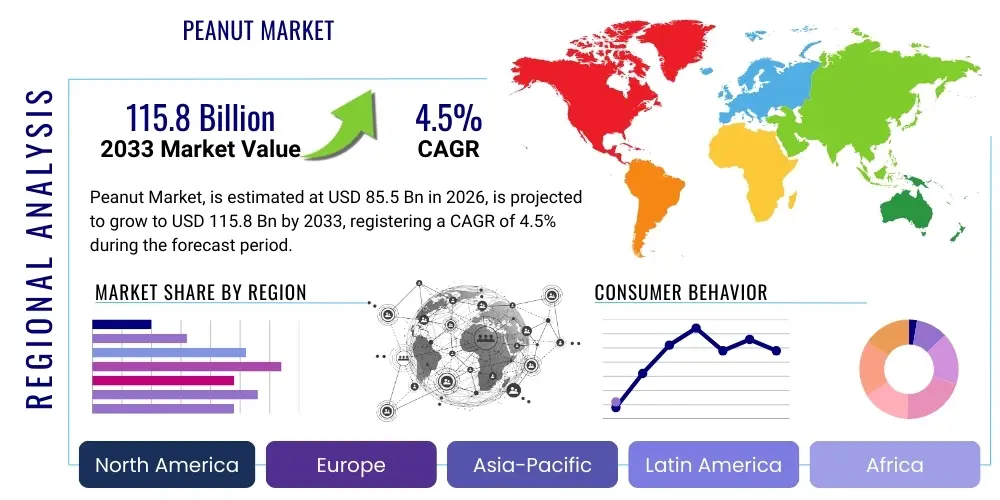

Peanut Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432050 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Peanut Market Size

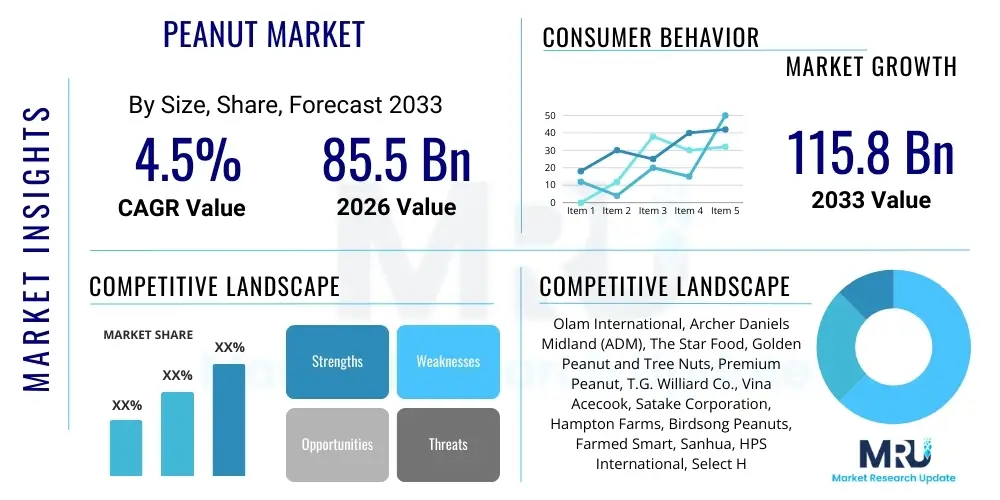

The Peanut Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $85.5 Billion in 2026 and is projected to reach $115.8 Billion by the end of the forecast period in 2033.

Peanut Market introduction

The Peanut Market encompasses the global cultivation, processing, trade, and consumption of peanuts (groundnuts), scientifically known as Arachis hypogaea. Peanuts are a crucial agricultural commodity, valued globally not only as a high-protein, calorie-dense food source but also for their versatility in industrial applications. The market spans raw kernel sales, various processed forms like oil, butter, and confectionery products, and their increasing utilization in the functional food and nutraceutical sectors due to their rich profile of unsaturated fats, vitamins, and antioxidants. Global demand is heavily influenced by population growth, changing dietary patterns in emerging economies, and the rising awareness of plant-based protein sources.

Major applications of peanuts are predominantly concentrated in the food industry, where they form the basis for peanut butter and spreads, a staple in many Western diets, and are extensively used as savory snacks, often roasted, salted, or flavored. Furthermore, peanuts are critical for the edible oil industry, yielding high-quality peanut oil known for its flavor profile and high smoke point, making it popular in diverse global cuisines, particularly in Asia. The residual peanut cake, after oil extraction, is a valuable component for animal feed, contributing significantly to the livestock and dairy sectors.

Key benefits driving the market include the nutritional density of peanuts, offering affordable protein compared to meat sources, and essential micronutrients, making them vital for food security in numerous regions. Driving factors fueling sustained market expansion involve the growing trend of clean-label and natural food ingredients, increased disposable incomes in the Asia Pacific region supporting higher consumption of processed snacks and oils, and continuous innovations in peanut processing and flavor development, which appeal to diverse consumer tastes. Additionally, strategic governmental support for oilseed cultivation in major producing countries like China, India, and the United States further stabilizes and promotes market growth.

Peanut Market Executive Summary

The global Peanut Market demonstrates robust growth driven primarily by shifting global demographics and an elevated consumer preference for affordable, protein-rich plant-based foods. Current business trends indicate a significant focus on vertical integration among major market players, aiming to secure raw material supply chains and ensure quality control from farm to consumer. There is an increasing proliferation of product innovation, specifically in the snack and confectionery segments, where peanuts are being utilized in high-value, health-conscious products, such as energy bars and specialty nut blends, catering to the active lifestyle demographic. Furthermore, sustainability and ethical sourcing have become critical factors influencing purchasing decisions, prompting companies to invest in certified sustainable farming practices.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market in terms of both production and consumption, led by China and India, where peanuts are integral to traditional diets and the culinary oil sector. However, North America and Europe remain high-value markets, characterized by advanced processing techniques and strong demand for premium peanut butter and processed snacks. The consumption pattern in these Western markets is evolving, with a growing segment of consumers seeking organic and non-GMO peanut products. Latin America and the Middle East & Africa (MEA) are emerging regions, benefiting from increased foreign investment in agricultural infrastructure and expanding local processing capacities, suggesting strong future growth potential.

Segmentation trends reveal that the Application segment dominated by peanut butter and spreads continues to hold a significant market share, bolstered by its convenience and nutritional value. However, the use of peanuts in high-end confectionery and flavored snack mixes is experiencing the fastest growth rate, reflecting consumer willingness to pay a premium for specialized tastes and textures. The Runner type of peanut remains the most cultivated variety due to its high yield and desirable kernel shape for processing into butter, while Valencia and Spanish varieties maintain niche dominance in specific regional snack and confectionery markets, appealing to distinct flavor preferences. Online retail distribution channels are witnessing accelerated expansion, capitalizing on the broader reach and convenience offered to urban consumers globally.

AI Impact Analysis on Peanut Market

User queries regarding the impact of Artificial Intelligence (AI) on the Peanut Market frequently center around optimizing agricultural yield, enhancing quality assurance, and improving supply chain resilience. Key user themes include the feasibility of predictive analytics for disease and pest management, the role of machine learning in sorting and grading efficiency, and how AI can stabilize market price volatility. Concerns often revolve around the initial investment cost for implementing advanced AI-driven farm machinery and the necessary training required for agricultural labor. Users expect AI to reduce operational costs, minimize waste during harvesting and processing, and ultimately provide transparent, verifiable sourcing information to end consumers.

AI adoption is poised to revolutionize the cultivation stage through precision agriculture. Machine learning models, utilizing satellite imagery, drone surveillance, and sensor data, can accurately predict soil conditions, monitor plant health, and determine optimal irrigation and fertilization schedules, directly boosting yield and reducing resource consumption. This technology minimizes the reliance on broad-spectrum chemical treatments, leading to healthier crops and meeting the growing consumer demand for residue-free products. Furthermore, AI-powered weather forecasting provides farmers with critical advance warnings, allowing for proactive measures against climate-related risks, which is vital for a climate-sensitive crop like peanuts.

In the processing and trade sectors, AI significantly enhances efficiency and quality control. Automated sorting systems employing computer vision and deep learning algorithms can identify and remove defective kernels, foreign materials, and contaminants, including potentially harmful aflatoxins, with far greater speed and accuracy than traditional methods. This stringent quality control improves food safety standards, crucial for maintaining international trade compliance and consumer trust. Additionally, AI-driven logistics platforms optimize transportation routes and inventory management, predicting demand fluctuations and reducing cold chain wastage, thereby making the global peanut supply chain more responsive and cost-effective.

- AI-driven predictive analytics optimizes planting, irrigation, and fertilization schedules, boosting yield per acre.

- Machine Learning (ML) algorithms improve quality control by rapidly detecting defects and aflatoxin contamination during processing.

- Computer vision systems enhance automated sorting and grading efficiency, ensuring standardized product quality for export.

- AI-enabled drone surveillance monitors crop health, identifying localized pest outbreaks and disease risks early.

- Predictive supply chain modeling minimizes storage costs and reduces wastage by forecasting market demand accurately.

- Robotics integrated with AI facilitates automated harvesting, reducing labor dependency and time-to-market.

- Blockchain technology, often paired with AI analytics, improves traceability and transparency of sourcing information.

DRO & Impact Forces Of Peanut Market

The dynamics of the Peanut Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the critical Impact Forces determining market trajectory. Key drivers include the inherent nutritional superiority of peanuts as an affordable, high-protein food source, making them essential for mitigating food insecurity and addressing protein deficiency, particularly in developing economies. This is coupled with the burgeoning global population and increasing acceptance of plant-based diets, which directly escalates the demand for derivatives such as peanut milk, vegetarian protein supplements, and diverse snack formats. Innovation in processing techniques, leading to extended shelf life and diversified product offerings, further accelerates market penetration across varied geographical and demographic segments.

However, significant restraints temper market growth. The primary concern is the susceptibility of peanuts to aflatoxin contamination, a naturally occurring toxin that requires strict and costly monitoring protocols throughout the supply chain, impacting export capabilities and market access. Furthermore, the rising prevalence of peanut allergies, particularly in Western markets, necessitates stringent labeling requirements and often leads consumers to seek alternative nut and seed butters, posing a structural challenge to market expansion. Additionally, climate change-induced weather volatility, including droughts and excessive rainfall, heavily impacts peanut crop yields and quality, introducing significant supply chain instability and price fluctuations.

Opportunities for growth are concentrated around emerging economies and the functional food sector. There is vast potential in utilizing peanut components, such as peanut protein isolate, in high-value nutritional products and sports supplements, catering to the fitness and wellness trends globally. Developing climate-resilient and high-yield peanut varieties through advanced biotechnology offers a long-term solution to supply constraints. Moreover, expanding the application of peanuts beyond traditional food uses, into biodiesel production or as bio-plastic fillers, represents a diversification strategy that could significantly broaden the market base and enhance commercial viability, particularly in regions with strong governmental support for sustainable agriculture.

Segmentation Analysis

The Peanut Market is segmented based on Type, Application, and Distribution Channel, reflecting the diverse utilization and consumption patterns globally. This segmentation is crucial for market stakeholders to tailor production, processing, and marketing strategies effectively. The classification by Type—Runner, Spanish, Virginia, and Valencia—is based on morphological characteristics, oil content, and suitability for specific end-uses, such as grinding into butter versus consumption as whole kernels. The segmentation by Application highlights the dominance of processed foods, oil extraction, and confectionery, demonstrating the commodity's versatility beyond simple consumption. Analyzing these segments provides actionable insights into consumer preferences and emerging trends across different product categories.

Runner peanuts dominate the market share due to their desirable uniform size, excellent roasting characteristics, and high yield, making them the preferred choice for peanut butter manufacturers globally. However, diversification across applications is key; the snack segment is increasingly valuing the smaller, higher oil content Spanish peanuts for their distinct nutty flavor, while the larger Virginia peanuts maintain a premium presence in in-shell snack markets. The segmentation also reflects regional culinary traditions; for instance, the use of peanuts in Asian cooking focuses heavily on oil and crushed garnishes, distinct from the Western emphasis on spreads and packaged snacks.

Analyzing the Distribution Channel segmentation reveals a shift toward modernization. While traditional channels like convenience stores and traditional grocery outlets remain vital, especially in developing countries, the increasing penetration of organized retail (supermarkets and hypermarkets) provides scale and cold chain infrastructure necessary for high-volume sales. Most notably, the rapid growth of the online retail segment is democratizing access to specialized and organic peanut products, allowing niche players to reach global audiences directly and efficiently, subsequently intensifying competition and driving faster product innovation across all segments.

- By Type:

- Runner

- Spanish

- Virginia

- Valencia

- By Application:

- Peanut Butter and Spreads

- Snacks (Roasted, Salted, Flavored)

- Confectionery

- Oil

- Animal Feed

- Others (Flours, Protein Isolates)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Traditional Grocery Stores

Value Chain Analysis For Peanut Market

The Peanut Market value chain begins with intensive upstream activities, primarily involving seed production, agricultural inputs (fertilizers, pesticides, machinery), and cultivation by farmers. This initial stage is crucial as it determines the quality and quantity of the raw material, with genetic selection and climate conditions playing major roles. Research and development institutions often partner with seed companies to develop disease-resistant, high-yield varieties, forming a critical knowledge input into the chain. Financial services and insurance providers also play a pivotal role upstream, mitigating the substantial financial risks associated with agricultural production.

Midstream activities encompass post-harvest handling, storage, shelling, drying, and primary processing. This stage is characterized by high capital expenditure in sorting and grading technologies, particularly those focused on aflatoxin control, which dictates suitability for human consumption versus animal feed or oil extraction. Large processors and trading houses manage global logistics, transporting raw and semi-processed kernels from major production centers (like China, India, and the USA) to major consumption and further processing hubs in Europe and North America. Efficient logistics management, including refrigerated storage, is essential to maintain quality and minimize spoilage across long-distance trade routes.

Downstream activities focus on secondary processing and distribution. This involves manufacturing finished products such as peanut butter, refined oil, snacks, and confectionery items, often requiring specialized branding and packaging designed for specific target markets. Distribution channels are complex, ranging from direct sales to large food manufacturers (B2B) to sales through organized retail and e-commerce platforms (B2C). Direct distribution channels involve manufacturers supplying large industrial clients, while indirect distribution relies on wholesalers, distributors, and retail intermediaries, ensuring widespread market penetration and accessibility to the final consumer across diverse demographic segments.

Peanut Market Potential Customers

Potential customers and end-users of peanut products span a wide spectrum, categorized primarily into the Food Manufacturing Industry, Retail Consumers, the Animal Feed Sector, and the Cosmetics/Industrial Sector. The largest volume buyers are food processors, including global snack manufacturers, confectionery companies requiring peanut components for bars and candies, and most notably, large-scale producers of peanut butter and spreads. These customers demand consistent supply, rigorous quality assurance standards, and competitive bulk pricing, focusing heavily on Runner peanuts for their versatile processing attributes and uniform sizing.

Retail consumers form the largest revenue base, purchasing packaged peanuts as snacks (roasted, flavored), peanut butter, and ready-to-eat meals containing peanut derivatives. This segment is highly sensitive to branding, flavor innovation, and health claims, driving demand for organic, non-GMO, and lower-sodium products. Specialty food producers and artisanal processors represent a growing niche, seeking premium varieties like Valencia and Virginia peanuts for high-end, differentiated products, emphasizing unique flavor profiles and sustainable sourcing narratives to justify higher price points.

The animal feed industry represents a critical, high-volume, albeit lower-value, end-market for residual peanut meal and lower-grade kernels unsuitable for human consumption. This sector is characterized by price sensitivity and nutritional specifications for livestock and poultry feed formulations. Finally, the cosmetics and pharmaceutical industries utilize refined peanut oil and extracts for specific applications, valuing the oil's stability and moisturizing properties, representing a smaller, yet high-value, segment requiring exceptional purity and traceability standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $85.5 Billion |

| Market Forecast in 2033 | $115.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olam International, Archer Daniels Midland (ADM), The Star Food, Golden Peanut and Tree Nuts, Premium Peanut, T.G. Williard Co., Vina Acecook, Satake Corporation, Hampton Farms, Birdsong Peanuts, Farmed Smart, Sanhua, HPS International, Select Harvests, Keventer Agro, Keystone Fruit Marketing, Mountaire Farms, Universal Corporation, Adani Wilmar, Cargill, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peanut Market Key Technology Landscape

The technological landscape of the Peanut Market is fundamentally transforming across cultivation, processing, and quality assurance, driven by the need for higher yields, reduced costs, and stringent food safety standards. In the farming stage, modern technology centers around precision agriculture, utilizing GPS-guided planting and harvesting equipment to optimize resource allocation and minimize soil compaction. Sophisticated sensor networks and internet of things (IoT) devices are deployed to monitor micro-climates, soil moisture, and nutrient levels in real-time, enabling farmers to make data-driven decisions that substantially improve crop quality and minimize the risk of fungal growth, a precursor to aflatoxin contamination.

Post-harvest processing technologies are increasingly focused on automation and advanced sorting. Optical sorting machines equipped with near-infrared (NIR) and hyperspectral imaging are becoming standard. These systems can analyze the chemical composition and surface characteristics of individual kernels, far surpassing human inspection capabilities in identifying defects, foreign materials, and, most crucially, sorting kernels based on color and potential contamination. High-efficiency shelling and blanching technologies minimize breakage and maintain kernel integrity, which is vital for high-value snack and confectionery applications, ensuring a superior final product appearance and texture.

Furthermore, technology related to safety and traceability is gaining prominence. Advanced analytical instruments, such as High-Performance Liquid Chromatography (HPLC) coupled with mass spectrometry, are used for rapid and accurate detection and quantification of aflatoxins and pesticide residues, ensuring compliance with strict global food safety regulations. Moreover, the adoption of blockchain technology in the supply chain provides immutable records of cultivation practices, processing batches, and shipping routes. This transparency enhances consumer trust, aids in rapid recall management if contamination occurs, and helps differentiate premium, verified-source peanut products in competitive international markets, serving as a powerful technological differentiator for major exporters.

Regional Highlights

The geographical analysis of the Peanut Market reveals distinct consumption, production, and trade dynamics across major regions, heavily influencing global supply chains and price formation. The Asia Pacific (APAC) region is indisputably the largest market, accounting for the vast majority of global production and consumption. This dominance is driven by China and India, the world’s two largest producers, where peanuts are a cultural staple, consumed widely as oil, snacks, and ingredients in traditional cuisines. Rapid urbanization and the expansion of the organized retail sector in Southeast Asian nations are accelerating the demand for processed peanut snacks and packaged goods, making APAC a high-growth revenue area.

North America, led by the United States, represents a highly mature and organized market characterized by high consumer spending and strong product innovation, particularly in the premium and specialty peanut butter segments. Production here is highly mechanized and focused on quality assurance, particularly managing aflatoxins to meet stringent federal standards, enabling the US to be a major global exporter of high-quality Runner peanuts. Consumer trends focus on fortified, organic, and non-GMO varieties, sustaining a high average price point relative to global averages.

Europe stands out as a net importer, heavily reliant on supply from the US, Argentina, and parts of Africa. The market is primarily driven by confectionery, snack manufacturing, and specialized oil usage. European regulations, particularly concerning Maximum Residue Levels (MRLs) and hygiene, are among the world's strictest, creating a demand for exceptionally high-quality, traceable imports. Latin America, particularly Argentina and Brazil, is a significant global exporter, utilizing vast agricultural lands and advanced processing technology to supply both North America and Europe, focusing on cost efficiency and export volume. Finally, the Middle East & Africa (MEA) region shows rapid growth, driven by local production in Sudan and Senegal, catering largely to local demand and regional trade, while Gulf nations demonstrate rising import volumes for high-value imported snacks.

- Asia Pacific (APAC): Dominant in both production (China, India) and consumption. Growth is fueled by massive domestic demand for oil and snacks, driven by population size and rising income levels. Focus on traditional and value-added products.

- North America: Mature market characterized by high consumption of peanut butter and spreads. Focus on high-quality, regulated production (USA), organic trends, and advanced food safety standards. Key exporter of Runner peanuts.

- Europe: Net importer with stringent quality controls (Aflatoxin limits). Demand is high for confectionery, snacks, and healthy nut mixes. Market growth is stable, driven by processed food manufacturers.

- Latin America: Important export hub (Argentina, Brazil). Focus on large-scale, cost-effective production for international trade, supplying high-quality raw kernels to Europe and Asia.

- Middle East & Africa (MEA): High growth potential. Local production centers (Sudan, Senegal) cater to regional needs, while wealthier Gulf countries drive import demand for premium packaged goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peanut Market.- Olam International

- Archer Daniels Midland (ADM)

- The Star Food

- Golden Peanut and Tree Nuts

- Premium Peanut

- T.G. Williard Co.

- Vina Acecook

- Satake Corporation

- Hampton Farms

- Birdsong Peanuts

- Farmed Smart

- Sanhua

- HPS International

- Select Harvests

- Keventer Agro

- Keystone Fruit Marketing

- Mountaire Farms

- Universal Corporation

- Adani Wilmar

- Cargill, Inc.

Frequently Asked Questions

Analyze common user questions about the Peanut market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Peanut Market?

The primary factor driving market growth is the increasing global demand for affordable, readily available plant-based protein sources, coupled with the expansion of the processed food industry, especially in the rapidly developing economies of the Asia Pacific region.

Which application segment holds the largest share in the global Peanut Market?

The Peanut Butter and Spreads application segment currently holds the largest revenue share, reflecting its established position as a staple food item in North American and European diets, supported by growing consumption in other regions.

How does the risk of aflatoxin contamination affect peanut trade?

Aflatoxin risk significantly restricts international trade, as many importing nations, particularly in Europe, enforce extremely low tolerance limits. This necessitates substantial investment in advanced sorting, testing technologies, and rigorous quality control protocols throughout the supply chain.

Which geographical region is projected to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to show the fastest market growth, driven by large production volumes, expanding consumer base, dietary shifts towards processed snacks and oils, and increasing urbanization favoring packaged goods consumption.

What role does technology play in modern peanut cultivation?

Technology plays a critical role through precision agriculture, utilizing IoT, sensors, and AI analytics to optimize irrigation and fertilization, improve yield predictability, and proactively mitigate climate-related risks and disease outbreaks, leading to enhanced quality and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Peanut Processing Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Peanut Allergy Therapeutics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Drinkable Peanut Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Peanut Flour Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Peanut Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager