Alumina Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433839 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Alumina Market Size

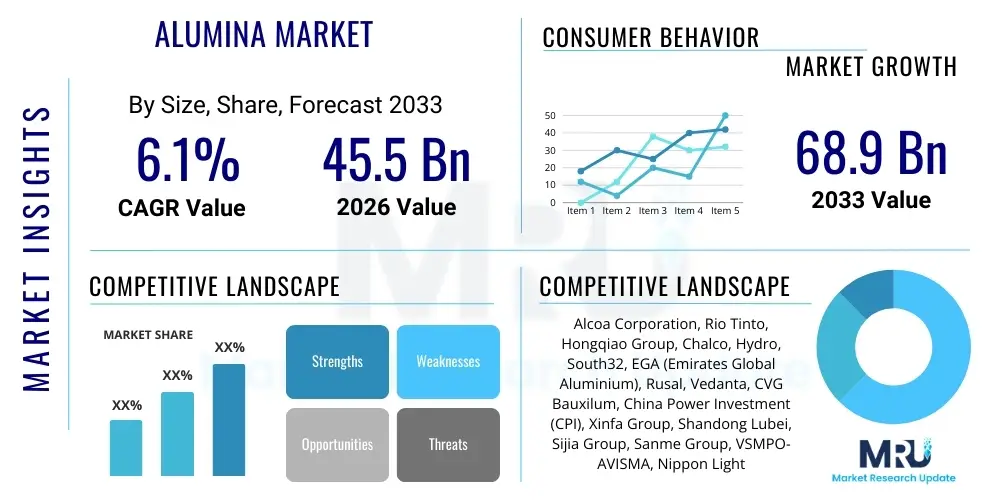

The Alumina Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 68.9 Billion by the end of the forecast period in 2033.

Alumina Market introduction

Alumina, chemically aluminum oxide (Al2O3), stands as a fundamentally critical industrial material derived primarily from bauxite ore through the Bayer process. Its market introduction is characterized by its dual role: serving as the essential feedstock for primary aluminum smelting, which consumes approximately 90% of global production, and offering high-performance technical grades for sophisticated non-metallurgical applications. The strategic importance of the Alumina Market is profoundly linked to global industrialization, infrastructural development, and the transition toward lighter, more energy-efficient materials, particularly in the automotive and aerospace sectors where aluminum usage is increasing rapidly.

The product description encompasses various forms, including calcined, tabular, fused, and activated alumina, each engineered for specific properties such as high hardness, chemical inertness, exceptional thermal stability, and high dielectric strength. Major applications span refractory ceramics used in steel and cement industries, advanced abrasives for precision grinding, electronic substrates requiring thermal management, and specialized filtration media for water purification and gas separation. The inherent benefits of alumina, such as its high melting point and resistance to wear and corrosion, position it as irreplaceable in extreme operating environments, driving sustained demand across diverse industrial ecosystems globally.

Driving factors for the market expansion are manifold and include escalating urbanization rates in emerging economies leading to increased infrastructure and construction activities, coupled with stringent environmental regulations that boost demand for specialized activated alumina used in pollution control. Furthermore, the persistent push for lightweight vehicle manufacturing to enhance fuel efficiency and reduce carbon emissions ensures continuous, strong demand for primary aluminum, thereby reinforcing the core requirement for metallurgical-grade alumina. Technological advancements in non-metallurgical grades, focusing on enhanced purity and tailored microstructure, are opening new frontiers in high-end ceramics and medical devices.

Alumina Market Executive Summary

The Alumina Market demonstrates resilience driven primarily by robust demand from the metallurgical sector, particularly in Asia Pacific, coupled with significant expansion in specialized, high-margin technical alumina segments. Key business trends indicate a heightened focus on efficiency improvements in the Bayer process to reduce energy consumption and manage increasing raw material costs, alongside strategic vertical integration by major mining companies to secure supply chains. Geopolitical stability concerning bauxite supply, particularly in West Africa and Australia, remains a crucial factor influencing global pricing and capacity expansion decisions, prompting diversification efforts among downstream aluminum producers.

Regional trends highlight the dominance of the Asia Pacific, spearheaded by China and India, which are the epicenter of global aluminum smelting capacity and rapid industrial expansion. China’s dual role as the largest producer and consumer dictates global market dynamics, although its environmental policies affecting refinery output introduce considerable volatility. North America and Europe, while having lower primary production growth, show significant increases in demand for high-purity, specialized alumina used in advanced ceramics, refractories, and catalysts, driven by established, high-technology end-use industries focusing on innovation and performance over volume.

Segment trends underscore the accelerated growth of non-metallurgical applications. While metallurgical-grade alumina maintains the largest market share by volume, segments like tabular and high-purity calcined alumina are witnessing superior growth rates due to their crucial role in high-wear refractory linings, aerospace components, and lithium-ion battery separators. The increasing necessity for sustainable materials is boosting the activated alumina segment for use in water treatment and desiccant applications, responding directly to global urbanization challenges and increasing regulatory pressures regarding clean water access and industrial effluent management.

AI Impact Analysis on Alumina Market

Users frequently inquire about how artificial intelligence (AI) can optimize the historically energy-intensive and complex processes involved in alumina refining, particularly concerning process efficiency, predictive maintenance, and quality control. Key concerns revolve around the integration costs, data infrastructure requirements, and the necessity of specialized skills for deploying sophisticated AI models within existing refinery infrastructure. Expectations center on AI's potential to dramatically improve yield rates, minimize waste generation, and enhance consistency in product quality, especially for technical grades that demand extremely tight specifications. The consensus is that AI deployment will move the industry towards smarter, more sustainable, and cost-effective production methodologies, mitigating risks associated with operational variance and fluctuating input quality.

- Optimization of the Bayer Process: AI algorithms analyze real-time sensor data (temperature, pressure, chemical composition) to dynamically adjust parameters, maximizing caustic soda utilization and minimizing energy consumption during digestion and calcination.

- Predictive Maintenance: Machine learning models predict equipment failures (e.g., kilns, pumps, heat exchangers) before they occur, reducing unplanned downtime and maintenance costs significantly.

- Bauxite Resource Management: AI assists in geological modeling and mine planning, optimizing the extraction sequence of bauxite to ensure consistent ore quality delivered to the refinery, despite natural variations in composition.

- Quality Control and Classification: Computer vision and AI-driven spectroscopy systems rapidly assess the purity, particle size distribution, and morphological characteristics of the final alumina product, ensuring compliance with strict customer specifications for technical applications.

- Supply Chain Forecasting: Advanced analytics and AI improve the accuracy of forecasting demand for specific alumina grades, optimizing inventory levels and mitigating market volatility risks associated with logistics and shipping delays.

- Environmental Compliance Monitoring: AI tools monitor emissions and wastewater composition in real-time, ensuring immediate detection of deviations and assisting in proactive adjustment to maintain compliance with increasingly stringent environmental regulations regarding red mud disposal and air quality.

DRO & Impact Forces Of Alumina Market

The Alumina Market operates under a complex set of internal and external forces, summarized by critical Drivers (D), significant Restraints (R), and promising Opportunities (O). Primary drivers include the relentless global demand for primary aluminum, fueled by electrification and lightweighting trends in transportation, coupled with the rising use of technical alumina in emerging technologies such as lithium-ion batteries and high-performance electronic packaging. Restraints largely center on the intensive energy requirements of the refining process, contributing to high operational costs, coupled with the environmental challenge of managing red mud (bauxite residue), which necessitates capital expenditure on sustainable disposal or beneficial reuse technologies. Opportunities are vast in developing high-purity alumina (HPA) for specialized electronics and sapphire production, and in implementing advanced digital technologies and automation (AI/IoT) to enhance process efficiency and reduce the overall environmental footprint, thus improving market competitiveness and long-term sustainability.

Impact forces stemming from geopolitical factors and regulatory changes significantly shape the market trajectory. The concentration of high-quality bauxite reserves in a few nations introduces supply chain volatility, making the market vulnerable to trade disputes or political instability in major sourcing regions, particularly Guinea and Australia. Furthermore, evolving global standards for carbon emissions and industrial waste management (especially in key manufacturing hubs like China and Europe) mandate substantial investments in green technologies, such as utilizing renewable energy for calcination and developing innovative, circular economy solutions for bauxite residue management. These forces compel producers to prioritize long-term sustainability over short-term production maximization, indirectly impacting capital deployment and expansion strategies.

The interplay of increasing infrastructural spending, especially in developing nations, and the parallel push for advanced, sustainable materials in developed economies creates a dynamic equilibrium for alumina pricing and segmentation strategy. While bulk metallurgical demand is tied closely to commodity cycles, the premium technical grades are insulated by specialized performance requirements and stringent qualification standards, leading to margin divergence across the market spectrum. The technological imperative to decarbonize the aluminum supply chain, including advancements in inert anode technology and potential shifts away from the traditional Bayer process, presents both a long-term threat and a high-value opportunity for manufacturers capable of pioneering sustainable production routes.

Segmentation Analysis

The Alumina Market is systematically segmented based on Type, Application, and End-Use Industry, reflecting the diversity of product specifications and functional requirements across various industrial domains. This segmentation is crucial as the performance and price points vary drastically between high-volume, standard metallurgical grades and low-volume, high-purity technical grades. Analysis of these segments reveals a market bifurcated between stable commodity demand driven by aluminum production and high-growth niche demand driven by advanced material science applications. Understanding these nuances allows market participants to strategically allocate resources toward segments offering superior growth potential and higher margins, particularly in the refractory and electronic sectors where specialized alumina is critical for performance.

The Type segment is defined by the processing method and resultant physical properties, ranging from standard Calcined Alumina (used widely in refractories and general ceramics) to specialized forms like Tabular Alumina (known for excellent heat and wear resistance in continuous casting) and Activated Alumina (critical for gas and liquid purification). The Application segmentation details how the material is utilized, with the overwhelming majority dedicated to aluminum smelting, followed by critical roles in ceramics, abrasives, and chemical catalysts. This layered approach demonstrates the functional versatility of Alumina, allowing for detailed assessment of demand drivers specific to each application, such as the relationship between global automotive production and demand for aluminum vs. the relationship between semiconductor manufacturing growth and demand for high-purity substrates.

The End-Use Industry segmentation provides a macro-view, linking alumina consumption directly to industrial activity across sectors such as Metallurgy (primary consumption), Automotive (lightweighting components and ceramics), Construction (refractories and insulation), and Electronics (substrates and polishing media). The fastest growth in consumption is observed in sectors prioritizing material performance under extreme conditions or demanding high purity, such as the healthcare industry (for dental ceramics and prosthetics) and specialized water treatment facilities. This detailed segmentation aids stakeholders in strategic planning, identifying where macroeconomic trends translate into tangible demand for specific alumina products, thereby justifying research and development investments in specific product grades and refinement technologies.

- By Type:

- Tabular Alumina

- Fused Alumina (White Fused Alumina, Brown Fused Alumina)

- Calcined Alumina (Standard, Low Soda, Reactive)

- Activated Alumina

- High Purity Alumina (HPA)

- By Application:

- Aluminum Production (Smelting/Metallurgical)

- Refractories (Continuous Casting, Kiln Linings)

- Ceramics (Structural, Technical, Electronic)

- Abrasives and Polishing Media

- Chemicals and Catalysts

- Filtration and Water Treatment

- By End-Use Industry:

- Metallurgy

- Automotive and Transportation

- Construction and Infrastructure

- Electrical & Electronics

- Healthcare and Medical Devices

- Water Treatment and Environmental

Value Chain Analysis For Alumina Market

The Alumina Market value chain is a complex, capital-intensive structure beginning with the extraction of bauxite ore and culminating in the use of specialized alumina products by diverse end-user industries. The upstream analysis is dominated by the mining and refining stages, where bauxite miners (often integrated with refiners) extract the ore and process it into alumina via the Bayer method. The high capital requirements and geopolitical concentration of quality bauxite resources dictate the upstream power dynamics. Efficiency in the Bayer process—specifically, minimizing energy consumption and caustic soda usage—is paramount for cost competitiveness in this foundational stage, particularly for metallurgical grades where margins are tight.

The midstream involves the transformation of standard metallurgical alumina into specialized technical grades (calcined, tabular, fused, activated) through advanced thermal and chemical treatments, which significantly increase the value and complexity of the product. This stage requires distinct technological expertise and high-quality control measures. Distribution channels are highly fragmented, differentiating between high-volume, direct contractual sales to large aluminum smelters and multi-tiered distribution networks involving specialized distributors and agents for technical alumina destined for refractories, ceramics, and abrasives sectors. Direct sales ensure stable throughput for major producers, while indirect channels provide market access and technical support for smaller, specialized consumers.

Downstream analysis focuses on the application sectors, with primary aluminum smelters consuming the vast majority of production. However, the rapidly growing, high-margin downstream users are in the advanced manufacturing sectors, including manufacturers of high-performance refractories for the steel and cement industries, technical ceramic components for aerospace and defense, and high-purity material integrators for lithium-ion battery separators and LED substrates. The influence of downstream innovation—such as the development of inert anodes or new ceramic matrix composites—is increasingly pulling the value chain towards higher purity and tailored material specifications, thereby driving investment in midstream processing capabilities and specialization.

Alumina Market Potential Customers

The Alumina Market serves a diverse yet concentrated customer base, categorized primarily into metallurgical consumers and technical consumers. Metallurgical customers, comprising integrated aluminum producers and independent smelters, represent the single largest volume buyers. These buyers require consistent, large-scale supply of smelter-grade alumina (SGA) with stringent requirements for low moisture and consistent particle size distribution to ensure optimal performance in electrolytic reduction cells. The purchasing decisions of these major players are heavily influenced by long-term supply agreements, logistical efficiency, and global LME aluminum pricing, making them highly price-sensitive but volume-stable anchors of the market.

Technical consumers represent the higher-value segment, demanding specialized physical and chemical properties. Key buyers include global refractory manufacturers that rely on tabular and fused alumina for lining kilns and furnaces in the steel, glass, and cement industries, requiring materials with exceptional thermal shock resistance and high mechanical strength. Additionally, manufacturers of advanced technical ceramics, serving the automotive, electrical, and aerospace industries, are crucial customers, purchasing high-purity grades for applications such as spark plug insulators, electronic substrates, and armor plating. These buyers prioritize quality, purity (HPA), and specialized particle morphology over bulk price.

Emerging customer segments include manufacturers of environmentally focused products, such as water treatment plants and specialized chemical companies that use activated alumina for fluoride and arsenic removal, or as catalysts and catalyst supports in petroleum refining and petrochemical processing. Furthermore, the proliferation of electric vehicles (EVs) drives demand from lithium-ion battery component manufacturers who require high-purity alumina for coating separators to enhance thermal stability and safety. These new segments are highly dynamic, requiring close collaboration with suppliers to meet rapidly evolving product specifications and rigorous regulatory standards, thereby offering significant opportunities for long-term strategic partnerships and premium pricing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 68.9 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alcoa Corporation, Rio Tinto, Hongqiao Group, Chalco, Hydro, South32, EGA (Emirates Global Aluminium), Rusal, Vedanta, CVG Bauxilum, China Power Investment (CPI), Xinfa Group, Shandong Lubei, Sijia Group, Sanme Group, VSMPO-AVISMA, Nippon Light Metal, Sumitomo Chemical, Hindalco Industries, Norsk Hydro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alumina Market Key Technology Landscape

The fundamental technology underpinning the Alumina Market remains the Bayer process, a century-old method for converting bauxite ore into aluminum hydroxide, which is subsequently calcined into alumina. However, modern technological advancements focus intensively on optimizing this process to enhance yield, reduce energy intensity, and improve environmental performance. Key technological innovations center on areas such as high-pressure digestion to handle lower-quality bauxite ores efficiently, specialized heat recovery systems within the refinery to minimize reliance on external energy sources, and sophisticated crystallization techniques to control particle size and morphology, which is crucial for technical-grade performance. These incremental improvements are vital for maintaining competitiveness against volatile energy prices and securing access to diversified bauxite sources globally.

A significant area of technological focus is the development of processes for producing High Purity Alumina (HPA, 4N to 6N purity), essential for non-metallurgical applications like LED phosphors, synthetic sapphire, and advanced electronic substrates. Unlike metallurgical alumina, HPA production often bypasses the traditional Bayer route, utilizing chemical methods such as acid leaching or fractional crystallization of aluminum precursors (e.g., aluminum chloride or aluminum sulfate). These non-Bayer methods are capital-intensive but necessary to achieve the ultra-high purity required by the electronics and optics industries. Furthermore, technologies addressing the notorious red mud residue are gaining prominence, including various dry stacking techniques, solidification methods, and attempts at mineral extraction (e.g., iron, rare earth elements) to transition waste into valuable resources, aligning the industry with circular economy principles.

The technology landscape is further characterized by the increasing implementation of Industry 4.0 concepts. Advanced sensor networks, Internet of Things (IoT) devices, and sophisticated data analytics platforms are being integrated across refineries to enable real-time monitoring and predictive control. This digital transformation improves operational stability, minimizes chemical reagent usage, and allows for precise adjustments necessary for producing specialty alumina products on demand. Additionally, research into new calcination furnace designs (e.g., highly efficient fluid bed calciners) and alternative, low-carbon processing routes (such as inert anode technology for downstream aluminum production which could eventually alter the requirements for alumina purity) signifies a continuous technological evolution aimed at achieving sustainability and cost leadership in the global market.

Regional Highlights

The regional dynamics of the Alumina Market are highly asymmetrical, dominated by production and consumption activities concentrated in the Asia Pacific region, primarily China, which operates under unique regulatory and economic pressures. China serves as the single largest global producer and consumer, driven by its massive domestic aluminum smelting capacity and rapidly expanding technical ceramics and refractory sectors. The government's environmental mandates, however, often lead to temporary capacity closures or production curtailments, introducing periodic supply tightness and price volatility felt globally. India is another major growth engine in APAC, buoyed by rapid infrastructure build-out and increasing domestic demand for both primary aluminum and technical grades, supported by substantial indigenous bauxite reserves and ongoing refinery expansions.

North America and Europe represent mature markets characterized by stable, though lower volume, demand for metallurgical alumina, but high-value growth in technical and specialty grades. In Europe, the focus is increasingly on sustainability and high-performance applications; demand is strong for tabular and specialized calcined alumina used in high-end automotive, aerospace, and advanced energy storage systems. European producers often concentrate on niche, high-margin products that adhere to stringent quality and environmental standards. North America shows consistent demand, particularly from the refractory sector supporting the large domestic steel industry, alongside growing usage of activated alumina in environmental applications such as advanced water filtration systems, driven by stricter municipal and industrial effluent regulations.

The Middle East and Africa (MEA) and Latin America regions are crucial for bauxite sourcing and emerging production capacity. The MEA region, particularly the GCC countries like the UAE (with EGA), has invested heavily in large-scale, cost-efficient alumina refining capacity, leveraging cheap energy and strategic logistical access to supply their domestic, large-scale aluminum smelters. Latin America, especially Brazil, holds vast bauxite reserves and established refining operations (like Hydro Alunorte), positioning the region as a critical global supplier of both bauxite and refined alumina. Future market expansion will depend significantly on the continued development of bauxite mining infrastructure and stable political environments in these key resource-rich regions, ensuring a diversified and stable global supply chain necessary to meet escalating global demand.

- Asia Pacific (APAC): Dominates global consumption and production, spearheaded by China and India. High growth fueled by metallurgical demand, infrastructure spending, and expansion of ceramics/electronics manufacturing. Subject to significant governmental influence regarding production capacity and environmental compliance.

- North America: Mature market focusing on high-value, specialized alumina (e.g., abrasives, activated alumina for filtration). Steady demand from aerospace, automotive, and traditional manufacturing sectors.

- Europe: Strong demand for technical alumina in high-performance applications (refractories, advanced ceramics, lightweight materials). Emphasis on sustainable production methods and adherence to strict regulatory frameworks.

- Latin America (LATAM): Key supplier of bauxite and alumina, particularly Brazil. Market dynamics heavily influenced by commodity cycles and capital investment stability in mining and refining projects.

- Middle East and Africa (MEA): Strategic hub for cost-competitive, integrated aluminum production, using regional energy advantages. Guinea is rapidly emerging as a critical global bauxite source, determining the long-term upstream supply stability for global refiners.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alumina Market.- Alcoa Corporation

- Rio Tinto

- Hongqiao Group

- Chalco (Aluminum Corporation of China)

- Hydro (Norsk Hydro)

- South32

- EGA (Emirates Global Aluminium)

- Rusal

- Vedanta Resources

- CVG Bauxilum

- China Power Investment (CPI)

- Xinfa Group

- Shandong Lubei

- Sijia Group

- Sanme Group

- VSMPO-AVISMA (Supplying titanium products requiring high purity inputs)

- Nippon Light Metal

- Sumitomo Chemical

- Hindalco Industries

- Gove Aluminium Finance Limited (GAC)

Frequently Asked Questions

Analyze common user questions about the Alumina market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for global Alumina market demand?

The primary driver is the massive global requirement for primary aluminum production (smelting), which consumes approximately 90% of all metallurgical-grade alumina. This demand is intrinsically linked to global industrial growth, urbanization, and the adoption of lightweight materials in transportation and construction sectors worldwide.

How do specialized Alumina grades differ from standard metallurgical-grade Alumina?

Specialized grades (e.g., Tabular, Fused, High Purity Alumina) undergo additional, intensive processing (like high-temperature sintering or chemical purification) to achieve superior properties such as enhanced thermal shock resistance, higher mechanical strength, and ultra-high chemical purity (up to 99.999%). These grades are used in high-margin applications like advanced ceramics, LED substrates, and specialized refractories, commanding significant price premiums over standard smelter-grade alumina.

What major environmental challenge faces Alumina refineries?

The most significant environmental challenge is the safe and sustainable disposal of bauxite residue, commonly known as "red mud." This waste product is voluminous, alkaline, and requires specialized impoundment or processing techniques to mitigate environmental risks, driving significant research into innovative utilization methods, such as recovering valuable elements or using it in construction materials.

Which geographic region holds the most influence over global Alumina pricing and supply?

The Asia Pacific region, particularly China, holds the most significant influence. China dominates global aluminum production and consumption, meaning changes in its domestic regulatory environment (especially concerning environmental compliance, energy costs, and production capacity) directly impact global supply volumes and subsequently affect international alumina commodity prices and trade flows.

How is AI and digitalization impacting the operational efficiency of Alumina production?

AI and digitalization are primarily used for process optimization, where machine learning models analyze vast sensor data to predict necessary adjustments in real-time, leading to reduced energy consumption, optimized chemical reagent usage (like caustic soda), and enhanced predictive maintenance scheduling, ultimately improving refinery yield and operational stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Spherical Alumina Filler Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Reactive Alumina Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Polishing Grade Alumina Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Alumina Fiber and Alumina Continuous Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Activated Alumina Ball Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager