Spirits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432271 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Spirits Market Size

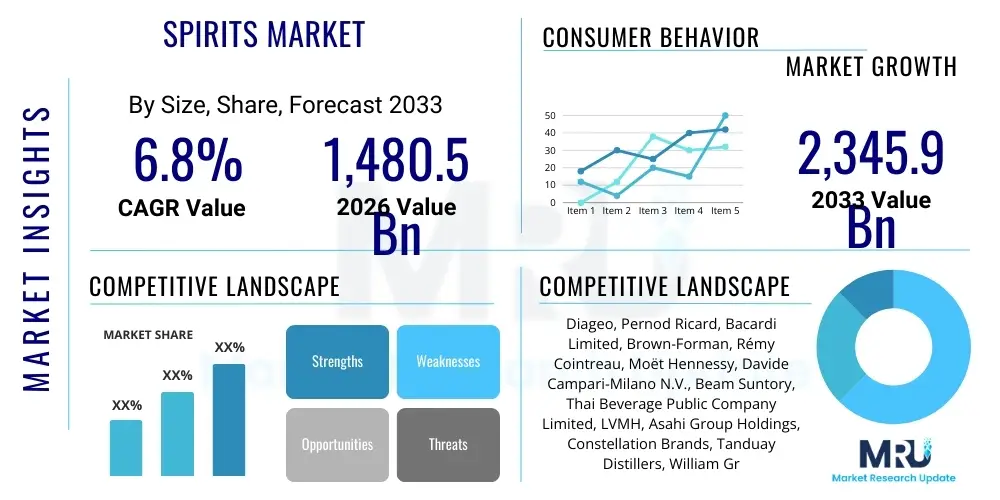

The Spirits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1,480.5 Billion in 2026 and is projected to reach $2,345.9 Billion by the end of the forecast period in 2033.

Spirits Market introduction

The global spirits market encompasses the production, distribution, and sale of alcoholic beverages typically containing 20% or more alcohol by volume (ABV), derived through distillation processes. Key product categories include whiskey, vodka, gin, rum, tequila, and brandy, each reflecting distinct cultural origins, production methods, and flavor profiles. The market is characterized by intense competition, driven by heritage brands, emerging craft distillers, and continuous product innovation focusing on premiumization, flavored variants, and ready-to-drink (RTD) cocktails. Consumer demand is increasingly shifting towards high-quality, authentic, and sustainably produced spirits, influencing supply chain practices and marketing strategies globally. Geographically, mature markets in North America and Europe continue to drive value growth through premium categories, while the Asia Pacific region, particularly China and India, represents the largest volume opportunities due to rising disposable incomes and changing consumption patterns among younger demographics.

Major applications for spirits include social consumption, celebratory events, culinary uses, and the burgeoning mixology industry, which elevates the perceived value of sophisticated spirit bases. The industry is heavily regulated, requiring companies to navigate complex taxation, licensing, and advertising laws across different jurisdictions. A primary benefit of this market is its high profitability potential, especially within the luxury and ultra-premium segments, which command superior margins. Furthermore, the spirits market acts as a significant economic driver, supporting agriculture (grains, fruits), manufacturing, hospitality, and retail sectors worldwide. Innovation in packaging, particularly lighter and more sustainable materials, is also becoming a crucial factor for maintaining competitive advantage and meeting consumer expectations regarding environmental responsibility.

Driving factors propelling market growth include rapid urbanization, increasing global disposable incomes, particularly across developing economies, and the widespread trend of ‘premiumization,’ where consumers opt for higher-priced, high-quality offerings. The normalization of moderate alcohol consumption as a lifestyle choice, coupled with sophisticated marketing campaigns that link spirits to aspirational experiences, further stimulates demand. Furthermore, the expansion of e-commerce and direct-to-consumer (DTC) channels has dramatically increased accessibility and convenience, especially for niche and craft spirits, allowing smaller brands to compete effectively outside traditional retail environments. Health and wellness trends, paradoxically, are also driving the growth of high-end spirits, as consumers often seek quality over quantity, preferring to savor fewer, higher-proof, and better-crafted drinks.

Spirits Market Executive Summary

The spirits market is undergoing a fundamental transformation, dominated by the relentless pursuit of premiumization and the integration of digital commerce. Business trends show major multinational corporations consolidating their portfolios by acquiring specialized craft distilleries, particularly those focused on categories like high-end tequila and American whiskey, to capitalize on localized authenticity and niche consumer segments. Sustainability and ethical sourcing have transitioned from optional considerations to critical strategic imperatives, influencing investor relations and consumer preference. Key operational shifts include optimizing global supply chains to mitigate geopolitical risks and inflation, and leveraging data analytics to refine targeted marketing and inventory management, ensuring that product availability matches highly fluctuating regional demand patterns. Furthermore, the growth of ready-to-drink (RTD) cocktails based on premium spirits is blurring the lines between traditional spirits and convenient packaged beverages, attracting new, younger consumer bases.

Regionally, North America remains the epicenter for innovation and value growth, largely driven by the boom in Tequila/Mezcal and American Whiskey (Bourbon and Rye), supported by robust on-trade recovery and mature e-commerce infrastructure. Europe demonstrates stable but nuanced growth, with strong performance in gin and traditional brown spirits, balanced by consumer demand for lower-ABV alternatives and locally sourced products. The Asia Pacific region is the primary engine for volume expansion, with China stabilizing its premium consumption and India emerging as a major focus due to its expanding middle class and increasing acceptance of Western spirit categories. Conversely, Latin America presents strong localized growth, particularly in Tequila and Cachaça, though economic volatility remains a constraint that often favors accessible pricing points over ultra-premium segments.

Segment trends highlight the exceptional performance of the Tequila category, which has outperformed nearly all other spirit types due to its versatility in cocktails and association with premium lifestyles. Within distribution channels, the shift towards Off-Trade (retail sales) and E-commerce, accelerated during the recent global disruption, is becoming normalized, forcing On-Trade establishments (bars, restaurants) to focus heavily on unique experiences and sophisticated offerings to retain market share. Furthermore, while glass bottles dominate, the rise of smaller, convenient packaging formats (like premium cans for RTDs) is revolutionizing consumption occasions. The demand for clear spirits remains strong, driven by the mixing culture, while the brown spirits segment is primarily fueled by collectors and connoisseurs focusing on aged and limited-edition releases, pushing average selling prices dramatically upwards across all key markets.

AI Impact Analysis on Spirits Market

Common user questions regarding AI's influence in the spirits market center on three primary themes: how AI can enhance the consumer experience, optimize complex supply chain logistics (from grain to glass), and accelerate product innovation. Users are keen to understand if AI can personalize spirit recommendations, predict flavor trends before they peak, and ultimately create entirely new spirit profiles tailored to hyper-localized tastes. Concerns often revolve around data privacy when utilizing consumer preference data and the potential reduction in the 'craftsmanship' perception if processes become overly automated. The overall expectation is that AI will drive efficiency, reduce waste, and provide deep predictive insights into shifting global consumption patterns, enabling distillers to manage inventory and production schedules with unprecedented accuracy, leading to superior responsiveness and customized product launches.

The integration of Artificial Intelligence is moving beyond basic data analytics into core operational and creative processes within the spirits industry. AI algorithms are being employed to analyze vast datasets of consumer reviews, sensory evaluation scores, and demographic purchasing habits to identify emerging flavor combinations and market white spaces. This allows distillers to shorten R&D cycles and develop successful new product variations, such as novel flavored vodkas or complex botanical gins, with higher confidence in commercial success. Additionally, in distillation, machine learning models are being used to monitor and optimize critical parameters like temperature, pressure, and flow rates in real-time, ensuring consistency in batch quality and maximizing yield, especially important in large-scale, high-volume production facilities. These systems learn from past successful batches, enabling precise replication of desired organoleptic properties.

Furthermore, AI is transforming the sales and marketing landscape. Virtual assistants and recommendation engines powered by AI are being deployed on e-commerce platforms and in retail environments to guide consumer choices based on past purchases, preferred cocktail ingredients, and price sensitivity. This personalization enhances the shopping experience and boosts conversion rates. On the supply chain front, predictive maintenance schedules for aging equipment, optimized routing for global distribution networks, and advanced demand forecasting that accounts for seasonality and localized events are all being handled by sophisticated AI systems. This operational efficiency is critical for managing high-value, slow-moving inventory like aged whiskey stocks, minimizing stockouts while preventing overproduction.

- AI-driven flavor profiling and new product development acceleration.

- Optimization of distillation parameters for enhanced batch consistency and yield efficiency.

- Predictive demand forecasting to minimize inventory holding costs for high-value aged stocks.

- Personalized e-commerce recommendations and virtual sommelier services for enhanced customer experience.

- Automated quality control and real-time defect detection during bottling and packaging.

- Supply chain optimization, including route planning and predictive maintenance scheduling.

DRO & Impact Forces Of Spirits Market

The dynamics of the Spirits Market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces influencing long-term strategic decisions. The dominant driver is the global consumer shift towards premium and super-premium products, reflecting rising discretionary income and a focus on quality over quantity. This premiumization trend allows brands to capture higher margins despite potentially stagnant volume growth in mature markets. Coupled with this is the robust expansion of digital channels, making specialized spirits more accessible to niche global consumers. However, regulatory constraints, high excise duties, and increasingly complex taxation structures across international borders act as significant restraints, often contributing to illicit trade and increasing the final consumer price point, especially in emerging economies. Health consciousness, including the rise of the ‘Sober Curious’ movement and preference for low- and no-alcohol alternatives, also poses a structural restraint on overall volume growth for high-ABV products.

Opportunities for market expansion are abundant, particularly in geographical diversification and category innovation. The rapid growth of localized spirit categories (e.g., Mezcal, specialized Rums) outside their traditional regions presents immense growth potential. Furthermore, continuous innovation in the Ready-to-Drink (RTD) cocktail segment, utilizing premium spirit bases, taps into consumer demand for convenience without compromising quality. The ongoing focus on sustainability, ethical sourcing, and transparency in production (e.g., farm-to-bottle tracking) offers a powerful opportunity for brands to differentiate themselves and build trust, particularly with Millennial and Gen Z consumers who prioritize ethical consumption. These opportunities require substantial investment in sustainable infrastructure and transparent communication practices, transforming operational costs into long-term strategic advantages.

These individual components combine to create powerful impact forces that reshape market competition. The 'Premiumization Force' forces legacy brands to innovate and refresh their marketing to justify higher price points, while simultaneously encouraging craft distillers to maintain authenticity and small-batch quality. The 'Regulatory Compliance Force' places a heavy burden on international trade, necessitating sophisticated legal and logistical frameworks for global players. Finally, the 'Digital Integration Force' fundamentally alters the route-to-market strategy, forcing traditional distributors and on-premise venues to partner with e-commerce platforms or develop robust direct-to-consumer strategies to capture the increasing volume of online transactions. Successfully navigating these forces requires agile strategies focused on innovation, transparency, and targeted digital engagement.

Segmentation Analysis

The global spirits market is segmented across multiple dimensions to reflect diverse consumer preferences, distribution methods, and product characteristics. Key segmentation revolves around the type of spirit (e.g., whiskey, vodka, tequila), which dictates production cycles, raw materials, and pricing tiers. Further crucial segmentation occurs by distribution channel, differentiating between the traditional On-Trade (bars, restaurants) and Off-Trade (retail, supermarkets), with the rapidly growing E-commerce channel requiring distinct strategies. Understanding these segments is vital for producers aiming to tailor their marketing, packaging, and pricing to maximize penetration in specific consumer groups or geographical areas. The increasing demand for customization has also led to sub-segmentation based on flavor profile, age statement, and production origin, particularly within highly regulated categories like Scotch and Bourbon.

The primary segments, such as Vodka and Whiskey, tend to dominate volume, while high-growth segments like Tequila and Gin drive significant value increase globally. Vodka, being versatile and culturally agnostic, maintains broad appeal across all demographics, often leading volume sales, but faces intense competition and margin pressure at the standard level. Conversely, the growth in Tequila is underpinned by its cultural cachet, suitability for mixology, and success in securing ultra-premium status, especially in North America. Distribution analysis shows that while Off-Trade captures the majority of consumption volume globally, On-Trade environments remain critical for brand visibility, education, and initiating consumer trials of new or premium expressions. The ability to manage these channels synergistically is essential for market leaders.

- Product Type:

- Whiskey (Scotch, Irish, American, Canadian, Japanese, Others)

- Vodka (Standard, Premium, Flavored)

- Rum (Light, Dark, Spiced, Premium Aged)

- Gin (London Dry, Old Tom, New Western, Flavored)

- Tequila and Mezcal (Blanco, Reposado, Añejo, Extra Añejo)

- Brandy (Cognac, Armagnac, Pisco, Calvados)

- Liqueurs and Cordials

- Other Spirits (Soju, Baijiu, Cachaça)

- Distribution Channel:

- On-Trade (Bars, Restaurants, Hotels)

- Off-Trade (Supermarkets, Hypermarkets, Liquor Stores)

- E-commerce/Online Retail

- Price Category:

- Standard

- Premium

- Super-Premium

- Ultra-Premium/Luxury

- Packaging:

- Glass Bottles

- Cans (For RTDs)

- Other Packaging

Value Chain Analysis For Spirits Market

The spirits market value chain is extensive and begins with upstream activities involving the sourcing of agricultural raw materials—grains (barley, rye, corn), sugarcane, or fruits—depending on the spirit type. Upstream analysis focuses heavily on secure, sustainable, and high-quality sourcing, as the quality of the base ingredient dictates the final spirit character, particularly for categories like single malt whisky or fine tequila. Key considerations at this stage include climate risk management, contracting with farmers, ensuring fair trade practices, and the energy efficiency of the initial fermentation process. Major distillers invest significantly in vertical integration or long-term partnerships to control quality and cost, especially for rare or unique materials like specific yeast strains or heritage barley varieties. Efficient management of this phase is crucial because ingredients like agave or specific oak types for aging barrels can take years to mature, introducing considerable inventory management challenges.

The core of the value chain involves the manufacturing processes: distillation, blending, and crucially, aging (for brown spirits). Distillation technologies vary widely, from traditional pot stills utilized by craft producers to continuous column stills used by high-volume vodka manufacturers. Efficiency in energy consumption during distillation is a growing strategic focus due to high operating costs and sustainability targets. Following distillation, blending expertise—the art of mixing different batches or ages to achieve brand consistency—is a proprietary and highly protected asset for global leaders. Distribution, spanning both direct and indirect models, is arguably the most complex segment, requiring vast global warehousing networks, adherence to diverse international customs and excise duties, and sophisticated logistical tracking to prevent counterfeiting and parallel imports, which severely erode brand equity and revenue.

Downstream activities center on distribution channels (On-Trade, Off-Trade, E-commerce) and marketing/sales. Direct channels, while resource-intensive, offer maximum control over branding and pricing, particularly for ultra-premium products sold in flagship stores or directly online. Indirect channels rely on established distributors and wholesalers who navigate complex regional regulations and provide access to vast networks of retailers and hospitality venues. The rise of e-commerce has dramatically altered the downstream landscape, creating a shorter route between the producer and the consumer, allowing for personalized marketing and quick adaptation to sales trends. Marketing investment is critical, often focusing on experiential elements, luxury sponsorships, and digital campaigns tailored to specific demographics, reinforcing the aspirational image associated with high-end spirits.

Spirits Market Potential Customers

The potential customer base for the Spirits Market is highly diversified, ranging from casual consumers seeking affordable, versatile options for mixing, to affluent collectors and connoisseurs prioritizing rarity, heritage, and aging credentials. End-users can be broadly categorized into hospitality providers (bars, restaurants, clubs), retail consumers (buying for home consumption or gifting), and industrial users (e.g., manufacturers of alcoholic confectionery or flavorings). The primary target demographic is the rapidly expanding global middle class, particularly in emerging economies of Asia Pacific and Latin America, who are increasingly adopting Western consumption habits and have growing disposable income to spend on quality leisure products. Within mature markets, the focus shifts to the younger generation (Gen Z and Millennials) who drive demand for low-ABV options, innovative flavors, and spirits with strong sustainability narratives.

For high-end and ultra-premium spirits, the target customers are typically high-net-worth individuals and established collectors. These buyers are driven by status, investment potential, and the desire for unique, limited-edition releases. Producers target this segment through exclusive private tastings, partnerships with luxury brands, and specialized auction houses. Conversely, standard and core spirit brands target the broad demographic of adult consumers globally, prioritizing accessibility, value, and familiarity. This segmentation demands highly differentiated product development and marketing strategies—a focus on tradition and exclusivity for premium segments, versus consistency and competitive pricing for volume categories.

The key buyers are increasingly digitally engaged, utilizing online platforms not just for purchasing but also for education, review aggregation, and seeking cocktail recipes. This necessitates a strong digital footprint and engagement strategy for distillers. Businesses in the hospitality sector (On-Trade) remain vital potential customers, as they influence consumption trends and brand perception through menu curation and expert recommendations. Therefore, distillers invest heavily in trade marketing, bartender education, and establishing robust relationships with key opinion leaders within the hospitality industry to secure preferential placement and drive consumer awareness at the point of consumption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,480.5 Billion |

| Market Forecast in 2033 | $2,345.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diageo, Pernod Ricard, Bacardi Limited, Brown-Forman, Rémy Cointreau, Moët Hennessy, Davide Campari-Milano N.V., Beam Suntory, Thai Beverage Public Company Limited, LVMH, Asahi Group Holdings, Constellation Brands, Tanduay Distillers, William Grant & Sons, Belvedere Group, Mast-Jägermeister, Sazerac Company, Patrón Spirits International AG, Heaven Hill Brands, Gruppo Montenegro |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spirits Market Key Technology Landscape

The spirits market is increasingly relying on technological advancements to enhance efficiency, quality control, and consumer engagement. One critical area is the adoption of advanced sensor technology and Industrial Internet of Things (IIoT) devices within distilleries. These technologies enable real-time monitoring of critical processes, such as fermentation temperature, spirit proofing, and cask maturation environment, moving far beyond traditional manual checks. This data connectivity ensures precise control over flavor profiles, crucial for maintaining consistency across global production sites. Furthermore, advanced filtration and purification systems, often utilizing reverse osmosis or specialized carbon beds, are continuously being refined to meet the high standards required for clear spirits like premium vodka and gin, ensuring the removal of trace contaminants while preserving desirable organoleptic characteristics.

Another major technological area is supply chain management and consumer transparency. Blockchain technology is emerging as a powerful tool for provenance tracking, particularly for high-value aged spirits susceptible to counterfeiting. By logging the entire journey—from the harvest of raw materials to the final sale—on an immutable ledger, brands can provide consumers with verifiable proof of authenticity, thereby protecting brand equity and justifying premium pricing. Simultaneously, consumer-facing technologies such as Augmented Reality (AR) and Near Field Communication (NFC) chips embedded in bottle labels are transforming packaging into an interactive marketing tool. Consumers can scan bottles to access cocktail recipes, historical brand information, or personalized tasting notes, deepening engagement and brand loyalty directly at the point of sale.

In the retail and e-commerce space, data science and AI-driven platforms are the foundational technologies. Advanced recommendation engines utilize complex algorithms to analyze large volumes of consumer data, predicting purchasing behavior and optimizing inventory placement geographically. Automated warehousing and robotic solutions are streamlining logistics within large distribution centers, improving picking accuracy and reducing labor costs associated with high-volume handling. Crucially, the move towards sustainable manufacturing is heavily technology-dependent; sophisticated wastewater treatment facilities, heat recapture systems during distillation, and the use of biofuels derived from production waste are becoming standard practices, driven by engineering innovation aimed at achieving net-zero emissions targets.

Regional Highlights

The spirits market exhibits profound regional heterogeneity, dictated by cultural traditions, regulatory environments, and economic development stages. North America, encompassing the United States and Canada, stands out as the global leader in value creation and trendsetting innovation. The region is characterized by high consumption of premium American Whiskey (Bourbon, Rye) and a relentless thirst for Tequila and Mezcal. E-commerce penetration and direct-to-consumer sales are highly developed, allowing rapid market access for new craft brands. Regulatory structures, while complex at the state level in the US, generally support robust competition and premium category development. High discretionary income and a strong cocktail culture ensure that this region drives global pricing trends in the luxury segment.

Europe represents a mature and diverse market, anchored by established traditions in categories like Scotch Whisky, Cognac, Gin, and Vodka. Western European countries are experiencing dual trends: sustained growth in high-end categories (driven by gifting and connoisseurship) alongside rising demand for low- and no-alcohol alternatives, reflecting proactive health management. Central and Eastern Europe remain significant volume markets, particularly for local vodkas and lower-priced brandies. Regulatory alignment within the European Union streamlines distribution but imposes stringent standards on appellation and production methods, safeguarding regional specialties like Champagne and Scotch.

Asia Pacific (APAC) is universally recognized as the future growth engine for volume and increasingly, value. This region, particularly led by China, India, and Southeast Asian nations, benefits from rapid urbanization, a growing youth population adopting Western habits, and increasing disposable income. While indigenous spirits like Baijiu and Soju dominate local consumption, imported categories like Scotch Whisky and Cognac serve as powerful status symbols, driving substantial value growth in the luxury sector. India, in particular, represents a massive volume opportunity due to its sheer population size and the ongoing shift from traditional beer/wine to high-proof spirits, although high tariffs often constrain the pricing of imported premium products.

Latin America (LATAM) and the Middle East and Africa (MEA) present contrasting market dynamics. LATAM is characterized by strong regional spirit consumption (Tequila in Mexico, Cachaça in Brazil, Pisco in Peru/Chile) and high loyalty to local brands. Economic volatility across several major LATAM economies often makes volume sensitive to price changes, though high-end consumption persists among affluent groups. The MEA region is fragmented, with strict regulatory constraints on alcohol sales in many Middle Eastern and North African countries limiting market access. However, South Africa and key urban centers in the UAE and Nigeria show robust growth in imported whiskey and vodka, largely driven by expatriate populations and growing local premiumization trends in permissible markets.

- North America (NA): Dominant in premiumization; driven by Tequila, American Whiskey, and robust e-commerce channels.

- Europe: Mature market focusing on authenticity (Scotch, Cognac, Gin) and balancing growth with strong demand for low/no-alcohol alternatives.

- Asia Pacific (APAC): Leading global volume growth; significant value driven by imported luxury spirits (Whiskey, Cognac) acting as status symbols in China and India.

- Latin America (LATAM): Strong localization of traditional spirits (Tequila, Cachaça); growth sensitive to economic stability but with high potential for regional exports.

- Middle East and Africa (MEA): Highly regulated market structure; growth concentrated in South Africa and key metropolitan hubs due to expatriate demand and tourism.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spirits Market.- Diageo

- Pernod Ricard

- Bacardi Limited

- Brown-Forman

- Rémy Cointreau

- Moët Hennessy

- Davide Campari-Milano N.V.

- Beam Suntory

- Thai Beverage Public Company Limited

- LVMH

- Asahi Group Holdings

- Constellation Brands

- Tanduay Distillers

- William Grant & Sons

- Belvedere Group

- Mast-Jägermeister

- Sazerac Company

- Patrón Spirits International AG

- Heaven Hill Brands

- Gruppo Montenegro

Frequently Asked Questions

Analyze common user questions about the Spirits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth in the global spirits market?

The primary driver is the widespread trend of premiumization, where consumers globally are trading up, preferring to purchase fewer quantities of higher-priced, high-quality, and authentic spirits across categories like Tequila, American Whiskey, and premium Gin.

How is e-commerce affecting the distribution of spirits?

E-commerce is profoundly transforming spirits distribution by offering increased accessibility, personalized shopping experiences, and direct-to-consumer opportunities, particularly boosting the market reach of niche craft distillers and facilitating the rapid adoption of RTD cocktails.

Which spirit category is experiencing the fastest growth in terms of market value?

The Tequila and Mezcal category is currently experiencing the fastest growth in market value, driven by strong demand in North America, its versatility in mixology, and successful marketing that positions it firmly within the super-premium and luxury segments.

What role does sustainability play in the spirits production process?

Sustainability is a critical strategic focus, involving initiatives such as reducing water usage, implementing circular economy practices (using production waste for biofuel), securing sustainable raw material sourcing, and adopting lightweight or recycled packaging to appeal to environmentally conscious consumers.

What are the major challenges facing the global spirits market?

Major challenges include navigating complex and often high excise taxes and regulatory hurdles across international jurisdictions, managing supply chain volatility, and adapting to the growing consumer preference for low- and no-alcohol beverage alternatives.

The demand for distilled spirits continues to demonstrate resilience and growth, underpinned by a global shift towards luxury consumption and experiential spending. Understanding the intricacies of regional consumer preferences is paramount for market participants seeking sustainable growth. The Asia Pacific region, despite its regulatory complexities, remains the most vital geographical target for long-term volume expansion, fueled by massive demographic changes and economic ascendancy. However, the profitability hinges significantly on performance in established markets like the US, where premium pricing justifies ongoing investment in brand building and innovation. Technological adoption, specifically the implementation of AI and blockchain, is no longer a competitive advantage but a foundational requirement for optimizing operations and ensuring brand integrity in a highly competitive digital landscape. Manufacturers must prioritize agility in their supply chains to manage the increasing complexity associated with specialized ingredients and prolonged aging requirements typical of premium brown spirits.

The structural evolution of distribution, heavily influenced by the permanence of e-commerce, necessitates integrated strategies that seamlessly connect online retail with traditional on-trade and off-trade channels. Consumers now expect consistent brand messaging and product availability across all touchpoints. Furthermore, regulatory alignment remains a critical, ongoing challenge; differing tax structures and advertising restrictions frequently constrain global market penetration, demanding tailored compliance strategies for every target country. The industry is also seeing a bifurcation in consumer choice: a move towards high-end, high-ABV craft products contrasting sharply with the rising acceptance of low and zero-ABV alternatives. Successful market players are those who manage to address both ends of this spectrum, offering portfolio diversity that captures the evolving definition of 'responsible indulgence.'

Innovation in packaging, particularly driven by sustainability mandates, is expected to accelerate, moving beyond traditional glass bottles to explore lighter, recyclable materials and format diversity, notably in the booming Ready-to-Drink (RTD) category. This category itself is instrumental in recruiting new, younger consumers who prioritize convenience and lower commitment. The financial health of the sector is robust, with high margins in premium segments offsetting slower volume growth in standard categories. Strategic mergers and acquisitions remain a defining feature of the competitive landscape, as large players continue to secure successful craft and regional brands to instantly gain authenticity and access to niche customer bases, thus consolidating control over the most profitable high-growth segments, such as artisanal Tequila and small-batch Gin. The intersection of verifiable provenance via technology and transparent corporate social responsibility reporting will define the ethical premiumization narrative for the next decade.

Looking forward, the spirits market must actively manage consumer health trends. While premiumization implies less frequent but higher quality consumption, the industry must proactively invest in research and development for appealing no-alcohol alternatives that mirror the sophistication of their full-strength counterparts. This strategic move is vital for future-proofing portfolios against evolving public health concerns. The competitive intensity among the top key players remains extremely high, demanding continuous differentiation through unique limited editions, personalized product offerings, and compelling brand storytelling rooted in heritage and craftsmanship. Investment in human capital—specifically, retaining expert blenders, master distillers, and flavor scientists—is crucial, as their proprietary knowledge remains the core differentiator in creating exceptional and consistent spirit quality. The report underscores that growth in this market is not solely about volume; it is fundamentally about driving value through perceived quality and consumer connection.

Specific regional dynamics, such as the rising affluence in markets like India, necessitate significant infrastructure investment to facilitate efficient distribution and prevent leakage in the supply chain. For multinational companies, navigating local protectionist policies and ensuring brand integrity in environments susceptible to counterfeit products require advanced security features, often integrated directly into the packaging via specialized printing or smart labels. The influence of global tourism and the hospitality sector cannot be overstated; the recovery of on-trade consumption post-pandemic is directly contributing to the premiumization trend, as consumers are willing to spend more on high-end cocktails and experiences in bars and restaurants. This reliance on the hospitality channel mandates strong partnership programs between distillers and major hotel and restaurant groups globally.

The future technology landscape will see increased deployment of robotic quality assurance systems capable of inspecting bottles and labels at speeds far exceeding human capability, ensuring flawless presentation, which is critical for luxury goods. Furthermore, digital marketing expenditure is shifting heavily towards micro-targeting on social media platforms, utilizing sophisticated demographic data to deliver age-appropriate and location-specific advertisements, thereby maximizing compliance with strict alcohol marketing regulations. The interplay between traditional craftsmanship and cutting-edge data analytics is setting the new industry standard, allowing brands to honor their heritage while simultaneously embracing precision marketing and operational efficiency. Ultimately, long-term success requires a holistic strategy that intertwines flavor innovation, digital superiority, ethical sourcing, and strategic regulatory compliance.

The spirits market's trajectory is deeply interwoven with global macroeconomic health. Economic stability enhances consumer confidence, directly translating into higher spending on premium spirits and luxury items. Conversely, economic downturns tend to drive consumers toward value brands or delay discretionary purchases of ultra-premium collectibles. This cyclical sensitivity requires companies to maintain flexible production capabilities and diverse product tiers. Geopolitical stability also impacts key inputs; for example, trade tariffs or disruptions in the supply of oak barrels (critical for whiskey and cognac aging) can introduce significant cost volatility. Therefore, strategic risk management, including geographical diversification of sourcing and manufacturing bases, is becoming standard practice for market leaders seeking to mitigate these external shocks.

The rising importance of 'clean labeling' and transparency is compelling distillers to disclose more about ingredients, processes, and even caloric content. This trend is a direct response to health-conscious consumers demanding greater accountability. Companies that adopt proactive transparency measures, often facilitated by digital platforms, are establishing a stronger trust relationship with their consumer base, especially among younger buyers. This emphasis on process and origin is particularly beneficial for terroir-driven categories like single-estate Tequila or specific regional brandies, where the connection to the land and traditional methods can be highlighted as a unique selling proposition. This trend reinforces the market’s move away from generic mass-produced offerings towards specialized, story-rich products.

Finally, regulatory shifts concerning cannabis and other recreational substances in various jurisdictions present an interesting dynamic for the spirits sector. While currently distinct, the eventual convergence or competition for consumer discretionary spending on mind-altering substances remains an area of uncertainty. Major spirits companies are cautiously monitoring these developments, with some investing in related adjacent businesses. Managing this evolving regulatory and competitive landscape requires foresight and flexibility, potentially leading to cross-category innovation or strategic partnerships to address changing adult consumer needs beyond traditional alcohol consumption. The overall outlook for the spirits market remains highly positive, driven by strong fundamentals in premiumization and global economic development, provided external regulatory and health trends are managed strategically.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Luxury Wines and Spirits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Alcoholic Spirits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wine And Spirits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Craft Spirits Market Size Report By Type (Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, Others), By Application (On-trade, Off-trade), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Alcoholic Spirits Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Gin, Brandy & Cognac, Rum, Tequila, White Spirits, Whiskey, Liqueurs, Other Spirits), By Application (Supermarket & Hypermarket, Liquor Specialist Store, Online Retailing, Duty-Free Stores, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager