Chromatography Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439451 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Chromatography Market Size

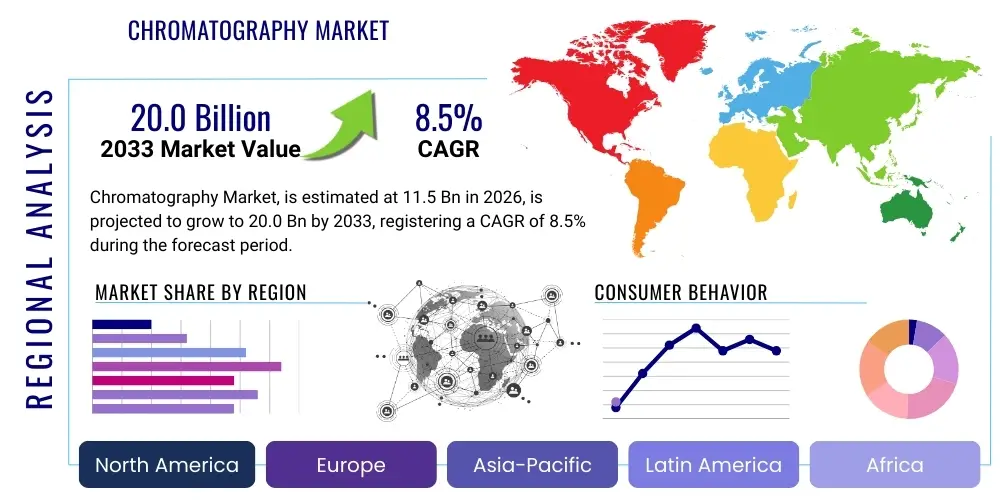

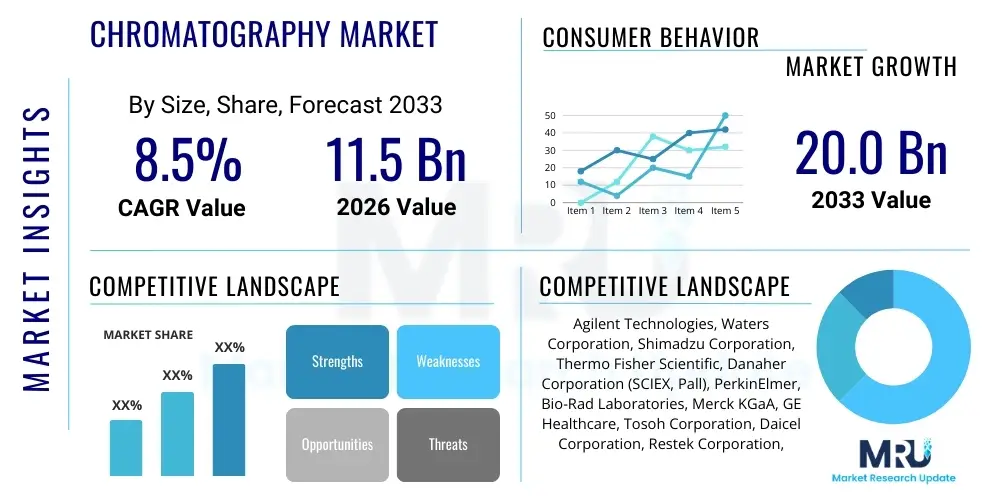

The Chromatography Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 20.0 Billion by the end of the forecast period in 2033. This growth is underpinned by continuous advancements in analytical techniques and increasing applications across diverse industries, from life sciences to environmental monitoring.

Chromatography Market introduction

The Chromatography Market encompasses a broad range of analytical separation techniques used to separate, identify, and quantify components in complex mixtures. These techniques exploit differential partitioning between a stationary phase and a mobile phase to achieve separation. Common product descriptions include high-performance liquid chromatography (HPLC), gas chromatography (GC), ion chromatography (IC), and supercritical fluid chromatography (SFC) systems, along with their essential consumables such such as columns, solvents, and detectors. Each system is designed for specific analytical challenges, offering unparalleled precision and sensitivity in molecular analysis.

Major applications for chromatography span the pharmaceutical and biotechnology sectors, where it is critical for drug discovery, development, and quality control; the food and beverage industry, for safety testing and quality assurance; environmental monitoring, to detect pollutants and contaminants; and clinical diagnostics, for disease markers and therapeutic drug monitoring. The versatility and high resolution of chromatographic methods make them indispensable tools in modern analytical laboratories, enabling breakthroughs in scientific research and ensuring product safety and efficacy across various commercial domains.

The primary benefits of chromatography include its high separation efficiency, sensitivity, and quantitative accuracy, allowing for the precise analysis of even trace amounts of substances. Driving factors for market expansion include the escalating demand for biopharmaceuticals and personalized medicine, increasing global investments in pharmaceutical and biotechnology R&D, stringent regulatory frameworks necessitating advanced analytical testing, and continuous technological innovations leading to more automated, miniaturized, and higher-throughput chromatographic systems. Furthermore, the rising awareness regarding food safety and environmental concerns fuels the adoption of these sophisticated analytical instruments worldwide, propelling market growth.

Chromatography Market Executive Summary

The global chromatography market is experiencing robust expansion, driven primarily by significant business trends such as escalating R&D spending within the pharmaceutical and biotechnology industries, particularly for novel drug discovery and biologics development. Market players are strategically investing in automation and digital integration to enhance throughput and reduce manual intervention, responding to the industry's push for efficiency and precision. Partnerships and collaborations between instrument manufacturers and end-users, along with mergers and acquisitions, are prevalent strategies to expand product portfolios and geographical reach, consolidating market leadership and fostering innovation. The demand for contract research and manufacturing services (CRO/CMO) that utilize advanced chromatographic techniques is also burgeoning, reflecting a broader trend towards outsourcing specialized analytical capabilities across the life sciences sector.

Regional trends indicate North America and Europe as dominant forces, characterized by well-established research infrastructures, high adoption rates of advanced technologies, and substantial investments from both public and private entities in pharmaceutical and biotechnological research. However, the Asia Pacific region is emerging as the fastest-growing market, fueled by increasing healthcare expenditures, expanding pharmaceutical manufacturing bases, and growing governmental support for scientific research and development, particularly in countries like China, India, and Japan. Latin America, the Middle East, and Africa are also showing promising growth, albeit at a slower pace, driven by improving healthcare infrastructure and rising awareness of analytical testing needs.

Segment trends highlight liquid chromatography, particularly HPLC and UHPLC, as the largest revenue-generating segment due to its widespread applicability in pharmaceutical analysis and biopharmaceutical purification. Gas chromatography also maintains a strong foothold, especially in environmental testing, petrochemicals, and forensics. The consumables segment, including columns, solvents, and reagents, consistently accounts for a substantial share of the market, driven by recurring demand and the necessity for high-quality, application-specific components. Furthermore, the services segment is gaining momentum as end-users seek expert support for instrument maintenance, validation, and training, underscoring the complexity and specialized nature of these analytical platforms.

AI Impact Analysis on Chromatography Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Chromatography Market primarily revolve around how AI can enhance efficiency, precision, and data interpretation, alongside concerns about integration challenges and the potential for job displacement. Common questions explore AI's role in automating method development, optimizing separation processes, and improving the analysis of complex chromatographic data, particularly for pattern recognition and anomaly detection. Users are keen to understand how AI can predict optimal experimental parameters, reduce human error, and accelerate research timelines, while also expressing interest in the ethical implications and the necessity for robust validation of AI-driven analytical outcomes. The prevailing sentiment is one of cautious optimism, acknowledging AI's transformative potential but also emphasizing the need for practical, validated applications that complement human expertise rather than fully replacing it, especially in critical quality control and research environments.

- Enhanced Data Processing and Interpretation: AI algorithms can quickly process vast amounts of chromatographic data, identify subtle patterns, detect anomalies, and provide deeper insights than traditional statistical methods, significantly speeding up data analysis and interpretation.

- Automated Method Development and Optimization: Machine learning models can predict optimal chromatographic conditions (e.g., column selection, mobile phase composition, temperature gradients) based on historical data and desired separation outcomes, drastically reducing the time and resources required for method development and validation.

- Predictive Maintenance and Instrument Control: AI can monitor instrument performance in real-time, predict potential malfunctions, schedule proactive maintenance, and even autonomously adjust operational parameters to maintain optimal performance, thereby increasing instrument uptime and longevity.

- Improved Peak Detection and Quantification: AI-driven algorithms can more accurately identify and quantify chromatographic peaks, even in complex chromatograms with overlapping peaks or baseline drifts, leading to more precise and reliable analytical results.

- Accelerated Drug Discovery and Development: By integrating AI into chromatographic workflows, researchers can accelerate the screening of compounds, identify impurities more efficiently, and optimize purification processes, ultimately shortening the drug discovery and development lifecycle.

- Enhanced Quality Control and Compliance: AI can assist in real-time quality control by flagging deviations from established chromatographic profiles, ensuring product consistency and facilitating compliance with stringent regulatory standards, minimizing human intervention and potential errors.

- Personalized Medicine Applications: AI-powered chromatography can enable more precise analysis of complex biological samples for biomarkers, aiding in the development and monitoring of personalized therapies by accurately identifying specific patient profiles and responses.

DRO & Impact Forces Of Chromatography Market

The Chromatography Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces. A primary driver is the burgeoning global pharmaceutical and biotechnology industry, with increasing investments in research and development for novel drug entities, biologics, and biosimilars, all of which heavily rely on advanced chromatographic techniques for separation, purification, and quality control. Furthermore, stringent regulatory standards imposed by health authorities worldwide for product safety, purity, and efficacy across various sectors, including food, environmental, and clinical, necessitate precise analytical methods, thereby boosting the demand for chromatography instruments and consumables. Technological advancements, such as the integration of automation, miniaturization, and higher-throughput capabilities in chromatographic systems, along with the adoption of hyphenated techniques, are also strong market drivers, enhancing efficiency and analytical power for complex sample analysis.

Despite these robust drivers, the market faces several restraints. The high initial capital investment required for sophisticated chromatography instruments, particularly advanced systems like UHPLC and GC-MS, poses a significant barrier to adoption for small to medium-sized laboratories and emerging markets with limited budgets. The operational complexity of these instruments, demanding skilled personnel for method development, sample preparation, and data interpretation, represents another constraint, as a shortage of trained professionals can hinder efficient utilization. Additionally, the recurring costs associated with high-quality consumables like columns, solvents, and reagents can add substantial operational expenses, influencing purchasing decisions and potentially slowing market penetration in cost-sensitive environments. These factors collectively temper the otherwise strong growth trajectory of the market.

Opportunities within the chromatography market are abundant and diverse. The increasing focus on personalized medicine and diagnostics, requiring ultra-sensitive and precise analytical tools for biomarker identification and therapeutic drug monitoring, opens new avenues for specialized chromatographic applications. Emerging economies in Asia Pacific and Latin America present significant untapped potential due driven by improving healthcare infrastructure, rising disposable incomes, and increasing investments in research and industrial development. The growing trend of outsourcing analytical testing to contract research organizations (CROs) also provides a fertile ground for market expansion, as CROs often invest in cutting-edge chromatographic technologies. Furthermore, the continuous development of novel stationary phases, column technologies, and detection methods, alongside the integration of artificial intelligence and machine learning for data analysis and method optimization, offers promising growth opportunities for market innovation and diversification. These opportunities are crucial for sustaining long-term market expansion and addressing evolving analytical needs across industries.

Segmentation Analysis

The Chromatography Market is extensively segmented to reflect its diverse product offerings, technological variations, wide range of applications, and varied end-user profiles. This segmentation provides a granular view of market dynamics, revealing specific growth areas and competitive landscapes within each category. The primary segmentation dimensions include the type of chromatography technique, the product categories (instruments, consumables, services), the end-user industries, and specific applications, each contributing uniquely to the overall market valuation and growth trajectory. Understanding these segments is crucial for strategic planning and identifying key market entry points, allowing stakeholders to target specific niche markets with tailored solutions. The versatility of chromatography allows it to serve numerous analytical needs, hence the detailed and multi-faceted segmentation.

- By Type:

- Liquid Chromatography (LC)

- High-Performance Liquid Chromatography (HPLC)

- Ultra-High-Performance Liquid Chromatography (UHPLC)

- Fast Protein Liquid Chromatography (FPLC)

- Gel Permeation Chromatography (GPC) / Size Exclusion Chromatography (SEC)

- Ion Chromatography (IC)

- Affinity Chromatography

- Chiral Chromatography

- Gas Chromatography (GC)

- Gas Chromatography-Mass Spectrometry (GC-MS)

- Gas Chromatography-Flame Ionization Detector (GC-FID)

- Gas Chromatography-Electron Capture Detector (GC-ECD)

- Gas Chromatography-Thermal Conductivity Detector (GC-TCD)

- Supercritical Fluid Chromatography (SFC)

- Thin-Layer Chromatography (TLC)

- Paper Chromatography

- Flash Chromatography

- Column Chromatography

- Liquid Chromatography (LC)

- By Product:

- Instruments

- Chromatography Systems

- Detectors (UV-Vis, PDA, Fluorescence, Refractive Index, Mass Spectrometry, ELSD)

- Autosamplers

- Fraction Collectors

- Pumps

- Data Systems & Software

- Consumables

- Columns (HPLC Columns, GC Columns, SFC Columns, TLC Plates, SPE Columns)

- Mobile Phases & Solvents

- Reagents & Standards

- Vials & Caps

- Fittings & Tubing

- Filters (Syringe Filters, Membrane Filters)

- Sample Preparation Products

- Services

- Installation & Qualification

- Maintenance & Repair

- Calibration Services

- Method Development & Validation Support

- Training & Education

- Consulting Services

- Instruments

- By Application:

- Pharmaceutical & Biotechnology Industry

- Drug Discovery & Development

- Quality Control & Assurance

- Biologics & Biosimilars Analysis

- Clinical Trials & Bioanalysis

- Impurity Profiling

- Food & Beverage Industry

- Food Safety & Quality Testing

- Nutritional Analysis

- Flavor & Aroma Profiling

- Adulteration Detection

- Environmental Testing

- Water & Wastewater Analysis

- Air Quality Monitoring

- Soil Analysis

- Pesticide Residue Analysis

- Clinical Diagnostics

- Therapeutic Drug Monitoring (TDM)

- Newborn Screening

- Metabolomics

- Forensic Toxicology

- Academics & Research Institutes

- Chemical & Petrochemical Industry

- Life Sciences Research

- Forensics & Toxicology

- Pharmaceutical & Biotechnology Industry

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Food & Beverage Companies

- Environmental Agencies & Industries

- Hospitals & Diagnostic Centers

- Contract Research Organizations (CROs)

- Contract Manufacturing Organizations (CMOs)

- Chemical & Petrochemical Companies

Value Chain Analysis For Chromatography Market

The value chain for the Chromatography Market is intricate, beginning with upstream activities focused on research and development, raw material procurement, and component manufacturing. Upstream analysis involves a broad network of suppliers providing high-purity chemicals, solvents, and advanced materials essential for producing stationary phases, columns, detectors, and other instrument components. Key players in this segment include specialty chemical manufacturers, electronics component suppliers, and precision engineering firms. Innovation in raw material science directly impacts the performance and efficiency of chromatographic systems, driving continuous collaboration between material science companies and instrument developers to optimize product attributes such as column longevity and detector sensitivity. This foundational stage is critical for ensuring the quality and reliability of the final chromatography products.

Further along the value chain, the core manufacturing and assembly of chromatography instruments and consumables take place. This stage involves complex processes from precision machining for instrument housing and fluidic paths to the highly specialized packing of chromatographic columns and the synthesis of unique stationary phases. Quality control and assurance are paramount at this juncture to meet stringent industry standards and regulatory requirements. Manufacturers often integrate advanced automation and lean manufacturing principles to enhance production efficiency and scalability, managing diverse product lines ranging from entry-level systems to highly sophisticated, integrated analytical platforms. Strategic sourcing and inventory management are also vital to ensure a steady supply of components and efficient production cycles.

Downstream analysis primarily focuses on distribution channels, sales, after-sales services, and end-user adoption. Products reach end-users through a combination of direct and indirect channels. Direct channels involve manufacturers selling directly to large pharmaceutical companies, major research institutions, or government agencies, often through dedicated sales teams that provide technical support and specialized consultations. Indirect channels leverage a network of distributors, regional dealers, and value-added resellers, particularly effective for reaching smaller laboratories, academic institutions, and international markets where local representation is crucial. Post-sales services, including installation, calibration, maintenance, repair, and user training, form a critical part of the value proposition, ensuring customer satisfaction and maximizing instrument uptime. The effectiveness of these distribution and service networks significantly influences market penetration and customer loyalty, making them a competitive differentiator in the chromatography market.

Chromatography Market Potential Customers

The potential customers for chromatography products and services are diverse, spanning a wide array of industries that require precise analytical separation and quantification capabilities. The largest segment of end-users are pharmaceutical and biotechnology companies. These organizations extensively utilize chromatography for every stage of drug development, from initial compound screening and impurity profiling to active pharmaceutical ingredient (API) analysis, quality control of finished products, and biopharmaceutical characterization. The stringent regulatory environment in drug manufacturing necessitates highly reliable and validated chromatographic methods, making these companies consistent and high-volume purchasers of both instruments and recurring consumables.

Academic and research institutes constitute another significant customer base. Universities, government laboratories, and private research centers employ chromatography across various scientific disciplines, including chemistry, biochemistry, environmental science, and materials science, for basic research, method development, and educational purposes. Their demand often focuses on versatile and robust systems that can handle a wide range of sample types and experimental designs. Food and beverage companies represent a rapidly growing segment, driven by increasing concerns over food safety, quality assurance, nutritional labeling, and the detection of contaminants, allergens, and adulterants. Chromatography is essential here for ensuring compliance with food safety regulations and maintaining product integrity.

Environmental agencies and industries are crucial buyers, utilizing chromatography for monitoring air, water, and soil quality, detecting pollutants, pesticides, and industrial contaminants. With increasing global environmental regulations and public awareness, the demand for sophisticated environmental analytical solutions is continuously rising. Clinical diagnostic laboratories and hospitals also use chromatography for therapeutic drug monitoring, newborn screening, metabolomics, and the detection of biomarkers associated with various diseases, contributing significantly to patient care and personalized medicine. Finally, contract research organizations (CROs) and contract manufacturing organizations (CMOs) are expanding their adoption of chromatography as they provide specialized analytical services to other industries, often requiring cutting-edge instruments and expertise to meet diverse client needs efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Waters Corporation, Shimadzu Corporation, Thermo Fisher Scientific, Danaher Corporation (SCIEX, Pall), PerkinElmer, Bio-Rad Laboratories, Merck KGaA, GE Healthcare, Tosoh Corporation, Daicel Corporation, Restek Corporation, Sartorius AG, Mitsubishi Chemical, Jasco Inc., Knauer GmbH, Sepax Technologies, VWR International (Avantor), Phenomenex (Danaher), Essentia Diagnostics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromatography Market Key Technology Landscape

The Chromatography Market is characterized by a rapidly evolving technological landscape, continuously driven by the demand for higher sensitivity, improved resolution, faster analysis times, and enhanced automation. A primary technological advancement is the widespread adoption of Ultra-High-Performance Liquid Chromatography (UHPLC), which utilizes smaller particle size columns and higher operating pressures to achieve significantly faster separations and superior resolution compared to traditional HPLC. This technology is critical in pharmaceutical analysis and drug discovery where speed and data quality are paramount. Another crucial area of development involves advanced detection systems, such as high-resolution mass spectrometry (HRMS) coupled with both LC and GC (LC-MS/MS, GC-MS/MS), which offer unparalleled specificity and sensitivity for identifying and quantifying trace components in complex matrices. These hyphenated techniques provide comprehensive analytical capabilities, allowing for simultaneous separation and identification.

Automation and robotics are profoundly transforming chromatographic workflows. Automated sample preparation systems, robotic autosamplers, and integrated data processing software streamline the entire analytical process, reducing manual intervention, minimizing human error, and increasing sample throughput. This automation is particularly beneficial in high-volume testing laboratories, such as those in pharmaceutical quality control and environmental monitoring. Miniaturization techniques, including microfluidic and lab-on-a-chip chromatography, are also gaining traction, offering the potential for reduced sample and solvent consumption, faster analysis, and portability. These innovations are opening new possibilities for point-of-care diagnostics and on-site environmental monitoring, making analytical science more accessible and efficient in diverse settings.

Furthermore, the development of novel stationary phases and column chemistries is a continuous area of innovation. This includes the creation of new chiral stationary phases for enantiomeric separations, hydrophilic interaction liquid chromatography (HILIC) columns for polar compounds, and specialized columns for biopharmaceutical analysis such as size exclusion and affinity chromatography. These advancements enable scientists to tackle increasingly challenging separation problems. The integration of advanced software for data analysis, method development, and instrument control, often incorporating Artificial Intelligence (AI) and Machine Learning (ML) algorithms, is another significant technological trend. These intelligent systems facilitate predictive modeling, optimize separation conditions, and improve pattern recognition in complex data sets, significantly enhancing the efficiency and accuracy of chromatographic analysis. The convergence of these technological innovations is shaping the future of analytical science, making chromatography more powerful and versatile than ever before.

Regional Highlights

- North America: This region holds a dominant share in the chromatography market, primarily due to significant investments in pharmaceutical and biotechnology R&D, the presence of numerous key market players, and a well-established healthcare infrastructure. The United States, in particular, leads in adopting advanced chromatographic technologies for drug discovery, clinical diagnostics, and environmental testing. Stringent regulatory guidelines further propel the demand for sophisticated analytical instruments, driving continuous innovation and market growth across the region.

- Europe: Europe represents another substantial market for chromatography, driven by strong governmental support for life science research, a robust pharmaceutical industry, and increasing focus on food safety and environmental protection. Countries like Germany, the UK, and France are major contributors, characterized by high academic and industrial research activity and the early adoption of cutting-edge analytical techniques. The region's emphasis on quality control and regulatory compliance sustains a consistent demand for high-performance chromatographic solutions.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, attributed to rapidly expanding pharmaceutical and biotechnology sectors, rising healthcare expenditure, and increasing awareness of environmental and food safety issues. Countries such as China, India, and Japan are investing heavily in research infrastructure and manufacturing capabilities. The growing number of contract research organizations (CROs) and contract manufacturing organizations (CMOs) in the region also contributes significantly to the escalating demand for chromatography instruments and services, positioning APAC as a key growth engine.

- Latin America: This region demonstrates steady growth in the chromatography market, driven by improving healthcare access, increasing investments in pharmaceutical production, and developing regulatory frameworks for quality control. Brazil and Mexico are leading contributors, showing growing demand for analytical instruments in both research and industrial applications. The expansion of local pharmaceutical manufacturing and increasing focus on public health initiatives are key factors propelling market expansion in this region.

- Middle East and Africa (MEA): The MEA region is witnessing gradual but consistent growth, primarily influenced by rising healthcare spending, expanding pharmaceutical industries in certain countries, and growing awareness of environmental monitoring. Investments in oil and gas industries also contribute to the demand for chromatography in petrochemical analysis. While smaller in market share compared to developed regions, the MEA market offers emerging opportunities driven by infrastructure development and increasing scientific collaborations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromatography Market.- Agilent Technologies

- Waters Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific

- Danaher Corporation (SCIEX, Pall Corporation, Phenomenex)

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- GE Healthcare (now Cytiva)

- Tosoh Corporation

- Daicel Corporation

- Restek Corporation

- Sartorius AG

- Mitsubishi Chemical Corporation

- Jasco Inc.

- Knauer GmbH Wissenschaftliche Geräte

- Sepax Technologies, Inc.

- VWR International (Avantor)

- LECO Corporation

- Dionex Corporation (acquired by Thermo Fisher Scientific)

Frequently Asked Questions

What is chromatography and why is it important?

Chromatography is a laboratory technique used to separate components of a mixture by passing it through a stationary phase with the help of a mobile phase. It is crucial across various industries, including pharmaceuticals, food and beverage, and environmental testing, for identifying, quantifying, and purifying substances, ensuring product quality, safety, and enabling scientific discovery.

Which types of chromatography are most commonly used?

The most commonly used types are High-Performance Liquid Chromatography (HPLC) and Gas Chromatography (GC). HPLC is widely adopted for analyzing non-volatile and thermally unstable compounds in life sciences, while GC is preferred for volatile and semi-volatile organic compounds in environmental, petrochemical, and forensic applications due to their high separation efficiency and sensitivity.

How do technological advancements impact the chromatography market?

Technological advancements, such as Ultra-High-Performance Liquid Chromatography (UHPLC), hyphenated techniques (e.g., LC-MS, GC-MS), and enhanced automation, significantly drive market growth. These innovations offer improved resolution, faster analysis times, higher sensitivity, and increased throughput, addressing the growing demand for efficient and precise analytical solutions across diverse industries.

What are the key drivers for the growth of the chromatography market?

Key drivers include the escalating R&D spending in the pharmaceutical and biotechnology sectors, increasingly stringent regulatory standards for product safety and quality, the rising global demand for biopharmaceuticals and personalized medicine, and continuous technological innovations leading to more advanced and automated chromatographic systems.

What challenges does the chromatography market face?

The market faces challenges such as the high initial cost of sophisticated chromatography instruments, which can be a barrier for smaller organizations. Additionally, the complexity of operation and the need for skilled personnel for method development and data interpretation, along with the recurring high cost of consumables, pose significant restraints on market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chromatography Syringes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Size Exclusion Chromatography (SEC) HPLC Column Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chromatography Paper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chromatography Columns Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chromatography Reagents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager