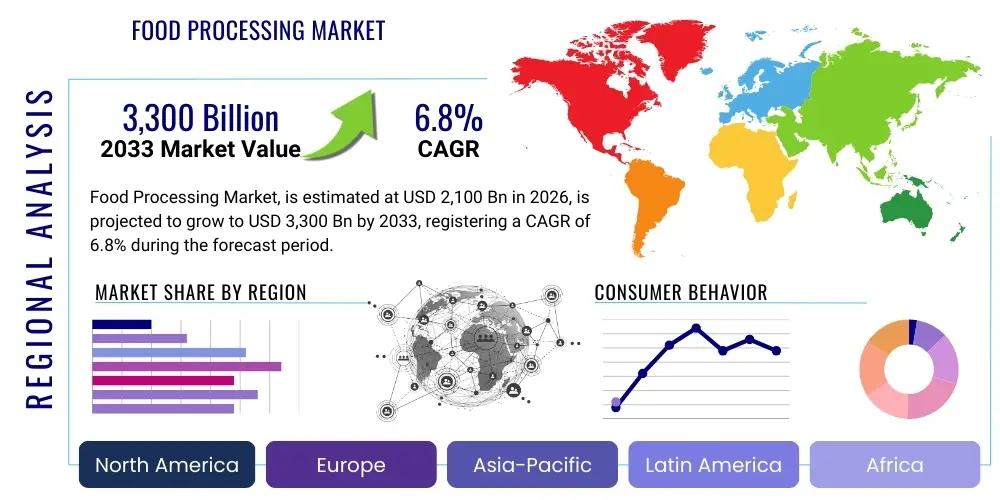

Food Processing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431368 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Food Processing Market Size

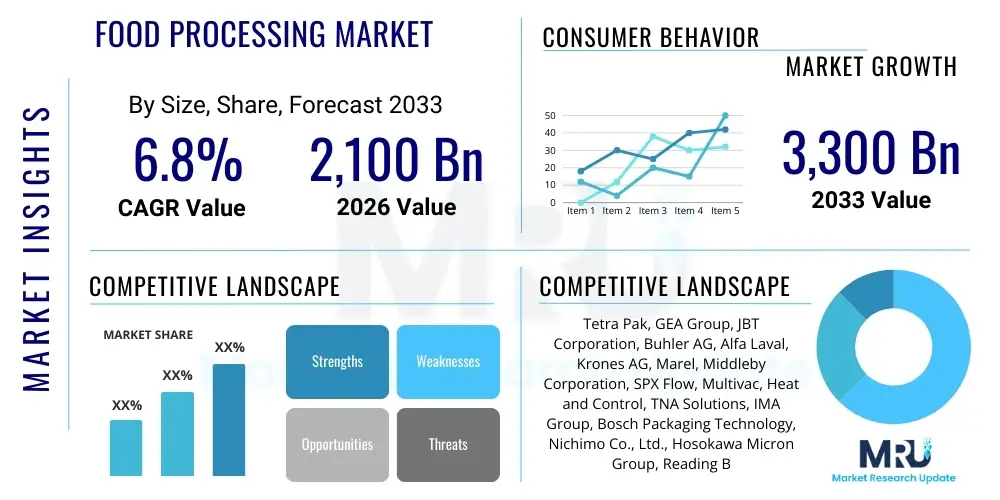

The Food Processing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2,100 Billion in 2026 and is projected to reach $3,300 Billion by the end of the forecast period in 2033.

Food Processing Market introduction

The Food Processing Market encompasses all activities and technologies involved in converting raw agricultural products into marketable food items suitable for consumption. This sector is characterized by its reliance on sophisticated machinery, automation systems, and advanced processing techniques designed to enhance food safety, extend shelf life, improve nutritional value, and meet diverse consumer demands for convenience and quality. Key aspects include thermal processing, fermentation, extraction, packaging, and quality control mechanisms, which are essential for transforming bulk ingredients into value-added products like prepared meals, canned goods, beverages, dairy products, and baked items. The sustained growth of this market is intrinsically linked to global population expansion, shifting dietary preferences toward ready-to-eat and processed foods, and the continuous drive for efficiency and waste reduction throughout the supply chain.

The core product offerings within this market range from primary processing equipment, such as sorting and grading systems, to highly complex secondary processing machinery, including extrusion, homogenization, and pasteurization units. Major applications span across various food sectors, including meat and poultry processing, dairy production, bakery and confectionery, beverages, and fruits and vegetables. The inherent benefits derived from advanced food processing techniques include standardized quality control, increased output volume, compliance with stringent international food safety standards (like HACCP and ISO 22000), and improved logistical feasibility for global distribution. Furthermore, processing enables the fortification of foods with essential nutrients, addressing widespread public health concerns related to nutritional deficiencies in certain regions. The integration of advanced diagnostics and traceability tools is enhancing consumer trust and regulatory oversight, further professionalizing the industry.

The market is primarily driven by macro-economic factors such as rapid urbanization in developing economies, leading to higher demand for packaged and shelf-stable foods, and the pervasive need for efficiency gains fueled by rising labor costs in developed nations. Technological advancements, particularly in automation, robotics, and hygienic design, are pivotal in enabling processors to handle large volumes while minimizing contamination risk. Regulatory landscapes, which are increasingly focusing on sustainability, clean labeling, and waste reduction, also serve as significant drivers, compelling manufacturers to invest in resource-efficient and environmentally compliant processing technologies. However, the initial capital investment required for state-of-the-art equipment and the complex regulatory framework governing food additives and processes represent key challenges that influence market trajectory.

Food Processing Market Executive Summary

The global Food Processing Market is exhibiting robust growth, underscored by profound business trends emphasizing automation, digitalization, and sustainability across the production lifecycle. Strategic investments are heavily channeled into advanced robotics for labor-intensive tasks and into IoT-enabled sensors for real-time monitoring of critical control points, enhancing operational efficiency and product quality simultaneously. Key industry consolidation activities, including mergers and acquisitions, are aimed at achieving scale, securing specialized technological capabilities, and optimizing complex global supply chains. Furthermore, the imperative for clean label products and transparent sourcing practices is pushing manufacturers to adopt gentler processing techniques and leverage advanced analytical tools to validate ingredient provenance and processing integrity. This trend is fundamentally reshaping product development cycles, prioritizing consumer trust and alignment with evolving ethical sourcing standards.

Regionally, the market dynamics show significant divergence. Asia Pacific (APAC) is emerging as the fastest-growing region, primarily driven by massive population bases, rising disposable incomes, and the swift modernization of supply chains, particularly in China and India, where demand for packaged and convenience foods is skyrocketing. North America and Europe, representing mature markets, focus heavily on incremental innovation, regulatory compliance, and the integration of highly sophisticated, interconnected processing systems (Industry 4.0 principles). These regions are leading in the adoption of sustainable processing technologies, such as high-pressure processing (HPP) and pulsed electric fields (PEF), aimed at reducing energy consumption and minimizing the use of chemical preservatives. The Middle East and Africa (MEA) region is characterized by substantial infrastructure investments, especially in cold chain logistics and staple food processing capabilities, addressing regional food security concerns.

Segmentation trends highlight the accelerating dominance of the processing equipment segment, particularly in areas related to sorting, mixing, and hygienic fluid handling, driven by the replacement of outdated machinery and new facility construction. By application, the prepared foods and beverage sectors are experiencing exponential demand growth, demanding flexible and high-capacity processing lines capable of handling diverse product formats and short production runs. The shift toward sustainable processing methods is notably prominent, leading to increased demand for resource-efficient technologies like advanced water treatment and waste valorization systems. The overall market narrative is defined by a rapid convergence of physical processing technology with digital intelligence, optimizing yields and ensuring superior food safety compliance worldwide.

AI Impact Analysis on Food Processing Market

User inquiries regarding the influence of Artificial Intelligence (AI) in the Food Processing Market consistently revolve around three core themes: operational efficiency through automation, predictive quality and safety assurance, and the optimization of complex supply chains. Users frequently ask how AI-driven vision systems can replace human inspectors for defect detection, whether machine learning models can predict equipment failure before it occurs (predictive maintenance), and if AI can streamline scheduling and inventory management across highly perishable supply chains. The primary expectation is that AI will be the central tool enabling the transition to fully autonomous processing facilities, significantly reducing waste, improving energy efficiency, and mitigating the pervasive risks associated with human error in food safety protocols. Concerns often focus on the high initial implementation costs, the requirement for highly specialized data scientists, and ensuring data privacy and security within interconnected processing environments. Users seek clear evidence of return on investment (ROI) in areas such as yield optimization and reduced downtime.

AI is fundamentally transforming production workflows by introducing unprecedented levels of precision and adaptability. In the context of sorting and grading, AI-powered computer vision systems analyze product characteristics (such as size, color, and density) at extremely high speeds, ensuring consistent quality that surpasses manual inspection capabilities. Furthermore, machine learning algorithms are crucial in optimizing process parameters—such as cooking temperatures, mixing speeds, and fermentation times—to maximize resource efficiency while maintaining specific taste and texture profiles. This capability allows for dynamic adjustments based on real-time ingredient variability, a major challenge in food manufacturing. AI integration is moving processing from reactive control to predictive optimization.

Beyond the factory floor, AI provides substantial benefits in regulatory compliance and supply chain resilience. Predictive analytics models use historical data, environmental factors, and consumer trends to forecast demand accurately, minimizing overproduction and subsequent spoilage. In food safety, AI monitors data streams from IoT sensors within processing equipment and logistics networks to identify anomalies that may indicate contamination risks, allowing for immediate corrective action. This predictive safety mechanism is far superior to traditional batch testing, offering continuous assurance of product integrity from farm to fork. The integration of AI tools is becoming mandatory for large-scale processors seeking to manage vast ingredient inputs and complex distribution networks effectively, ensuring compliance and enhancing brand reputation.

- AI-driven vision systems for real-time defect detection and quality grading.

- Predictive maintenance algorithms optimizing equipment uptime and lifecycle management.

- Machine learning models for optimizing processing parameters (e.g., thermal treatment, flow rates).

- Automated recipe adjustment based on real-time ingredient composition variability.

- Enhanced food safety traceability using blockchain and AI for rapid recall management.

- Demand forecasting and inventory optimization reducing perishable food waste.

- Robotics guidance and autonomous handling systems improving hygiene and reducing human contact.

DRO & Impact Forces Of Food Processing Market

The Food Processing Market is characterized by strong synergistic forces that both accelerate growth and impose significant constraints, framed by impactful strategic opportunities. Key drivers include accelerating global demand for processed, packaged, and convenience foods, especially driven by changing lifestyles and increased female participation in the workforce globally. Alongside this, technological advancements in automation, particularly the integration of high-speed robotics and sophisticated sensor technology, significantly enhance operational efficiency and minimize production costs, making high-throughput processing economically viable. Furthermore, strict global food safety and hygiene regulations, while initially costly, compel investment in modern, high-standard processing equipment, thereby driving market modernization and replacement cycles. These drivers collectively push the market toward higher volumes, greater precision, and enhanced food security standards.

Restraints in this industry center predominantly on the substantial capital investment required for adopting advanced processing technologies and the pervasive challenge of skilled labor shortages necessary to operate and maintain complex automated systems. Regulatory complexity across multiple jurisdictions, particularly concerning novel processing aids, additives, and GMO labeling, creates significant barriers to market entry and cross-border trade standardization. Additionally, growing consumer apprehension regarding ultra-processed foods, coupled with increased scrutiny over ingredient sourcing and environmental impact, necessitates costly reformulations and transparent marketing efforts. The inherent volatility in raw material prices due to climate change and geopolitical instability also introduces substantial financial risks that processors must constantly manage, impacting profit margins and long-term planning.

Opportunities are strongly aligned with sustainability and digitalization. The pressing need for resource efficiency, coupled with consumer demand for eco-friendly products, opens vast avenues for technologies such as waste valorization systems, water recycling, and energy-efficient processing equipment (e.g., HPP). The expansion of emerging markets, notably in Southeast Asia, Latin America, and Africa, presents greenfield opportunities for establishing modern, scalable processing infrastructure. Furthermore, the integration of Industry 4.0 elements—IoT, big data analytics, and cloud computing—provides strategic opportunities for end-to-end supply chain visibility and predictive quality control, offering a competitive edge to companies that successfully transition to smart manufacturing paradigms. These forces dictate strategic priorities, emphasizing operational resilience, technological superiority, and alignment with consumer values for transparency and environmental responsibility.

Segmentation Analysis

The segmentation of the Food Processing Market allows for a granular understanding of its diverse components, categorized primarily based on the Type of Equipment, Application, Technology, and Operating Mode. Analyzing these segments is essential for identifying specific growth pockets and technological adoption rates within the broader industry landscape. The equipment segment, comprising cutting, peeling, and mixing machinery, dominates expenditure, driven by the continuous need for upgrading and expanding production capacities globally. Application segments, particularly meat and poultry processing and the fast-growing beverages sector, exhibit high technological demands due to stringent hygiene requirements and the need for high-speed, flexible production lines. Furthermore, distinctions in technology, such as conventional versus novel non-thermal processing methods, reveal shifts toward preservation techniques that better retain nutritional and sensory qualities.

Understanding the market by Operating Mode, specifically distinguishing between automatic, semi-automatic, and manual systems, reflects regional differences in labor costs and technological maturity. Developed economies show a clear preference for fully automatic, integrated processing lines to maximize throughput and minimize labor dependency. Conversely, emerging markets often utilize semi-automatic systems as a transitional phase toward complete automation. The sustained emphasis on improving food quality and safety across all segments continues to drive substantial investment in sensor technology, sanitation systems (Clean-in-Place or CIP), and advanced control software, ensuring market growth remains tied to regulatory compliance and efficiency enhancements.

- By Type:

- Processing Equipment (e.g., mixers, grinders, slicers, extruders)

- Packaging Equipment (e.g., filling, sealing, labeling, wrapping)

- Service and Maintenance

- By Application:

- Meat, Poultry, and Seafood

- Dairy Products

- Bakery and Confectionery

- Beverages (Alcoholic and Non-Alcoholic)

- Fruits, Vegetables, and Nuts

- Prepared Meals and Convenience Foods

- Fats and Oils

- By Operating Mode:

- Automatic

- Semi-Automatic

- Manual

- By Technology:

- Conventional Processing (e.g., thermal processing, canning)

- Novel/Non-Thermal Processing (e.g., High-Pressure Processing (HPP), Pulsed Electric Fields (PEF))

Value Chain Analysis For Food Processing Market

The value chain for the Food Processing Market is complex and highly integrated, starting with upstream activities involving raw material sourcing and logistics. Upstream analysis focuses on securing consistent, high-quality agricultural outputs, which necessitates strong relationships with farmers and primary producers, often involving contractual farming and stringent quality checks upon delivery. Key challenges at this stage include managing seasonal variability, ensuring traceability of ingredients, and adhering to ethical sourcing standards. Efficiency gains at the upstream level often rely on optimizing agricultural practices through IoT and precision farming to stabilize input costs and quality, which directly impacts the feasibility and profitability of subsequent processing stages.

The core midstream activity involves the actual processing and manufacturing—including primary processing (cleaning, sorting, mixing) and secondary processing (cooking, forming, preservation, and packaging). This stage requires significant capital expenditure on sophisticated machinery, rigorous quality control protocols, and highly trained technical staff. Optimization in the midstream centers on maximizing yield, minimizing energy consumption, and implementing advanced sanitation protocols (like CIP systems) to prevent contamination. The downstream analysis focuses on distribution channels, which are crucial for maintaining the quality and shelf stability of finished products. The selection between direct distribution (to large retail chains or food service providers) and indirect distribution (through third-party logistics and wholesalers) depends on the product's perishability, market reach, and volume requirements. Cold chain logistics management is a critical factor for temperature-sensitive products, demanding high reliability and continuous monitoring.

Direct distribution offers greater control over branding and pricing but requires extensive logistical infrastructure investment, suitable for large multinational corporations with established retail partnerships. Indirect distribution, leveraging wholesalers and specialized food distributors, provides broader market penetration, particularly in fragmented retail environments, but often involves relinquishing some control over the final presentation and handling of the product. Technological solutions, such as warehouse management systems (WMS) and route optimization software, are increasingly vital in both direct and indirect channels to ensure timely delivery and reduce transit spoilage. The entire chain is under pressure to enhance transparency and sustainability reporting, driven by consumer and regulatory demands for end-to-end product integrity and environmental accountability.

Food Processing Market Potential Customers

Potential customers for food processing equipment and services span a wide array of organizations involved in transforming raw ingredients into consumer-ready products. The primary buyer segment comprises large multinational food and beverage corporations (F&B giants) that operate multiple high-volume production facilities globally. These customers demand state-of-the-art, high-throughput, fully automated processing lines, often seeking customized, integrated solutions for complex product portfolios, such as sophisticated bottling lines, advanced bakery ovens, or continuous meat processing systems. Their purchasing decisions are heavily influenced by factors such as equipment lifespan, energy efficiency, ease of sanitation (hygienic design), and adherence to global regulatory standards like GFSI benchmarks. They prioritize long-term service contracts and technological partnerships for continuous improvement and process validation.

A second major customer group includes mid-sized regional food manufacturers, often specializing in specific product categories like regional cheeses, artisanal bread, or niche health food products. While they may not require the massive scale of multinational systems, their demand is focused on flexible, scalable equipment that allows for product diversification and rapid changeovers to cater to evolving local consumer trends. These buyers are highly sensitive to initial capital expenditure and frequently seek modular systems that can be gradually expanded. Their core purchasing drivers revolve around improving product consistency, extending shelf life for regional distribution, and achieving regulatory compliance necessary for expanding beyond local markets. Financing options and accessible maintenance support are crucial considerations for this segment.

The third significant group consists of institutional food service providers, catering companies, and governmental food programs that rely on efficient, safe processing to prepare large volumes of meals (e.g., schools, hospitals, military bases). Though they may not purchase high-end primary processing equipment, they are major consumers of secondary processing and packaging systems, such as advanced slicing, portioning, and modified atmosphere packaging (MAP) technologies, ensuring food safety and longevity for bulk distribution. Furthermore, startups and vertical farming operations entering the market represent an emerging customer base, seeking specialized, compact, and automated processing solutions tailored for immediate, localized distribution models, focusing heavily on minimal waste and sustainability certifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2,100 Billion |

| Market Forecast in 2033 | $3,300 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tetra Pak, GEA Group, JBT Corporation, Buhler AG, Alfa Laval, Krones AG, Marel, Middleby Corporation, SPX Flow, Multivac, Heat and Control, TNA Solutions, IMA Group, Bosch Packaging Technology, Nichimo Co., Ltd., Hosokawa Micron Group, Reading Bakery Systems, Duravant, Dover Corporation, Key Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Processing Market Key Technology Landscape

The Food Processing Market is rapidly evolving through the adoption of highly advanced, interconnected, and hygienic technologies designed to maximize efficiency and assure product safety. The most significant technological shift centers on Industry 4.0 concepts, particularly the integration of the Internet of Things (IoT) sensors and Artificial Intelligence (AI) throughout the production line. IoT sensors are deployed for continuous, real-time monitoring of critical process parameters such as temperature, pressure, flow rates, and equipment vibration. This data is fed into centralized platforms and analyzed by AI models to optimize processing settings dynamically, predict equipment failure (predictive maintenance), and provide comprehensive digital traceability records, significantly reducing the likelihood of catastrophic production failures and enhancing compliance auditing capabilities. The implementation of high-speed industrial robotics and collaborative robots (cobots) is transforming labor-intensive areas such as packaging, palletizing, and primary handling, minimizing human intervention and elevating hygienic standards.

Alongside digitalization, innovations in food preservation are crucial drivers of technological change. Non-thermal processing technologies, particularly High-Pressure Processing (HPP) and Pulsed Electric Fields (PEF), are gaining substantial traction as alternatives to conventional heat treatments. HPP uses extreme pressure to inactivate pathogens and spoilage microorganisms while retaining the fresh flavor, color, and nutritional profile of the food, appealing directly to consumer demand for minimally processed, 'clean label' products. PEF technology offers energy-efficient microbial inactivation, commonly used in liquid products like juices and dairy. These novel preservation techniques require highly specialized, durable equipment and sophisticated control systems, representing a premium sector within the overall equipment market.

Furthermore, advancements in food safety and sanitation technology are non-negotiable within the processing landscape. Automated Clean-in-Place (CIP) and Sterilization-in-Place (SIP) systems, which ensure thorough internal cleaning of pipelines and vessels without manual disassembly, are mandatory for maintaining stringent hygiene levels, particularly in dairy and beverage processing. The design philosophy of equipment is increasingly focused on hygienic design principles (e.g., seamless welds, sloped surfaces, accessible parts) to minimize microbial harborage and facilitate effective cleaning. Packaging technology also plays a critical role, with Modified Atmosphere Packaging (MAP) and active packaging solutions utilizing specialized films and gases to extend the shelf life of perishable goods, crucial for global distribution networks. These integrated technological advancements collectively define the competitive edge in the modern Food Processing Market, prioritizing safety, efficiency, and sustainability.

Regional Highlights

- North America: North America, particularly the United States, represents a highly mature yet innovative market characterized by high levels of automation and stringent regulatory oversight. Investment here is focused less on capacity expansion and more on technological replacement, adopting advanced robotics, AI-driven sorting, and data analytics to optimize existing high-volume facilities. The region leads in demand for sophisticated food safety testing equipment and non-thermal processing methods (HPP) due to strong consumer preference for minimally processed foods. High labor costs necessitate rapid automation across meat, dairy, and prepared meal segments, driving substantial sales for high-throughput, integrated processing systems.

- Europe: Europe is defined by its strong emphasis on sustainability, clean labeling, and compliance with rigorous environmental and food safety standards (such as CE marking and EU directives on additives). Western European countries like Germany, Italy, and the Netherlands are global leaders in manufacturing high-quality processing equipment, often specializing in hygienic design and energy-efficient solutions. The market is propelled by the need to meet targets for food waste reduction and the transition toward plant-based alternatives, necessitating flexible processing lines adaptable for alternative proteins and specialty ingredients. Eastern Europe provides opportunities for facility modernization and capacity build-out, capitalizing on lower operational costs.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven by massive population growth, increasing urbanization, and a burgeoning middle class demanding packaged and branded food products. Countries such as China, India, and Indonesia are experiencing a rapid transition from traditional food preparation to modern industrial processing. This market is characterized by significant infrastructure investment in primary processing facilities (especially grains, meat, and seafood) and cold chain logistics. While automation is increasing, particularly in high-wage economies like Japan and South Korea, many developing APAC nations still utilize semi-automatic or manual processing methods, offering significant long-term potential for equipment manufacturers selling scalable solutions.

- Latin America (LATAM): The LATAM market exhibits strong growth linked to the export-oriented processing of key agricultural commodities, including meat, sugar, and soybeans. Brazil and Mexico are dominant regional players, requiring substantial investment in equipment for handling large volumes of raw materials for international export. Market dynamics are influenced by fluctuating economic conditions, but there is a consistent push toward improving local processing standards to meet international import requirements, driving demand for quality control, chilling, and packaging technologies.

- Middle East and Africa (MEA): The MEA region is heavily focused on achieving food security, leading to state-backed investment in localized food processing infrastructure, particularly for staples like grain, dairy, and beverages. Growth is often concentrated around large-scale projects aimed at reducing dependency on imported finished goods. The region demands robust, easy-to-maintain equipment suitable for challenging climatic conditions and reliable cold chain solutions, especially in rapidly urbanizing Gulf Cooperation Council (GCC) countries and resource-rich African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Processing Market.- Tetra Pak

- GEA Group AG

- JBT Corporation

- Buhler AG

- Alfa Laval AB

- Krones AG

- Marel hf.

- The Middleby Corporation

- SPX Flow Inc.

- Multivac Sepp Haggenmüller SE & Co. KG

- Heat and Control, Inc.

- TNA Solutions Pty Ltd.

- IMA Group

- Bosch Packaging Technology (Syntegon Technology)

- Nichimo Co., Ltd.

- Hosokawa Micron Group

- Reading Bakery Systems

- Duravant LLC

- Dover Corporation

- Key Technology (a Duravant Company)

- Meyer Industries

- C. R. Bard, Inc.

- Barry-Wehmiller Companies

- Fuji Machinery Co., Ltd.

- Paxiom Group

Frequently Asked Questions

Analyze common user questions about the Food Processing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Food Processing Market?

Growth is driven primarily by increasing global demand for packaged and convenience foods due to urbanization and busy lifestyles, stringent food safety regulations necessitating new equipment investments, and the continuous integration of automation technologies (robotics, AI) to optimize efficiency and combat rising labor costs worldwide. Technological modernization is accelerating market expansion across all major regional segments.

How is sustainability impacting investment decisions in food processing equipment?

Sustainability is a core investment driver, compelling processors to adopt energy-efficient machinery, advanced water recycling systems, and waste valorization technologies. There is increasing demand for equipment that supports 'clean label' products and minimizes environmental footprint, such as non-thermal preservation methods like High-Pressure Processing (HPP) that reduce energy use and additive requirements.

Which regional market is anticipated to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to experience the fastest growth rate. This is fueled by significant demographic shifts, including rapid urbanization and expanding middle-class populations in nations like China and India, leading to high-volume demand for modern packaged foods and substantial government investment in upgrading regional processing infrastructure.

What is the role of Industry 4.0 and AI in modern food processing operations?

Industry 4.0, powered by IoT and AI, enables smart manufacturing through real-time data collection and analysis. AI facilitates predictive maintenance, optimizes processing parameters for better yield, and powers advanced computer vision systems for automated quality control, leading to superior operational efficiency, minimal downtime, and enhanced compliance with food safety standards (AEO optimized for 'smart manufacturing in food').

What are the main technological challenges facing food processing equipment manufacturers?

The primary challenges include the high cost and complexity of integrating sophisticated digital technologies (AI, IoT) into existing legacy infrastructure, the persistent shortage of skilled personnel required to manage advanced automated systems, and the need to design equipment that meets increasingly demanding hygienic standards while maintaining flexibility for rapid product changeovers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Seafood Processing Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Food Processing System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Food Processing Boiler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Gas Fired Water-Tube Food Processing Boiler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Food Processing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager