Oncology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438921 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Oncology Market Size

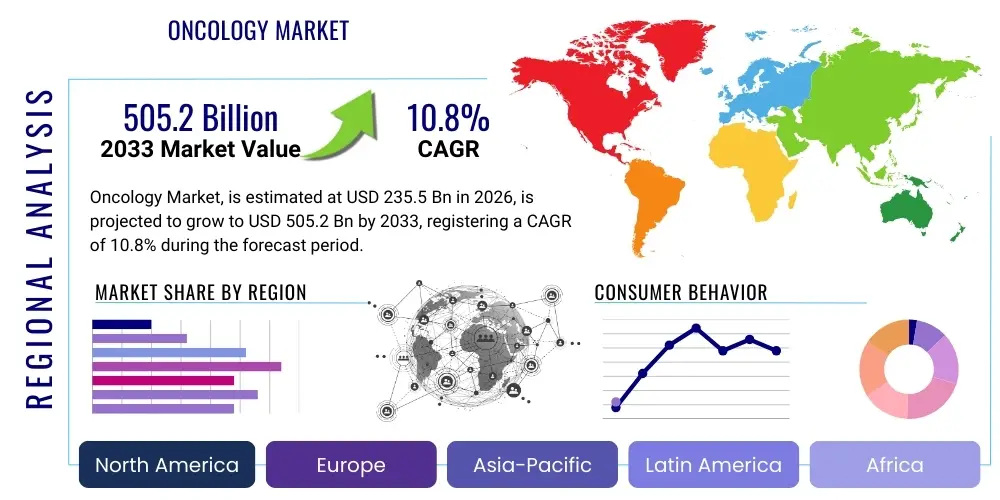

The Oncology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% CAGR between 2026 and 2033. This robust growth trajectory is underpinned by significant advancements in targeted therapies, increasing incidence rates of various cancer types globally, and expanding investment in precision medicine approaches. The market dynamics reflect a shift toward personalized treatments and the integration of sophisticated diagnostic tools.

The market is estimated at USD 235.5 Billion in 2026 and is projected to reach USD 505.2 Billion by the end of the forecast period in 2033. This substantial valuation increase is driven by the rapid commercialization of innovative biological drugs, including monoclonal antibodies (mAbs) and chimeric antigen receptor T-cell (CAR-T) therapies. Furthermore, continuous regulatory approvals for novel drug combinations and the penetration of advanced screening technologies in emerging economies contribute significantly to the overall market expansion.

The valuation reflects the high cost associated with cutting-edge oncology treatments, particularly in developed regions like North America and Europe, which continue to dominate the expenditure landscape. However, the increasing focus on biosimilar development and value-based pricing models are expected to introduce competitive dynamics, ensuring long-term sustainability while maintaining high research and development investment levels necessary for addressing unmet clinical needs in late-stage cancers.

Oncology Market introduction

The Oncology Market encompasses the entire ecosystem dedicated to the prevention, diagnosis, and treatment of cancer, involving pharmaceutical products, biotechnological tools, medical devices, and supportive care services. This complex sector is characterized by intense research and development activities aimed at improving patient outcomes and quality of life. Key products include chemotherapeutic agents, immunotherapies, targeted molecular therapies, hormonal therapies, and sophisticated radiation delivery systems. The rapid transition from cytotoxic chemotherapy to highly specific biological and precision medicine approaches defines the modern oncology landscape, focusing on drugs that interact directly with molecular targets expressed by cancer cells, thereby minimizing systemic toxicity and maximizing therapeutic efficacy.

Major applications of oncology products span diverse cancer types, including breast cancer, lung cancer, colorectal cancer, prostate cancer, and hematological malignancies such as leukemia and lymphoma. The market's primary benefit lies in extending patient survival rates, offering curative solutions for early-stage diseases, and providing effective management strategies for advanced or metastatic cancers. Recent breakthroughs, especially in immuno-oncology, have fundamentally altered treatment paradigms, turning historically poor-prognosis diseases into manageable chronic conditions for a substantial patient population. The increasing emphasis on companion diagnostics is crucial, ensuring that the right patient receives the right targeted therapy at the optimal time, thereby maximizing therapeutic response and optimizing healthcare expenditure.

The driving factors propelling market growth are multifaceted. These include the rising global geriatric population, which is more susceptible to cancer development; improvements in early detection and screening programs, leading to larger treatable patient cohorts; and significant governmental and private funding allocated to cancer research. Moreover, the increasing adoption of combination therapies, integrating surgical intervention with pharmacological treatments and radiation oncology, provides comprehensive care solutions. The development pipeline remains robust, featuring a high volume of novel compounds focused on overcoming drug resistance mechanisms and targeting previously inaccessible tumor microenvironments, ensuring sustained innovation and market expansion over the forecast period.

Furthermore, globalization of clinical trials, improvements in healthcare infrastructure across emerging economies, and enhanced patient awareness regarding treatment options are crucial elements sustaining the market momentum. The shift towards decentralized clinical trials and the implementation of real-world evidence (RWE) platforms further accelerate the time-to-market for promising oncology drugs, ensuring quicker access to life-saving treatments. The intersection of genomics and drug discovery continues to unlock new therapeutic targets, driving pharmaceutical companies to invest heavily in advanced platform technologies like gene editing and messenger RNA (mRNA) therapeutics tailored specifically for oncological applications.

Oncology Market Executive Summary

The Oncology Market is experiencing dynamic business trends characterized by intense mergers and acquisitions (M&A) focused on acquiring specialized biotechnological platforms, particularly those centered on cell and gene therapies and next-generation immunotherapies. Pharmaceutical giants are strategically aligning with smaller biotechs possessing proprietary assets in novel targets, aiming to replenish maturing pipelines and establish dominance in high-growth segments like personalized medicine. Furthermore, there is a pronounced shift towards establishing strategic partnerships and collaborative agreements between academic institutions, biotech firms, and large pharmaceutical companies to accelerate translational research and mitigate the high risks associated with early-stage drug development, ensuring a diversified portfolio approach.

Regionally, North America maintains its market supremacy due to superior healthcare expenditure, extensive research infrastructure, and high adoption rates of advanced therapies. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by improving healthcare access, large, untreated patient pools, and rising government initiatives focused on cancer control. European markets are driven by strong regulatory frameworks and significant investment in clinical research, although pricing and reimbursement hurdles remain a constant challenge. The Middle East and Africa (MEA) and Latin America are emerging growth poles, facilitated by increasing urbanization, greater awareness, and the gradual integration of specialized cancer treatment centers.

Segment trends reveal that immunotherapy, specifically PD-1/PD-L1 inhibitors and CAR-T cell therapies, currently dominates the treatment landscape, registering unprecedented commercial success due to their long-term remission potential in various hard-to-treat cancers. Within diagnostics, liquid biopsy technologies are gaining traction, offering non-invasive, repeatable methods for early detection, monitoring therapeutic response, and identifying minimal residual disease (MRD). Application-wise, lung cancer and breast cancer segments contribute the largest revenue share due to high incidence and the availability of multiple approved targeted treatment options. The hospital segment remains the largest end-user, though specialized cancer centers and clinics are rapidly increasing their market penetration due to a focus on specialized, outpatient oncology care.

The market trajectory is significantly influenced by technological advancements, particularly the integration of Artificial Intelligence (AI) and Machine Learning (ML) in drug discovery, clinical trial optimization, and personalized treatment planning. Regulatory trends, emphasizing expedited review pathways for breakthrough oncology designations, also play a pivotal role in accelerating market access for novel drugs. The overarching executive narrative points to a market resilient to economic pressures, focused on high-value innovation, and poised for sustained double-digit growth driven primarily by biological and precision therapeutics.

AI Impact Analysis on Oncology Market

User queries regarding the impact of Artificial Intelligence (AI) on the Oncology Market frequently center on three critical themes: accelerating drug discovery timelines, improving diagnostic accuracy (particularly in image analysis and pathology), and personalizing treatment protocols. Users are keen to understand how AI algorithms can rapidly identify novel drug targets, optimize the selection of compounds, and reduce the high failure rates currently plaguing preclinical development. Concerns often revolve around data privacy, the validation standards for AI-driven diagnostic tools, and the necessary integration of diverse, high-quality patient data sets (genomic, proteomic, clinical) required to train effective predictive models for precision oncology. Expectations are high regarding AI’s potential to democratize access to expert-level diagnostics and forecast patient responses to complex treatment regimens, thereby enhancing clinical decision support systems.

AI is transforming drug discovery by significantly enhancing the efficiency of target identification and lead optimization. Machine learning models analyze vast chemical libraries and biological data, predicting compound efficacy, toxicity profiles, and potential synergistic effects faster than traditional high-throughput screening methods. This capability reduces the time and cost associated with bringing a new therapy from bench to bedside, addressing a major bottleneck in oncology drug development. Furthermore, AI is crucial for identifying patient subgroups likely to benefit from specific targeted therapies, leveraging complex genomic data to move beyond simple biomarker testing and enabling true precision medicine.

In clinical operations, AI is optimizing resource allocation, improving clinical trial design by identifying ideal patient cohorts, and monitoring patient adherence and adverse events in real-time. For diagnostics, deep learning algorithms are proving invaluable in radiology and digital pathology, automating the detection of subtle cancerous lesions and quantifying tumor burden with superior consistency compared to manual human analysis. This not only speeds up the diagnostic process but also minimizes inter-observer variability, which is critical for standardization in cancer staging and prognosis. The deployment of AI tools for treatment planning, especially in radiation oncology, allows for rapid calculation of optimal dose distributions, preserving healthy tissue while maximizing tumor eradication.

- AI accelerates target identification and validation, decreasing drug discovery cycles by up to 40%.

- Enhancement of diagnostic accuracy in digital pathology and radiology through deep learning algorithms for automated tumor detection.

- Optimization of clinical trial design, patient recruitment, and stratification based on complex genomic and phenotypic data.

- Development of predictive biomarkers using machine learning to forecast patient response, resistance, and toxicity profiles for immunotherapies.

- Improvement in radiation treatment planning efficiency and precision through AI-driven dose calculation and contouring.

- Facilitation of personalized medicine by integrating multi-omics data for highly individualized therapeutic recommendations.

- Streamlining of administrative tasks and real-time monitoring of patient health status through AI-powered remote monitoring systems.

DRO & Impact Forces Of Oncology Market

The Oncology Market's trajectory is determined by a powerful interplay of Driving forces, Restraints, and Opportunities (DRO). Key drivers include the escalating global incidence of cancer, driven by lifestyle changes and an aging population, coupled with remarkable breakthroughs in biological sciences, particularly in immuno-oncology and cell therapy. Restraints primarily involve the exorbitant cost of novel treatments, leading to access and affordability issues in various healthcare systems, coupled with stringent and prolonged regulatory approval processes, particularly for complex therapies like gene-edited cells. Significant opportunities lie in the expansion into emerging markets, the successful commercialization of liquid biopsy for widespread early detection, and the integration of advanced technologies like AI to optimize therapeutic development and delivery, collectively shaping the market's competitive dynamics and growth potential.

The impact forces influencing the market are multifaceted, encompassing technological advancement, economic viability, regulatory complexity, and intense competitive pressures. Technological innovation, such as the emergence of next-generation sequencing (NGS) and CRISPR-based tools, acts as a pivotal force, continually unveiling new therapeutic targets and enabling the development of highly specific drugs. Economic forces, including global healthcare spending trends and the shift towards value-based care models, compel manufacturers to demonstrate superior clinical efficacy and cost-effectiveness. Regulatory environments dictate the speed of innovation adoption, while competition necessitates continuous pipeline diversification and strategic alliances to maintain market share against established incumbents and rapidly evolving biotech innovators.

Moreover, societal forces, particularly increased patient advocacy and global awareness campaigns focused on cancer screening and prevention, drive demand for diagnostics and early-stage treatment options. The continuous need to overcome tumor heterogeneity and acquired drug resistance remains a major biological restraint, necessitating ongoing high-risk research investment. However, the opportunity presented by orphan drug designations and fast-track regulatory pathways for treatments addressing rare cancers provides strong incentives for R&D spending, mitigating some commercial risk and ensuring a steady flow of specialized oncology products into the market, thereby securing sustained growth across specialized sub-segments.

Segmentation Analysis

The Oncology Market segmentation provides a granular view of revenue streams, driven primarily by therapy type, specific cancer application, and end-user adoption patterns. Therapy type segmentation highlights the revolutionary shift towards biologics and targeted agents, moving away from conventional cytotoxic chemotherapy, reflecting superior clinical outcomes and reduced systemic toxicity. Application segmentation focuses on high-prevalence cancers such as lung, breast, and prostate, which represent the largest patient pools and highest revenue generation due to established treatment guidelines and extensive diagnostic infrastructure. End-user segmentation reveals the dominance of hospitals, which handle complex surgeries and inpatient chemotherapies, though specialized oncology clinics are rapidly growing, particularly in administering sophisticated outpatient infusion therapies and radiation services.

Further analysis of the segmentation reveals critical growth disparities. The diagnostic segment is heavily influenced by the adoption of molecular diagnostics and companion diagnostics, essential for patient stratification required by precision therapies. Within the drug class, small molecules still hold significant market share but are increasingly challenged by monoclonal antibodies and novel immunotherapies. Geographically, segments in high-reimbursement regions like North America command premium pricing, while volume growth is concentrated in APAC, where the focus is shifting toward establishing localized manufacturing and distribution capabilities to address massive patient demand with generic and biosimilar alternatives.

Understanding these segments is crucial for strategic planning. Companies must align their research pipelines with the segments showing the highest unmet need and rapid technological integration, such as the solid tumor segment for CAR-T therapy development, or the diagnostic segment for multi-cancer early detection (MCED) screening. The segmentation underscores a market moving toward complexity and personalization, requiring highly tailored marketing and distribution strategies for each distinct product category and geographical region to maximize commercial penetration and optimize patient access.

- Therapy Type

- Chemotherapy

- Targeted Therapy (Small Molecules, Biologics)

- Immunotherapy (Checkpoint Inhibitors, Vaccines, CAR-T, Bispecific Antibodies)

- Hormonal Therapy

- Radiation Therapy

- Application

- Breast Cancer

- Lung Cancer (Non-Small Cell Lung Cancer, Small Cell Lung Cancer)

- Colorectal Cancer

- Prostate Cancer

- Hematological Malignancies (Leukemia, Lymphoma, Myeloma)

- Ovarian Cancer

- Liver Cancer

- End-User

- Hospitals and Clinics

- Cancer Research Centers

- Specialty Oncology Centers

- Academic Research Institutes

- Diagnosis and Screening

- Imaging (MRI, CT, PET)

- Biopsy (Liquid Biopsy, Tissue Biopsy)

- In-Vitro Diagnostics (IVD)

- Molecular Diagnostics (NGS, PCR)

Value Chain Analysis For Oncology Market

The Value Chain for the Oncology Market is extensive, starting from upstream research and development (R&D) to downstream patient care and reimbursement. Upstream activities are dominated by pharmaceutical and biotechnology companies, alongside academic institutions, focusing intensely on identifying novel targets, conducting preclinical studies, and optimizing drug candidates. This phase is capital-intensive and high-risk, characterized by partnerships between academic labs and industry for specialized drug discovery platforms, including genomics, proteomics, and computational biology. Specialized contract research organizations (CROs) play a crucial role here by managing complex, multi-site clinical trials globally, optimizing the R&D workflow and ensuring regulatory compliance across different phases.

Midstream activities involve large-scale manufacturing and quality control. Given the complexity of modern oncology drugs, especially biologics and cell therapies, manufacturing requires highly specialized facilities (e.g., cGMP standards) and robust cold chain management. For small molecule drugs, generic manufacturers contribute significantly, particularly as patents expire. Distribution channels are highly regulated and critical for maintaining product integrity. Direct distribution models are often used for highly sensitive and high-cost therapies (like CAR-T), requiring direct interaction between manufacturers and specialized hospital centers to manage logistics, preparation, and administration protocols meticulously. Indirect distribution relies on specialized wholesalers and distributors, who handle bulk logistics and inventory management, ensuring widespread availability across regional pharmacy networks and integrated healthcare systems.

Downstream operations focus on prescription, administration, and reimbursement. This involves oncologists and multidisciplinary cancer care teams determining treatment protocols, followed by drug dispensing, patient monitoring, and supportive care. The complexity of reimbursement is a major downstream hurdle, requiring sophisticated health economics and outcomes research (HEOR) to negotiate pricing with payers, governments, and private insurance companies, particularly for high-cost therapies. Effective collaboration between manufacturers, payers, and healthcare providers is paramount to ensure patient access and sustainable market growth, demonstrating the critical link between successful commercialization and integrated value demonstration throughout the supply chain.

Oncology Market Potential Customers

The primary potential customers and end-users of oncology products and services are diverse, comprising entities responsible for research, diagnosis, treatment, and management of cancer patients globally. Hospitals and integrated delivery networks (IDNs) represent the largest segment, as they serve as the central hubs for complex surgical procedures, intensive inpatient chemotherapy regimens, and advanced radiation therapies, purchasing high volumes of drugs, devices, and diagnostic kits. Specialty oncology centers and private clinics constitute a rapidly expanding customer base, specializing in outpatient care, sophisticated infusion services, and precision medicine administration, focusing on personalized patient experiences and faster turnaround times for treatment initiation.

Academic research institutes and specialized cancer research centers are crucial customers for high-end research reagents, advanced genomic sequencing services, and early-stage drug candidates utilized in translational studies and investigator-initiated clinical trials. These institutions drive the foundational knowledge required for future therapeutic breakthroughs. Furthermore, governmental bodies and public health organizations are major buyers, particularly for mass screening programs (e.g., HPV, mammography) and stocking essential chemotherapeutic agents and supportive care drugs as part of national health policies, ensuring baseline cancer care accessibility across populations.

Finally, pharmaceutical and biotechnology companies themselves are customers of advanced technologies, purchasing genomic data analysis tools, AI/ML platforms, and high-throughput screening equipment from specialized vendors to power their internal drug discovery and development pipelines. In the diagnostic space, specialized reference laboratories are key end-users of molecular diagnostic platforms, including Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR) systems, offering complex testing services to clinicians. All these entities collectively constitute the sophisticated demand landscape of the Oncology Market, each driven by distinct needs related to clinical efficacy, research innovation, cost-effectiveness, and regulatory compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 235.5 Billion |

| Market Forecast in 2033 | USD 505.2 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F. Hoffmann-La Roche Ltd, Bristol-Myers Squibb Company, Merck & Co., Inc., Pfizer Inc., Novartis AG, AstraZeneca PLC, Johnson & Johnson, Gilead Sciences, Inc., AbbVie Inc., Sanofi S.A., Eli Lilly and Company, Amgen Inc., Regeneron Pharmaceuticals, Inc., Takeda Pharmaceutical Company Limited, Bayer AG, BeiGene, Ltd., Seattle Genetics, Inc., Exelixis, Inc., Clovis Oncology, Inc., Mirati Therapeutics, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oncology Market Key Technology Landscape

The Oncology Market is defined by a rapidly evolving technological landscape centered on high-precision diagnostics and next-generation therapeutics. Key technologies utilized include Next-Generation Sequencing (NGS), which enables comprehensive genomic profiling of tumors, identifying actionable mutations crucial for guiding targeted therapy selection. This technology is foundational for precision oncology, moving away from single-gene testing towards multi-gene panel analysis. Another crucial area is liquid biopsy, which utilizes circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs) found in blood samples for non-invasive detection, monitoring of treatment response, and detection of minimal residual disease (MRD), offering significant advantages over traditional tissue biopsies for serial monitoring.

In the therapeutic domain, cell and gene therapy platforms, particularly Chimeric Antigen Receptor (CAR) T-cell therapy, represent a cutting-edge technological breakthrough for hematological malignancies, with intense research ongoing to extend its applicability to solid tumors. Manufacturing technologies are advancing rapidly, moving towards decentralized and automated systems to handle the complex, personalized nature of cell therapy production. Furthermore, the development of sophisticated antibody-drug conjugates (ADCs) and bispecific antibodies represents another significant technological progression, offering enhanced tumor specificity and reduced systemic toxicity by directly delivering cytotoxic payloads to cancer cells expressing specific surface antigens.

Beyond drug development, technology integration in clinical delivery is paramount. Advanced radiation oncology systems, such as Intensity-Modulated Radiation Therapy (IMRT) and Proton Therapy, provide highly conformal radiation doses, maximizing tumor destruction while sparing adjacent healthy tissues. The adoption of AI and Machine Learning in medical imaging interpretation, diagnostic decision support, and clinical trial matching further optimizes the technological environment, facilitating faster, more accurate diagnosis and personalized treatment pathways, cementing the market’s reliance on integrated digital and biological innovations.

Regional Highlights

The regional distribution of the Oncology Market showcases varied growth dynamics driven by differences in regulatory frameworks, healthcare expenditure, cancer prevalence, and adoption rates of novel therapies.

- North America: This region, particularly the United States, commands the largest market share globally due to robust R&D investment, high concentration of major pharmaceutical and biotech firms, and favorable reimbursement policies for innovative, high-cost therapies like immunotherapies and CAR-T treatments. The rapid adoption of personalized medicine, coupled with advanced diagnostic infrastructure (NGS, liquid biopsy), ensures its continued dominance. Furthermore, the presence of leading academic research centers fosters a constant pipeline of clinical innovation. The focus here remains on premium, first-in-class oncology products and specialized patient care pathways, supported by significant government and private sector funding for cancer research initiatives.

- Europe: Western European countries (Germany, France, UK, Italy, Spain) form the second-largest market. Growth is propelled by centralized healthcare systems that facilitate population-level screening programs and high public awareness. While adoption of novel drugs is high, cost containment measures, mandatory health technology assessments (HTAs), and subsequent negotiation challenges often lead to delayed access compared to the US. However, strong governmental commitment to medical research, including EU-funded oncology projects, ensures continued technological uptake, particularly in advanced radiation oncology and biosimilar market penetration, which helps manage overall pharmaceutical expenditure.

- Asia Pacific (APAC): This region is projected to be the fastest-growing market globally. The expansion is driven by the massive and aging population, increasing disposable incomes, and significant improvements in healthcare infrastructure, especially in countries like China, India, and Japan. While Japan and South Korea are early adopters of global standards and precision medicine, emerging economies like China and India focus heavily on expanding access to affordable generic and biosimilar oncology drugs. Increasing incidence of lifestyle-related cancers and government initiatives aimed at modernizing cancer treatment facilities are primary growth catalysts, making APAC a critical hub for future volume expansion.

- Latin America (LATAM): This market exhibits potential, constrained by economic volatility and highly fragmented healthcare systems. Key markets like Brazil and Mexico are improving oncology access through specialized public health programs, but disparities between public and private sector care remain wide. Adoption is primarily focused on conventional chemotherapies and essential targeted therapies, with limited penetration of ultra-high-cost biologics due to budget restrictions and slower regulatory processes. Investment in localized clinical trials and regional manufacturing partnerships is key to unlocking the full market potential here.

- Middle East and Africa (MEA): Growth in the MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, driven by high government healthcare spending and sophisticated private healthcare sectors focusing on medical tourism and the rapid adoption of advanced therapies and technology. However, the African continent remains underserved, facing significant challenges related to infectious disease prevalence, lack of infrastructure, and poor access to diagnostics and essential oncology medicines. Efforts are focused on establishing basic cancer care infrastructure and improving diagnostic capabilities through global aid and localized private investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oncology Market.- F. Hoffmann-La Roche Ltd.

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- Pfizer Inc.

- Novartis AG

- AstraZeneca PLC

- Johnson & Johnson

- Gilead Sciences, Inc.

- AbbVie Inc.

- Sanofi S.A.

- Eli Lilly and Company

- Amgen Inc.

- Regeneron Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

- Bayer AG

- BeiGene, Ltd.

- Seattle Genetics, Inc.

- Exelixis, Inc.

- Clovis Oncology, Inc.

- Mirati Therapeutics, Inc.

Frequently Asked Questions

Analyze common user questions about the Oncology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary therapeutic segments driving revenue growth in the Oncology Market?

The primary revenue drivers are novel biological therapies, specifically Immunotherapy (Checkpoint Inhibitors like PD-1/PD-L1 inhibitors) and Targeted Therapy (Monoclonal Antibodies and small molecule kinase inhibitors). These segments demonstrate superior clinical efficacy and are utilized across a broad range of high-incidence cancers, commanding premium pricing due to their complexity and innovation.

How is the integration of personalized medicine affecting the market landscape?

Personalized medicine is fundamentally reshaping the market by necessitating sophisticated diagnostic tools, such as Next-Generation Sequencing (NGS) and liquid biopsy, to match specific treatments to individual patient tumor profiles. This approach shifts focus from broad-spectrum drugs to niche, high-value targeted agents, leading to better patient outcomes and driving demand for companion diagnostics.

What are the major challenges restraining market growth, despite high demand?

The major challenges include the extreme cost associated with novel treatments, which strains healthcare budgets and limits patient access in resource-constrained regions. Additionally, the complexity and prolonged nature of regulatory approval pathways for advanced therapies (e.g., CAR-T), coupled with the increasing prevalence of acquired drug resistance in tumors, restrain exponential growth.

Which geographical region offers the highest growth potential for oncology companies?

The Asia Pacific (APAC) region, particularly China and India, offers the highest future growth potential. This is driven by massive untapped patient populations, rapidly improving healthcare infrastructure, and government initiatives aimed at boosting access to advanced oncology treatments, providing significant opportunities for volume-based market penetration, especially for biosimilars and established therapies.

What role does Artificial Intelligence play in the future of oncology treatment development?

AI plays a critical role by accelerating key R&D processes, including the identification of novel drug targets, prediction of compound toxicity, and optimization of clinical trial design and patient selection. Furthermore, AI enhances diagnostic precision in radiology and pathology, paving the way for more accurate and timely personalized cancer care decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Generic Oncology Sterile Injectable Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Oncology Adjuvants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Immuno-Oncology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Generic Oncology Sterile Injectable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Oncology Adjuvants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager