Steel Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436266 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Steel Pipe Market Size

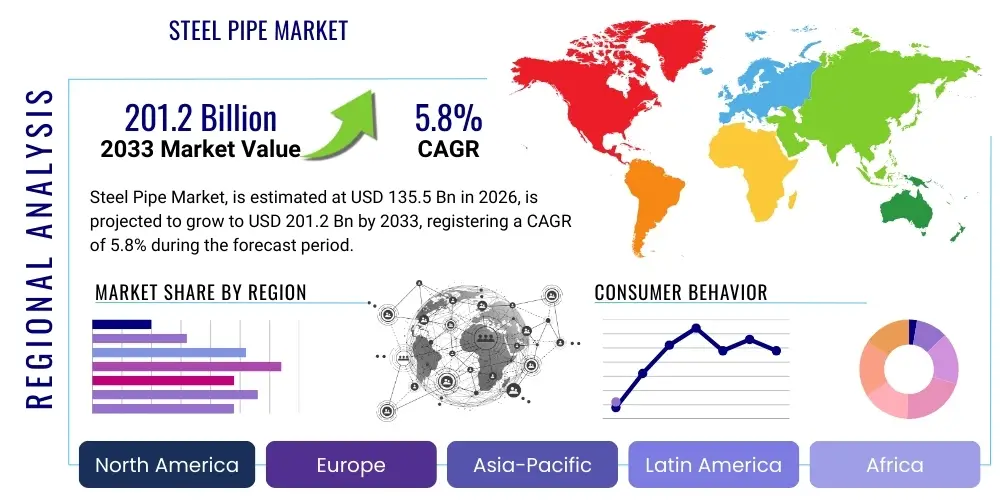

The Steel Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at 135.5 Billion USD in 2026 and is projected to reach 201.2 Billion USD by the end of the forecast period in 2033.

Steel Pipe Market introduction

The global steel pipe market encompasses the manufacturing and distribution of cylindrical tubes fabricated primarily from steel, utilized across a diverse range of critical industrial applications. Steel pipes are foundational components in modern infrastructure, essential for the safe and efficient transportation of fluids (liquids and gases) and solids (slurry), as well as serving structural purposes in construction and engineering projects. Products vary significantly based on material composition (carbon steel, stainless steel, alloy steel) and manufacturing methods, predominantly categorized into seamless pipes, which offer superior pressure resistance and uniformity, and welded pipes, which are more cost-effective for large diameters and lower-pressure applications. The robust nature, high tensile strength, and exceptional durability of steel pipes make them irreplaceable in sectors where reliability and safety are paramount, such as the energy and utilities industries.

Major applications driving the demand for steel pipes include the vast infrastructure requirements of the oil and gas sector for upstream exploration, midstream transmission pipelines, and downstream refining processes. Furthermore, the burgeoning global construction industry, particularly in emerging economies focused on urbanization and large-scale public works like bridges, commercial buildings, and high-rise structures, remains a pivotal consumer. The benefits associated with steel pipes, such as corrosion resistance (especially in coated or stainless variants), temperature stability, and suitability for high-pressure environments, cement their dominant position over alternative materials. This extensive utility profile ensures sustained demand, intricately linking the steel pipe market's performance to global macroeconomic activity and infrastructure investment cycles.

Driving factors stimulating market expansion include the increasing necessity for robust energy infrastructure modernization and expansion across North America and Asia Pacific. Additionally, governmental mandates promoting water and wastewater management projects, requiring extensive piping networks, contribute significantly to market volume. The continuous technological advancements in metallurgy and manufacturing processes, such as precision welding techniques and the development of specialized high-strength low-alloy (HSLA) steels, enhance product performance and reduce installation costs. This interplay of essential applications, inherent product benefits, and favorable macroeconomic drivers establishes the steel pipe market as a stable and strategically important industrial sector.

Steel Pipe Market Executive Summary

The Steel Pipe Market Executive Summary highlights robust growth primarily propelled by persistent global energy demands and accelerated infrastructure development, particularly within the Asia Pacific and Middle Eastern regions. Business trends indicate a strong focus on vertical integration among key manufacturers, aiming to secure raw material supply (steel coil and billets) and optimize operational efficiencies to counter fluctuating steel prices. The market exhibits a strategic shift toward premium products, specifically high-grade seamless pipes used in hostile environments like deep-sea drilling and high-temperature chemical processing, driven by stringent regulatory standards concerning pipeline safety and environmental protection. This emphasis on quality translates into higher average selling prices and improved profitability margins for specialized manufacturers, fostering innovation in anti-corrosion coatings and internal flow efficiency technologies.

Regionally, Asia Pacific maintains its dominance, spurred by massive investments in residential, commercial, and transportation infrastructure, alongside extensive pipeline projects in China and India designed to enhance energy security. North America shows stable growth, heavily influenced by the resurgence of the oil and gas sector (shale extraction) requiring specialized tubular goods (OCTG) and major pipeline replacement cycles under aging infrastructure mandates. Meanwhile, segments trends underscore the dominance of welded pipes in terms of volume due to their suitability for large-diameter municipal water lines and structural applications, while the seamless pipe segment commands higher value due to its critical role in high-pressure applications within the oil, gas, and automotive industries. Market competitiveness is characterized by intense pricing pressures in standard welded pipe segments, necessitating continuous operational improvement and geographic expansion to maintain market share.

The overarching market trajectory is positive, supported by global urbanization trends and the mandated need for reliable utility networks. Key challenges, such as volatile raw material costs, trade tariffs, and environmental scrutiny regarding steel production, are being mitigated through sustainable manufacturing practices and diversified sourcing strategies. The forecast period anticipates strong demand from renewable energy projects, particularly geothermal and offshore wind installations, which require specialized piping systems. Overall, the market remains fundamentally strong, characterized by cyclical yet necessary demand across its core industrial consumer base, positioning the steel pipe sector for sustained moderate growth through 2033.

AI Impact Analysis on Steel Pipe Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Steel Pipe Market primarily center on optimizing manufacturing efficiency, enhancing predictive maintenance capabilities for pipelines, and automating quality control processes. Common themes include questions about how AI can mitigate defects in welding and rolling, reduce energy consumption in steel mills, and improve supply chain forecasting amidst fluctuating raw material costs. Users are keenly interested in the application of Machine Learning (ML) algorithms to analyze massive datasets generated by non-destructive testing (NDT) to predict the remaining useful life (RUL) of installed pipelines, thereby minimizing catastrophic failures and associated maintenance expenses. Furthermore, there is significant interest in using AI for complex route planning and monitoring of long-distance pipeline networks, optimizing logistics, and ensuring regulatory compliance in real-time.

The integration of AI technologies is fundamentally transforming the production floor, moving towards smart manufacturing paradigms. Predictive analytics, powered by ML, is enabling steel pipe producers to monitor parameters like furnace temperature, rolling speeds, and chemical composition in real-time, allowing for immediate process adjustments that enhance yield and reduce material waste. This capability addresses key concerns about operational cost reduction and material standardization. Beyond manufacturing, AI systems are crucial in pipeline asset management, employing computer vision and sensor fusion to detect microscopic cracks, corrosion spots, or anomalies in pipe wall thickness with greater accuracy and speed than traditional inspection methods. This drastically improves the reliability and safety performance, particularly in high-risk environments such as deep-sea or permafrost regions.

Expectations are high that AI will revolutionize the supply chain, moving from reactive inventory management to predictive procurement. ML models can analyze geopolitical factors, demand signals from construction and oil sectors, and commodity market fluctuations to forecast optimal raw material purchasing times, stabilizing operational expenditures. Moreover, AI-driven automation in administrative tasks, such as automated compliance reporting and contract management using natural language processing (NLP), contributes to overall business efficiency. While adoption requires substantial upfront investment in sensors, data infrastructure, and specialized talent, the long-term benefits in quality assurance, risk reduction, and operational throughput are compelling drivers for market participants.

- AI-driven Predictive Maintenance: Utilizing sensor data and ML algorithms to forecast pipe failure and scheduling maintenance proactively, reducing downtime and operational risk.

- Automated Quality Control: Employing computer vision systems and deep learning models for real-time defect detection during welding and finishing processes, ensuring higher product quality standards.

- Supply Chain Optimization: ML-based demand forecasting and raw material price prediction to optimize procurement strategies and inventory levels.

- Process Efficiency Improvement: AI analysis of manufacturing parameters (temperature, pressure, speed) to minimize energy usage and material waste in steel production.

- Digital Twin Modeling: Creating virtual representations of extensive pipeline networks for scenario testing, flow simulation, and risk assessment before physical deployment.

DRO & Impact Forces Of Steel Pipe Market

The dynamics of the Steel Pipe Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by various impact forces stemming from economic, technological, and regulatory spheres. Key drivers include the accelerated global investment in oil and gas infrastructure, particularly in developing nations seeking to expand their energy grids and transport resources efficiently over long distances. Simultaneously, the relentless pace of urbanization and the subsequent need for expansive water, sewage, and structural piping systems in major metropolitan areas globally provide a constant baseline demand. Technological advancements enabling the production of more durable, lightweight, and corrosion-resistant specialty pipes further stimulate market uptake by expanding applicability in hostile operational environments, leading to higher performance requirements and material specifications.

However, the market faces significant restraints primarily related to the inherent volatility of raw material prices, notably iron ore and steel scrap, which introduces considerable uncertainty into manufacturing costs and profit margins. Furthermore, stringent environmental regulations governing industrial emissions and steel manufacturing processes, coupled with growing pressure to adopt sustainable practices, necessitate costly capital expenditure on cleaner technologies and potentially slow down production capacity expansion. The cyclical nature of the end-user industries, especially construction and oil & gas exploration, means that sudden economic downturns or geopolitical instability can lead to rapid fluctuations in demand, posing a consistent risk management challenge for manufacturers worldwide.

Opportunities for growth are abundant, particularly through strategic pivot points such as the emerging demand from the renewable energy sector, including specialized piping for geothermal energy systems, carbon capture and storage (CCS) projects, and hydrogen transport infrastructure. Furthermore, the massive global effort underway to replace or rehabilitate aging infrastructure, particularly in developed regions like North America and Europe, represents a consistent, multi-decade opportunity for high-performance and coated steel pipes. The predominant impact force remains the correlation between energy prices and exploration activity; when crude oil prices are high, E&P budgets increase, directly translating to higher demand for specialized OCTG and line pipes, reinforcing the market’s responsiveness to global commodity price trends.

Segmentation Analysis

The Steel Pipe Market is segmented based on several key criteria including the material used, the manufacturing process employed, and the primary application or end-user industry. This segmentation is crucial for understanding the diverse supply chain dynamics and specific market requirements across different industrial domains. The variance in specifications, such as diameter, wall thickness, tensile strength, and corrosion resistance, dictates which market segment a specific product serves. For instance, high-pressure pipelines in the oil and gas sector require expensive seamless alloy steel pipes, whereas large-diameter water transmission lines often utilize more cost-effective welded carbon steel pipes. Analyzing these segments helps stakeholders tailor production capabilities, marketing efforts, and investment strategies to address the heterogeneous needs of the global clientele.

The manufacturing process segmentation, dividing the market into seamless and welded pipes, represents a fundamental distinction in production technology and end-use suitability. Seamless pipes, made by drawing a solid billet over a piercing mandrel, offer superior structural integrity without the vulnerability of a welded seam, making them mandatory for critical applications involving high pressure and extreme temperatures, such as boiler tubing and hydraulic systems. Conversely, welded pipes, fabricated by rolling steel plate and welding the edges, allow for greater production flexibility in terms of size and are significantly preferred for lower-pressure applications, including structural frameworks and conventional fluid transportation. This differentiation ensures that the market caters efficiently to both the performance-critical and volume-driven demands of the global economy.

Application-based segmentation provides the clearest view of demand drivers, demonstrating that sectors such as construction and oil and gas collectively account for the vast majority of consumption volume and value. As global infrastructure spending increases, so too does the demand for structural steel pipes, while volatility in the energy sector directly impacts the market for Oil Country Tubular Goods (OCTG) and large-scale transmission pipes. The diversification of demand into water treatment, chemicals, and automotive sectors offers resilience against slowdowns in any single industry, promoting a stabilized long-term growth trajectory for the steel pipe market as an essential component of modern industrialization.

- By Material:

- Carbon Steel Pipe

- Stainless Steel Pipe

- Alloy Steel Pipe

- By Manufacturing Process:

- Seamless Steel Pipe

- Welded Steel Pipe (ERW, LSAW, SSAW)

- By Application:

- Oil and Gas

- Construction and Infrastructure

- Water and Wastewater Treatment

- Chemical and Petrochemical

- Automotive

- Mechanical and Structural Applications

- By Diameter:

- Small Diameter Pipe (Less than 15 inches)

- Large Diameter Pipe (Greater than 15 inches)

Value Chain Analysis For Steel Pipe Market

The Value Chain for the Steel Pipe Market begins with upstream activities focused heavily on raw material procurement, principally iron ore, coking coal, and steel scrap, which are processed into steel billets or flat steel coils by integrated steel manufacturers or mini-mills. This upstream segment is highly capital-intensive and critically sensitive to commodity price fluctuations, forming the basis of input costs for the pipe producers. Key activities here include mining, smelting, and primary steel production, where technological advancements in efficiency and environmental compliance (decarbonization efforts) are becoming increasingly important competitive factors. Relationships between pipe manufacturers and primary steel suppliers are often strategic, involving long-term contracts to ensure stable quality and supply volume, mitigating risks associated with market volatility.

The midstream phase involves the core manufacturing process of converting raw steel into finished pipes, encompassing seamless rolling, electric resistance welding (ERW), submerged arc welding (SAW—both longitudinal and spiral), and finishing processes such as coating, threading, and heat treatment. This stage adds significant value through precision engineering, quality assurance, and compliance with specific industry standards (e.g., API specifications for oil and gas). Distribution channels play a vital role in delivering the bulky and geographically specific products. Direct channels are typically utilized for large, customized infrastructure projects or specific industrial applications (e.g., direct sales to major oil companies), offering specialized technical support and tight project management integration. Indirect distribution involves leveraging specialized pipe distributors, stockists, and third-party logistics providers, especially for smaller orders, standardized products, and servicing diverse regional markets, ensuring rapid availability and inventory management closer to the end-users.

Downstream activities center on installation, integration, and post-sales services within end-user applications such as large pipeline construction (midstream), urban development (structural and utility piping), or industrial retrofits. Specialized contractors and engineering procurement construction (EPC) firms act as the primary consumers here, demanding high levels of reliability, timely delivery, and certified quality. The final value added comes from the longevity and performance of the installed pipe, contributing directly to the operational efficiency and safety of assets in sectors like energy and water management. Value chain optimization efforts across the industry focus on digitalization to improve traceability from the raw billet to the installed pipeline, enhancing transparency and reducing time-to-market while adhering to increasingly strict regulatory frameworks.

Steel Pipe Market Potential Customers

The primary potential customers and end-users of the Steel Pipe Market are broadly categorized into heavy industrial sectors reliant on robust fluid transportation and structural integrity. The Oil and Gas industry represents one of the largest and most valuable customer bases, encompassing exploration and production (E&P) companies requiring Oil Country Tubular Goods (OCTG) such as drill pipes, casing, and tubing, as well as midstream pipeline operators demanding high-strength line pipes for transmitting crude oil, natural gas, and refined products across vast distances. These customers prioritize performance specifications, material grade, and adherence to stringent safety standards (like API 5L or ISO 3183), often resulting in long procurement cycles and high-value contracts for specialized, corrosion-resistant alloy pipes designed for hostile environments.

The Construction and Infrastructure sector forms another immense customer segment, absorbing significant volumes of both welded and seamless pipes for structural support (piling, scaffolding), residential and commercial building plumbing systems, and massive public works projects like bridges, tunnels, and foundational supports. Municipal governments and utility companies are core buyers within this segment, needing durable, large-diameter pipes for water supply networks, sewage conveyance, and storm drain systems, where the key purchasing criteria often center on longevity, cost-effectiveness, and ease of installation, favoring coated carbon steel and high-density polyethylene (HDPE) lined steel pipes to minimize maintenance over decades of service.

Beyond the core energy and construction markets, significant specialized demand arises from the Chemical and Petrochemical Processing industry, which requires pipes capable of handling corrosive substances and extreme temperatures and pressures within plant environments (heat exchangers, reactors). The Automotive sector, while consuming smaller diameters, is a crucial customer for high-precision, often seamless, pipes used in exhaust systems, fuel lines, and structural components that benefit from steel's strength-to-weight ratio. Finally, emerging sectors such as power generation (including specialized steam piping in conventional and nuclear plants) and the rapidly developing hydrogen and CCS transmission markets represent future customer growth avenues, demanding next-generation materials and joining technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 135.5 Billion USD |

| Market Forecast in 2033 | 201.2 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Nippon Steel Corporation, Vallourec, Tenaris, JFE Holdings, EVRAZ, TMK Group,宝武 Steel Group (Baowu Steel Group), U. S. Steel Corporation, ChelPipe, JSW Steel, Jindal Saw Ltd., Nucor Corporation, Tata Steel Limited, PAO Severstal, Tubos Reunidos S.A., Salzgitter AG, Canam Group, Hyundai Steel Company, APL Apollo Tubes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steel Pipe Market Key Technology Landscape

The technological landscape within the steel pipe market is characterized by continuous innovation aimed at improving material performance, manufacturing efficiency, and structural integrity under demanding operational conditions. A crucial area of development is advanced welding technology, especially for welded pipes, including high-frequency induction (HFI) welding and sophisticated double submerged arc welding (DSAW) methods, which ensure stronger, more uniform seams and higher production speeds, particularly for large-diameter pipelines. Furthermore, the development and refinement of high-strength, low-alloy (HSLA) steels and specialized coating technologies are paramount. Fusion-bonded epoxy (FBE), three-layer polyethylene (3LPE), and internal flow-efficiency coatings are essential for protecting pipes against corrosion, abrasion, and scaling, significantly extending their service life, especially in aggressive environments like sour gas fields or deep-sea installations. These material science advancements directly address regulatory pressures for improved safety and reduced environmental leakage risks.

In the seamless pipe segment, technological focus is on enhancing piercing and rolling capabilities to produce pipes with tighter dimensional tolerances and superior internal surface finishes, which are critical for precision applications like hydraulic cylinders and heat exchangers. Hot rotary piercing mills and mandrel mill technologies are continuously being upgraded with digital controls and sensor feedback loops (part of Industry 4.0 integration) to maximize material yield and consistency while minimizing wall thickness variation. Non-destructive testing (NDT) methodologies are also rapidly evolving; automated ultrasonic testing (AUT) and electromagnetic acoustic transducers (EMAT) are replacing manual inspection methods, offering faster, more comprehensive defect detection throughout the manufacturing line, ensuring that products meet exacting industry standards such before deployment.

Digitalization and automation are also reshaping the overall production environment. The implementation of AI and Machine Learning models is optimizing production scheduling, reducing energy consumption during the heating and cooling phases, and improving the accuracy of steel composition adjustment. Beyond the factory floor, technological innovation extends to installation and maintenance. Automated welding rigs for field applications and advanced pipeline inspection gauges (PIGs) equipped with high-resolution magnetic flux leakage (MFL) sensors and inertial measurement units (IMUs) are crucial for monitoring installed assets. These inspection technologies provide precise mapping and detailed assessment of pipeline integrity, enabling proactive maintenance strategies that are essential for long-term operational success in large-scale infrastructure projects globally.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for steel pipes globally, driven primarily by massive infrastructural development, rapid urbanization, and extensive industrialization in China, India, and Southeast Asian nations. High demand stems from residential and commercial construction, coupled with large-scale government investments in water distribution networks and cross-country natural gas pipelines. China and India, in particular, remain central to the region's dominance due to their robust domestic steel production capacities and persistent demand for structural and line pipes.

- North America: This region represents a mature yet dynamic market characterized by high consumption of specialized, high-value tubular goods, especially Oil Country Tubular Goods (OCTG) required for shale oil and gas extraction in the US and Canada. Growth is also supported by the mandated need to replace and modernize aging pipeline infrastructure, requiring premium, highly coated steel pipes to ensure environmental compliance and operational safety. Imports play a crucial role, but domestic producers focus heavily on advanced seamless and specialty alloy pipes.

- Europe: Growth in the European steel pipe market is steady, driven by the rehabilitation of municipal infrastructure, investments in natural gas transmission pipelines connecting new sources (e.g., Eastern Mediterranean), and expanding offshore wind and geothermal energy projects. Stringent environmental standards necessitate a focus on high-quality, corrosion-resistant materials and manufacturing processes that minimize the carbon footprint. Germany, Russia (for domestic and export pipeline projects), and the UK are key regional demand centers.

- Middle East and Africa (MEA): This region is heavily influenced by large-scale, state-owned oil and gas projects, necessitating significant volumes of large-diameter line pipes for crude oil and LNG transmission, often across challenging desert terrains. Investment in infrastructure related to regional diversification away from crude oil, particularly in construction and water desalination projects in Saudi Arabia and the UAE, provides ancillary market growth. MEA demand is characterized by extremely large project sizes and highly specific technical requirements (e.g., resistance to hydrogen sulfide).

- Latin America (LATAM): The LATAM market growth is tied to fluctuations in regional economic stability and investment cycles in the energy sector, particularly in Brazil, Mexico, and Argentina. Deep-sea exploration projects (pre-salt) in Brazil drive demand for highly specialized seamless pipes. Infrastructure investments, although often subject to political uncertainties, provide continuous demand for standard welded pipes in water and sanitation projects across major metropolitan areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steel Pipe Market.- ArcelorMittal

- Nippon Steel Corporation

- Vallourec

- Tenaris

- JFE Holdings

- EVRAZ

- TMK Group

- 宝武 Steel Group (Baowu Steel Group)

- U. S. Steel Corporation

- ChelPipe

- JSW Steel

- Jindal Saw Ltd.

- Nucor Corporation

- Tata Steel Limited

- PAO Severstal

- Tubos Reunidos S.A.

- Salzgitter AG

- Canam Group

- Hyundai Steel Company

- APL Apollo Tubes

Frequently Asked Questions

Analyze common user questions about the Steel Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for seamless versus welded steel pipes?

Demand for seamless pipes is driven by high-pressure, high-temperature critical applications (e.g., deep-sea drilling, boiler tubing) due to their superior integrity and uniform structure. Welded pipe demand is volumetric, driven by cost-effectiveness and suitability for structural applications, water lines, and low-pressure fluid transport.

How is the volatility of steel prices impacting the profitability of pipe manufacturers?

Raw material price volatility severely compresses margins, particularly for manufacturers operating in high-volume, low-margin segments. Companies mitigate this through hedging strategies, vertical integration to secure input costs, and shifting production focus toward high-value alloy and specialty coated pipes.

Which geographical region holds the largest market share for steel pipes, and why?

The Asia Pacific region holds the largest market share due to unparalleled rates of infrastructure development, massive urbanization projects, and extensive governmental investment in energy and water utility expansion, particularly concentrated in China and India.

What role does corrosion resistance technology play in current steel pipe market growth?

Corrosion resistance is crucial for market growth as regulatory mandates require longer asset lifespans and greater environmental safety. Advanced coatings like FBE and 3LPE, alongside specialized stainless steel alloys, increase pipe longevity, reducing maintenance costs and catastrophic failure risks in demanding environments.

How are technological advancements like Industry 4.0 influencing the production of steel pipes?

Industry 4.0 technologies, including AI, advanced sensors, and automation, are primarily enhancing operational efficiency, standardizing product quality through real-time defect detection (NDT), optimizing energy consumption, and improving supply chain resilience and forecasting capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Stainless Steel Pipe Cutter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Steel Pipe Piles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Drawn Over Mandrel (DOM) Steel Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Precision Stainless Steel Pipe Market Statistics 2025 Analysis By Application (Automotive and Transportation, Heavy Industry, Consumer goods, Buildings and Construction, Others), By Type (Cold Drawn, Hot Rolled), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Helical Submerged Arc Welding (HSAW) Steel Pipe Market Statistics 2025 Analysis By Application (Water, Oil & Gas, Construction, Chemical Industry), By Type (O.D. 18-24 Inches, O.D. 24-48 Inches, Above 48 Inches, HSAW with an outer diameter of 24-48 feet account for more than half of the market, about 61%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager