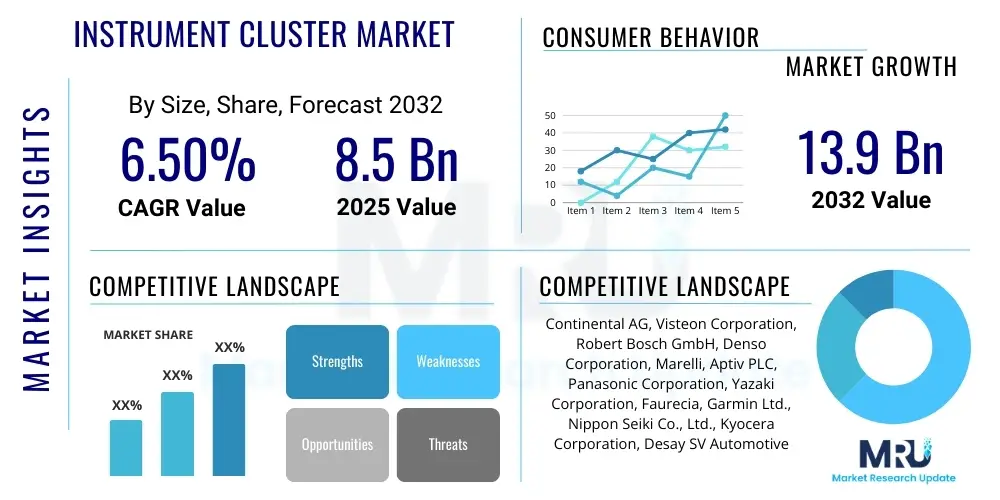

The Instrument Cluster Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 8.5 billion in 2025 and is projected to reach USD 13.9 billion by the end of the forecast period in 2032.

Instrument Cluster Market introduction

The instrument cluster, a pivotal human-machine interface (HMI) in vehicles, provides crucial driving information, evolving significantly from rudimentary analog displays to sophisticated digital systems. This transformation is driven by advancements in display technologies, processing power, and software integration, enabling a seamless and immersive user experience. Modern instrument clusters are no longer mere gauges; they are interactive information hubs displaying navigation, infotainment, advanced driver-assistance system (ADAS) data, and vehicle diagnostics, forming an indispensable part of the contemporary automotive interior and influencing driving safety and comfort.

The product encompasses various types, including analog, hybrid, and fully digital clusters, with the latter gaining substantial traction due to their flexibility and capability to present diverse information dynamically. Digital instrument clusters leverage high-resolution TFT-LCD or OLED screens, offering extensive customization options and superior graphics. Major applications span across passenger vehicles, commercial vehicles, and the rapidly expanding electric vehicle (EV) segment, where they play a critical role in conveying battery status, range, and energy consumption efficiently. The benefits extend beyond mere information display to include enhanced driver awareness, reduced cognitive load, and improved aesthetic appeal, contributing significantly to the overall perceived quality and technological sophistication of a vehicle.

Key driving factors for market expansion include the increasing demand for advanced vehicle safety features, particularly the integration of ADAS warnings and visual aids directly into the drivers primary field of view. The proliferation of electric vehicles, which require detailed and dynamic battery and range information, is another major impetus. Furthermore, the rising consumer preference for sophisticated in-cabin electronics, connected car features, and personalized user interfaces are compelling automotive original equipment manufacturers (OEMs) to adopt more advanced and feature-rich instrument clusters. Regulatory mandates for certain safety features and the competitive landscape among automakers to differentiate their offerings also fuel innovation and adoption in this market segment.

Instrument Cluster Market Executive Summary

The Instrument Cluster Market is witnessing robust growth, largely propelled by the automotive industrys pivot towards electrification, autonomous driving, and advanced connectivity. Key business trends indicate a strong shift from traditional analog and hybrid clusters to fully digital, customizable, and integrated display solutions that serve as comprehensive human-machine interfaces. Manufacturers are increasingly focusing on developing clusters that seamlessly integrate with other in-vehicle systems, such as infotainment, navigation, and advanced driver-assistance systems (ADAS), to provide a unified and intuitive user experience. This integration necessitates higher processing power, sophisticated software, and high-resolution display technologies, driving substantial research and development investments across the value chain. The demand for enhanced personalization and dynamic information display is also shaping product development, pushing the boundaries of what instrument clusters can offer.

Regional trends highlight Asia-Pacific as the leading market, primarily due to the burgeoning automotive production in countries like China, India, Japan, and South Korea, coupled with the rapid adoption of electric vehicles and smart technologies in these regions. European and North American markets are also significant contributors, characterized by a strong emphasis on premium vehicle segments, stringent safety regulations, and a high rate of technological innovation and early adoption of advanced in-car features. These regions are at the forefront of implementing sophisticated digital clusters that support semi-autonomous and fully autonomous driving functionalities. Emerging markets in Latin America and Africa are gradually catching up, driven by increasing vehicle sales and a growing consumer appetite for modern vehicle interiors, albeit with a slower pace of adoption for the most advanced digital solutions.

Segment trends underscore the dominance and rapid expansion of fully digital instrument clusters, which offer unparalleled flexibility in information presentation and design customization. Display technology evolution, from TFT-LCD to advanced OLED panels, is a critical enabler for these digital solutions, providing superior contrast, brightness, and wider viewing angles. The market is also segmented by vehicle type, with passenger cars accounting for the largest share, followed by commercial vehicles and a rapidly expanding segment for electric vehicles, each with specific requirements for data presentation. Moreover, the emergence of augmented reality (AR) heads-up displays (HUDs) is anticipated to transform the instrument cluster landscape further, projecting critical information directly onto the drivers field of vision and blurring the lines between traditional dashboard displays and external reality, thereby enhancing safety and immersion.

AI Impact Analysis on Instrument Cluster Market

The integration of Artificial Intelligence (AI) into instrument clusters represents a transformative shift, addressing user expectations for more intuitive, predictive, and personalized driving experiences. Users frequently inquire about how AI can enhance safety features, provide more intelligent driver assistance, and create a truly adaptive cabin environment. Concerns often revolve around data privacy, the reliability of AI-driven suggestions, and the potential for information overload. The prevailing expectation is that AI will move beyond basic data display to offer proactive insights, anticipating driver needs and responding to various driving conditions dynamically, thereby improving both driver engagement and overall road safety. This involves processing vast amounts of real-time data from vehicle sensors, navigation systems, and driver inputs to present the most relevant information at the opportune moment, reducing cognitive load and improving decision-making.

AIs influence is profound, enabling instrument clusters to become central hubs for intelligent vehicle interaction. It facilitates advanced driver monitoring systems that can detect fatigue or distraction, providing timely alerts to enhance safety. Furthermore, AI algorithms power predictive maintenance notifications, informing drivers of potential vehicle issues before they escalate, and optimize route guidance by considering real-time traffic, weather, and driver preferences. The personalization aspect is also significantly boosted, as AI can learn driver habits, preferred settings, and frequently used functions, automatically adjusting display layouts, information priority, and even ambient lighting to create a tailored driving environment. This adaptive capability not only adds convenience but also contributes to a more focused and comfortable driving experience, particularly relevant in the context of increasing vehicle autonomy.

The continued evolution of AI in instrument clusters is poised to support higher levels of autonomous driving, where the cluster may transition from primary information display to a comprehensive interaction and entertainment hub when the vehicle is in self-driving mode. This transition will require AI to manage complex interactions between the driver, vehicle, and external environment, ensuring seamless handover control and maintaining driver engagement when human intervention is required. The ability to process natural language commands, interpret gestures, and even recognize facial expressions will further enhance the intuitive nature of instrument clusters, making them more responsive and user-friendly. However, the development needs to balance advanced functionality with simplicity and reliability, ensuring that AI-driven features are genuinely beneficial and do not compromise driver safety or increase complexity.

- Enhanced predictive analytics for maintenance and routing.

- Personalized user interfaces and adaptive display layouts based on driver behavior and context.

- Integration with advanced driver-assistance systems (ADAS) for intelligent warning and guidance.

- Driver monitoring for fatigue and distraction detection, improving safety.

- Voice and gesture control for intuitive interaction with cluster functions.

- Real-time traffic and hazard alerts, optimizing information delivery.

- Seamless integration with autonomous driving modes, managing information flow.

DRO & Impact Forces Of Instrument Cluster Market

The Instrument Cluster Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, influenced by several powerful impact forces. A primary driver is the accelerating trend of vehicle electrification and the advent of autonomous driving technologies, which necessitate sophisticated digital displays to convey complex information regarding battery status, range, ADAS functionalities, and navigation in an intuitive manner. Concurrently, increasing consumer demand for advanced human-machine interfaces (HMI), connected car features, and personalized in-cabin experiences propels the adoption of fully digital and reconfigurable clusters. The evolving regulatory landscape, particularly with new safety standards mandating advanced driver information systems, also acts as a critical driver, compelling OEMs to integrate more sophisticated cluster technologies. These factors collectively stimulate innovation and investment in advanced display and processing solutions, leading to continuous market expansion and technological advancement.

Despite robust growth, several restraints challenge the market. High research and development costs associated with developing cutting-edge display technologies, advanced graphics processors, and integrated software platforms pose a significant barrier, especially for smaller market players. The complex cybersecurity threats inherent in connected and highly integrated digital clusters represent another substantial restraint, requiring continuous investment in robust security protocols to protect sensitive vehicle and driver data. Furthermore, the intense competition and price pressure within the automotive supply chain often push manufacturers to balance innovation with cost-effectiveness, potentially limiting the adoption of the most advanced, premium solutions in mass-market vehicles. Material sourcing challenges and supply chain disruptions, as experienced recently with semiconductor shortages, also present ongoing operational hurdles for manufacturers, impacting production volumes and market growth.

Opportunities for growth are abundant, particularly in the realm of augmented reality (AR) head-up displays (HUDs) and seamless integration with the broader smart cabin ecosystem. The development of advanced AR technologies that project crucial information directly onto the drivers field of vision holds immense potential to revolutionize driver information delivery, enhancing safety and immersion. Emerging markets, with their rapidly growing middle-class populations and increasing vehicle penetration, offer significant untapped potential for digital cluster adoption, as consumers in these regions increasingly seek modern vehicle features. The ongoing shift towards software-defined vehicles also presents opportunities for recurring revenue through over-the-air (OTA) updates for new functionalities and personalization options, extending the lifecycle and value proposition of instrument clusters. Strategic collaborations between automotive OEMs, technology providers, and software developers will be key to unlocking these future opportunities and fostering innovative solutions.

- Drivers:

- Rising demand for vehicle electrification and hybrid vehicles.

- Increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving.

- Growing consumer preference for advanced human-machine interface (HMI) and connected car features.

- Technological advancements in display and processing units.

- Stringent safety regulations and mandates for driver information systems.

- Restraints:

- High research and development costs for advanced cluster technologies.

- Cybersecurity concerns related to connected digital displays.

- Intense price competition and cost-effectiveness pressures on OEMs.

- Supply chain vulnerabilities, particularly for semiconductors and display components.

- Opportunities:

- Emergence of Augmented Reality (AR) Head-Up Displays (HUDs).

- Growth in emerging automotive markets, especially Asia-Pacific.

- Integration with the broader smart cabin and infotainment ecosystem.

- Development of software-defined clusters offering over-the-air (OTA) updates.

- Partnerships between OEMs and technology providers for innovation.

- Impact Forces:

- Rapid technological evolution in display and semiconductor industries.

- Shifting consumer preferences towards digital and personalized experiences.

- Global economic conditions influencing vehicle sales and R&D investments.

- Evolving regulatory frameworks for vehicle safety and data privacy.

- Environmental concerns driving EV adoption and related cluster demands.

Segmentation Analysis

The Instrument Cluster Market is meticulously segmented to provide a granular understanding of its diverse components and growth trajectories. These segmentations allow for a comprehensive analysis of market dynamics across various technological implementations, display characteristics, vehicle applications, and end-user types. Understanding these segments is crucial for identifying key growth areas, assessing competitive landscapes, and formulating targeted market strategies. The markets evolution from purely mechanical to highly sophisticated digital interfaces underscores the importance of these distinctions, as different segments exhibit varying growth rates, adoption patterns, and technological requirements, reflecting the heterogeneous demands of the global automotive industry. This detailed breakdown helps stakeholders identify niches and emerging trends within the broader market, informing product development and investment decisions effectively.

- By Technology:

- Analog Clusters: Traditional mechanical gauges, declining market share.

- Hybrid Clusters: Combination of analog gauges and digital displays, offering a balance.

- Digital Clusters: Fully digital displays (TFT-LCD, OLED), offering high customization and information density.

- By Display Size:

- Below 5 inches: Typically for entry-level vehicles or specific information panels.

- 5-10 inches: Common in mid-range and some premium vehicles, offering a good balance of size and cost.

- Above 10 inches: Predominantly in premium, luxury, and electric vehicles, for extensive information display.

- By Vehicle Type:

- Passenger Cars: Largest segment, driven by consumer demand for advanced features.

- Commercial Vehicles: Focus on robustness, essential information, and specific fleet management data.

- Electric Vehicles (EVs): Growing segment, requiring specialized displays for battery, range, and charging data.

- By End-User:

- Original Equipment Manufacturers (OEMs): Primary customers, integrating clusters into new vehicle production.

- Aftermarket: Replacement units and upgrades, a smaller but significant segment.

- By Application:

- Conventional Vehicles: Standard combustion engine cars.

- Semi-Autonomous Vehicles: Integrating ADAS and partial autonomous driving information.

- Autonomous Vehicles: Designed for future fully self-driving cars, possibly with new interaction modes.

Instrument Cluster Market Value Chain Analysis

The value chain for the Instrument Cluster Market is intricate, encompassing a wide array of specialized participants from raw material suppliers to final vehicle integration. At the upstream end, the chain begins with suppliers of critical components such as semiconductors (microcontrollers, graphics processors), display panels (TFT-LCD, OLED), sensors, and specialized software modules for graphics rendering, HMI development, and functional safety. These suppliers form the foundational layer, providing the advanced technological building blocks necessary for sophisticated digital clusters. The quality, innovation, and cost-effectiveness of these upstream components directly influence the performance, features, and overall competitiveness of the final instrument cluster product. Strategic partnerships and long-term contracts with these specialized component providers are crucial for ensuring a stable supply chain and accessing cutting-edge technologies.

Midstream in the value chain are the Tier 1 suppliers, who act as integrators and primary manufacturers of the complete instrument cluster system. Companies like Continental, Visteon, Bosch, and Denso procure components from various upstream suppliers, design the cluster architecture, develop the embedded software, integrate hardware, and conduct rigorous testing to meet automotive industry standards and OEM specifications. These Tier 1 suppliers play a pivotal role in product innovation, transforming discrete components into a cohesive, functional unit. Their expertise in systems integration, software development, and manufacturing efficiency is paramount to delivering high-quality, feature-rich instrument clusters that meet the demanding requirements of automotive OEMs regarding performance, reliability, and cost targets. The ability to offer tailored solutions and collaborate closely with OEMs during vehicle development cycles is a key differentiator for these suppliers.

The downstream segment of the value chain primarily involves automotive Original Equipment Manufacturers (OEMs) who integrate the instrument clusters into their new vehicle models during the assembly process. This represents the direct distribution channel, where clusters are supplied directly to OEM production lines. OEMs evaluate and select Tier 1 suppliers based on various factors including technological capability, cost, quality, and the ability to meet production schedules. The aftermarket segment constitutes an indirect distribution channel, where instrument clusters are sold as replacement parts or for upgrades through authorized service centers, independent repair shops, and specialized aftermarket retailers. This segment, while smaller in volume compared to OEM sales, plays an important role in extending product lifecycle and offering customization options. The efficiency and reliability of both direct and indirect distribution networks are vital for market penetration and customer satisfaction across the globe.

Instrument Cluster Market Potential Customers

The primary potential customers for instrument clusters are global automotive Original Equipment Manufacturers (OEMs) across various vehicle segments. These include major passenger car manufacturers ranging from economy segment brands to premium and luxury vehicle producers, all requiring advanced digital clusters to meet evolving consumer expectations and integrate sophisticated vehicle functionalities. The relentless pursuit of vehicle differentiation, enhanced safety features, and a superior user experience by OEMs drives the demand for innovative instrument cluster solutions. Furthermore, the rapidly expanding electric vehicle (EV) manufacturers, both established players and new startups, are crucial customers due as EVs inherently require specialized and highly efficient digital clusters to display battery status, range management, and regenerative braking information clearly and dynamically, which often differs significantly from conventional internal combustion engine vehicles.

Beyond passenger cars, commercial vehicle manufacturers, including producers of heavy-duty trucks, light commercial vehicles, and buses, represent another significant customer segment. For these vehicles, instrument clusters must be exceptionally robust, reliable, and capable of displaying essential operational data, fleet management information, and compliance-related indicators. Specialized vehicle manufacturers, such as those producing construction equipment, agricultural machinery, and military vehicles, also constitute potential customers, albeit with highly specific requirements for durability, environmental resilience, and functional integration unique to their operational contexts. The emphasis in these segments often leans towards robust design and clear, unambiguous information presentation, even in challenging operating conditions, to ensure operational efficiency and safety. These end-users demand customized solutions that can withstand harsh environments and provide critical data to operators effectively.

The aftermarket segment, though smaller in scale, also comprises potential customers, including vehicle owners seeking to upgrade their existing instrument clusters for enhanced functionality or aesthetic appeal, as well as independent garages and authorized service centers that require replacement units. While the bulk of the market is driven by new vehicle production, the aftermarket provides a continuous, albeit slower, stream of demand. Additionally, technology development companies that are building demonstration vehicles or specialized prototypes for autonomous driving research or other mobility solutions can also be considered niche, high-value customers for advanced, custom-built instrument cluster solutions. These customers prioritize cutting-edge technology and flexibility, often driving the demand for highly customizable and experimental cluster designs that can pave the way for future mainstream applications.

Instrument Cluster Market Key Technology Landscape

The technology landscape of the Instrument Cluster Market is characterized by rapid innovation, driven primarily by advancements in display technologies, processing power, and sophisticated software integration. At its core, the shift from analog to digital clusters has been enabled by the proliferation of high-resolution Thin-Film Transistor Liquid Crystal Display (TFT-LCD) panels, which offer versatility in displaying a wide array of information and graphics. More recently, Organic Light Emitting Diode (OLED) displays are gaining traction, especially in premium vehicles, due to their superior contrast ratios, deeper blacks, faster response times, and thinner form factors, allowing for more dynamic and visually striking interfaces. The integration of advanced graphics rendering engines and powerful microcontrollers, often from leading semiconductor manufacturers, is critical for smoothly processing complex animations, 3D graphics, and real-time data from multiple vehicle systems, ensuring a fluid and responsive user experience.

Beyond the primary display, the market is increasingly adopting Head-Up Display (HUD) technology, which projects vital driving information directly onto the windshield in the drivers line of sight. This technology significantly enhances safety by reducing the need for drivers to look away from the road. The advent of Augmented Reality (AR) HUDs represents the next frontier, capable of overlaying navigation directions, ADAS warnings, and other context-aware information onto the real-world view outside the vehicle. This blurs the line between digital information and the physical environment, offering a truly immersive and intuitive interface. Furthermore, the development of haptic feedback systems, integrating subtle vibrations or tactile responses into steering wheels or cluster controls, adds another dimension to driver interaction, providing non-visual cues for warnings or confirmations, thereby improving safety and ergonomic comfort.

Connectivity is another paramount technological trend, with instrument clusters evolving to integrate seamlessly with connected car ecosystems. This involves embedding communication modules (e.g., 5G, V2X - Vehicle-to-Everything) that allow the cluster to receive real-time traffic updates, over-the-air (OTA) software updates, and cloud-based services. The incorporation of Artificial Intelligence (AI) and machine learning algorithms is also transforming clusters, enabling personalized user profiles, predictive analytics for maintenance or route optimization, and intelligent driver monitoring systems. These AI capabilities allow the cluster to adapt to driver behavior, driving conditions, and preferences, making the interface more intuitive and proactive. The overarching trend is towards a holistic digital cockpit experience, where the instrument cluster is just one component of a larger, interconnected HMI system that includes infotainment screens, voice assistants, and advanced gesture controls, all working in concert to provide a comprehensive and highly interactive in-vehicle environment.

Regional Highlights

- Asia Pacific: This region dominates the Instrument Cluster Market, driven by high automotive production volumes, particularly in China, Japan, India, and South Korea. Rapid adoption of electric vehicles and increasing consumer demand for advanced in-cabin technologies contribute significantly to market expansion. Governments in these countries also actively promote smart mobility and advanced manufacturing, fostering innovation and local production capacities. The presence of key automotive OEMs and a robust electronics manufacturing ecosystem further solidifies its leading position.

- Europe: A significant market characterized by a strong presence of premium and luxury vehicle manufacturers, which are early adopters of advanced digital and AR-HUD clusters. Countries like Germany, France, and the UK lead in technological innovation and research & development, driven by stringent safety regulations and a high consumer expectation for sophisticated in-car technology. The shift towards electric and hybrid vehicles also fuels demand for advanced cluster solutions.

- North America: This region exhibits high demand for advanced instrument clusters, particularly in the US and Canada, fueled by a strong automotive industry and a consumer base open to adopting new technologies. The focus here is on integrating ADAS features, connected car services, and high-resolution digital displays. Investments in autonomous vehicle development also drive the need for highly interactive and informative cluster systems.

- Rest of the World (ROW): Encompasses Latin America, the Middle East, and Africa. This region is a growing market, with increasing vehicle sales and a rising middle class driving demand for modern vehicle features. While adoption rates for the most advanced digital clusters may lag behind developed regions, there is a steady transition from analog to hybrid and basic digital clusters. Local manufacturing capabilities and economic conditions play a crucial role in market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Instrument Cluster Market.- Continental AG

- Visteon Corporation

- Robert Bosch GmbH

- Denso Corporation

- Marelli (formerly Magneti Marelli)

- Aptiv PLC

- Panasonic Corporation

- Yazaki Corporation

- Faurecia (FORVIA)

- Garmin Ltd.

- Nippon Seiki Co., Ltd.

- Kyocera Corporation

- Desay SV Automotive

Frequently Asked Questions

What is the future of instrument clusters?

The future of instrument clusters is characterized by full digitalization, immersive augmented reality (AR) integrations, and advanced AI-driven personalization. They will evolve into highly adaptive, predictive human-machine interfaces that seamlessly integrate with autonomous driving systems, providing dynamic information and entertainment tailored to driver and passenger needs.

How are Electric Vehicles (EVs) impacting instrument cluster design?

EVs are significantly impacting cluster design by necessitating dynamic displays for critical information such as battery state-of-charge, real-time range estimation, energy consumption, and charging status. This drives demand for larger, high-resolution digital screens that can clearly and efficiently communicate complex electric powertrain data, optimizing driver awareness and range anxiety management.

What role does Human-Machine Interface (HMI) play in modern clusters?

HMI is central to modern clusters, focusing on intuitive interaction and reduced cognitive load. It involves ergonomic design, clear information hierarchy, touch/gesture controls, and voice commands to ensure drivers can effortlessly access and process vital data. Advanced HMI aims to create a seamless, safe, and personalized driving experience, integrating various vehicle functions harmoniously.

Are augmented reality (AR) clusters becoming mainstream?

While fully immersive AR clusters are not yet mainstream, AR Head-Up Displays (HUDs) are gaining traction, especially in premium vehicles. These systems project navigation and ADAS warnings onto the windshield, overlaying them onto the real road environment. As technology advances and costs decrease, AR elements are expected to become more prevalent, enhancing safety and driver immersion.

What are the main challenges faced by instrument cluster manufacturers?

Manufacturers face challenges including high R&D costs for advanced display and processing technologies, maintaining cybersecurity against evolving threats, managing complex supply chains for critical components like semiconductors, and balancing innovation with cost-effectiveness to meet OEM price targets. Intense market competition and rapidly evolving consumer expectations also add pressure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Reconfigurable Instrument Cluster Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Vehicle Instrument Cluster Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Digital Instrument Cluster Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Passive Matrix Liquid Crystal Display Market Size Report By Type (Instrument Cluster Displays, Head-up Display, Centre Stack Display, Driver Information Display, Advanced Instrument Cluster Display, Rear- Seat Entertainment Touch Screen Display, Camera Information Display), By Application (Navigation, Telematics, Infotainment, Blind Spot Detection), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Automotive Instrument Cluster Market Size Report By Type (Hybrid Cluster, Analog Cluster, Digital Cluster), By Application (Passenger Vehicle, Commercial Vehicle), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager