Server Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429472 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Server Market Size

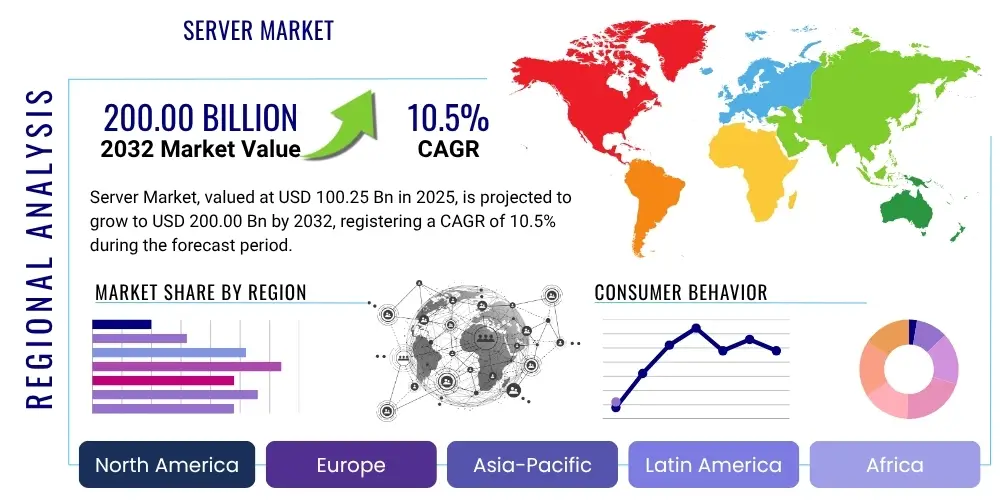

The Server Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at USD 100.25 Billion in 2025 and is projected to reach USD 200.00 Billion by the end of the forecast period in 2032.

Server Market introduction

The server market encompasses the global demand, supply, and technological advancements of computing devices designed to process requests and deliver data to other computers over a network. These essential components of modern IT infrastructure are built for high performance, reliability, and continuous operation, forming the backbone of cloud computing, enterprise data centers, and various digital services. Products range from rack and blade servers optimized for space and power efficiency in large data centers to tower servers for smaller businesses and microservers for specialized edge computing applications. The primary applications of servers include hosting websites, managing databases, running enterprise resource planning (ERP) systems, supporting email services, facilitating cloud storage, and powering artificial intelligence workloads.

The fundamental benefits of robust server infrastructure include enhanced data processing capabilities, reliable storage solutions, improved network performance, and the ability to handle complex computational tasks efficiently. Servers provide the necessary scalability and resilience for businesses to operate critical applications, store vast amounts of data, and support a growing user base without compromising performance. They are pivotal in ensuring business continuity, enabling remote work, and facilitating global digital transformation initiatives. The market's growth is primarily driven by the escalating demand for digital services, the proliferation of data, the rapid adoption of cloud computing models, and the increasing integration of advanced technologies such as artificial intelligence and the Internet of Things.

Server Market Executive Summary

The Server Market is experiencing dynamic shifts, characterized by significant business trends including the expansion of hyperscale data centers, the growing importance of edge computing, and a strong industry focus on sustainable and energy-efficient server solutions. Enterprises are increasingly adopting hybrid cloud strategies, leading to diversified demand for both on-premises and cloud-optimized server architectures. Regional trends indicate North America and Europe as mature markets with sustained demand driven by digital transformation and cloud migration, while the Asia Pacific region emerges as a high-growth area due to rapid industrialization, increasing internet penetration, and significant investments in IT infrastructure from countries like China, India, and Japan. Latin America and the Middle East & Africa are also showing promising growth as digital economies develop.

Segment trends highlight the dominance of rack servers for general-purpose computing and high-density environments, alongside a rising demand for specialized servers equipped with GPUs and other accelerators to handle intensive AI and machine learning workloads. Blade servers continue to be preferred in certain enterprise settings for their modularity and management simplicity, while microservers are gaining traction for distributed computing at the network edge. The x86 architecture remains prevalent, but ARM-based servers are making inroads, particularly in cloud and edge applications, offering power efficiency advantages. This evolving landscape reflects a market driven by technological innovation and the pervasive need for robust, scalable, and intelligent computing infrastructure across all industries.

AI Impact Analysis on Server Market

The pervasive integration of Artificial Intelligence (AI) across industries has fundamentally reshaped user expectations and demands within the server market. Common user questions revolve around the necessary infrastructure to support AI workloads, the optimal server configurations for machine learning training versus inference, the role of specialized hardware like GPUs and AI accelerators, and the anticipated impact on data center power consumption and cooling requirements. Users are concerned with achieving high computational density, maximizing performance for complex neural networks, and ensuring scalability for evolving AI applications. There is a strong emphasis on understanding how server designs are adapting to the unique demands of AI, including advancements in processing power, memory bandwidth, and high-speed interconnects. Users also seek insights into the total cost of ownership for AI-optimized servers, factoring in both initial hardware investment and ongoing operational expenses related to energy and cooling.

- Increased demand for high-performance computing (HPC) servers.

- Proliferation of GPU-accelerated servers and specialized AI chips.

- Development of new server architectures optimized for AI inference at the edge.

- Enhanced focus on energy efficiency and advanced cooling solutions.

- Growth in demand for high-bandwidth memory and faster interconnects.

- Shift towards software-defined infrastructure to manage diverse AI workloads.

- Emergence of AI-driven automation for server management and optimization.

- Impact on supply chains for advanced processor components.

- Requirement for robust security features for AI data processing.

DRO & Impact Forces Of Server Market

The Server Market is propelled by several key drivers, primarily the exponential growth in data generation from various sources such as IoT devices, social media, and enterprise applications, necessitating robust storage and processing capabilities. The widespread adoption of cloud computing services, including Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS), continues to fuel demand for hyperscale data center infrastructure. Furthermore, the increasing deployment of artificial intelligence, machine learning, and big data analytics across industries requires specialized, high-performance servers with advanced processing units. The ongoing digital transformation initiatives undertaken by businesses globally to enhance operational efficiency and improve customer experience further contribute to the market's expansion, alongside the rising demand for efficient IT infrastructure to support remote work environments and online services.

However, the market also faces significant restraints, including the substantial initial capital expenditure required for server hardware and associated infrastructure, which can be a barrier for smaller enterprises. The high operational costs associated with power consumption and cooling systems for large-scale data centers present ongoing challenges, exacerbated by rising energy prices and environmental concerns. Supply chain disruptions, particularly for critical components like semiconductors, have impacted production and lead times. Moreover, increasing cybersecurity threats and data privacy regulations necessitate continuous investment in robust security measures, adding to the complexity and cost of server deployment and management. Despite these hurdles, numerous opportunities exist for innovation and growth within the market.

Key opportunities for server market players include the burgeoning field of edge computing, where servers are deployed closer to data sources to enable real-time processing and reduce latency for applications such as autonomous vehicles and smart cities. The rollout of 5G technology is expected to drive demand for new server infrastructure to support enhanced mobile broadband and massive IoT connectivity. Furthermore, advancements in sustainable server technologies, including liquid cooling and renewable energy integration, present avenues for differentiation and compliance with environmental mandates. The growing need for specialized servers for quantum computing research and development, as well as for hybrid cloud environments, also offers significant growth potential. These opportunities highlight areas where strategic investments and technological innovation can lead to substantial market expansion and competitive advantage.

Segmentation Analysis

The Server Market is comprehensively segmented to provide granular insights into its diverse components and evolving dynamics. This segmentation helps in understanding specific product categories, technological preferences, operational environments, and end-user applications that collectively define the market landscape. Analyzing these segments reveals key growth areas, market saturation points, and opportunities for innovation across different verticals and geographies. Each segment exhibits unique characteristics and demand drivers, influenced by technological advancements, regulatory frameworks, and specific industry requirements.

- By Type

- Rack Servers

- Blade Servers

- Tower Servers

- Microservers

- Hyperscale Servers

- By Operating System

- Windows

- Linux

- Unix

- Others

- By Processor Type

- x86-based

- ARM-based

- Power-based

- Others

- By Deployment

- On-premise

- Cloud (Public, Private, Hybrid)

- Edge

- By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-User Industry

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecommunication

- Government and Public Sector

- Healthcare

- Manufacturing

- Retail

- Media and Entertainment

- Education

- Others

Value Chain Analysis For Server Market

The server market's value chain commences with upstream activities involving the design and manufacturing of critical components. This includes semiconductor companies that produce CPUs, GPUs, memory chips (DRAM, NAND), and specialized AI accelerators, along with suppliers of motherboards, power supplies, cooling systems, and networking components. These foundational elements dictate the performance, efficiency, and cost structure of the final server product. Research and development in this upstream segment are crucial for driving innovation in processing power, energy efficiency, and miniaturization, enabling the evolution of server capabilities to meet future demands for data processing and storage.

Midstream activities involve original design manufacturers (ODMs) and original equipment manufacturers (OEMs) who assemble these components into complete server systems. OEMs typically focus on branded servers with integrated software and support services, while ODMs often produce servers for hyperscale cloud providers under custom specifications. Distribution channels then play a pivotal role, encompassing both direct sales from manufacturers to large enterprises and cloud service providers, as well as indirect channels through value-added resellers (VARs), system integrators, and online retailers for small and medium-sized businesses. The choice of distribution channel often depends on the customer's scale, technical requirements, and preference for integrated solutions versus bare metal hardware.

Downstream analysis focuses on the end-users and their consumption of server products and services. This includes hyperscale cloud providers who purchase servers in vast quantities to build their global infrastructure, large enterprises operating private data centers, and SMEs utilizing servers for various business applications. Post-sales services, such as maintenance, technical support, and eventual decommissioning or recycling, form an integral part of the value chain, ensuring server longevity and sustainable practices. The efficiency of this entire chain, from component sourcing to end-user support, directly impacts the market's ability to deliver cost-effective and high-performance computing solutions to a diverse global clientele.

Server Market Potential Customers

The server market serves a broad spectrum of potential customers, ranging from massive hyperscale cloud providers to individual researchers and small businesses. Hyperscale cloud service providers such as Amazon Web Services, Microsoft Azure, Google Cloud, and Alibaba Cloud represent a significant customer segment, continuously investing in vast quantities of servers to expand their global data center infrastructure and offer a wide array of cloud services. These entities demand highly customized, energy-efficient, and scalable server solutions to meet the ever-increasing computational and storage needs of their diverse client base.

Large enterprises across various sectors, including banking and financial services, IT and telecommunications, manufacturing, healthcare, and retail, form another crucial customer group. These organizations utilize servers to host their critical applications, manage extensive databases, support enterprise resource planning (ERP) and customer relationship management (CRM) systems, and power their internal data analytics initiatives. Their requirements often involve high reliability, robust security, and seamless integration with existing IT ecosystems, driving demand for enterprise-grade servers and comprehensive support services.

Beyond large corporations, the market also caters to small and medium-sized enterprises (SMEs) seeking cost-effective and manageable server solutions for their digital operations, as well as government agencies, educational institutions, and research organizations with specific needs for secure data processing, scientific computing, and academic research. The emergence of edge computing has further expanded the customer base to include industries requiring real-time data processing closer to the source, such as smart factories, autonomous vehicle developers, and telecommunications providers deploying 5G infrastructure. Each of these customer segments presents unique demands and purchasing criteria, influencing server design, sales strategies, and service offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 100.25 Billion |

| Market Forecast in 2032 | USD 200.00 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dell Technologies, Hewlett Packard Enterprise (HPE), Lenovo, Inspur, Cisco Systems, IBM, Huawei Technologies, Super Micro Computer, Fujitsu, Oracle, NEC Corporation, Intel, Advanced Micro Devices (AMD), NVIDIA, Quanta Computer, Wistron, Inventec, GIGABYTE Technology, Sugon, Atos |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Server Market Key Technology Landscape

The server market's technology landscape is defined by continuous innovation aimed at enhancing performance, efficiency, and adaptability to evolving computing demands. Central to this are advancements in processor architectures, including multi-core CPUs from Intel and AMD that offer increasing core counts and improved per-core performance, alongside the growing prominence of ARM-based processors for their power efficiency, particularly in cloud and edge computing environments. Complementing these are specialized accelerators like GPUs from NVIDIA and AMD, and dedicated AI chips, which are crucial for handling the parallel processing requirements of machine learning, deep learning, and other high-performance computing (HPC) workloads. These processing units are integral to the next generation of data-intensive applications.

Memory and storage technologies also play a vital role, with developments in high-bandwidth memory (HBM) and NVMe (Non-Volatile Memory Express) SSDs significantly reducing data access latency and increasing throughput. Networking innovations, such as 100GbE, 200GbE, and even 400GbE Ethernet, along with InfiniBand, are crucial for facilitating rapid data transfer within and between servers in large data centers. Software-defined infrastructure (SDI), including software-defined networking (SDN) and software-defined storage (SDS), enables greater flexibility, automation, and efficiency in managing complex server environments. Virtualization and containerization technologies continue to be fundamental, allowing for optimized resource utilization and simplified application deployment.

Furthermore, the market is seeing increased adoption of advanced cooling solutions, such as liquid cooling systems, to manage the heat generated by increasingly powerful processors and accelerators, thereby improving energy efficiency and server longevity. Security technologies, including hardware-level encryption, trusted platform modules (TPMs), and advanced threat detection systems, are integrated to protect critical data and applications. Innovations in server management software, including artificial intelligence for IT operations (AIOps), are automating monitoring, maintenance, and optimization tasks, contributing to higher operational efficiency and reduced downtime. These interconnected technologies collectively drive the server market forward, enabling more powerful, efficient, and resilient computing platforms.

Regional Highlights

- North America: This region stands as a dominant force in the global server market, characterized by early adoption of advanced technologies, the presence of major hyperscale cloud service providers, and significant investments in data center infrastructure. The United States, in particular, drives substantial demand due fueled by extensive digital transformation across industries, a robust IT sector, and pioneering efforts in AI and edge computing. Canada also contributes with its growing cloud adoption and digital economy initiatives.

- Europe: The European server market is marked by strong growth, driven by digital transformation agendas, stringent data privacy regulations like GDPR necessitating localized data processing, and increasing adoption of cloud and hybrid IT strategies. Germany, the UK, France, and the Nordics are key contributors, investing heavily in modernizing their IT infrastructure and building sustainable data centers. Emphasis on energy efficiency and green IT solutions is particularly pronounced in this region.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, propelled by rapid economic expansion, increasing internet penetration, massive investments in digital infrastructure, and a burgeoning number of startups and enterprises. China, India, Japan, South Korea, and Australia are at the forefront, with China leading in hyperscale data center construction and AI adoption. The region's manufacturing prowess also supports the supply chain for server components and finished products.

- Latin America: This emerging market shows promising growth potential due to increasing digitalization, expansion of e-commerce, and investments in cloud infrastructure, particularly in Brazil, Mexico, and Argentina. While still developing, the region is witnessing a gradual shift towards modern data center solutions and is a key area for future expansion as enterprises seek to optimize their IT operations and leverage cloud services.

- Middle East and Africa (MEA): The MEA region is experiencing significant investment in IT infrastructure, driven by government initiatives to diversify economies away from oil, smart city projects, and rising internet and mobile penetration. Countries like UAE, Saudi Arabia, and South Africa are leading the charge in data center development and cloud adoption, creating a growing demand for advanced server technologies to support their digital ambitions and expanding technological ecosystems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Server Market.- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Lenovo

- Inspur

- Cisco Systems

- IBM

- Huawei Technologies

- Super Micro Computer

- Fujitsu

- Oracle

- NEC Corporation

- Intel

- Advanced Micro Devices (AMD)

- NVIDIA

- Quanta Computer

- Wistron

- Inventec

- GIGABYTE Technology

- Sugon

- Atos

Frequently Asked Questions

What is a server and why is it essential for modern businesses?

A server is a powerful computer or system that provides resources, data, services, or programs to other computers, known as clients, over a network. It is essential for modern businesses because it forms the backbone of IT infrastructure, enabling data storage, application hosting, communication, and processing capabilities crucial for digital operations, cloud services, and business continuity.

How is artificial intelligence impacting the demand for servers?

Artificial intelligence is significantly increasing the demand for servers, particularly those optimized for high-performance computing (HPC). AI workloads, especially machine learning training and inference, require specialized servers equipped with powerful GPUs, AI accelerators, and high-bandwidth memory to process vast datasets and complex algorithms efficiently, driving innovation in server architecture and cooling solutions.

What are the key trends shaping the server market in the coming years?

Key trends in the server market include the expansion of hyperscale data centers, the growing adoption of edge computing for real-time data processing, increasing demand for sustainable and energy-efficient server designs, the widespread integration of specialized processors for AI workloads, and the continued shift towards hybrid cloud environments that balance on-premises and cloud resources.

Who are the major manufacturers of server hardware globally?

The major manufacturers of server hardware globally include industry leaders such as Dell Technologies, Hewlett Packard Enterprise (HPE), Lenovo, Inspur, Cisco Systems, IBM, Huawei Technologies, and Super Micro Computer. These companies offer a diverse range of server products, from rack and blade servers to specialized AI-optimized and edge computing solutions.

What role does edge computing play in the server market's growth?

Edge computing is a crucial growth driver for the server market by extending computational power closer to data sources, reducing latency, and enabling real-time processing for applications like IoT, autonomous vehicles, and 5G networks. This necessitates demand for compact, rugged, and energy-efficient microservers and edge servers capable of operating outside traditional data centers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Server Power Supply Units Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- AI Inference Server Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- VPN Server Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Server Hosting and Rental Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Data Center Server Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager