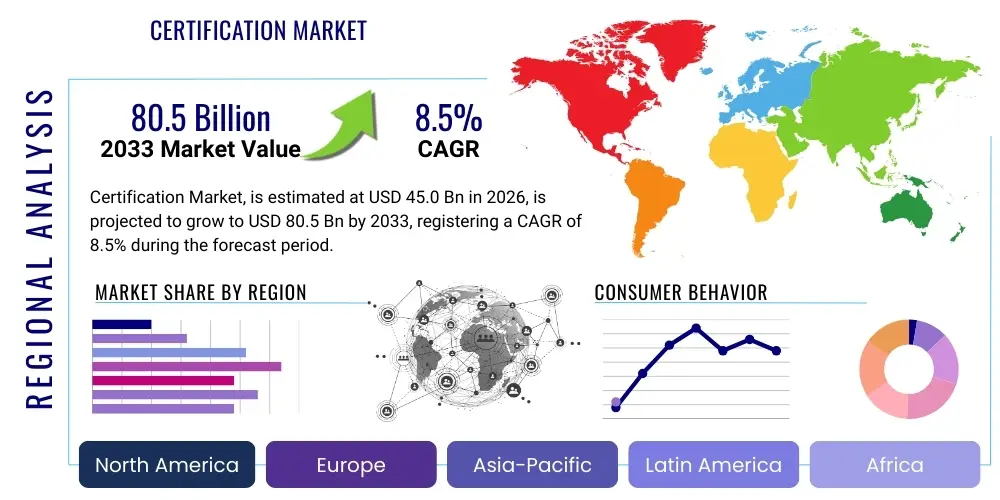

Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437604 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Certification Market Size

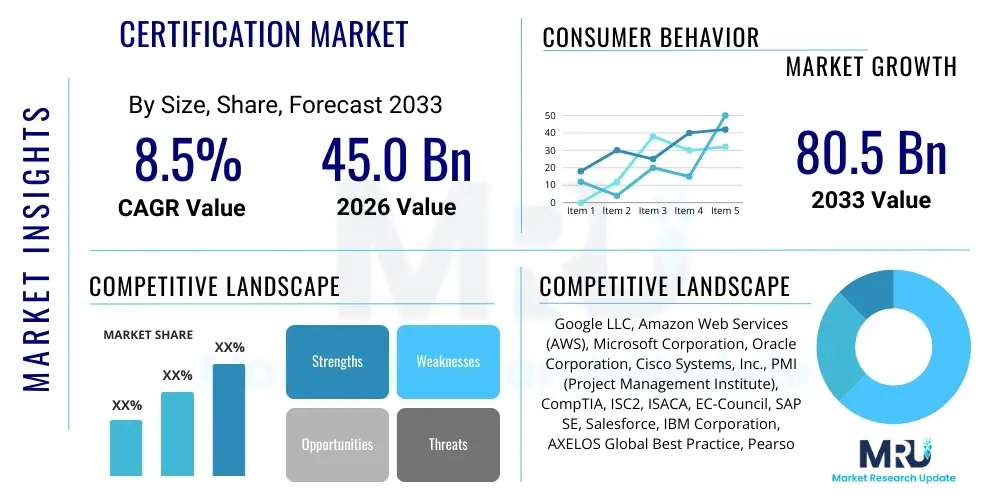

The Certification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 45.0 Billion in 2026 and is projected to reach USD 80.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is fundamentally fueled by the accelerating pace of technological obsolescence, particularly within the digital economy, necessitating continuous skill validation and professional development across established and emerging industries. Enterprises globally are increasingly relying on professional certifications as a standardized, verifiable metric for ensuring workforce competency in complex areas such as cybersecurity, cloud architecture, data science, and agile project management methodologies. The quantifiable return on investment (ROI) associated with certified professionals, including improved efficiency and reduced operational risk, further solidifies the economic rationale driving market expansion.

The market valuation reflects a significant shift from traditional, institution-centric qualifications to flexible, vendor-specific, or industry-specific credentialing models. The transition towards digital badging and blockchain-verified certifications enhances security, portability, and instant validation, making professional credentials more attractive and easier to manage for both individuals and corporate training departments. Furthermore, regulatory bodies across highly regulated sectors, such as finance, healthcare, and engineering, frequently mandate specific certifications, creating a stable, mandatory demand floor for specialized certifications, thereby contributing substantially to the overall market size and predictable growth pattern observed throughout the forecast period. Investment in learning technologies, including AI-driven personalized training modules and sophisticated proctoring solutions, is enhancing the scalability and integrity of the global certification ecosystem.

Certification Market introduction

The Certification Market encompasses the ecosystem of programs, assessments, and verifiable credentials awarded by professional bodies, academic institutions, and technology vendors to individuals who demonstrate mastery of specific occupational skills or knowledge areas. This market is defined by the rigorous process of assessment, which often includes standardized examinations, practical performance evaluations, and adherence to professional standards, culminating in the issuance of a formal certificate or digital credential. The core product of this market is trust and validation, providing employers with objective evidence of an individual's capabilities, thereby mitigating hiring risk and informing professional development strategies. Major applications span critical sectors including Information Technology (IT), healthcare, project management, financial services, and manufacturing, where specific, high-stakes knowledge is mandatory for safe and effective operation.

The primary benefits driving the high demand for certifications include career advancement opportunities for individuals, standardized workforce quality assurance for organizations, and enhanced professional credibility in competitive job markets. Certifications often unlock specialized roles, mandate higher salaries, and contribute to continuous professional education (CPE) requirements necessary for maintaining licensure or standing. For organizations, certified workforces are correlated with higher productivity, better adherence to quality standards (like ISO or Six Sigma), and improved security posture (in the case of cybersecurity certifications). Key driving factors propelling the market forward include the rapid obsolescence of foundational skills due to disruptive technologies (like AI and IoT), the increasing complexity of regulatory environments globally, and the pervasive global skills gap requiring rapid upskilling and reskilling initiatives.

Certification Market Executive Summary

The Certification Market is experiencing dynamic transformation characterized by accelerated digital delivery and the rise of niche, stackable micro-credentials addressing hyper-specific skill gaps, fundamentally altering traditional business models. Major business trends include the consolidation of independent certification bodies seeking to leverage larger platforms and scale their offerings, alongside substantial corporate investment in enterprise-wide learning management systems (LMS) and customized certification pathways tailored to internal strategic goals. Regional trends indicate that the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by massive investments in infrastructure development, rapid industrialization, and a burgeoning tech-savvy youth population demanding career differentiation. North America and Europe, while mature, maintain dominance in high-value, specialized certifications, particularly those related to cloud infrastructure and regulatory compliance (e.g., GDPR, HIPAA).

Segmentation trends highlight the increasing prominence of IT certifications, specifically in Cloud Computing (AWS, Azure, Google Cloud), Cybersecurity (CISSP, CompTIA Security+), and Data Science, which collectively command the highest market share and exhibit the strongest growth potential due to the foundational role these technologies play in modern business operations. Furthermore, the segmentation by delivery mode shows a decisive shift towards fully online, self-paced learning combined with virtual proctoring, allowing global accessibility and reducing the logistical barriers associated with traditional testing centers. Segment trends related to end-users indicate that corporate buyers are increasingly shifting budgets towards custom, in-house certification programs delivered through partnerships with major vendors or academic entities, focusing less on generic training and more on job-role specific competency validation. This strategic pivot ensures that certification efforts directly translate into measurable operational improvements and strategic capability building, reinforcing the value proposition of certified talent.

The market’s competitive landscape is defined by intense innovation in assessment methodology, with providers moving beyond rote memorization testing toward performance-based evaluations (PBEs) and hands-on labs (HOLs) that better simulate real-world job tasks. This methodological evolution is critical for maintaining the relevance and integrity of certifications in highly technical fields. Economically, the market is resilient against minor downturns because the need for regulatory compliance and essential specialized skills training often persists regardless of macroeconomic conditions. Successful certification providers are leveraging sophisticated analytics to track credential validity, industry demand, and learner success, optimizing their curricula and pricing strategies to maximize market penetration and secure long-term recurring revenue streams derived from continuing education and recertification requirements.

AI Impact Analysis on Certification Market

Users frequently question how Artificial Intelligence (AI) will fundamentally alter the value of existing professional certifications, particularly those focused on rote technical knowledge, and simultaneously, what new certifications will emerge to validate proficiency in AI deployment and governance. Key user concerns revolve around the potential for AI tools to automate complex tasks, thus potentially devaluing human expertise, and the risk that current assessment methods are insufficient to measure skills needed in an AI-augmented workplace. Conversely, there is high expectation that AI will dramatically personalize learning paths, optimize study materials, and provide sophisticated, adaptive testing environments. These concerns reflect a pivot in the market from certifying static knowledge to validating dynamic adaptive skills, ethical understanding of AI deployment, and human-machine collaboration capabilities, necessitating a complete reevaluation of certification curricula and testing paradigms.

The core influence of AI is twofold: first, AI is transforming the operational mechanics of certification delivery, and second, it is creating an entirely new category of specialized credentials. AI-driven platforms facilitate enhanced content generation, automatic performance feedback, and sophisticated test item banking, dramatically improving the efficiency and consistency of training programs. Adaptive learning technologies, powered by machine learning algorithms, customize educational content flow and difficulty based on individual learner performance, significantly improving knowledge retention and reducing completion times. This focus on personalized learning optimizes the preparatory phase, making certifications more attainable for diverse global populations and maintaining the high quality of the certified pool. The integrity of assessments is also being bolstered by AI-enabled anti-cheating measures, including advanced facial recognition and behavioral biometrics used during virtual proctoring.

The second major impact is the burgeoning demand for certifications related directly to AI and related technologies. As AI moves from theoretical research to enterprise implementation, organizations require certified professionals proficient in MLOps (Machine Learning Operations), AI Governance, responsible AI design, and the ethical management of large language models (LLMs). This dynamic shift ensures that while some older, less critical certifications may decline in value, the overall market growth is accelerated by the introduction of high-value, future-focused credentials essential for navigating the complex digital landscape, thereby reinforcing the market's relevance.

- AI-driven adaptive learning pathways enhance personalized training efficiency and time-to-certification.

- Advanced AI proctoring solutions ensure enhanced examination integrity and combat fraudulent certification attempts globally.

- Emergence of mandatory certifications focused on MLOps, Responsible AI, and LLM engineering expertise.

- Automation of entry-level tasks necessitates current certifications shift focus toward higher-order critical thinking and problem-solving skills.

- AI tools facilitate continuous curriculum updates, ensuring certification content remains relevant to rapidly changing industry demands.

DRO & Impact Forces Of Certification Market

The Certification Market is shaped by a robust interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively constitute the Impact Forces influencing its direction and velocity. A primary Driver is the pervasive digital transformation across all industry verticals, which continuously creates skill gaps in areas like cloud computing, data security, and specialized software applications, making certification a mandatory requirement for organizational competency and competitive differentiation. Regulatory compliance mandates, particularly in sectors such as finance (e.g., anti-money laundering regulations) and healthcare (e.g., patient data privacy), serve as a non-discretionary driver, guaranteeing a baseline demand for specific credentials. Additionally, globalization of labor markets elevates the necessity for standardized, internationally recognized certifications to ensure mutual recognition of skills across borders and continents.

However, significant Restraints challenge rapid market expansion and vendor profitability. The high cost of obtaining premium certifications, including training, examination fees, and associated time investment, presents a substantial barrier to entry for individual learners, particularly in developing economies. Furthermore, the persistent issue of 'certification fatigue'—where professionals are overwhelmed by the sheer number of available credentials and the required effort for recertification—can dilute the perceived value of qualifications. Another key restraint is the rapid obsolescence of technical content; certification bodies struggle to update curricula fast enough to keep pace with technological changes, leading to instances where certified knowledge is already outdated upon issuance, thereby reducing employer confidence.

Opportunities in the market center around the burgeoning demand for specialized, granular knowledge reflected in micro-credentials and digital badges, offering flexible, lower-cost pathways to skill verification. The expansion into niche, non-traditional domains, such as sustainability certification (ESG reporting) and soft skills validation (leadership and emotional intelligence), represents new avenues for market penetration beyond the saturated IT sector. The primary Impact Forces are the rapid adoption of remote work models, necessitating portable and immediately verifiable digital credentials, and the accelerating integration of AI into both the delivery mechanism and the content scope of training, forcing providers to innovate assessment methods and curriculum relevance to secure long-term market leadership and ensure the continued credibility of their offerings.

Segmentation Analysis

The Certification Market is structurally diverse, segmented across various dimensions including the type of expertise validated, the mode of content delivery, the final application or industry focus, and the nature of the end-user. This layered segmentation is critical for market participants, enabling providers to tailor their offerings—whether high-stakes, comprehensive IT certifications or low-cost, flexible compliance badges—to meet precise market demands. The overall market is witnessing a convergence, where traditional academic accreditations are adopting industry-specific, competency-based assessment models characteristic of professional certifications, reflecting a broader market demand for credentials that directly map to quantifiable job performance outcomes rather than theoretical knowledge.

The dominant segment, based on market value, remains the Information Technology sector, encompassing specialized areas such as cloud computing, network architecture, and cybersecurity, driven by perpetual corporate spending on digital infrastructure and risk mitigation. However, significant growth momentum is observed in the Non-IT sector, particularly within Project Management (PMP, PRINCE2), Financial Services (CFA, CPA), and Healthcare (nursing, medical device operation), where strict quality control and regulatory adherence are non-negotiable. Furthermore, the segmentation by delivery channel underscores the irreversible trend towards online and self-paced modalities, primarily due to their superior scalability, geographic reach, and cost-effectiveness compared to traditional instructor-led classroom training, which now often serves high-end, corporate clients demanding bespoke, intense training experiences.

Analyzing segmentation by End-User reveals a crucial distinction between Individual Learners, typically focused on career progression and salary increases, and Corporate/Enterprise Buyers, who prioritize large-scale workforce development, standardized compliance training, and skill-gap closure aligned with organizational transformation projects. Corporate buyers often demand customized content, volume discounts, and integrated reporting capabilities, driving providers to offer bundled service packages and strategic partnerships rather than transactional product sales. Understanding these granular segment preferences allows vendors to optimize their channel strategy, content development roadmap, and pricing tiers for maximal market penetration across the varied demands of the certification landscape.

- By Certification Type:

- Information Technology (IT) Certifications (Cloud, Cybersecurity, Networking, Data Science)

- Non-IT Certifications (Project Management, Healthcare, Finance, HR, Legal)

- By Delivery Mode:

- Online/Self-Paced Learning

- Blended Learning (Hybrid Model)

- Traditional Classroom/Instructor-Led Training (ILT)

- By End-User:

- Individual Consumers (B2C)

- Corporate/Enterprise (B2B)

- Government & Defense Agencies

- By Application:

- Compliance and Regulatory Training

- Skill Development and Career Advancement

- Vendor Specific Product Proficiency

Value Chain Analysis For Certification Market

The Value Chain of the Certification Market initiates with the Upstream activities, which involve the rigorous process of defining required competencies and developing the corresponding curriculum, training materials, and assessment frameworks. This phase is highly knowledge-intensive, requiring deep domain expertise, collaboration with industry subject matter experts (SMEs), and often, initial accreditation by independent bodies to ensure legitimacy. Key upstream participants include curriculum designers, technical writers, psychometricians who design reliable and valid assessments, and content authoring platforms. The quality and relevance of the initial content and assessment design are paramount, directly influencing the credibility and market acceptance of the final certification product. Strategic investments in content creation technologies and SME partnerships determine a provider’s ability to quickly respond to emerging skills demands, particularly in fast-moving technical domains.

The Downstream activities focus on the delivery, testing, and credentialing components. Delivery channels are increasingly sophisticated, ranging from self-paced Learning Management Systems (LMS) and Massive Open Online Courses (MOOCs) to specialized training partners and authorized technology academies. The examination and assessment phase is critical, often involving high-security testing centers or sophisticated virtual proctoring platforms to maintain integrity. Post-certification activities include continuous professional education (CPE) requirements, recertification pathways, and the issuance and verification of digital credentials, frequently managed via blockchain technology for enhanced security and portability. Effective downstream execution requires robust IT infrastructure, global logistical networks for physical testing (where applicable), and scalable digital validation systems.

The Distribution Channel structure is a complex hybrid model involving both Direct and Indirect approaches. Direct channels include proprietary online platforms where certification bodies sell training and examinations straight to individuals or corporate clients, offering greater control over pricing and customer experience. Indirect distribution relies heavily on Authorized Training Partners (ATPs), global testing centers (like Pearson VUE or Prometric), value-added resellers (VARs), and strategic alliances with large educational institutions. This indirect network is essential for achieving broad geographic reach and deep market penetration, particularly in regions where local language support or localized training is mandatory. Successful market players strategically manage these channels, leveraging direct sales for high-margin corporate contracts and indirect partners for volume testing and global accessibility, ensuring optimization across the entire value chain.

Certification Market Potential Customers

The primary End-Users and Buyers in the Certification Market are broadly categorized into three core segments: individual professionals seeking career advancement, large corporate and enterprise organizations focused on workforce competency, and governmental/regulatory bodies mandating specific qualifications for public service or compliance. Individual learners represent a high-volume, fragmented segment, primarily driven by immediate career goals, such as securing a new job, gaining a promotion, or transitioning to a specialized field. Their purchasing decisions are heavily influenced by the recognition value of the certification brand, the quantifiable salary increase potential, and the accessibility/flexibility of the learning format. High-demand certifications in cloud computing, project management, and data analysis attract this group universally.

Corporate and Enterprise customers constitute the most valuable segment in terms of contract size and recurring revenue potential. These buyers, typically represented by HR, Learning & Development (L&D), and departmental leadership, purchase certification services to address large-scale skill gaps identified through talent audits, ensure company-wide adherence to regulatory standards (e.g., ISO, ITIL compliance), and standardize best practices across global operations. Their primary focus is on return on investment (ROI), requiring robust reporting metrics on training effectiveness, customizable content integration into proprietary systems, and ongoing professional development tracks (recertification and upskilling). Corporations often prefer comprehensive B2B arrangements that include training vouchers, customized bootcamps, and direct access to assessment resources for thousands of employees.

Government and regulatory agencies act as key purchasers and mandators, particularly in defense, public health, infrastructure, and financial regulation. These entities often mandate specific certification levels for contractors and employees handling sensitive data or critical infrastructure, such as security clearances or specialized engineering licenses. This segment demands certifications with the highest levels of integrity, recognized global standards, and strict adherence to governmental procurement processes. Furthermore, educational institutions (universities and vocational colleges) also act as buyers, integrating industry certifications into their academic curricula to enhance graduate employability, thereby creating a long-term pipeline of future customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.0 Billion |

| Market Forecast in 2033 | USD 80.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google LLC, Amazon Web Services (AWS), Microsoft Corporation, Oracle Corporation, Cisco Systems, Inc., PMI (Project Management Institute), CompTIA, ISC2, ISACA, EC-Council, SAP SE, Salesforce, IBM Corporation, AXELOS Global Best Practice, Pearson VUE, Prometric, Red Hat, Inc., Adobe Inc., ASQ, The Linux Foundation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Certification Market Key Technology Landscape

The technology landscape underpinning the Certification Market is undergoing radical modernization, characterized by the integration of advanced digital tools aimed at enhancing security, personalization, and accessibility across the entire credentialing lifecycle. Central to this transformation is the widespread adoption of robust Learning Management Systems (LMS) and Learning Experience Platforms (LXP), which serve as the foundational infrastructure for content delivery, progress tracking, and interactive learning modules. These platforms leverage APIs and deep data analytics to provide personalized learning journeys, adapting content difficulty and format based on learner performance data, ensuring efficient knowledge acquisition leading up to the final assessment. Furthermore, gamification elements and social learning functionalities within these platforms boost learner engagement and improve overall course completion rates, directly impacting the success metrics of certification providers.

Assessment integrity is significantly bolstered by next-generation proctoring technologies, which include sophisticated virtual proctoring solutions powered by Artificial Intelligence (AI) and machine learning algorithms. These technologies utilize facial recognition, eye-tracking, and behavioral biometrics to continuously monitor test-takers during remote examinations, ensuring adherence to strict security protocols and preventing fraudulent activities without the need for physical testing centers. This technology is crucial for maintaining the credibility of high-stakes certifications in a globally decentralized testing environment. The move towards performance-based testing (PBT) environments, often delivered through secure, virtualized labs (sandboxes), allows candidates to demonstrate practical skills in a simulated, real-world context, moving beyond multiple-choice questions to validate true competency, particularly prevalent in IT and engineering certifications.

The post-assessment technology ecosystem is defined by the crucial role of blockchain and decentralized ledger technology (DLT) in credential management. Certification bodies are increasingly using DLT to issue verifiable, tamper-proof digital credentials and badges. This technology eliminates the risk of counterfeit certificates, enables instantaneous, secure verification by employers globally, and provides individuals with sovereign control over their professional credentials, streamlining the verification process and enhancing the trust associated with certified status. This technological evolution ensures that the certification process remains secure, scalable, and responsive to the demands of the modern, rapidly evolving professional environment.

Regional Highlights

The global Certification Market exhibits diverse regional growth profiles, heavily influenced by local economic maturity, regulatory landscapes, and the rate of digital infrastructure adoption. North America currently holds the largest market share, driven by a highly mature IT industry, significant corporate investment in workforce upskilling, and a strong culture of professional credentialing, particularly in cybersecurity, cloud services, and financial compliance. The United States, being home to major technology vendors and global certification bodies, dominates the region, with high per-capita spending on continuing professional education (CPE). The demand here is shifting towards specialized, niche certifications that address highly complex or emerging technological domains, reflecting a premium market focused on expertise maintenance and cutting-edge skill development.

Europe represents a robust, stable market segment, characterized by stringent regulatory environments (e.g., GDPR, MiFID II) that mandate continuous certification and training across sectors, particularly finance, pharmaceuticals, and manufacturing. Growth in Europe is catalyzed by digital single market initiatives and government-backed programs aimed at closing the digital skills gap. The UK, Germany, and France are key contributors, with high demand for foundational IT, Agile methodologies (Scrum, PRINCE2), and language proficiency certifications. Unlike North America, the European market shows strong uptake of vendor-neutral certifications (like CompTIA and ISACA) alongside vendor-specific offerings, balancing specialization with broad foundational knowledge required by diverse industrial bases.

The Asia Pacific (APAC) region is projected to register the fastest CAGR during the forecast period. This exponential growth is primarily fueled by rapid economic expansion, massive governmental investment in digital infrastructure (e.g., India's Digital India initiative, China's "Internet Plus" strategy), and a vast, young, and increasingly educated workforce eager for international career mobility. Countries like India, China, and Southeast Asian nations are driving demand for certifications in foundational IT skills, project management, and English language proficiency. The sheer volume of learners, combined with the rising middle class's willingness to invest in career differentiation, makes APAC the critical growth engine for the future of the Certification Market, although price sensitivity remains a key factor influencing purchasing decisions in several sub-regions.

- North America: Dominates market value, focused on high-stakes cybersecurity and cloud certifications; driven by corporate IT budgets and immediate skill gap needs.

- Europe: Stable growth fueled by regulatory compliance mandates (GDPR, financial services laws) and strong emphasis on quality standards (ISO).

- Asia Pacific (APAC): Fastest-growing region; driven by large population demographics, technological investment, and demand for career advancement credentials (especially in foundational IT and project management).

- Latin America (LATAM): Emerging market with increasing demand, particularly for vendor-specific certifications (Microsoft, Cisco) linked to regional infrastructure projects and outsourcing growth.

- Middle East and Africa (MEA): Growth driven by diversification efforts away from oil economies, significant investment in smart cities, and public sector demand for standardized certifications (e.g., Saudi Arabia, UAE).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Certification Market.- Google LLC

- Amazon Web Services (AWS)

- Microsoft Corporation

- Oracle Corporation

- Cisco Systems, Inc.

- PMI (Project Management Institute)

- CompTIA

- ISC2

- ISACA

- EC-Council

- SAP SE

- Salesforce

- IBM Corporation

- AXELOS Global Best Practice

- Pearson VUE

- Prometric

- Red Hat, Inc.

- Adobe Inc.

- ASQ

- The Linux Foundation

Frequently Asked Questions

Analyze common user questions about the Certification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Certification Market?

The Certification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, driven primarily by continuous digital transformation and the global imperative for specialized skill validation.

How is Artificial Intelligence (AI) influencing the delivery of professional certifications?

AI is fundamentally transforming certification delivery by enabling adaptive learning pathways, personalizing content, and employing advanced virtual proctoring technologies to enhance assessment security and maintain the integrity of remote examinations.

Which certification segment holds the highest market share currently?

The Information Technology (IT) certification segment, particularly credentials related to Cloud Computing (AWS, Azure) and Cybersecurity (CISSP, CompTIA), currently commands the highest market share and exhibits strong ongoing growth due to pervasive enterprise digital adoption.

What major factor restrains growth in the global Certification Market?

A primary restraint is the high cost and significant time investment required for high-stakes, specialized certifications, which can pose a substantial barrier to entry for individual learners and contribute to overall professional certification fatigue.

Which geographic region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is forecast to exhibit the fastest growth, propelled by large-scale governmental investments in digital infrastructure, rapid industrialization, and a substantial, career-focused youth population seeking internationally recognized credentials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- ISO Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- ISO 27001 Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Photovoltaic Module Testing and Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- SSL Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cyber Security Testing, Inspection And Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager