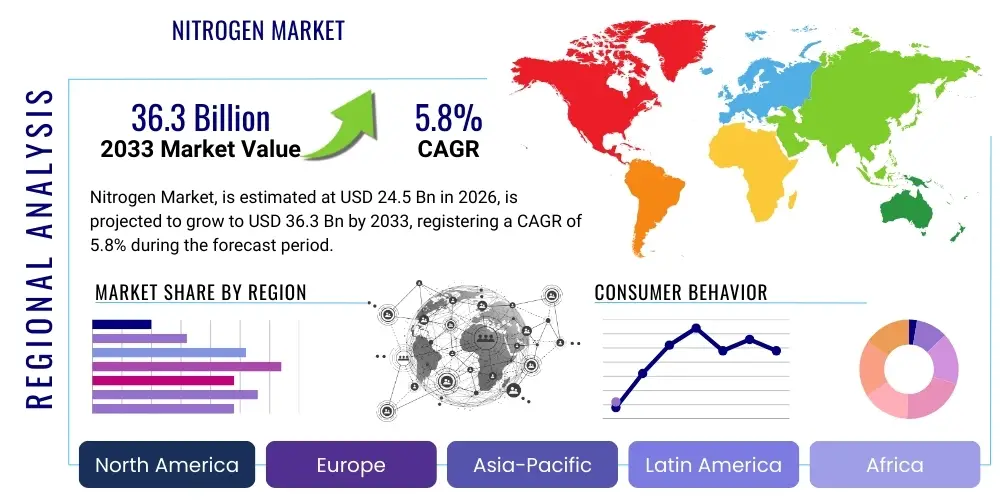

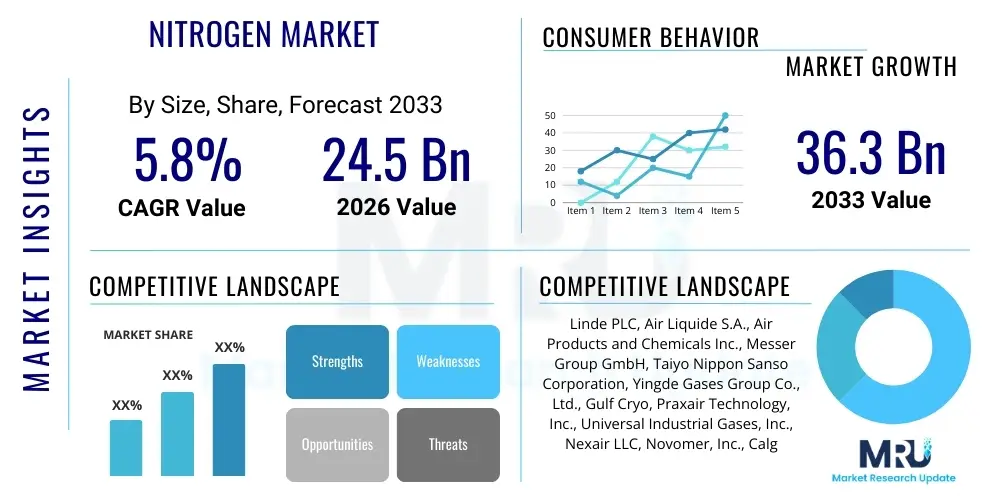

Nitrogen Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436622 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Nitrogen Market Size

The Nitrogen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 24.5 Billion in 2026 and is projected to reach USD 36.3 Billion by the end of the forecast period in 2033.

Nitrogen Market introduction

Nitrogen, an inert and non-metallic element, constitutes approximately 78% of the Earth's atmosphere and is a fundamental component utilized extensively across various industrial, technological, and medical applications globally. Industrially produced nitrogen gas, typically obtained through cryogenic distillation of air or non-cryogenic methods like Pressure Swing Adsorption (PSA) and membrane separation, is crucial for processes requiring an inert atmosphere to prevent oxidation, combustion, or contamination. Its primary physical properties—being colorless, odorless, tasteless, and largely non-reactive—make it indispensable in sectors ranging from food preservation and pharmaceutical manufacturing to advanced electronics fabrication and enhanced oil recovery. The market expansion is fundamentally driven by the escalating demand for high-purity nitrogen in sensitive manufacturing environments, particularly within the semiconductor and specialty chemicals industries where purity levels directly impact end-product quality and yield rates.

The product description spans two major forms: gaseous nitrogen (GAN) and liquid nitrogen (LIN). GAN is predominantly used in bulk industrial applications such as purging, blanketing, and fire suppression, delivered via pipeline or tube trailers. LIN, stored at extremely low temperatures (-196 °C or -320 °F), serves crucial cryogenic cooling purposes, including cryopreservation of biological materials, cooling sensitive electronic components during testing, and freeze grinding in the food industry. Major applications center around creating inert atmospheres (blanketing/purging) in chemical reactors and storage tanks, packaging of perishable goods (Modified Atmosphere Packaging or MAP), inflating tires and cushioning systems, and utilizing its cold properties for refrigeration and freezing. The flexibility in delivery method and purity specification allows nitrogen suppliers to cater to a highly diversified customer base, cementing its role as a vital industrial gas.

The core benefits of using nitrogen include increased safety by eliminating explosive atmospheres, extended shelf life for food products by displacing oxygen, enhanced operational efficiency in chemical processing by controlling reaction kinetics, and achieving ultra-clean environments essential for high-tech manufacturing. Driving factors encompass rapid industrialization across Asia Pacific, particularly in chemical processing and petrochemicals; the booming demand for frozen foods and packaged snacks necessitating MAP technologies; and the relentless growth of the global semiconductor industry, which requires massive volumes of ultra-high purity nitrogen (UHP N2) for etching, cleaning, and carrier gas applications. Furthermore, regulatory mandates emphasizing workplace safety and explosion prevention in hazardous environments continually bolster the adoption of nitrogen blanketing systems across diverse industries, ensuring sustained market impetus throughout the forecast period.

Nitrogen Market Executive Summary

The Nitrogen Market is characterized by robust industrial expansion, driven significantly by global business trends emphasizing high-purity material requirements and optimized supply chain logistics. A major business trend involves the shift towards non-cryogenic nitrogen generation (PSA and membrane technologies) which offers cost-effectiveness and scalability for on-site production, especially benefiting smaller enterprises and those in remote locations. This trend challenges traditional bulk supply models but simultaneously expands market penetration by lowering the entry barrier for high-volume users. Furthermore, consolidation among major industrial gas players focused on vertical integration and technological innovation in gas purification remains a pivotal business strategy, aiming to secure long-term supply contracts with foundational industries like petrochemicals and electronics manufacturing.

Regionally, the Asia Pacific (APAC) market exhibits the highest growth trajectory, primarily fueled by massive infrastructural investments, rapid expansion of electronics and semiconductor manufacturing hubs (particularly in China, Taiwan, and South Korea), and the burgeoning middle class driving demand for packaged food and beverages. North America and Europe, while mature markets, maintain high revenue shares driven by consistent demand from established pharmaceutical, healthcare (cryopreservation), and advanced materials sectors. Regional trends also reflect increasing investment in sustainable and energy-efficient nitrogen production methods, aligning with global environmental, social, and governance (ESG) standards, especially pronounced in Western economies. Geopolitical stability and energy costs significantly influence regional supply dynamics, impacting the production costs associated with energy-intensive cryogenic separation.

Segmentation trends highlight the dominance of the commercial application segment, driven by large-scale consumption in petrochemical refining and chemical synthesis, where nitrogen is used extensively for inerting and purging operations. However, the electronics segment, demanding Ultra High Purity (UHP) nitrogen, is projected to register the fastest growth rate due to continuous advancements in semiconductor fabrication processes (e.g., smaller node sizes requiring stricter contamination control). Segmentation by technology shows steady revenue contribution from cryogenic air separation units (ASUs) for large-volume bulk users, while non-cryogenic methods gain traction rapidly for medium-to-low volume applications owing to their modularity and lower operational expenditure (OPEX). This dual growth structure ensures market resilience across varied industrial needs and scales.

AI Impact Analysis on Nitrogen Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Nitrogen Market frequently center on optimizing the highly energy-intensive production processes, specifically cryogenic distillation and large-scale ASU operations. Users are keen to understand how AI can predict equipment failures, minimize energy consumption (which represents a significant operating cost for nitrogen producers), and enhance the purity control in real-time. Concerns often revolve around the initial capital investment required to integrate sophisticated AI platforms and the necessity for specialized data science expertise to manage predictive maintenance models and complex process optimization algorithms. Expectations are high regarding AI’s potential to revolutionize supply chain management, ensuring just-in-time delivery for high-demand regions and minimizing storage losses, particularly for Liquid Nitrogen (LIN) which necessitates careful thermal management.

AI’s influence is primarily felt in enhancing operational efficiencies and reliability across the nitrogen supply chain, moving beyond traditional automation into predictive and prescriptive control. In the manufacturing phase, machine learning algorithms analyze vast datasets—including temperature readings, pressure fluctuations, and power consumption—to model optimal operating parameters for Air Separation Units (ASUs). This leads to significant energy savings by adjusting compression and separation cycles dynamically based on real-time electricity costs and purity requirements. Furthermore, AI-driven sensor analytics are pivotal in detecting minute anomalies indicative of potential equipment breakdown, thereby shifting maintenance from reactive to proactive, ensuring minimal downtime in critical, 24/7 production facilities, which is crucial for maintaining supply stability for key end-users like hospitals and large manufacturing plants.

The integration of AI also transforms nitrogen distribution and application. In smart warehousing and LIN logistics, AI optimizes routes and manages inventory levels based on predicted customer demand and tank telemetry data, reducing boil-off losses and ensuring timely replenishment. For end-user applications, such as controlling inert atmospheres in complex chemical reactors or managing the ultra-pure gas flow in semiconductor chambers, AI provides superior closed-loop control, maintaining purity and pressure within extremely tight tolerances. This level of precision, unattainable through conventional methods, reinforces nitrogen’s reliability as a critical process element and drives market preference toward suppliers leveraging advanced digital capabilities for enhanced product quality and service delivery.

- AI optimizes energy consumption in Air Separation Units (ASUs) through dynamic process modeling.

- Predictive maintenance schedules are generated by AI, reducing operational downtime and lowering maintenance costs.

- Enhanced purity and quality control achieved via real-time AI-driven sensor data analysis during production.

- AI-optimized logistics and route planning minimize Liquid Nitrogen (LIN) boil-off losses during transport.

- Improved safety monitoring and risk assessment in high-pressure systems using machine learning algorithms.

- Demand forecasting accuracy increased, allowing producers to align supply better with volatile industrial consumption patterns.

DRO & Impact Forces Of Nitrogen Market

The Nitrogen Market is fundamentally shaped by a confluence of accelerating drivers and persistent structural restraints, balanced by emerging technological opportunities. A primary driver is the pervasive and rapidly expanding demand from the food and beverage industry, specifically for Modified Atmosphere Packaging (MAP) technology, which significantly extends the shelf life of perishable goods by replacing oxygen with inert nitrogen. Concurrently, the exponential growth of the global electronics sector, particularly the manufacturing of advanced semiconductors, demands ultra-high purity nitrogen (UHP N2) as a purging agent and carrier gas, acting as a crucial non-negotiable growth engine. This demand is coupled with increasing safety and environmental regulations in the chemical and petrochemical sectors, mandating the use of nitrogen for inerting tanks and pipelines to prevent explosions and fires, thereby institutionalizing nitrogen consumption.

However, the market faces significant restraints, chiefly related to the high energy consumption inherent in conventional cryogenic air separation, which directly translates to volatile operational costs sensitive to global energy price fluctuations. Furthermore, the substantial initial capital investment required for establishing large-scale Air Separation Units (ASUs) acts as a high barrier to entry for new market participants, leading to high market concentration among established industrial gas giants. While non-cryogenic methods (PSA and membranes) offer flexibility, they often cannot achieve the stringent purity levels required by sophisticated end-users like the semiconductor industry, creating a technological bottleneck for widespread adoption across all sectors.

Opportunities in the nitrogen market are largely concentrated in the technological advancements of non-cryogenic production and the exploration of new, high-value applications. The continuous refinement of PSA and membrane technologies aims to improve purity output and reduce production costs, offering viable, modular alternatives to centralized ASUs for medium-volume users. Furthermore, emerging opportunities lie in specialized applications such as supercritical fluid extraction utilizing nitrogen for green chemistry processes, and expanded use in cryotherapy and advanced medical imaging techniques. The impact forces are currently skewed towards technological innovation and regulatory support, pushing the market towards localized, demand-driven supply models, mitigating the traditional geographical constraints and high transport costs associated with bulk gas delivery. Technological innovation in purification and efficiency is thus the most potent market impact force currently.

Segmentation Analysis

The Nitrogen Market is comprehensively segmented based on technology, form, application, and end-user industry, reflecting the diverse requirements of its customer base. Analyzing these segments provides crucial insight into the varying purity, volume, and logistical demands placed upon suppliers. The segmentation by technology, primarily split between Cryogenic Distillation, Pressure Swing Adsorption (PSA), and Membrane Separation, determines production cost, scalability, and achievable purity levels, directly influencing adoption rates across different industrial scales. Meanwhile, segmentation by form (Gas vs. Liquid) dictates the required infrastructure for storage and delivery, with liquid nitrogen dominating applications requiring cryogenic temperatures, and gaseous nitrogen prevalent in high-volume blanketing operations. The granular segmentation by application and end-user is critical for strategic planning, revealing that while the chemicals sector consumes the highest volume, the electronics and healthcare segments command the highest premium due to stringent purity specifications and critical application needs.

- By Technology:

- Cryogenic Distillation

- Pressure Swing Adsorption (PSA)

- Membrane Separation

- Other Methods (e.g., adsorption, combustion-based)

- By Form:

- Gaseous Nitrogen (GAN)

- Liquid Nitrogen (LIN)

- By Application:

- Blanketing and Purging

- Freezing and Refrigeration (Cryogenic Applications)

- Electronics Processing

- Chemical Synthesis

- Packaging

- Medical and Healthcare

- Others (e.g., enhanced oil recovery, tire filling)

- By End-User Industry:

- Chemicals and Petrochemicals

- Food and Beverage

- Pharmaceuticals and Healthcare

- Electronics and Semiconductors

- Manufacturing and Metal Fabrication

- Automotive and Transportation

- Energy

Value Chain Analysis For Nitrogen Market

The Nitrogen Market value chain commences with the upstream process, which is the procurement and compression of atmospheric air—the primary raw material. This phase is characterized by intense energy dependency, as the air compression and subsequent cooling processes in cryogenic separation units require significant electrical input. Upstream suppliers are predominantly energy providers (electricity and natural gas) and manufacturers of highly specialized capital equipment, such as air compressors, heat exchangers, and distillation columns. Efficiency and reliability in the upstream segment are critical determinants of the final cost of nitrogen, meaning technological innovation focused on reducing the Specific Energy Consumption (SEC) of Air Separation Units (ASUs) is paramount for competitive positioning among industrial gas producers.

The core midstream segment involves the actual production and purification processes, dominated by the major industrial gas companies who own and operate the ASUs, PSA, or membrane plants. This segment includes the cryogenic separation process for bulk supply of ultra-high purity nitrogen and non-cryogenic methods for mid-to-low volume on-site generation. Quality control and achieving precise purity specifications (e.g., 99.999% purity for electronics) are key value-add activities here. Post-production, the midstream phase extends to liquefaction, storage, and specialized transportation logistics, requiring proprietary technology for cryogenic vessels and transport tankers, demonstrating high fixed costs and complexity in handling the product.

Downstream analysis focuses on the distribution channels and end-user consumption. Direct distribution, involving pipelines for continuous, very large volume users (e.g., integrated petrochemical complexes) and bulk delivery via specialized cryogenic tankers (LIN) or tube trailers (GAN), constitutes the major channel. Indirect distribution involves smaller volumes delivered via cylinders or micro-bulk storage, often managed through third-party distributors or specialized regional gas suppliers who cater to laboratories, smaller fabrication shops, and local medical facilities. The value chain concludes at the application point, where the effectiveness of the nitrogen in processes like inerting, cooling, or packaging dictates the final customer satisfaction and long-term contract renewal potential. The trend is moving towards suppliers offering integrated gas management solutions rather than just selling the gas commodity.

Nitrogen Market Potential Customers

The potential customer base for nitrogen is extremely broad, spanning foundational heavy industries to highly sensitive technological and life science sectors. The primary industrial consumers, often referred to as bulk customers, include large chemical manufacturers, petrochemical refineries, and ammonia synthesis plants, which rely on nitrogen continuously for inerting reactors, purging pipelines, and managing safety within explosive atmospheres. These customers typically require pipeline delivery or very large on-site generation facilities (ASUs) due to the sheer volume of consumption, making them cornerstone clients for major industrial gas providers. Demand stability in this sector is intrinsically linked to global industrial output and energy prices.

A rapidly growing segment of potential customers resides in the electronics and semiconductor manufacturing industries. These entities require ultra-high purity (UHP) nitrogen for critical fabrication steps, including wafer cleaning, etching, and maintaining particle-free manufacturing environments. The strict quality requirements in this sector mean that suppliers must adhere to exacting purification and handling standards, resulting in higher pricing and specialized delivery contracts. The rapid expansion of 5G technologies, AI infrastructure, and data centers continuously fuels the demand for UHP nitrogen as semiconductor production scales globally, making this segment highly valuable.

Furthermore, critical sectors like Food and Beverage, and Pharmaceuticals and Healthcare represent another vital customer category. Food producers use nitrogen for Modified Atmosphere Packaging (MAP) to preserve freshness and quality, appealing to customers seeking extended shelf life. Healthcare customers utilize liquid nitrogen primarily for cryopreservation (storing biological samples, sperm, eggs, and tissues) and dermatological cryosurgery, where reliability and purity are non-negotiable. The steady demographic trends and increasing focus on advanced medical procedures ensure consistent, non-cyclical demand from the healthcare sector, providing a stable revenue stream for the nitrogen market suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 24.5 Billion |

| Market Forecast in 2033 | USD 36.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde PLC, Air Liquide S.A., Air Products and Chemicals Inc., Messer Group GmbH, Taiyo Nippon Sanso Corporation, Yingde Gases Group Co., Ltd., Gulf Cryo, Praxair Technology, Inc., Universal Industrial Gases, Inc., Nexair LLC, Novomer, Inc., Calgaz, BASF SE, Iwatani Corporation, INOX Air Products Pvt. Ltd., Asia Industrial Gases Pte. Ltd., Gascon Systems, Enerflex Ltd., Nikkiso Co., Ltd., Sichuan Air Separation Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nitrogen Market Key Technology Landscape

The technology landscape for nitrogen production is predominantly defined by three mature yet continuously evolving methods: Cryogenic Distillation, Pressure Swing Adsorption (PSA), and Membrane Separation. Cryogenic Distillation, involving the cooling and liquefaction of air followed by fractional distillation, remains the benchmark technology for producing very large volumes of high-purity and ultra-high purity (UHP) nitrogen, essential for demanding applications like electronics and integrated pipeline networks. Advances in cryogenic technology focus mainly on improving the energy efficiency of the compressors and heat exchangers, thereby reducing the significant operational expenses associated with this method. Modern ASUs are increasingly modularized and integrated with smart control systems to dynamically adjust production rates, optimizing output purity and energy use based on real-time market demands.

In contrast to large centralized ASUs, non-cryogenic technologies such as PSA and Membrane Separation offer flexible, cost-effective on-site nitrogen generation, particularly advantageous for medium to low-volume consumption or remote industrial sites. PSA technology utilizes specialized adsorbent materials (molecular sieves) to selectively remove oxygen, carbon dioxide, and moisture from compressed air, delivering nitrogen purity up to 99.999%. Recent technological developments in PSA focus on developing superior adsorbent materials that provide longer operational lifecycles and enhanced selectivity, improving the recovery rate and reducing purge gas losses. This refinement has made PSA systems increasingly competitive even for applications requiring moderately high purity levels.

Membrane separation relies on polymeric hollow fibers that separate gases based on permeability differences, producing nitrogen with purities typically ranging from 95% to 99.5%. This method is highly favored for applications requiring moderate purity, simplicity of operation, and low capital investment, such as tire filling, basic blanketing, and fire suppression systems. The primary technological focus in membranes involves creating more durable, higher flux membrane materials that can operate efficiently under varying temperature and pressure conditions, thereby improving the system's overall footprint and energy efficiency. The interplay between these three technologies ensures that the market can meet the highly diverse purity, volume, and logistical requirements across all major end-user sectors globally, contributing to market stability and accessibility.

Regional Highlights

The Nitrogen Market exhibits distinct regional dynamics driven by varying levels of industrialization, regulatory frameworks, and sectorial concentration.

- Asia Pacific (APAC): APAC represents the fastest-growing region, primarily driven by China and India’s robust manufacturing growth, massive infrastructure projects, and the region's position as the global hub for semiconductor and electronics production. The demand for UHP nitrogen in countries like Taiwan, South Korea, and Singapore is exceptionally high due to large-scale semiconductor fabrication facilities. Furthermore, the region's expanding middle class is accelerating the adoption of packaged and frozen foods, fueling demand for nitrogen in Modified Atmosphere Packaging (MAP). Significant investment in new ASU capacity is concentrated here to meet this surging industrial and consumer demand.

- North America: North America holds a substantial market share, characterized by mature and stable demand from the oil and gas sector (enhanced oil recovery, pipeline purging), large pharmaceutical manufacturing bases, and advanced aerospace applications. The regional focus leans heavily toward high-value segments, including specialized medical cryopreservation and sophisticated chemical synthesis. Technological adoption in North America is advanced, with a strong trend toward on-site nitrogen generation (PSA/Membrane) to improve operational resilience and reduce reliance on bulk delivery logistics, reflecting high labor costs and emphasis on supply chain optimization.

- Europe: Europe is a key market, driven by stringent environmental and safety regulations that necessitate widespread use of nitrogen for inerting and purging in the chemical and petrochemical industries, particularly in Germany and the Benelux region. The focus on green manufacturing and sustainability also drives investment in highly efficient cryogenic separation technologies. The region’s advanced healthcare system and significant R&D activities in pharmaceuticals ensure a consistent, high-value demand for liquid nitrogen in research and cryogenic storage applications. Economic stability and established infrastructure support steady market growth.

- Latin America (LATAM): The LATAM market is marked by developing industrial infrastructure, with demand concentrated in large-scale resource extraction (mining and oil & gas) and food processing sectors (especially Brazil and Mexico). Market growth is steady but highly sensitive to commodity prices and foreign investment levels. The reliance on imported technology and fluctuating regulatory environments present some challenges, often leading to preference for smaller, flexible PSA units rather than massive centralized ASUs.

- Middle East and Africa (MEA): The MEA market is largely driven by its massive oil and gas and petrochemical sectors, where nitrogen is critical for inerting storage tanks, purging pipelines, and refinery safety. Large-scale industrial projects and infrastructure expansion in the Gulf Cooperation Council (GCC) countries are significant demand accelerators. South Africa also contributes substantially through its mining and chemicals sectors. The region often requires bulk liquid nitrogen for remote operations where centralized supply chains are impractical, necessitating complex logistics planning.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nitrogen Market.- Linde PLC

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Yingde Gases Group Co., Ltd.

- Gulf Cryo

- Universal Industrial Gases, Inc.

- Nexair LLC

- Iwatani Corporation

- INOX Air Products Pvt. Ltd.

- Asia Industrial Gases Pte. Ltd.

- Gascon Systems

- Enerflex Ltd.

- Nikkiso Co., Ltd.

- BASF SE

- Cryogenic Industries (Nikkiso Clean Energy & Industrial Gases Group)

- Kryoconsult GmbH

- Tech Air (A subsidiary of Airgas, an Air Liquide company)

- Sichuan Air Separation Group

Frequently Asked Questions

Analyze common user questions about the Nitrogen market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Ultra High Purity (UHP) Nitrogen?

The surging growth of the global semiconductor and electronics manufacturing industry is the primary driver. UHP Nitrogen is indispensable for processes like wafer cleaning, etching, and maintaining inert, contamination-free environments, where minute impurities can significantly compromise product yield and quality.

How do Cryogenic Distillation and non-cryogenic technologies compare in terms of cost and purity?

Cryogenic distillation offers the highest purity (up to 99.9999%) and is most cost-effective for extremely large-volume users, despite high initial capital investment. Non-cryogenic methods (PSA/Membrane) offer lower capital cost, modularity, and better flexibility for medium volumes, but typically achieve slightly lower purity levels, making them suitable for blanketing and general industrial uses.

Which end-user industry consumes the largest volume of industrial nitrogen globally?

The Chemicals and Petrochemicals industry consumes the largest sheer volume of industrial nitrogen. It is critically used for inerting storage tanks, purging reaction vessels, and providing a safety blanket to prevent combustion and explosion hazards throughout refining and synthesis processes.

What is the impact of rising energy costs on the Nitrogen Market?

Rising energy costs pose a significant restraint as Air Separation Units (ASUs) are highly energy-intensive. Increased energy prices directly escalate the operational costs of nitrogen producers, leading to higher final pricing for bulk gas and potentially accelerating the adoption of more energy-efficient non-cryogenic on-site generation methods in energy-sensitive regions.

How is Liquid Nitrogen (LIN) primarily used in the Healthcare sector?

Liquid Nitrogen is crucial in the Healthcare sector for cryopreservation, enabling the long-term storage of biological materials such as blood, stem cells, tissue samples, and reproductive cells at extremely low temperatures (-196 °C). It is also utilized in medical diagnostics and dermatological cryosurgery.

What is the primary environmental benefit of using nitrogen in industrial processes?

The primary environmental benefit lies in replacing oxygen with inert nitrogen in storage and transport operations, thereby reducing the risk of accidental fires and explosions. This prevents the release of hazardous combustion byproducts and enhances overall industrial safety and compliance with environmental regulations.

Is on-site nitrogen generation becoming more popular than traditional bulk delivery?

Yes, on-site generation, primarily through Pressure Swing Adsorption (PSA) and membrane systems, is gaining significant traction, particularly among medium-volume users. This shift is driven by the desire to reduce long-term transportation and logistics costs, ensure a stable, dedicated supply, and gain greater control over gas purity and production scheduling.

Which region is expected to demonstrate the fastest growth rate for the nitrogen market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrial expansion, massive investments in electronics and semiconductor manufacturing, and escalating demand for packaged food leveraging Modified Atmosphere Packaging (MAP) technology.

How does nitrogen contribute to the extended shelf life of packaged foods?

Nitrogen is utilized in Modified Atmosphere Packaging (MAP) to displace oxygen within food packaging. By removing oxygen, nitrogen inhibits the growth of aerobic spoilage bacteria and retards the oxidation of fats and oils, effectively extending the freshness, quality, and shelf life of perishable items like meat, snacks, and produce.

What role does Artificial Intelligence play in optimizing nitrogen production?

AI is increasingly used to optimize the highly energy-intensive operations of Air Separation Units (ASUs). Machine learning algorithms analyze real-time process data to predict and mitigate equipment failure, fine-tune compression cycles for maximum energy efficiency, and maintain stringent purity levels with greater precision than traditional control systems.

Are there significant regulatory barriers impacting the nitrogen market?

While nitrogen itself is non-toxic, the primary regulatory impacts stem from the stringent safety requirements related to its handling and storage, particularly high-pressure gaseous nitrogen and ultra-cold liquid nitrogen. Regulations enforced by bodies like OSHA or equivalent national agencies govern equipment specifications, operational procedures, and workplace safety protocols.

What is nitrogen blanketing, and why is it essential in the chemical industry?

Nitrogen blanketing, or inerting, involves introducing nitrogen into a tank or vessel headspace to maintain a positive pressure, displacing flammable air and oxygen. This practice is essential in the chemical industry to prevent the formation of explosive atmospheres, control moisture ingress, and protect sensitive products from oxidative degradation, ensuring safety and product integrity.

How does the Nitrogen market contribute to the automotive sector?

In the automotive sector, nitrogen is used in several ways: to inflate high-performance racing tires (due to its consistent pressure stability), in metal fabrication and welding processes for inert shielding, and increasingly in the manufacturing of lightweight composite materials where inert conditions are required during curing.

What are the key technical challenges facing membrane separation technology?

Key technical challenges include achieving purities consistently above 99.5% (which is lower than cryogenic methods), sensitivity to gas contaminants that can degrade membrane performance, and the need for frequent replacement of membrane modules over long operational periods, impacting long-term operational expenditure for high-demand purity users.

What emerging application is expected to drive significant future demand for nitrogen?

A significant future driver is the rapidly expanding field of cryo-electron microscopy and advanced materials science research, requiring large, reliable supplies of liquid nitrogen for maintaining ultra-low temperatures essential for high-resolution imaging and material synthesis.

What is the typical difference in delivery methods between Gaseous Nitrogen (GAN) and Liquid Nitrogen (LIN)?

GAN is typically delivered via high-pressure cylinders, tube trailers, or dedicated pipelines for continuous, high-volume use. LIN requires specialized delivery in cryogenic tanker trucks and must be stored in vacuum-insulated dewars or bulk storage tanks at the customer site to maintain its ultra-low temperature.

How is the nitrogen market structured regarding competition?

The global nitrogen market is highly consolidated, dominated by a few multinational industrial gas majors (like Linde, Air Liquide, and Air Products). Competition focuses on scale of operations, efficient distribution networks, technological superiority in gas production, and securing long-term supply contracts with foundational industries.

Does the market see significant seasonality in demand for nitrogen?

Demand for nitrogen tends to be relatively stable year-round across core industrial users (chemicals, electronics). However, there can be slight seasonality related to the agricultural sector (fertilizer production components) and increased consumption in the food and beverage sector during holiday or peak packaging seasons.

How important is pipeline delivery in the overall nitrogen distribution system?

Pipeline delivery is extremely important for large-scale, continuous users situated near major production hubs (ASUs or chemical clusters). It represents the most cost-effective method for delivering massive volumes of nitrogen and bypasses the logistical costs and limitations associated with truck or trailer transport.

What is the role of nitrogen in advanced metal fabrication?

In advanced metal fabrication, nitrogen is commonly used as a shielding gas or assist gas in laser cutting and plasma welding operations. Its inert properties prevent oxidation and discoloration of the metal surfaces, ensuring cleaner cuts, superior weld quality, and higher precision in processes involving stainless steel and other reactive alloys.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Intelligent Nitrogen Drying Oven Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Samarium Iron Nitrogen Magnet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Nitrogen Generation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Nitrogen Tire Inflator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Food & Beverage Nitrogen Generators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager