Banana Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434297 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Banana Market Size

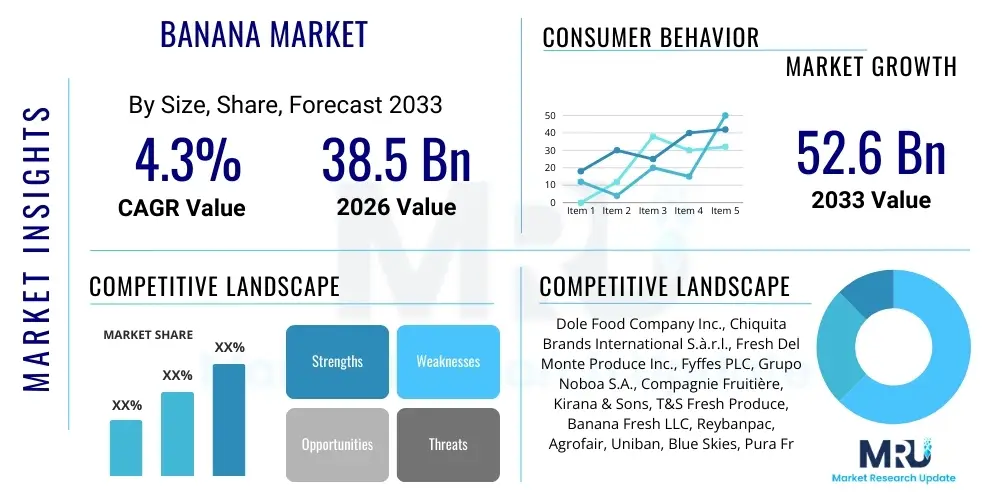

The Banana Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.3% between 2026 and 2033. The market is estimated at USD 38.5 Billion in 2026 and is projected to reach USD 52.6 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing global demand for healthy, affordable, and readily available fruit options, especially in emerging economies where bananas constitute a critical staple food source. The sustained focus on nutrient-dense diets and convenience food consumption patterns globally further underpins this market expansion across developed and developing nations.

Banana Market introduction

The Banana Market encompasses the global production, trade, distribution, and consumption of various edible banana species belonging to the Musa genus. This staple fruit is internationally recognized as one of the most widely consumed agricultural commodities worldwide, serving as a critical component of global food security and generating significant international trade volumes. The product description largely centers around the export-dominant Cavendish variety, known for its consistency and durability during long-distance shipping, alongside numerous specialty varieties like plantains, red bananas, and culinary types that cater to specific regional and niche market demands, reflecting the deep diversification of the market.

Major applications of bananas extend significantly beyond simple fresh consumption, incorporating industrial processing into essential items such as chips, infant formula, concentrated puree, baked goods (utilizing banana flour), and specialized functional food ingredients like resistant starch derived from green bananas. The fundamental benefits driving perennial high demand include the banana's rich content of essential nutrients, specifically high levels of potassium, Vitamin B6, and dietary fiber, positioning it as an ideal energy source, particularly for athletic recovery and general wellness. Furthermore, its cost-effectiveness relative to other fruits ensures wide accessibility across diverse socio-economic groups, reinforcing its market stability and essential commodity status.

Key driving factors propelling global market growth include rapid urbanization across Asia Pacific and Latin America, leading to increased demand for convenient, packaged food items, alongside a persistent rise in disposable incomes that fuels the consumption of high-quality imported fruits. Additionally, continuous technological advancements and strategic investments aimed at improving cold chain logistics and storage infrastructure play a pivotal role, ensuring reduced post-harvest losses and enabling the efficient, high-volume international distribution required to sustain global supply. However, these positive drivers are perpetually challenged by the biological vulnerability of the primary commercial cultivars and the unpredictable consequences of global climate variability on production zones.

Banana Market Executive Summary

The global Banana Market exhibits dynamic growth propelled by several converging business trends, most notably the escalating consumer focus on health and wellness, driving increased demand for organic and ethically sourced bananas. Business trends indicate a critical shift towards comprehensive sustainability and traceability solutions, where multinational corporations are investing heavily in certified production processes (e.g., Fair Trade, Global G.A.P.) to meet stringent retail standards in high-value import markets like Europe and North America. The market structure remains highly competitive, characterized by the dominance of a few vertically integrated global trading firms managing complex, long-haul supply chains from source to consumer market.

Regional trends unequivocally highlight Asia Pacific (APAC) as the powerhouse region, leading the world in sheer production and total consumption volume, primarily fueled by domestic demand in populous nations like India and China, although Latin America remains the crucial engine for global exports. North America and Europe define the demand side, prioritizing stringent quality metrics, long shelf life, and ethical sourcing standards, often paying a premium for certified produce. Latin America, particularly countries situated in Central and South America, maintains its structural role as the primary export hub, leveraging geographical advantages and specialized infrastructure to serve high-volume international trade routes efficiently, while simultaneously navigating rising concerns over labor practices and biosecurity threats.

Segment trends underscore the enduring market leadership of the Cavendish variety in the fresh consumption category due to its transport suitability. However, the processed products segment is experiencing the fastest growth acceleration, driven by innovative uses of bananas in dietary supplements, functional foods, and gluten-free flour manufacturing, reflecting changing consumer dietary needs. Furthermore, the distribution channel is gradually evolving, with a measured increase in penetration by online retail and specialized convenience stores, though conventional supermarkets and hypermarkets retain the overwhelming majority of market share due to their established cold chain capabilities and consumer traffic volume. The market's resilience will increasingly depend on its ability to quickly adopt new disease-resistant varieties and leverage AI for operational optimization.

AI Impact Analysis on Banana Market

User inquiries regarding the disruptive impact of Artificial Intelligence (AI) on the Banana Market are heavily concentrated on enhancing operational resilience, particularly in yield prediction, combating pervasive crop diseases, and optimizing highly complex, temperature-sensitive logistics networks. Common user concerns center on how AI can provide early warning systems for the devastating Fusarium wilt TR4, improve resource efficiency in water and fertilizer application, and ensure product quality consistency throughout the shipping process to maximize export revenue. The collective expectation is that AI will transition banana farming from a traditional, reactive agricultural model to a predictive, data-driven system, thereby mitigating biological risks inherent in monoculture farming and enhancing profitability.

The application of AI and machine Learning (ML) models is introducing revolutionary changes to primary banana cultivation through advanced precision agriculture techniques. AI-driven platforms process vast amounts of data collected via drone-mounted multispectral cameras, satellite imaging, and ground-based IoT sensors to construct detailed, real-time health maps of plantations. These systems can accurately identify subtle indicators of nutrient stress, pest infestations, or early disease onset (such as Black Sigatoka or TR4) long before they become visible to the human eye. This predictive capability allows growers to implement hyper-localized treatments, significantly reducing the overall use of agrochemicals, lowering costs, and minimizing the environmental footprint associated with conventional farming practices.

Further downstream in the supply chain, AI is transforming the notoriously challenging aspects of perishable logistics. Predictive analytics optimize shipping routes, container loading strategies, and warehouse management by forecasting demand fluctuations and modeling the impact of external variables, such as port congestion or weather delays. ML algorithms continuously monitor in-transit conditions (temperature, humidity, CO2 levels) via smart sensors, adjusting environmental controls automatically or alerting operators to potential quality degradation risks. This optimized cold chain management, facilitated by intelligent systems, drastically cuts down the substantial post-harvest losses typically associated with fruit exports, guaranteeing that consumers receive optimal quality fruit and directly contributing to increased operational profitability across the entire value chain.

- AI-powered Disease Detection and Biosecurity: Utilizing convolutional neural networks (CNNs) on aerial imagery for high-accuracy, early identification of fungal and viral diseases, enabling targeted biosecurity interventions.

- Precision Farming & Resource Management: Deploying ML models to analyze soil data, climate forecasts, and plant metrics for precise irrigation scheduling and nutrient application, boosting yield while conserving water and reducing fertilizer use.

- Supply Chain and Logistics Optimization: Implementation of predictive analytics for demand forecasting, dynamic routing, and intelligent cold chain monitoring to minimize transit time and drastically reduce spoilage rates.

- Automated Quality Grading and Sorting: Machine vision systems utilize AI algorithms to rapidly and consistently grade bananas based on size, color, ripeness stage, and defect levels, improving processing speed and export quality standardization.

- Climate Change Resilience Modeling: AI platforms simulate the effects of various climate change scenarios (e.g., increased storm frequency) on plantation yields, allowing producers to formulate proactive risk management and adaptation strategies.

DRO & Impact Forces Of Banana Market

The global Banana Market is shaped by a critical balance of Drivers, Restraints, and Opportunities (DRO), collectively constituting the complex impact forces that dictate market expansion and stability. A central driver is the consistently high global population growth and the concurrent need for affordable, calorie-dense staple foods, positioning bananas as an indispensable commodity in both developing and developed nations. Market opportunities are strongly vested in leveraging advanced technologies, particularly in gene editing and advanced crop breeding, to overcome inherent biological limitations and introduce robust, high-yielding, disease-resistant cultivars. Conversely, the market faces overwhelming restraints, chiefly the severe vulnerability of commercial varieties to pandemic-level plant diseases and increasing environmental pressures due to climate change volatility.

Specific drivers contributing to sustained market demand include the escalating consumer preference for fruits that support active, health-conscious lifestyles, where the banana is celebrated as the ultimate natural energy source rich in potassium and fiber. Furthermore, the structural enhancement of global logistics, encompassing rapid vessel transit and sophisticated containerization technologies, has drastically improved the speed and reliability of long-haul shipments, ensuring fresh bananas can reach geographically disparate consumer bases efficiently. Economic development in emerging markets translates into higher discretionary spending, further accelerating the demand for imported, high-quality fruit, thereby stimulating production and investment in the export regions.

The primary restraints severely challenging market growth are structural, biological, and environmental. The global reliance on the Cavendish monoculture creates a systemic vulnerability, making the industry highly susceptible to diseases such as Fusarium wilt TR4, which has necessitated enormous expenditure on containment and prevention strategies. Environmental restraints include the increasing frequency and intensity of tropical cyclones, droughts, and excessive rainfall events, directly devastating crop yields and disrupting harvest schedules. Socio-economic restraints also play a role, as labor costs increase and ethical sourcing demands become stricter, placing financial pressure on producers to maintain profitability while adhering to higher standards of corporate social responsibility (CSR) and worker welfare.

Opportunities for differentiation and high-value generation are prominent in several areas. The cultivation and promotion of niche and specialty banana varieties (e.g., red bananas, specific plantains) offer avenues to mitigate reliance on Cavendish and tap into premium markets seeking unique flavors or culinary uses. Furthermore, substantial value addition exists in the processed segment, capitalizing on the demand for functional foods such as banana flour and starch, which can be marketed globally to the rapidly expanding gluten-free and health food industries. Finally, embracing sustainability certifications and deploying advanced traceability technologies, such as blockchain, provides a robust market opportunity for players to demonstrate environmental stewardship and ethical compliance, commanding greater brand loyalty and securing long-term contracts with major retailers.

Segmentation Analysis

Segmentation analysis is instrumental in deciphering the intricate demand structure and supply dynamics of the Banana Market, allowing stakeholders to precisely target specific consumer needs and align production capacity with market segment growth. The market framework is segmented based on essential characteristics, including the type of banana cultivar traded, the ultimate application destination of the fruit (fresh versus processed use), and the distribution channels utilized to reach end-consumers globally. This detailed segmentation aids in identifying where investment should be directed, differentiating between high-volume commodity trade and high-margin specialty product niches.

Segmentation by Product Type clearly illustrates the dichotomy between the overwhelmingly dominant Cavendish variety, which accounts for the vast majority of international trade and export revenue, and the diverse group of Plantains, Lady Fingers, and other regional varieties that primarily serve local food security and specialized culinary markets. While Cavendish provides the volume stability for global commerce, the growth in specialty segments offers producers diversification strategies against biological threats. Analyzing the Application segments reveals the strong base of Fresh Consumption, which dictates immediate logistics and quality requirements, juxtaposed with the accelerated expansion of the Processed Products category, driven by industrial buyers seeking raw materials for manufacturing high-value, shelf-stable goods.

The segmentation by Distribution Channel highlights the commercial dominance exerted by Supermarkets and Hypermarkets, which rely on economies of scale and sophisticated cold chain management to handle the high volume of perishable fresh fruit. However, the market structure is undergoing contemporary change with the notable expansion of Online Retail platforms, particularly for packaged banana snacks and processed derivatives, offering consumers convenience and wider geographic reach. Understanding the interplay between these segments—for instance, the application of specific varieties in the processed segment through modern distribution channels—allows market players to develop resilient, consumer-centric supply chain models that maximize efficiency and respond swiftly to market shifts.

- By Product Type:

- Cavendish (Global Export Standard)

- Plantain (Culinary Staple)

- Lady Finger (Sucrier)

- Red Bananas (Red Dacca)

- Others (Local and Specialty Cultivars)

- By Application:

- Fresh Consumption (Direct retail and household use)

- Processed Products

- Banana Puree and Pulp (Baby food, smoothies)

- Banana Chips and Snacks (Dried fruit snacks)

- Banana Flour and Starch (Gluten-free baking)

- Beverages and Juice (Non-alcoholic fruit drinks)

- Nutritional Supplements

- By Distribution Channel:

- Supermarkets/Hypermarkets (Dominant high-volume channel)

- Convenience Stores and Small Grocery Retail

- Online Retail (Growing for processed and specialty segments)

- Conventional/Local Markets and Street Vendors

- Food Service Sector (Restaurants, institutional buyers)

Value Chain Analysis For Banana Market

The Banana Market value chain is globally distributed and intensely focused on maintaining the integrity of a highly perishable product from its tropical origin to the temperate consumer market. The upstream segment involves critical activities such as research and development into disease-resistant cultivars, high-volume production of tissue culture planting material to ensure pathogen-free stock, and the procurement of necessary agricultural chemicals and specialized packaging materials designed for long-haul transport. Success in the upstream stage hinges on large-scale infrastructure investment, robust biosecurity protocols, and adherence to evolving international phytosanitary standards required by importing nations, often posing a significant barrier to entry for smaller producers.

The core midstream activities encompass harvesting, complex post-harvest handling, washing, chemical treatment (to control ripening and fungal growth), and meticulous packing into specialized boxes, immediately followed by pre-cooling and loading onto temperature-controlled vessels. Distribution channels in this phase reveal a strong reliance on large, integrated multinational corporations (MNCs) that operate direct channels, controlling vast contract farms and proprietary shipping lines, thereby ensuring end-to-end control over quality and logistics. Indirect distribution often involves small to medium-sized growers selling through local cooperatives or third-party exporters, relying on global shipping brokers and bulk carriers, which introduces greater variability in handling and quality control.

The downstream segment, crucial for maximizing product value, involves managing the final stages of the supply chain in the destination market. This includes offloading, mandatory customs clearance, and most critically, the operation of temperature-controlled ripening chambers where bananas are exposed to controlled ethylene gas to achieve optimal yellow maturity precisely when required by retail schedules. Direct distribution enables MNCs to manage these ripening cycles exactly to the retailer’s demand, guaranteeing consistent quality. Indirect distribution involves various layers of wholesalers and distributors who purchase batches post-shipment for distribution to various retail formats, including local markets and smaller convenience stores. The efficiency of this downstream segment directly influences the final selling price, consumer perception, and the overall volume of food waste generated.

Banana Market Potential Customers

The potential customer landscape for the Banana Market is exceptionally broad, segmented into consumer households, industrial processors, and institutional entities, reflecting the fruit's status as a global dietary staple. Consumer households represent the foundational and largest purchasing segment globally, driving demand for fresh, affordable fruit for direct consumption, quick snacking, and basic cooking. This segment is highly responsive to factors like price, convenience, and perceived nutritional value, with growing subsets focusing on organic certifications and ethical sourcing labels, demonstrating a willingness to pay premium prices for assurance of sustainability and quality traceability.

Industrial processors constitute a critical, high-volume customer segment that requires bananas as raw material for manufacturing value-added products. These buyers include global food manufacturers specializing in high-demand items such as baby food, breakfast cereals, dried fruit snacks (chips), specialized bakery mixes, and the burgeoning functional food industry that utilizes green banana flour for its resistant starch content. Procurement decisions by this segment are driven by the need for consistent volume, specific ingredient specifications (e.g., starch level, ripeness criteria), and reliable supply contracts that often span several years, stabilizing demand across the supply chain.

Institutional buyers encompass large organizations like governmental food aid programs, national school systems, healthcare facilities, and military bases that procure massive quantities of bananas for feeding large populations cost-effectively while meeting nutritional guidelines. The food service sector, including restaurant chains and catering businesses, represents another substantial buyer, requiring a steady supply of both dessert bananas and specific volumes of plantains for culinary applications. Serving this diverse institutional customer base requires suppliers to maintain exceptionally stringent hygiene standards, robust logistical capacity, and the ability to fulfill bulk orders with varying quality and ripeness specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 38.5 Billion |

| Market Forecast in 2033 | USD 52.6 Billion |

| Growth Rate | 4.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dole Food Company Inc., Chiquita Brands International S.à.r.l., Fresh Del Monte Produce Inc., Fyffes PLC, Grupo Noboa S.A., Compagnie Fruitière, Kirana & Sons, T&S Fresh Produce, Banana Fresh LLC, Reybanpac, Agrofair, Uniban, Blue Skies, Pura Fruta, Agroamerica. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Banana Market Key Technology Landscape

The technological landscape of the Banana Market is fundamentally shaped by the necessity to enhance biosecurity, improve yield per hectare, and extend the viability of the fruit across extensive global supply chains. Key technological applications span genetics, sophisticated agricultural monitoring, and advanced logistics management. In agricultural science, advanced biotechnology, specifically high-volume tissue culture propagation (micropropagation), is universally employed to mass-produce genetically identical, pathogen-free planting material, which is critical for preventing the spread of diseases like Bunchy Top Virus and maintaining the genetic purity required for export standards. Furthermore, cutting-edge genetic engineering techniques, including CRISPR, are being investigated by research institutes to introduce durable resistance genes into commercial cultivars against pathogens like TR4.

Cultivation practices are being revolutionized by the widespread adoption of precision agriculture methodologies. This involves integrating high-resolution remote sensing technologies, utilizing Unmanned Aerial Vehicles (UAVs) and satellite imagery, with dense networks of IoT sensors embedded in the soil. These systems feed real-time environmental data into AI and Machine Learning platforms, enabling highly localized decision-making regarding water usage, fertilization rates, and pest control deployment. This technological integration ensures optimal resource utilization, which is essential for environmental sustainability commitments, and significantly enhances early detection capabilities for stressed or diseased plants, allowing for rapid, targeted intervention before an outbreak becomes unmanageable across the plantation.

Post-harvest and supply chain technologies are equally transformative, focusing on preserving quality during long-distance transit. Sophisticated cold chain management systems incorporate advanced refrigeration and controlled atmosphere (CA) technologies within shipping containers to precisely regulate temperature, humidity, and atmospheric gas compositions, drastically slowing down the ripening process. IoT-enabled traceability systems and the nascent adoption of blockchain technology are increasing transparency throughout the supply chain, allowing stakeholders, including consumers, to verify the origin, handling conditions, and ethical certifications of the product. Modern ripening facilities utilize computerized ethylene injection systems to ensure precise, uniform maturation based on specific market requirements, maximizing visual appeal and reducing retailer waste.

Regional Highlights

Regional segmentation provides critical insights into the production, trade, and consumption patterns that characterize the heterogeneous global Banana Market. The market dynamics are highly asymmetrical, reflecting diverse climatic suitability for cultivation, varying levels of investment in export infrastructure, and distinct consumer preferences for dessert versus culinary varieties. This regional analysis is vital for companies establishing procurement strategies and market entry points, recognizing that efficiency requirements and regulatory standards differ significantly across continents.

Asia Pacific (APAC) stands out as the dominant force in the market in terms of both volume of production and total domestic consumption. Countries such as India (the world’s largest producer), China, and the Philippines generate vast quantities of bananas, primarily to meet internal food demands, making their trade structure less export-focused compared to Latin America. The rapid economic growth and urbanization in this region drive increased demand for processed banana products and necessitate continuous expansion of modern retail infrastructure. However, APAC is also the region most severely impacted by the current spread of Fusarium wilt TR4, placing immense pressure on regional governments and producers to invest in containment and R&D solutions.

Latin America (LATAM), encompassing major exporters like Ecuador, Costa Rica, and Colombia, remains the globally critical export hub, supplying the majority of fresh Cavendish bananas to North American and European markets. This region is defined by highly efficient, large-scale, export-oriented plantation structures, benefiting from established trade lanes and optimized cold chain logistics developed over decades. Europe and North America function as the major import regions, characterized by high per capita consumption and sophisticated consumer demand for attributes such as organic certification, ethical sourcing, and pesticide residue minimization, dictating premium market access criteria for exporting countries and driving the adoption of sustainable farming practices globally.

The Middle East and Africa (MEA) region presents significant market complexities. Africa is a massive producer and consumer of plantains, which form essential staple foods, though international export of dessert bananas is comparatively lower. The market growth opportunity in Africa lies in improving post-harvest technologies and logistics to tap into international markets, thereby diversifying local economies. The Middle East, conversely, is a high-value import market due to limited local production and high consumer purchasing power, making it a critical destination for quality produce from LATAM and specialized South Asian exporters. Overall, stability and resilience in the global market are intrinsically linked to successful regional biosecurity measures and climate adaptation strategies.

- Asia Pacific (APAC): Dominates global production volume; strong domestic consumption growth; epicenter of the TR4 disease challenge; rapid growth in the processed segment driven by regional economic development.

- Latin America (LATAM): Undisputed leader in global banana exports; crucial supplier of Cavendish to the US and EU; characterized by integrated MNC operations and optimized maritime logistics networks.

- Europe: High-value import market with stringent quality and ethical standards (Fair Trade, organic); sophisticated ripening infrastructure; major focus on reducing carbon footprint associated with transport.

- North America: Large-scale import market driven by consumer convenience and nutritional awareness; dominated by major supermarket retailers; increasing demand for transparency and traceable sourcing.

- Middle East and Africa (MEA): Africa is a primary consumer of plantains as a staple food; Middle East is a high-value import market; significant potential for improving cold chain and regional trade efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Banana Market.- Dole Food Company Inc.

- Chiquita Brands International S.à.r.l.

- Fresh Del Monte Produce Inc.

- Fyffes PLC (Sumitomo Corporation)

- Grupo Noboa S.A. (Bonita)

- Compagnie Fruitière

- Kirana & Sons

- T&S Fresh Produce

- Banana Fresh LLC

- Reybanpac

- Agrofair

- Uniban

- Blue Skies

- Pura Fruta

- Agroamerica

- Global G.A.P.

- Tropical Trade & Development

- Terra Exports

- Sanitation Fruit & Vegetables

- Ecuadorian Banana Corporation (EBC)

Frequently Asked Questions

Analyze common user questions about the Banana market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining growth in the global Banana Market?

The primary restraint is the threat posed by Fusarium Wilt Tropical Race 4 (TR4), a soil-borne fungus that devastates the dominant Cavendish variety, necessitating significant global investment in resistant variety development and strict biosecurity measures.

Which region dominates the export volume of bananas globally?

Latin America, particularly countries like Ecuador and Costa Rica, dominates the global export volume due to optimal climatic conditions, robust large-scale plantation infrastructure, and established trade routes to major consumer markets in North America and Europe.

How is technology impacting banana cultivation and supply chain efficiency?

Technology is driving efficiency through AI-powered precision agriculture for targeted resource use, biotechnology for creating disease-resistant plants, and IoT monitoring in the cold chain to minimize post-harvest loss and ensure optimal ripening for consumer markets.

What is banana flour, and why is it a growing segment in the market?

Banana flour is a processed product derived from unripe (green) bananas, valued for being gluten-free and high in resistant starch. Its growth is driven by increasing consumer demand for healthy, specialty functional ingredients and gluten intolerance awareness globally.

What are the key ethical concerns affecting the procurement of bananas?

Key ethical concerns include fair wages and working conditions for plantation laborers, pesticide use impacts on worker health and the environment, and land use sustainability, leading to growing demand for ethically certified products (e.g., Fair Trade, Rainforest Alliance).

Why is the Cavendish variety so dominant despite its vulnerability to disease?

Cavendish dominates because of its superior shipping characteristics, including resistance to bruising during transport, longer shelf life, and predictable ripening process, making it ideal for the complex international logistics required by the global fresh fruit trade.

What role does climate change play in the future of the Banana Market?

Climate change poses a significant risk by increasing the frequency and intensity of extreme weather events (storms, droughts), which directly reduce yields, damage infrastructure, and create favorable conditions for certain banana pathogens to spread, increasing market volatility.

How are organic bananas differentiating themselves in the market?

Organic bananas command premium prices by appealing to health-conscious consumers and avoiding synthetic pesticides and fertilizers. However, they face higher production costs and greater vulnerability to pests and diseases, requiring specialized organic farming techniques.

Which distribution channel holds the largest market share for fresh bananas?

Supermarkets and hypermarkets currently hold the largest market share globally for fresh bananas, utilizing efficient cold chain logistics and high volume purchasing power to maintain consistent supply and competitive pricing for mass consumers.

What are the major applications of bananas beyond direct fresh consumption?

Major applications include processing into banana puree (for baby food and smoothies), manufacturing dried banana chips (snacks), extracting flour and resistant starch (functional ingredients), and use in specialized food service and baking industries.

How does the value chain for bananas differ between conventional and specialty varieties?

The conventional (Cavendish) value chain is long, globally centralized, and optimized for bulk shipping and ripening. Specialty varieties often have shorter, more localized value chains focusing on flavor, handling specific culinary uses, and reaching niche, premium markets with quicker transit times.

What is the significance of the base year 2025 in this market analysis?

2025 serves as the baseline reference year for projections, allowing market analysts to incorporate the most recent short-term trends, technological implementations, and post-pandemic adjustments into the long-term forecast (2026-2033) for accurate growth rate calculation.

How is Generative Engine Optimization (GEO) applied to market content?

GEO ensures the content is structured and detailed enough to train and satisfy large language models (LLMs) and generative search systems, providing comprehensive answers across all dimensions of the market (Size, DRO, Technology, Regional Highlights) in a highly organized format.

Describe the current competitive landscape of the global banana trade.

The competitive landscape is oligopolistic, dominated by a few large multinational corporations (MNCs) like Dole, Chiquita, and Del Monte, which control vast plantation contracts, shipping fleets, and ripening centers, while regional players compete based on specialty product differentiation and local market dominance.

Why is tissue culture critical for modern banana farming?

Tissue culture (micropropagation) is critical because it enables the production of large volumes of genetically uniform, disease-free planting material, essential for rapidly establishing new commercial plots and replacing diseased plants, thus safeguarding plantation biosecurity.

What differentiates plantains from dessert bananas in the market?

Plantains (cooking bananas) are starchier, lower in sugar, and generally consumed cooked as a staple carbohydrate in tropical regions, whereas dessert bananas (like Cavendish) are high in natural sugars, consumed fresh, and dominate international fruit trade.

How do certification schemes influence the market price of bananas?

Certification schemes (e.g., Fair Trade, Rainforest Alliance) influence price by guaranteeing adherence to higher environmental and social standards. This assurance allows certified producers to charge a premium, satisfying consumer demand for ethical sourcing and sustainability.

What is the current trend regarding labor practices in major banana producing countries?

The trend is moving towards greater scrutiny and formalization of labor practices, driven by consumer advocacy and corporate social responsibility (CSR) initiatives. There is increased pressure on exporters to ensure fair wages, safe working conditions, and rights to collective bargaining.

How is the banana market responding to the trend of gluten-free diets?

The market is responding by increasing the production and marketing of banana flour, derived from green bananas, as a naturally gluten-free alternative to wheat flour, capitalizing on the growing global movement towards eliminating gluten from diets.

What is the role of blockchain technology in the banana supply chain?

Blockchain technology is being implemented to provide immutable records of transactions and quality checks throughout the supply chain, enhancing transparency, proving origin traceability, and speeding up product recalls if contamination or quality issues arise.

Which region shows the highest projected CAGR in the forecast period?

The Asia Pacific region, despite its current high production, is projected to show one of the highest CAGRs in terms of market value expansion, driven by massive domestic consumption growth and increasing adoption of processed banana products and modern retail channels.

How do import tariffs affect the price and availability of bananas in consumer markets?

Import tariffs can significantly inflate the final price paid by consumers. Trade agreements, such as those between the EU and Latin American suppliers, often involve complex tariff schedules that directly impact import competitiveness and market accessibility.

What is the major application of bananas in the institutional food sector?

In the institutional sector (schools, hospitals), the major application is the provision of fresh, whole fruit as a quick, nutritious, and cost-effective dietary component due to its high potassium content and suitability for mass distribution.

How are packaging innovations changing banana logistics?

Innovations in controlled atmosphere packaging (CAP) and specialized containers are extending the shelf life of bananas, reducing the need for chemical treatment, and improving the quality of fruit arriving at distant markets, lowering waste rates.

Why is research into Fusarium wilt resistance so critical for the entire industry?

Research into Fusarium wilt resistance is critical because the disease threatens the commercial viability of the highly traded Cavendish variety, representing a systemic risk to global food security and the economic stability of major export nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Banana Juice Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Banana Syrup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Banana Puree Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Banana Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Banana Paper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager