Rail Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433375 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Rail Market Size

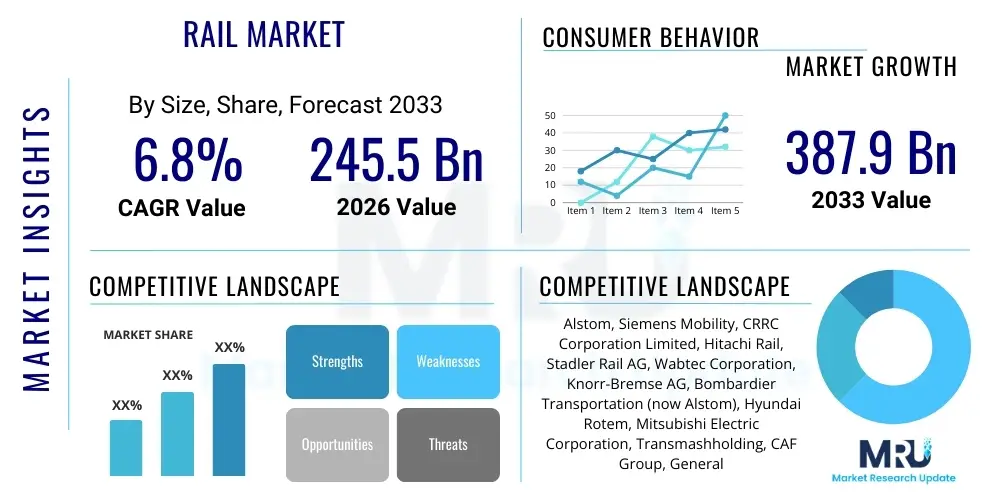

The Rail Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $245.5 Billion in 2026 and is projected to reach $387.9 Billion by the end of the forecast period in 2033. This robust expansion is fueled by massive global investments in high-speed rail networks, urban metro expansion projects across developing economies, and the critical need to modernize aging railway infrastructure in established regions like Europe and North America. The shift towards sustainable transportation options, coupled with governmental stimulus packages focusing on green infrastructure, provides a long-term growth trajectory for the entire rail value chain, encompassing rolling stock, signaling systems, and advanced maintenance services.

Rail Market introduction

The Rail Market encompasses the entire ecosystem dedicated to rail transportation, including the design, manufacturing, maintenance, and operation of rolling stock, rail infrastructure, signaling and control systems, and associated services. This sector is undergoing a profound transformation, moving beyond traditional diesel locomotives and mechanical signaling towards highly digitalized, electric, and autonomous operations. Products range from high-speed trains (HST) and intercity passenger trains to heavy-haul freight wagons and complex urban metro systems. Key components driving performance include advanced train control systems (e.g., ETCS), predictive maintenance solutions leveraging IoT, and sustainable power technologies.

Major applications of the rail sector span passenger transportation (commuting, intercity travel, tourism) and freight transportation (bulk goods, intermodal container shipping). The inherent efficiency of rail in moving large volumes of goods and people with a lower carbon footprint compared to road or air travel positions it as a cornerstone of modern sustainable logistics and urban mobility. The market is characterized by high barriers to entry, stringent safety regulations, and long procurement cycles, emphasizing quality, reliability, and lifecycle cost management over short-term savings.

The principal driving factors include increasing urbanization, requiring efficient mass transit solutions; governmental mandates focused on decarbonization and reducing highway congestion; and the necessity for global supply chains to maintain resilience and predictability. Furthermore, technological advancements like autonomous trains and digital infrastructure management systems are enhancing operational efficiency and capacity, making rail an increasingly attractive investment for both public and private entities globally. The integration of rail networks into multimodal transport hubs further cements its indispensable role in the modern economy.

Rail Market Executive Summary

The global Rail Market is poised for substantial growth driven primarily by unprecedented infrastructure investments in Asia Pacific and the increasing digitalization of European and North American networks. Business trends indicate a strong move towards comprehensive service contracts (maintenance, repair, and overhaul - MRO), rather than purely transactional sales of rolling stock, providing stable recurring revenue streams for major players. Strategic mergers, acquisitions, and technological partnerships focused on integrating sophisticated sensor technology and AI into existing fleets are defining the competitive landscape. Operators are increasingly prioritizing solutions that offer high energy efficiency, reduced noise pollution, and enhanced passenger experience, pushing manufacturers to innovate rapidly in materials science and propulsion technology, specifically focusing on hydrogen fuel cell trains and advanced battery solutions.

Regionally, Asia Pacific maintains dominance due to China's continuous expansion of high-speed networks and significant metro projects underway in India, Southeast Asia, and Australia, demanding extensive infrastructure and rolling stock procurement. Europe is characterized by stringent interoperability standards (facilitated by initiatives like the Shift2Rail Joint Undertaking) and a heavy focus on upgrading legacy signaling systems to ETCS Level 2 and 3, driving growth in the signaling and control segment. North America's market growth is concentrated in freight rail optimization, specifically heavy-haul solutions and implementing Positive Train Control (PTC) systems, alongside moderate expansion in commuter and high-speed corridor development.

Segmentation analysis highlights the rolling stock segment's leading market share, closely followed by infrastructure and services. Within rolling stock, electric multiple units (EMU) and metro cars are experiencing the fastest growth reflecting global urbanization trends. Technologically, the predictive maintenance and IoT solutions segment is emerging as a high-growth area, as operators seek to maximize asset utilization and minimize unexpected downtime. Sustainability is now a core segment driver, leading to increased adoption of eco-friendly materials, regenerative braking systems, and advanced condition monitoring technologies across all market verticals.

AI Impact Analysis on Rail Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Rail Market overwhelmingly focus on four key themes: safety enhancement through autonomous operations, efficiency gains via predictive maintenance, optimization of complex network scheduling, and managing cybersecurity risks associated with integrated digital systems. Users frequently ask about the timeline for fully autonomous freight and passenger trains, the return on investment (ROI) of AI-driven operational planning tools, and how AI can improve fault detection rates in critical infrastructure components like tracks and catenary systems. There is considerable user expectation that AI will fundamentally redefine staffing models, especially in control rooms and maintenance depots, prompting concerns about workforce transition and necessary upskilling.

The rail industry is strategically adopting AI, shifting from pilot projects to core operational implementation, particularly in areas where data volume and complexity exceed human analytical capacity. AI and Machine Learning (ML) are crucial for interpreting the vast amounts of sensor data generated by modern trains and smart infrastructure, enabling real-time condition monitoring that significantly extends asset life and reduces catastrophic failures. This integration is paramount for addressing major operational challenges, such as unexpected delays and high maintenance costs. Furthermore, AI-powered systems are being developed to optimize energy consumption by calculating the most efficient speed profiles for trains across complex routes, directly supporting the sector's sustainability objectives. The future of rail operations is intrinsically linked to sophisticated AI algorithms that manage traffic, forecast passenger demand, and ensure seamless synchronization between rolling stock movements and signaling infrastructure.

However, the implementation of AI faces hurdles related to regulatory approval for safety-critical applications, ensuring the robustness and explainability of ML models used in operational decision-making, and securing legacy systems against cyber threats that target interconnected AI components. Ethical considerations, such as data privacy concerning passenger movement tracking and bias in scheduling algorithms, also form a critical part of the deployment strategy. Successfully navigating these technological, regulatory, and ethical landscapes will be vital for unlocking the full transformative potential of AI, leading to significantly safer, more reliable, and ultimately more cost-effective rail services globally.

- Predictive Maintenance Systems: AI algorithms analyze sensor data (vibration, temperature, acoustic) from bogies, power systems, and tracks to predict component failure with high accuracy, minimizing unplanned downtime and optimizing maintenance scheduling.

- Autonomous Train Operation (ATO): AI is foundational for Grade of Automation (GoA) 3 and GoA 4 systems, enabling automated driving, precise docking, and dynamic speed adjustments, enhancing capacity and reducing human error risk.

- Demand Forecasting and Revenue Management: Machine learning models process historical ridership data, external events, and pricing variables to optimize ticket pricing, schedule frequency, and resource allocation in real-time.

- Network Optimization and Traffic Management: AI-driven systems provide dynamic rescheduling capabilities to manage disruptions (weather, delays) by recalculating optimal routes and speeds across complex, congested networks instantly.

- Visual Inspection Automation: Utilizing computer vision and deep learning to automate the inspection of rail tracks, catenary wires, and tunnel walls from moving trains, drastically speeding up fault detection and categorization.

- Energy Efficiency Optimization: AI models calculate optimal traction and braking profiles to minimize power consumption while adhering to timetables, resulting in substantial operational cost savings.

- Cybersecurity Threat Detection: ML is used to detect anomalies and sophisticated cyber intrusions within the operational technology (OT) environment of signaling and control systems (SCADA, interlocking), protecting critical infrastructure.

- Rolling Stock Design Optimization: Generative AI and simulation tools assist engineers in optimizing aerodynamic profiles and material use, improving efficiency and reducing manufacturing costs.

- Workforce Safety and Monitoring: AI video analytics monitor worker behavior and site conditions, ensuring compliance with safety protocols in maintenance areas and construction zones.

- Inventory Management: Predictive ML forecasts the need for spare parts based on component degradation models, ensuring efficient inventory levels and reducing obsolescence costs.

- Passenger Flow Analysis: AI analyzes real-time video feeds and sensor data in stations to manage crowding, optimize platform utilization, and improve overall passenger safety and comfort.

- Digital Twin Development: AI integrates disparate data sources to create highly accurate digital replicas of rail networks, allowing for risk-free simulation of operational changes and infrastructure upgrades.

- Data Quality and Governance: AI techniques are employed to clean, standardize, and validate the massive data lakes generated by IoT sensors, ensuring data integrity for safety-critical applications.

- Environmental Monitoring: AI analyzes data related to noise, vibration, and emissions, enabling operators to maintain strict regulatory compliance and improve public relations.

- Speech Recognition for Control Rooms: AI facilitates voice commands and automatic transcription in control centers, improving dispatcher efficiency and communication accuracy during critical events.

DRO & Impact Forces Of Rail Market

The Rail Market is shaped by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which collectively exert substantial Impact Forces on its trajectory. Key drivers include aggressive government spending on public transportation and high-speed rail development, especially in response to climate change mitigation strategies, and the pressing need for reliable, cost-effective freight solutions amid increasing global trade. However, the sector is restrained by extraordinarily high capital expenditures required for infrastructure projects, lengthy regulatory approval processes, and the significant challenge of integrating diverse legacy systems across different national networks. These dynamic forces necessitate careful strategic planning by market participants, balancing large initial investments with the promise of long-term stability and high passenger/freight throughput.

Opportunities in the market center around technological disruption and geographical expansion. The proliferation of IoT, AI, and 5G technology is creating massive opportunities in the services segment, enabling sophisticated predictive maintenance contracts and the monetization of operational data. Geographically, emerging economies in Africa and Latin America, facing rapid urbanization and deficient existing transport networks, represent substantial untapped markets for new rail construction and system development. Furthermore, the global push towards hydrogen and battery-electric trains offers a major chance for rolling stock manufacturers to lead the transition away from fossil fuels, securing long-term competitive advantage through sustainable innovation that meets stringent environmental targets.

The overall impact forces are accelerating the market's evolution towards a digital, interconnected, and sustainable paradigm. Regulatory mandates, such as mandatory adoption of Positive Train Control (PTC) in North America and the rollout of European Train Control System (ETCS) across the EU, act as significant accelerators for technology adoption, even if they initially pose a financial restraint. The long-term impact is a higher safety standard and enhanced interoperability, fostering a larger, more unified global rail supply market. Companies that successfully navigate the complex interplay between massive upfront investment (Restraint) and guaranteed future efficiency gains via digitalization (Opportunity/Driver) will dominate the competitive landscape, shifting the industry focus from hardware provision to comprehensive mobility solutions.

- Drivers:

- Governmental Mandates for Decarbonization and Sustainable Transport Solutions.

- Increasing Global Urbanization Leading to Higher Demand for Metro and Commuter Rail Systems.

- Expansion of International Trade Driving Demand for Efficient and Reliable Freight Rail Capacity.

- Technological Advancements in Signaling (ETCS/CBTC) Improving Safety and Network Capacity.

- Favorable Public Policies and Subsidies Supporting High-Speed Rail (HSR) Corridors globally.

- Restraints:

- Extremely High Initial Capital Investment and Long Payback Periods for Infrastructure Projects.

- Complexity and Bureaucracy of Regulatory Approval and Interoperability Standards Across Borders.

- Shortage of Skilled Workforce in Digital Rail Technologies (AI, Cybersecurity, Data Analytics).

- Disruptions to Supply Chains, Particularly for Critical Microelectronics and Raw Materials.

- Competition from Alternative Transport Modes (Automated Road Freight and Low-Cost Airlines).

- Opportunities:

- Development and Commercialization of Zero-Emission Rolling Stock (Hydrogen Fuel Cell and Battery Trains).

- Rapid Adoption of IoT and 5G Enabling Real-Time Condition Monitoring and Predictive Maintenance Services.

- Modernization and Digitalization of Aging Networks in Established Markets (Europe, North America).

- Market Penetration into High-Growth Developing Economies (India, Southeast Asia, Africa) for New Construction.

- Integration of Rail into Multimodal Logistics Chains through Advanced Intermodal Terminals.

- Impact Forces:

- Interoperability Standard Convergence: Global push towards common standards (e.g., ETCS) standardizes requirements but increases initial compliance costs.

- Sustainability Imperative: Drives immediate R&D investment towards electric and hydrogen propulsion, fundamentally changing rolling stock manufacturing priorities.

- Digital Transformation Pressure: Forces system integrators to acquire or develop sophisticated AI and software capabilities to meet demand for autonomous operations.

- Geopolitical Influence: Government-backed infrastructure projects are often influenced by geopolitical alignment, impacting major global supplier market access (e.g., China's Belt and Road Initiative).

- Safety Regulation Reinforcement: Stricter global safety protocols necessitate higher investment in advanced signaling, sensors, and cybersecurity measures, increasing complexity but reducing long-term risk.

Segmentation Analysis

The Rail Market is broadly segmented based on Component, Application, and Type, providing a detailed view of market structure and growth dynamics. The component segmentation, which includes Rolling Stock, Infrastructure, and Services, reveals where investment capital is primarily flowing. Services, covering MRO (Maintenance, Repair, and Overhaul) and consulting, are increasingly important due to the long operational lifespan of rail assets and the growing sophistication of monitoring technology. Infrastructure development remains the foundational element, driven by new track laying and the installation of complex signaling and electrification systems necessary for high-speed operation.

Within the rolling stock segment, the market is differentiated by vehicle type, such as locomotives, wagons, passenger coaches, and specialized metro/tram units. The fastest growth is observed in Electric Multiple Units (EMUs) and high-performance freight wagons designed for heavy haul and intermodal transport, reflecting demographic shifts towards urban areas and the demand for efficient global logistics. The application segment clearly delineates the market into Passenger Rail (intercity, commuter, metro) and Freight Rail, each with distinct technological requirements—passenger rail prioritizes speed, comfort, and advanced connectivity, while freight rail focuses on payload capacity, durability, and operational longevity.

Strategic analysis of segmentation reveals that integrated suppliers offering solutions across rolling stock, signaling, and long-term maintenance contracts are positioned for robust growth. Furthermore, the emphasis on upgrading existing networks means that the market for rail control systems and communications-based train control (CBTC) systems for metros is experiencing significant uptake. These technology-centric segments often boast higher margins and shorter implementation cycles compared to massive, long-term infrastructure construction projects, attracting specialized technology firms into the traditional rail market ecosystem.

- By Component:

- Rolling Stock

- Locomotives (Diesel, Electric, Hybrid, Fuel Cell)

- Wagons (Freight, Tank, Hopper, Container)

- Passenger Coaches

- Electric Multiple Units (EMU)

- Diesel Multiple Units (DMU)

- Metro and Light Rail Vehicles (LRV)

- Infrastructure

- Rail Tracks and Sleepers

- Catenary and Electrification Systems

- Bridges, Tunnels, and Viaducts

- Stations and Depot Facilities

- Signaling and Control Systems

- Interlocking Systems

- Train Control Systems (ETCS, PTC, CBTC)

- Communication Systems (GSM-R, LTE-R)

- Services

- Maintenance, Repair, and Overhaul (MRO)

- Consulting and Engineering Services

- System Integration and Software Services

- By Application:

- Passenger Transit

- Urban Rail (Metro, Tram, Light Rail)

- Intercity Rail

- High-Speed Rail (HSR)

- Freight Rail

- Heavy Haul

- Intermodal Freight

- General Freight

- By Technology:

- Conventional Rail Systems

- High-Speed Rail Systems

- Maglev Technology

- By Ownership Model:

- Publicly Owned Rail Networks

- Private Freight Operators

- Public-Private Partnerships (PPP)

Value Chain Analysis For Rail Market

The Rail Market value chain is intricate, beginning with upstream suppliers of raw materials and sophisticated components and extending through manufacturing, system integration, operation, and ultimately, long-term maintenance services. The upstream analysis focuses on specialized material providers (steel, aluminum alloys, composite materials for lighter rolling stock) and high-tech component manufacturers (traction systems, power electronics, sensors, and sophisticated onboard communication systems). Due to the high safety requirements, supplier qualification processes are rigorous, leading to strong, long-term relationships between large OEMs and certified component suppliers who can guarantee reliability and traceability. Investment in advanced materials that reduce vehicle weight and improve energy efficiency is a key competitive differentiator in this phase.

Midstream activities are dominated by major global rail manufacturers and system integrators who design, assemble, and test rolling stock and complex signaling infrastructure. These players rely heavily on R&D for compliance with evolving interoperability standards and technological innovation, particularly in digitalization and autonomous capabilities. The system integration aspect, where signaling, rolling stock, and control systems must seamlessly interact, is critical and often represents the highest value-add activity. This stage involves complex engineering and project management, often executed through extensive multi-year governmental contracts.

Downstream analysis covers the deployment, operational, and maintenance phases. Distribution channels are primarily direct, involving contractual relationships between major OEMs/Integrators and government transport authorities or private rail operators. Direct sales are mandatory due to the bespoke nature and sheer scale of rail projects. Indirect channels are utilized mainly for aftermarket parts, standardized components, and specialized IT services provided by third-party maintenance contractors. The long-term service contracts (MRO) represent a stable and growing revenue stream downstream, often extending decades and incorporating advanced digital services like predictive maintenance, ensuring high asset utilization and forming a crucial link in the market's long-term profitability model.

Rail Market Potential Customers

The primary customers in the Rail Market are governmental entities, public transport authorities, and major freight rail operators, whose purchasing decisions are highly influenced by public policy, budgetary allocations, and long-term infrastructure planning mandates. National railway companies and public bodies responsible for urban transit (e.g., city metro administrations, regional transport authorities) are the largest buyers, particularly for passenger rolling stock and complex signaling infrastructure upgrades necessary to meet growing commuter demand and safety standards. These customers prioritize solutions offering lifecycle cost efficiency, regulatory compliance, and proven reliability in high-density operational environments.

A second major customer segment includes private freight rail companies, particularly prevalent in North America and parts of Europe, who purchase heavy-haul locomotives, specialized wagons, and advanced sensor technology for optimizing logistics and track management. These private operators focus intensively on efficiency, fuel consumption reduction, and minimizing operational delays, driving demand for predictive maintenance tools and data analytics platforms. Additionally, industrial end-users with captive fleets, such as mining and port operations, represent a niche customer base seeking robust, tailored rail solutions for specialized material handling.

In emerging markets, the customer landscape often includes newly established state-owned enterprises or dedicated project companies utilizing Public-Private Partnership (PPP) models for large infrastructure development. These entities require comprehensive, turnkey solutions that include financing, construction, technology transfer, and long-term operational training. The purchasing criteria for these customers are strongly influenced by favorable financing terms, proven international technology transfer capabilities, and compliance with local content requirements, driving major suppliers to form localized consortiums to secure contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $245.5 Billion |

| Market Forecast in 2033 | $387.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alstom, Siemens Mobility, CRRC Corporation Limited, Hitachi Rail, Stadler Rail AG, Wabtec Corporation, Knorr-Bremse AG, Bombardier Transportation (now Alstom), Hyundai Rotem, Mitsubishi Electric Corporation, Transmashholding, CAF Group, General Electric (GE) Transportation (now Wabtec), Vossloh AG, Škoda Transportation, Indra Sistemas, Thales Group, Toshiba Corporation, Metrans, Pesa Bydgoszcz SA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rail Market Key Technology Landscape

The technology landscape of the Rail Market is defined by digitalization, automation, and sustainability, moving away from purely mechanical systems towards highly intelligent and interconnected networks. Core technological focus areas include advanced train control systems, such as the European Train Control System (ETCS) Levels 2 and 3, which facilitate cross-border interoperability and enhance network capacity by moving signaling logic from trackside equipment onto the train. Communications-Based Train Control (CBTC) remains the dominant technology for dense urban metro systems, offering maximum headway reduction and optimizing throughput in high-traffic corridors. The integration of 5G and Long-Term Evolution for Rail (LTE-R) is essential for providing the high bandwidth and low latency required for transmitting large volumes of real-time operational data necessary for these advanced control systems and passenger connectivity services.

In rolling stock, the technological shift is centered on propulsion and lightweighting. Manufacturers are aggressively pursuing zero-emission solutions, with battery-electric multiple units (BEMUs) and hydrogen fuel cell trains (Hydrail) gaining traction as viable alternatives to diesel power on non-electrified lines, particularly in Europe and Asia Pacific. Simultaneously, the development of sophisticated sensors (IoT integration) and embedded computing within the rolling stock enables Condition-Based Monitoring (CBM) and Predictive Maintenance (PdM) capabilities. This technology transforms maintenance from reactive scheduling to proactive intervention, drastically improving asset availability and reducing total cost of ownership over the vehicle's lifespan.

Further innovation is concentrated in infrastructure monitoring and cybersecurity. Digital twin technology is increasingly employed to create virtual models of entire rail networks, allowing operators to simulate upgrades and optimize complex scheduling without impacting real-world operations. Advanced track inspection involves the use of drone technology and LiDAR systems integrated with AI analysis to detect microscopic defects and track degradation much faster than traditional methods. Given the critical nature of rail infrastructure, resilient cybersecurity measures, including intrusion detection systems specifically tailored for Operational Technology (OT) and interlocking systems, are becoming non-negotiable requirements for all new technology deployments, ensuring network stability against evolving cyber threats.

- European Train Control System (ETCS): Standardized signaling and train control system promoting interoperability across European railways, with ongoing deployment of Level 3 for enhanced capacity.

- Communications-Based Train Control (CBTC): High-capacity train control system optimized for metro lines, utilizing continuous, two-way digital communication.

- Positive Train Control (PTC): Mandatory safety overlay system in North America designed to prevent train-to-train collisions and over-speed derailments.

- Internet of Things (IoT) and Sensors: Integration of thousands of sensors across rolling stock and infrastructure for real-time data acquisition regarding vibration, temperature, and component stress.

- Predictive Maintenance (PdM): AI/ML applications analyzing sensor data to forecast equipment failure, optimizing maintenance windows and minimizing service disruption.

- Hydrogen Fuel Cell Trains (Hydrail): Zero-emission propulsion technology utilizing hydrogen fuel cells, primarily targeting non-electrified regional lines.

- Battery Electric Multiple Units (BEMU): Battery-powered trains for regional routes, utilizing regenerative braking and fast-charging capabilities.

- Long-Term Evolution for Rail (LTE-R) / 5G: Next-generation communication infrastructure providing high-speed data transmission essential for ATO and real-time data analytics.

- Autonomous Train Operation (ATO): Technology enabling driverless operation (GoA 3 and GoA 4), increasing capacity and operational flexibility, especially in metro environments.

- Digital Twin Technology: Creation of high-fidelity virtual replicas of rail assets and networks for simulation, testing, and proactive performance management.

- Advanced Materials: Use of carbon fiber, composite alloys, and high-strength steels to reduce rolling stock weight, enhancing energy efficiency and durability.

- Cybersecurity Solutions: Specialized intrusion detection and network segmentation protocols designed to protect safety-critical Operational Technology (OT) systems from malicious attacks.

- Dynamic Ticketing and Passenger Information Systems: Real-time platforms utilizing AI to manage passenger flow, provide accurate delay information, and optimize fare structures.

- Smart Infrastructure Monitoring: Deployment of drones, LiDAR, and automated geometry cars for high-speed, non-intrusive inspection of track and overhead lines.

- Regenerative Braking Systems: Technology converting kinetic energy during braking into electrical energy to be fed back into the grid or stored in onboard batteries, improving overall energy consumption.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Rail Market, driven by disparate levels of economic development, regulatory frameworks, and infrastructure maturity. Asia Pacific (APAC) currently dominates the market, primarily due to relentless investment in new high-speed lines and extensive urban metro projects, particularly in China and India. China possesses the world's largest high-speed network, and its ongoing infrastructure programs continue to fuel demand for rolling stock and advanced signaling systems. India, conversely, is a high-potential market characterized by massive metro expansion and the modernization of its legacy main line network. The APAC region focuses heavily on volume manufacturing and rapid deployment.

Europe represents a highly mature but technologically advanced market, distinguished by its focus on modernization, interoperability, and sustainability. The European Union mandates the adoption of ETCS across national boundaries, which drives significant investment in digital signaling systems and onboard equipment retrofitting. Furthermore, Europe is leading the transition toward zero-emission trains, with countries like Germany, Austria, and the UK pioneering the deployment of hydrogen and battery technologies. The key emphasis here is not merely growth in track length, but technological sophistication and standardization across the continent, facilitating seamless cross-border freight and passenger movement.

North America's market is primarily defined by the robust private freight sector and ongoing regulatory compliance requirements. The completion and operational integration of Positive Train Control (PTC) systems represented a massive, multi-year investment phase. Future growth is tied to optimizing heavy-haul efficiency, implementing advanced telemetry and track monitoring for long-distance freight, and targeted development of commuter rail and specific high-speed passenger corridors (e.g., California, Texas). Latin America and the Middle East & Africa (MEA) are emerging regions, where rail development is highly localized, often linked to resource extraction projects (MEA) or massive urban sprawl (Brazil, Gulf States), offering high growth potential for specific, bespoke projects, frequently financed through international development banks or state sovereign wealth funds.

- Asia Pacific (APAC): Market leader driven by large-scale infrastructure projects (China's HSR, India's Metro expansions), strong domestic manufacturing capabilities, and rapid urbanization demanding urban rail solutions.

- Europe: Focuses on digital transformation, interoperability (ETCS rollout), and sustainability (leading in hydrogen/battery trains). High demand for retrofit and MRO services for aging assets.

- North America: Dominated by the sophisticated freight rail sector; growth driven by efficiency optimization, implementation of PTC, and moderate public investment in commuter and high-speed passenger lines.

- China: Center of global rolling stock production and the largest consumer of HSR technology and infrastructure development worldwide.

- India: Experiencing explosive growth in urban mobility projects (metro networks) and undertaking massive modernization of its passenger and freight core networks.

- Germany: Key R&D hub for digital rail, signaling technology, and pioneering the commercial application of fuel cell trains.

- United Kingdom: Significant investment in infrastructure upgrades, including High Speed 2 (HS2), and major signaling modernization projects.

- Middle East: Emerging market characterized by large, capital-intensive prestige projects (e.g., Saudi Arabia, UAE) connecting major economic hubs and ports.

- Latin America: Growth concentrated in urban centers (e.g., São Paulo, Mexico City) and select industrial corridors requiring heavy-haul freight transport solutions.

- Japan and South Korea: Highly mature markets focusing on continuous innovation in high-speed rail safety, comfort, and advanced maglev technology R&D.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rail Market.- Alstom

- Siemens Mobility

- CRRC Corporation Limited

- Hitachi Rail

- Wabtec Corporation

- Stadler Rail AG

- Knorr-Bremse AG

- Hyundai Rotem

- Mitsubishi Electric Corporation

- Thales Group

- CAF Group

- Vossloh AG

- Bombardier Transportation (Integrated into Alstom)

- General Electric (GE) Transportation (Integrated into Wabtec)

- Transmashholding

- Škoda Transportation

- Indra Sistemas

- Toshiba Corporation

- Pesa Bydgoszcz SA

- L&T Technology Services

Frequently Asked Questions

Analyze common user questions about the Rail market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the transition towards zero-emission rolling stock in the Rail Market?

The primary driver is stringent global governmental regulation aimed at achieving net-zero carbon targets, especially in the EU and leading Asian economies. This regulatory pressure, coupled with public demand for quieter and cleaner transport, mandates the adoption of alternative propulsion technologies like hydrogen fuel cells and high-capacity battery-electric units, reducing reliance on traditional diesel locomotives across non-electrified routes.

How significant is the role of digitalization in maximizing rail network capacity and safety?

Digitalization is profoundly significant; it allows operators to manage more trains on existing lines safely. Technologies such as ETCS Level 3 and CBTC enable dynamic block systems, moving signaling intelligence from the track to the train, thereby reducing the minimum separation distance (headway) between trains and increasing overall network throughput capacity by up to 40%. Digitalization is central to enhancing both capacity optimization and operational safety through autonomous monitoring.

Which geographical segment offers the highest potential for new rail infrastructure development?

Asia Pacific (APAC), specifically India, Southeast Asia (Vietnam, Indonesia), and ongoing urbanization projects in China, offers the highest potential for new infrastructure development. These regions require vast investments in urban metro systems and high-speed connections to support massive demographic shifts and economic growth, contrasting with the mature markets of Europe and North America which focus more heavily on modernization and service upgrades.

What are the key challenges associated with implementing Positive Train Control (PTC) and similar advanced signaling systems?

The key challenges include the immense capital expenditure required for installing complex onboard and trackside hardware, ensuring seamless technical interoperability across diverse legacy fleet types, and navigating the lengthy regulatory certification process. Furthermore, the integration of these proprietary safety systems into existing, non-standardized communication networks often poses significant logistical and technical hurdles, requiring extensive system integration expertise.

How does the shift toward predictive maintenance impact the Rail Market service segment?

The shift to predictive maintenance (PdM), powered by AI and IoT, fundamentally transforms the service segment by moving contracts from time-based scheduling to condition-based management. This necessitates higher investment in sensor technology and data analytics platforms, but it offers rail operators guaranteed uptime and reduced life-cycle costs. The service segment therefore becomes highly technology-intensive, generating high-margin recurring revenue for OEMs and specialized software providers who offer long-term MRO and data-as-a-service contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Commuter Rail and Public Bus Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hiking & Trail Footwear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Household Kitchen Rail Kits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Crane rail Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- DIN Rail Power Supply Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager