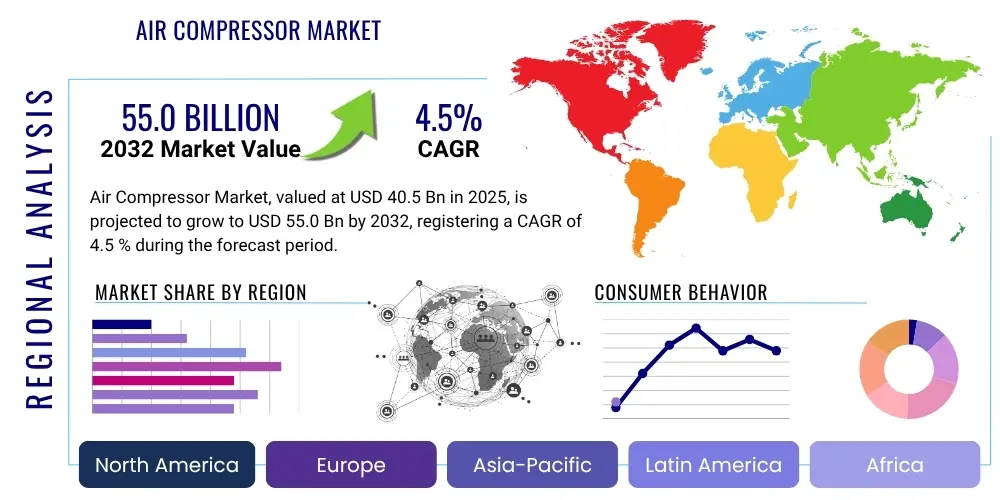

Air Compressor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427880 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Air Compressor Market Size

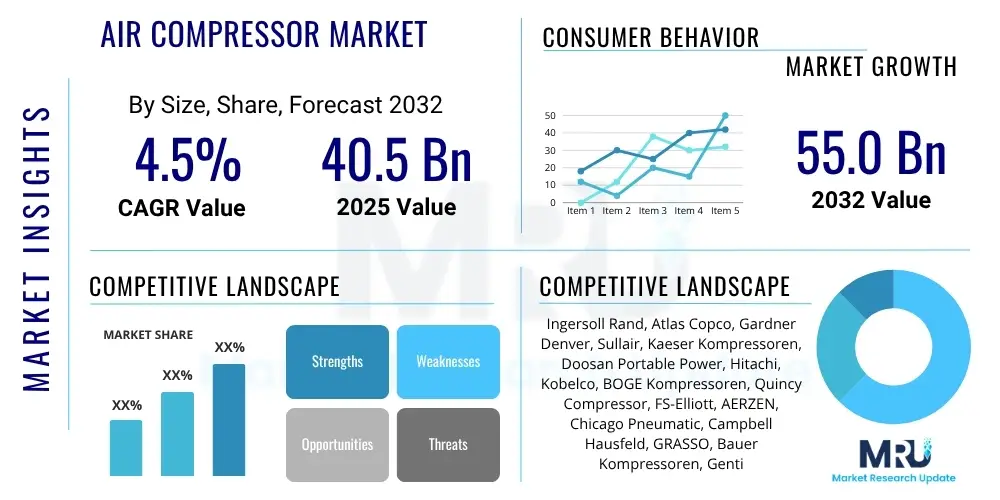

The Air Compressor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2032. The market is estimated at USD 40.5 billion in 2025 and is projected to reach USD 55.0 billion by the end of the forecast period in 2032.

Air Compressor Market introduction

The air compressor market encompasses a diverse range of equipment designed to convert power, typically from an electric motor or diesel engine, into potential energy stored in pressurized air. This pressurized air is then utilized for various industrial, commercial, and even domestic applications, driving pneumatic tools, operating machinery, and facilitating processes across a multitude of sectors. The fundamental principle involves drawing in ambient air, reducing its volume, and thereby increasing its pressure, making it a versatile and indispensable utility in modern industry.

Products within this market range from small, portable units used for household tasks or automotive applications to large, stationary industrial compressors providing high volumes of compressed air for heavy manufacturing, oil and gas operations, and power generation. Key product types include reciprocating (piston) compressors, rotary screw compressors, and centrifugal compressors, each offering distinct advantages in terms of efficiency, pressure range, and flow rate, tailored to specific operational requirements. Technological advancements continue to refine these designs, focusing on enhancing energy efficiency, reducing noise levels, and improving overall reliability to meet evolving industry standards and environmental regulations.

Major applications of air compressors span across nearly every industrial sector. In manufacturing, they power assembly lines, paint sprayers, and material handling systems. The oil and gas industry relies on them for drilling, pipeline maintenance, and process control. Healthcare uses oil-free compressors for medical gases and dental equipment, while construction sites leverage portable units for jackhammers and pneumatic tools. The benefits of using compressed air are numerous, including safety (no sparks from electricity), versatility in power delivery, and relatively low maintenance compared to hydraulic systems, making it a foundational utility for operational efficiency and productivity across the global economy.

Air Compressor Market Executive Summary

The air compressor market is experiencing robust growth driven by accelerating industrialization, increasing automation across various sectors, and the rising demand for energy-efficient compressed air solutions. Business trends indicate a strong focus on innovation, particularly in the development of smart compressors integrated with IoT capabilities for predictive maintenance and remote monitoring. Manufacturers are also heavily investing in research and development to produce units with lower lifecycle costs, improved operational efficiency, and reduced environmental footprints, aligning with global sustainability initiatives. The competitive landscape is characterized by a mix of established global players and niche specialists, all striving to differentiate through technological superiority, extensive service networks, and tailored solutions for diverse end-user needs. Strategic partnerships and mergers and acquisitions are frequently observed as companies seek to expand their market reach and product portfolios.

Regional trends reveal significant growth potential in emerging economies, particularly across the Asia Pacific, Latin America, and Middle East & Africa regions, fueled by rapid infrastructural development, burgeoning manufacturing bases, and increasing foreign investments. North America and Europe, while mature, continue to present opportunities through the adoption of advanced, energy-efficient technologies and the replacement of older, less efficient compressor systems. Stringent environmental regulations in developed regions are further pushing the demand for oil-free and low-noise compressors. Urbanization and the expansion of smart city projects also contribute to localized demand spikes for various compressor types, from those used in public utilities to specialized applications in advanced logistics and public transportation systems.

Segmentation trends highlight a shift towards oil-free compressors due to their critical importance in sensitive applications like food and beverage, pharmaceuticals, and electronics, where air purity is paramount. Rotary screw compressors maintain their dominance owing to their efficiency and continuous duty capabilities, while variable speed drive (VSD) technology is gaining traction for its energy-saving attributes in applications with fluctuating air demand. The demand for portable compressors is witnessing steady growth, particularly in construction and rental markets, offering flexibility and ease of deployment. End-use industries such as manufacturing, oil and gas, and energy and utilities remain the largest consumers, with significant investments anticipated in upgrading and expanding their compressed air infrastructure to enhance operational throughput and minimize energy consumption.

AI Impact Analysis on Air Compressor Market

Users frequently inquire about how Artificial Intelligence (AI) will transform air compressor operations, focusing on benefits like predictive maintenance, energy optimization, and enhanced system intelligence. Common questions revolve around the integration challenges of AI with existing infrastructure, the accuracy of AI-driven diagnostics, and the potential for reduced human intervention. There is a strong expectation that AI will lead to more autonomous and energy-efficient compressor systems, addressing key operational pain points and contributing significantly to cost savings and increased uptime. Concerns often surface regarding data security, the need for skilled personnel to manage AI systems, and the initial investment required for such advanced implementations, indicating a desire for clear demonstrations of ROI and practical implementation pathways for adopting AI-driven solutions in the air compressor market.

- Predictive maintenance: AI algorithms analyze sensor data (pressure, temperature, vibration, current) to anticipate equipment failures, scheduling maintenance before breakdowns occur, thereby minimizing downtime and extending asset life.

- Energy optimization: AI-powered systems dynamically adjust compressor output to match demand fluctuations, identifying inefficiencies and optimizing operational parameters to significantly reduce energy consumption, often the largest operational cost.

- Remote monitoring and control: AI enables continuous, real-time monitoring of compressor performance from any location, allowing for immediate adjustments and troubleshooting, enhancing operational flexibility and responsiveness.

- Automated fault detection: AI can quickly identify anomalies and diagnose root causes of performance issues or potential malfunctions, providing actionable insights that improve diagnostic accuracy and speed.

- Enhanced system integration: AI facilitates seamless integration of compressors with broader industrial control systems (e.g., SCADA, DCS), enabling centralized management and optimized resource allocation across entire production facilities.

- Supply chain optimization: AI can predict demand patterns for spare parts and consumables, optimizing inventory levels and ensuring timely availability, which further supports preventive maintenance strategies.

- Adaptive control: Machine learning allows compressors to adapt to changing environmental conditions or operational loads, optimizing performance without constant manual recalibration.

- Safety improvements: By monitoring operational parameters and predicting potential hazards, AI can contribute to safer working environments by flagging conditions that could lead to equipment failure or operational risks.

DRO & Impact Forces Of Air Compressor Market

The Air Compressor Market is propelled by several robust drivers, primarily the persistent growth in industrial manufacturing and the expansion of infrastructure projects globally. As industries continue to automate and modernize their processes, the demand for reliable and efficient compressed air systems, crucial for pneumatic tools, material handling, and process instrumentation, inherently rises. Furthermore, the increasing emphasis on energy efficiency and sustainability standards across industries is pushing manufacturers to develop and adopt advanced compressor technologies like Variable Speed Drive (VSD) systems, which significantly reduce energy consumption and operational costs, thereby fostering market expansion. The versatility of air compressors across diverse sectors such as oil and gas, food and beverage, automotive, and healthcare also ensures a broad and resilient demand base.

Conversely, the market faces notable restraints that could temper its growth trajectory. The high initial capital expenditure associated with purchasing and installing advanced air compressor systems can be a significant barrier for small and medium-sized enterprises (SMEs). Additionally, the substantial operational and maintenance costs, particularly for electricity consumption, pose a challenge, though mitigated by energy-efficient models. Environmental regulations pertaining to noise pollution and carbon emissions, while driving innovation, can also add to manufacturing costs and operational complexities. Fluctuations in raw material prices, such as steel and copper, essential for compressor manufacturing, can impact production costs and final product pricing, leading to market volatility.

Opportunities for growth are abundant, especially in emerging economies undergoing rapid industrialization and urbanization, offering untapped markets for new installations and system upgrades. Technological advancements, including the integration of IoT, AI, and cloud-based solutions for predictive maintenance, remote monitoring, and energy management, present significant avenues for market development and value creation. The growing demand for specialized, oil-free compressors in sensitive applications like pharmaceuticals, food processing, and electronics also represents a lucrative niche. Moreover, retrofitting older, less efficient compressor systems with newer, energy-efficient models presents a substantial opportunity for market players in developed regions focused on optimizing existing industrial infrastructure and achieving sustainability goals.

Segmentation Analysis

The air compressor market is broadly segmented based on various critical parameters, including type, lubrication, technology, end-use industry, portability, and pressure. Each segment addresses specific market needs and application requirements, contributing to the overall diversity and complexity of the market landscape. This comprehensive segmentation allows market players to tailor their product offerings and strategic approaches to cater to distinct customer bases, ranging from large industrial conglomerates requiring high-capacity, stationary compressors to small businesses and consumers needing portable and compact units. Understanding these segmentations is crucial for identifying growth pockets and developing targeted market strategies that align with evolving industry demands and technological advancements across different operational environments.

- By Type

- Reciprocating (Piston) Compressors

- Rotary Compressors

- Rotary Screw Compressors

- Rotary Vane Compressors

- Rotary Lobe Compressors

- Centrifugal Compressors

- Axial Compressors

- Radial Compressors

- By Lubrication

- Oil-Lubricated Compressors

- Oil-Free Compressors

- By Technology

- Variable Speed Drive (VSD) Compressors

- Fixed Speed Compressors

- By End-Use Industry

- Manufacturing

- Automotive

- Food & Beverage

- Packaging

- Electronics & Semiconductors

- Textiles

- Oil & Gas

- Energy & Utilities

- Healthcare & Pharmaceuticals

- Construction

- Mining

- Chemical & Petrochemical

- Agriculture

- Home Appliances & DIY

- Manufacturing

- By Portability

- Portable Compressors

- Stationary Compressors

- By Pressure

- Low-Pressure Compressors

- Medium-Pressure Compressors

- High-Pressure Compressors

Value Chain Analysis For Air Compressor Market

The value chain for the air compressor market begins with upstream activities, primarily involving the sourcing of raw materials and the manufacturing of critical components. This phase includes the procurement of metals like steel, aluminum, and copper for housings, rotors, pistons, and piping, as well as specialized components such as electric motors, air ends, control systems, filters, and lubricants. Suppliers in this segment focus on delivering high-quality, durable, and cost-effective materials and parts, often adhering to stringent industry specifications. Research and development also play a crucial upstream role, as manufacturers continuously innovate designs, improve energy efficiency, and integrate advanced technologies like IoT sensors and smart controls, directly influencing the performance and market appeal of the final product.

The core of the value chain is the manufacturing and assembly process, where various components are brought together to create the complete air compressor unit. This stage involves precision engineering, quality control, and rigorous testing to ensure product reliability and compliance with safety and performance standards. Once manufactured, the products enter the distribution channel, which can be either direct or indirect. Direct distribution involves manufacturers selling directly to large industrial clients, often through their own sales teams and service centers, which allows for customized solutions, direct technical support, and comprehensive after-sales service. This approach is common for large, complex industrial compressor systems that require specialized installation and ongoing maintenance.

Indirect distribution involves leveraging a network of distributors, dealers, and value-added resellers (VARs) to reach a broader customer base, particularly for smaller, standardized units or in regions where direct sales are less feasible. These intermediaries often provide localized sales support, installation services, and initial maintenance, acting as crucial links between manufacturers and end-users. Downstream activities focus on installation, commissioning, maintenance, repair, and overhaul (MRO) services, as well as the provision of spare parts and consumables. After-sales support is critical in the air compressor market, given the equipment's long operational lifespan and the need for consistent performance. Companies that offer comprehensive service agreements, remote diagnostics, and readily available parts tend to build stronger customer loyalty and capture recurring revenue streams, contributing significantly to the overall value proposition for end-users.

Air Compressor Market Potential Customers

Potential customers for air compressors span a vast array of industries and sectors, each with unique requirements and operational demands. Industrial manufacturing facilities represent a primary and substantial customer base, including automotive assembly plants, where compressed air powers pneumatic tools, robotics, and paint shops; food and beverage processing plants, which require oil-free compressors for product handling, packaging, and fermentation; and electronics and semiconductor manufacturers, for whom ultra-clean, dry compressed air is critical for precision assembly and cleanroom environments. These industries typically demand high-capacity, reliable, and often specialized compressor systems that can operate continuously and efficiently, making energy efficiency and uptime crucial purchasing criteria.

The oil and gas industry is another major end-user, utilizing air compressors for drilling operations, pipeline cleaning, process control, and powering various pneumatic instruments in refineries and offshore platforms. The construction sector relies heavily on portable air compressors to power jackhammers, concrete vibrators, and spray painting equipment on job sites, valuing durability, ease of transport, and robust performance in challenging outdoor environments. Similarly, the energy and utilities sector, including power generation plants and wastewater treatment facilities, employs compressors for instrument air, soot blowing, and aeration processes, where reliability and minimal maintenance are paramount due to the critical nature of their operations.

Beyond these large industrial users, a significant market exists within commercial applications and smaller enterprises. Automotive repair shops, carpentry workshops, and dry cleaning services use smaller-to-medium sized compressors for various tasks, valuing cost-effectiveness, compact size, and sufficient power for their specific tools. The healthcare and pharmaceutical sectors are also vital customers, requiring oil-free, medical-grade compressors for dental offices, hospitals (for medical air and vacuum systems), and pharmaceutical manufacturing, where air purity is a non-negotiable factor. Even domestic users represent a segment, with small, portable compressors used for tire inflation, household repairs, and hobbyist applications, highlighting the broad spectrum of potential buyers across the economic landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 40.5 Billion |

| Market Forecast in 2032 | USD 55.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ingersoll Rand, Atlas Copco, Gardner Denver, Sullair, Kaeser Kompressoren, Doosan Portable Power, Hitachi, Kobelco, BOGE Kompressoren, Quincy Compressor, FS-Elliott, AERZEN, Chicago Pneumatic, Campbell Hausfeld, GRASSO, Bauer Kompressoren, Gentilin S.p.A., BEKO TECHNOLOGIES, Fusheng Co., Ltd., Elgi Equipments |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Compressor Market Key Technology Landscape

The air compressor market's technological landscape is rapidly evolving, driven by demands for enhanced energy efficiency, increased reliability, and intelligent operation. Variable Speed Drive (VSD) technology stands out as a paramount innovation, allowing compressors to adjust their motor speed according to real-time air demand. This capability dramatically reduces energy consumption, especially in applications with fluctuating load requirements, leading to significant operational cost savings compared to traditional fixed-speed compressors. VSD technology integrates sophisticated control algorithms and power electronics to precisely match output to demand, making it a cornerstone for sustainable industrial operations and a key factor in new equipment installations and system upgrades across various industries.

Beyond VSD, the integration of Industry 4.0 principles, including the Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing, is transforming air compressor systems into smart, connected assets. IoT sensors collect vast amounts of operational data on parameters such as pressure, temperature, vibration, and energy consumption. This data is then transmitted to cloud platforms for real-time monitoring and analysis, enabling predictive maintenance, fault diagnosis, and performance optimization. AI algorithms process this data to identify anomalous patterns, predict potential failures before they occur, and suggest optimal maintenance schedules, thereby maximizing uptime and extending the lifespan of the equipment while minimizing unplanned service interruptions and associated costs.

Further technological advancements include improvements in air end design, material science, and motor efficiency. New rotor profiles in rotary screw compressors and advanced impeller designs in centrifugal compressors are continually being developed to maximize volumetric efficiency and reduce energy losses. The adoption of permanent magnet motors and highly efficient IE4/IE5 motors is also becoming more prevalent, offering superior energy conversion compared to older motor technologies. Moreover, manufacturers are focusing on developing advanced filtration systems to ensure higher air purity, crucial for sensitive applications, and sophisticated control systems that allow for seamless integration with broader plant automation networks, thereby enhancing overall operational intelligence and resource management within industrial environments.

Regional Highlights

- North America: This region demonstrates a mature market characterized by the steady adoption of energy-efficient and advanced compressor technologies. Driving factors include robust industrial manufacturing, stringent environmental regulations pushing for oil-free solutions, and a strong emphasis on automation across various sectors. The market here also benefits from substantial investments in infrastructure and the replacement of aging equipment with newer, more efficient models.

- Europe: Similar to North America, Europe is a highly developed market with a strong focus on sustainability and compliance with strict energy efficiency directives. Key drivers include a sophisticated manufacturing base, particularly in automotive and machinery, and a growing demand for customized, high-performance compressors. Germany, Italy, and the UK are major contributors, with increasing investment in smart factory initiatives integrating IoT and AI into compressed air systems.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by rapid industrialization, urbanization, and significant government investments in infrastructure development, particularly in countries like China, India, and Southeast Asian nations. The burgeoning manufacturing sector, including electronics, textiles, and automotive, is creating immense demand for all types of air compressors. The region also sees a rising adoption of energy-efficient solutions as environmental concerns become more prominent.

- Latin America: This region exhibits steady growth, driven by expansion in the mining, oil and gas, and manufacturing sectors. Brazil and Mexico are leading markets, with increasing foreign direct investment stimulating industrial activity. The demand here often focuses on robust, durable compressors capable of operating in diverse and sometimes challenging environmental conditions, coupled with an increasing awareness of the benefits of energy efficiency.

- Middle East and Africa (MEA): The MEA region is experiencing substantial growth propelled by massive investments in oil and gas exploration, infrastructure projects, and the diversification of economies beyond hydrocarbons, especially in construction and manufacturing. Countries like Saudi Arabia, UAE, and South Africa are key markets. There is a growing need for reliable and high-performance compressors to support large-scale industrial operations and burgeoning urban development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Compressor Market.- Ingersoll Rand

- Atlas Copco

- Gardner Denver

- Sullair

- Kaeser Kompressoren

- Doosan Portable Power

- Hitachi

- Kobelco

- BOGE Kompressoren

- Quincy Compressor

- FS-Elliott

- AERZEN

- Chicago Pneumatic

- Campbell Hausfeld

- GRASSO

- Bauer Kompressoren

- Gentilin S.p.A.

- BEKO TECHNOLOGIES

- Fusheng Co., Ltd.

- Elgi Equipments

Frequently Asked Questions

What is the projected growth rate of the Air Compressor Market?

The Air Compressor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2032, indicating a steady expansion driven by industrial demand and technological advancements.

What are the primary types of air compressors used in industrial applications?

The primary types include reciprocating (piston) compressors, rotary screw compressors, and centrifugal compressors. Each type is suited for different applications based on factors like pressure requirements, flow rates, and operational efficiency needs.

How do Variable Speed Drive (VSD) compressors contribute to energy efficiency?

VSD compressors automatically adjust their motor speed to match real-time air demand, preventing energy waste during periods of low or fluctuating demand. This capability significantly reduces electricity consumption and operational costs compared to fixed-speed models.

Which end-use industries are the largest consumers in the Air Compressor Market?

The largest end-use industries include manufacturing (automotive, food & beverage, electronics), oil & gas, energy & utilities, and construction. These sectors rely heavily on compressed air for diverse operations, from powering pneumatic tools to critical process control.

What role does AI play in the future of air compressor technology?

AI is increasingly integrated into air compressor systems for predictive maintenance, energy optimization, and remote monitoring. AI-powered analytics can anticipate failures, fine-tune performance, and enhance overall system intelligence, leading to increased uptime and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fuel Cell Air Compressor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Oil-free Air Compressor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Oil Filled Air Compressor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Portable Air Compressor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Air Compressor Market Size Report By Type (Portable, Stationary, Reciprocating/Piston, Rotary/Screw, Centrifugal), By Application (Manufacturing, Semiconductors & Electronics, Food & Beverage, Healthcare/Medical, Home Appliances, Energy, Oil & Gas, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager