Tumor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435910 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Tumor Market Size

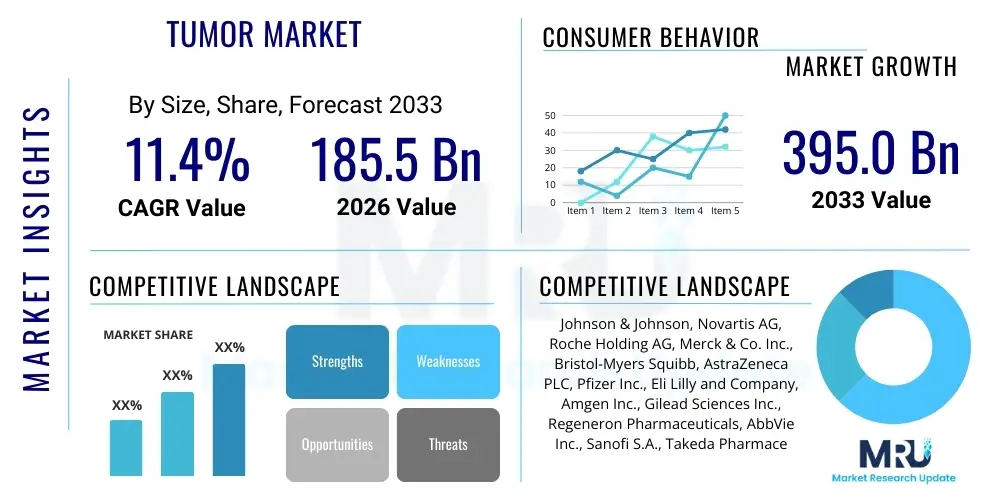

The Tumor Market, encompassing therapeutics, diagnostics, and supportive care for neoplastic diseases across various tissue types, is projected to exhibit robust expansion driven by increasing global cancer incidence and advancements in targeted therapies. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.4% between 2026 and 2033. This significant growth trajectory reflects ongoing innovation in precision medicine and the integration of advanced biotechnological platforms, such as gene sequencing and immunotherapy, into standard clinical practice.

The market is estimated at $185.5 Billion USD in 2026, a valuation underpinned by the substantial revenue generated from established chemotherapies, monoclonal antibodies, and emerging cell and gene therapies. This initial valuation also accounts for the growing demand for sophisticated diagnostic imaging and molecular profiling tools necessary for early detection and personalized treatment planning in complex tumor types.

By the end of the forecast period in 2033, the market is projected to reach $395.0 Billion USD. This exponential increase is primarily attributed to the anticipated approval and commercialization of numerous late-stage pipeline drugs, especially in areas previously characterized by high unmet clinical needs, such as glioblastoma, pancreatic cancer, and certain rare tumors. Furthermore, expanded global access to advanced oncology treatments in developing economies will serve as a powerful catalyst for market value appreciation over the next decade.

Tumor Market introduction

The Tumor Market represents the global ecosystem dedicated to the diagnosis, treatment, and management of malignant and benign neoplastic conditions. This expansive domain includes pharmaceutical products (chemotherapy, targeted drugs, immunotherapies), medical devices (radiotherapy equipment, surgical instruments), and diagnostic tools (biomarker assays, imaging technologies). The primary objective of the market stakeholders is to improve patient outcomes through early and accurate diagnosis, effective disease control, and enhanced quality of life. The continuous surge in cancer prevalence worldwide, largely attributed to aging populations and lifestyle changes, fundamentally anchors the market's growth potential. Technological breakthroughs, particularly in genomic sequencing and liquid biopsy, are continually reshaping diagnostic paradigms, enabling highly specific and minimally invasive detection methods.

Key products within this market include blockbuster monoclonal antibodies targeting specific oncogenic pathways, sophisticated checkpoint inhibitors that revolutionize immunotherapy, and advanced radiation delivery systems that minimize damage to surrounding healthy tissue. Major applications span solid tumors (lung, breast, prostate, colorectal) and hematological malignancies (leukemia, lymphoma). The primary benefit delivered by this market is the prolongation of patient survival rates and, increasingly, the achievement of long-term remission or cure for previously incurable cancers. The shift toward personalized medicine, where treatment is tailored based on the tumor's unique molecular signature, is a critical driving factor ensuring sustained investment and innovation.

Driving factors fueling this market expansion include robust government funding for cancer research, expedited regulatory pathways (such as Fast Track and Breakthrough Therapy designations) for novel oncology products, and strong collaborative partnerships between academic institutions, biotechnology startups, and major pharmaceutical corporations. Furthermore, rising awareness and screening programs in high-income countries contribute to earlier stage diagnosis, increasing the market demand for curative treatment options. The continuous evolution of surgical techniques, particularly robotic-assisted surgery, also enhances recovery rates and expands the eligible patient population for curative interventions, solidifying the market's positive outlook.

Tumor Market Executive Summary

The Tumor Market is characterized by intense innovation and significant investment, positioning it as one of the most dynamic sectors within global healthcare. Business trends are dominated by strategic mergers and acquisitions focused on securing rights to promising cell and gene therapy platforms, particularly CAR T-cell therapies and novel tumor-agnostic treatments. Pharmaceutical companies are heavily investing in companion diagnostics to maximize the efficacy and regulatory success of their targeted drugs. Furthermore, there is a pronounced shift toward combination therapies, where immunotherapies are paired with conventional treatments or other targeted agents to overcome drug resistance and enhance therapeutic responses, reflecting a core business model focused on synergistic drug development.

Regional trends indicate that North America, particularly the United States, maintains market dominance due to high healthcare expenditure, leading-edge research infrastructure, and favorable reimbursement policies for advanced oncology treatments. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment, driven by increasing disposable income, expanding access to western-standard healthcare facilities, and a large, untapped patient pool. European markets continue to experience growth, supported by centralized healthcare systems prioritizing cost-effectiveness and outcome-based pricing models, leading to steady adoption rates of new therapeutic modalities. Latin America and the Middle East & Africa (MEA) are witnessing infrastructural improvements, enabling gradual market penetration for specialized oncology care.

Segmentation trends highlight the increasing prominence of the Immunotherapy segment, specifically Immune Checkpoint Inhibitors, which have fundamentally altered the treatment landscape across multiple cancer types. The Diagnostics segment is rapidly evolving, driven by the commercial viability of liquid biopsy—non-invasive tests for circulating tumor DNA (ctDNA) that offer real-time monitoring of disease progression and treatment efficacy. Among tumor types, lung cancer and breast cancer segments continue to command the largest market share due to high incidence, while segments addressing rare or difficult-to-treat cancers are experiencing the highest percentage growth rates, spurred by orphan drug designations and accelerated clinical development timelines, ensuring targeted segment diversification and specialized treatment options.

AI Impact Analysis on Tumor Market

Users frequently inquire about Artificial Intelligence's capacity to revolutionize cancer diagnostics, drug discovery timelines, and personalized treatment prediction. Key themes center on AI’s ability to analyze massive volumes of genomic and imaging data faster and more accurately than human physicians, specifically asking how machine learning models can identify subtle patterns indicative of early malignancy or predict a patient's response to specific immunotherapies. Concerns often revolve around data privacy, the validation of AI algorithms in diverse patient populations, and the potential displacement of human roles, particularly in pathology and radiology. Expectations are high, anticipating that AI will significantly shorten the drug development cycle, reduce the cost of clinical trials, and ultimately enable truly precision oncology by guiding optimal therapeutic selection based on complex multidimensional patient data inputs.

The application of AI in oncology drug discovery is transforming the initial identification and validation of therapeutic targets. Machine learning models can swiftly screen billions of compounds, predicting their efficacy and toxicity profiles, thereby de-risking the preclinical phase and accelerating candidates into human trials. This computational power also extends to analyzing complex patient stratification data, ensuring that clinical trials recruit patients most likely to respond, leading to higher success rates and more efficient use of resources. This efficiency gains are crucial in the highly expensive and time-consuming realm of oncology drug development.

Furthermore, AI is pivotal in enhancing diagnostic accuracy and workflow efficiency. In radiology, deep learning algorithms are proving invaluable for automated tumor segmentation, volume tracking, and malignancy risk scoring on MRI and CT scans, often identifying lesions too subtle for the unaided human eye. Similarly, in digital pathology, AI assists in quantifying tumor-infiltrating lymphocytes, predicting genetic mutations from histopathology slides, and standardizing grading systems, minimizing inter-observer variability. The integration of these AI tools promises a future where cancer diagnosis is faster, more objective, and intrinsically linked to personalized treatment pathways.

- AI accelerates target identification and lead optimization in drug discovery, reducing preclinical timelines.

- Machine learning enhances diagnostic accuracy in radiology and pathology through automated image analysis and quantitative feature extraction.

- AI supports personalized medicine by predicting patient response to specific therapies (e.g., checkpoint inhibitors) based on genomic, proteomic, and clinical data.

- Predictive modeling optimizes clinical trial design, identifying ideal patient cohorts and predicting treatment toxicity profiles.

- Natural Language Processing (NLP) extracts structured data from unstructured Electronic Health Records (EHRs) for large-scale epidemiological and outcomes research.

- AI-driven tools assist in automating radiation planning, optimizing dosage and trajectory for maximum tumor ablation and minimal organ-at-risk damage.

- Computational biology utilizes AI for complex genomic analysis, identifying novel biomarkers and therapeutic resistance mechanisms in real-time.

- AI improves operational efficiency by streamlining patient scheduling, resource allocation, and inventory management in oncology centers.

DRO & Impact Forces Of Tumor Market

The Tumor Market is shaped by a confluence of powerful Drivers, fundamental Restraints, strategic Opportunities, and overarching Impact Forces that dictate its evolution. The primary drivers include the escalating global incidence of various cancers, rapid innovation in immunotherapy and molecular diagnostics, and significant government and private sector investment in oncology research and development. Restraints largely center on the high cost associated with advanced cancer treatments, complex regulatory hurdles for novel biological therapies, and challenges related to achieving equitable access to care across diverse socioeconomic strata. Opportunities arise through the development of cell and gene therapies, the leveraging of Artificial Intelligence (AI) for precision oncology, and expansion into emerging markets where prevalence rates are rising but treatment penetration is currently low. These elements interact as Impact Forces, ensuring that market growth is sustained yet subject to continual pressure regarding pricing, access, and technological integration.

Key drivers creating momentum include the remarkable success of immune checkpoint inhibitors (PD-1/PD-L1 antagonists) and the subsequent excitement surrounding multi-specific antibodies and neoantigen vaccines, which are expanding the scope of treatable cancers. Furthermore, the advancements in diagnostic technologies, specifically liquid biopsies and high-throughput sequencing, allow for non-invasive monitoring and early relapse detection, thereby increasing the market utilization of both diagnostic and therapeutic products. Regulatory support, exemplified by accelerated approval pathways for high-impact oncology treatments, significantly reduces the time-to-market for promising drug candidates, fueling investor confidence and R&D spending.

However, the market faces significant restraints that necessitate strategic navigation. The severe toxicity profiles and manufacturing complexities associated with certain cell and gene therapies, such as CAR T-cells, pose logistical and clinical adoption challenges. Furthermore, the persistent ethical debate and pricing pressure surrounding high-cost innovative drugs limit widespread uptake, particularly in markets with constrained healthcare budgets. Opportunities remain abundant, particularly in addressing chemotherapy resistance mechanisms through novel drug combinations, exploring tumor microenvironment modulation, and targeting currently undruggable oncogenes, creating fertile ground for specialized biotech firms and large pharmaceutical collaborations focused on overcoming current therapeutic bottlenecks and maximizing patient benefit.

Segmentation Analysis

The Tumor Market is extensively segmented based on Treatment Type, Tumor Type, End-User, and Region, reflecting the diverse approaches required for comprehensive cancer care. Segmentation based on Treatment Type—spanning chemotherapy, radiotherapy, targeted therapy, and immunotherapy—is critical, as it tracks the paradigm shift from traditional cytotoxic agents toward highly specific biological and cellular interventions. Immunotherapy currently dominates growth projections due to its high efficacy across several solid and liquid tumors. Analysis by Tumor Type provides insights into prevalence and unmet needs, with segments like breast, lung, and colorectal cancers contributing the highest volumes, while niche segments like ovarian and pancreatic cancers often drive highly specialized R&D investment. End-User segmentation, focusing on hospitals, specialty clinics, and research institutions, helps delineate the primary points of therapeutic adoption and consumption patterns. The meticulous breakdown of these segments is vital for stakeholders to allocate resources effectively, identify high-growth areas, and tailor marketing and distribution strategies to meet specific clinical demands.

The strategic importance of segmentation lies in understanding the complex landscape of therapeutic competition and diagnostic innovation. Within the Treatment Type segment, the accelerated adoption of cell and gene therapies, despite their high cost, is redefining the competitive dynamics, pressuring developers of older, less specific treatments. The differentiation within Tumor Type segmentation highlights the significant clinical and financial risks associated with pipeline development; treatments for high-incidence cancers generally offer greater market returns but face greater competition, whereas orphan oncology indications offer exclusivity and premium pricing, balancing the overall portfolio risk for major players. Understanding End-User requirements, especially the needs of large hospital oncology centers for integrated diagnostic and therapeutic solutions, guides service provision and platform development.

Geographically, segmentation illuminates regional variations in access, regulation, and prevalence. North America and Europe typically lead in early adoption of cutting-edge treatments, influencing global guidelines and market benchmarks. However, the rapid expansion in APAC demands strategies tailored to diverse regulatory environments, varying purchasing power, and increasing focus on domestic drug manufacturing and clinical trial capabilities. Effective segmentation analysis thus provides a granular view of market forces, enabling stakeholders to optimize product lifecycle management, pipeline prioritization, and global market penetration strategies, ensuring maximum reach and return on investment in the highly competitive oncology space.

- By Treatment Type:

- Chemotherapy

- Targeted Therapy (Small molecules, Biologics)

- Immunotherapy (Checkpoint Inhibitors, CAR T-cell Therapy, Vaccines)

- Hormonal Therapy

- Radiation Therapy

- Surgery and Ablation

- By Tumor Type:

- Breast Cancer

- Lung Cancer (Non-Small Cell and Small Cell)

- Colorectal Cancer

- Prostate Cancer

- Hematological Malignancies (Leukemia, Lymphoma, Myeloma)

- Liver Cancer

- Ovarian Cancer

- Glioblastoma Multiforme (GBM)

- By Modality/Delivery:

- Injectable

- Oral

- External Beam Radiation

- Brachytherapy

- By End-User:

- Hospitals and Clinics

- Cancer Research Centers

- Academic and Research Institutes

- Diagnostic Laboratories

Value Chain Analysis For Tumor Market

The value chain of the Tumor Market is intricate, beginning with extensive upstream research and development (R&D) activities focused on identifying novel targets and therapeutic molecules, moving through complex manufacturing processes, and concluding with downstream distribution, prescription, and patient administration. Upstream analysis primarily involves biopharmaceutical companies, academic labs, and biotech startups engaging in basic science, preclinical testing, and complex early-stage clinical trials. This phase is capital-intensive and highly knowledge-driven, relying heavily on advanced genomics, proteomics, and computational biology to validate targets. Success in the upstream segment determines the quality and innovation of the therapeutic pipeline, with intellectual property rights forming the foundation of future market value. Key activities here include biomarker identification and companion diagnostic co-development to ensure the therapeutic relevance of emerging treatments.

Midstream activities are characterized by the specialized, often bio-intensive manufacturing of drugs, particularly biologics, cell therapies, and radiopharmaceuticals. For advanced therapies like CAR T-cells, the manufacturing process is highly personalized, demanding robust, quality-controlled, and cold-chain logistics protocols. Traditional pharmaceuticals also require stringent adherence to Good Manufacturing Practices (GMP). This stage involves Contract Manufacturing Organizations (CMOs) and major pharmaceutical internal facilities, where operational efficiency and scalability are paramount for achieving profitable economies of scale and meeting global demand for high-value treatments. The complexity of these processes contributes significantly to the final cost of oncology therapeutics.

Downstream analysis focuses on distribution channels and patient access. Direct channels involve pharmaceutical companies supplying high-cost drugs directly to large specialized oncology hospitals or integrated delivery networks (IDNs). Indirect channels utilize specialized wholesalers, distributors, and pharmacy benefit managers (PBMs) to manage inventory and ensure secure, temperature-controlled delivery to smaller clinics and outpatient settings. The reimbursement landscape, involving governmental payers and private insurance companies, significantly influences which drugs are accessible. Potential customers, including specialist oncologists and hospitals, ultimately determine consumption, driven by clinical guidelines, efficacy data, and patient-specific needs, making effective sales and education strategies crucial for market penetration.

Tumor Market Potential Customers

The primary customers in the Tumor Market are heterogeneous, encompassing healthcare providers who prescribe and administer treatments, diagnostic laboratories that perform necessary molecular testing, and large institutional purchasers who manage patient populations and procurement budgets. End-users are predominantly specialized oncology centers, large teaching hospitals with comprehensive cancer programs, and standalone specialty clinics offering chemotherapy and radiation services. These institutions are the vital hubs for therapeutic delivery, requiring a constant supply of innovative drugs, advanced surgical tools, and sophisticated imaging technology. The purchasing decisions of these institutional buyers are governed by clinical efficacy data, safety profiles, institutional guidelines, and crucially, favorable reimbursement coverage, ensuring the feasibility of deploying high-cost technologies.

A rapidly growing segment of potential customers includes specialized diagnostic laboratories, both centralized commercial labs and in-house hospital pathology departments, which are the main consumers of molecular diagnostic kits, liquid biopsy assays, and advanced sequencing platforms. As precision medicine mandates detailed molecular profiling before treatment initiation, these labs drive demand for high-throughput, accurate diagnostic tools. Their requirements focus on throughput capacity, automation, accuracy validation, and regulatory compliance (e.g., CLIA certification in the U.S.). Their purchasing power is increasingly leveraged through large group purchasing organizations (GPOs) aiming for standardized, cost-effective diagnostic workflows.

Furthermore, research organizations, including academic institutions and contract research organizations (CROs), represent significant consumers of research-grade reagents, preclinical models, and early-stage trial drugs and devices. These groups play a pivotal role in validating the next generation of oncology products. Finally, governmental healthcare agencies and large private payers, while not direct consumers of the product, act as gatekeepers through formulary inclusion and reimbursement policies, profoundly influencing the commercial viability and adoption rate of new treatments. Successful market penetration requires engaging with all these customer types across the value chain to ensure clinical acceptance and financial viability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion USD |

| Market Forecast in 2033 | $395.0 Billion USD |

| Growth Rate | 11.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Novartis AG, Roche Holding AG, Merck & Co. Inc., Bristol-Myers Squibb, AstraZeneca PLC, Pfizer Inc., Eli Lilly and Company, Amgen Inc., Gilead Sciences Inc., Regeneron Pharmaceuticals, AbbVie Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Bayer AG, BeiGene Ltd., Seagen Inc., Daiichi Sankyo Company Limited, Seattle Genetics, Vertex Pharmaceuticals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tumor Market Key Technology Landscape

The Tumor Market's technological landscape is rapidly evolving, moving beyond conventional cytotoxic treatments toward highly sophisticated biological and mechanical interventions. Key technologies driving this transformation include advancements in Immuno-Oncology (IO), characterized by the development of next-generation checkpoint inhibitors, bi-specific and tri-specific antibodies designed to enhance immune cell targeting, and personalized neoantigen vaccines that leverage the unique mutational profile of an individual’s tumor. Cell and gene therapy platforms, notably Chimeric Antigen Receptor (CAR) T-cell therapy, represent a cutting-edge, curative-intent technology, demanding high-level specialization in collection, modification, expansion, and delivery. Furthermore, the integration of advanced molecular diagnostics, such as Next-Generation Sequencing (NGS) and digital Polymerase Chain Reaction (dPCR) for highly sensitive mutation detection and minimal residual disease (MRD) monitoring, is foundational to the application of precision medicine, ensuring therapies are matched to specific genomic alterations.

The diagnostic technology sector is witnessing massive disruption through the commercialization of liquid biopsy assays. These non-invasive blood tests analyze circulating tumor cells (CTCs) and circulating tumor DNA (ctDNA) to detect cancer recurrence earlier, monitor treatment efficacy in real-time, and profile molecular changes that may indicate resistance. This technology significantly reduces the need for invasive tissue biopsies and enables more frequent, dynamic surveillance. Simultaneously, the radiation oncology field is advancing with technologies like proton beam therapy and Stereotactic Body Radiation Therapy (SBRT), which offer highly conformal radiation delivery, minimizing systemic toxicity and improving local tumor control by focusing radiation precisely on the tumor volume while sparing critical adjacent structures, thereby enhancing therapeutic ratio.

Digital health and computational oncology technologies, anchored by AI and machine learning, are now intrinsic to the R&D pipeline and clinical delivery. AI is crucial for processing massive datasets—from high-resolution radiological images to complex genomic and transcriptomic profiles—to identify novel biomarkers and predict patient outcomes. Furthermore, robotic-assisted surgical systems offer improved precision, reduced invasiveness, and faster patient recovery for tumor resection procedures, setting new standards for surgical oncology. The convergence of these technological streams—advanced biology, high-precision diagnostics, and computational power—defines the competitive edge in the Tumor Market, demanding significant ongoing investment in technological infrastructure and specialized expertise across all facets of cancer care.

Regional Highlights

Regional dynamics significantly influence the Tumor Market, reflecting variations in healthcare infrastructure, regulatory environments, patient demographics, and expenditure capacities. North America, particularly the United States, is the undisputed leader, accounting for the largest market share. This dominance is driven by the presence of major pharmaceutical and biotech headquarters, high per capita healthcare spending, advanced clinical research capabilities, and rapid adoption of innovative, high-cost therapies like CAR T-cells and advanced immunotherapies. Favorable reimbursement policies and a well-established network of specialized cancer centers ensure that North America remains the primary testing ground and market driver for cutting-edge oncology solutions. The robust intellectual property protection and strong governmental funding for institutions like the National Cancer Institute further solidify its leading position in R&D investment.

Europe represents the second-largest market, characterized by sophisticated centralized healthcare systems (like the NHS in the UK or statutory health insurance funds in Germany) that emphasize cost-effectiveness and health technology assessments (HTA). While the region adopts new treatments quickly, market access is often contingent on demonstrating superior value for money, leading to intense negotiation on drug pricing. Western European countries are early adopters, whereas Central and Eastern European markets offer significant untapped growth potential as healthcare infrastructure improves and economic stability enhances. The European Medicines Agency (EMA) plays a critical role in standardizing regulatory approval, facilitating cross-country access, though individual national price negotiations remain a key hurdle.

The Asia Pacific (APAC) region is projected to experience the fastest growth, driven by an immense population base, increasing prevalence of lifestyle-related cancers, and substantial improvements in economic indicators and healthcare access, particularly in countries like China, Japan, and India. China's market is rapidly expanding due to supportive government policies aiming to accelerate drug approval and promote domestic drug manufacturing, while Japan maintains high spending on advanced oncology technologies due to its aging population structure. Latin America and the Middle East & Africa (MEA) present nascent markets, where growth is constrained by lower overall healthcare spending and infrastructural limitations, but opportunities exist for generic oncology drugs and basic diagnostic services as universal healthcare coverage expands.

- North America: Market leader due to high adoption of precision oncology, advanced research funding, and favorable reimbursement for innovative therapies; strong presence of key industry players and cutting-edge clinical trials.

- Europe: Second largest market, characterized by rigorous HTA processes and strong emphasis on value-based pricing; high penetration of established pharmaceuticals and radiotherapy devices, with increasing focus on personalized medicine pathways.

- Asia Pacific (APAC): Fastest-growing region, fueled by rising cancer prevalence, improving healthcare infrastructure, and government initiatives promoting domestic R&D and drug access in large markets like China and India.

- Latin America (LATAM): Emerging market with increasing penetration of generic and biosimilar oncology drugs; constrained by varied economic conditions and fragmented regulatory structures, yet offering potential for targeted market entry.

- Middle East & Africa (MEA): Growth concentrated in affluent GCC nations (Saudi Arabia, UAE) benefiting from high investment in specialized cancer centers and medical tourism; the wider African market faces significant challenges related to access and affordability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tumor Market, highlighting their strategic initiatives, product portfolios, and R&D pipelines which collectively drive market dynamics and innovation.- Johnson & Johnson

- Novartis AG

- Roche Holding AG

- Merck & Co. Inc.

- Bristol-Myers Squibb

- AstraZeneca PLC

- Pfizer Inc.

- Eli Lilly and Company

- Amgen Inc.

- Gilead Sciences Inc.

- Regeneron Pharmaceuticals

- AbbVie Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Bayer AG

- BeiGene Ltd.

- Seagen Inc.

- Daiichi Sankyo Company Limited

- Seattle Genetics

- Vertex Pharmaceuticals

Frequently Asked Questions

Analyze common user questions about the Tumor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the global Tumor Market?

The Tumor Market growth is primarily driven by the escalating global incidence of various cancer types, substantially linked to aging populations and widespread changes in lifestyle factors. Crucially, technological advancements in oncology, particularly the introduction of highly effective immunotherapies (like checkpoint inhibitors) and sophisticated targeted drug delivery systems, coupled with ongoing government and private investment in cancer research, accelerate market expansion. Furthermore, enhanced early detection capabilities through advanced molecular diagnostics contribute significantly to the demand for treatment products.

How is precision medicine impacting the development and cost of oncology drugs?

Precision medicine is profoundly reshaping the oncology landscape by shifting treatment from broad chemotherapy regimens to individualized therapies based on the tumor's specific genomic and molecular profile. This approach necessitates co-development of drugs and companion diagnostics, leading to higher development costs for highly specific drugs, but simultaneously increasing efficacy and reducing treatment failure rates in targeted patient populations. While initial costs for these specialized drugs are high, they often deliver superior outcomes, potentially reducing overall long-term healthcare expenditure related to ineffective treatments and disease relapse.

Which geographical region holds the largest market share in the Tumor Market, and why?

North America, specifically the United States, currently holds the largest share of the Tumor Market. This dominance is attributable to several key factors, including the region’s massive investment in oncology R&D, advanced and widespread adoption of cutting-edge technologies (such as cell and gene therapies), high prevalence of cancer, and a robust, favorable reimbursement environment that supports the high pricing of innovative therapeutics. The presence of numerous global pharmaceutical headquarters and specialized oncology centers further cements its market leadership.

What role does Artificial Intelligence play in the future expansion of the Tumor Market?

Artificial Intelligence (AI) is integral to the future growth and innovation within the Tumor Market. AI applications span accelerating drug discovery by identifying novel targets and predicting compound efficacy, enhancing diagnostic accuracy in radiology and pathology, and personalizing treatment plans by analyzing complex patient data. AI-driven solutions are expected to significantly reduce the time and cost associated with drug development and improve patient outcomes through earlier, more accurate, and more tailored therapeutic interventions, thereby unlocking immense efficiency potential across the oncology pipeline.

What are the key restraints and challenges facing manufacturers in the Tumor Market?

Manufacturers face significant restraints, primarily revolving around the extraordinarily high cost of developing and manufacturing advanced therapies, particularly cell and gene treatments, which creates global pressure regarding drug affordability and access. Regulatory hurdles remain complex, requiring extensive clinical validation for novel biological products. Additionally, market saturation in certain high-incidence cancer types and the development of drug resistance mechanisms in patients continually challenge the long-term efficacy and commercial viability of existing treatment portfolios, requiring constant, expensive R&D investment to stay competitive.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pseudotumor Cerebri Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Tumor Markers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Metastases Spinal Tumor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Circulating Tumor Cells and Cancer Stem Cells Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Tumor Necrosis Factor Inhibitor Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager