Super Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442003 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Super Market Size

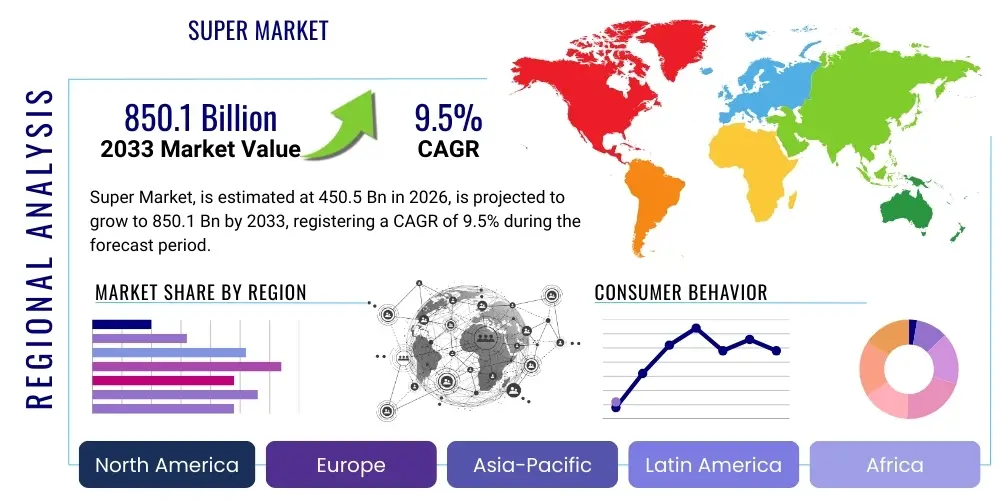

The Super Market, defined as the global integrated retail technology and logistics solutions sector, is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $450.5 Billion USD in 2026 and is projected to reach $850.1 Billion USD by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the accelerated digital transformation of global retail operations, driven by consumer demand for frictionless shopping experiences and the necessity for retailers to optimize complex supply chain networks.

The valuation methodology accounts for revenues derived from hardware components such as smart shelves, RFID tags, automated guided vehicles (AGVs), and sophisticated software solutions including advanced analytics platforms, AI-driven inventory management systems, and specialized Point of Sale (POS) terminals. Market size forecasting considers macroeconomic variables such as global GDP growth, evolving consumer purchasing power in emerging economies, and regulatory shifts impacting cross-border e-commerce and data privacy. Furthermore, the increasing capital expenditure by Tier-1 and Tier-2 retailers globally towards store automation and omnichannel integration forms a critical input for projecting future market expansion.

Key indicators supporting the high CAGR include the rapid deployment of cloud-based retail management systems, which lower the entry barrier for small and medium-sized enterprises (SMEs) to adopt advanced solutions, and the pervasive integration of the Internet of Things (IoT) sensors throughout physical retail environments. The shift from traditional labor-intensive processes to automated workflows, particularly in warehousing and last-mile delivery, provides significant operational efficiencies, justifying the high initial investment costs for major market participants, thereby sustaining the robust market growth projection through 2033.Super Market introduction

The Super Market, focusing on the sophisticated retail technology ecosystem, encompasses all hardware, software, and services designed to enhance efficiency, customer engagement, and operational transparency across the retail value chain, ranging from procurement to final sale and returns management. Products within this scope include next-generation POS systems, enterprise resource planning (ERP) solutions tailored for retail, automated storage and retrieval systems (AS/RS), customer relationship management (CRM) platforms, and predictive analytics tools leveraging machine learning. Major applications span inventory optimization, demand forecasting, personalized marketing, cashierless checkout, and automated fulfillment centers. The primary benefits realized by adopting these technologies include reduced operational costs, minimized inventory shrinkage, increased customer loyalty through highly tailored experiences, and enhanced supply chain resilience against external shocks, positioning this sector as essential for modern retail competitiveness and sustainability in an increasingly digitalized global economy.

The market is defined by its ability to converge physical (brick-and-mortar) and digital (e-commerce) retail channels, creating true omnichannel environments. This integration requires sophisticated middleware and data synchronization capabilities, enabling a single view of inventory and customer interactions regardless of the touchpoint. Specific attention is paid to technologies that solve the "last mile" problem, such as drone delivery systems and intelligent locker networks, and those that transform the in-store experience, like augmented reality (AR) shopping assistants and facial recognition payment systems. The evolution of the Super Market is intrinsically linked to advancements in cloud computing infrastructure, allowing for scalable deployment and real-time data processing critical for dynamic pricing strategies and immediate response to shifting consumer trends.

Driving factors include the fiercely competitive landscape forcing retailers to seek efficiency gains, the rising penetration of smartphones leading to mobile commerce dominance, and the structural shift in consumer expectations toward instant gratification and highly personalized service. Furthermore, significant investment in developing countries to modernize legacy retail infrastructure provides ample opportunities for technology vendors. Regulatory factors, such as stricter food safety traceability requirements and mandates for secure payment processing (PCI DSS compliance), also push retailers toward adopting cutting-edge, compliant technological solutions, thereby sustaining the innovation cycle and market expansion.

Super Market Executive Summary

The Super Market is characterized by accelerating business trends focused on ecosystem integration, where modular solutions replace monolithic systems, fostering interoperability between various retail technologies, including loyalty programs, warehouse management, and e-commerce platforms. Key business drivers include venture capital funding for retail technology startups specializing in niche areas like headless commerce and sustainable packaging logistics, prompting incumbent technology giants to aggressively acquire or partner with these innovators to maintain market relevance. Regionally, Asia Pacific (APAC) is dominating growth due to rapid urbanization, immense population size, and leapfrogging adoption of mobile-first payment solutions, while North America and Europe lead in implementing sophisticated AI and robotics for labor displacement mitigation and operational precision. Segmentation trends highlight the critical pivot from generalized retail software towards vertical-specific solutions, notably in grocery and fashion, demanding specialized inventory and compliance features, alongside a massive shift toward "Everything-as-a-Service" (XaaS) models, favoring subscription-based software over perpetual licensing, which stabilizes recurring revenue streams for vendors and reduces large upfront capital expenditure for end-users.

A significant trend observable across major economies is the consolidation of the vendor landscape through mergers and acquisitions (M&A) activity aimed at achieving scale and integrating complimentary technological stacks, particularly in data analytics and fulfillment automation. This consolidation often results in vertically integrated offerings that promise end-to-end solutions, reducing complexity for large multinational retailers. Simultaneously, sustainability and ethical sourcing requirements are becoming embedded within retail technology procurement decisions; hence, solutions demonstrating energy efficiency in data centers or providing transparency regarding supply chain carbon footprints gain a competitive edge. The global push for faster, more reliable network infrastructure, specifically 5G, is further enabling complex in-store and remote operations, unlocking applications like real-time visual analytics for loss prevention and enhanced interactive displays for customer engagement.

In terms of specific segments, the software component consistently outperforms hardware growth, driven by continuous innovation in machine learning algorithms for pricing optimization and fraud detection, which offer immediate and measurable return on investment (ROI). Geographically, the maturation of infrastructure in developing regions like Southeast Asia and Latin America is opening up high-volume markets for mobile POS and basic inventory tracking systems, contrasting with the sophisticated, highly specialized requirements of mature markets like Germany and Japan, which prioritize robotics and advanced predictive modeling for complex logistics. This market duality necessitates vendors to maintain tiered product offerings, catering to both fundamental digitalization needs and cutting-edge technological demands, ensuring broad market capture and sustained growth across diverse operational environments.

AI Impact Analysis on Super Market

User queries regarding the impact of Artificial Intelligence (AI) on the Super Market predominantly revolve around three critical themes: workforce automation (job displacement vs. skill augmentation), the efficacy and ethical implications of hyper-personalization, and the reliability of AI-driven supply chain forecasting during periods of high volatility (e.g., pandemics, geopolitical conflicts). Users frequently ask: "How much inventory planning is truly automated by AI?", "Will cashier jobs disappear entirely?", and "What are the data security risks associated with using AI to analyze customer behavior?" The collective analysis indicates a high expectation for AI to revolutionize operational efficiency, particularly in demand sensing and pricing elasticity, coupled with significant underlying concern regarding data privacy compliance (GDPR, CCPA) and the transparency (explainability) of AI decision-making processes, especially when these decisions affect pricing or personalized offers, ultimately requiring robust governance frameworks and explainable AI (XAI) capabilities to build trust and ensure ethical deployment.

The integration of generative AI is moving beyond simple chatbots to creating dynamic, virtual shopping environments and generating targeted marketing content tailored specifically to individual historical purchasing data and anticipated future needs. This level of personalization, while driving conversions, necessitates stringent ethical controls to prevent predatory marketing practices or discriminatory pricing. Furthermore, AI's role in optimizing store layouts based on real-time foot traffic analysis, utilizing computer vision systems, is a major investment area. This technology allows retailers to dynamically adjust merchandising and staffing levels, maximizing sales per square foot. These systems generate massive datasets, making the scalability and security of cloud infrastructure integral to successful AI deployment.

In the supply chain, AI is transitioning from descriptive and diagnostic analytics to highly accurate predictive and prescriptive models. Retailers rely on these algorithms to navigate complex global logistics, identify potential bottlenecks months in advance, and recommend optimal sourcing and transportation strategies. This technological adoption is not merely incremental; it represents a paradigm shift from reacting to market forces to proactively shaping outcomes. However, the success is contingent upon the quality and integration of legacy data systems, which often pose a significant barrier to entry, requiring substantial upfront investment in data cleansing and harmonization projects before advanced AI models can yield reliable results.

- AI-driven demand sensing reduces inventory costs and stockouts by 15-30%.

- Computer vision and machine learning enable cashierless checkout systems and enhanced loss prevention.

- Generative AI personalizes marketing content and dynamically updates product descriptions based on buyer intent.

- Predictive maintenance algorithms optimize lifespan and uptime of warehouse robotics and operational hardware.

- AI powers dynamic pricing models, adjusting prices in real-time based on competitor actions and localized demand signals.

- Natural Language Processing (NLP) enhances customer service through sophisticated chatbots and voice assistants.

- Robotic process automation (RPA) handles repetitive back-office tasks like invoice processing and order verification.

- Ethical AI frameworks are critical for managing data bias and ensuring transparent decision-making in credit scoring or product recommendations.

DRO & Impact Forces Of Super Market

The dynamics of the Super Market are governed by powerful driving forces (D) such as the imperative for omnichannel integration and surging consumer adoption of digital commerce, offset by significant restraints (R) including high initial implementation costs for integrated systems and persistent challenges related to data privacy and cybersecurity compliance across disparate geographies. Opportunities (O) are plentiful, anchored by the expansion into untapped emerging markets, particularly Southeast Asia and Africa, and the development of sustainable, circular retail models supported by specialized technology. These internal market dynamics are amplified by external impact forces, which include accelerated technological obsolescence (a primary threat), stringent government regulations on labor and data protection, and geopolitical instability affecting global supply chain reliability. The confluence of these factors necessitates a highly adaptive strategy for market participants, emphasizing flexible, scalable, and secure cloud-native solutions capable of responding quickly to rapidly evolving consumer behaviors and regulatory environments globally.

Key drivers center on retailers' urgent need for supply chain optimization, leveraging IoT and blockchain to achieve end-to-end visibility, particularly following recent global logistics disruptions that highlighted vulnerability. The consumer-driven mandate for personalized and swift fulfillment, including same-day and sub-hour delivery services, pushes investment into micro-fulfillment centers and sophisticated delivery routing software. However, restraints are substantial; legacy systems often resist integration with modern cloud platforms, requiring costly and complex migration projects. Furthermore, the global shortage of skilled technical talent capable of deploying and maintaining advanced AI and robotics infrastructure acts as a significant limiting factor to rapid market penetration. The regulatory divergence between regions regarding data handling adds complexity, requiring multi-jurisdictional compliance and increasing operational overhead for global retailers.

The major opportunities lie in pioneering technology that supports sustainable retail—tracking carbon emissions, managing waste streams, and facilitating product returns for reuse or recycling. Additionally, leveraging augmented reality (AR) and virtual reality (VR) to create immersive shopping experiences, both in-store and remotely, represents a growth vector, enhancing customer engagement and reducing return rates by improving pre-purchase visualization. Impact forces, such as the increasing sophistication of cyberattacks targeting large retail data repositories, mandate continuous investment in advanced security protocols, including zero-trust architectures and encryption technologies. Moreover, economic shifts, such as inflation and corresponding reductions in discretionary consumer spending, force retailers to prioritize technology investments that guarantee immediate operational cost savings, shifting focus away from purely experiential technologies toward efficiency-enhancing automation.

Segmentation Analysis

The Super Market is fundamentally segmented based on the type of technology deployed, the operational application area within the retail enterprise, and the size of the end-user organization. This structure allows for precise targeting of solutions, differentiating between highly capital-intensive robotics solutions required by Tier 1 grocery chains and modular, subscription-based cloud software suitable for small, specialized boutique retailers. The key segments reflect the evolutionary stage of retail digitalization, moving from basic infrastructure (hardware) to complex intelligence layers (software and services), which consistently command higher value due to the proprietary algorithms and domain expertise embedded within them.

- By Component:

- Hardware (e.g., POS Terminals, RFID Readers, Robotics, IoT Sensors)

- Software (e.g., Inventory Management, ERP, CRM, Predictive Analytics, Cybersecurity)

- Services (e.g., Managed Services, Professional Consulting, Integration and Deployment)

- By Application:

- Supply Chain Management and Logistics (Forecasting, Warehousing Automation, Last-Mile Delivery)

- Store Operations (Self-Checkout, Electronic Shelf Labels, Loss Prevention)

- Customer Experience and Engagement (Personalization Engines, Mobile Commerce, Loyalty Programs)

- Payment and Financial Operations (Payment Gateways, Fraud Detection)

- By End-User:

- Grocery and FMCG (Fast-Moving Consumer Goods)

- Apparel and Fashion

- Electronics and Consumer Goods

- Department Stores and Specialty Retail

- By Deployment Model:

- On-Premise

- Cloud-Based (SaaS, PaaS)

Value Chain Analysis For Super Market

The value chain of the Super Market is intricate, beginning with upstream suppliers focused on semiconductor manufacturing, sensor development (IoT components), and specialized robotics engineering. These suppliers provide the foundational hardware components and computing power essential for retail technology solutions. Midstream activities involve the core market players—software developers who create the AI and analytics platforms, system integrators who customize and deploy these solutions across complex retail environments, and hardware assemblers. Downstream, the distribution channel is primarily bifurcated into direct sales models, favored for large, complex enterprise resource planning (ERP) or robotics installations involving long-term consultation, and indirect channels relying on value-added resellers (VARs) and strategic partnership networks, particularly for standardized, cloud-based software-as-a-service (SaaS) offerings aimed at the mid-market and SME segments. Efficiency and margin capture are heavily dependent on robust integration services, as seamless interoperability between various systems defines the value proposition for the end-user retailer.

Upstream analysis reveals that dependency on specific high-performance components, such as specialized GPUs for running machine learning models and proprietary sensor arrays for computer vision systems, creates potential bottlenecks related to global supply chain volatility, exemplified by recent chip shortages. Therefore, strategic partnerships with key component manufacturers are vital for market participants to ensure consistent product supply and technological superiority. Innovation at this stage focuses on miniaturization, increased processing power at the edge (edge computing devices), and improved energy efficiency, which directly impacts the performance and operational cost of downstream retail applications, such as battery life for mobile POS and the real-time processing capability of in-store cameras.

The downstream segment, encompassing system deployment and post-sales support, is crucial for realizing value. Direct distribution channels maintain higher control over the customer experience and technical implementation, often providing bespoke customization required by large multinational retailers seeking highly tailored solutions that integrate seamlessly with legacy infrastructure. Conversely, the indirect distribution via VARs is crucial for achieving geographic scale and market penetration in regions where local expertise is essential for navigating cultural and regulatory nuances. The rise of cloud-based deployment has dramatically shifted emphasis toward service provision, where recurring revenue from maintenance, updates, and data security services now constitutes a significant portion of the total market value, demonstrating the premium placed on reliable, continuous operational support.

Super Market Potential Customers

Potential customers for the Super Market's advanced retail technology solutions span the entire spectrum of goods distribution, categorized primarily by size, vertical specialty, and existing technological maturity. The primary end-users or buyers are large, multinational retail chains (Tier 1), particularly those operating in the highly competitive grocery, general merchandise, and fast-fashion sectors, driven by the absolute necessity to achieve operational scale, minimize shrinkage, and manage complex global supply chains efficiently. Mid-sized regional retailers (Tier 2) form a rapidly growing customer base, increasingly adopting cloud-based SaaS solutions to compete with larger players without requiring massive initial capital outlay. Furthermore, pure-play e-commerce platforms represent a crucial subset, demanding specialized solutions for optimizing dark stores, warehouse automation, and hyper-efficient fulfillment logic to sustain rapid delivery speeds and handle complex return logistics.

The adoption propensity varies significantly by vertical. Grocery retailers are the largest adopters of automation technologies (robotics, AS/RS) due to high volume, low margin operations requiring maximum efficiency, alongside sophisticated cold chain monitoring solutions mandated by regulatory compliance. Conversely, high-end luxury and fashion retailers prioritize customer experience technologies, such as interactive digital displays, personalized AR try-ons, and advanced CRM systems designed to build exclusive, high-value customer relationships. The purchasing decision for Tier 1 customers is highly strategic, often involving multi-year contracts and requiring deep integration with enterprise-level financial systems, making implementation cycles lengthy but highly lucrative for vendors specializing in seamless enterprise architecture integration.

Emerging markets present a unique customer profile, characterized by mobile-first purchasing behavior and a lower installed base of legacy systems, enabling a leapfrogging effect where they often adopt the latest cloud and mobile POS technologies directly. These customers prioritize affordable, scalable solutions that require minimal on-premise infrastructure. Technology vendors must tailor their offerings to address specific regional challenges, such as unreliable power grids or intermittent internet connectivity in remote areas, often leading to the development of specialized hybrid on-premise/cloud solutions to maintain operational resilience and continuous service delivery. The growing demand from small and medium enterprises (SMEs) is channeled primarily through indirect reseller networks, seeking simplified, subscription-based models for basic inventory tracking and payment processing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Billion USD |

| Market Forecast in 2033 | $850.1 Billion USD |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Amazon Web Services (AWS), Honeywell International Inc., Zebra Technologies Corporation, Toshiba Global Commerce Solutions, NCR Corporation, Salesforce, Shopify Inc., Adobe Systems Inc., Manhattan Associates, Blue Yonder, Kuka AG, Fanuc Corporation, Pingo Systems, AutoStore, E-Service, Ingenico Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Super Market Key Technology Landscape

The Super Market’s technological evolution is defined by the convergence of foundational network infrastructure and advanced computational methods, creating an environment where real-time, context-aware decision-making is possible. Core technologies include the Internet of Things (IoT), which utilizes sensors embedded in shelves, pallets, and vehicles to generate vast amounts of operational data critical for inventory accuracy and cold chain monitoring. This massive data generation is processed efficiently via Edge Computing capabilities, minimizing latency for mission-critical operations such as autonomous vehicle navigation and immediate pricing updates. Furthermore, Blockchain technology is gaining traction, primarily in securing supply chain traceability, providing an immutable ledger that verifies the provenance and handling conditions of high-value or perishable goods, thereby building consumer trust and ensuring regulatory compliance in areas like food safety and ethical sourcing standards across global networks.

The operational backbone relies heavily on advanced robotics and automation, encompassing Autonomous Mobile Robots (AMRs) for in-warehouse logistics and sophisticated robotic arms for product picking and packaging in micro-fulfillment centers. These systems leverage sophisticated AI algorithms for pathfinding and task allocation, significantly reducing the reliance on manual labor and enabling 24/7 operational capability, which is essential for meeting aggressive e-commerce fulfillment timelines. Coupled with automation, 5G networking infrastructure plays a pivotal role, offering the high bandwidth and ultra-low latency necessary for the reliable control of thousands of simultaneous IoT devices and robotic systems, ensuring seamless communication between centralized control systems and distributed physical assets, which is critical for scaling warehouse operations across distributed geographies.

Beyond physical automation, the technology landscape is being reshaped by advancements in Human-Machine Interaction (HMI) and data visualization. Augmented Reality (AR) tools are increasingly used by store associates for efficient shelf restocking, inventory verification, and providing enhanced product information to customers. Machine Learning (ML) platforms continue to mature, moving beyond predictive modeling into prescriptive analytics that recommend specific actions, such as optimal markdown strategies or personalized promotion distribution via mobile applications. The ability to integrate these disparate technologies—from a robust 5G network to secure blockchain ledgers and advanced AI software—into a unified, cloud-native architecture determines the competitiveness of technology vendors and the operational resilience of the adopting retailers in the Super Market.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, fueled by rapid digitalization in emerging economies like India and Southeast Asia (Indonesia, Vietnam). The region benefits from a large, mobile-first consumer base and massive investments in logistics infrastructure modernization, particularly China’s aggressive deployment of automated fulfillment centers and India’s burgeoning e-commerce ecosystem, leading adoption in mobile payment solutions and logistics technology.

- North America: North America holds the largest market share in terms of revenue, driven by early and aggressive adoption of advanced AI, robotics, and cloud-based enterprise systems by major retail giants. High labor costs necessitate automation across the supply chain, while high consumer expectations drive investment in sophisticated omnichannel integration and personalized shopping experiences, maintaining regional dominance in high-value software segments.

- Europe: Europe is characterized by stringent regulatory environments, particularly concerning data privacy (GDPR) and sustainability standards. This drives investment into secure, compliant technology solutions, including blockchain for traceability and advanced analytics for waste reduction. Western European countries lead in cashierless technology pilot programs and smart store implementations, focusing on enhancing operational efficiency while adhering to complex union and labor regulations.

- Latin America (LATAM): LATAM represents a high-potential market undergoing significant infrastructure development. The region sees strong growth in basic digitalization tools, mobile Point of Sale (mPOS) systems, and cloud adoption, driven by the need to formalize retail operations and improve operational visibility across fractured supply chains. Brazil and Mexico are the primary investment hubs, capitalizing on increasing internet penetration.

- Middle East and Africa (MEA): MEA growth is concentrated in the Gulf Cooperation Council (GCC) countries, driven by government-led diversification initiatives (e.g., Saudi Vision 2030) and massive infrastructure spending on smart cities and logistics hubs. Africa’s growth is nascent but promising, focusing heavily on mobile money solutions and foundational digital retail platforms tailored to low-connectivity environments, presenting substantial long-term opportunity for basic retail technology deployment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Super Market.- SAP SE

- Oracle Corporation

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services (AWS)

- Honeywell International Inc.

- Zebra Technologies Corporation

- Toshiba Global Commerce Solutions

- NCR Corporation

- Salesforce

- Shopify Inc.

- Adobe Systems Inc.

- Manhattan Associates

- Blue Yonder

- Kuka AG

- Fanuc Corporation

- Pingo Systems

- AutoStore

- E-Service

- Ingenico Group

Frequently Asked Questions

Analyze common user questions about the Super market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving investment in Super Market technology?

The central driver is the imperative for seamless omnichannel integration, allowing retailers to provide consistent customer experiences and highly efficient fulfillment across physical stores, e-commerce platforms, and mobile channels. This integration minimizes inventory discrepancies and maximizes customer lifetime value.

How is AI specifically transforming retail inventory management?

AI is transforming inventory management through predictive analytics that accurately forecasts localized demand fluctuations and optimizes stock levels in real-time. This reduces capital tied up in excess inventory and minimizes losses due to spoilage or obsolescence, particularly critical in the FMCG sector.

Which geographical region exhibits the fastest growth potential in retail technology adoption?

The Asia Pacific (APAC) region is projected to register the fastest growth due to rapid urbanization, increasing middle-class spending, and the widespread adoption of mobile-first retail and payment solutions across large, previously untapped consumer bases.

What are the main security concerns associated with new retail technologies like IoT and computer vision?

Major security concerns include the vulnerability of networked IoT sensors to hacking (creating potential entry points for cyberattacks) and the necessity for secure handling of large volumes of biometric and personal customer data collected by computer vision systems, demanding robust encryption and compliance protocols.

What role does 5G infrastructure play in enhancing the Super Market?

5G provides the high bandwidth and ultra-low latency required for real-time applications such as precise control of Autonomous Mobile Robots (AMRs) in warehouses, high-definition video streaming for visual analytics, and immediate data synchronization across large retail networks, accelerating operational automation and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Super Pure Aqueous Ammonia Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Super Precision Bearing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Super Engineering Plastics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Super Fine Talc Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Super Glue Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager