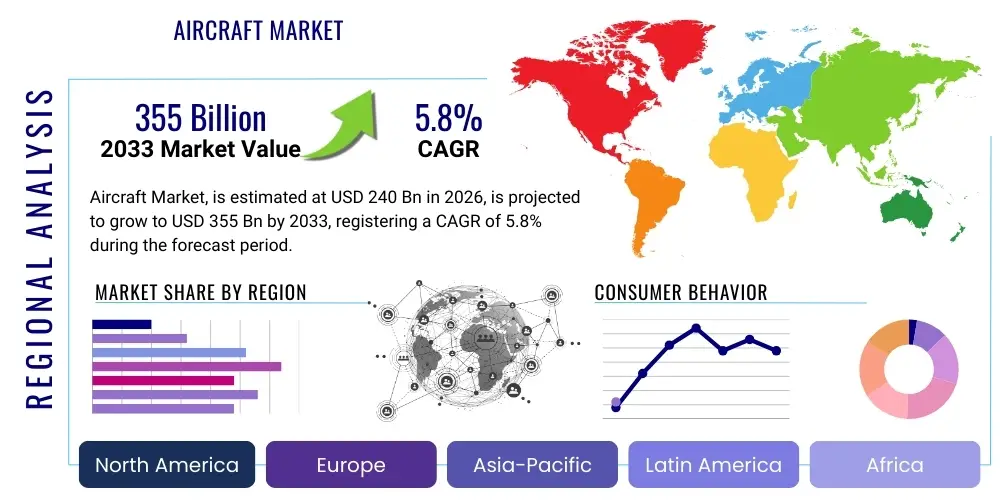

Aircraft Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438316 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Aircraft Market Size

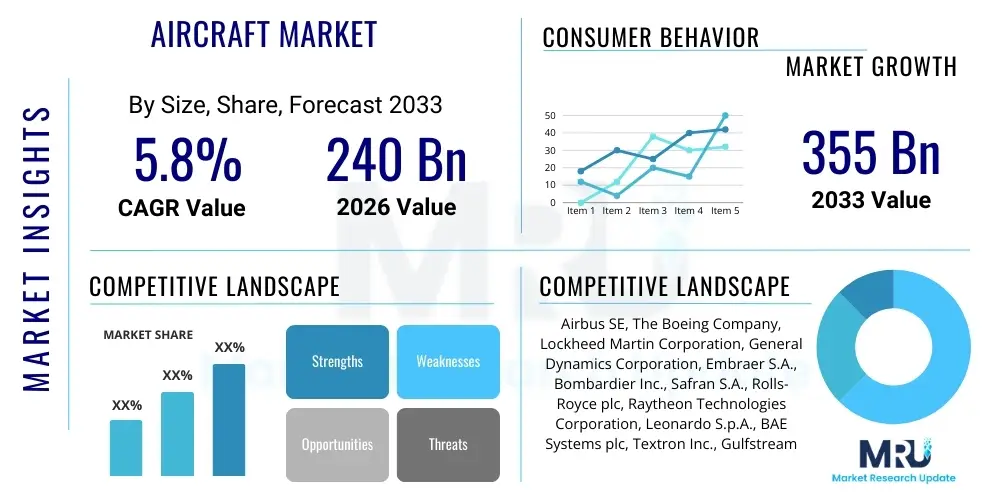

The Aircraft Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth is underpinned by steady demand for commercial air travel, accelerated modernization programs in military aviation, and increasing adoption of advanced aerospace technologies globally. The market is estimated at $240 Billion in 2026 and is projected to reach $355 Billion by the end of the forecast period in 2033, driven largely by emerging economies and the necessity for fleets to transition to more fuel-efficient and sustainable models, particularly within the commercial passenger segment. This expansion reflects significant investments in research and development aimed at enhancing propulsion efficiency, reducing noise pollution, and integrating digitalization across aircraft platforms, encompassing both fixed-wing and rotary-wing segments.

Aircraft Market introduction

The Aircraft Market encompasses the global manufacturing, assembly, maintenance, and deployment of fixed-wing and rotary-wing aerial vehicles designed for various applications, including passenger transport, cargo shipment, defense operations, and general aviation. Products range from large wide-body commercial jets and advanced fighter aircraft to business jets and specialized unmanned aerial systems (UAS). Major applications span across commercial air travel (e.g., maximizing seat capacity and route expansion), military defense (e.g., ensuring air superiority and surveillance capabilities), and freight logistics (e.g., optimizing global supply chains). Key benefits derived from this market include improved global connectivity, enhanced national security capabilities, rapid deployment of goods, and significant economic contribution through aerospace industrialization and job creation.

Driving factors for sustained market growth include the burgeoning middle class in Asia Pacific leading to higher air passenger miles, the global trend of military modernization programs focusing on fifth and sixth-generation fighters, and technological advancements such as the integration of advanced composite materials and hybrid-electric propulsion systems. Furthermore, the stringent regulatory landscape pushing for carbon emission reduction necessitates continuous fleet renewal and investment in sustainable aviation fuel (SAF)-compatible aircraft. The competitive dynamics of the market are shaped by high barriers to entry, lengthy certification processes, and intense rivalry between established Tier 1 manufacturers, often influenced by geopolitical factors and large government procurement contracts.

Aircraft Market Executive Summary

The Aircraft Market is experiencing strong recovery and strategic realignment following global disruptions, characterized by a dual focus on commercial fleet replenishment and defense technology superiority. Business trends indicate a shift towards sustainable manufacturing processes, increased reliance on digital twins for aircraft development, and strategic vertical integration by key players to secure critical supply chain components, particularly semiconductors and specialized raw materials. Major commercial airframers are prioritizing narrow-body production rate increases to meet immediate airline demand, while simultaneously launching next-generation programs focusing on long-term sustainability goals. Geographically, the Asia Pacific region, led by China and India, remains the primary engine of demand for new aircraft deliveries, driven by infrastructure expansion and increasing disposable incomes supporting air travel growth. North America and Europe continue to dominate high-value segments, specifically defense spending and premium business jet sales.

Segment trends reveal robust expansion in the military aircraft segment, fueled by rising global tensions necessitating upgrades to fighter fleets, surveillance, and transport capabilities. Concurrently, the General Aviation segment, particularly the super mid-size and long-range business jet categories, shows resilience, benefiting from increased demand for private travel solutions. Technology-wise, significant traction is observed in the integration of advanced avionics, specifically predictive maintenance systems utilizing Artificial Intelligence (AI) and Machine Learning (ML) for enhanced operational uptime and safety compliance. The transition towards unmanned aerial vehicles (UAVs) and the exploration of Urban Air Mobility (UAM) platforms also represent crucial emerging segments that are attracting substantial venture capital and industrial investment, indicating future diversification of the traditional aircraft manufacturing scope.

AI Impact Analysis on Aircraft Market

User inquiries regarding the influence of AI on the Aircraft Market typically revolve around three core themes: operational safety enhancements, cost reduction through predictive maintenance, and the integration of autonomous flight capabilities. Users frequently question how AI algorithms can predict component failure more accurately than traditional methods, thereby minimizing costly unplanned downtime and improving Maintenance, Repair, and Overhaul (MRO) efficiency. Furthermore, there is significant interest in AI's role in the design and manufacturing phase, specifically generative design and advanced simulation, which promises to accelerate aircraft development cycles and optimize structural weight. The consensus expectation is that AI will be foundational to next-generation flight control systems, enhancing decision support for pilots and paving the way for eventual single-pilot or fully autonomous commercial flights, contingent upon stringent regulatory approval and public acceptance.

The integration of AI technologies across the aircraft lifecycle, from initial concept to end-of-life recycling, represents a paradigm shift in aerospace operations. In the cockpit, AI is enabling advanced route optimization systems that dynamically adjust flight plans based on real-time weather and air traffic data, leading to substantial fuel savings and reduced environmental impact. On the manufacturing floor, robotic process automation coupled with computer vision systems powered by AI ensures higher precision in complex assembly tasks and superior quality control checks, vastly reducing manufacturing defects. The ability of machine learning models to analyze vast datasets generated by modern aircraft sensors is transforming fleet management, allowing operators to transition from scheduled maintenance routines to proactive, condition-based maintenance strategies, significantly lowering operating expenses and extending asset lifespan.

- Implementation of predictive maintenance using ML to forecast component degradation and reduce AOG (Aircraft on Ground) time.

- Enhancement of flight control and navigation systems through deep learning algorithms, improving safety margins and optimizing fuel efficiency.

- Application of generative design and topology optimization in R&D to create lighter, stronger airframe structures.

- Development of advanced automated inspection systems utilizing AI-powered visual recognition for rapid defect detection during MRO.

- Integration of AI-driven decision support tools in cockpits for improved situational awareness and risk management in complex airspaces.

- Acceleration of training simulations through virtual reality and AI agents, providing realistic scenarios for pilot proficiency development.

- Optimization of supply chain logistics and inventory management for spare parts using AI forecasting models.

- Enabling the foundational technology required for future autonomous cargo and urban air mobility (UAM) vehicles.

DRO & Impact Forces Of Aircraft Market

The Aircraft Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces that determine market trajectory. Key drivers include the overwhelming global demand for new aircraft driven by commercial traffic growth, particularly in emerging markets, coupled with the urgent requirement for airlines to replace aging, less fuel-efficient fleets to meet carbon reduction mandates. However, the market faces formidable restraints such as extremely high capital expenditure requirements for aircraft procurement, protracted lead times for component deliveries exacerbated by ongoing supply chain bottlenecks, and the immense regulatory hurdles governing certification and airworthiness standards across different global jurisdictions. These elements collectively necessitate careful planning and substantial financial backing from market participants.

Opportunities for growth are heavily concentrated in technological innovation and diversification. The push towards sustainable aviation, including the development and adoption of Sustainable Aviation Fuels (SAF), hybrid-electric, and fully electric aircraft, presents a significant long-term growth avenue. Furthermore, the rapid advancement and militarization of Unmanned Aerial Systems (UAS/drones) and the nascent Urban Air Mobility (UAM) ecosystem offer entirely new segments outside traditional commercial and military platforms. The primary impact forces are economic buoyancy (which dictates airline profitability and thus purchase decisions), geopolitical stability (affecting defense budgets and trade relations), and technological disruption (which mandates continuous investment in R&D to stay competitive and meet environmental targets). The cyclical nature of the aerospace industry amplifies the sensitivity of the market to global GDP performance and access to affordable financing.

The cyclical nature of the market is intensely amplified by exogenous shocks, such as pandemics or major geopolitical conflicts, which necessitate dynamic responses from manufacturers regarding production rates and workforce management. Restraints related to labor shortages, particularly for highly skilled engineers and maintenance technicians, further compound the operational challenges faced by the industry. Consequently, manufacturers are heavily investing in automation and digital tools to mitigate these pressures and improve production throughput. Opportunities related to defense spending escalation, particularly across NATO countries and the Asia Pacific, provide a stable and high-margin counter-balance to the inherent volatility of the commercial sector, ensuring continued market resilience through diverse revenue streams.

Segmentation Analysis

The Aircraft Market is extensively segmented based on criteria such as type, system, application, and end-user, allowing for precise market analysis tailored to specific operational requirements and investment profiles. Segmentation by aircraft type—Commercial, Military, and General Aviation—reflects the core operational missions and regulatory frameworks governing each sector, with Commercial Aviation dominating in terms of volume and economic value, while Military Aviation commands the highest unit cost and technological complexity. Analyzing the market through the lens of critical systems, such as avionics, engines, and airframes, provides detailed insights into where technological investment and supply chain value are concentrated, highlighting dependencies on specialist component suppliers.

The application segment distinguishes between passenger transport (scheduled and chartered), dedicated cargo operations, and specialized military functions (e.g., intelligence, surveillance, reconnaissance - ISR). Furthermore, the delineation by technology, such as conventional jet engine versus hybrid or electric propulsion, is becoming increasingly relevant as the industry pivots towards decarbonization goals. This detailed segmentation is crucial for stakeholders to tailor their product offerings, identify lucrative niche markets like vertical takeoff and landing (VTOL) aircraft for UAM, and strategically allocate R&D resources toward high-growth areas, particularly those underpinned by sustainable and autonomous flight technologies.

- By Aircraft Type:

- Commercial Aircraft (Narrow-body, Wide-body, Regional Jets)

- Military Aircraft (Fighter Jets, Trainer Jets, Military Transport, Rotorcraft)

- General Aviation (Business Jets, Light Aircraft, Helicopters)

- By System:

- Airframe (Fuselage, Wings, Tail Assembly)

- Engine (Turbofan, Turboprop, Turbojet, Turboshaft)

- Avionics (Flight Control Systems, Navigation, Communication Systems)

- Landing Gear

- By Application:

- Passenger Transport

- Cargo Transport

- Military Operations and Defense

- Private and Business Use

- By Technology:

- Conventional Combustion Engines

- Hybrid-Electric Propulsion

- Electric Propulsion (Emerging)

- Advanced Composite Materials

Value Chain Analysis For Aircraft Market

The Aircraft Market value chain is characterized by multiple tiered structures, demanding high levels of integration and collaboration across specialized fields. The upstream segment involves raw material suppliers (e.g., aluminum, titanium, advanced composites) and component manufacturers (Tier 2 and 3 suppliers providing highly specialized parts like actuators, wiring harnesses, and fasteners). These suppliers must adhere to extremely rigorous quality control and certification standards, facing long lead times and high intellectual property requirements. The core of the value chain rests with Tier 1 system integrators and Original Equipment Manufacturers (OEMs) such as Boeing and Airbus, who undertake the complex process of design, final assembly, integration of major systems (engines, avionics), and extensive flight testing and certification, representing the segment with the highest capital expenditure and regulatory risk.

Downstream activities focus on the distribution and operational lifecycle management of the aircraft. Distribution channels primarily involve direct sales (Business-to-Government for military sales, and Business-to-Business for commercial carriers), often facilitated by complex financing structures and long-term service agreements. Post-delivery, the value chain shifts to Maintenance, Repair, and Overhaul (MRO) service providers—a highly profitable segment encompassing scheduled checks, component repair, and major overhauls, driven by regulatory requirements for airworthiness. Both direct channels (OEM proprietary MRO services) and indirect channels (third-party MRO specialists and airline in-house maintenance) are vital, ensuring aircraft reliability and minimizing operational disruption.

The complexity of the global supply network means that effective supply chain management is a critical determinant of OEM success. Manufacturers increasingly rely on digitalization (e.g., blockchain for tracking parts authenticity, IoT for predictive maintenance feedback) to enhance efficiency and transparency across the value chain. Strategic partnerships with key suppliers (like engine manufacturers such as Rolls-Royce and GE) are essential, often involving risk-sharing agreements in development programs. The strong emphasis on aftermarket services provides stable, high-margin revenue streams that often counterbalance the cyclical nature of new aircraft deliveries, solidifying the importance of long-term customer relationships and integrated digital service offerings throughout the operational lifespan of the asset.

Aircraft Market Potential Customers

The potential customers for the Aircraft Market are diverse, highly capitalized, and categorized based on their operational mandates and procurement requirements. Commercial aviation represents the largest volume buyer, primarily comprising major global airlines (e.g., Delta, Emirates, Lufthansa) and low-cost carriers (e.g., Ryanair, Southwest) that purchase aircraft for passenger and dedicated cargo services. Aircraft leasing companies (e.g., AerCap, GECAS) also constitute massive purchasers, acquiring large fleets and subsequently leasing them to airlines worldwide, acting as crucial financial intermediaries in the market.

The second primary customer group is the government sector, encompassing national defense ministries and paramilitary organizations. These entities acquire military aircraft, helicopters, and specialized ISR platforms through large, multi-year procurement contracts often influenced by political alliances and national security objectives. The final significant customer segment is high-net-worth individuals, corporations, and charter operators who purchase business jets and general aviation aircraft for private, corporate, or chartered travel needs, prioritizing speed, comfort, and operational flexibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $240 Billion |

| Market Forecast in 2033 | $355 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Airbus SE, The Boeing Company, Lockheed Martin Corporation, General Dynamics Corporation, Embraer S.A., Bombardier Inc., Safran S.A., Rolls-Royce plc, Raytheon Technologies Corporation, Leonardo S.p.A., BAE Systems plc, Textron Inc., Gulfstream Aerospace (General Dynamics Subsidiary), Dassault Aviation, Mitsubishi Heavy Industries, Commercial Aircraft Corporation of China, Ltd. (COMAC), Triumph Group, Spirit AeroSystems, Honeywell Aerospace. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Market Key Technology Landscape

The current Aircraft Market technology landscape is defined by continuous innovation focused on three pillars: efficiency, sustainability, and digitalization. A pivotal development is the accelerated adoption of advanced materials, particularly carbon fiber reinforced plastics (CFRPs) and specialized titanium alloys. These materials are crucial for reducing the structural weight of aircraft, directly contributing to lower fuel burn and extended operational range. Furthermore, additive manufacturing (3D printing) is transforming the prototyping and production of complex, geometrically optimized parts for both engines and airframes, reducing waste and lead times, though challenges remain in certifying critical load-bearing components manufactured this way. Engine technology is evolving rapidly, moving beyond high-bypass turbofans toward open-rotor designs and ultra-high bypass ratio (UHBR) architectures to maximize propulsive efficiency and minimize noise footprint, while simultaneously ensuring compatibility with 100% Sustainable Aviation Fuels (SAF).

Digitalization permeates all aspects of modern aircraft design and operation. The reliance on digital twins—virtual replicas of physical aircraft systems—allows manufacturers to perform millions of simulations for maintenance planning, performance optimization, and failure prediction before the physical asset is even operational. In the avionics suite, the shift is toward fully integrated modular avionics (IMA) architectures, which consolidate multiple functions onto standardized computing platforms, reducing complexity, weight, and facilitating easier software upgrades. This move is foundational for supporting increasingly automated and potentially autonomous flight modes, relying heavily on sophisticated sensor fusion and AI processing capabilities to interpret real-time environmental and operational data, especially critical for next-generation military platforms and future UAM vehicles.

Sustainability mandates are driving technological focus into disruptive propulsion methods. Significant R&D is being channeled into hybrid-electric and pure electric propulsion systems, especially for smaller regional aircraft and UAM concepts, aiming to achieve zero direct operational emissions. While battery energy density remains a constraint for large commercial applications, the progress in fuel cell technology and hydrogen propulsion is positioning these as viable, albeit long-term, solutions for long-haul flights. This technological evolution requires significant collaboration between traditional airframers, engine manufacturers, and specialized electric powertrain developers, fundamentally changing the competitive landscape and driving the need for new skill sets across the aerospace engineering domain.

Regional Highlights

The global Aircraft Market exhibits significant regional variations in demand, technological adoption, and manufacturing concentration. North America remains the leading market in terms of technology development, defense spending, and MRO activities. The region hosts the headquarters of major OEMs like Boeing and Lockheed Martin, benefiting from robust domestic demand, particularly for business jets and high-end military platforms. The strict regulatory environment and massive governmental expenditure on aerospace R&D further cement its technological leadership, driving innovation in autonomous systems and advanced materials.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This growth is predominantly fueled by rapid urbanization, expanding middle-class populations, and the resulting surge in air travel demand, necessitating vast fleet expansion and the establishment of new airline routes. Countries like China and India are major drivers, not only demanding imported aircraft but also fostering domestic manufacturing capabilities (e.g., COMAC in China). Infrastructure development, including new airport construction and modernization, supports this upward trajectory, although geopolitical tensions and trade restrictions can influence procurement decisions, particularly in the military segment.

Europe holds a strong position, anchored by Airbus SE and major system integrators like Safran and Rolls-Royce. European market growth is primarily driven by fleet replacement, focusing heavily on sustainability goals, evidenced by substantial investments in SAF research and the development of zero-emission flight demonstrators. Latin America and the Middle East & Africa (MEA) represent important emerging markets. MEA, particularly the Gulf Cooperation Council (GCC) states, acts as a critical hub for international air travel, driving demand for wide-body aircraft and advanced MRO services, while Latin America exhibits strong demand for regional jets and general aviation platforms, often tied to resource extraction industries and complex geographical terrains.

- North America: Dominates defense spending; significant market for business jets; hub for advanced MRO and technology R&D (AI, autonomy).

- Asia Pacific (APAC): Highest volume growth due to rising passenger traffic and rapid fleet expansion; increasing domestic manufacturing capacity (China).

- Europe: Strong focus on fleet decarbonization and sustainability; major presence of Tier 1 OEMs and engine manufacturers; robust regional jet market.

- Middle East & Africa (MEA): Key strategic transit hub driving wide-body aircraft demand; substantial government investment in modernizing national carriers and defense capabilities.

- Latin America: Growing demand for regional aircraft and helicopters; economic growth tied to natural resource extraction influencing private aviation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Market, encompassing airframers, engine manufacturers, and major system integrators. These companies shape the global landscape through innovation, production capacity, and strategic alliances.- Airbus SE

- The Boeing Company

- Lockheed Martin Corporation

- General Dynamics Corporation

- Embraer S.A.

- Bombardier Inc.

- Safran S.A.

- Rolls-Royce plc

- Raytheon Technologies Corporation

- Leonardo S.p.A.

- BAE Systems plc

- Textron Inc.

- Gulfstream Aerospace (General Dynamics Subsidiary)

- Dassault Aviation

- Mitsubishi Heavy Industries

- Commercial Aircraft Corporation of China, Ltd. (COMAC)

- Northrop Grumman Corporation

- Honeywell Aerospace

- L3Harris Technologies

- Spirit AeroSystems

Frequently Asked Questions

Analyze common user questions about the Aircraft market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for long-term growth in the Commercial Aircraft Market?

The primary driver is the growth of the global middle class, particularly across the Asia Pacific region, resulting in sustained increases in air passenger traffic and the subsequent need for major airlines to continuously expand and modernize their fleets with more fuel-efficient narrow-body and wide-body aircraft.

How are environmental regulations impacting new aircraft manufacturing?

Environmental regulations are compelling manufacturers to heavily invest in Sustainable Aviation Fuels (SAF) compatibility and develop next-generation propulsion systems, such as hybrid-electric and ultra-high bypass ratio engines, to meet stringent carbon emission reduction targets imposed by global aviation bodies like ICAO and EASA.

What role does the aftermarket segment play in the overall market value?

The aftermarket segment, encompassing Maintenance, Repair, and Overhaul (MRO), is crucial. It provides stable, high-margin revenue streams and accounts for a significant portion of the total market value, driven by regulatory mandates ensuring aircraft airworthiness and operational safety over their entire lifecycle.

Which technological innovation is expected to most significantly alter future aircraft design?

The most significant technological alteration is expected to stem from the integration of Artificial Intelligence (AI) and advanced composite materials. AI will revolutionize manufacturing quality, predictive maintenance, and flight autonomy, while composite usage will drastically reduce weight and improve fuel efficiency across all aircraft types.

What are the main risks associated with the Aircraft supply chain?

The main risks include high vulnerability to geopolitical tensions, which affect access to specialized raw materials (e.g., titanium), and chronic component shortages (e.g., semiconductors and specialized forgings) that lead to extended production delays and increase the overall cost of new aircraft delivery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Aircraft Refueling Trucks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aircraft Hangar Door Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aircraft Carpets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aircraft Fuel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aircraft and Aerospace Aluminum Casting Components Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager