Wedding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434715 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wedding Market Size

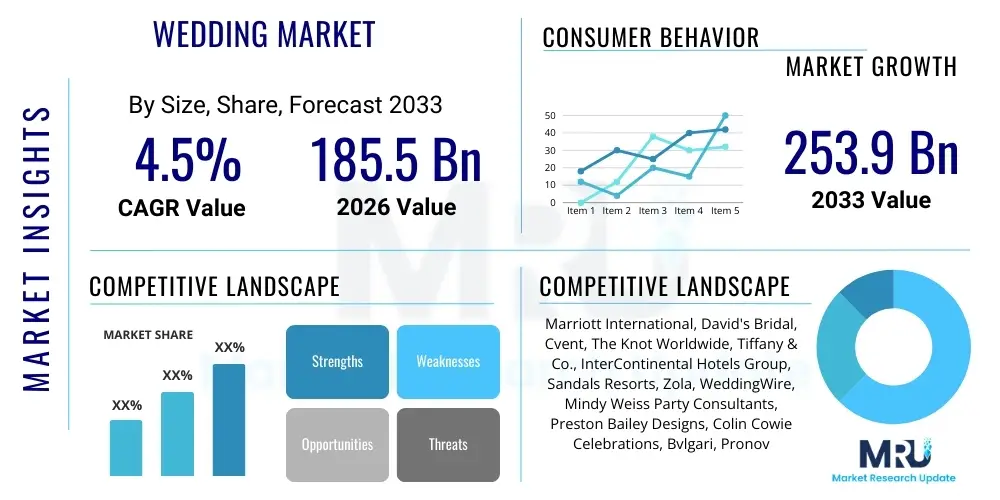

The Wedding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 185.5 billion in 2026 and is projected to reach USD 253.9 billion by the end of the forecast period in 2033. This growth trajectory is primarily fueled by increasing disposable incomes globally, the resurgence of large-scale celebrations post-pandemic restrictions, and the rising consumer demand for highly personalized and luxurious experiential wedding services. Furthermore, the global proliferation of destination weddings, supported by robust tourism infrastructure and specialized vendor networks, contributes significantly to the market's value expansion.

Wedding Market introduction

The Wedding Market encompasses all services, products, and expenditures related to the planning and execution of marital ceremonies and associated celebrations, ranging from pre-wedding preparations and bridal attire to venue sourcing, catering, photography, and honeymoon travel. This highly fragmented yet lucrative ecosystem is defined by emotional investment, demanding exceptional quality and customization. Key product offerings include venue booking, professional planning services, rings and jewelry, entertainment, and digital tools for guest management and vendor coordination. The market serves a universal demographic, continuously adapting to evolving cultural norms and technological advancements, positioning itself as a resilient sector within the broader hospitality and luxury goods industries.

Major applications of market services revolve around comprehensive event management, where professional planners leverage extensive networks to deliver seamless experiences, particularly for high-net-worth individuals and elaborate multi-day affairs. Benefits derived from utilizing professional market services include reduced planning stress, adherence to budgets, superior vendor quality assurance, and the realization of complex, personalized themes. The increasing globalization of wedding trends, characterized by cross-cultural blending and the adoption of Westernized ceremonial elements in emerging economies, further expands the market's serviceable opportunities and heightens the average spending per wedding event.

Driving factors for sustained market expansion include demographic shifts, specifically the continued growth in the marrying-age population in APAC and MEA regions, coupled with the increasing trend towards delayed marriage resulting in higher lifetime savings available for wedding expenditure. The pervasive influence of social media platforms and digital visualization tools sets higher benchmarks for event aesthetics, compelling consumers to invest more heavily in décor, specialized vendors, and unique entertainment. Additionally, the integration of sustainability and ethical sourcing into wedding planning, appealing to environmentally conscious millennials and Gen Z, opens new segments and drives innovation in product development, from recycled materials for rings to eco-friendly venue choices and catering.

Wedding Market Executive Summary

The Wedding Market is currently experiencing a dynamic transformation characterized by pronounced segmentation based on expenditure, complexity, and destination. Key business trends indicate a strong shift towards digitalization, with online platforms consolidating vendor services, offering sophisticated planning software, and facilitating virtual consultations, thus enhancing efficiency and transparency. Geographically, while North America and Europe remain dominant in terms of average spend per wedding, the Asia Pacific region, particularly India and China, represents the fastest-growing market due to substantial population size and rapid increases in disposable income driving lavish ceremonies. Segment trends reveal sustained growth in the Luxury Wedding segment, emphasizing personalization and experiential elements, alongside emerging popularity in sustainable and intimate wedding formats, which require specialized planning expertise but often allow for higher investment in quality over quantity of guests.

Regional dynamics are crucial, with Asia Pacific exhibiting significant potential driven by large-scale traditional weddings, increasing preference for destination weddings in Southeast Asia, and robust growth in the organized planning sector. In established markets like North America and Europe, the focus shifts toward vendor specialization (e.g., bespoke attire, avant-garde photography, niche catering) and optimizing the integration of technology, particularly augmented reality (AR) for venue visualization and digital payment solutions. Consumer willingness to allocate substantial portions of personal wealth toward creating memorable, shareable experiences continues to underpin market stability, influencing investment across the entire value chain, from venue infrastructure enhancement to advanced production technology for entertainment.

Overall, the market is moderately competitive, with fragmentation at the local vendor level and consolidation among major global wedding planning agencies, apparel brands, and destination resort groups. Strategic initiatives by market leaders include geographical expansion into high-growth developing economies, strategic partnerships with technology providers to offer end-to-end digital solutions, and acquisitions of niche, specialized service providers to broaden the service portfolio. The consistent demand for highly customized, quality-driven experiences, insulated somewhat from general economic downturns due to the non-discretionary nature of commitment expenditure, ensures positive long-term market forecasts, contingent upon stable global economic conditions and continued liberalization of international travel for destination events.

AI Impact Analysis on Wedding Market

Common user questions regarding AI's impact on the Wedding Market primarily revolve around automation of mundane planning tasks, enhancing personalization, and potentially reducing the reliance on human planners, raising concerns about job displacement versus efficiency gain. Users frequently inquire about AI's capability to select perfect vendors based on style and budget constraints, generate hyper-realistic virtual previews of venues and décor, and optimize complex logistical schedules for multi-day events. The key themes summarized from user queries highlight high expectations for AI tools to streamline the highly detailed and time-consuming aspects of wedding planning, enabling couples to focus on creative input and emotional connection, while mitigating risks associated with vendor inconsistencies or planning oversight. There is a clear appetite for AI-driven tools that provide predictive analytics regarding guest attendance, budgeting overruns, and trend forecasting, transforming traditional manual processes into data-driven decision-making frameworks.

The integration of sophisticated Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize the operational efficiency and client engagement models within the Wedding Market. AI-powered planning assistants, utilizing natural language processing (NLP), can handle initial client intake, answer routine inquiries, and generate preliminary mood boards and budget allocations based on simple conversational input, drastically reducing the initial consultation workload for human planners. Furthermore, ML models analyze vast datasets of past wedding expenditures, vendor performance metrics, and client satisfaction scores to provide highly accurate recommendations and risk assessments, ensuring couples are matched with the most reliable and suitable service providers, thereby improving overall quality control and client satisfaction rates.

Beyond planning logistics, AI's influence extends deeply into the creative and experiential aspects of weddings. Computer Vision and Generative AI are employed in virtual reality (VR) and augmented reality (AR) tools, allowing clients to virtually walk through venues, experiment with décor layouts in real-time, and visualize attire and floral arrangements before significant financial commitment. This capability minimizes errors, manages client expectations effectively, and reduces the environmental footprint associated with physical mock-ups and repeated site visits. Ultimately, AI serves not as a replacement for the human touch of a wedding planner, but as a powerful co-pilot, enhancing speed, precision, personalization, and creative visualization throughout the entire preparation cycle, cementing its role as a crucial disruptive force in the market's technological evolution.

- AI-driven personalized vendor matching and procurement optimization.

- Implementation of AI chatbots and NLP for 24/7 client support and initial inquiry management.

- Predictive analytics for budget control, risk assessment, and guest capacity forecasting.

- Integration of Generative AI for virtual venue staging, décor visualization (AR/VR), and custom invitation design.

- Automation of complex logistical scheduling and timeline management, particularly for destination weddings.

- Enhanced security and fraud detection in online payment processing and contract management.

DRO & Impact Forces Of Wedding Market

The dynamics of the Wedding Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces. Key drivers include rising global affluence and consumer willingness to spend significantly on once-in-a-lifetime events, coupled with the influence of social media driving demand for elaborate, photographically perfect ceremonies. Restraints often center on high cost and debt accumulation associated with large weddings, economic volatility impacting discretionary spending, and regulatory hurdles for international destination events. Opportunities are abundant in the areas of technological integration (AI planning, blockchain for vendor contracts), sustainability initiatives catering to eco-conscious consumers, and the rapid expansion into untapped regional markets like specialized luxury segments in APAC and MEA. These forces collectively dictate the market’s pace of growth and evolution.

Impact forces, which exert systemic influence, include globalization facilitating destination weddings and cross-cultural adoption of wedding practices, thereby expanding the geographical service scope of vendors. Societal shifts, such as changing marriage ages and the acceptance of non-traditional formats (e.g., elopements, intimate micro-weddings), force planners and venues to offer flexible, scalable solutions. Economic cycles significantly impact market velocity; while the core need for marriage services remains, periods of recession often force couples to downgrade event size or utilize more cost-effective solutions, affecting the high-end luxury segments disproportionately. Furthermore, health and safety concerns, amplified by global events, necessitate the market to adapt quickly by offering robust contingency planning and digital alternatives for remote participation.

The strategic mitigation of restraints, particularly through transparent pricing models, flexible financing options, and promoting smaller, high-quality alternatives, is essential for sustained market health. Leveraging opportunities involves substantial investment in digital infrastructure to capture tech-savvy consumers and developing supply chains that adhere to increasingly stringent ethical and sustainability standards, providing a competitive edge. The increasing complexity of modern weddings—often involving multiple events, diverse cultural requirements, and sophisticated production setups—reinforces the necessity of professional planning services, thus ensuring that the core service offering remains resistant to extreme commoditization and providing strong foundational demand across various income brackets.

Segmentation Analysis

The Wedding Market is meticulously segmented based on service type, wedding type, expenditure level, and geographical location, providing a nuanced understanding of consumer spending patterns and vendor specialization. Segmentation by service type, which includes catering, venue booking, photography, and attire, highlights where the majority of the event budget is allocated, with venue and catering typically dominating expenditures. Segmentation by wedding type (e.g., Destination, Traditional, Luxury, Intimate/Micro) illustrates the shifting preferences of modern couples, showing a decisive move towards experiential events that prioritize guest experience and location uniqueness over sheer size. Analyzing these segments is critical for vendors to tailor their marketing strategies, optimize service delivery, and invest in areas exhibiting the highest growth potential and profitability margins.

Expenditure level segmentation is vital for market analysis, broadly categorizing weddings into Budget, Mid-Range, and Luxury segments. The Luxury segment, despite representing a smaller volume of total events, often commands a disproportionately large share of market revenue due to high average spend, demanding specialized high-end services such as custom couture, private estate rentals, and international vendor coordination. Conversely, the Mid-Range segment represents the largest volume market, focusing on value-for-money, quality standardization, and packaged services. Understanding these financial stratifications allows businesses to accurately position their pricing structures and manage inventory effectively, ensuring accessibility across different consumer demographics.

Furthermore, the segmentation analysis reveals distinct regional variances. While Western markets show a mature, stable demand characterized by personalization and high professional service uptake, emerging markets in APAC are driven by large family sizes and cultural expectations demanding multiple, grand ceremonies, providing immense scale opportunities. Successful market entry and expansion strategies hinge on adapting service offerings to these specific cultural, economic, and logistical requirements, such as offering multilingual planning services or complying with regional regulatory frameworks concerning event licenses and vendor labor practices. This comprehensive segmentation framework ensures that market stakeholders can identify niche markets and capitalize on specific demographic and behavioral trends.

- By Service Type:

- Venue & Decoration

- Catering Services (Food & Beverage)

- Photography & Videography

- Attire & Accessories (Bridal wear, Groom wear)

- Jewelry & Rings

- Planning Services (Full Service, Partial Planning, Day-of Coordination)

- Entertainment (Music, Performers, Specialized Acts)

- Other Services (Hair & Makeup, Transportation, Stationery)

- By Wedding Type:

- Traditional/Local Weddings

- Destination Weddings

- Luxury/High-End Weddings

- Intimate/Micro Weddings & Elopements

- Theme-based/Specialty Weddings

- By Expenditure Level:

- Budget

- Mid-Range

- Luxury

Value Chain Analysis For Wedding Market

The Wedding Market value chain is intricate, beginning with upstream activities focused on sourcing raw materials and developing essential services, flowing through core event execution, and concluding with downstream distribution and consumer feedback loops. Upstream analysis involves suppliers of high-value components such as diamond and precious metal providers for jewelry, luxury textile mills for bridal couture, and specialized food and beverage providers for high-end catering. Efficiency and ethical sourcing in this stage directly impact the quality and cost structure of the final wedding product. Maintaining robust relationships with key upstream suppliers ensures consistent access to premium materials and allows for customization necessary for luxury market segments.

The core execution stage involves a network of direct service providers: venues, professional wedding planners, photographers, designers, and florists. Planners act as crucial nodes, coordinating the entire array of services, managing complex timelines, and ensuring seamless execution. Downstream analysis focuses on how these services reach the end-user. Distribution channels are highly varied, encompassing direct sales (planner-client or venue-client), digital platforms (online vendor marketplaces, planning apps), and indirect channels such as travel agents specializing in destination weddings who bundle services. The increasing reliance on online platforms has democratized access to vendors, but has also heightened competition and the need for strong digital marketing presence.

Direct channels, characterized by bespoke, high-touch consultation, remain dominant in the luxury and custom planning segments where personalized trust and detailed coordination are paramount. Indirect channels, typically involving established referral networks, affiliate partnerships between planners and venues, or technology aggregators, provide scalability and streamlined booking processes, especially for standardized packages or destination weddings requiring cross-border logistics. Optimization of this value chain demands technological integration, particularly in inventory management for venues and real-time communication tools for coordinating diverse, often geographically dispersed, vendor teams, thereby reducing logistical friction and enhancing the overall customer experience.

Wedding Market Potential Customers

The primary end-users or buyers in the Wedding Market are engaged couples planning their nuptial events. This demographic spans a broad range of age groups, income levels, and cultural backgrounds, each segment possessing distinct needs and spending capacities. While millennials (aged 27-42) currently form the largest group of potential customers, characterized by high demands for personalization, unique experiences, and digital integration in planning, Gen Z (young adults) is rapidly emerging, prioritizing value, sustainability, and authenticity in their celebration choices. Potential customers are heavily influenced by digital trends and social media validation, requiring vendors to maintain high visual appeal and responsiveness across digital touchpoints.

Beyond the core couple, key secondary potential customers include parents and family members, who often provide significant financial contributions, particularly in traditional markets like Asia Pacific. These stakeholders frequently influence decisions regarding venue size, guest lists, and adherence to cultural rituals, requiring planners and vendors to engage with and satisfy multiple decision-makers. The B2B component of the market involves corporate clients, such as event companies and travel agencies, which act as institutional buyers of bulk services (e.g., resort venue packages, large-scale catering) on behalf of the end consumer, demanding reliable contracts, quality assurance, and favorable partnership terms.

The market also serves niche segments, including second-time marrying couples who often prefer smaller, more refined celebrations, and LGBTQ+ couples, whose specific legal and social requirements drive demand for inclusive and specialized vendor services. Effective engagement with potential customers necessitates deep demographic targeting, leveraging data analytics to predict spending patterns and preferred communication methods. Customization remains the paramount driver; customers are seeking highly bespoke experiences that reflect their individual narratives, driving demand for specialized planners who can curate unique vendor teams, manage complex logistics, and deliver highly differentiated events that surpass conventional expectations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Billion |

| Market Forecast in 2033 | USD 253.9 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marriott International, David's Bridal, Cvent, The Knot Worldwide, Tiffany & Co., InterContinental Hotels Group, Sandals Resorts, Zola, WeddingWire, Mindy Weiss Party Consultants, Preston Bailey Designs, Colin Cowie Celebrations, Bvlgari, Pronovias, MunaLuchi Bride, Kleinfeld Bridal, Wedding Planners Institute of Canada, Aisle Planner, Shane Co., Eventbrite. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wedding Market Key Technology Landscape

The Wedding Market's technological landscape is rapidly evolving, driven by the need for efficiency, visualization, and remote accessibility. Central to this evolution is the proliferation of comprehensive wedding planning software and platforms (SaaS solutions) that offer end-to-end management capabilities, from budget tracking and guest list management to vendor communication and digital payment processing. These platforms utilize cloud technology to provide real-time updates and collaborative tools, essential for coordinating complex, multi-vendor events, particularly those spanning diverse geographical locations. Moreover, the adoption of specialized Customer Relationship Management (CRM) tools tailored for planners and venues allows for highly personalized client communication and detailed tracking of preferences, enhancing service quality and driving repeat business through strong referral networks.

Advanced immersive technologies, including Augmented Reality (AR) and Virtual Reality (VR), are reshaping the pre-event decision-making process. AR applications allow couples to digitally place décor items, test color palettes, and visualize floral arrangements within a physical venue space using their mobile devices, significantly reducing uncertainty and the cost of physical mock-ups. VR technology takes this further, offering immersive virtual tours of venues located internationally or regionally, enabling remote selection and reducing the necessity for multiple costly site visits. This integration of visualization technology not only enhances the client experience but also provides vendors with powerful sales tools, increasing conversion rates by bridging the gap between imagination and reality.

Furthermore, blockchain technology is being explored to enhance security and transparency within the vendor contract and payment ecosystem. By creating immutable digital ledgers, blockchain can provide a verifiable record of contract terms, payment milestones, and service delivery agreements, minimizing disputes between couples and vendors, particularly in high-value transactions. Alongside this, Artificial Intelligence (AI) and Machine Learning (ML) are deployed for hyper-personalization, analyzing style preferences and budget data to generate optimized vendor recommendations, curate bespoke mood boards, and automate complex logistical algorithms, cementing technology’s role as the foundation for modern, streamlined wedding planning operations and strategic vendor partnerships.

Regional Highlights

Geographical analysis reveals significant variances in market maturity, average spending, and cultural influence across major regions. North America, particularly the United States, represents a highly mature market characterized by robust professional service utilization, high average spending per event, and early adoption of digital planning technologies. The market here is driven by a strong consumer preference for personalized, elaborate experiences, leading to sustained demand for high-end photography, bespoke attire, and sophisticated event production. The trend toward micro-weddings and sustainable practices is notably strong in this region, influencing vendor specialization and innovation in eco-conscious service provision.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven by the sheer volume of weddings in populous countries like India and China, coupled with rapidly expanding middle and high-net-worth classes. Traditional ceremonies in APAC are often multi-day, multi-generational affairs requiring complex logistics and substantial investment in catering, gold jewelry, and luxurious venue setups. While this region maintains strong traditional influence, there is a burgeoning trend towards adopting Westernized elements and an increasing demand for destination weddings in locations like Thailand and Bali, prompting international planners to expand their operational footprints and localize their service offerings effectively.

Europe maintains a strong market position, defined by a significant preference for destination weddings in picturesque locations such as Italy, France, and Spain, capitalizing on historical venues and established luxury hospitality sectors. The European market focuses heavily on quality, heritage brands (especially in attire and jewelry), and high-quality, regionally sourced catering. Meanwhile, the Middle East and Africa (MEA) exhibit explosive growth in the luxury segment, particularly in the Gulf Cooperation Council (GCC) countries, where royal and ultra-high-net-worth weddings drive unparalleled expenditure on high-security, custom-built venues, international entertainment, and bespoke design. Latin America, though facing economic fluctuations, shows stable growth, prioritizing cultural traditions, vibrant entertainment, and local craftsmanship, often relying heavily on personal networks for vendor selection rather than large digital platforms.

- North America: Market maturity, highest average spending, significant penetration of digital planning apps (Zola, The Knot), strong focus on experiential luxury and personalization.

- Europe: Dominance in destination weddings (Italy, France), emphasis on heritage, quality, and small to mid-sized sophisticated events, strong regulation compliance requirements.

- Asia Pacific (APAC): Highest volume growth, driven by India and China, large-scale traditional ceremonies, rapidly increasing disposable income driving luxury segments, burgeoning demand for international destination planning.

- Middle East and Africa (MEA): Exceptionally high growth in the luxury sector (GCC), high expenditure on security, custom venues, and international vendor sourcing, culturally driven elaborate events.

- Latin America: Stable growth, emphasis on family involvement, traditional values, and vibrant local cultural elements; emerging opportunities in eco-tourism destination weddings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wedding Market.- Marriott International

- David's Bridal

- Cvent

- The Knot Worldwide

- Tiffany & Co.

- InterContinental Hotels Group (IHG)

- Sandals Resorts

- Zola

- WeddingWire

- Mindy Weiss Party Consultants

- Preston Bailey Designs

- Colin Cowie Celebrations

- Bvlgari

- Pronovias

- MunaLuchi Bride

- Kleinfeld Bridal

- Wedding Planners Institute of Canada (WPIC)

- Aisle Planner

- Shane Co.

- Eventbrite

Frequently Asked Questions

Analyze common user questions about the Wedding market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth in the Luxury Wedding segment?

Growth in the Luxury segment is primarily driven by increasing global wealth, the desire for hyper-personalized and highly experiential events, and the influence of social media setting higher aesthetic benchmarks. Couples are prioritizing uniqueness and quality over traditional size, investing heavily in specialized vendors, exotic destinations, and sophisticated production technology for multi-day celebrations.

How is technology reshaping wedding planning services?

Technology is enhancing planning through AI-powered vendor matching, budget tracking, and scheduling optimization. Virtual Reality (VR) and Augmented Reality (AR) tools allow remote venue visualization and décor preview, streamlining decision-making and improving client certainty, while specialized SaaS platforms centralize communication and contract management between all stakeholders.

Which geographical region offers the most significant growth potential?

The Asia Pacific (APAC) region offers the most significant growth potential, led by high-volume markets in India and China. This growth is sustained by rising middle-class disposable income, continued cultural emphasis on large, multi-day traditional ceremonies, and increasing adoption of luxury and destination wedding trends.

What are the key consumer trends concerning sustainability in the Wedding Market?

Key sustainability trends include demand for ethically sourced attire and jewelry, preference for venues with strong environmental practices, local sourcing of catering and flowers to reduce carbon footprint, and a movement towards digital stationery and reduced physical waste. Consumers are actively seeking vendors who prioritize verifiable eco-friendly and ethical operations.

What financial factors typically restrain market growth?

The primary restraints include the high average cost of professional weddings leading to consumer debt concerns, global economic volatility impacting discretionary spending budgets, and lack of transparency in vendor pricing which can lead to budget overruns and client dissatisfaction, particularly in non-luxury segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wedding Planning Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wedding Venue Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wedding and Anniversary Gift Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wedding Ring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wedding Gown Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager