Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428246 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Transformer Market Size

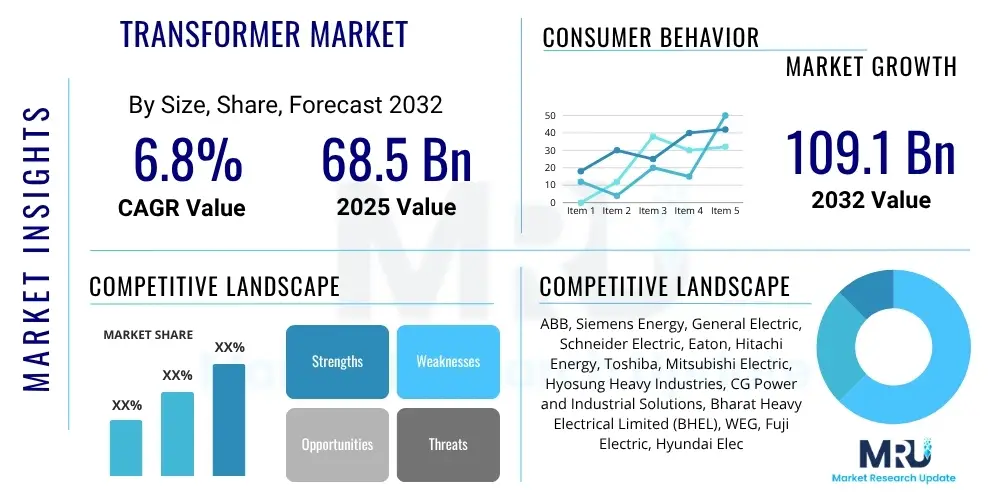

The Transformer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 68.5 Billion in 2025 and is projected to reach USD 109.1 Billion by the end of the forecast period in 2032.

Transformer Market introduction

The Transformer Market stands as a cornerstone of modern electrical infrastructure, representing a critical segment within the broader power and energy sector. Transformers are static electrical devices that transfer electrical energy between two or more circuits, enabling the conversion of voltage levels up or down, which is essential for efficient power transmission and distribution. Their fundamental role ensures that electricity generated at power plants can be safely and effectively transported over long distances to diverse end-users, from heavy industries to individual homes.

The core products within this market include power transformers, distribution transformers, instrument transformers, and specialty transformers, each designed for specific applications and voltage ratings. Power transformers, for instance, are crucial for high-voltage transmission, while distribution transformers reduce voltage for local consumption. Major applications span across power generation, transmission, and distribution utilities, as well as various industrial sectors such (manufacturing, oil & gas, mining), commercial buildings, and residential complexes. The inherent benefits of transformers, such as their high efficiency in voltage regulation, minimal energy loss during transfer, and contribution to grid stability, underscore their indispensability.

Key driving factors propelling the growth of the transformer market include rapid global industrialization and urbanization, which consistently fuel electricity demand and necessitate robust power infrastructure. The accelerating integration of renewable energy sources into national grids further drives demand for specialized transformers capable of handling intermittent power generation. Moreover, ongoing grid modernization initiatives worldwide, aimed at enhancing reliability, efficiency, and intelligence of power networks, are creating substantial opportunities for advanced transformer technologies. These factors collectively position the transformer market for sustained expansion in the coming years.

Transformer Market Executive Summary

The global transformer market is currently experiencing dynamic shifts driven by evolving energy landscapes, technological advancements, and increasing electrification demands. Business trends indicate a strong focus on strategic mergers and acquisitions among leading players, aimed at consolidating market share, expanding geographical reach, and enhancing product portfolios, particularly in smart and eco-friendly transformer solutions. Furthermore, digital transformation initiatives are gaining traction, with manufacturers investing in IoT-enabled transformers and predictive maintenance services to offer greater value propositions to utility and industrial customers, thereby optimizing operational efficiencies and extending asset lifespans.

Regional trends highlight Asia-Pacific as the dominant and fastest-growing market, primarily fueled by massive infrastructure development projects, rapid industrialization, and burgeoning electricity demand from countries like China, India, and Southeast Asian nations. North America and Europe are characterized by significant investments in grid modernization, renewable energy integration, and the replacement of aging infrastructure, driving demand for advanced and efficient transformers. Emerging economies in Latin America, the Middle East, and Africa are also poised for substantial growth due to increasing urbanization, industrial expansion, and electrification efforts, albeit with varying levels of technological adoption and regulatory frameworks.

In terms of segment trends, power transformers continue to hold a substantial market share, driven by their critical role in high-voltage transmission networks, especially with the expansion of renewable energy generation facilities requiring connection to the main grid. Distribution transformers, vital for last-mile power delivery, are seeing demand bolstered by increasing residential and commercial construction. Dry-type transformers are gaining popularity across industrial and commercial applications due to their enhanced safety features, lower environmental impact, and reduced maintenance requirements compared to traditional oil-immersed counterparts. The market is also witnessing a shift towards higher efficiency transformers and those incorporating smart grid functionalities, reflecting a broader industry push for sustainability and operational intelligence.

AI Impact Analysis on Transformer Market

The integration of Artificial Intelligence (AI) into the transformer market is fundamentally reshaping how these critical assets are monitored, maintained, and operated, addressing common user questions about enhancing efficiency, predicting failures, and optimizing grid performance. Users frequently inquire about AI's ability to transition from reactive to proactive maintenance strategies, its role in improving energy efficiency across the power grid, and the potential for real-time analytics to prevent costly outages. There is also significant interest in how AI can manage the complexities introduced by renewable energy sources and smart grid technologies, while concerns regarding data security, integration challenges, and the initial investment required for AI infrastructure are also prominent.

AI's influence is particularly transformative in enabling predictive maintenance, where algorithms analyze vast datasets from sensors embedded within transformers to detect anomalies and forecast potential failures before they occur. This capability significantly reduces unplanned downtime, extends the operational life of transformers, and optimizes maintenance schedules, thereby lowering operational costs for utilities and industrial operators. Beyond maintenance, AI contributes to enhanced grid stability and efficiency by optimizing voltage regulation, load balancing, and power flow management across the network, dynamically responding to demand fluctuations and integrating distributed energy resources more effectively. This intelligent approach moves the market towards a more resilient, responsive, and cost-efficient power infrastructure.

- AI-driven predictive maintenance and fault detection.

- Optimized energy efficiency and load management for transformers.

- Real-time monitoring and analytics for operational insights.

- Enhanced grid stability and resilience through intelligent control.

- Automated voltage regulation and reactive power compensation.

- Improved asset management and lifecycle extension.

- Integration with smart grid technologies for dynamic energy flow.

- Challenges in data privacy, cybersecurity, and initial implementation costs.

DRO & Impact Forces Of Transformer Market

The Transformer Market is significantly shaped by a confluence of drivers, restraints, and opportunities, coupled with external impact forces that dictate its trajectory. Among the primary drivers is the escalating global demand for electricity, propelled by rapid urbanization, industrialization, and population growth, particularly in emerging economies. Complementing this is the widespread adoption of renewable energy sources like solar and wind power, which necessitate specialized transformers for grid integration. Furthermore, government initiatives focused on smart grid development, grid modernization, and the replacement of aging infrastructure across developed nations are creating substantial demand for new and technologically advanced transformers capable of enhancing efficiency and reliability.

Despite these robust drivers, the market faces notable restraints. The high initial capital expenditure associated with purchasing and installing transformers, especially large power transformers, can deter investments, particularly in regions with limited financial resources. Volatility in the prices of key raw materials such as copper, steel, and insulating oil directly impacts manufacturing costs and profit margins. Additionally, stringent environmental regulations regarding transformer manufacturing, materials used, and end-of-life disposal, while necessary, can add to operational complexities and costs. Competition from alternative power transmission technologies and a shortage of skilled labor for installation and maintenance also pose challenges to market expansion.

Opportunities for market growth are abundant and diverse. Developing economies present a vast untapped market, with ongoing efforts to expand electrification access and upgrade rudimentary power grids. The growing trend of retrofitting and upgrading existing transformer fleets with smarter, more efficient, and eco-friendly models in mature markets offers a significant revenue stream. Niche applications, such as those arising from the burgeoning electric vehicle (EV) charging infrastructure and microgrids, are creating demand for specialized and compact transformers. External impact forces such as macroeconomic conditions, energy policies, technological advancements in materials science and digital integration, and geopolitical stability or instability directly influence investment decisions, raw material supply chains, and overall market dynamics, underscoring the complex interplay of factors affecting the transformer market.

Segmentation Analysis

The global transformer market is intricately segmented across various dimensions, reflecting the diverse applications, technological specifications, and operational requirements of these essential electrical components. Understanding these segments is crucial for analyzing market dynamics, identifying growth opportunities, and developing targeted strategies. The segmentation allows for a granular view of demand patterns, technological preferences, and competitive landscapes within different sub-markets, enabling stakeholders to make informed decisions and tailor their offerings to specific end-user needs. Each segment, from the type of transformer to its application and insulation method, plays a distinct role in the overall market structure and evolution.

- By Type

- Power Transformer

- Distribution Transformer

- Instrument Transformer

- Specialty Transformer

- By Insulation Type

- Oil-Immersed Transformer

- Dry-Type Transformer

- Gas-Filled Transformer

- By Voltage Rating

- Small Power Transformer (Up to 100 MVA)

- Medium Power Transformer (101 MVA to 500 MVA)

- Large Power Transformer (Above 500 MVA)

- By Phase

- Single Phase Transformer

- Three Phase Transformer

- By Application

- Residential

- Commercial

- Industrial

- Utility (Generation, Transmission, Distribution)

- By End-Use Sector

- Power Generation

- Power Transmission

- Power Distribution

Value Chain Analysis For Transformer Market

The value chain for the transformer market encompasses a comprehensive sequence of activities, starting from raw material procurement through manufacturing, distribution, and ultimately to end-use and after-sales service. At the upstream analysis stage, the market is heavily reliant on a stable supply of key raw materials such as electrical steel (silicon steel), copper, aluminum, insulating materials (e.g., cellulose paper, epoxy resins, insulating oils like mineral oil or ester oils), and various components like tap changers, bushings, and cooling systems. The quality and availability of these materials directly impact the cost, performance, and durability of the final transformer product, making strong relationships with suppliers crucial for manufacturers. Price volatility of these commodities can significantly affect production costs and market competitiveness.

The manufacturing process involves complex engineering and assembly, transforming raw materials into sophisticated electrical devices. This stage includes core and coil winding, insulation application, tank fabrication, and final assembly, testing, and quality control. Following manufacturing, the transformers enter the distribution channel, which can be direct or indirect. Direct sales typically involve large utility companies or major industrial clients purchasing directly from manufacturers, often facilitated by long-term contracts and customized solutions. Indirect channels involve a network of distributors, wholesalers, and electrical contractors who cater to smaller industrial, commercial, and residential projects, providing wider market reach and localized support.

Downstream analysis focuses on the installation, commissioning, operation, and maintenance of transformers. This segment is supported by a robust ecosystem of service providers, including engineering, procurement, and construction (EPC) firms, electrical contractors, and specialized maintenance companies. Post-sales services, such as routine inspections, preventive and predictive maintenance, repairs, upgrades, and eventually decommissioning and recycling, constitute a significant portion of the value chain. The efficiency and reliability of these downstream services are paramount for ensuring the long-term performance and safety of transformers, ultimately impacting customer satisfaction and market reputation. The integration of digital technologies and AI is increasingly optimizing these downstream operations, leading to enhanced asset management and reduced operational expenditures for end-users.

Transformer Market Potential Customers

The potential customers for transformers are incredibly diverse, spanning across every sector that requires electrical power for its operations, from large-scale utilities to individual households. Primarily, utility companies represent the largest segment of buyers, encompassing power generation, transmission, and distribution entities. These organizations require a vast range of transformers, including large power transformers for substations, medium-sized distribution transformers for local grids, and specialized transformers for integrating renewable energy sources into the existing infrastructure. Their purchasing decisions are often driven by grid expansion, modernization projects, replacement of aging assets, and compliance with energy efficiency regulations.

Beyond utilities, the industrial sector constitutes a significant customer base. This includes heavy industries such as manufacturing, mining, oil & gas, chemicals, and metals, which rely on transformers to power their machinery and facilities at various voltage levels. Commercial establishments, including office buildings, shopping malls, data centers, and hospitals, also require distribution transformers to step down high-voltage power from the grid to levels suitable for their internal electrical systems. The demand in these sectors is driven by new construction, facility upgrades, and the need for reliable and efficient power supply to support continuous operations.

Furthermore, residential developers and individual homeowners indirectly contribute to the demand for distribution transformers as part of new community electrification projects and ongoing infrastructure maintenance. The growing trend of microgrids and decentralized power generation, including rooftop solar installations, also creates a niche market for smaller, specialized transformers. In essence, any entity that consumes electricity beyond basic low-voltage applications, or is involved in its generation or delivery, stands as a potential customer for the various types of transformers available in the market, making the customer landscape broad and dynamic.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 68.5 Billion |

| Market Forecast in 2032 | USD 109.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens Energy, General Electric, Schneider Electric, Eaton, Hitachi Energy, Toshiba, Mitsubishi Electric, Hyosung Heavy Industries, CG Power and Industrial Solutions, Bharat Heavy Electrical Limited (BHEL), WEG, Fuji Electric, Hyundai Electric, Alstom, Prolec GE, SGB-SMIT Group, TBEA, Delta Star, Ltd., Virginia Transformer Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transformer Market Key Technology Landscape

The Transformer Market is undergoing a significant technological transformation, driven by the imperative for greater efficiency, reliability, and environmental sustainability. One of the most prominent advancements is the development and increasing adoption of smart transformers. These intelligent devices are integrated with sensors, communication modules, and data processing capabilities, allowing for real-time monitoring of various operational parameters such as voltage, current, temperature, and oil levels. This connectivity enables remote diagnostics, predictive maintenance, and optimized performance through integration with Supervisory Control and Data Acquisition (SCADA) systems and advanced grid management platforms, making the grid more resilient and responsive to fluctuations.

Another critical area of technological innovation lies in materials science and design. Amorphous core transformers, for instance, utilize amorphous metals in their core instead of traditional silicon steel, significantly reducing no-load losses and improving energy efficiency, particularly beneficial for distribution networks where transformers operate at varying loads. The shift towards eco-friendly insulation liquids, such as ester oils (natural and synthetic), is gaining traction as an environmentally responsible alternative to mineral oil. These ester oils offer higher fire points, lower environmental impact, and biodegradability, enhancing safety and sustainability for both oil-immersed power and distribution transformers, addressing growing environmental concerns and regulatory pressures.

Furthermore, the integration of the Internet of Things (IoT) and artificial intelligence (AI) is revolutionizing transformer operations. IoT platforms facilitate the collection and analysis of massive datasets from connected transformers, providing utilities with unprecedented insights into asset health and grid performance. AI algorithms then leverage this data for advanced analytics, enabling more accurate fault prediction, optimized asset management, and dynamic grid control. These technological advancements collectively contribute to the evolution of the transformer market towards higher efficiency, lower environmental footprint, enhanced operational intelligence, and improved grid resilience, aligning with global trends towards smart grids and sustainable energy systems.

Regional Highlights

- North America: This region is characterized by substantial investments in modernizing aging grid infrastructure, integrating renewable energy sources, and enhancing grid resilience. Demand is driven by smart grid initiatives, infrastructure replacement projects, and increasing focus on energy efficiency across the United States and Canada.

- Europe: Driven by ambitious decarbonization goals, the European market is focused on renewable energy integration, smart grid development, and replacing conventional transformers with more energy-efficient and eco-friendly models. Strict environmental regulations also promote the adoption of dry-type and ester-filled transformers.

- Asia Pacific (APAC): The APAC region stands as the largest and fastest-growing market due to rapid industrialization, urbanization, significant infrastructure development, and escalating electricity demand, particularly in China, India, and Southeast Asian countries. Government initiatives for electrification and smart cities are key growth catalysts.

- Latin America: This region is experiencing growth driven by increasing electrification rates, industrial expansion, and investments in resource-intensive sectors like mining and oil & gas. Modernization of existing power grids and expansion of renewable energy capacity also contribute to market demand.

- Middle East and Africa (MEA): The MEA region's transformer market is propelled by a rapidly growing population, increasing energy demand, substantial investments in infrastructure projects, and the development of new power generation capacities, including renewable energy initiatives and industrial zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transformer Market.- ABB

- Siemens Energy

- General Electric

- Schneider Electric

- Eaton

- Hitachi Energy

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- CG Power and Industrial Solutions Limited

- Bharat Heavy Electricals Limited (BHEL)

- WEG S.A.

- Fuji Electric Co., Ltd.

- Hyundai Electric & Energy Systems Co., Ltd.

- Alstom S.A.

- Prolec GE

- SGB-SMIT Group

- TBEA Co., Ltd.

- Delta Star, Ltd.

- Virginia Transformer Corp.

Frequently Asked Questions

Analyze common user questions about the Transformer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a power transformer and how does it differ from a distribution transformer?

A power transformer is designed for high-voltage transmission between the power generation plant and primary substations, typically operating at constant full load for maximum efficiency. A distribution transformer, conversely, steps down voltage from the primary distribution lines to levels suitable for end-users (residential, commercial, industrial), operating closer to consumption points and experiencing varying loads.

What are the primary drivers of growth in the global transformer market?

The key drivers for the transformer market include increasing global electricity demand due to urbanization and industrialization, significant investments in smart grid infrastructure and grid modernization, rapid integration of renewable energy sources, and the need to replace aging power transmission and distribution equipment worldwide.

What are the advantages of dry-type transformers over oil-immersed transformers?

Dry-type transformers offer several advantages including enhanced fire safety due to the absence of flammable liquids, reduced maintenance requirements, lower environmental impact (no oil spills), and suitability for indoor installations or areas with strict environmental regulations, making them ideal for commercial and industrial applications.

How is Artificial Intelligence impacting the transformer market?

AI is revolutionizing the transformer market by enabling predictive maintenance through real-time data analysis, optimizing operational efficiency, enhancing grid stability and load management, and facilitating intelligent monitoring. This leads to reduced downtime, extended asset lifespans, and more responsive power networks.

Which region holds the largest share in the transformer market and why?

The Asia Pacific (APAC) region currently holds the largest share in the transformer market. This dominance is attributed to rapid industrialization, extensive urbanization, massive infrastructure development projects, burgeoning electricity demand, and government initiatives for grid expansion and modernization in countries such as China, India, and across Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Optical Instrument Transformer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Amorphous Alloy Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Biobased Transformer Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electrical Power Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Transformer Rectifiers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager