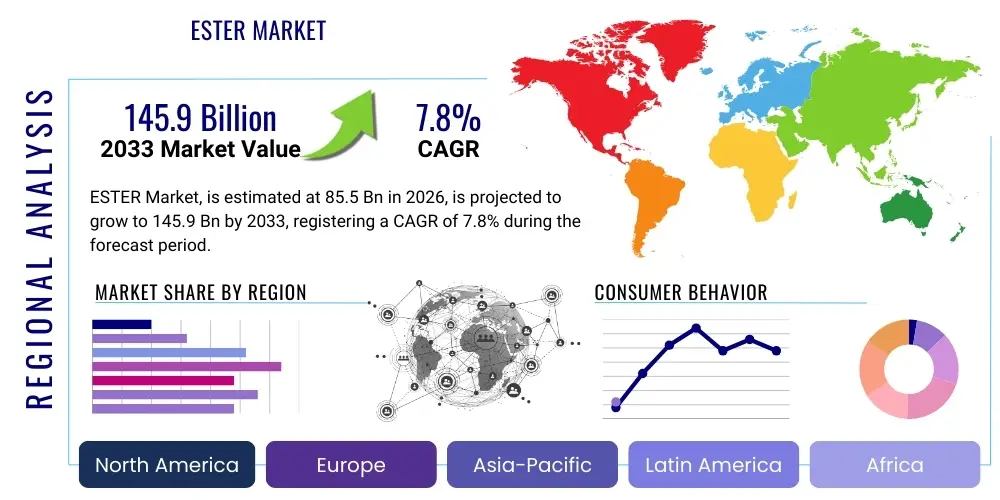

ESTER Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443034 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

ESTER Market Size

The ESTER Market, which encompasses a broad range of organic compounds critical for various industrial applications, is experiencing robust expansion driven by increasing demand across end-use sectors such as plastics, lubricants, and personal care products. The versatility of esters, particularly their use as plasticizers, solvents, and flavorings, positions them centrally within modern manufacturing supply chains. Furthermore, the push towards sustainability and bio-based chemistry is catalyzing the development and adoption of bio-esters, adding significant momentum to market growth projections over the coming decade. This fundamental shift is supported by evolving regulatory frameworks favoring environmentally conscious chemical alternatives.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. This consistent growth trajectory is underpinned by heavy investments in R&D aimed at enhancing ester performance characteristics, such as thermal stability and biodegradability. Manufacturers are increasingly focusing on specialized ester types, including phthalate-free plasticizers and high-performance synthetic lubricants, to meet stringent industry standards and consumer preferences. The dynamic interplay between industrial scale-up, technological innovation, and sustainability mandates ensures a strong forecast for market valuation. The anticipated demand spike in developing economies, particularly in the Asia Pacific region due to rapid infrastructure and manufacturing expansion, will be a key contributing factor to the overall market size increment.

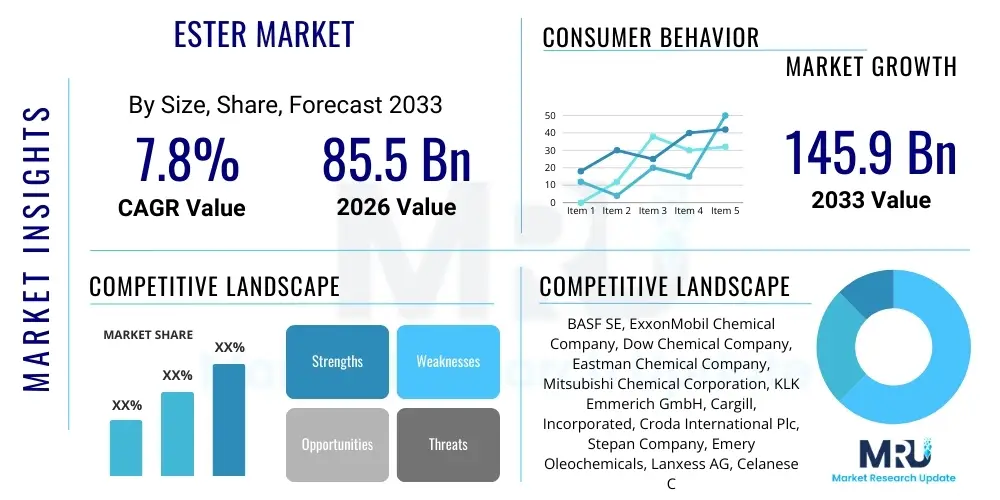

The ESTER Market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 145.9 Billion by the end of the forecast period in 2033. This substantial increase reflects not only volume growth but also value addition stemming from premium, high-purity ester products. Key sectors driving this valuation growth include synthetic lubricants for automotive and industrial machinery, where esters offer superior temperature stability and lower volatility compared to mineral oils, and the growing complexity and demand within the flavors and fragrances industry, which relies heavily on specific ester compounds for characteristic notes and profiles. The transition away from traditional, less sustainable chemistries towards high-performance ester solutions solidifies the foundation for this projected financial expansion.

ESTER Market introduction

The ESTER market centers on a class of organic compounds characterized by the functional group R–COO–R′, formed typically by the reaction of an alcohol and an organic or inorganic acid. These compounds are ubiquitous in chemical synthesis and commercial products, serving fundamental roles due to their excellent solvency, low toxicity, pleasant odors, and compatibility with various materials. Esters are manufactured in large volumes globally, ranging from simple fatty acid esters used in biodiesel and cosmetics to complex polymeric esters utilized in high-performance engineering plastics and specialized lubricants. Their inherent versatility allows for tailored properties, making them indispensable components across diverse industrial sectors.

Major applications of esters span multiple critical industries. In the plastics and polymer industry, phthalate esters and their sustainable alternatives function primarily as plasticizers, imparting flexibility and durability to polyvinyl chloride (PVC) products used in construction, medical devices, and automotive components. The lubricants sector relies heavily on synthetic esters for formulation of high-performance engine oils and hydraulic fluids, valued for their superior thermal stability and lubricating properties under extreme conditions. Furthermore, esters are foundational in the personal care and cosmetics market, acting as emollients, thickeners, and carrying agents, while the food and beverage industry uses specific volatile esters as synthetic flavorings and aromatic agents. The complexity and sheer breadth of application underscore the market's foundational importance in the global chemical landscape.

Driving factors for the ESTER market include the escalating demand for high-quality, synthetic lubricants in advanced machinery, stringent environmental regulations pushing the adoption of bio-based and non-phthalate plasticizers, and continuous growth in the consumption of packaged foods and personal care products globally. The benefits offered by esters—such as enhanced performance, biodegradability potential, and low odor—further fuel their adoption, particularly in sensitive applications. However, volatility in raw material pricing, particularly petroleum derivatives, and the regulatory scrutiny on certain long-chain esters pose intermittent challenges that manufacturers actively mitigate through process optimization and diversification into renewable feedstocks.

ESTER Market Executive Summary

The ESTER market is poised for significant expansion, driven primarily by favorable business trends emphasizing sustainability and high-performance materials. Key business trends include the widespread commercialization of bio-based esters derived from vegetable oils, positioning companies strategically to comply with global environmental mandates and capture consumer demand for eco-friendly products. There is also a pronounced shift towards digitalization in manufacturing processes, leveraging automation and advanced analytics to optimize ester synthesis and improve purity levels, thereby enhancing profitability margins. Mergers and acquisitions focused on securing proprietary feedstock technologies or expanding regional manufacturing footprints are also defining the competitive landscape, leading to consolidation and optimization of the supply chain.

Regionally, Asia Pacific (APAC) stands out as the paramount growth engine, commanding the largest market share and demonstrating the highest projected CAGR. This dominance is attributed to massive industrial growth, particularly in China and India, involving expansion in construction, automotive manufacturing, and consumer goods production, all of which require substantial volumes of plasticizers and functional fluids. North America and Europe, while being mature markets, focus heavily on technological innovation and regulatory compliance, driving demand for premium, specialized esters such as phosphate esters for flame retardancy and high-grade synthetic esters for aerospace applications. The Middle East and Africa (MEA) and Latin America are emerging regional trends, characterized by increasing foreign investment and nascent infrastructure development stimulating moderate growth in lubricant and polymer applications.

Segment trends highlight the dominance of Phthalate Esters historically, though their growth is slowing due to regulatory pressures, accelerating the transition towards non-phthalate alternatives like Adipate and Trimellitate esters. Glycerol Esters are experiencing rapid growth, largely due to their integral role in the food emulsifiers and biodiesel sectors. Application-wise, the Lubricants segment is exhibiting the most robust value growth, driven by the increasing complexity of machinery requiring synthetic base oils that offer superior thermal stability and reduced environmental impact. Conversely, the Polymer and Plasticizer segment remains the largest volume consumer, adapting swiftly to innovative, sustainable plasticizing solutions to maintain market viability amidst tightening environmental controls.

AI Impact Analysis on ESTER Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the ESTER market primarily revolve around optimizing chemical synthesis, predicting material performance, and enhancing quality control. Users frequently question how AI algorithms can accelerate the discovery of novel ester compounds with specific properties (e.g., enhanced biodegradability or lower volatility) and how machine learning (ML) models are being utilized to optimize reaction conditions, thereby reducing waste and energy consumption in large-scale production facilities. Concerns also focus on the adoption barriers, such as the need for vast, high-quality chemical data sets and the specialized expertise required to implement complex predictive maintenance and process optimization systems within traditional chemical manufacturing environments. Expectations are high concerning AI's potential to dramatically cut research timelines and refine product formulation strategies to meet evolving regulatory demands instantaneously.

AI is fundamentally transforming the R&D pipeline within the ESTER market by leveraging cheminformatics and computational chemistry. Machine learning models are now capable of screening thousands of potential feedstock combinations and reaction pathways virtually, identifying optimal synthesis routes for novel esters far faster than traditional laboratory experimentation. This capability not only speeds up time-to-market for specialized products but also significantly reduces the costs associated with iterative physical experimentation. Furthermore, AI-driven predictive maintenance systems are being deployed in large ester production plants to analyze sensor data from reactors, pumps, and distillation columns, forecasting equipment failures before they occur and minimizing costly downtime, directly translating to enhanced operational efficiency and increased output reliability.

Beyond R&D and operations, AI is playing a crucial role in market analysis and supply chain resilience. Algorithms analyze vast datasets of consumer preferences, regulatory changes across jurisdictions, and commodity price fluctuations, providing manufacturers with highly accurate demand forecasts. This intelligence allows companies to optimize procurement strategies for raw materials, particularly renewable feedstocks, and adjust production schedules to minimize inventory risks. The application of AI in quality control, utilizing image processing and spectroscopic analysis to ensure batch-to-batch consistency and purity, is raising the standard for high-grade esters, particularly those used in pharmaceuticals and high-end cosmetics, ensuring compliance and enhancing customer trust in product quality.

- AI optimizes reaction conditions (temperature, pressure, catalyst concentration) in ester synthesis, leading to higher yields and reduced energy expenditure.

- Machine Learning accelerates the discovery of novel, bio-based ester plasticizers and lubricants, streamlining the transition to sustainable chemistries.

- Predictive maintenance systems minimize operational downtime by analyzing sensor data from manufacturing equipment, improving asset utilization rates.

- AI-driven supply chain analytics provide precise demand forecasting, optimizing feedstock procurement and inventory management to mitigate price volatility risks.

- Computational chemistry, powered by AI, simulates molecular interactions to predict the performance (e.g., thermal stability, viscosity) of new ester formulations digitally.

- Advanced quality control uses AI for real-time spectroscopic analysis, ensuring the purity and consistency of high-specification ester batches.

DRO & Impact Forces Of ESTER Market

The dynamics of the ESTER market are governed by a robust interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its trajectory. The primary Drivers stem from the persistent global demand for high-performance specialty chemicals, particularly in complex applications like synthetic lubricants (driven by stringent emission norms and advanced engine designs) and non-phthalate plasticizers (driven by health and environmental concerns). The inherent stability, efficiency, and customizable properties of synthetic esters provide a significant performance advantage over mineral oil alternatives, solidifying their market position. Additionally, the proliferation of manufacturing activities in emerging economies, notably in construction and automotive sectors, significantly accelerates the need for bulk ester chemicals.

Restraints, however, pose critical challenges to sustained expansion. The market faces significant volatility in raw material costs, as many traditional ester feedstocks are derived from petrochemical sources, linking production costs to fluctuating crude oil prices. Furthermore, intense regulatory scrutiny across North America and Europe on specific ester compounds, particularly long-chain phthalates, forces manufacturers to incur substantial R&D costs to develop and validate replacement compounds. While this ultimately drives innovation (an opportunity), the initial compliance costs and the time required for regulatory approval present short-term headwinds. The capital-intensive nature of chemical plant setup and expansion also acts as a barrier to entry for smaller or newer players, limiting immediate competitive diversification.

Opportunities are predominantly centered around the transition to renewable and bio-based chemistry. The increasing focus on carbon neutrality and circular economy models presents a massive opportunity for the widespread adoption of bio-esters derived from sustainable sources such as vegetable oils, fatty acids, and agricultural residues. Technological advancements in enzymatic esterification offer process intensification and lower environmental impact, opening new avenues for production efficiency. Furthermore, niche applications, such as high-purity esters for pharmaceutical delivery systems, specialized dielectric fluids for high-voltage transformers, and complex esters for advanced flavor encapsulation techniques, represent high-value growth pockets that promise superior margins and market diversification for leading chemical manufacturers.

Segmentation Analysis

The ESTER market is comprehensively segmented based on Type, Application, and End-User Industry, reflecting the diversity of chemical compositions and their functional roles across the global economy. Segmentation by Type is crucial as it dictates the physical and chemical properties, regulatory standing, and primary uses of the ester compounds, distinguishing between high-volume commodities and low-volume, high-value specialties. The market structure reveals a complex landscape where established segments like Phthalate Esters face replacement pressure from emerging bio-based alternatives, necessitating strategic portfolio adjustments by manufacturers. This analysis enables stakeholders to pinpoint areas of highest growth potential and greatest regulatory risk, informing investment and product development decisions.

Segmentation by Application highlights the crucial functional roles esters perform, such as plasticization, lubrication, solvency, and emulsification. The dominance of the polymer and plasticizer sector in terms of volume consumption contrasts sharply with the high-value growth potential exhibited by specialized segments like lubricants and flavorings, where performance attributes command premium pricing. End-user segmentation mirrors these applications, focusing on the ultimate consuming industries—ranging from automotive and construction (heavy industry users) to food and cosmetics (consumer goods users). Understanding these segments allows for targeted marketing and supply chain optimization, ensuring that specific purity standards and performance requirements unique to each industry are consistently met. The increasing demand from the biodiesel sector, where methyl esters are primary components, also represents a growing and distinct segmentation category.

- Type:

- Phosphate Esters

- Acrylates

- Glycerol Esters (Mono-, Di-, Tri-glycerides)

- Sorbitan Esters

- Sucrose Esters

- Phthalate Esters (DOP, DINP, DIDP)

- Non-Phthalate Esters (Adipates, Trimellitates, Citrates)

- Methyl Esters (Biodiesel)

- Application:

- Plasticizers

- Lubricants & Base Oils

- Solvents

- Emollients & Emulsifiers

- Flavors & Fragrances

- Surfactants

- Flame Retardants

- Coatings & Resins

- End-User Industry:

- Automotive & Transportation

- Construction & Building Materials

- Food & Beverages

- Cosmetics & Personal Care

- Pharmaceuticals

- Paints & Coatings

- Industrial Manufacturing (Hydraulic Fluids)

- Textiles

Value Chain Analysis For ESTER Market

The Value Chain for the ESTER market begins with the Upstream Analysis, focusing on the procurement and processing of raw materials. Esters are derived primarily from alcohols and acids, which themselves originate from petrochemical refining (e.g., methanol, ethanol, fatty acids from petroleum) or oleochemical sources (e.g., vegetable oils, animal fats for fatty acids and glycerol). The cost structure of the final ester product is highly sensitive to the stability and pricing of these upstream feedstocks. Key upstream activities involve the extraction, refining, and purification of these precursor molecules, often requiring complex chemical processes and energy-intensive distillation. Strategic sourcing of renewable raw materials, such as bio-methanol or sustainably sourced fatty acids, represents a critical competitive advantage in the modern market, mitigating reliance on volatile fossil fuel prices and supporting environmental credentials.

Midstream activities encompass the actual production and synthesis of esters, involving esterification reactions typically catalyzed by strong acids or enzymes. This stage is characterized by high capital investment in reactors, separation equipment, and process control systems necessary to ensure high purity and yield. Efficiency in the manufacturing process—including energy utilization and waste minimization—is paramount for maintaining cost competitiveness. Specialized manufacturers often focus on tailor-making specific esters for niche applications, requiring rigorous quality control and specialized downstream purification techniques, such as fractional distillation or chromatographic separation, to meet stringent requirements for industries like pharmaceuticals or high-end cosmetics. Innovation in midstream activities is focused on green chemistry principles, including the use of solid acid catalysts and solvent-free esterification methods.

The Downstream Analysis involves the distribution channel and the final application or consumption of the ester product. Esters move through complex channels, including direct sales to large end-users (e.g., major PVC manufacturers, large lubricant blenders) and indirect distribution via regional chemical distributors and specialized agents who handle smaller volume orders, provide technical support, and manage local inventory. Direct channels are common for bulk commodities, allowing for cost efficiencies and direct technical collaboration. Indirect channels are crucial for specialty esters that require significant technical guidance and inventory flexibility for diverse SME users. Potential customers span industrial giants in automotive and construction to consumer product formulators in food and cosmetics, each requiring different packaging, logistics, and regulatory documentation, emphasizing the need for a robust and adaptable distribution network capable of handling diverse product specifications and geographic requirements.

ESTER Market Potential Customers

Potential customers in the ESTER market are highly diversified, reflecting the broad functional utility of these compounds. End-users span the full spectrum of industrial activity, primarily seeking esters for their properties as plasticizers, solvents, lubricants, emulsifiers, and flavors. Within the heavy industry sector, major customers include large-scale manufacturers of PVC pipes, films, and cables (Construction & Infrastructure), where phthalate and non-phthalate plasticizers are essential inputs to achieve desired flexibility and durability. The Automotive industry is a massive consumer, utilizing synthetic ester base oils for high-performance engine lubricants, gear oils, and hydraulic fluids that are critical for modern, energy-efficient vehicles requiring extended drain intervals and exceptional thermal stability under demanding operational conditions.

The consumer goods sectors represent another critical cohort of buyers. Cosmetics and personal care manufacturers rely heavily on specific esters, such as isopropyl myristate or various fatty acid esters, which function as emollients, dispersants, and texture enhancers in lotions, creams, and makeup. These customers prioritize high purity, dermatological compatibility, and regulatory compliance. Similarly, the Food and Beverage industry acts as a major buyer for highly purified glycerol esters (emulsifiers) and specialized volatile esters (flavors and fragrances) used to enhance the sensory appeal and shelf life of processed foods and drinks. The stringent regulatory requirements (e.g., FDA, EFSA approvals) for these applications dictate specific purchasing criteria and require robust supplier traceability systems.

Beyond these primary sectors, specialty end-users include pharmaceutical companies (using esters as solubilizers and carriers in drug formulations), paint and coatings manufacturers (relying on ester solvents for viscosity control and film formation), and the burgeoning Biodiesel industry, where bulk methyl esters derived from vegetable oils are the core product. For all customer types, the shift towards sustainable procurement means that suppliers offering certified bio-based esters or products manufactured through environmentally friendly processes are increasingly favored, influencing long-term procurement partnerships and driving market demand towards innovative, greener alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 145.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, ExxonMobil Chemical Company, Dow Chemical Company, Eastman Chemical Company, Mitsubishi Chemical Corporation, KLK Emmerich GmbH, Cargill, Incorporated, Croda International Plc, Stepan Company, Emery Oleochemicals, Lanxess AG, Celanese Corporation, Arkema Group, Polynt-Reichhold Group, Perstorp Holding AB, Sinopec, Solvay S.A., Adeka Corporation, Wanhua Chemical Group Co., Ltd., Evonik Industries AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ESTER Market Key Technology Landscape

The ESTER market is undergoing continuous technological evolution focused primarily on improving process efficiency, enhancing product performance, and increasing sustainability metrics. A fundamental technology is advanced catalytic esterification, moving beyond traditional mineral acid catalysts to utilize solid acid catalysts (e.g., sulfonated resins, heteropolyacids). Solid catalysts offer superior separation capabilities, reduce corrosion, and facilitate continuous-flow processes, which significantly lowers operational costs and improves the environmental profile by minimizing the need for neutralization and salt disposal. Furthermore, highly selective catalysts are being developed to target specific ester linkages, enabling the precise synthesis of complex esters required for high-end applications like specialty lubricants and pharmaceutical ingredients, where isomeric purity is critical.

Another crucial technological advancement involves enzymatic esterification, a cornerstone of sustainable and green chemistry. Enzymes (lipases and esterases) derived from biological sources allow ester synthesis to occur under mild conditions (lower temperature and pressure), drastically reducing energy consumption and preventing undesirable side reactions, leading to higher product purity. This technology is particularly vital for producing bio-esters and food-grade emulsifiers, as it avoids harsh chemical residues. The continuous improvement in enzyme immobilization techniques and bioreactor design is making enzymatic processes economically viable at industrial scale, challenging conventional thermal and acid catalysis methods, especially for the production of biodiesel and high-value oleochemical derivatives, positioning it as a key disruptive force.

Process intensification technologies, including reactive distillation and microreactors, are also reshaping the manufacturing landscape. Reactive distillation combines the chemical reaction and product separation steps into a single unit operation, dramatically reducing equipment footprint and energy requirements, making production lines more compact and efficient. Microreactor technology, offering precise control over heat and mass transfer, is being utilized for hazardous or highly exothermic esterification reactions, ensuring safer operations and enabling the synthesis of unstable or highly reactive ester intermediates. These technologies, coupled with sophisticated real-time monitoring and control systems (often leveraging AI and IoT sensors), are setting new benchmarks for productivity, quality, and safety within the modern ESTER chemical manufacturing sector.

Regional Highlights

The global ESTER market exhibits distinct regional dynamics, driven by varied industrial development, regulatory frameworks, and consumer preferences. Asia Pacific (APAC) stands out as the predominant market in terms of both volume and growth rate. Rapid industrialization, particularly in China, India, and Southeast Asian nations, fuels enormous demand for esters, especially for plasticizers in the expansive construction and infrastructure sectors and for methyl esters used in biodiesel. Government initiatives supporting manufacturing growth and high foreign direct investment inflows further solidify APAC’s status as the primary consumption and production hub. Local manufacturers are increasingly scaling up capacity, often focusing on competitive bulk ester production, while also adopting advanced technology for specialty esters.

North America and Europe represent mature, high-value markets characterized by stringent regulatory oversight and a strong focus on high-performance and sustainability. In Europe, regulations like REACH and directives concerning phthalates drive rapid substitution towards non-phthalate alternatives (e.g., citrates, adipates), necessitating high R&D spending. Demand here is concentrated in specialty applications, including synthetic esters for high-end automotive lubricants, aerospace fluids, and high-purity cosmetic emollients. North America follows a similar trajectory, with strong emphasis on bio-based chemistries and the adoption of high-performance polyol esters for advanced industrial lubricants and refrigeration systems. These regions command premium pricing due to the required levels of technical support, compliance, and product sophistication.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions showing promising growth. LATAM’s growth is tied to developing automotive production and agricultural output, driving demand for lubricants and biodiesel. MEA, particularly the GCC nations, is increasing its capacity in petrochemical derivatives, which provides a strong base for upstream raw materials, potentially shifting the region from a net importer to a significant producer of basic esters. Demand in MEA is primarily driven by construction projects and developing industrial manufacturing bases. These emerging markets offer considerable long-term opportunities for global ester manufacturers willing to invest in new production facilities and build local distribution networks, capitalizing on improving economic conditions and industrial expansion.

- Asia Pacific (APAC): Highest volume market, driven by construction, automotive expansion in China and India, and rising demand for biodiesel; major focus on capacity expansion and bulk chemical synthesis.

- North America: Mature market concentrating on high-performance synthetic lubricants, stringent environmental standards (driving bio-ester adoption), and specialty chemicals for aerospace and defense.

- Europe: Regulatory leader (REACH), emphasizing non-phthalate plasticizers and sustainable, high-purity esters for cosmetics and pharmaceuticals; significant investment in enzymatic and green chemistry processes.

- Latin America (LATAM): Growth driven by expanding automotive manufacturing base, increasing agricultural mechanization, and local biodiesel programs, necessitating increased lubricant and fuel additive consumption.

- Middle East and Africa (MEA): Emerging market with strong upstream feedstock availability (petrochemicals); demand primarily from infrastructure development, construction, and nascent industrial manufacturing requiring basic ester inputs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ESTER Market, analyzing their product portfolios, strategic initiatives, regional presence, and competitive strategies to provide comprehensive insights into the industry structure and competitive dynamics. These companies are instrumental in driving innovation and dictating global supply trends, navigating complex regulatory landscapes, and investing heavily in sustainable ester chemistries to maintain market leadership. Their strategic focus often involves securing upstream feedstock supply, optimizing high-volume production through advanced catalysis, and diversifying product offerings into high-margin specialty segments such as non-phthalate plasticizers and performance lubricants, ensuring resilience against market volatility and regulatory pressures.- BASF SE

- ExxonMobil Chemical Company

- Dow Chemical Company

- Eastman Chemical Company

- Mitsubishi Chemical Corporation

- KLK Emmerich GmbH

- Cargill, Incorporated

- Croda International Plc

- Stepan Company

- Emery Oleochemicals

- Lanxess AG

- Celanese Corporation

- Arkema Group

- Polynt-Reichhold Group

- Perstorp Holding AB

- Sinopec

- Solvay S.A.

- Adeka Corporation

- Wanhua Chemical Group Co., Ltd.

- Evonik Industries AG

- Huntsman Corporation

- Ineos Group Holdings S.A.

- Shell plc

- Ashland Global Holdings Inc.

- Sumitomo Chemical Co., Ltd.

- DIC Corporation

- P&G Chemicals

- Versalis S.p.A.

- SABIC (Saudi Basic Industries Corporation)

- Cognis Corporation (now part of BASF)

- The Lubrizol Corporation

- TotalEnergies SE

- Sasol Limited

- Fuji Silysia Chemical Ltd.

- Novozymes A/S

- Godrej Industries Ltd.

- Puyang Huicheng Electronic Material Co., Ltd.

- Kao Corporation

- Clariant AG

- Kolb Distribution Ltd.

- Oxea GmbH

- Hexion Inc.

- Ecogreen Oleochemicals

- Chemtura Corporation (now part of Lanxess)

- M. & T. Chemicals Inc.

- Kaneka Corporation

- Azelis Group

- Brenntag AG

- Kukdo Chemical Co., Ltd.

- Taiwan Union Technology Corporation (TUTC)

- Jiangsu Jurong Chemical Co., Ltd.

- Indorama Ventures Public Company Limited (IVL)

- Harcros Chemicals Inc.

- Triveni Interchem Pvt. Ltd.

- Global Bio-chem Technology Group Company Limited

- Shandong Jiahong Chemical Co., Ltd.

- Yip’s Chemical Holdings Limited

- Chembridge International Co., Ltd.

- PT. Musim Mas

- Permira GmbH

- Targray Technology International Inc.

- Dongying Rich Chemical Co., Ltd.

- Sanyo Chemical Industries, Ltd.

- Mitsui Chemicals, Inc.

- Kuraray Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the ESTER market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of the shift towards non-phthalate plasticizers in the ESTER market?

The primary drivers are stringent regulatory mandates, particularly in Europe and North America, aimed at reducing health and environmental risks associated with traditional phthalates, coupled with increasing consumer demand for safer, non-toxic alternatives in consumer products like toys and medical devices. This regulatory push accelerates the adoption of bio-based and alternative ester plasticizers like adipates and citrates.

How significant is the role of bio-based ESTERs in achieving sustainability goals?

Bio-based esters, derived from renewable resources such as vegetable oils and animal fats, are crucial for sustainability as they offer lower carbon footprints, enhanced biodegradability, and reduce reliance on finite petrochemical feedstocks. They are seeing rapid adoption in lubricants, plasticizers, and biodiesel, helping industries comply with circular economy principles and green chemistry objectives globally.

Which application segment holds the largest market share for ESTER consumption?

The Plasticizers application segment traditionally holds the largest volume share of the ESTER market, driven by the massive scale of the polyvinyl chloride (PVC) industry in construction, automotive, and general consumer goods. While regulatory pressure is shifting the type of esters used, the total volume demand from plasticization remains dominant.

What technological advancements are most impacting ESTER manufacturing efficiency?

Enzymatic esterification and the use of solid acid catalysts are the most impactful technological advancements, as they facilitate synthesis under milder conditions, reduce energy consumption, minimize hazardous waste, and improve product selectivity and purity. The integration of AI for process optimization further enhances efficiency and predictive maintenance in large-scale production facilities.

Which geographical region is projected to exhibit the fastest growth rate in the ESTER market?

The Asia Pacific (APAC) region, led by China and India, is projected to exhibit the fastest growth rate. This rapid expansion is fueled by unprecedented growth in infrastructure development, automotive production, and consumer goods manufacturing, all requiring substantial volumes of ester-based chemicals and specialty fluids.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Berry Harvester Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Polyester Plasticizers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ethyl Acrylate Ester Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Flying Probe Tester Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Anaerobic Digester Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager