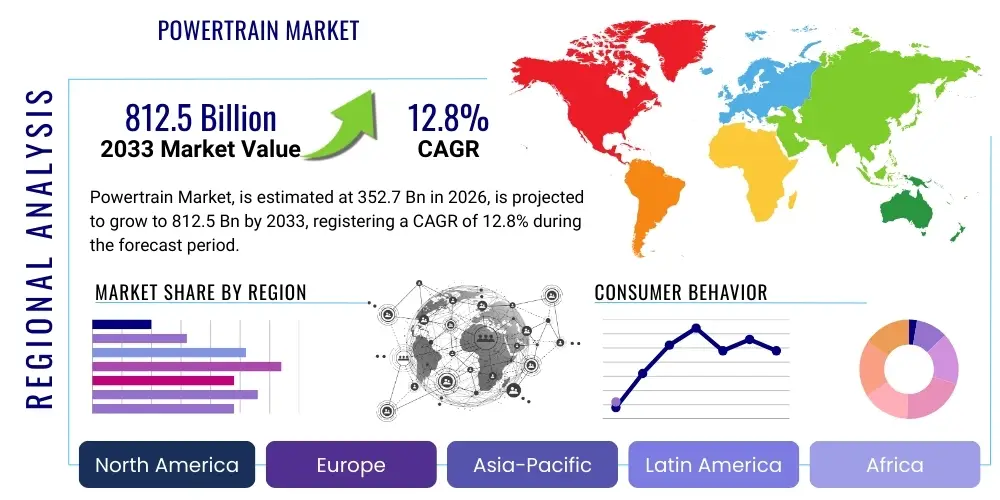

Powertrain Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439804 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Powertrain Market Size

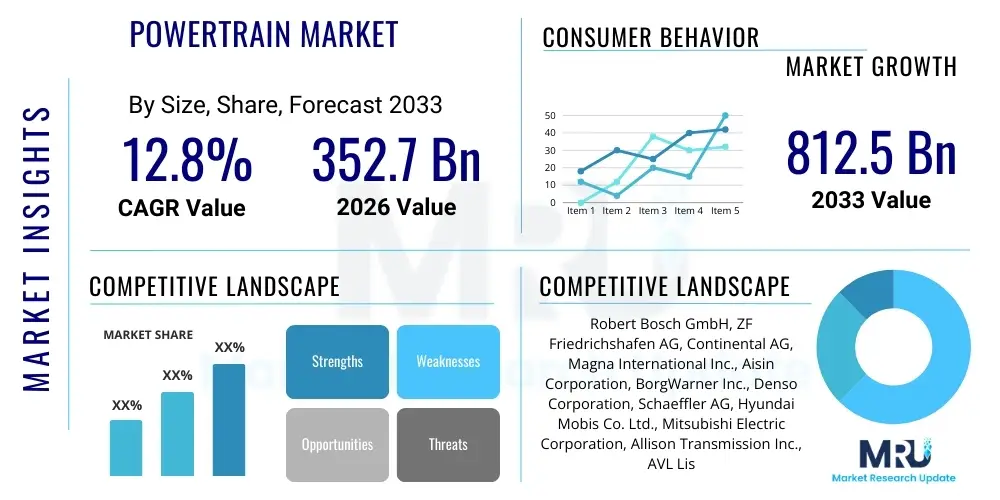

The Powertrain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 352.7 billion in 2026 and is projected to reach USD 812.5 billion by the end of the forecast period in 2033. This robust growth is primarily driven by the global automotive industry's rapid transition towards electrification and the increasing demand for enhanced fuel efficiency and reduced emissions across various vehicle segments.

The market expansion is further propelled by significant technological advancements in battery chemistry, electric motor design, and power electronics, which are making electric and hybrid powertrains more efficient, affordable, and accessible. Governments worldwide are implementing stringent emission regulations and offering incentives for electric vehicle adoption, creating a favorable environment for powertrain market growth. The ongoing innovation in conventional internal combustion engine (ICE) technologies, focusing on hybridization and efficiency improvements, also contributes to the market's overall trajectory, albeit at a slower pace compared to electric alternatives.

Powertrain Market introduction

The powertrain market encompasses the entire system responsible for generating power and delivering it to the driving wheels of a vehicle or the working mechanism of machinery. This complex system includes the engine or motor, transmission, driveshaft, axles, and differential, along with associated control units and software. Historically dominated by internal combustion engines, the market is undergoing a profound transformation driven by the imperative to reduce greenhouse gas emissions and improve energy efficiency, leading to a surge in hybrid, electric, and fuel cell powertrain solutions across automotive, commercial vehicle, and off-highway sectors.

Major applications of powertrain systems are predominantly found in the automotive industry, spanning passenger cars, light commercial vehicles, heavy-duty trucks, and buses. Beyond road transport, powertrains are critical in construction equipment, agricultural machinery, marine vessels, and industrial applications. The core benefits derived from advanced powertrain technologies include superior fuel economy, reduced environmental impact through lower emissions, enhanced vehicle performance, improved driving dynamics, and often a quieter, smoother operational experience, particularly with electric powertrains. The continuous evolution of these systems is vital for meeting global sustainability goals and consumer expectations.

Key driving factors for the powertrain market include escalating environmental concerns and strict regulatory mandates for emission reductions, which are compelling manufacturers to innovate cleaner and more efficient systems. The rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) globally stands as a primary catalyst, fueled by technological breakthroughs in battery cost and energy density, and advancements in electric motor efficiency. Furthermore, consumer demand for high-performance vehicles, coupled with government incentives and expanding charging infrastructure, significantly contributes to the market's dynamic growth and diversification, pushing manufacturers to invest heavily in research and development for next-generation powertrain solutions.

Powertrain Market Executive Summary

The global powertrain market is experiencing a profound shift driven by the accelerating transition towards electrification and sustainable mobility. Business trends indicate a significant increase in strategic partnerships, joint ventures, and mergers among traditional automotive OEMs, technology companies, and component suppliers, aimed at pooling resources for electric powertrain development and overcoming technological hurdles. There is a strong focus on modular and scalable powertrain architectures to reduce costs and accelerate time-to-market for diverse vehicle platforms. Furthermore, the market is witnessing an intensified competition for critical raw materials used in batteries and electric motors, alongside a growing emphasis on localized supply chains to enhance resilience and reduce geopolitical risks.

Regional trends highlight Asia Pacific as the leading and fastest-growing market, primarily due to robust EV adoption policies in China, India, and South Korea, coupled with significant manufacturing capacities. Europe is also a major player, driven by stringent emission regulations and substantial investments in charging infrastructure and domestic battery production. North America shows steady growth, propelled by supportive government initiatives like the Inflation Reduction Act and increasing consumer interest in electric vehicles. Conversely, regions in Latin America, the Middle East, and Africa are gradually adopting electric powertrains, though internal combustion engine vehicles continue to dominate due to cost considerations and developing infrastructure.

Segmentation trends reveal that electric powertrains, encompassing battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), are projected to capture the largest market share and exhibit the highest growth rate over the forecast period. This growth is underpinned by advancements in battery technology, reduction in manufacturing costs, and expanding model availability. Within components, electric motors, power electronics (inverters, converters), and advanced battery packs are experiencing unprecedented demand. While the internal combustion engine segment will see gradual decline in market share, innovations in mild and full hybrid systems continue to provide a transitional pathway, extending the life and improving the efficiency of conventional powertrain architectures.

AI Impact Analysis on Powertrain Market

User inquiries concerning AI's influence on the powertrain market frequently revolve around its potential to optimize performance, enhance efficiency, reduce development cycles, and enable new functionalities, especially within electric and autonomous vehicles. Common questions address how AI contributes to battery management system (BMS) intelligence, predictive maintenance for complex powertrain components, and the real-time optimization of energy consumption in hybrid and electric systems. Users are keen to understand AI's role in the design and simulation of next-generation powertrains, expecting breakthroughs in thermal management, material science, and the integration of diverse powertrain elements for superior overall system performance and extended operational ranges. There is also significant interest in AI's capacity to facilitate autonomous driving integration by providing advanced control and decision-making capabilities for vehicle propulsion, ensuring seamless interaction between the powertrain and autonomous systems for improved safety and efficiency.

- AI optimizes battery management systems for extended range and lifespan through predictive analytics.

- AI enhances real-time energy management in hybrid and electric vehicles, improving fuel economy and efficiency.

- Predictive maintenance for powertrain components is enabled by AI, reducing downtime and operational costs.

- AI accelerates powertrain design and simulation, leading to faster innovation cycles and cost reduction.

- Adaptive cruise control and autonomous driving systems leverage AI for optimized powertrain control.

- AI-driven data analysis identifies performance bottlenecks and suggests improvements in powertrain efficiency.

- Advanced thermal management systems for batteries and motors are developed using AI algorithms.

- Manufacturing processes for powertrain components are optimized by AI, enhancing quality and production efficiency.

DRO & Impact Forces Of Powertrain Market

The powertrain market is shaped by a confluence of drivers, restraints, and opportunities, exerting significant impact forces. Key drivers include stringent global emission regulations mandating lower carbon footprints and improved fuel efficiency, propelling the shift towards electric and hybrid solutions. The escalating consumer demand for high-performance, technologically advanced, and environmentally friendly vehicles is a major catalyst. Furthermore, government incentives, subsidies, and infrastructural development supporting electric vehicles (EVs) are accelerating market adoption and investment in next-generation powertrain technologies. Continuous innovation in battery technology, electric motors, and power electronics is also driving efficiency improvements and cost reductions, making advanced powertrains more accessible.

However, the market faces notable restraints such as the high upfront cost associated with electric vehicles and advanced hybrid systems, which can deter price-sensitive consumers. The limited charging infrastructure in many regions, especially for heavy-duty electric vehicles, poses a significant adoption barrier. Supply chain complexities, particularly concerning critical raw materials for batteries like lithium, cobalt, and nickel, and geopolitical tensions surrounding their sourcing, create volatility and price pressures. Additionally, the substantial research and development (R&D) investments required for continuous innovation in powertrain technology represent a financial challenge for manufacturers, further complicated by a shortage of skilled labor in specialized areas like power electronics and software integration.

Opportunities within the powertrain market are abundant, primarily centered around the development of advanced battery technologies offering higher energy density and faster charging capabilities, which can alleviate range anxiety and improve EV practicality. The emergence of hydrogen fuel cell electric vehicles (FCEVs) presents a promising avenue for heavy-duty and long-haul transport, leveraging hydrogen production from renewable sources. Furthermore, the integration of autonomous driving systems requires sophisticated and highly responsive powertrains, opening new design and control opportunities. The increasing demand for software-defined vehicles allows for over-the-air updates and performance enhancements, transforming the powertrain into a continuously evolving digital system. Strategic partnerships and cross-industry collaborations are also creating novel opportunities for shared development and market expansion.

Segmentation Analysis

The global powertrain market is comprehensively segmented by various criteria, including vehicle type, component, powertrain type, and fuel type. Each segment reveals distinct trends, growth rates, and technological advancements, reflecting the diverse demands and regulatory landscapes across the automotive and industrial sectors. This granular analysis provides a clear understanding of market dynamics, identifying key areas of investment and innovation, and highlighting shifts in consumer preferences and industry standards. The detailed segmentation helps stakeholders to strategize effectively by focusing on specific high-growth areas or addressing particular market needs within the evolving powertrain ecosystem.

- By Vehicle Type

- Passenger Car

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Off-Highway Vehicles

- By Component

- Engine (ICE components, Hybrid engine components)

- Transmission (Manual, Automatic, AMT, CVT, DCT, EV single-speed)

- Driveshaft

- Axle

- Differential

- Battery

- Electric Motor

- Inverter

- Converter

- Fuel Cell Stack

- By Powertrain Type

- Internal Combustion Engine (ICE) Powertrain

- Hybrid Powertrain (Mild Hybrid, Full Hybrid, Plug-in Hybrid)

- Electric Powertrain (BEV, FCEV)

- By Fuel Type

- Gasoline

- Diesel

- Electric

- Hybrid

- Hydrogen

Value Chain Analysis For Powertrain Market

The powertrain market's value chain is a complex network spanning raw material extraction to final product delivery and aftermarket services. Upstream analysis begins with the sourcing of essential raw materials, including steel, aluminum, copper, and critical battery minerals like lithium, cobalt, nickel, and rare earth elements. These materials are processed and supplied to component manufacturers specializing in engine blocks, transmission cases, electric motor laminations, battery cells, and power electronics. This stage is characterized by significant capital investment, stringent quality control, and an increasing focus on sustainable and ethical sourcing practices due to environmental and social concerns associated with mineral extraction.

Midstream activities involve the manufacturing and assembly of individual powertrain components such as internal combustion engines, transmissions, electric motors, inverters, battery packs, and fuel cell stacks. These components are then integrated into complete powertrain systems by Tier 1 suppliers who often specialize in specific modules, offering advanced systems like complete e-axles or hybrid drivetrains. Original Equipment Manufacturers (OEMs) then procure these integrated systems, along with other vehicle components, for final vehicle assembly. This stage involves sophisticated manufacturing processes, extensive testing, and collaborative engineering efforts between suppliers and OEMs to ensure compatibility and optimal performance, focusing heavily on reducing manufacturing costs and improving system efficiency.

Downstream analysis covers the distribution channels and end-user engagement. Direct distribution involves OEMs selling vehicles directly to consumers or fleet operators through dealerships or online platforms. Indirect channels include independent distributors and aftermarket parts suppliers who provide components for vehicle maintenance, repair, and upgrades. The rise of direct-to-consumer models, especially for electric vehicles, is reshaping traditional dealership networks. End-users are primarily automotive consumers, commercial fleet owners, and industrial equipment operators. Post-sale services, including maintenance, software updates, and battery recycling or second-life applications, form a crucial part of the value chain, extending the lifecycle of powertrain components and addressing sustainability goals. The entire chain is becoming increasingly digitized, with data analytics playing a vital role in optimizing logistics, production, and predictive maintenance.

Powertrain Market Potential Customers

Potential customers for powertrain products and systems span a wide array of industries, primarily centered around vehicle manufacturing and industrial machinery. Automotive Original Equipment Manufacturers (OEMs) constitute the largest customer segment, encompassing global giants like Toyota, Volkswagen, General Motors, Ford, Hyundai, Stellantis, and emerging electric vehicle manufacturers such as Tesla, BYD, and Rivian. These OEMs require diverse powertrain solutions for their passenger cars, SUVs, and light commercial vehicle lineups, ranging from conventional ICE powertrains to advanced hybrid, battery electric, and fuel cell systems, driven by market demand and regulatory compliance. They continuously seek innovative, efficient, and cost-effective solutions to maintain competitiveness and meet evolving consumer expectations for performance and sustainability.

Beyond passenger vehicles, manufacturers of heavy commercial vehicles (HCVs) such as Daimler Truck, Volvo Group, PACCAR, and Traton Group represent a significant customer base. These companies procure robust powertrain systems for their trucks and buses, with an increasing focus on electric and hydrogen fuel cell options for freight and public transport to meet emission targets and operational efficiency demands. Similarly, off-highway vehicle manufacturers in the construction, agriculture, and mining sectors (e.g., Caterpillar, John Deere, Komatsu) are transitioning towards hybrid and electric powertrains to comply with stricter environmental regulations and improve operational efficiency in challenging environments, seeking durable and high-torque solutions. The defense sector also represents a niche but critical customer, requiring specialized powertrains for military vehicles that offer reliability, power, and often hybrid capabilities for silent operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 352.7 billion |

| Market Forecast in 2033 | USD 812.5 billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, ZF Friedrichshafen AG, Continental AG, Magna International Inc., Aisin Corporation, BorgWarner Inc., Denso Corporation, Schaeffler AG, Hyundai Mobis Co. Ltd., Mitsubishi Electric Corporation, Allison Transmission Inc., AVL List GmbH, GKN Automotive Ltd., Vitesco Technologies Group AG, Cummins Inc., Toyota Motor Corporation, Volkswagen AG, Tesla Inc., General Motors Company, BYD Company Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Powertrain Market Key Technology Landscape

The powertrain market's technology landscape is undergoing a profound transformation, primarily driven by the imperative for increased efficiency, reduced emissions, and the widespread adoption of electric mobility. Key technological advancements include significant improvements in battery technology, focusing on higher energy density, faster charging capabilities, enhanced safety, and longer cycle life. Innovations such as solid-state batteries and advanced lithium-ion chemistries are poised to revolutionize the performance and cost structures of electric vehicles. Concurrently, the development of more efficient and compact electric motors, including permanent magnet synchronous motors (PMSM) and internally excited synchronous motors (IESM), coupled with advanced power electronics like silicon carbide (SiC) and gallium nitride (GaN) inverters, are critical for optimizing electric powertrain performance and extending range. These components are fundamental to the energy conversion and management within electric and hybrid systems, ensuring minimal energy loss.

Beyond electrification, significant advancements are still being made in conventional internal combustion engine (ICE) technology, particularly in hybrid configurations. This includes the integration of sophisticated mild-hybrid (MHEV) and full-hybrid (HEV) systems that combine an ICE with an electric motor to improve fuel economy and reduce emissions through regenerative braking and electric assist. Advanced combustion strategies, turbocharging, direct injection, and variable valve timing systems continue to evolve, squeezing more efficiency out of every drop of fuel. Thermal management systems are also becoming increasingly sophisticated, crucial for maintaining optimal operating temperatures for batteries, electric motors, power electronics, and ICE components, thereby enhancing performance, longevity, and safety across all powertrain types. These systems are essential for mitigating heat generation, especially in high-power electric drivetrains.

The rise of software-defined powertrains represents another pivotal technological shift, where sophisticated control algorithms and artificial intelligence (AI) are used to optimize powertrain operation in real time. This includes predictive energy management, adaptive torque vectoring, and over-the-air (OTA) updates for continuous performance improvement and feature enhancements. Furthermore, hydrogen fuel cell technology is gaining traction, particularly for heavy-duty applications, with advancements in fuel cell stack efficiency, hydrogen storage solutions, and infrastructure development. The integration of advanced sensors and communication technologies (V2X) for seamless interaction between the powertrain and other vehicle systems, including autonomous driving functions, is also becoming a standard. This holistic approach to powertrain development, combining hardware innovation with intelligent software, defines the cutting-edge of the market, ensuring systems are not only powerful and efficient but also intelligent and interconnected.

Regional Highlights

- Asia Pacific (APAC): Dominates the global powertrain market, driven by rapid urbanization, stringent environmental regulations in countries like China and India, and aggressive government incentives for EV adoption. China is a global leader in EV production and sales, creating immense demand for electric powertrains. Japan and South Korea are also strong contributors with advanced automotive manufacturing and significant investments in hybrid and fuel cell technologies. The region benefits from robust manufacturing capabilities and a large consumer base.

- Europe: A key market experiencing significant growth, primarily fueled by strict emission norms (e.g., Euro 7) and strong policy support for electrification. Countries like Germany, Norway, France, and the UK are at the forefront of EV adoption, fostering innovation in battery technology, electric motors, and charging infrastructure. The region also sees substantial investment in hydrogen fuel cell research and development, particularly for heavy-duty transport.

- North America: Showing substantial growth, particularly in the United States, driven by consumer preference for SUVs and light trucks, combined with increasing federal and state-level incentives for electric vehicle purchases and manufacturing. The shift towards electrification is evident in major automakers' investment strategies and the expansion of charging networks. Canada and Mexico also contribute to market growth with their own automotive industries and evolving regulatory landscapes.

- Latin America: An emerging market for advanced powertrains, with a gradual but steady transition towards electrification. Brazil and Mexico are leading the region with growing automotive manufacturing bases and increasing government focus on reducing emissions. Hybrid powertrains currently play a significant role as an intermediary step towards full electrification, due to developing infrastructure and economic considerations.

- Middle East and Africa (MEA): This region is in the early stages of advanced powertrain adoption, with varied paces across countries. Gulf nations are exploring EV adoption and sustainable transport solutions, often driven by government diversification strategies away from oil dependency. South Africa is a notable market with a developing automotive industry and growing interest in electric vehicles, though infrastructure and affordability remain key challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Powertrain Market.- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- Magna International Inc.

- Aisin Corporation

- BorgWarner Inc.

- Denso Corporation

- Schaeffler AG

- Hyundai Mobis Co. Ltd.

- Mitsubishi Electric Corporation

- Allison Transmission Inc.

- AVL List GmbH

- GKN Automotive Ltd.

- Vitesco Technologies Group AG

- Cummins Inc.

- Toyota Motor Corporation

- Volkswagen AG

- Tesla Inc.

- General Motors Company

- BYD Company Ltd.

Frequently Asked Questions

Analyze common user questions about the Powertrain market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Powertrain Market?

The primary driver is the global shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs), fueled by stringent emission regulations, government incentives, and increasing consumer demand for sustainable and efficient transportation solutions.

How is AI impacting the development and performance of powertrain systems?

AI is significantly impacting powertrains by optimizing battery management, enhancing real-time energy efficiency, enabling predictive maintenance, accelerating design processes, and improving integration with autonomous driving functionalities for superior performance and longevity.

What are the key challenges facing the Powertrain Market?

Key challenges include the high upfront cost of electric and advanced hybrid powertrains, limited charging infrastructure availability, complexities in the supply chain for critical battery raw materials, and the substantial R&D investments required for continuous innovation.

Which regions are leading the adoption of advanced powertrain technologies?

Asia Pacific, particularly China, leads in the adoption of advanced powertrains due to strong EV policies and manufacturing capabilities. Europe follows closely with stringent regulations and significant investments in electrification, while North America is also growing rapidly.

What are the emerging technological trends in the Powertrain Market?

Emerging trends include advanced battery chemistries (e.g., solid-state), highly efficient electric motors and power electronics (SiC, GaN), software-defined powertrains with AI optimization, and the growing prominence of hydrogen fuel cell technology for heavy-duty applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Powertrain Testing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Powertrain Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electric Powertrain Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Hybrid Powertrain Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- CNG Powertrain Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager